Keeping track of paper receipts is a big hassle.

Do you hate stuffing crumpled paper into your pockets? We all do.

If you lose those receipts, you actually lose your own money.

That stress adds up quickly. Tax time becomes a nightmare, and nobody wants that.

But there is an easier way to handle it.

Expensify automates the whole messy process for you. It scans receipts immédiatement.

Then it automatically builds your reports.

Stop wasting your valuable time on paperwork. Learn how to use Expensify right now.

Save 83% of your time on paperwork. Small teams can save $37,859 by switching to Expensify. Join 15 million users and start your free trial today!

Expensify Tutorial

Mastering Expensify is simple. You do not need technical skills.

We will guide you through the process.

First, download the mobile app. Next, snap a picture of any receipt.

SmartScan reads the numbers automatically.

Finally, submit your report for approval.

It really is that easy to manage your money.

How to Use Expense Management Feature

Managing your money should not be a full-time job.

With an expense management platform like Expensify, you can stop worrying about lost receipts.

This system helps you manage expenses without the stress of manual données entrée.

You can keep your financial data organized and up to date with just a few taps.

Step 1: Capture Your Receipts with SmartScan Technology

The first step in Expensify is getting your receipts into the system.

You don’t need to type in prices or dates yourself.

- Open the app on your mobile device.

- Use the smart scan feature to take a photo of your paper receipt.

- If you have a digital receipt, forward it from your email or phone number directly to the app.

- The AI will read the receipt and fill in the details for you.

Step 2: Organize with Expense Categories and Mileage

Once your receipts are in, you need to tell the system what they are for.

This keeps your financial operations running smoothly and helps you identify spending trends plus tard.

- Assign each item to a specific expense category, such as “Voyage,” “Meals,” or “Office Supplies.

- Use the app to track mileage if you drive for work; it uses GPS to calculate distance automatically.

- Check that each entry complies with your company policies to avoid issues later.

Step 3: Use Approval Workflows and Syncing

The final part of the expense management process is getting your money back.

Expensify connects to your comptabilité software to make this fast.

- Submit your items into tailored reports that show exactly what you spent.

- The system uses approval workflows to send your report to the right manager.

- Once they approve expenses, the data syncs with your company’s books.

- You get paid back directly into your bank account.

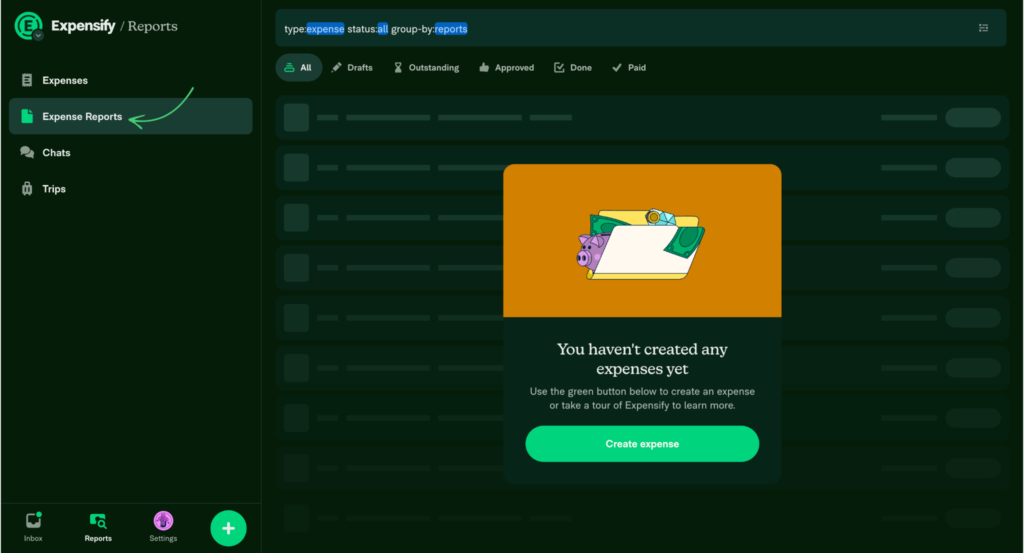

How to Use Expensify Expense Reports

Creating reports is the best way for businesses and employees to stay organized.

This platform makes it easy to group your spending so you can get reimbursed quickly.

You can use your own device to handle everything while you are away from the office.

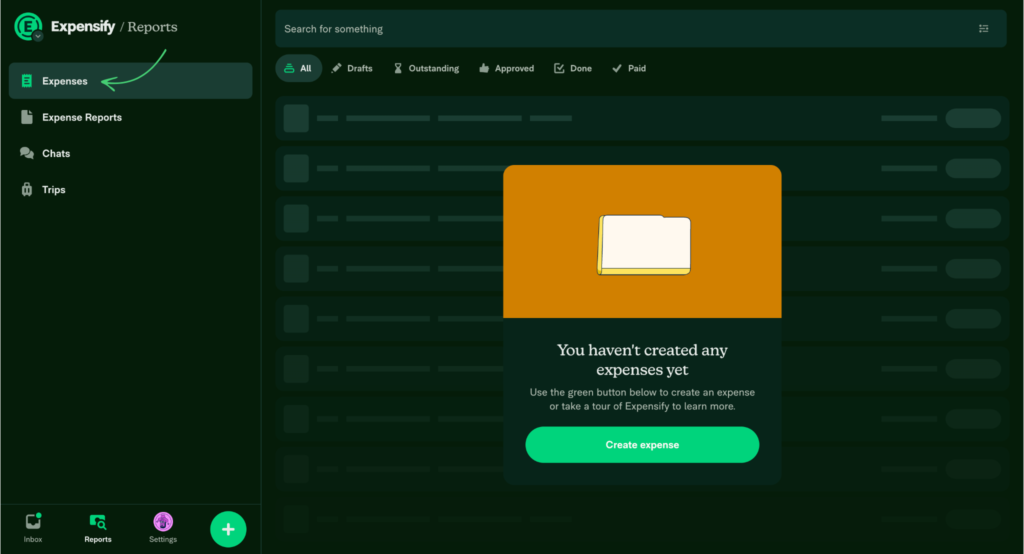

Step 1: Create a New Report Folder

The first step is creating a place for your receipts.

You want to keep things neat, so there are no errors when it is time for a manager to sign off on your money.

- Open the Expensify system and go to the reports tab.

- Click to create a new report and give it a clear name based on projects or the current date.

- You can access your past reports here as well if you need to check old data.

- If you use an Expensify card, your transactions will show up here automatically to streamline the process.

Step 2: Add Expenses and Check Rules

Now you need to put your receipts into the report.

You musensure thatre everythincomplies withws the rules your company has set.

This keeps everyone in compliance and protects the company’s funds.

- Pick the individual expenses or invoices you want to include.

- Move them into your new report folder.

- Look for any red flags from the system that show a mistake.

- Users can see if they spent too much in certain departments before they hit submit.

Step 3: Submit for Approval

Once your report looks good, it is time to send it away.

This functionality is what makes Expensify so helpful for users who want to save time.

- Review the final total to make sure it matches your actual spending.

- Hit the “Submit” button to send it to the right person.

- Vous pouvez même trouver YouTube tutorials if you get stuck on a specific step.

- Once you establish this habit, you won’t have to worry about losing money again.

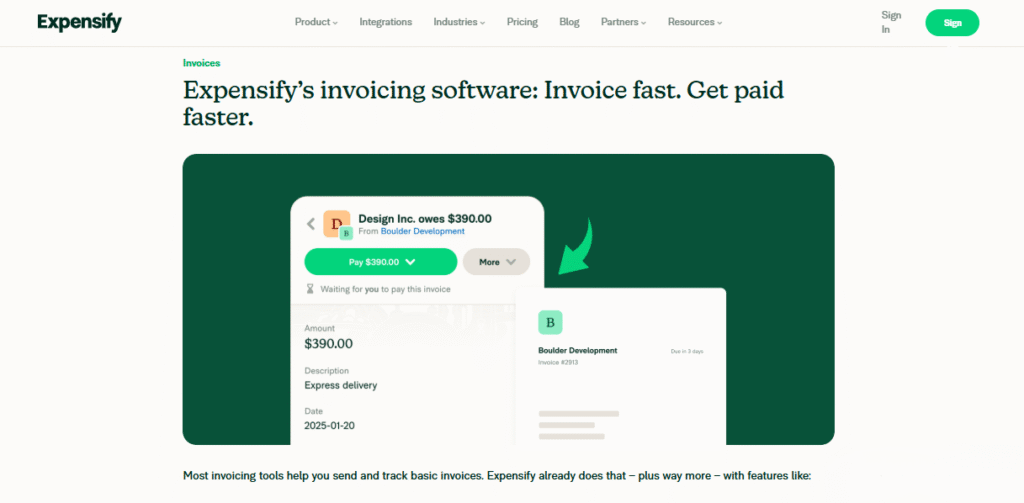

How to Use Expensify Bill Pay and Invoicing

Managing money coming in and going out is vital for any entreprise.

Expensify helps you handle bills and send invoices without the stress of messy spreadsheets.

You can manage everything from one simple screen.

Step 1: Set Up Your Business Billing Profile

Before you send your first bill, you need to tell the system who you are. This ensures your documents look professional to your clients and vendors.

- Go to your settings and enter your legal entreprise name and tax ID.

- Upload your company logo so it appears on every invoice you send.

- Link your business bank account so you can receive payments or pay vendors directly.

Step 2: Create and Send a Professional Invoice

Getting paid for your hard work should be the easy part. You can create an invoice in seconds and send it to your client’s boîte de réception.

- Click on “New Invoice” and type in your client’s email address.

- Add line items for the work you did or the products you sold.

- Set a due date for the payment and hit the “Send” button.

- The system will track if the client has opened or paid the invoice yet.

Step 3: Pay Company Bills Electronically

Paying your own bills is just as simple as getting paid. You can keep all your outgoing money organized in one place.

- Forward any bills you receive to your unique Expensify email address.

- Review the bill details that the system automatically pulls from the document.

- Use the approval workflow to make sure the right person okays the spend.

- Click to pay the vendor via ACH or credit card without leaving the app.

Alternatives to Expensify

- Dext: Ce logiciel automatise l'extraction de données à partir des reçus et des factures. Il permet de gagner du temps en numérisant vos documents et en éliminant la saisie manuelle.

- Docyt: Cette plateforme, basée sur l'intelligence artificielle, automatise la comptabilité et les tâches administratives. Docyt vise à éliminer la saisie manuelle de données et à fournir des analyses financières en temps réel, ce qui en fait une solution performante pour les entreprises recherchant une solution hautement automatisée.

- SageUne plateforme performante offrant des solutions adaptées aux entreprises de toutes tailles. Elle constitue une alternative intéressante, notamment pour les entreprises aux besoins financiers plus complexes.

- Xero: Il s'agit d'une plateforme comptable en nuage populaire. C'est une alternative aux fonctionnalités de comptabilité d'Atera, offrant des outils pour la facturation, le rapprochement bancaire et le suivi des dépenses.

- Fin de mois facile: Ce logiciel spécialisé est conçu spécifiquement pour simplifier le processus de clôture financière. Il s'intègre à d'autres plateformes comptables comme QuickBooks et Xero afin de garantir une fin de mois simple et rapide.

- Puzzle io: Il s'agit d'un logiciel de comptabilité moderne conçu spécifiquement pour les startups. Il facilite la production de rapports financiers et l'automatisation, en offrant des informations en temps réel et en optimisant la comptabilité pour une clôture plus rapide.

- Sage: Sage, fournisseur reconnu de logiciels de gestion d'entreprise, propose une gamme de solutions comptables et financières pouvant servir d'alternative au module de gestion financière d'Atera.

- Synder: Ce logiciel permet de synchroniser vos plateformes de commerce électronique et de paiement avec votre logiciel comptable. Il constitue une solution intéressante pour les entreprises qui souhaitent automatiser le flux de données de leurs canaux de vente vers leur comptabilité.

- Fin de mois facile: Cet outil est spécialement conçu pour simplifier le processus de clôture de fin de mois. Il s'agit d'une solution spécialisée pour les entreprises souhaitant améliorer et automatiser leurs tâches de reporting financier et de rapprochement.

- Docyt: Docyt, une plateforme de comptabilité basée sur l'IA, automatise les flux de travail financiers. Elle se positionne en concurrent direct des fonctionnalités de comptabilité pilotées par l'IA d'Atera, offrant des données en temps réel et une gestion documentaire automatisée.

- Rafraîchir-moi: Il s'agit d'une plateforme de gestion des finances personnelles. Bien qu'elle ne soit pas une alternative directe aux plateformes professionnelles, elle offre des fonctionnalités similaires, comme le suivi des dépenses et des factures.

- Vague: Il s'agit d'un logiciel financier gratuit et populaire. C'est un bon choix pour les travailleurs indépendants et les petites entreprises pour la facturation, la comptabilité et la numérisation des reçus.

- Accélérer: Un outil bien connu pour la gestion des finances personnelles et des petites entreprises. Il facilite la budgétisation, le suivi des dépenses et la planification financière.

- Hubdoc: Ce logiciel est un outil de gestion documentaire. Il récupère automatiquement vos documents financiers et les synchronise avec votre logiciel comptable.

- QuickBooks: L'un des logiciels de comptabilité les plus utilisés. QuickBooks est une alternative performante qui offre une gamme complète d'outils pour la gestion financière.

- Saisie automatique: Cet outil automatise la saisie de données. Il constitue une bonne alternative aux fonctionnalités de capture de reçus et de factures d'Atera.

- FreshBooks: Ce logiciel est idéal pour la facturation et la comptabilité. Il est très apprécié des indépendants et des petites entreprises qui recherchent une solution simple pour suivre leur temps et leurs dépenses.

- NetSuite: NetSuite est une suite logicielle de gestion d'entreprise puissante et complète, basée sur le cloud. Elle constitue une alternative pour les grandes entreprises qui ont besoin de bien plus qu'une simple gestion financière.

Comparaison avec Expensify

- Expensify contre PuzzleCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Expensify contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- Expensify contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- Expensify contre SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Expensify vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Expensify contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- Expensify contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Expensify contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Expensify vs WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- Expensify vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- Expensify contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Expensify vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Expensify contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Expensify contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Conclusion

Learning how to use Expensify is a smart move for your work life.

You can say goodbye to lost receipts and messy piles of paper.

The simple interface makes it easy for any individual to get started.

Just select the features you need, and the dashboard will show you your spending trends.

You can sync your bank accountdirectly witho the system.

This helps reduce mistakes and ensure total accuracy.

Your manager will love how fast you follow company policies.

Do not let the complexities of business voyage slow you down anymore.

It only takes one tap to start. You can level up your workflow today.

Join the many people who focus on their work instead of paperwork.

Start by starting your first report right now.

Foire aux questions

Is Expensify no longer free?

Expensify still offers a Plan gratuit for individuals, limited to 25 SmartScans per month. For businesses, paid plans start at roughly $5 per user/month (Collect plan) if you use the Expensify Card. Without the card, prices are higher (approx. $10-$18/user), so checking the latest bundled pricing is essential.

What are the pros and cons of Expensify?

Pros: Industry-leading “SmartScan” technology, seamless integration with QuickBooks/Xero, and fast next-day reimbursement. Inconvénients : The pricing model can be confusing (often requiring their corporate card for the best rates), and customer support is primarily chat-based rather than phone-based.

What is the difference between QuickBooks and Expensify?

Pensez à QuickBooks as your complete financial engine (invoicing, payroll, P&L), while Expensify is a specialized fuel injector. Expensify handles the nitty-gritty of receipt scanning and employee reimbursements, then syncs that clean data directly into QuickBooks for final comptabilité.

Is Expensify good for small business?

Absolutely. It is specifically designed to scale from travailleurs indépendants to SMBs. The “Collect” plan automates receipt tracking and approval workflows, which saves small teams hours of manual data entry and simplifies tax season significantly.

How do I submit expenses using Expensify?

The easiest method is using the mobile app to snap a photo of your receipt; SmartScan automatically extracts the merchant, date, and amount. Alternatively, you can forward email receipts to receipts@expensify.com or manually enter details via the web dashboard.

Is Expensify easy to learn?

Yes, it boasts a “mobile-first” design that is highly intuitive. Most users master the core loop—snap a photo, create a report, hit submit—within minutes. The platform minimizes buttons and relies on automation faire le gros du travail.

How do I get started with Expensify?

Simply download the app or sign up on their website to create a free account. You can immediately start scanning receipts. For business use, connect your logiciel de comptabilité (like Xero or NetSuite) and invite employees to begin automating their expense reports.

More Facts about Expensify

- Pick Your Account: When you sign up, you can choose between a personal account or your business account.

- Le tableau de bord : After you join, you get a main screen that shows your recent spending and reports that need work.

- Personnalisez-le : You can create your own spending categories and rules when you set up your account.

- Mistake Finder: The app automatically points out if you break a rule or enter the same receipt twice.

- Get Paid Back: You can send your reports through the app to get reimbursed for work costs.

- Approval Steps: Bosses can review and approve your spending before any money is paid out.

- Supplémentaire Sécurité: You can also enable two-factor authentication to keep your account even safer.

- SmartScan: You can take a picture of a receipt, and the app “reads” it to find the date, store name, and price.

- Work Anywhere: The mobile app lets you do almost everything on your phone, even without an internet connection. connection

- Easy Sending: You can build and send whole reports right from your smartphone.

- Email Receipts: You can forward receipts from your email to the app, and it will process them for you.

- Travel Help: The app integrates with travel tools so you can book trips and easily track costs.

- Automatic Work: Expensify handles the hard parts, from scanning the paper to putting money in your bank.

- Right Person, Right Time: The system knows exactly which manager should see your report based on company rules.

- Rule Watcher: The app continuously checks your spending against your company’s rules to ensure everything is in order.

- Group Workspace: You can create a “Workspace” to keep your team’s expenses organized.

- Accounting Links: Expensify talks to tools like QuickBooks and Xero to keep the math correct.

- Conseil de pro : For the best results, scan receipts as soon as you get them and use the same names for your categories.

- Card Links: Link your own credit card so your purchases appear in the app automatically.

- The Expensify Card: Using their special card can give you 2% back on your spending and even lower your monthly bill by half.

- Distance Tracker: The app uses GPS to see how far you drove for work and calculates how much money you should get back.

- Live Spending: You can watch how much money is being spent in real-time on your dashboard.

- Budgets: You can set a spending limit and receive a warning if you exceed it.

- Scheduled Submit: A feature that collects your receipts and automatically sends them to your boss on a set day.