Many founders hate accounting because it feels messy and slow.

Manual data entry takes hours and leads to costly errors.

You might feel like you are drowning in receipts and spreadsheets.

This stress pulls you away from growing your negócios.

There is a better way to manage your money.

Knowing how to use Puzzle IO changes everything for your team.

It uses AI to automate your contabilidade in real time.

Follow this easy guide to setting up your account.

Junte-se a mais de 700.000 empresas que já fazem parte dessa rede. usando DextEconomize tempo em contabilidade e alcançar 99% de precisão nos dados. Comece seu teste gratuito hoje mesmo!

Puzzle IO Tutorial

Setting up Puzzle is simple. First, connect your bank accounts & credit cards.

The AI then automatically organizes your spending.

Review your dashboard to see real-time dados.

This process keeps your books clean without the usual manual work or stress.

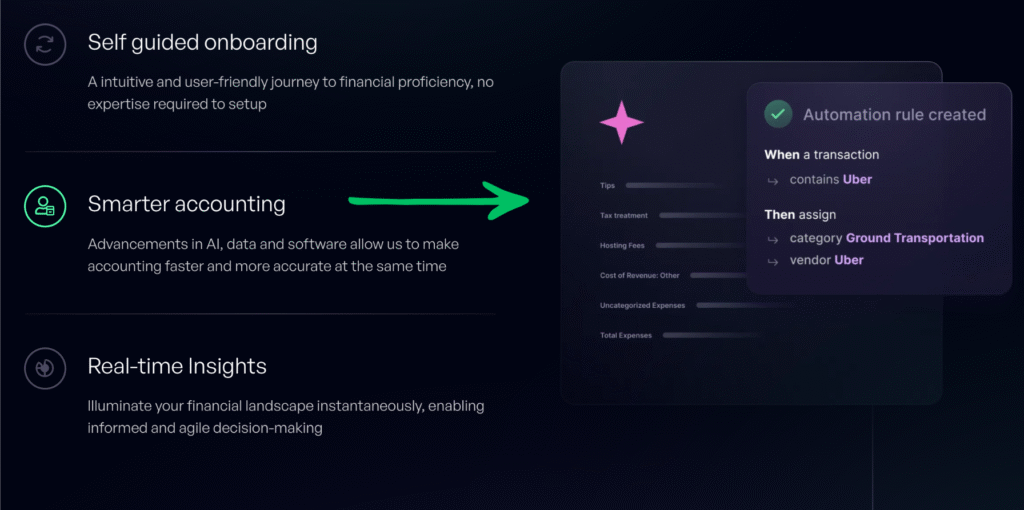

How to Use Smarter Accounting

Managing your general ledger used to be hard work.

You had to type in every single transaction manually.

This old way wasted time and led to mistakes.

Mais inteligente Contabilidade uses intelligent automation to do the heavy lifting for you.

It learns from your activity and imediatamente suggests the right categories.

This gives startup founders financial clarity without needing a professional bookkeeper to watch every penny.

Step 1: Connect Your Financial Accounts

First, you need to feed financial data into the system.

This allows the software to see what is happening with your money.

- Log in to your Puzzle dashboard.

- Click on the Connections tab in the settings menu.

- Select your bank (like Mercury or Brex) and credit card providers.

- Follow the secure prompts to link your accounts.

- The system pulls your transaction history automatically to start cash monitoring.

Step 2: Review AI Suggestions

The software is built specifically for early-stage companies.

It uses AI to guess where your money is going.

- Go to the General Ledger or Transactions feed.

- Look for the “Suggested” tag next to new expenses.

- The AI will guess if a purchase is for “Software,” “Viagem,” or “Meals.

- If the AI is right, you don’t need to do anything. This helps you save time on manual entry.

Step 3: Correct and Train the AI

Sometimes, the AI might make a mistake. You can fix it quickly.

This teaches the tool how to manage your startup’s finances more effectively.

- If a category looks wrong, click the transaction line.

- Select the correct category from the dropdown menu.

- Checked the box that says “Apply to similar future transactions.”

- This trains the system to be more accurate next time and helps ensure compliance.

Step 4: Set Up Autopilot Rules

You can stop doing repetitive tasks completely. Set up rules for recurring bills.

- Identify recurring bills, like your monthly server costs or rent.

- Create a Rule that tells Puzzle to always categorize “AWS” as “Hosting.”

- Save the rule to automate this task forever.

- This keeps your financial statements clean and gives you better real-time insights.

How to Use Financial Insights

Founders need to know their cash flow right now, not next month.

The Financial Insights feature gives you a live look at your money.

This helps you make faster decisions about hiring or spending.

You can use this platform to see your business’s current state without waiting.

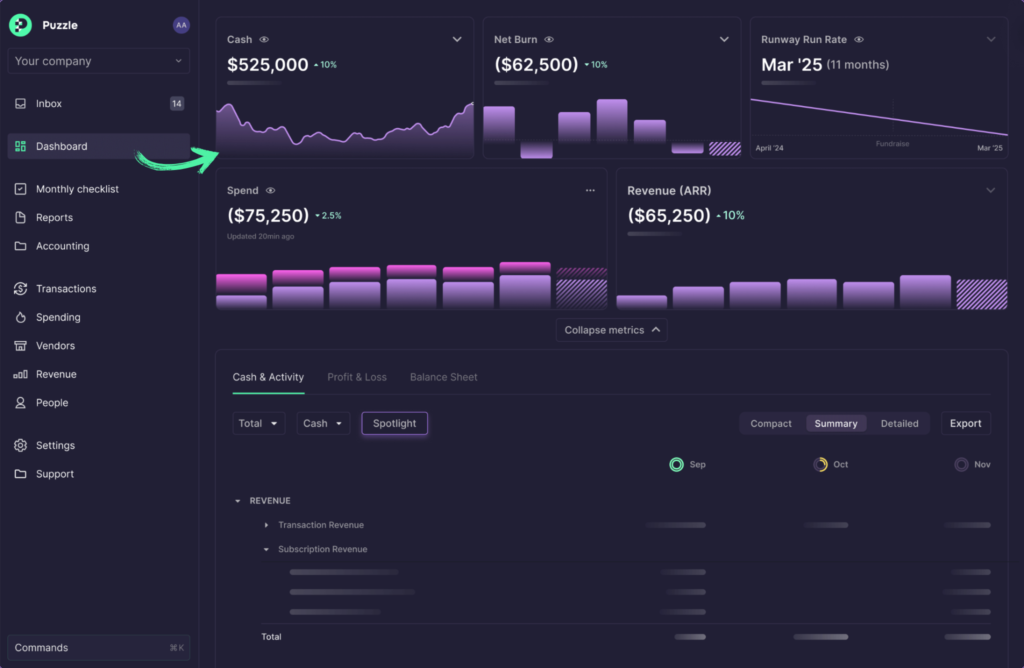

Step 1: Access the Main Dashboard

First, you need to see exactly how much money you have.

This helps you understand the value of your cash on hand.

- Log in to the Puzzle app.

- Click the Insights tab on the left sidebar to access your data.

- View your “Cash Balance” and “Burn Rate” widgets at the top.

- These numbers update instantly, so you always know your cash position.

Step 2: Drill Down into Burn Rate

Next, check where your money is going.

This helps your company keep expenses low.

- Click on the Burn Rate chart to expand it.

- Toggle between “Gross Burn” and “Net Burn.”

- Hover over specific months to see spikes in costs.

- Use this data to focus on areas where you can save money.

Step 3: Analyze Revenue Trends

You also need to track who is paying you. This tracks your sales success.

- Scroll down to the Revenue section.

- Filter by specific customer or product lines.

- See which clients are paying on time for your services.

- This helps you spot individual transactions that drive growth.

Step 4: Generate a PDF Report

Finally, share your results with others.

You don’t need to hire an accountant or bookkeeper to build these reports manually.

- Locate the Export button at the top right of the Insights page.

- Select “Monthly Financial Package” to create a plan for your stakeholders.

- Download the PDF to share with your investors or board members.

- The software uses automação and smart systems to do this for you.

- These tools make reportagem easy without any extra work.

How to Use the Partner Ecosystem

Seu software de contabilidade shouldn’t live on an island.

Puzzle connects with other tools you already use.

This feature adds new capabilities to your negócios.

It allows different apps to talk to each other.

Step 1: Open the Integrations Library

First, you need to find the right tools to connect.

- Navigate to Settings and select the integration menu.

- Explore the list of available partners, such as Gusto, Rippling, or Stripe.

- You will see options that support Payroll, Revenue, and Banks.

Step 2: Connect Your Payroll Provider

Next, link the system that pays your team. This saves you from typing in data by hand.

- Select your payroll tool from the list.

- Click Connect. It only takes a moment to sign in.

- Allow Puzzle to read your payroll details.

- This automatically pulls in salaries and taxes.

Step 3: Sync Revenue Data

Finally, make sure your sales numbers are correct.

- Find the vendor for your payments, like Stripe.

- Sync your sales data to keep your contabilidade accurate.

- Note that this helps you calculate your real burn pista.

- The system uses rules to sort fees and sales by date.

- Check this every week to keep your books clean.

Alternativas ao Puzzle IO

Aqui estão algumas alternativas populares ao Puzzle IO:

- Destreza: Este software tem como foco automatizar a extração de dados de recibos e faturas. Ele economiza tempo na entrada manual de dados, digitalizando sua documentação.

- Xero: Esta é uma plataforma de contabilidade em nuvem bastante popular. É uma alternativa aos recursos de contabilidade da Atera, oferecendo ferramentas para faturamento, conciliação bancária e controle de despesas.

- Sábio: A Sage, fornecedora renomada de software de gestão empresarial, oferece uma gama de soluções contábeis e financeiras que podem servir como alternativa ao módulo de gestão financeira da Atera.

- Zoho Books: Integrante do pacote Zoho, esta é uma ferramenta de contabilidade robusta para pequenas e médias empresas. Ela auxilia na emissão de faturas, controle de despesas e gestão de estoque, sendo uma ótima alternativa para quem precisa de ferramentas financeiras completas.

- Snyder: Este software tem como foco a sincronização das suas plataformas de e-commerce e de pagamento com o seu software de contabilidade. É uma alternativa útil para empresas que precisam automatizar o fluxo de dados dos canais de venda para a sua contabilidade.

- Fim de mês tranquilo: Esta ferramenta foi projetada especificamente para agilizar o processo de fechamento mensal. É uma alternativa especializada para empresas que desejam aprimorar e automatizar suas tarefas de relatórios financeiros e conciliação.

- Docyt: A Docyt é uma plataforma de contabilidade com inteligência artificial que automatiza fluxos de trabalho financeiros. Ela compete diretamente com os recursos de contabilidade com inteligência artificial da Atera, oferecendo dados em tempo real e gerenciamento automatizado de documentos.

- Me atualize: Esta é uma plataforma de gestão financeira pessoal. Embora não seja uma alternativa direta para empresas, oferece funcionalidades semelhantes, como o controle de despesas e faturas.

- Aceno: Este é um software financeiro gratuito bastante popular. É uma ótima opção para freelancers e pequenas empresas para emissão de faturas, contabilidade e digitalização de recibos.

- Acelerar: Uma ferramenta bastante conhecida para finanças pessoais e de pequenas empresas. Ela auxilia no orçamento, controle de gastos e planejamento financeiro.

- Hubdoc: Este software é uma ferramenta de gerenciamento de documentos. Ele busca automaticamente seus documentos financeiros e os sincroniza com seu software de contabilidade.

- Despesar: Esta plataforma é focada na gestão de despesas. É ótima para digitalizar recibos, viagens a negócios e criar relatórios de despesas.

- QuickBooks: Um dos softwares de contabilidade mais utilizados. O QuickBooks é uma excelente alternativa que oferece um conjunto completo de ferramentas para gestão financeira.

- Entrada automática: Esta ferramenta automatiza a entrada de dados. É uma boa alternativa às funcionalidades de captura de recibos e faturas do Atera.

- FreshBooks: Este programa é ótimo para faturamento e contabilidade. É popular entre freelancers e pequenas empresas que precisam de uma maneira simples de controlar tempo e despesas.

- NetSuite: Uma suíte de gestão empresarial completa e poderosa baseada na nuvem. O NetSuite é uma alternativa para empresas maiores que precisam de mais do que apenas gestão financeira.

Comparação de Puzzle IO

Analisamos como o Puzzle IO se compara a outras ferramentas de contabilidade. Aqui está uma breve descrição de seus principais recursos:

- Puzzle IO vs Xero: O Xero oferece amplas funcionalidades de contabilidade com integrações robustas.

- Puzzle IO vs Dext: A Puzzle IO se destaca em análises e previsões financeiras baseadas em IA..

- Puzzle IO vs Snyder: O Synder se destaca na sincronização de dados de vendas e pagamentos.

- Puzzle IO vs Easy Month End: O Easy Month End simplifica o processo de fechamento financeiro.

- Puzzle IO vs Docyt: A Docyt utiliza inteligência artificial para automatizar tarefas de contabilidade.

- Puzzle IO vs RefreshMe: O RefreshMe concentra-se no monitoramento em tempo real do desempenho financeiro.

- Puzzle IO vs Sage: A Sage oferece soluções contábeis robustas para empresas de diversos portes.

- Puzzle IO vs Zoho Books: O Zoho Books oferece contabilidade acessível com CRM integração.

- Puzzle IO vs Wave: A Wave oferece software de contabilidade gratuito para pequenas empresas.

- Puzzle IO vs Quicken: O Quicken é conhecido por sua ferramenta de gestão financeira para pessoas físicas e pequenas empresas.

- Puzzle IO vs Hubdoc: A Hubdoc é especializada em coletar documentos e extrair dados..

- Puzzle IO vs Expensify: Expensify oferece relatórios e gerenciamento de despesas completos.

- Puzzle IO vs QuickBooks: O QuickBooks é uma escolha popular para a contabilidade de pequenas empresas.

- Puzzle IO vs Entrada Automática: O AutoEntry automatiza a entrada de dados a partir de faturas e recibos.

- Puzzle IO vs FreshBooks: O FreshBooks foi desenvolvido especificamente para faturamento de empresas prestadoras de serviços.

- Puzzle IO vs NetSuite: O NetSuite oferece um conjunto completo de soluções para planejamento de recursos empresariais.

Conclusão

You now understand how to use Puzzle io to manage your money.

This tool is perfect for AI startups that need to move fast.

It gives you actionable insights so that you can make smart choices instantly.

You can check your revenue insights and cash burn runway at any time.

This keeps your financial health strong as you grow.

The software even handles hard tasks like accrual contabilidade automaticamente.

There is a huge demand for simple financial tools right now.

Start using Puzzle io to save time and focus on building your business.

Perguntas frequentes

What is puzzle accounting software?

Puzzle is an AI-powered accounting tool designed for startups. It automates data entry, categorizes expenses, and provides real-time financial insights to help founders manage their money easily.

Is puzzle an ERP?

No, Puzzle is not a full Enterprise Resource Planning (ERP) system. It focuses specifically on core accounting, general ledger management, and financial reporting for early-stage companies.

Can you use AI to solve puzzles?

Yes, Puzzle io uses advanced AI to solve accounting challenges. It automatically identifies merchants, categorizes transactions, and learns from your corrections to improve accuracy over time.

How to solve the puzzle easily?

To solve your accounting puzzle, connect your bank accounts to the software. The Autopilot feature organizes your data, leaving you with just a few items to review.

How to build a puzzle step by step?

Building your financial books is easy. First, link your accounts. Second, review AI suggestions. Third, set up rules for recurring costs. This creates a complete financial picture.

More Facts about Puzzle

- Simple Dashboard: Puzzle gives you a single, easy-to-read screen to checkthe health of your company’s finances.

- Built for Startups: This software is made just for startups and handles the two main types of accounting (cash and accrual) automatically.

- Easier than QuickBooks: Many people find Puzzle more modern and easier to understand than QuickBooks.

- Why People Switch: Users often leave QuickBooks for Puzzle to avoid high costs, confusing screens, and hard-to-use features.

- QuickBooks is Still Big: Even though Puzzle is easier to use, QuickBooks remains the industry leader because it offers a vast range of features and integrations.

- Opção gratuita: Puzzle is popular because it offers a free plan for companies spending less than $5,000 a month.

- Fast Setup: Switching from QuickBooks to Puzzle is simple and takes just a few minutes.

- Ajuda de especialistas: You can invite bookkeepers or finance experts into the software to help you manage your money.

- Drafts in Minutes: When you first join, the software can create a rough draft of your financial reports in about 15 minutes.

- Metrics Tracking: The dashboard lets you track key metrics, such as how much cash you have and how quickly you are spending it.

- Bom Segurança: Puzzle uses strong security measures, such as encryption, to keep your money and data safe.

- Central de Ajuda: A library of articles and answers to common questions for users who need help.

- Web-Based: You use Puzzle primarily through a web browser on your computer or phone, not a downloaded program.

- Clean Look: Users really like that the software looks clean and simple to use.

- Real-Time Sync: A big plus is that Puzzle connects to your bank account instantly, so you don’t have to type in numbers by hand.

- AI Concerns: Some users worry that the computer (AI) tries to organize transactions on its own and sometimes makes mistakes that are hard to fix.

- Support Issues: Some users have reported that customer support and the setup process can be frustrating.

- Feels New: Some people say the software feels like it is still in a testing phase (“beta”) and is missing some basic features.

- Due Diligence: The software gives you instant access to the financial reports investors need to review before investing.

- Automates Boring Work: Puzzle does the repetitive, boring accounting tasks for you automatically.

- Investor View: It helps founders move from a messy startup style to a more organized, professional way of running a business.

- Monthly Checklist: The software includes a checklist to help you ensure all your accounts match at the end of the month.

Facts about Puzzle (The Workflow & Process Tool)

- Responsibility Cards: This tool creates cards that show new team members exactly what tasks they are responsible for.

- Visual Database: It uses a visual system to track how well work is flowing and spot where things are getting stuck.

- Project Breakdowns: Users can add sections and steps to their workspace to break big projects into smaller pieces.

- Syncs with Tools: The platform integrates with other modern tools to eliminate manual work.

- Organized Workspaces: It organizes projects into separate areas, keeping things clear and efficient.

- Detailed Notes: You can add notes, links, and training documents to the side of your project view for extra detail.

- Visual Management: A tool that helps teams see and manage their daily processes.

- Define Roles: It lets you clearly say who “owns” a task so everyone knows who is responsible.

- Cost Tracking: You can see exactly how much every step in your process costs, which helps you decide what to fix first.

- Team Chat: Teams can leave comments on specific steps to discuss work and stay on the same page.

- Step-by-Step Maps: Users can create visual maps that show how a process works, step by step.

- ROI Tracking: The tool helps you track the return on investment (ROI) for each tool and step you use.