Struggling to manage your business finances?

Most small business owners feel buried under a mountain of messy receipts and unpaid invoices.

It is stressful and takes forever to track every dollar.

If you get it wrong, you lose money.

It feels like you are drowning in paperwork instead of doing the work you love.

Our guide shows you exactly how to use FreshBooks to automate your billing and save hours of time.

You will learn to send invoices in seconds.

Ready to save 90% of your time on paperwork? Join over 3,000 firms that use Saisie automatique to process documents with 99% accuracy. Start your free trial today and automate your first 25 documents for free!

FreshBooks Tutorial

Setting up your account is the first step toward easier billing.

Start by adding your company logo and entreprise details.

This makes your invoices look professional.

Next, connect your bank account to track every dollar automatically without manual data entry.

How to Use Project Management

Managing your work can be hard.

If you do not track what you do, you might lose money.

La plupart logiciel de comptabilité is complicated and confusing.

But your FreshBooks account makes it simple.

You can keep your team and your money organized in one place.

This helps your cash flow stay positive so you can keep growing.

Step 1: Create a New Project

First, you need a specific place to put your work details.

This sets you up for easy financial reporting plus tard.

- Go to the “Projects” tab on your dashboard.

- Click the button to make a new project.

- Give it a name and pick a client.

- Decide if you charge a flat rate or by the hour.

This is much easier than other comptabilité logiciel.

You get everything set up correctly right from the start.

Step 2: Invite Your Team Members

You might have people helping you with the work.

You need to invite team members to the project so they know exactly what to do.

- Open your project settings inside the project you just made.

- Add your staff or contractors by entering their email addresses.

- Pick what they are allowed to see to keep sensitive info safe.

Your team can even use the mobile apps to check in from anywhere.

This keeps everyone on the same page without endless meetings.

Step 3: Track Time and Expenses

Now you need to log the work. This is how you ensure you get paid correctly.

- Use the built-in timer to track time while you work on tasks.

- Add new expenses by snapping a photo of the receipt.

- Sort these costs into expense categories so you stay organized.

How to Use Payment Management

Getting paid is the best part of the job.

But keeping track of who paid you and who didn’t is hard work.

The FreshBooks platform solves this problem.

It is the right software to help you manage your money without stress.

In this comprehensive guide, we will look at how to set up payments so you can get cash in the bank faster.

Step 1: Connect Your Bank Account

You need to link your bank to the system first.

This lets you see all your financial information on your computer screen.

- Go to settings to connect FreshBooks to your bank.

- Enter your basic information to verify it is really you.

- This is much safer than emailing csv files to your accountant.

- Update your company profile and contact details so everything matches.

Once this is done, you don’t have to create messy journal entries manually anymore.

The system does it for you.

Step 2: Enable Online Payments

You want to make it easy for customers to pay you.

FreshBooks offers great ways to accept money online.

- Turn on the option to accept credit cards.

- Connect PayPal if your clients prefer to use that.

- When a client opens an invoice, they can just sign in and pay immédiatement.

This works better than other tools because it is all in one place.

You can even use these records later if you need to run payroll for your team.

Step 3: Set Up Checkout Links

Sometimes you need to bill a new client quickly. You can use helpful tools to automate this.

- Use recurring templates if you bill the same amount every month.

- Set up automatic late fees so people pay you on time.

- Check your reports and profit and loss statements to see how much you made.

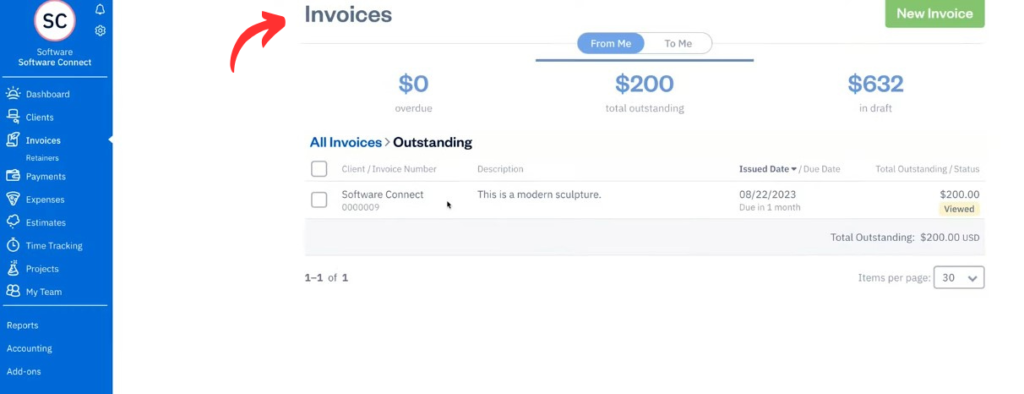

How to Use Custom Invoicing

Your invoice is how you request payment. It should look professional.

This is very important for freelancers who want to be taken seriously.

If your invoices look good, clients trust you more.

This tool takes the hard work out of comptabilité so you can focused on earning more revenue.

Step 1: Choose Your Template

You want your bill to match your style.

You can find all the features you need right inside the software.

- Start at your main dashboard and click on “Invoices.”

- Pick a template style that looks clean and simple.

- Upload your logo to make it look official.

You have full access to change the colors and fonts.

It is easy to make it look just right.

Step 2: Add Line Items and Taxes

Now you need to list what you did. This ensures you correctly count all your income.

- Add a line for each service or product you sold.

- Write a clear description so the client knows what they are paying for.

- Add the tax rate so the math is done for you.

This helps you keep your records straight without extra math. It is one of the best ways to keep your entreprise organisé.

Step 3: Send and Automate Reminders

Sending the bill is the final step. You want to make it easy for your client to pay.

- Check the preview to make sure everything is correct.

- Send it by email directly from the system.

- Turn on automatic reminders so you don’t have to chase people for money.

Your client can click a link to pay.

They usually do not need a password to view the bill.

This makes it fast and easy for you to get paid.

Alternatives to FreshBooks

Voici les Alternatives à FreshBooks avec une extension sur une ligne pour chacun :

- Puzzle IO: Ce logiciel est axé sur la planification financière basée sur l'intelligence artificielle.

- Dext: Cet outil est idéal pour la capture de documents et l'extraction de données.

- Xero: Il s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises.

- Synder: Elle est spécialisée dans la synchronisation des données de commerce électronique et de paiement avec les logiciels comptables.

- Fin de mois facile: Ce logiciel est conçu pour simplifier vos tâches financières de fin de mois.

- Docyt: Elle utilise l'intelligence artificielle pour la comptabilité et automatise les flux de travail financiers.

- Sage: Il s'agit d'une suite logicielle complète pour la gestion d'entreprise et la comptabilité.

- Livres Zoho: Cet outil de comptabilité en ligne est réputé pour son prix abordable et son adéquation aux petites entreprises.

- Vague: Cette option propose un logiciel de comptabilité gratuit pour les petites entreprises.

- Accélérer: Un outil populaire de gestion des finances personnelles qui aide à organiser les budgets.

- Hubdoc: Elle est spécialisée dans la collecte et l'organisation des documents financiers pour la comptabilité.

- Expensify: Cette application est axée sur la gestion des dépenses, facilitant le suivi et la soumission des reçus.

- QuickBooks: Un logiciel de comptabilité très connu qui aide les entreprises dans tous leurs besoins, de la facturation à la paie.

- Saisie automatique: Cet outil automatise la saisie de données en scannant et en analysant des documents tels que les factures et les reçus.

- NetSuite: Une suite logicielle de gestion d'entreprise puissante et complète, basée sur le cloud, pour les grandes entreprises.

Freshbooks Compared

- FreshBooks contre Puzzle IOCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- FreshBooks contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- FreshBooks contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- FreshBooks contre SnyderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- FreshBooks vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- FreshBooks contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- FreshBooks contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- FreshBooks contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- FreshBooks contre WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- FreshBooks contre QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- FreshBooks vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- FreshBooks contre ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- FreshBooks contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- FreshBooks vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- FreshBooks contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Conclusion

You now know how to use FreshBooks to run your business better.

It makes managing expenses very simple.

You do not need to create journal entries manually anymore.

Just connect your payment processors to get paid faster.

You can also set up to your automatic payment reminders so you never have to ask for money.

This keeps your balance sheet healthy and accurate.

If you have any questions, the support team is ready with helpful tips.

You can focus on your work instead of paperwork.

Start using it today to save time and grow your business.

Foire aux questions

How much do FreshBooks cost monthly?

Regular pricing typically starts at 19 $/mois for the Lite plan, 33 $/mois for Plus, and 60 $/mois for Premium. However, they frequently offer deep discounts (like 70% off) for new users. Adding team members costs an additional 11 $/utilisateur/mois.

What are the downsides of FreshBooks?

Le Lite plan is extremely restrictive, limiting you to just 5 billable clients. Additionally, it lacks the deep inventory management tools found in QuickBooks, and essential features like Payroll are paid add-ons rather than built-in.

Is FreshBooks easier to use than QuickBooks?

Generally, yes. FreshBooks is specifically designed for freelancers and service businesses, prioritizing a clean, jargon-free interface. QuickBooks is a robust accounting tool, but often feels “clunkier” and has a steeper learning curve for non-accountants.

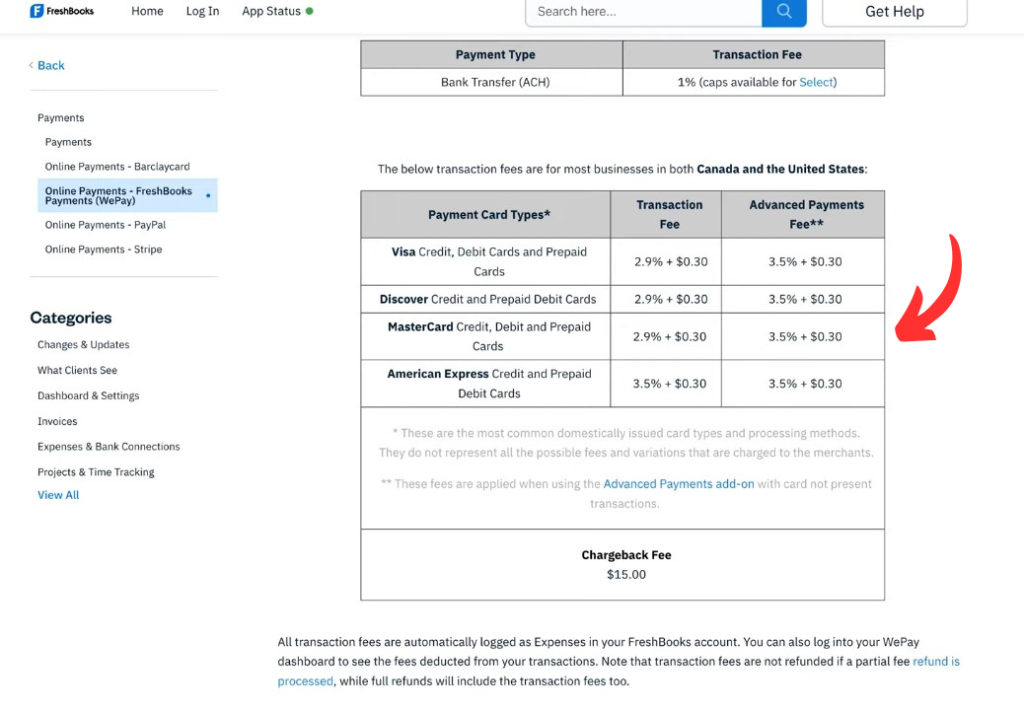

How much does FreshBooks charge per transaction?

If you use FreshBooks Payments, standard credit cards (Visa/Mastercard) cost 2.9% + $0.30 per transaction. Bank transfers (ACH) are cheaper at 1%, while AMEX transactions are higher at 3.5% + $0.30.

Does FreshBooks have a chart of accounts?

Oui, but with a caveat. The customizable Chart of Accounts is available only on the Plus, Premium, and Select plans. It allows you to organize assets, liabilities, equity, and expenses for accurate double-entry accounting.

Is FreshBooks easy to learn?

Absolutely. It is widely considered one of the most user-friendly accounting platforms on the market. The dashboard is intuitive, allowing most users to send invoices and track expenses within minutes of signing up, without needing accounting knowledge.

How do FreshBooks work?

It is a cloud-based accounting platform. You connect your bank accounts to automatically import and categorize expenses. From the dashboard or mobile app, you can create professional invoices, track billable time, and generate financial reports instantly.

More Facts about FreshBooks

- FreshBooks is online accounting software built for petite entreprise propriétaires et travailleurs indépendants.

- You can easily set up your account by entering your business name and email.

- The software lets you add your company logo and colors to make invoices look professional.

- You can connect your bank account to track incoming and outgoing money automatically.

- There is a main dashboard that shows you a summary of your bills and unpaid invoices.

- You can run reports, such as profit-and-loss statements, to see how your business is doing.

- If you get stuck, there is a help center and customer support team ready to answer questions.

- You can change your settings at any time to update your profile or preferences.

- After entering your info, you click “Save” to keep your changes.

- You can invite your team members to help manage the account.

- It is possible to upload a list of clients or vendors from a spreadsheet file.

- You can save photos of your receipts to keep track of what you spend.

- The software lets you create new invoices quickly by entering who needs to pay and what for.

- You can email invoices to people or have FreshBooks send a paper copy by mail.

- FreshBooks can send automatic reminders to clients so they don’t forget to pay you.

- Using this software helps you to save time on billing and paperwork.

- The system helps match your bank transactions to your records to ensure the math is correct.

- You can also use the mobile app to snap pictures of receipts and read the numbers automatically.

- FreshBooks uses professional accounting methods to keep your records accurate.

- You can use the software on your iPhone or Android phone.

- It is designed for people who are not accountants, so it is easy to use.

- Users often get paid faster because the software makes paying easy for clients.

- The tools help you stay organized and keep all your business info in one place.

- You can invite clients to view projects and collaborate within the software.

- FreshBooks integrates with other tools you might use, like Gusto for payroll.

- It also works with apps for online stores, inventory, and project management.

- You can share a direct link on réseaux sociaux or your website to get paid without sending an invoice.