Keeping track of paper receipts is a big hassle.

Do you hate stuffing crumpled paper into your pockets? We all do.

If you lose those receipts, you actually lose your own money.

That stress adds up quickly. Tax time becomes a nightmare, and nobody wants that.

But there is an easier way to handle it.

Expensify automates the whole messy process for you. It scans receipts instantáneamente.

Then it automatically builds your reports.

Stop wasting your valuable time on paperwork. Learn how to use Expensify right now.

Save 83% of your time on paperwork. Small teams can save $37,859 by switching to Expensify. Join 15 million users and start your free trial today!

Expensify Tutorial

Mastering Expensify is simple. You do not need technical skills.

We will guide you through the process.

First, download the mobile app. Next, snap a picture of any receipt.

SmartScan reads the numbers automatically.

Finally, submit your report for approval.

It really is that easy to manage your money.

How to Use Expense Management Feature

Managing your money should not be a full-time job.

With an expense management platform like Expensify, you can stop worrying about lost receipts.

This system helps you manage expenses without the stress of manual datos entrada.

You can keep your financial data organized and up to date with just a few taps.

Step 1: Capture Your Receipts with SmartScan Technology

The first step in Expensify is getting your receipts into the system.

You don’t need to type in prices or dates yourself.

- Open the app on your mobile device.

- Use the smart scan feature to take a photo of your paper receipt.

- If you have a digital receipt, forward it from your email or phone number directly to the app.

- The AI will read the receipt and fill in the details for you.

Step 2: Organize with Expense Categories and Mileage

Once your receipts are in, you need to tell the system what they are for.

This keeps your financial operations running smoothly and helps you identify spending trends más tarde.

- Assign each item to a specific expense category, such as “Viajar,” “Meals,” or “Office Supplies.

- Use the app to track mileage if you drive for work; it uses GPS to calculate distance automatically.

- Check that each entry complies with your company policies to avoid issues later.

Step 3: Use Approval Workflows and Syncing

The final part of the expense management process is getting your money back.

Expensify connects to your contabilidad software to make this fast.

- Submit your items into tailored reports that show exactly what you spent.

- The system uses approval workflows to send your report to the right manager.

- Once they approve expenses, the data syncs with your company’s books.

- You get paid back directly into your bank account.

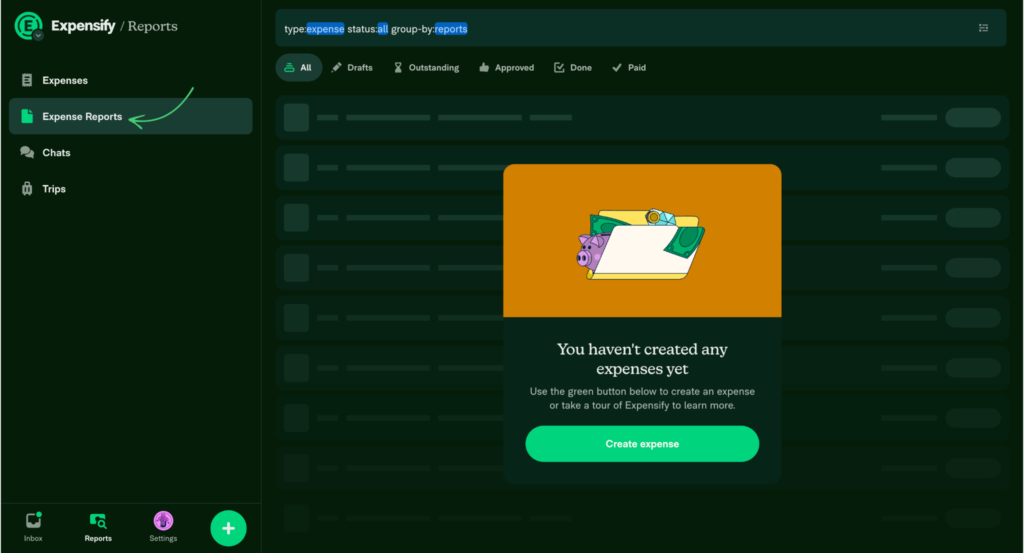

How to Use Expensify Expense Reports

Creating reports is the best way for businesses and employees to stay organized.

This platform makes it easy to group your spending so you can get reimbursed quickly.

You can use your own device to handle everything while you are away from the office.

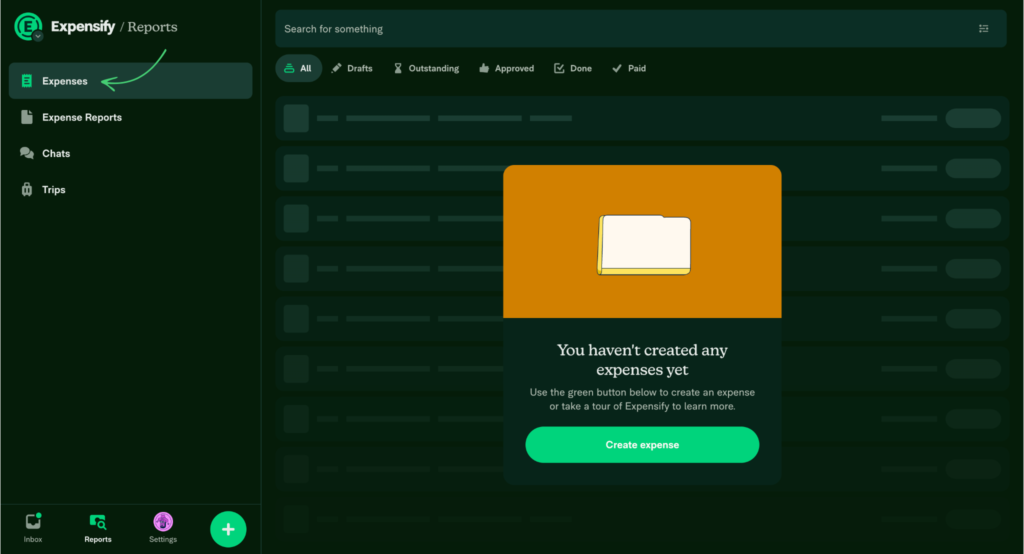

Step 1: Create a New Report Folder

The first step is creating a place for your receipts.

You want to keep things neat, so there are no errors when it is time for a manager to sign off on your money.

- Open the Expensify system and go to the reports tab.

- Click to create a new report and give it a clear name based on projects or the current date.

- You can access your past reports here as well if you need to check old data.

- If you use an Expensify card, your transactions will show up here automatically to streamline the process.

Step 2: Add Expenses and Check Rules

Now you need to put your receipts into the report.

You musensure thatre everythincomplies withws the rules your company has set.

This keeps everyone in compliance and protects the company’s funds.

- Pick the individual expenses or invoices you want to include.

- Move them into your new report folder.

- Look for any red flags from the system that show a mistake.

- Users can see if they spent too much in certain departments before they hit submit.

Step 3: Submit for Approval

Once your report looks good, it is time to send it away.

This functionality is what makes Expensify so helpful for users who want to save time.

- Review the final total to make sure it matches your actual spending.

- Hit the “Submit” button to send it to the right person.

- Incluso puedes encontrar YouTube tutorials if you get stuck on a specific step.

- Once you establish this habit, you won’t have to worry about losing money again.

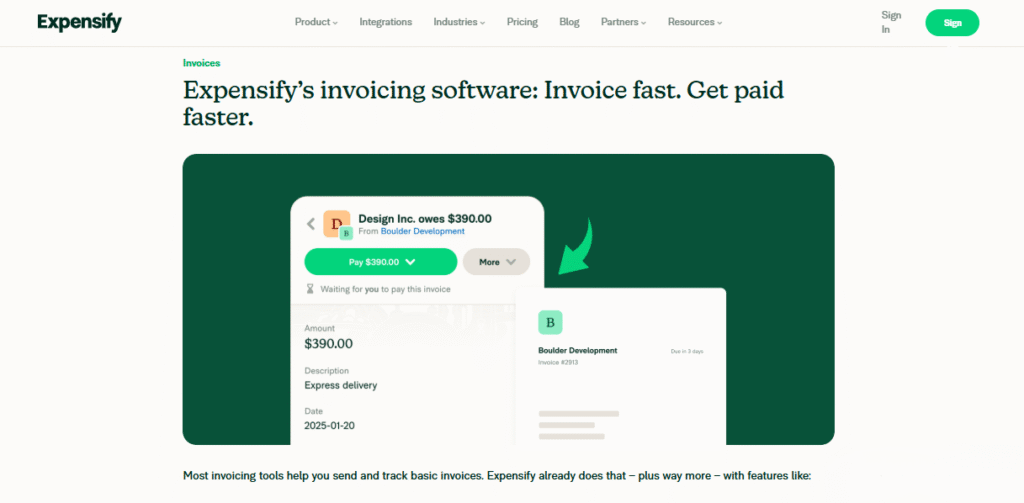

How to Use Expensify Bill Pay and Invoicing

Managing money coming in and going out is vital for any negocio.

Expensify helps you handle bills and send invoices without the stress of messy spreadsheets.

You can manage everything from one simple screen.

Step 1: Set Up Your Business Billing Profile

Before you send your first bill, you need to tell the system who you are. This ensures your documents look professional to your clients and vendors.

- Go to your settings and enter your legal negocio name and tax ID.

- Upload your company logo so it appears on every invoice you send.

- Link your business bank account so you can receive payments or pay vendors directly.

Step 2: Create and Send a Professional Invoice

Getting paid for your hard work should be the easy part. You can create an invoice in seconds and send it to your client’s bandeja de entrada.

- Click on “New Invoice” and type in your client’s email address.

- Add line items for the work you did or the products you sold.

- Set a due date for the payment and hit the “Send” button.

- The system will track if the client has opened or paid the invoice yet.

Step 3: Pay Company Bills Electronically

Paying your own bills is just as simple as getting paid. You can keep all your outgoing money organized in one place.

- Forward any bills you receive to your unique Expensify email address.

- Review the bill details that the system automatically pulls from the document.

- Use the approval workflow to make sure the right person okays the spend.

- Click to pay the vendor via ACH or credit card without leaving the app.

Alternatives to Expensify

- Dext: Este software se centra en automatizar la extracción de datos de recibos y facturas. Ahorra tiempo en la entrada manual de datos al digitalizar su documentación.

- Docyt: Esta plataforma se basa en IA para automatizar la contabilidad y las tareas administrativas. Docyt busca eliminar la introducción manual de datos y proporcionar información financiera en tiempo real, lo que la convierte en una potente alternativa para las empresas que buscan una solución altamente automatizada.

- SabioUna plataforma potente que ofrece soluciones para empresas de todos los tamaños. Es una alternativa sólida, especialmente para empresas con necesidades financieras más complejas.

- Xero: Esta es una popular plataforma de contabilidad en la nube. Es una alternativa a las funciones de contabilidad de Atera, ofreciendo herramientas para facturación, conciliación bancaria y seguimiento de gastos.

- Fin de mes fácil: Este software especializado está diseñado específicamente para simplificar el proceso de cierre financiero. Se integra con otras plataformas de contabilidad como QuickBooks y Xero para garantizar un cierre de mes fluido y sencillo.

- Rompecabezas io: Este es un software de contabilidad moderno, diseñado específicamente para startups. Facilita la generación de informes financieros y la automatización, ofreciendo información en tiempo real y un enfoque en la optimización de la contabilidad para un cierre más rápido.

- Sabio: Sage, un conocido proveedor de software de gestión empresarial, ofrece una gama de soluciones contables y financieras que pueden servir como alternativa al módulo de gestión financiera de Atera.

- Synder: Este software se centra en sincronizar sus plataformas de comercio electrónico y pago con su software de contabilidad. Es una alternativa útil para empresas que necesitan automatizar el flujo de datos desde los canales de venta hasta sus libros contables.

- Fin de mes fácil: Esta herramienta está diseñada específicamente para agilizar el proceso de cierre de mes. Es una alternativa especializada para empresas que desean mejorar y automatizar sus informes financieros y tareas de conciliación.

- Docyt: Docyt, una plataforma de contabilidad basada en IA, automatiza los flujos de trabajo financieros. Competirá directamente con las funciones de contabilidad basadas en IA de Atera, ofreciendo datos en tiempo real y gestión automatizada de documentos.

- Refrescarme: Esta es una plataforma de gestión financiera personal. Si bien no es una alternativa empresarial directa, ofrece funciones similares, como el seguimiento de gastos y facturas.

- Ola: Este es un popular software financiero gratuito. Es una excelente opción para autónomos y pequeñas empresas para la facturación, la contabilidad y el escaneo de recibos.

- Acelerar: Una herramienta reconocida para finanzas personales y de pequeñas empresas. Facilita la elaboración de presupuestos, el control de gastos y la planificación financiera.

- Hubdoc: Este software es una herramienta de gestión documental. Obtiene automáticamente sus documentos financieros y los sincroniza con su software de contabilidad.

- QuickBooks: Uno de los programas de contabilidad más utilizados. QuickBooks es una alternativa potente que ofrece un conjunto completo de herramientas para la gestión financiera.

- Entrada automática: Esta herramienta automatiza la entrada de datos. Es una buena alternativa a las funciones de captura de recibos y facturas de Atera.

- FreshBooks: Este programa es ideal para facturación y contabilidad. Es popular entre autónomos y pequeñas empresas que necesitan una forma sencilla de controlar el tiempo y los gastos.

- NetSuite: Una potente y completa suite de gestión empresarial basada en la nube. NetSuite es una alternativa para grandes empresas que necesitan más que solo gestión financiera.

Comparación de Expensify

- Expensify vs PuzzleEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Expensify frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Expensify frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Expensify frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Expensify vs. Fin de mes fácilEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Expensify frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Expensify frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Expensify frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Expensify frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- Expensify frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Expensify frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Expensify vs. AutoEntryEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Expensify frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Expensify frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Conclusión

Learning how to use Expensify is a smart move for your work life.

You can say goodbye to lost receipts and messy piles of paper.

The simple interface makes it easy for any individual to get started.

Just select the features you need, and the dashboard will show you your spending trends.

You can sync your bank accountdirectly witho the system.

This helps reduce mistakes and ensure total accuracy.

Your manager will love how fast you follow company policies.

Do not let the complexities of business viajar slow you down anymore.

It only takes one tap to start. You can level up your workflow today.

Join the many people who focus on their work instead of paperwork.

Start by starting your first report right now.

Preguntas frecuentes

Is Expensify no longer free?

Expensify still offers a Plan gratuito for individuals, limited to 25 SmartScans per month. For businesses, paid plans start at roughly $5 per user/month (Collect plan) if you use the Expensify Card. Without the card, prices are higher (approx. $10-$18/user), so checking the latest bundled pricing is essential.

What are the pros and cons of Expensify?

Pros: Industry-leading “SmartScan” technology, seamless integration with QuickBooks/Xero, and fast next-day reimbursement. Contras: The pricing model can be confusing (often requiring their corporate card for the best rates), and customer support is primarily chat-based rather than phone-based.

What is the difference between QuickBooks and Expensify?

Piensa en QuickBooks as your complete financial engine (invoicing, payroll, P&L), while Expensificar is a specialized fuel injector. Expensify handles the nitty-gritty of receipt scanning and employee reimbursements, then syncs that clean data directly into QuickBooks for final contabilidad.

Is Expensify good for small business?

Absolutely. It is specifically designed to scale from trabajadores autónomos to SMBs. The “Collect” plan automates receipt tracking and approval workflows, which saves small teams hours of manual data entry and simplifies tax season significantly.

How do I submit expenses using Expensify?

The easiest method is using the mobile app to snap a photo of your receipt; SmartScan automatically extracts the merchant, date, and amount. Alternatively, you can forward email receipts to receipts@expensify.com or manually enter details via the web dashboard.

Is Expensify easy to learn?

Yes, it boasts a “mobile-first” design that is highly intuitive. Most users master the core loop—snap a photo, create a report, hit submit—within minutes. The platform minimizes buttons and relies on automatización para hacer el trabajo pesado.

How do I get started with Expensify?

Simply download the app or sign up on their website to create a free account. You can immediately start scanning receipts. For business use, connect your software de contabilidad (like Xero or NetSuite) and invite employees to begin automating their expense reports.

More Facts about Expensify

- Pick Your Account: When you sign up, you can choose between a personal account or your business account.

- El tablero de instrumentos: After you join, you get a main screen that shows your recent spending and reports that need work.

- Hazlo tuyo: You can create your own spending categories and rules when you set up your account.

- Mistake Finder: The app automatically points out if you break a rule or enter the same receipt twice.

- Get Paid Back: You can send your reports through the app to get reimbursed for work costs.

- Approval Steps: Bosses can review and approve your spending before any money is paid out.

- Extra Seguridad: You can also enable two-factor authentication to keep your account even safer.

- SmartScan: You can take a picture of a receipt, and the app “reads” it to find the date, store name, and price.

- Work Anywhere: The mobile app lets you do almost everything on your phone, even without an internet connection. connection

- Easy Sending: You can build and send whole reports right from your smartphone.

- Email Receipts: You can forward receipts from your email to the app, and it will process them for you.

- Travel Help: The app integrates with travel tools so you can book trips and easily track costs.

- Automatic Work: Expensify handles the hard parts, from scanning the paper to putting money in your bank.

- Right Person, Right Time: The system knows exactly which manager should see your report based on company rules.

- Rule Watcher: The app continuously checks your spending against your company’s rules to ensure everything is in order.

- Group Workspace: You can create a “Workspace” to keep your team’s expenses organized.

- Accounting Links: Expensify talks to tools like QuickBooks and Xero to keep the math correct.

- Consejo profesional: For the best results, scan receipts as soon as you get them and use the same names for your categories.

- Card Links: Link your own credit card so your purchases appear in the app automatically.

- The Expensify Card: Using their special card can give you 2% back on your spending and even lower your monthly bill by half.

- Distance Tracker: The app uses GPS to see how far you drove for work and calculates how much money you should get back.

- Live Spending: You can watch how much money is being spent in real-time on your dashboard.

- Budgets: You can set a spending limit and receive a warning if you exceed it.

- Scheduled Submit: A feature that collects your receipts and automatically sends them to your boss on a set day.