Vous en avez assez de passer des heures à saisir des factures et des reçus ?

C'est vraiment pénible, n'est-ce pas ?

Vous cherchez un moyen de gagner du temps et de vous recentrer sur la gestion de votre entreprise. entreprise.

Des outils formidables peuvent vous aider à vous passer du manuel. données entrée.

Deux grands noms que vous avez peut-être entendus sont Xero et AutoEntry.

Aperçu

Nous avons passé du temps à tester Xero et AutoEntry en profondeur.

Observer comment ils gèrent la réalité comptabilité tâches.

Cette comparaison est basée sur notre expérience pratique, qui consiste à examiner de près les fonctionnalités de chaque logiciel et ses performances.

Rejoignez plus de 2 millions d'entreprises qui utilisent le logiciel de comptabilité en ligne Xero. Découvrez dès maintenant ses puissantes fonctionnalités de facturation !

Tarification : Il propose un essai gratuit. L'abonnement payant commence à 29 $/mois.

Caractéristiques principales :

- Rapprochement bancaire

- Facturation

- Signalement

Arrêtez de perdre plus de 10 heures par semaine à saisir manuellement des données. Découvrez comment la saisie automatique a réduit de 40 % le temps de traitement des factures. Sage utilisateurs.

Tarification : Il propose un essai gratuit. L'abonnement payant commence à 12 $/mois.

Caractéristiques principales :

- Extraction de données

- Numérisation des reçus

- Automatisation des fournisseurs

Qu'est-ce que Xero ?

Alors, quel est le problème avec Xero ?

Il s'agit essentiellement d'une plateforme en ligne pour gérer toutes les finances de votre entreprise.

Considérez-le comme un classeur numérique, un guichetier et un service de rapports. générateur Tout en un.

Cela vous permet de suivre vos dépenses sans être submergé par la paperasse.

Découvrez également nos favoris Alternatives à Xero…

Notre avis

Rejoignez plus de 2 millions d'entreprises utilisation de Xero Logiciel de comptabilité. Découvrez dès maintenant ses puissantes fonctionnalités de facturation !

Principaux avantages

- Rapprochement bancaire automatisé

- Facturation et paiements en ligne

- Gestion des factures

- Intégration de la paie

- Rapports et analyses

Tarification

- Démarreur: 29 $/mois.

- Standard: 46 $/mois.

- Prime: 69 $/mois.

Avantages

Cons

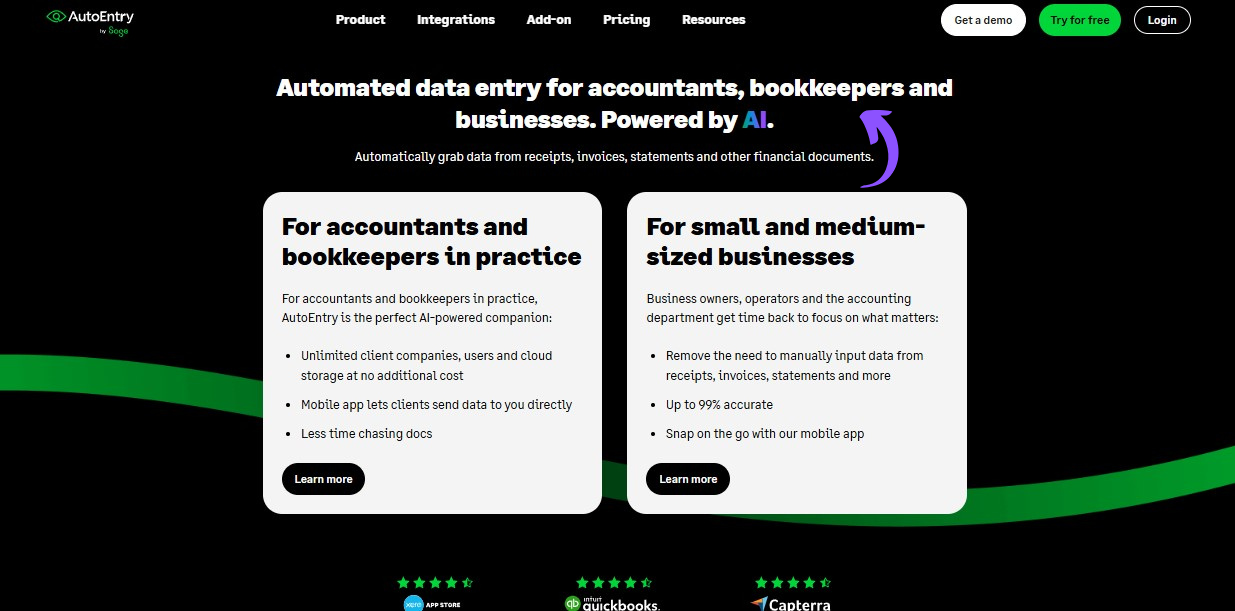

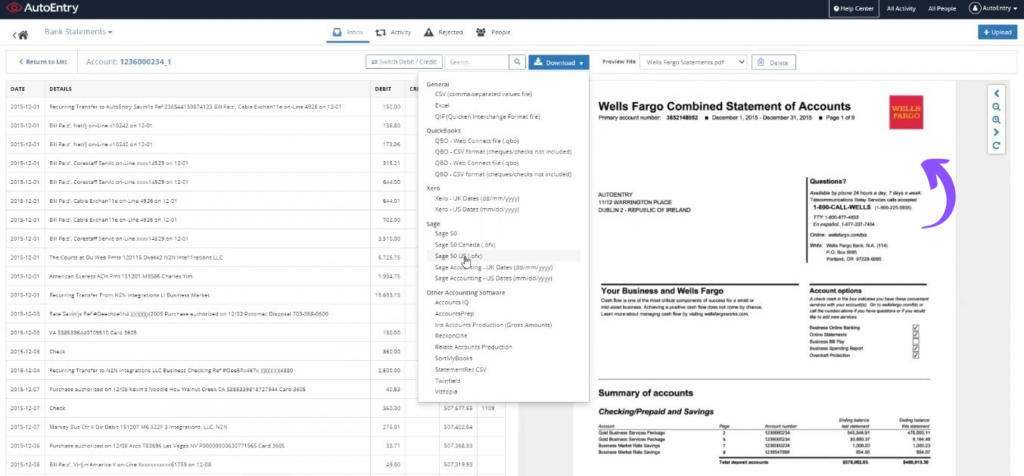

Qu'est-ce que l'AutoEntry ?

Parlons maintenant d'AutoEntry. Cet outil a pour seul but de simplifier la saisie de données.

Imaginer just snapping a photo of your invoices and receipts.

Et hop ! L’information est automatiquement capturée. C’est comme avoir un assistant numérique pour vos papiers.

Découvrez également nos favoris Alternatives à AutoEntry…

Notre avis

Prêt à réduire votre temps de comptabilité ? AutoEntry traite plus de 28 millions de documents chaque année et offre une précision jusqu’à 99 %. Commencez dès aujourd’hui et rejoignez les plus de 210 000 entreprises dans le monde qui ont réduit leur temps de saisie de données jusqu’à 80 % !

Principaux avantages

Le plus grand atout d'AutoEntry est de nous faire gagner des heures de travail fastidieux.

Les utilisateurs constatent souvent une réduction de jusqu'à 80 % du temps consacré à la saisie manuelle de données.

Elle promet une précision allant jusqu'à 99 % dans l'extraction de données.

AutoEntry n'offre pas de garantie de remboursement spécifique, mais ses forfaits mensuels vous permettent d'annuler à tout moment.

- Précision des données jusqu'à 99 %.

- Utilisateurs illimités sur tous les forfaits payants.

- Extrait les lignes complètes des factures.

- Application mobile simple pour photographier les reçus.

- Les crédits non utilisés sont reportés sous 90 jours.

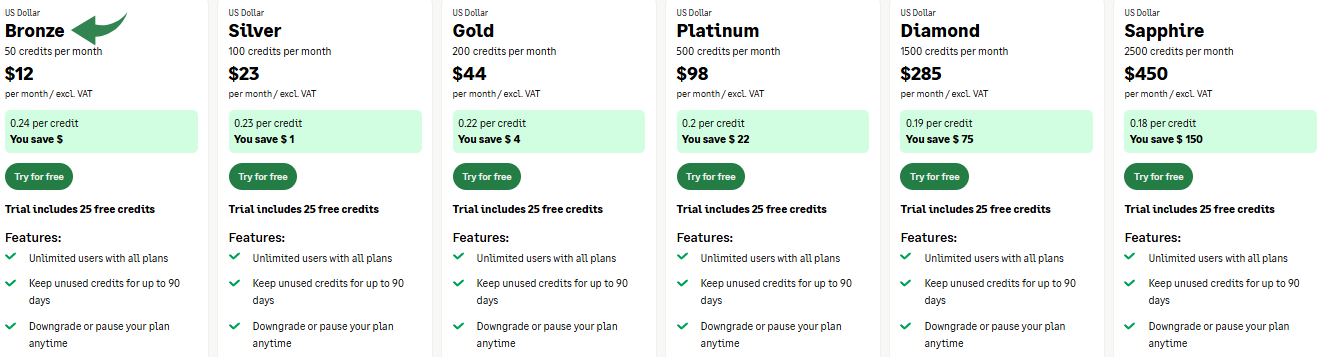

Tarification

- Bronze: 12 $/mois.

- Argent: 23 $/mois.

- Or: 44 $/mois.

- Platine: 98 $/mois.

- Diamant: 285 $/mois.

- Saphir: 450 $/mois.

Avantages

Cons

Comparaison des fonctionnalités

Comparons directement Xero et AutoEntry en examinant leurs fonctionnalités spécifiques pour vous aider à choisir la solution cloud la plus adaptée à vos besoins. comptabilité Des logiciels pour votre entreprise.

1. Automatisation et capture des données

- Xero : Bien que Xero permette de saisir les factures et les reçus, son objectif principal est la gestion des opérations financières une fois celles-ci intégrées au système. La plateforme offre certaines fonctionnalités. automationmais ce n'est pas son objectif principal.

- Saisie automatique : AutoEntry est un logiciel conçu pour l'automatisation. Sa fonction principale est d'extraire des données des factures, des reçus et autres documents financiers grâce à une technologie OCR avancée. C'est un outil spécialisé, optimisé pour cette tâche spécifique.

2. Information financière

- Xero : Xero excelle dans ce domaine. Il offre une suite complète de fonctionnalités personnalisables. reportage options. C'est un élément clé de Xero comptabilité Ce logiciel vous offre une vision claire des performances de votre entreprise, de votre situation financière et de vos flux de trésorerie. Vous obtenez ainsi de précieuses informations.

- Saisie automatique : AutoEntry ne fournit pas de rapports financiers. Son rôle est de préparer les données avec précision et de vous les envoyer. comptabilité un logiciel vous permettant de créer des rapports.

3. Flux bancaires et rapprochement

- Xero : Grâce à ses flux bancaires automatiques, Xero simplifie les rapprochements bancaires. Il extrait les données en temps réel de vos comptes bancaires et suggère des correspondances, vous faisant ainsi gagner un temps précieux. C'est un argument de vente majeur.

- Saisie automatique : AutoEntry peut également gérer les relevés bancaires. Il extrait les données page par page pour accélérer le processus de rapprochement bancaire une fois le relevé importé dans votre système principal. comptabilité logiciel.

4. Comptes fournisseurs et clients

- Xero : The accounts payable and accounts receivable features in Xero logiciel de comptabilité are very strong. You can create online invoicing and schedule payments. The established plan even includes purchase orders for growing businesses.

- Saisie automatique : L'objectif principal d'AutoEntry est d'automatiser la saisie de vos factures. Il gère les données des comptes fournisseurs, mais ne propose pas les outils de gestion complets d'un système comptable cloud.

5. Gestion des stocks

- Xero : Xero vous permet de gérer vos stocks et de suivre vos niveaux de stock. Ses fonctionnalités de gestion des stocks contribuent à la santé financière de votre entreprise, car toutes vos données d'inventaire sont liées à vos enregistrements de ventes.

- Saisie automatique : AutoEntry ne possède aucune fonctionnalité de gestion des stocks. Son but est de traiter des documents, et non de suivre les stocks.

6. Tarification et forfaits

- Xero : La tarification de Xero repose sur des formules évolutives. La formule de base comporte des limitations, comme un maximum de cinq factures et vingt notes de frais, tandis que la formule supérieure offre un nombre illimité de factures et de notes de frais pour les entreprises en pleine croissance.

- Saisie automatique : La tarification d'AutoEntry est basée sur l'utilisation du crédit, offrant ainsi un modèle tarifaire plus flexible. Vous ne payez que pour les documents que vous traitez, ce qui peut être très avantageux pour les travailleurs indépendants ou les très petits professionnels. petite entreprise propriétaires.

7. Assistance clientèle

- Xero : Xero propose une assistance client principalement en ligne via le système Xero Central. Vous trouverez également de nombreuses ressources d'aide dans les guides et articles.

- Saisie automatique : AutoEntry jouit d'une excellente réputation en matière de service client. Ses ressources en ligne et son chat en direct sont très bien notés dans de nombreux avis sur AutoEntry, vous assurant ainsi de pouvoir obtenir de l'aide quand vous en avez besoin.

8. Sécurité Cloudflare

- Xero : Si votre demande de test de Xero ou d'utilisation d'un tableau de bord Xero est bloquée, c'est souvent parce que… sécurité Un service comme Cloudflare a été déclenché. Il s'agit d'une solution de sécurité courante pour protéger un site contre les attaques en ligne. L'identifiant Cloudflare Ray est un identifiant unique figurant sur la page d'erreur.

- Saisie automatique : Vous pourriez rencontrer une erreur similaire en accédant au site AutoEntry. Si votre requête est bloquée, cela signifie qu'une action que vous venez d'effectuer a déclenché la mesure de sécurité. Il peut s'agir d'une commande SQL, de données malformées ou simplement d'une action susceptible de provoquer ce blocage, comme la saisie d'un certain mot ou d'une certaine expression. Nous vous recommandons de contacter le propriétaire du site par e-mail afin de résoudre ce problème.

9. Suivi des dépenses et accès mobile

- Xero : L'application mobile Xero, disponible sur iOS Cette application, compatible avec les appareils Android, est idéale pour le suivi des dépenses. Elle vous permet de consulter vos informations financières et de gérer votre trésorerie où que vous soyez.

- Saisie automatique : AutoEntry propose également une application mobile. Celle-ci vous permet de numériser vos reçus et dépenses en les photographiant, assurant ainsi une intégration parfaite entre vos documents physiques et vos données financières.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

- Fonction principale : Avez-vous besoin du logiciel de comptabilité Xero complet ou d'un outil spécifique pour télécharger une facture d'achat ?

- Automation: Utilise-t-il la reconnaissance optique de caractères pour une saisie de données rapide et précise, y compris les lignes de commande ?

- Évolutivité : Est-ce un logiciel destiné aux entreprises établies ou aux entreprises en phase de démarrage ? Peut-il gérer plusieurs devises et plusieurs sites ?

- Fonctionnalités avancées : Offre-t-il des fonctionnalités clés comme le suivi de projet et la gestion des stocks, ou est-il basique ?

- Signalement : Explorez les fonctionnalités de reporting de Xero pour obtenir une analyse approfondie de votre gestion financière.

- Expérience utilisateur : L'interface de Xero est-elle conviviale et facile à utiliser pour votre équipe et vos clients, avec un minimum d'effort ?

- Coût: Le coût total de Xero correspond-il à votre budget mensuel ?

- Sécurité: Sachez que les sites web se protègent des menaces en ligne grâce à un service de sécurité comme Cloudflare. Si vous n'y avez pas accès, vérifiez l'identifiant Cloudflare Ray.

Verdict final

Si vous êtes un chef d'entreprise à la recherche d'une plateforme complète, nous vous recommandons Xero.

Il s'agit du véritable logiciel de comptabilité Xero, offrant les fonctionnalités de données financières, de transactions bancaires et de taxe de vente nécessaires à la croissance de l'entreprise.

Bien qu'il ne s'agisse pas d'un système de planification des ressources d'entreprise complet.

Ses fonctionnalités et ses intégrations sont idéales pour les services professionnels.

AutoEntry est idéal pour gagner du temps sur la saisie de données, mais Xero vous offre une vue d'ensemble complète pour gérer votre entreprise.

Si vous voyez un identifiant Cloudflare, il s'agit simplement d'un service de sécurité destiné à protéger le site contre diverses actions susceptibles d'être déclenchées.

Plus d'informations sur Xero

Choisir le bon logiciel de comptabilité implique d'examiner plusieurs options.

Voici un aperçu rapide de Xero par rapport à d'autres produits populaires.

- Xero contre QuickBooks: QuickBooks est un concurrent majeur. Bien que les deux logiciels offrent des fonctionnalités de base similaires, Xero est souvent apprécié pour son interface épurée et son nombre illimité d'utilisateurs. QuickBooks peut s'avérer plus complexe, mais il propose des outils de reporting très performants.

- Xero contre FreshBooks: FreshBooks est une option populaire, notamment pour les travailleurs indépendants et les entreprises de services. Il excelle dans la facturation et le suivi du temps. Xero offre une solution comptable plus complète.

- Xero contre Sage: Sage et Xero proposent tous deux des solutions pour les petites entreprises. Cependant, Sage fournit également des outils de planification des ressources d'entreprise (ERP) plus complets pour les grandes entreprises.

- Xero contre Zoho Books: Zoho Books fait partie d'une vaste suite d'applications professionnelles. Elle offre souvent des fonctionnalités avancées pour la gestion des stocks et se révèle très économique. Xero, quant à elle, est une solution de choix pour sa simplicité et sa facilité d'utilisation.

- Xero contre Wave: Wave est réputé pour sa version gratuite. C'est une excellente option pour les très petites entreprises ou les indépendants disposant d'un budget limité. Xero offre une gamme de fonctionnalités plus étendue et est mieux adapté à la croissance des entreprises.

- Xero contre Quicken: Quicken est principalement destiné aux finances personnelles. Bien qu'il propose certaines fonctionnalités professionnelles, il ne s'agit pas d'une véritable solution de comptabilité d'entreprise. Xero, quant à lui, est conçu spécifiquement pour gérer la complexité de la comptabilité d'entreprise.

- Xero contre HubdocCes deux outils ne sont pas des concurrents directs. Dext et Hubdoc automatisent la capture de documents et la saisie de données. Ils s'intègrent directement à Xero pour une comptabilité plus rapide et plus précise.

- Xero contre Synder: Synder est une plateforme qui connecte les canaux de vente et les passerelles de paiement aux logiciels de comptabilité. Elle automatise la saisie de données provenant de plateformes comme Shopify et Stripe directement dans Xero.

- Xero contre ExpensifyExpensify se concentre spécifiquement sur la gestion des dépenses. Bien que Xero propose des fonctionnalités de gestion des dépenses, Expensify offre des outils plus avancés pour la gestion des frais et des remboursements des employés.

- Xero contre Netsuite: NetSuite est un système ERP complet destiné aux grandes entreprises. Il offre une suite complète d'outils de gestion. Xero n'est pas un ERP, mais constitue une excellente solution comptable pour les petites entreprises.

- Xero contre Puzzle IO: Puzzle IO est une plateforme financière conçue pour les startups, axée sur les états financiers en temps réel et la saisie automatisée de données.

- Xero vs Easy Month End: Ce logiciel est un outil spécialisé permettant d'automatiser le processus de clôture mensuelle, facilitant le rapprochement bancaire et la traçabilité des opérations. Il est conçu pour fonctionner avec Xero, et non pour le remplacer.

- Xero contre Docyt: Docyt utilise l'IA pour automatiser les tâches administratives et comptables. Elle permet de consulter tous vos documents et données financières au même endroit.

- Xero contre RefreshMe: RefreshMe est un logiciel de comptabilité plus simple, doté de fonctionnalités de base, souvent utilisé pour les finances personnelles ou les très petites entreprises.

- Xero contre AutoEntry: À l'instar de Dext et Hubdoc, AutoEntry est un outil qui automatise l'extraction de données à partir de reçus et de factures, conçu pour s'intégrer et améliorer les logiciels comptables tels que Xero.

Comparaison de la saisie automatique

- Saisie automatique vs PuzzleCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Saisie automatique vs DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- AutoEntry vs XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- AutoEntry vs SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Saisie automatique vs Fin de mois simplifiéeIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- AutoEntry vs DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- AutoEntry vs SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- AutoEntry vs Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Saisie automatique vs WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- AutoEntry vs QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- AutoEntry vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- AutoEntry vs ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- AutoEntry vs QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- AutoEntry vs FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- AutoEntry vs NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Xero propose-t-il un essai gratuit ?

Oui, Xero propose généralement une période d'essai gratuite pour vous permettre de tester ses fonctionnalités avant de vous abonner. Consultez leur site web pour connaître l'offre du moment.

AutoEntry peut-il fonctionner sans logiciel de comptabilité ?

Non, AutoEntry est conçu pour s'intégrer aux logiciels de comptabilité comme Xero ou QuickBooks Saisie de données automatisée en ligne.

L'extraction de données d'AutoEntry est-elle précise ?

AutoEntry se targue d'une grande précision, souvent supérieure à 99 %, mais la qualité de l'image du document peut affecter les résultats.

Quel logiciel est le mieux adapté aux très petites entreprises ?

Cela dépend. AutoEntry permet de gagner du temps sur la saisie des données, tandis que Xero offre des fonctionnalités comptables plus complètes. Réfléchissez à votre besoin principal.

Xero ou AutoEntry proposent-ils un essai gratuit ?

Oui, Xero et AutoEntry proposent généralement aux nouveaux utilisateurs un essai gratuit ou un crédit gratuit pour évaluer leurs services.