Struggling to keep your entreprise finances neat and tidy?

Beaucoup petite entreprise owners face the headache of managing receipts, invoices, and bank statements.

Imaginer a world where your financial documents organize themselves.

This is where tools like Wave vs Hubdoc step in.

Let’s dive in and find out, so you can faire Un choix judicieux qui vous permettra de revenir à ce que vous faites de mieux.

Aperçu

We put Wave and Hubdoc through real-world tests.

We tried them with different businesses. This helped us see how each one works.

Now, we can share what we found to help you compare them easily.

Plus de 4 millions petites entreprises Confiez la gestion de vos finances à Wave. Découvrez les offres de Wave et trouvez celle qui vous convient.

Tarification : Formule gratuite disponible. Formule payante à partir de 19 $/mois.

Caractéristiques principales :

- Facturation

- Bancaire

- Module complémentaire de paie.

Gagnez du temps avec Hubdoc ! Les utilisateurs économisent en moyenne 4 heures par semaine sur la saisie de données. De plus, Hubdoc organise automatiquement 99 % des documents.

Tarification : Il propose un essai gratuit. L'abonnement premium est disponible à partir de 12 $/mois.

Caractéristiques principales :

- Récupération automatisée de documents

- Extraction de données

- Direct Comptabilité Intégration

Qu'est-ce qu'une vague ?

Bon, parlons de Wave.

Considérez-le comme un ami précieux pour les finances de votre entreprise.

Il vous permet notamment d'envoyer des factures et de suivre les entrées et sorties d'argent.

Cela peut vous aider à avoir une vision d'ensemble des finances de votre entreprise.

Découvrez également nos favoris Alternatives aux vagues…

Notre avis

N’acceptez pas moins ! Rejoignez les plus de 2 millions de petites entreprises qui font confiance dès aujourd’hui aux puissantes fonctionnalités comptables gratuites de Wave pour optimiser leurs finances.

Principaux avantages

Les points forts de Wave incluent :

- Un plan de comptabilité de base 100% gratuit.

- Au service de plus de 2 millions de petites entreprises.

- Création de factures et traitement des paiements simplifiés.

- Aucun contrat ni garantie à long terme.

Tarification

- Plan de démarrage : 0 $ par mois.

- Formule Pro : 19 $ par mois.

Avantages

Cons

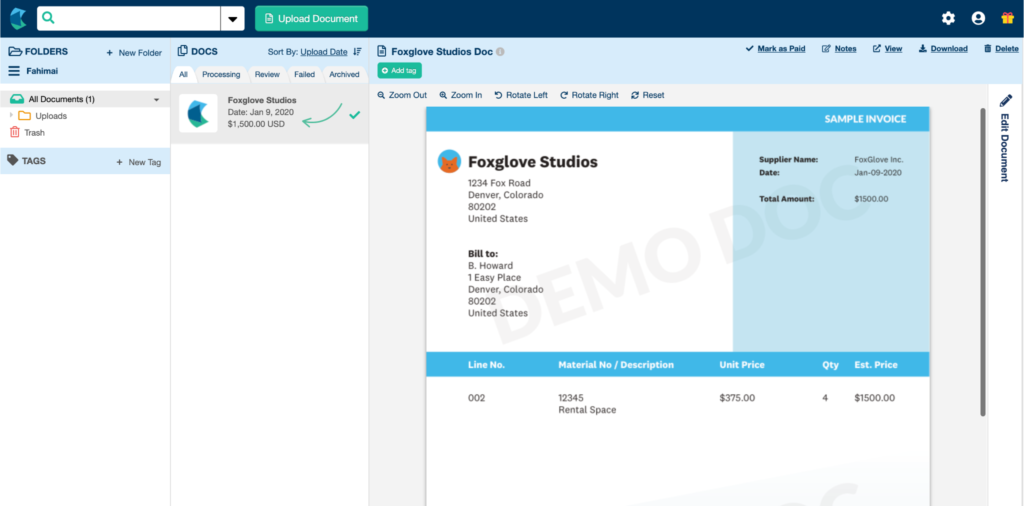

Qu'est-ce que Hubdoc ?

Bon, parlons de Hubdoc.

Considérez-le comme un assistant précieux pour vos travaux.

Il récupère vos factures et relevés provenant de différents sites en ligne.

Ensuite, cela permet de les garder tous organisés au même endroit.

Plutôt chouette, non ?

Découvrez également nos favoris Alternatives à Hubdoc…

Principaux avantages

Le principal atout de Hubdoc réside dans son orientation vers l'automatisation des documents.

- Précision de 99 %Hubdoc utilise la reconnaissance optique de caractères (OCR) pour garantir une saisie correcte des données.

- stockage à l'épreuve des auditsIl stocke vos documents en toute sécurité, vous ne perdrez donc plus jamais un fichier.

- Gain de 10 heures par moisLes utilisateurs font état d'un gain de temps considérable grâce à la suppression de la saisie manuelle.

- Recherche automatisée de fournisseurs.

- Capture de photos mobiles.

- Intégration transparente de Xero.

Tarification

- Prix Hubdoc : 12 $/mois.

Avantages

Cons

Comparaison des fonctionnalités

Selecting the best comptabilité software is a matter of understanding each platform’s core specialty.

This Wave review and Hubdoc review will evaluate a free accounting software against a powerful document automation tool, guiding petite entreprise owners to the right solution for their business operations.

1. Objectif principal et plateforme

- Vague Financial is a full small business logiciel de comptabilité solution. Its free platform includes the general ledger, comptabilité records, and core accounting features. Wave makes managing personal finance simple and is built for the small business owner.

- Hubdoc is a document and données capture service, not an accounting platform. Its key features automate tasks by collecting financial documents and converting them into usable bank transactions. It works as a third party app to help accountant access data for other online accounting systems.

2. Tarification et abonnement

- Vague offers a complete free version (free starter plan), including unlimited invoices and multiple companies management. Wave’s two plans structure offers a paid pro plan for advanced features with optional additional costs for add-ons, making it a very cost-effective choice.

- Hubdoc is often available as free comptabilité software when bundled with other popular business apps (like Xero), but it is a paid product on its own. The billing period is typically monthly, and its value is measured by the suivi du temps and save time it provides the bookkeeper.

3. Expense and Data Automation

- Vague helps track expenses by allowing you to connect to bank accounts to auto import bank transactions. Digital receipt capture is available, and the auto merge feature helps reconcile bank transactions with less manual effort.

- Hubdoc is a specialist in document automation. It can automatically file records and bank statements and extract data from them, significantly reducing the time tracking spent on manual data entry for expenses. The mobile app is excellent for receipt scanning receipts on the go.

4. Facturation et paiements

- Vague Financial’s invoicing software allows you to create and send recurring invoices. You can accept multiple online payments via credit card payments (credit card transaction) and bank payments, with integrated payment processing that includes Apple Pay.

- Hubdoc has no native invoicing features. Its payments functionality is limited to capturing vendor bills and invoices sent to you (accounts payable), which it then pushes to other systems like QuickBooks Online for the accountant to pay bills.

5. Paie et suivi du temps

- Vague Payroll is an integrated accounting and payroll add-on that enables payroll processing and direct deposit for both active employee and independent contractor paid. Wave does not, however, offer dedicated billable hours or track mileage functionality.

- Hubdoc does not have run payroll or payroll processing capabilities. It is focused on financial documents and does not track employee time or manage sales tax calculations.

6. User Access and Collaboration

- Vague supports unlimited users for free, making it an ideal free platform for collaboration with your accountant or bookkeeper. It also allows you to track expenses for multiple companies from a single account.

- Hubdoc allows you to grant accountant access to clients’ records. This collaborative feature ensures that the accountant or bookkeeper always has the latest files via the internet connection, allowing them to spend less time requesting documents.

7. Financial Analysis and Reporting

- Vague offers essential financial reports and tools to view cash flow and profit from your income and expenses. This allows the small business owner to keep a full picture of their personal finance and business finances.

- Hubdoc does not generate financial reports or offer budgeting tools. It merely collects the raw source records and data so that the connected online accounting system can generate reports and provide real time data.

8. Fonctionnalités mobiles et accès

- Both platforms offer a strong mobile app. Wave mobile app allows you to create invoices and manage payments on the go. Hubdoc’s app is purely focused on receipt scanning and document upload to the cloud.

- Hubdoc cloud-native nature ensures you have access to your documents from anywhere in the world with an internet connection. Wave is also cloud-based, so you can run your business from any mobile device.

9. Automation of Cash Flow and Payments

- Vague products help with cash flow by providing automated payment reminders and recurring billing. Wave integrates its own services seamlessly to simplify the entire process of getting paid and pay bills.

- Hubdoc helps automate the front end of cash flow management by collecting and organizing bank statements and vendor bills. This saves time for the bookkeeping tasks and the back-end process of tax time. The wave accounting review is why many recommend wave as a strong online accounting platform.

Quels sont les critères à prendre en compte pour choisir un logiciel de comptabilité ?

To find the right financial solution, you must evaluate an accounting platform on five key dimensions that determine its value and fit.

- Évolutivité: Can the software grow with any of your business?Scalability is crucial, especially when deciding between self hosted and cloud-based solutions. A strong subscription level should support unlimited bookkeeping records and allow you to easily add multiple users. Unlike on premise systems that require purchasing new hardware, cloud platforms allow you to pay for your needs through a tiered structure (such as a free plan to a paid plan), often with a discounted rate for commitment, ensuring your financial system adapts over time.

- Soutien: What kind of help is available if you have questions?Support quality is paramount for giving peace of mind and simplifying tax filing. Ensure the vendor has a reliable help center and can address issues related to bank transfers and accounts receivable quickly. Look for clear support channels that promise resolution within a few business days.

- Facilité d'utilisation: Is it something you and your team can learn quickly? The simplicity of the user interface affects how quickly multiple users can become proficient. The software should make it easy to track expenses and manage money management features. It should also efficiently handle core operations, like automatically importing transactions automatically from your bank, to reduce manual effort.

- Besoins spécifiques: Does it handle the unique things your business does? The system must directly support your core workflows. If you manage sales, it should integrate purchase orders and facilitate accounts receivable. If you have global customers, it should support multiple tax jurisdictions. Features like accept online payments are crucial for modern customers. For advanced users, particularly those integrating with add-ons (like Xero users frequently do), checking API compatibility is essential.

- Sécurité: How safe is your financial data with this software?Security is non-negotiable for bank transfers and managing customers’ payment data. The vendor must protect your information with advanced security measures, such as multi factor authentication. You should be able to segment reportage for a specific date range for security audits and be confident that your tax filing data is secure.

Verdict final

Which one wins: Wave or Hubdoc?

If you need a full, free comptabilité system, choose Wave.

It offers invoicing and basic expense tracking. It’s great for small businesses.

But if you struggle with receipts and bank statements, pick Hubdoc.

It’s very smart. It grabs details automatically. We tested both tools. We saw them work in real businesses.

Choose Wave for all your comptabilité.

Pick Hubdoc for document help. Your business will be happier.

Plus de Wave

- Wave vs Puzzle IOCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Wave contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- Wave contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- Vague contre SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Wave vs Easy Fin de moisIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Wave vs DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- Vague contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Wave vs Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Wave vs QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- Wave vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- Wave contre ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- Wave contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Wave vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Wave contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Wave contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Plus d'informations sur Hubdoc

- Hubdoc contre PuzzleCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Hubdoc vs DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- Hubdoc contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- Hubdoc vs SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Hubdoc vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Hubdoc vs Docyt: Ceci utilise l'IA pour la comptabilité des entreprises et automationL'autre utilise l'IA comme assistant de finances personnelles.

- Hubdoc vs SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Hubdoc contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Hubdoc vs WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- Hubdoc vs ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- Hubdoc contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Hubdoc vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Hubdoc contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Hubdoc vs NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Is Wave really free for users?

Yes, Wave offers its core accounting, invoicing, and receipt tracking features for free. They make money from paid services like payroll and credit card processing. This makes Wave a great option for travailleurs indépendants and small businesses on a budget.

How does Wave vs Hubdoc compare for document collection?

Hubdoc specializes in automated document collection and data extraction. It’s superior for gathering receipts, bills, and bank statements automatically. Wave also allows receipt uploads, but Hubdoc’s smart capture is more robust for high-volume document management.

Can Hubdoc integrate with accounting software other than Xero?

While Hubdoc is owned by Xero and integrates seamlessly, it also offers connections to other platforms. You can export data to other accounting software, but its deepest functionality and automation are typically realized when paired with Xero.

Is Hubdoc better for bank reconciliation?

Hubdoc helps a lot with bank reconciliation by automatically fetching bank statements and extracting transaction data. This pre-populates information, making the reconciliation process smoother and faster in your accounting software like Xero or FreshBooks, or even Livres Zoho.

How do you make money from these comparisons?

Our aim is to offer objective reviews. We may earn a referral fee when you visit a vendor or provider through our links. This does not impact our research or methodology, ensuring our reviews are authentic and unbiased to help you choose the best tool.