Essayez-vous de déterminer lequel logiciel de comptabilité est-ce le meilleur choix pour votre entreprise ?

Avec autant de choix, ça peut être difficile !

Deux options populaires à considérer sont Puzzle IO et QuickBooks.

Gérer ses finances ne devrait pas être une corvée, et les tâches que vous pourriez automatiser ne devraient pas l'être non plus.

Dans cet article, nous comparerons Puzzle IO et QuickBooks pour vous aider à décider lequel vous convient le mieux.

Aperçu

Nous avons passé du temps à explorer à la fois Puzzle IO et QuickBooks.

En analysant leurs caractéristiques et leur fonctionnement pour différents entreprise besoins.

Cette comparaison est basée sur une expérience pratique et une évaluation minutieuse afin de vous donner une image claire de ce que chacun propose.

Envie de simplifier vos finances ? Découvrez comment Puzzle IO peut vous faire gagner jusqu’à 20 heures par mois. Voyez la différence.

Tarification : Formule gratuite disponible. Formule payante à partir de 42,50 $/mois.

Caractéristiques principales :

- Planification financière

- Prévision

- Analyses en temps réel

Utilisé par plus de 7 millions d'entreprises, QuickBooks peut vous faire gagner en moyenne 42 heures par mois sur comptabilité.

Tarification : Il propose un essai gratuit. L'abonnement commence à 1,90 $/mois.

Caractéristiques principales :

- Gestion des factures

- Suivi des dépenses

- Signalement

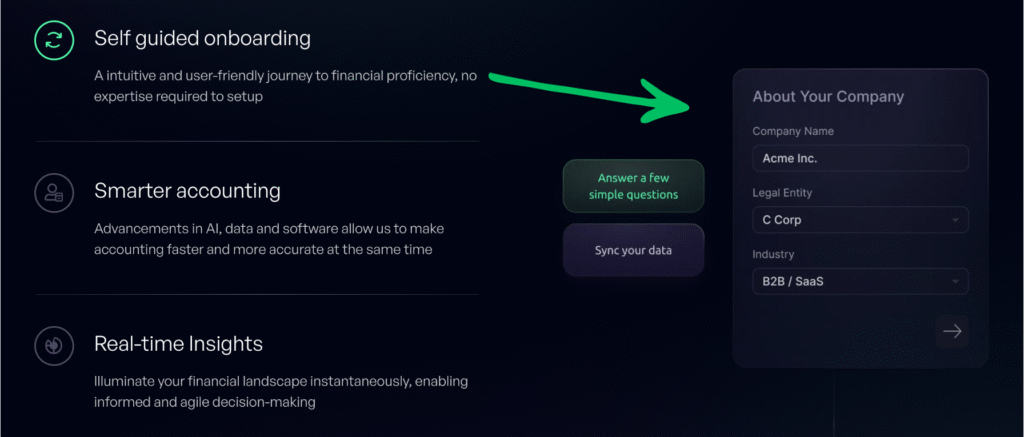

Qu'est-ce que Puzzle IO ?

Alors, Puzzle IO, de quoi s'agit-il exactement ?

Considérez-le comme un outil qui vous aide réellement à anticiper l'avenir financier de votre entreprise.

Il ne s'agit pas seulement de ce qui se passe maintenant, mais aussi de ce qui pourrait arriver.

Découvrez également nos favoris Alternatives à Puzzle IO…

Notre avis

Envie de simplifier vos finances ? Découvrez comment Puzzle io peut vous faire gagner jusqu’à 20 heures par mois. Faites-en l’expérience dès aujourd’hui !

Principaux avantages

Puzzle IO excelle vraiment lorsqu'il s'agit de vous aider à comprendre où votre entreprise se dirige.

- 92% de Les utilisateurs font état d'une meilleure précision des prévisions financières.

- Obtenez des informations en temps réel sur vos flux de trésorerie.

- Créez facilement différents scénarios financiers pour planifier.

- Collaborez harmonieusement avec votre équipe sur les objectifs financiers.

- Suivez les indicateurs clés de performance (KPI) en un seul endroit.

Tarification

- Notions de base en comptabilité : 0 $/mois.

- Perspectives de Accounting Plus : 42,50 $/mois.

- Comptabilité et automatisation avancée : 85 $/mois.

- Échelle Accounting Plus : 255 $/mois.

Avantages

Cons

Qu'est-ce que QuickBooks ?

Très bien, parlons de QuickBooks. C'est probablement un nom que vous avez déjà entendu.

Beaucoup de petites entreprises l'utiliser pour gérer leurs finances quotidiennes.

Considérez-le comme une plateforme centrale pour les factures, les dépenses et le suivi des performances actuelles de votre entreprise.

Découvrez également nos favoris Alternatives à QuickBooks…

Principaux avantages

- Catégorisation automatisée des transactions

- Création et suivi des factures

- Gestion des dépenses

- Services de paie

- Rapports et tableaux de bord

Tarification

- Démarrage simple : 1,90 $/mois.

- Essentiel: 2,80 $/mois.

- Plus: 4 $/mois.

- Avancé: 7,60 $/mois.

Avantages

Cons

Comparaison des fonctionnalités

Voici un aperçu comparatif des performances de ces deux entreprises sur la base de leurs principaux indicateurs financiers.

Cela vous permettra d'obtenir les informations claires dont vous avez besoin pour choisir la meilleure solution pour votre petite entreprise.

1. Indicateurs en temps réel et trésorerie disponible

Il s'agit souvent d'un élément déterminant pour les fondateurs et cofondateurs en phase de démarrage.

- Puzzle IO : Fournit des informations en temps réel sur des indicateurs clés tels que les liquidités piste et le taux de consommation sur un tableau de bord clair. Cela donne rapidement une image précise et actualisée de la situation actuelle de l'entreprise.

- QuickBooks : Il faut davantage d'efforts manuels pour obtenir une image précise de ces indicateurs clés. Les utilisateurs ont souvent besoin d'exporter des données commerciales. données les obligeant à utiliser des tableurs pour calculer eux-mêmes leur autonomie financière, ils doivent attendre plus longtemps pour obtenir des informations cruciales..

2. Automatisation et catégorisation des transactions basées sur l'IA

Flux de travail automation est essentiel pour gagner du temps sur les tâches fastidieuses.

- Puzzle IO : Features AI-powered workflow automation for transaction categorization directly into the general ledger. This is designed to reduce errors and make bookkeeping easier for non-accountants.

- QuickBooks : Il dispose d'une bonne automatisation pour lier les comptes bancaires et les cartes de crédit, mais la catégorisation des transactions nécessite souvent une vérification manuelle, ce qui signifie que les non-comptables peuvent passer plus de temps à corriger les erreurs.

3. Comptabilisation des produits et comptabilité d'exercice

Gestion complexe comptabilité Le respect correct des règles est essentiel pour un suivi précis des revenus.

- Puzzle IO : Offre une comptabilisation et une régularisation des revenus intégrées et automatisées comptabilitéCe qui est essentiel pour obtenir une image précise des revenus pour les investisseurs. Cela garantit la conformité fiscale sans nécessiter l'intervention d'un expert financier à temps plein dès le début.

- QuickBooks: Bien qu'il prenne en charge la comptabilisation comptabilitéLes règles complexes de comptabilisation des produits nécessitent souvent un travail manuel important ou l'intervention d'un comptable expérimenté pour être mises en place et maintenues correctement.

4. Immobilisations et charges payées d'avance

Un suivi et un amortissement corrects des actifs et des dépenses sont indispensables au moment de la déclaration de revenus.

- Puzzle IO : Ce système automatise le suivi et l'amortissement des immobilisations ainsi que la comptabilisation des charges payées d'avance. Il simplifie considérablement la tenue de la comptabilité pour les fondateurs de startups, qui peuvent ainsi la présenter à leur expert-comptable au moment de la déclaration d'impôts.

- QuickBooks : Il prend en charge à la fois les immobilisations et les charges payées d'avance, mais nécessite davantage de configuration manuelle et d'écritures comptables, ce qui peut augmenter le risque d'erreurs pour les non-comptables.

5. Tableau de bord financier et analyses financières

Avoir une visibilité instantanée sur sa trésorerie et ses revenus change tout.

- Puzzle IO : Le tableau de bord est conçu pour fournir aux fondateurs de startups des informations en temps réel et des données financières exploitables. Sa structure permet d'obtenir rapidement une vue d'ensemble claire de la situation actuelle de l'entreprise.

- QuickBooks : Les tableaux de bord mettent l'accent sur le grand livre et les états financiers traditionnels. Bien que très utiles, les informations financières qu'ils fournissent nécessitent souvent une analyse plus approfondie, et obtenir une vision précise peut attendre la clôture des comptes par votre expert-comptable.

6. Fonctionnalités de paie

La gestion des paiements aux employés et aux sous-traitants est une tâche régulière.

- Puzzle IO : Il s'intègre généralement à des services tiers comme Gusto ou Rippling pour la gestion de la paie. Son objectif principal est d'enregistrer de manière transparente les transactions de paie dans le grand livre.

- QuickBooks : Offre des options intégrées comme la paie QuickBooks (y compris le service complet QuickBooks). comptabilité (avec le service de paie) pour les virements directs et les paiements aux prestataires. Cela permet de centraliser la gestion de la paie et de la comptabilité.

7. Version de bureau vs version en ligne

L'accessibilité et les fonctionnalités varient selon les produits QuickBooks utilisés.

- Puzzle IO : Il s'agit d'une version en ligne uniquement, offrant un accès en ligne depuis n'importe où.

- QuickBooks : QuickBooks propose deux produits principaux : QuickBooks Online (basé sur le cloud) et QuickBooks Desktop (installation locale avec une licence pour un seul ordinateur). QuickBooks Desktop offre des fonctionnalités spécifiques absentes des versions en ligne.

8. Traitement des factures et des bons de commande

La gestion des sommes dues aux fournisseurs est essentielle à la trésorerie.

- Puzzle IO : Permet l'automatisation du paiement des factures par Suivi des sorties de trésorerie et intégration aux plateformes de gestion des dépenses.

- QuickBooks : Offre des fonctionnalités robustes pour payer les factures, créer des factures pour les clients et utiliser les bons de commande pour tenir des registres d'inventaire précis, notamment dans la version de bureau de QuickBooks.

9. Pourquoi les fondateurs ont choisi Puzzle

Un bref aperçu de la mentalité qui sous-tend ce choix.

- Puzzle IO : De nombreux fondateurs ont choisi Puzzle car il fonctionne comme QuickBooks, mais avec une approche moderne basée sur l'IA, ce qui permet de gagner du temps sur les tâches fastidieuses et d'obtenir des informations financières plus approfondies.

- QuickBooks : Les utilisateurs restent fidèles à QuickBooks parce que c'est le industrie comptable norme. La large acceptation et le caractère exhaustif de Intuit QuickBooks pour tous petites entreprises est un facteur majeur.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

Voici une liste rapide à garder à l'esprit :

- Facilité d'utilisation : L'interface est-elle intuitive ? Recherchez une configuration simple qui vous aide à rester organisé.

- Fonctions principales : Permet-il de suivre efficacement les flux financiers, de gérer votre plan comptable et d'effectuer les rapprochements bancaires ?

- Signalement Pouvoir: Peut-il générer facilement des rapports essentiels tels que des bilans et des rapports financiers détaillés permettant de démontrer votre santé financière ?

- Automation: Permet-il de minimiser la saisie manuelle des données et d'offrir une bonne automatisation des flux de travail ?

- Intégration: Est-ce qu'il s'intègre bien avec d'autres outils que vous utilisez, comme QuickBooks Time pour la gestion du temps des employés ou les systèmes de gestion des ventes ?

- Prêt pour les impôts : Est-ce que cela simplifie les calculs de la taxe de vente et la préparation des déclarations fiscales en fin d'année ?

- Gestion de la clientèle : Peut-il gérer la facturation des clients et envoyer des rappels de paiement ?

- Spécificités de QuickBooks : Vous migrez depuis un ordinateur fixe et avez besoin des fonctionnalités offertes par QuickBooks, ou vous êtes travailleur indépendant et avez simplement besoin d'un suivi de base ?

- Coûts et assistance : Prenez connaissance de tous les frais potentiels avant de vous inscrire et consultez les avis sur QuickBooks pour obtenir des informations sur le service client et la facilité d'annulation.

- Réflexions finales : Le meilleur logiciel est celui qui offre à votre entreprise le plus d'avantages avec le moins de tracas.

Verdict final

Choisir entre un puzzle et QuickBooks dépend avant tout de vos besoins.

Si la planification à long terme et des états financiers solides sont essentiels pour votre startup, vous pouvez essayer leur essai gratuit.

Puzzle IO pourrait être génial.

Pour les fonctionnalités comptables quotidiennes et ses nombreuses possibilités de connexion, QuickBooks l'emporte.

While no fully free logiciel de comptabilité does it all.

Leurs plans conviennent à beaucoup. Nous les avons examinés.

Et la connaissance de vos principaux objectifs guidera votre choix.

Plus de Puzzle IO

Nous avons comparé Puzzle IO à d'autres outils comptables. Voici un aperçu de ses principales caractéristiques :

- Puzzle IO contre Xero: Xero offre des fonctionnalités comptables étendues avec de solides intégrations.

- Puzzle IO contre Dext: Puzzle IO excelle dans l'analyse et la prévision financières grâce à l'IA..

- Puzzle IO contre Synder: Synder excelle dans la synchronisation des données de vente et de paiement.

- Puzzle IO contre Easy Month End: Easy Month End simplifie le processus de clôture financière.

- Puzzle IO contre Docyt: Docyt utilise l'IA pour automatiser les tâches comptables.

- Puzzle IO contre RefreshMe: RefreshMe se concentre sur le suivi en temps réel des performances financières.

- Puzzle IO contre Sage: Sage propose des solutions comptables robustes adaptées aux entreprises de toutes tailles.

- Puzzle IO contre Zoho Books: Zoho Books propose une comptabilité abordable avec CRM intégration.

- Puzzle IO contre Wave: Wave propose un logiciel de comptabilité gratuit pour les petites entreprises.

- Puzzle IO contre Quicken: Quicken est connu pour la gestion des finances personnelles et des petites entreprises.

- Puzzle IO vs Hubdoc: Hubdoc se spécialise dans la collecte de documents et l'extraction de données..

- Puzzle IO contre Expensify: Expensify propose des solutions complètes de gestion et de reporting des dépenses.

- Puzzle IO contre QuickBooks: QuickBooks est un choix populaire pour la comptabilité des petites entreprises.

- Puzzle IO vs AutoEntry: AutoEntry automatise la saisie des données à partir des factures et des reçus.

- Puzzle IO contre FreshBooks: FreshBooks est conçu sur mesure pour la facturation des entreprises de services.

- Puzzle IO contre NetSuite: NetSuite propose une suite complète pour la planification des ressources d'entreprise.

Plus d'informations sur QuickBooks

- QuickBooks contre Puzzle IOCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- QuickBooks contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- QuickBooks contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- QuickBooks contre SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- QuickBooks vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- QuickBooks contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- QuickBooks contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- QuickBooks contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- QuickBooks contre WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- QuickBooks contre QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- QuickBooks contre HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- QuickBooks contre ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- QuickBooks contre AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- QuickBooks contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- QuickBooks contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Quel logiciel est le mieux adapté aux petites et moyennes entreprises, comme QuickBooks ?

Cela dépend des besoins comptables spécifiques. QuickBooks est performant pour la comptabilité générale, tandis que d'autres logiciels peuvent offrir des fonctionnalités plus ciblées.

L'automatisation des flux de travail peut-elle améliorer les finances de mon entreprise avec l'un ou l'autre de ces logiciels ?

Oui, Puzzle IO et QuickBooks offrent tous deux des fonctionnalités permettant d'automatiser des tâches comme la facturation et la saisie de données, ce qui permet de gagner du temps.

Comment Puzzle IO se compare-t-il aux normes du secteur comptable ?

Puzzle IO se concentre sur la prévision et les analyses basées sur l'IA, une approche plus moderne que les logiciels traditionnels.

Quels sont les facteurs clés à prendre en compte pour évaluer les besoins comptables de mon entreprise ?

Réfléchissez à votre budget, aux fonctionnalités requises (comme la facturation ou la paie), aux intégrations et à vos plans de croissance futurs.

Est-il difficile de passer d'une plateforme comptable (comme QuickBooks) à une autre ?

La migration peut prendre du temps et nécessite une planification minutieuse pour garantir une migration des données précise et une adaptation de votre équipe au nouveau système.