Fatigué(e) des finances désordonnées et des feuilles de calcul interminables ?

Nombre d'entre nous se sentent dépassés par la gestion de l'argent, en particulier les petites entreprises et les travailleurs indépendants.

C'est un vrai casse-tête.

Et si vous pouviez automatiser tout votre suivi financier ?

Imaginer getting a clear view of your money without the hassle.

Fintable promet justement de faire cela. Nous allons explorer comment Fintable peut résoudre vos problèmes financiers et simplifier votre vie.

Cet outil est-il fait pour vous ? Découvrons-le !

Envie de gagner plus de 10 heures par mois sur vos tâches financières ? Rejoignez plus de 5 000 utilisateurs qui simplifient la gestion de leur argent avec Fintable dès aujourd’hui !

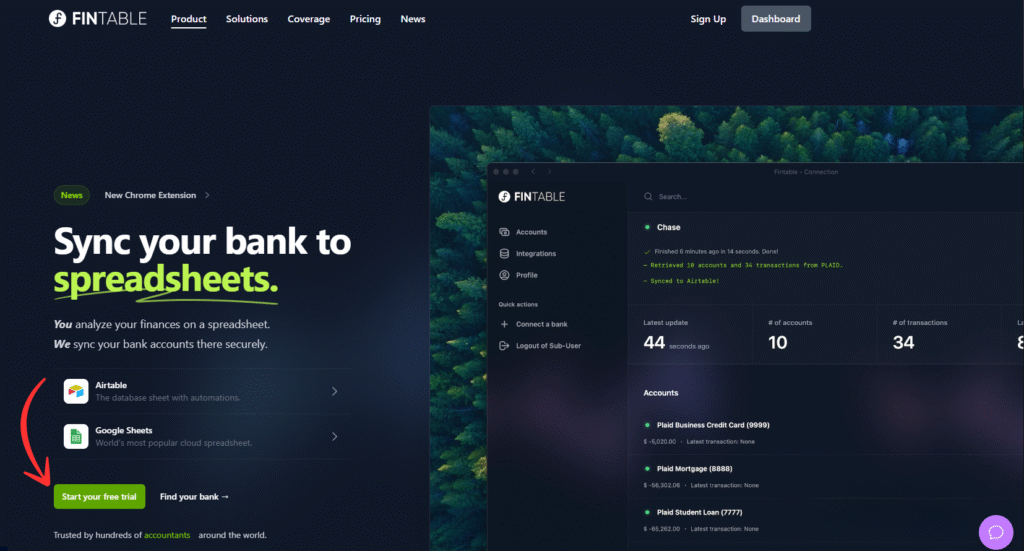

Qu'est-ce que Fintable ?

Fintable est une application qui vous aide à gérer facilement votre argent.

Considérez-le comme un pont entre vos comptes bancaires et vos feuilles de calcul préférées.

Il se connecte directement à vos comptes bancaires et centralise toutes vos données financières.

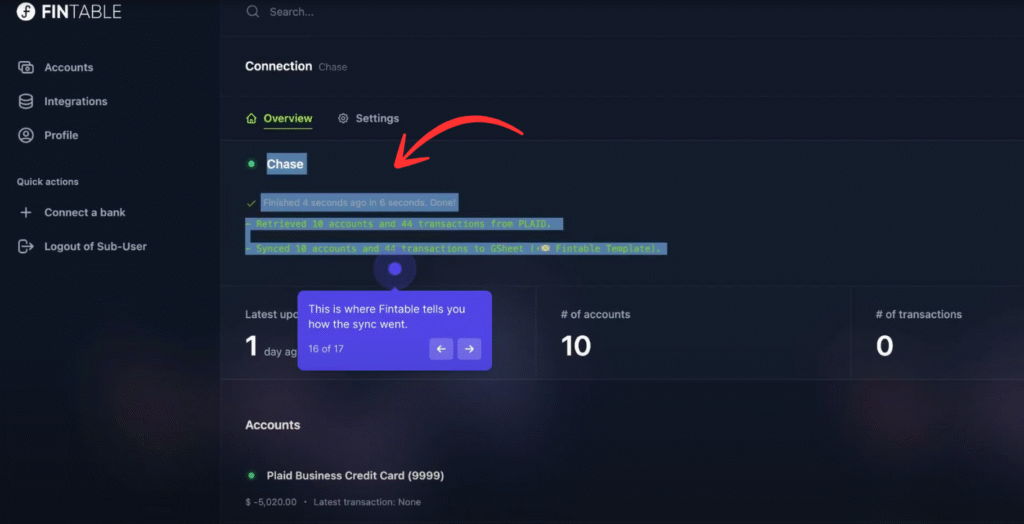

Plus précisément, Fintable envoie vos soldes bancaires et vos transactions vers Google Sheets ou Airtable.

Cela signifie que vous avez une vue d'ensemble claire de chaque transaction effectuée sur vos comptes.

Vous pouvez consulter vos soldes bancaires les plus récents, mis à jour régulièrement.

Fintable simplifie considérablement la gestion de vos finances.

Vous n’avez donc pas à saisir de données ni à passer des heures à organiser manuellement vos informations financières.

Qui a créé Fintable ?

Fintable a été créé par Isa Hasenko.

L'idée de Fintable lui est venue en 2020 alors qu'il essayait de gérer son propre argent.

Il était à Kyiv et s'est dit : « Et si je pouvais faire tout ça dans Airtable ? »

Son objectif était de permettre à chacun d'intégrer facilement ses données financières dans des tableurs, sans nécessiter de compétences particulières.

Fintable ambitionne d'être le moyen le plus rapide d'utiliser les données bancaires pour les finances personnelles ou professionnelles, aidant ainsi les utilisateurs à gagner du temps et à réduire leur stress.

Principaux avantages de Fintable

Voici quelques-uns des principaux avantages que vous retirez de l'utilisation de Fintable :

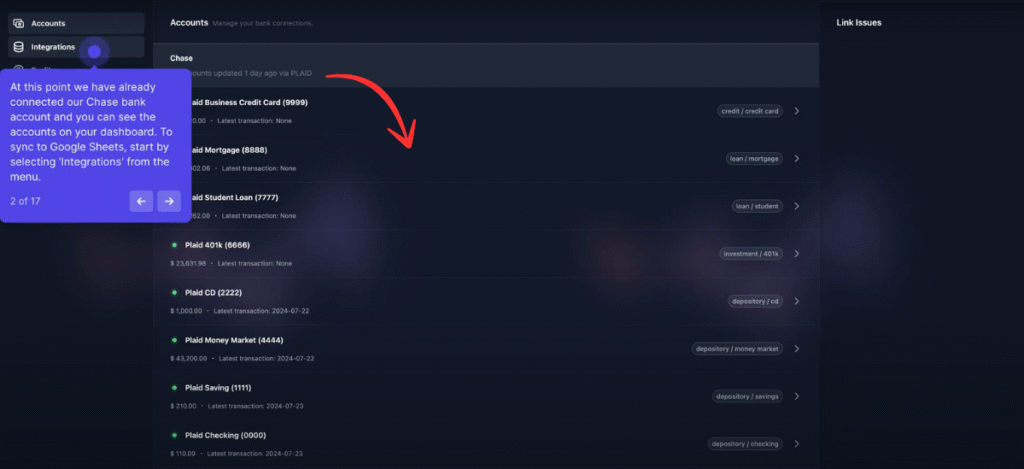

- Connexion de données facile : Fintable utilise Plaid pour établir une connexion sécurisée avec vos comptes bancaires. Vos données financières sont ainsi accessibles en toute simplicité et en toute sécurité.

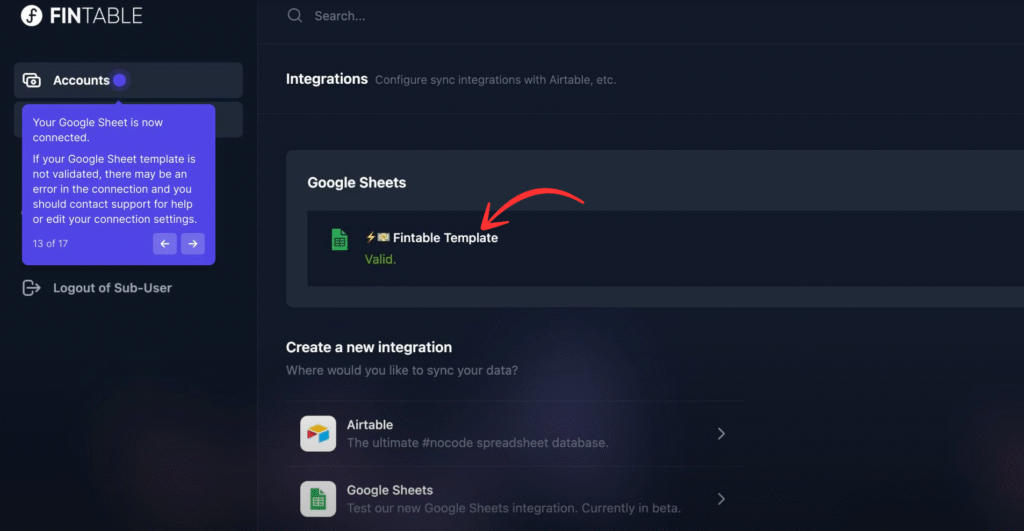

- Intégration transparente : Il s'intègre parfaitement à vos outils de tableur préférés comme Google Sheets et Airtable. Vous pouvez ainsi intégrer facilement vos flux de données financières sans configuration complexe.

- Une meilleure gestion budgétaire : En regroupant toutes vos transactions au même endroit, il est beaucoup plus facile de gérer votre budget. Vous pouvez voir clairement où va votre argent et faire des choix de dépenses plus judicieux pour vos finances.

- Automatisation permettant de gagner du temps : Fintable automatise l'extraction des données de votre banque. Vous gagnez ainsi un temps précieux que vous consacriez auparavant à la mise à jour manuelle de vos feuilles de calcul.

- Personnalisable selon vos besoins : Que vous soyez un utilisateur régulier ou un développeur, vous pouvez configurer Fintable pour qu'il corresponde exactement à vos besoins en matière de suivi financier. Il est flexible et s'adapte à de nombreux usages.

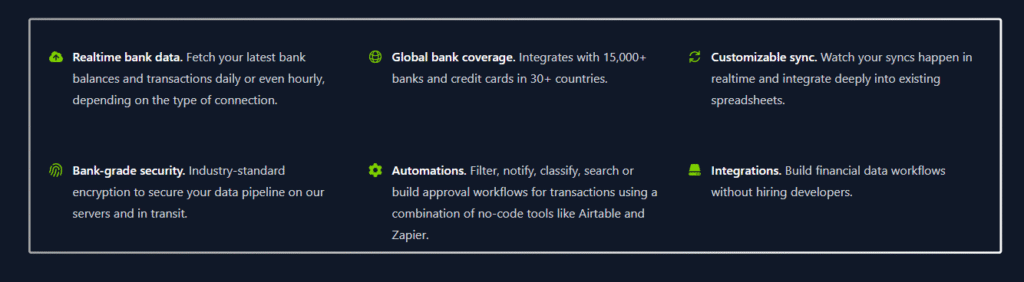

Principales caractéristiques de Fintable

Fintable offre des fonctionnalités puissantes qui simplifient la gestion de vos données financières.

Ces outils uniques vous aident à mieux gérer votre argent avec moins d'efforts et plus de sérénité.

1. Données bancaires en temps réel

Fintable peut récupérer très rapidement vos derniers soldes bancaires et transactions.

Cela signifie que vous disposez toujours d'informations à jour directement dans votre feuille de calcul.

Plus besoin d'attendre des jours pour consulter vos dernières dépenses ou vos derniers revenus.

2. Sécuriser le pipeline

Vos informations financières sont sensibles, et Fintable les traite comme telles.

Il utilise un processus très sécurisé, ou « pipeline », pour transférer vos données de votre banque vers votre feuille de calcul.

Cela permet de protéger vos informations pendant leur transmission.

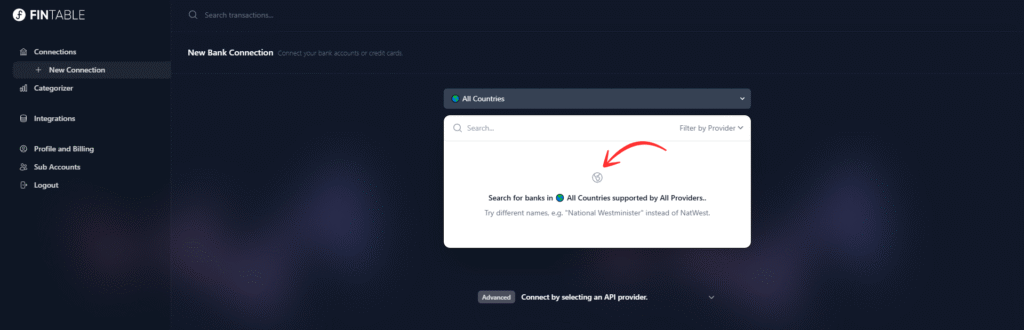

3. Couverture bancaire mondiale

Que vous soyez aux États-Unis, en Europe ou dans de nombreux autres endroits, Fintable travaille probablement avec votre banque.

Elle se connecte à des milliers de banques et de cartes de crédit dans plus de 30 pays.

Cette large diffusion en fait un outil utile pour de nombreux utilisateurs à travers le monde.

4. Garantie de qualité bancaire

Fintable utilise des mesures de sécurité de haut niveau, tout comme les banques.

Cela inclut un chiffrement robuste et le respect de règles strictes du secteur pour protéger vos données.

Vous pouvez avoir l'assurance que vos informations financières sont bien protégées.

5. Automatisations

L'un des aspects les plus intéressants de Fintable est sa capacité à automatiser les tâches.

Vous pouvez configurer des règles pour filtrer, catégoriser ou même recevoir des alertes concernant vos transactions.

Cela vous fait gagner beaucoup de temps et rend la gestion de votre argent beaucoup plus efficace.

Tarification

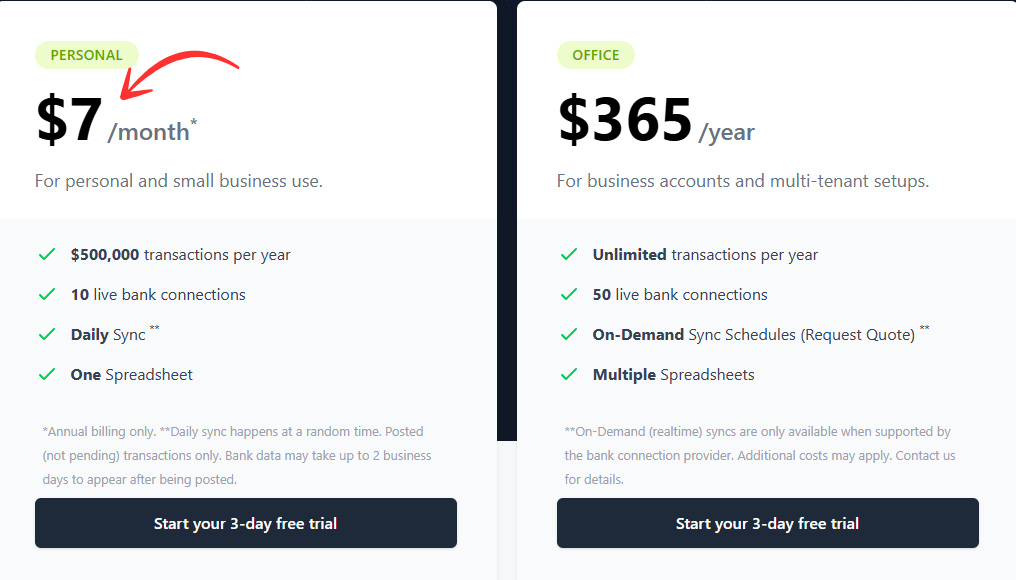

Fintable propose différents forfaits afin que vous puissiez choisir celui qui vous convient le mieux.

Voici un aperçu rapide de leurs principales options tarifaires :

| Plan | Coût | Caractéristiques principales |

| Personnel | 7 $ par mois (facturé annuellement) | Jusqu'à 500 000 $ de transactions par an, 10 connexions bancaires, synchronisation quotidienne, une seule feuille de calcul. |

| Bureau | 365 $ par an | Transactions illimitées, 50 connexions bancaires, synchronisation à la demande (peut entraîner des frais supplémentaires), plusieurs feuilles de calcul. |

Avantages et inconvénients

Avant de prendre une décision, il est judicieux de peser le pour et le contre.

Examinons les principaux avantages et inconvénients de Fintable pour vous aider à prendre votre décision.

Avantages

Cons

Alternatives à Fintable

Fintable est certes un excellent outil, mais il est utile de connaître les autres options disponibles. Chaque outil répond à des besoins différents ; vous pourriez donc trouver celui qui vous convient le mieux.

- Argent du Tiller : Ce service permet également de connecter vos comptes bancaires à Google Sheets ou Excel. Il vous offre un contrôle total sur vos données dans vos feuilles de calcul, idéal pour les adeptes des tableurs.

- Menthe: Mint est une application gratuite et populaire de gestion de finances personnelles. Elle propose des fonctionnalités de budgétisation, de suivi des factures et de surveillance du score de crédit, et se connecte directement à de nombreuses institutions financières.

- Flux en direct : LiveFlow aide les entreprises à obtenir des rapports financiers en temps réel directement dans Excel ou Google Sheets. Il se connecte aux systèmes comptables tels que QuickBooks et Xero.

- Simplifier par Accélérer: Cet outil propose un tableau de bord simple pour une vue d'ensemble de vos finances. C'est un bon choix pour un équilibre entre fonctionnalités et facilité d'utilisation.

- PocketGuard : Cette application vous aide à éviter les dépenses excessives en vous indiquant le montant qu'il vous reste après le paiement de vos factures. Elle est intuitive, même pour ceux qui ont du mal à contrôler leurs achats impulsifs.

- QuickBooks Online : Un ensemble logiciel de comptabilité Pour les petites entreprises. Il gère la facturation, le suivi des dépenses et la paie.

- Xero : Un autre logiciel de comptabilité performant pour petites entreprisesXero est connu pour sa prise en charge multidevises et sa grande robustesse. reportage.

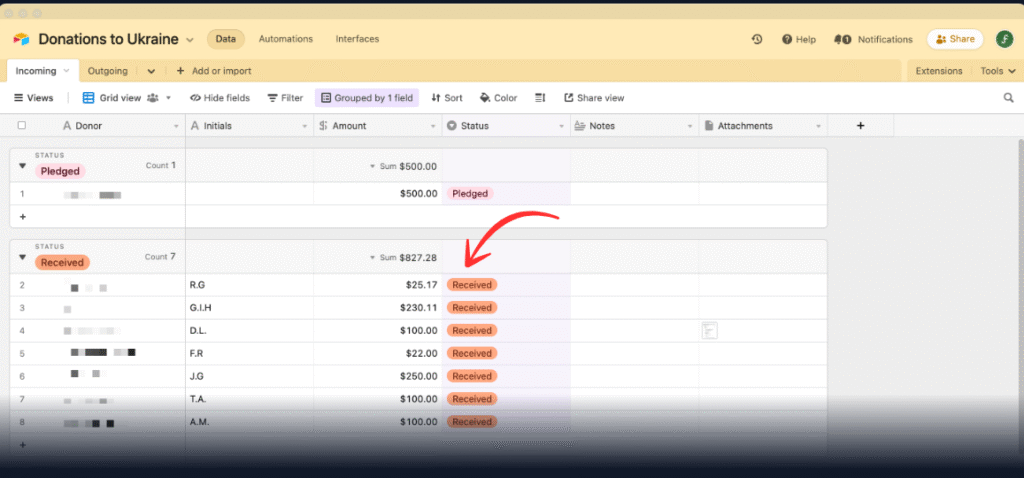

Expérience personnelle avec Fintable

Notre équipe a récemment testé Fintable pour la gestion des finances opérationnelles de Link Finder.

Nous avions besoin d'une meilleure façon de suivre les dépenses et les revenus sans saisie manuelle de données.

Fintable avait promis de simplifier les choses, et elle a tenu parole.

Voici comment Fintable nous a aidés :

- Données bancaires en temps réel : Nous recevions des mises à jour instantanées de nos comptes bancaires. Cela signifiait que nous connaissions toujours nos soldes actuels.

- Pipeline sécurisé : Nos données financières étaient en sécurité lors de leur migration vers Google Sheets. Nous n'avions aucune inquiétude concernant les risques de sécurité.

- Intégration transparente : Fintable s'est facilement intégré à nos feuilles Google existantes. Il s'est parfaitement intégré à notre flux de travail.

- Automatisations : Nous avons mis en place des règles pour étiqueter automatiquement les transactions. Cela nous a permis de gagner des heures de tri chaque semaine.

- Une meilleure gestion budgétaire : Avec toutes les données centralisées, la budgétisation est devenue beaucoup plus claire. Nous pouvions voir exactement où allait l'argent de Link Finder.

Réflexions finales

Fintable offre une solution performante pour connecter directement vos données bancaires à des tableurs comme Google Sheets ou Airtable.

Il simplifie le suivi financier en fournissant des mises à jour en temps réel.

Sécurité renforcée et couverture bancaire mondiale.

Bien que son utilisation puisse nécessiter un temps d'apprentissage pour les novices en tableurs, ou que certaines fonctionnalités avancées soient payantes.

Sa capacité à automatiser la saisie des données et à rationaliser votre flux de travail financier est un atout majeur.

Si vous en avez assez du manuel comptabilité & vous souhaitez un outil flexible pour gérer efficacement votre argent.

Fintable mérite assurément d'être pris en considération. Prêt à simplifier vos finances ?

Visitez fintable.io dès aujourd'hui et découvrez comment il peut transformer votre gestion financière.

Foire aux questions

Fintable est-il compatible avec ma banque ?

Oui, Fintable est compatible avec des milliers de banques et de cartes de crédit. Sa couverture mondiale s'étend à plus de 30 pays. Vous pouvez généralement consulter leur site web pour connaître la banque prise en charge.

Mes données financières sont-elles en sécurité chez Fintable ?

Absolument. Fintable utilise des mesures de sécurité de niveau bancaire. Cela inclut un chiffrement robuste et des partenariats avec des courtiers en données de confiance comme Plaid pour protéger vos informations.

Fintable peut-il catégoriser automatiquement mes transactions ?

Oui, Fintable propose des fonctionnalités d'automatisation. Vous pouvez également configurer des règles pour catégoriser automatiquement vos transactions. Cela vous fait gagner du temps et facilite la gestion de votre budget.

Ai-je besoin de savoir programmer pour utiliser Fintable ?

Non, vous n'avez pas besoin de coder. Fintable est conçu pour être facile à utiliser. Il s'intègre avec des outils sans code comme Google Sheets et Airtable pour une configuration simplifiée.

Quelles sont les données financières que Fintable collecte ?

Fintable synchronise principalement vos soldes bancaires et vos transactions. Pour certaines banques, il peut également récupérer les transactions en cours ou vos avoirs en placement.