Vous en avez assez de devoir gérer tous ces reçus ?

Imaginez s'il existait un moyen simple de gérer toutes vos dépenses sans prise de tête.

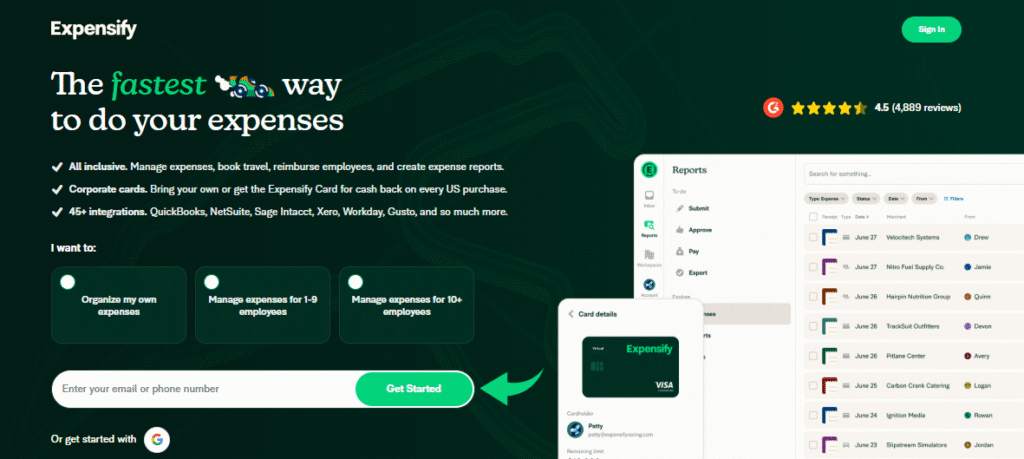

Expensify est une application populaire qui prétend pouvoir faire Les choses sont beaucoup plus simples.

Mais est-ce vraiment la meilleure solution pour vous en 2025 ?

Cet avis sur Expensify vous aidera à déterminer si cette solution répond à vos problèmes de suivi des dépenses.

Examinons cela de plus près !

Simplifiez la gestion de vos dépenses avec Expensify. Rejoignez les plus de 10 millions d'utilisateurs qui ont automatisé leurs notes de frais. Avec Expensify, finies les prises de tête !

Qu'est-ce qu'Expensify ?

Expensify est un logiciel qui vous aide à suivre automatiquement vos dépenses.

Considérez-le comme un outil super pratique sur votre téléphone !

Vous pouvez utiliser leur application mobile pour créer facilement un compte.

L'une de ses fonctionnalités intéressantes est la façon dont elle gère vos reçus et vos dépenses.

Il vous suffit de prendre en photo vos reçus papier, et l'application vous aide à les organiser.

Si votre entreprise vous fournit une carte spéciale, Expensify peut souvent s'y connecter.

Cela permet de suivre les dépenses des employés sans trop d'efforts.

Cela facilite grandement la gestion des dépenses !

Qui a créé Expensify ?

Expensify a été créé par David BarrettIl a créé l'entreprise en 2008.

David voulait créer une meilleure façon pour les gens de gérer leurs dépenses.

Avant Expensify, il a travaillé dans d'autres entreprises technologiques.

Sa vision était de rendre le processus de gestion des reçus et des dépenses facile à utiliser pour tous.

Il souhaitait éliminer l'ancien système d'envoi de reçus papier et d'attente de remboursement.

Au lieu d'envoyer des documents par courriel et d'attendre une approbation, il a imaginé un système plus simple pour les employés des entreprises et les particuliers.

Expensify travaille désormais avec de nombreuses autres entreprises dynamiques pour simplifier le suivi des dépenses.

Principaux avantages d'Expensify

Voici quelques-uns des principaux avantages d'utiliser Expensify :

- Gérez facilement les dépenses de votre équipe : il est simple de voir qui dépense quoi et de tenir tout le monde au courant.

- Remboursement plus rapide : les employés soumettent leurs notes de frais par voie numérique, ce qui accélère considérablement le remboursement.

- Utilisez Expensify N'importe où : Vous pouvez ajouter des dépenses sur votre téléphone ou votre ordinateur, ce qui en fait un outil pratique où que vous soyez.

- Établissez et appliquez la politique de votre entreprise : il est facile de définir des règles concernant les dépenses autorisées, ce qui permet à chacun de suivre les directives.

- Approbation des dépenses en un clic : les responsables peuvent rapidement examiner et approuver les dépenses, ce qui permet à tous de gagner du temps.

- Meilleure information sur les dépenses : Vous obtenez des informations claires données vous indiquer où va votre argent et vous aider à comprendre les coûts.

- S'intégrer parfaitement à logiciel de comptabilité comme QuickBooks et Xero : cela signifie que vous n’avez pas besoin de saisir manuellement les données dans différents systèmes ; elles se synchronisent automatiquement.

- Idéal pour voyage Gestion des dépenses : le suivi des vols, hôtels et repas devient beaucoup plus simple. Vous pouvez même connecter votre carte professionnelle à Expensify pour enregistrer automatiquement les transactions et les catégoriser à des fins fiscales.

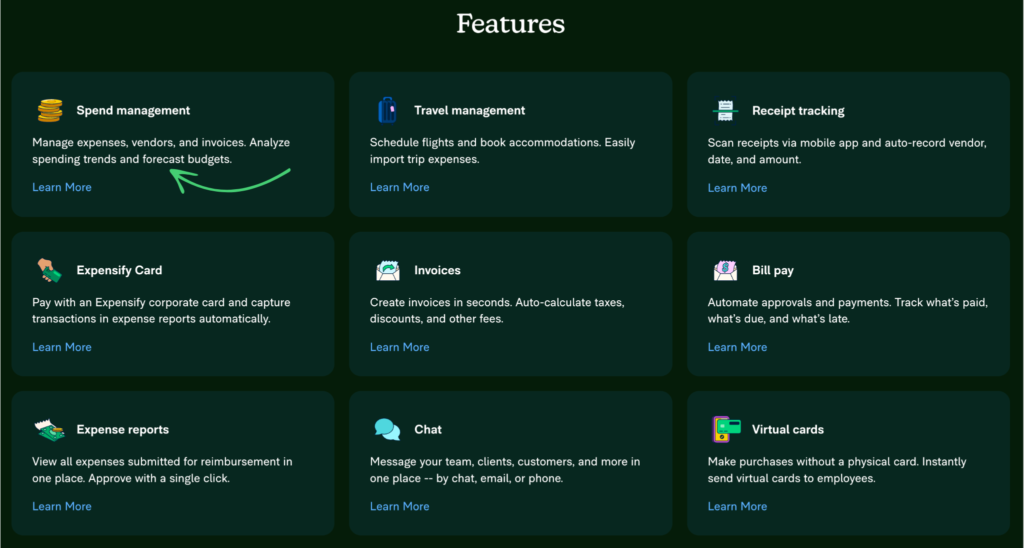

Meilleures fonctionnalités

Expensify propose des fonctionnalités vraiment intéressantes pour simplifier considérablement la gestion de l'argent.

Il dispose d'outils spéciaux qui vous aident à suivre vos dépenses, à établir des rapports et même à planifier des voyages !

Examinons quelques-uns des meilleurs avantages qu'Expensify peut vous offrir.

1. Processus de gestion des dépenses

Avant, garder une trace de tous les reçus était une vraie galère.

Avec Expensify, il vous suffit de prendre une photo de votre reçu avec votre téléphone.

L'application peut lire les informations importantes, comme le montant et l'endroit où vous avez dépensé l'argent.

Cela signifie que vous n'avez pas besoin de tout noter manuellement.

C'est un moyen simple de voir toutes vos transactions au même endroit.

Cette fonctionnalité vous aide à gérer vos dépenses et vous assure de ne perdre aucune information importante.

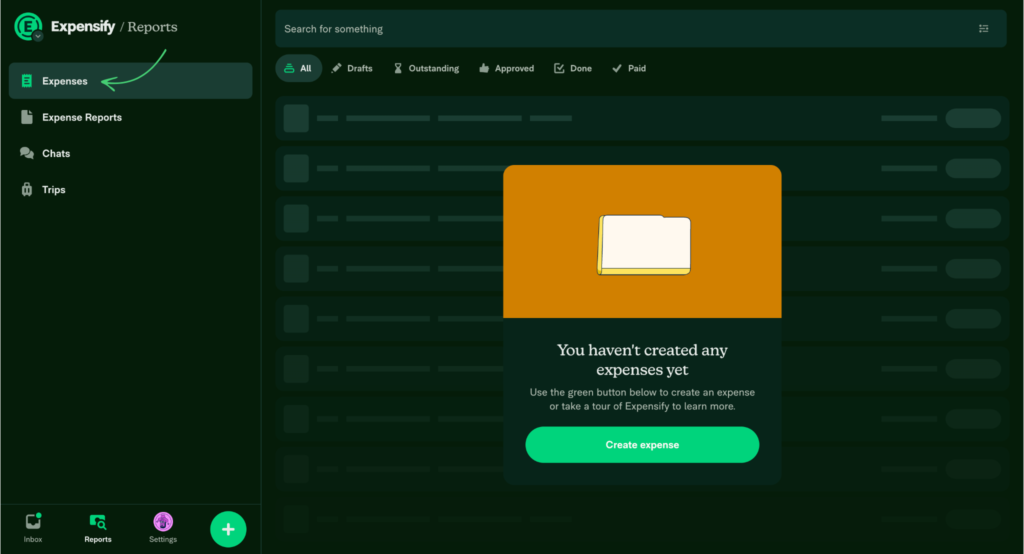

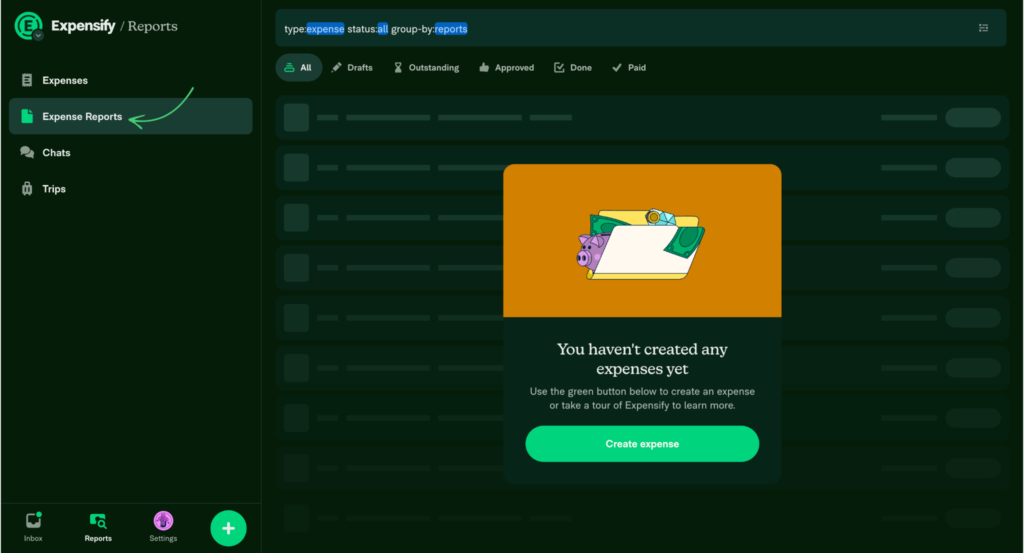

2. Notes de frais

Vous devez généralement rédiger un rapport lorsque vous devez informer votre entreprise du montant de vos dépenses.

Expensify rend ce processus beaucoup plus rapide.

Une fois que vous avez suivi vos dépenses, vous pouvez facilement créer des rapports.

Le logiciel s'occupe de tout pour vous, vous n'avez donc pas à le faire.

Les responsables peuvent alors approuver rapidement ces rapports.

Cela permet à tout le monde de gagner du temps et de fluidifier le processus d'approbation.

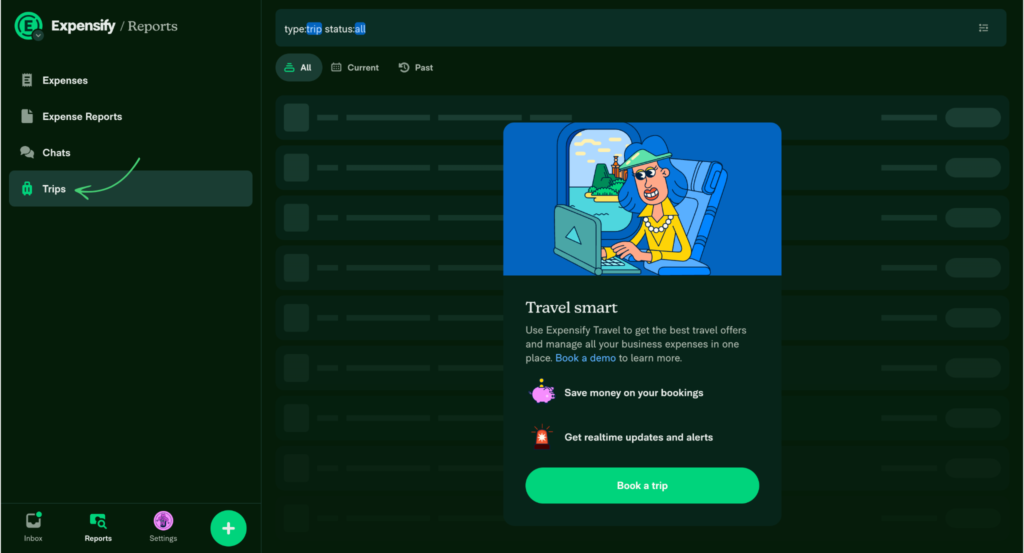

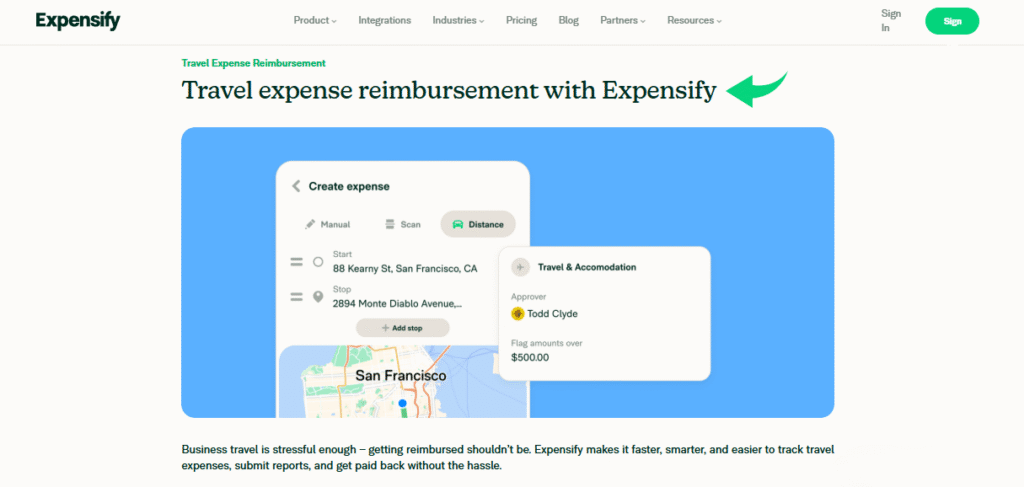

3. Offres de voyage

Si tu voyage Pour le travail, Expensify peut même vous aider à trouver des offres intéressantes.

Cette fonctionnalité peut vous afficher des offres de vols et hôtels.

C'est comme avoir un petit assistant de voyage intégré directement dans votre application de gestion des dépenses.

Cela peut aider votre entreprise à économiser de l'argent et à rendre la planification des voyages moins stressante pour les employés.

4. Carte Expensify

Expensify propose également sa propre carte spéciale, appelée la carte Expensify.

Si votre entreprise utilise ces cartes, le suivi des dépenses peut être encore plus simple.

Lorsqu'un employé utilise la carte Expensify pour ses frais professionnels, les transactions apparaissent automatiquement dans l'application.

Dans de nombreux cas, vous n'avez même pas besoin de prendre une photo du reçu !

Cela permet de centraliser toutes les dépenses par carte d'entreprise et simplifie considérablement le processus de gestion des reçus et des dépenses.

Vous pouvez même définir des limites de dépenses et des règles pour la carte, ce qui aide votre entreprise à contrôler les coûts et à respecter sa politique.

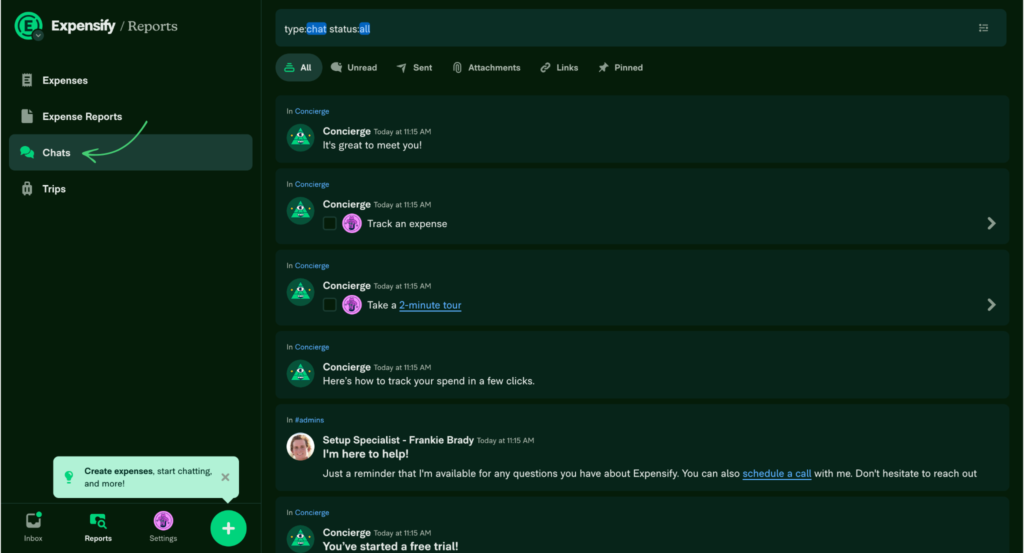

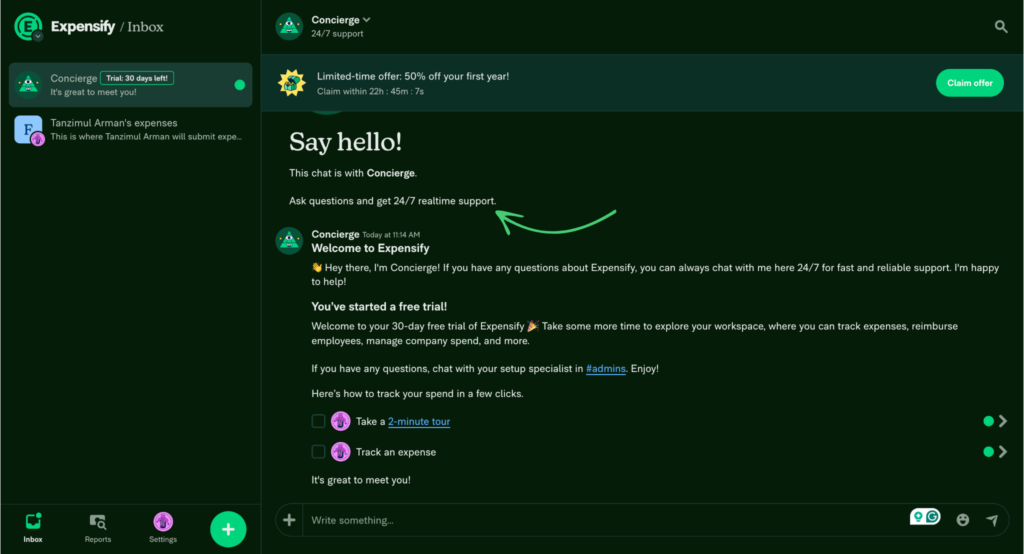

5. Discussions faciles

Parfois, il faut parler à des gens d'une dépense.

Expensify dispose d'une fonctionnalité de chat qui vous permet de communiquer avec votre équipe directement dans l'application.

Si un manager a un question Concernant une transaction, vous pouvez y répondre rapidement.

Cela facilite le traitement des informations et permet à tout le monde d'être sur la même longueur d'onde.

C'est un moyen simple de communiquer sans avoir à envoyer de nombreux courriels.

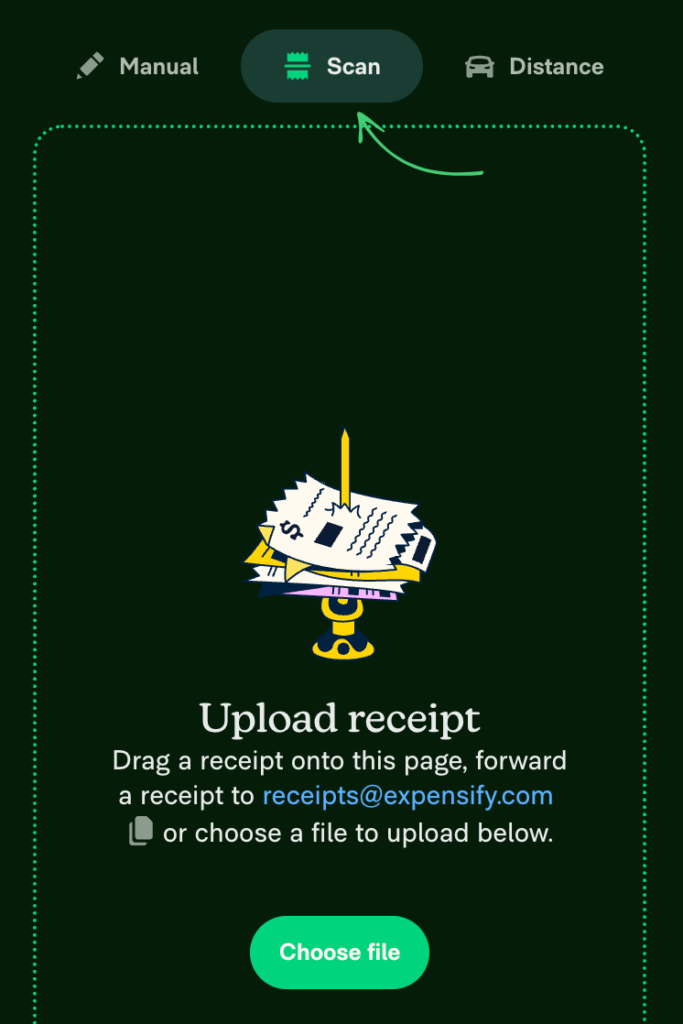

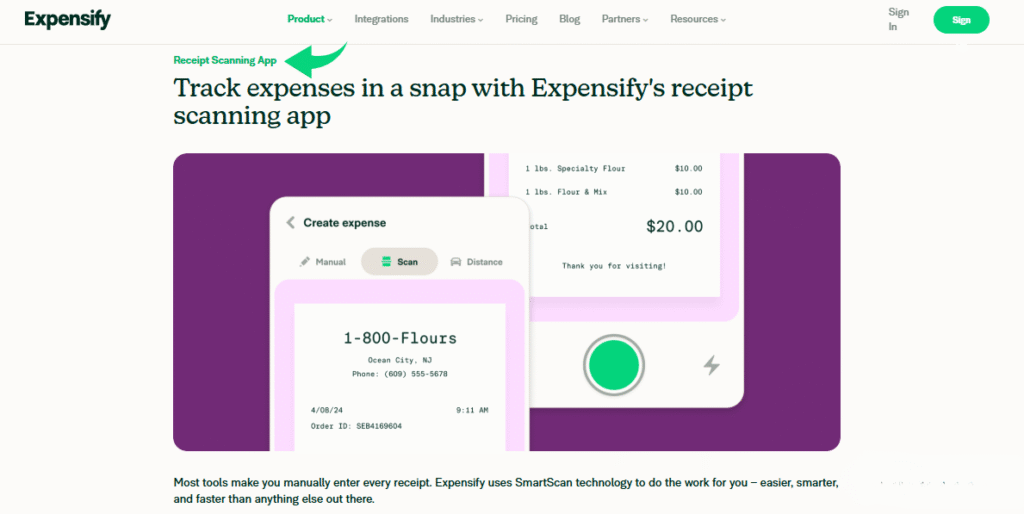

6. Numérisation des reçus

Expensify propose une fonctionnalité très pratique pour scanner les reçus. Il suffit de prendre une photo du reçu avec son téléphone.

La technologie de l'application, appelée SmartScan, lit le reçu.

Cela vous évite d'avoir à saisir toutes les informations vous-même.

Cela permet d'ajouter rapidement et facilement de nouvelles dépenses.

Vous pouvez jeter le reçu papier après l'avoir scanné.

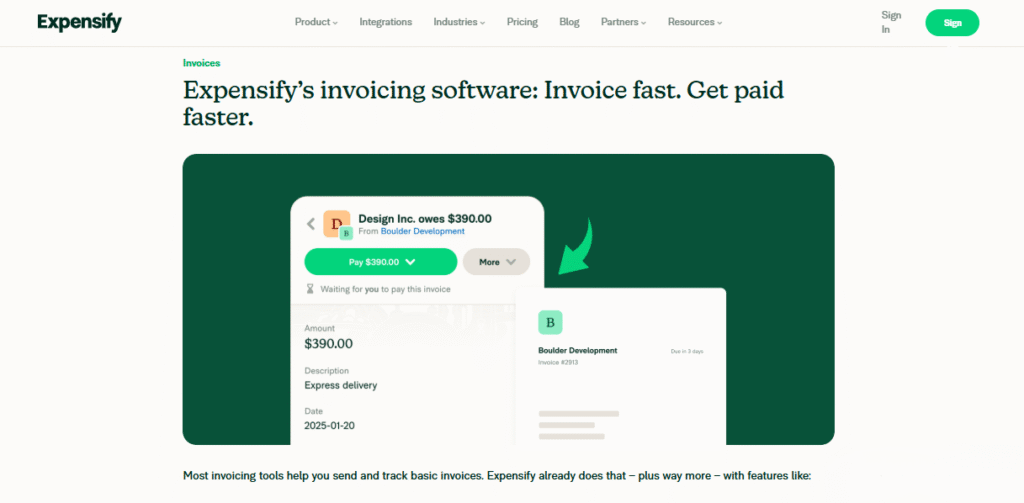

7. Paiement des factures et facturation

Expensify peut faire bien plus que simplement gérer les dépenses.

Cela signifie que vous pouvez être payé plus rapidement et gérer l'argent de votre entreprise au même endroit.

Cela vous permet de suivre ce que vous devez et ce qui vous est dû.

Cela vous permet de garder le contrôle de votre entreprise finances.

8. Remboursements globaux

Si vous avez des employés qui travaillent à l'étranger, Expensify peut vous aider.

Elle peut rembourser les employés et les sous-traitants du monde entier.

Elle les paiera même dans leur monnaie locale.

Cela simplifie le paiement des personnes, quel que soit leur endroit.

Il fonctionne avec de nombreuses banques et devises différentes.

9. Intégration avec d'autres logiciels

Expensify peut se connecter à de nombreux autres programmes que vous utilisez déjà.

Cela fonctionne avec comptabilité Des logiciels comme QuickBooks et Xero permettent de centraliser et de transférer vos informations financières d'un système à un autre.

Vous n'aurez pas à saisir les mêmes informations à plusieurs reprises.

Cela vous fait gagner beaucoup de temps et d'efforts.

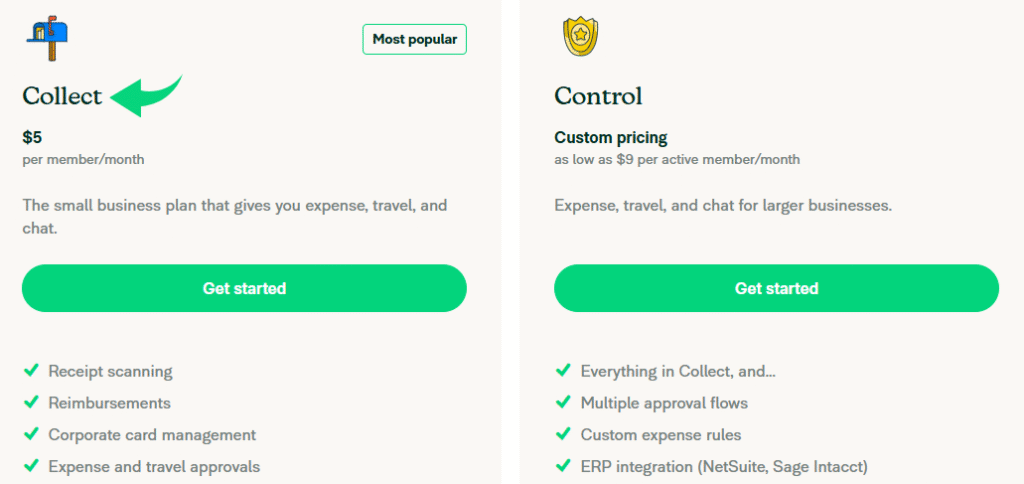

Tarification

| Nom du plan | Prix |

| Collecter | 5 $/membre/mois |

| Contrôle | À partir de 9 $/membre/mois |

Avantages et inconvénients

Connaître les avantages et les inconvénients vous aide à prendre une décision.

Voici un aperçu de ce qu'offre Expensify et de ses éventuelles lacunes.

Avantages

Cons

Alternatives à Expensify

Bien qu'Expensify possède de nombreuses fonctionnalités intéressantes, d'autres logiciels peuvent également faciliter la gestion des reçus et des dépenses.

Voici quelques alternatives à Expensify à envisager :

- Puzzle IO: Ce logiciel est axé sur la planification financière basée sur l'intelligence artificielle.

- Dext: Cet outil est idéal pour la capture de documents et l'extraction de données.

- Xero: Il s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises.

- Synder: Elle est spécialisée dans la synchronisation des données de commerce électronique et de paiement avec les logiciels comptables.

- Fin de mois facile: Ce logiciel est conçu pour simplifier vos tâches financières de fin de mois.

- Docyt: Elle utilise l'intelligence artificielle pour la comptabilité et automatise les flux de travail financiers.

- Sage: Il s'agit d'une suite logicielle complète pour la gestion d'entreprise et la comptabilité.

- Livres Zoho: Cet outil de comptabilité en ligne est réputé pour son prix abordable et son adéquation aux petites entreprises.

- Vague: Cette option propose un logiciel de comptabilité gratuit pour les petites entreprises.

- Hubdoc: Elle est spécialisée dans la collecte et l'organisation des documents financiers pour la comptabilité.

- QuickBooks: Un logiciel de comptabilité très connu qui aide les entreprises dans tous leurs besoins, de la facturation à la paie.

- Saisie automatique: Cet outil automatise la saisie de données en scannant et en analysant des documents tels que les factures et les reçus.

- FreshBooks: Ce logiciel est spécialement conçu pour les travailleurs indépendants et les petites entreprises, et met l'accent sur la facturation et le suivi du temps.

- NetSuite: Une suite logicielle de gestion d'entreprise puissante et complète, basée sur le cloud, pour les grandes entreprises.

Comparaison avec Expensify

- Expensify contre PuzzleCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- Expensify contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- Expensify contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- Expensify contre SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- Expensify vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- Expensify contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- Expensify contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- Expensify contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- Expensify vs WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- Expensify vs HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- Expensify contre QuickBooksIl s'agit d'un logiciel de comptabilité bien connu des entreprises. Son alternative est conçue pour les finances personnelles.

- Expensify vs AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- Expensify contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- Expensify contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Mon expérience personnelle avec Expensify

Notre équipe avait besoin d'un meilleur accès web pour gérer les notes de frais.

L'ancienne méthode était lente et complexe. Nous avons opté pour Expensify afin de déclencher des actions.

Ce produit nous a permis de gérer nos dépenses beaucoup plus facilement.

Nous avons pu éliminer les reçus papier et accélérer l'ensemble de notre processus.

Désormais, nous pouvons tout gérer rapidement et avec beaucoup plus de précision.

- La possibilité de photographier un reçu et d'en extraire automatiquement les informations a été un atout considérable. La photo pouvait être scannée en quelques secondes, éliminant ainsi la saisie manuelle de données. Toutes les informations étaient immédiatement capturées et prêtes à être archivées.

- Nous avons offert à chaque employé une solution flexible pour déclarer ses dépenses. Ils pouvaient utiliser l'application sur ordinateur ou sur leur mobile. Cela leur permettait d'enregistrer facilement leurs dépenses au fur et à mesure. Les informations relatives aux dépenses étaient ensuite stockées en toute sécurité dans l'application.

- Le système était excellent sécuritéNos données financières étaient en sécurité. La connexion à notre comptabilité Le logiciel était également sécurisé. Nous savions que les informations de notre entreprise étaient protégées.

- Nous avons pu répondre aux demandes de remboursement de frais en temps réel, ce qui nous a permis de résoudre les problèmes immédiatement et d'éviter à nos responsables d'être bloqués par une longue liste d'approbations.

- Cet outil nous a permis d'ajouter des étiquettes et des catégories personnalisées pour différents projets. Cela a facilité le suivi des dépenses au sein de notre organisation et a permis à nos employés de garder un œil sur les dépenses engagées.

- The app’s built-in mileage tracker was a key feature. It would log our entreprise trips automatically. This was much better than writing down the miles by hand.

- Nous avons pu exporter nos données en quelques clics seulement. C'était prévu et cela a facilité la création de rapports. simplifié Ce processus nous a permis d'obtenir un meilleur soutien de notre équipe comptable.

- Nous pouvions utiliser un code spécifique pour chaque projet ou client, ce qui nous offrait un meilleur contrôle et permettait un suivi des dépenses encore plus précis pour nos clients.

Réflexions finales

Si la gestion de vos finances est difficile pour vous ou votre travail, Expensify pourrait vous aider.

C'est comme une aide pour vos reçus et vos dépenses. Prendre des photos de reçus est facile.

Le remboursement est plus rapide.

Il peut même fonctionner avec d'autres logiciels informatiques que vous pourriez utiliser.

Certaines options coûtent plus cher. Mais si vous voulez gagner du temps et vous épargner des tracas,

Expensify mérite qu'on s'y intéresse.

Vous voulez simplifier la gestion de vos dépenses ?

Rendez-vous sur le site web d'Expensify et voyez comment cela fonctionne pour vous !

Foire aux questions

Is Expensify any good?

Yes, it is a powerhouse for automating receipt tracking. The “SmartScan” technology saves hours of manual data entry by immédiatement extracting details from photos. However, the interface can feel slightly cluttered for users who prefer a minimalist design.

How much does Expensify cost per month?

Pricing varies by usage. For individuals, plans start around 4,99 $/mois. For businesses, the “Collect” plan starts at $5 per user/month (if bundled with the Expensify Card), while the “Control” plan starts around $9 per user/month.

Is Expensify really free?

Sort of. Expensify offers a free tier (often called “New Expensify”) that allows for basic expense tracking and splitting bills. However, it is limited to about 25 SmartScans per month; heavy users will hit a paywall.

What is the difference between QuickBooks and Expensify?

Think of them as partners, not rivals. QuickBooks is a general ledger for overall comptabilité. Expensify is a specialized tool for capturing receipts and managing employee reimbursements. They integrate seamlessly to keep your books accurate.

Did Expensify sponsor the F1 movie?

Yes, they did. Expensify famously sponsored the fictional APX GP racing team in the Apple Original film F1, starring Brad Pitt. Their branding appears on the cars and kits in the movie.

Is Expensify a real company?

Absolutely. Expensify is a legitimate, publicly traded company (Ticker: EXFY). They are headquartered in Portland, Oregon, and comply with major security standards like PCI-DSS and SOC 1/SOC 2.

What is better than Expensify?

Cela dépend de vos besoins spécifiques. Ramp is often preferred for its free corporate card program. Zoho Expense can be a cheaper alternative for very small teams, while QuickBooks Online has built-in receipt features that might suffice for solopreneurs.

More Facts about Expensify

What Expensify Does

- It handles everything in one place: Expensify is an all-in-one tool for managing spending for both personal and business use.

- It automates the work: The software tracks receipts and manages expenses so you do not have to do so manually.

- It covers the whole process: Users can create reports, submit them, get them approved, and get paid back all within the app.

- It reads receipts for you: When you take a photo of a receipt, a feature called SmartScan reads the details and automatically creates an expense report.

- It helps businesses of all sizes: The platform is designed to help small and medium-sized businesses handle their money reportage.

- It has its own credit card: The company offers a business credit card called the Expensify Card.

- It tracks travel: You can use the app to upload travel costs and track the miles you drive.

- It matches bank data: The system can automatically match your receipts to the charges on your bank statement.

- It connects to other software: Expensify works together with comptabilité programs like QuickBooks and Xero.

- It stores records: The app saves digital copies of your receipts so you do not lose them.

Why Users Like It

- It saves a lot of time: Teams say that work that used to take hours now only takes minutes.

- It is easy to use: Many people praise the app for its simple design and good mobile scanner.

- It automatically sends reports: The app sends expense reports straight to supervisors, which speeds things up.

- It reduces paperwork: Users like how the app cuts down on boring office work, like forwarding receipts from email.

- It pays people back quickly: Users can get their money back in as few as a few days.

- It works smoothly and is considered a strong, effective way to manage costs.

- It works all over the world: The app can handle money from different countries and pay people back in their local currency.

- It is highly rated: Expensify is a popular tool that has a high rating (around 4.5 stars) from thousands of reviews.

Challenges and Criticisms

- The scanner makes mistakes: Sometimes SmartScan reads a receipt incorrectly, so users have to fix it by hand.

- Support can be frustrating: Some users get annoyed when they have to talk to a “chat robot” instead of a real person for help.

- Setup can be hard: Even though the app looks simple, setting up the rules and options can be tricky for new administrators.

- Pricing is confusing: Many users complain that the software’s pricing is hard to understand or too expensive.

- Hidden costs: Some people feel there are hidden charges they did not expect.

- Pushy sales: Some rev