En tant que immobilier agent, your time is your most valuable asset.

You’re busy showing properties, meeting clients, and negotiating deals.

The last thing you want to do is spend hours buried in spreadsheets.

You’re not alone; many agents struggle with the tedious, time-consuming parts of comptabilité.

What if you could spend less time on paperwork and more time on closing deals?

The answer lies in the right tools.

This article will lead you through the 9 Best AI Accounting Software for Real Estate Agents in 2025, showing you how they can transform your entreprise and give you back your time.

What is the Best Accounting Software for Real Estate Agents?

Choisir le meilleur logiciel de comptabilité IA Cela dépend de vos besoins.

The right AI powered tools can streamline business processes and drive business growth by giving you a clear view of your company’s financial performance.

You’ll find that these tools, especially the top expense management software, handle relevant données avec aisance.

This helps you focus on what’s important, and don’t worry—AI won’t replace comptables; it just makes their job easier.

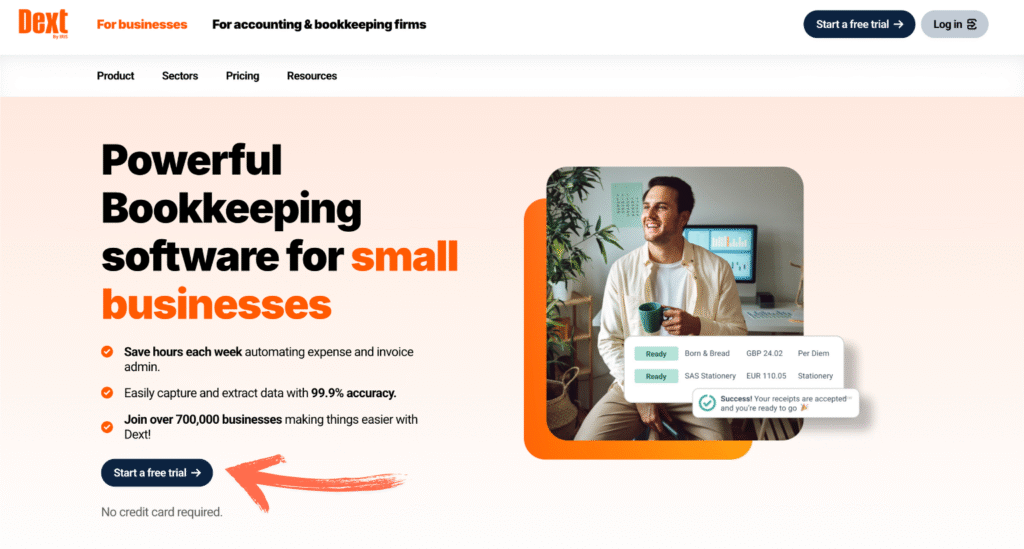

1. Dext (⭐4,8)

Dext is a powerful tool for comptabilité firms and professionals.

Elle utilise l'intelligence artificielle pour automatiser comptabilité.

You can simply upload receipts and invoices, and Dext will use AI technology to extract the financial data.

It saves so much time and helps reduce errors.

The data analysis it provides helps you get a better handle on your finances.

Libérez son potentiel grâce à notre Tutoriel Dext.

Notre avis

Prêt à récupérer plus de 10 heures par mois ? Découvrez comment la saisie de données automatisée, le suivi des dépenses et les rapports de Dext peuvent simplifier vos finances.

Principaux avantages

Dext excelle vraiment lorsqu'il s'agit de simplifier au maximum la gestion des dépenses.

- 90 % des utilisateurs font état d'une diminution significative de l'encombrement de papiers.

- Il affiche un taux de précision supérieur à 98 %. dans l'extraction de données à partir de documents.

- Créer des notes de frais devient incroyablement rapide et facile.

- S'intègre parfaitement aux plateformes comptables populaires, telles que QuickBooks et Xero.

- Permet de ne jamais perdre la trace de documents financiers importants.

Tarification

- Abonnement annuel : $24

Avantages

Cons

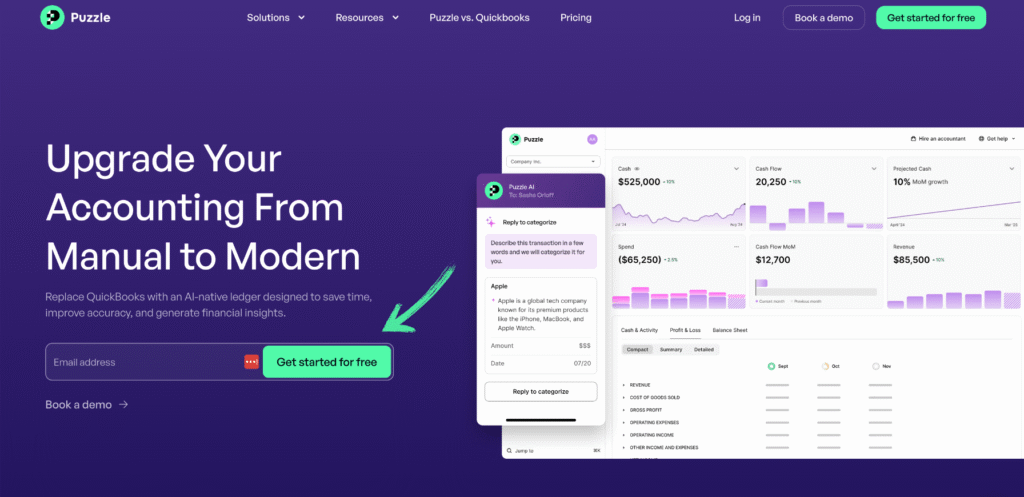

2. Puzzle IO (⭐4,5)

Puzzle IO is built for real-time financial data.

This software uses AI to automate many financial processes, from comptabilité to reporting.

It continuously analyzes financial data to catch errors before they become a problem.

It’s perfect for those who want their books to be accurate and up-to-date every single day, not just at month’s end.

Libérez son potentiel grâce à notre Tutoriel Puzzle IO.

Notre avis

Envie de simplifier vos finances ? Découvrez comment Puzzle io peut vous faire gagner jusqu’à 20 heures par mois. Faites-en l’expérience dès aujourd’hui !

Principaux avantages

Puzzle IO excelle vraiment lorsqu'il s'agit de vous aider à comprendre où votre entreprise se dirige.

- 92% de Les utilisateurs font état d'une meilleure précision des prévisions financières.

- Obtenez des informations en temps réel sur vos flux de trésorerie.

- Créez facilement différents scénarios financiers pour planifier.

- Collaborez harmonieusement avec votre équipe sur les objectifs financiers.

- Suivez les indicateurs clés de performance (KPI) en un seul endroit.

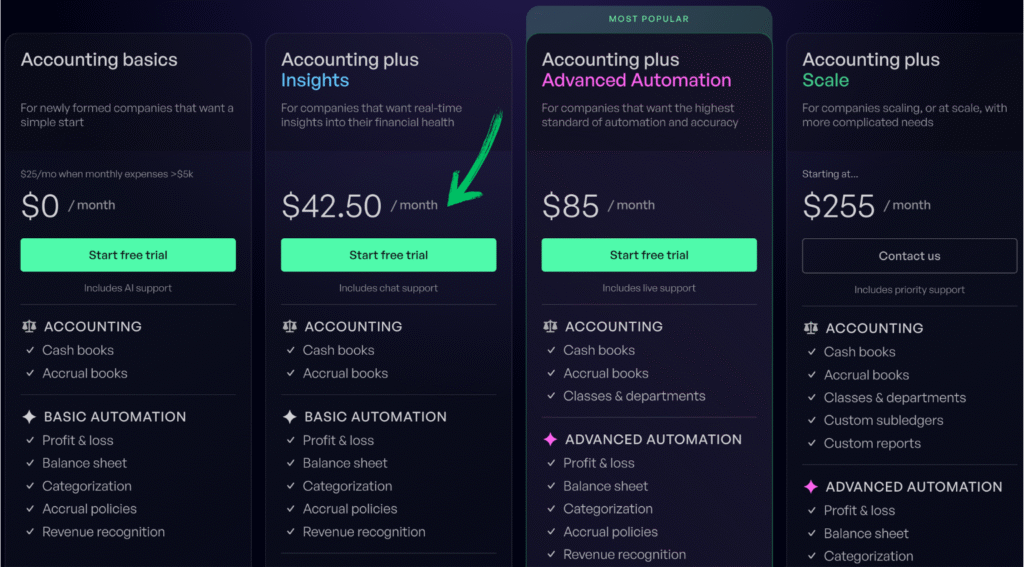

Tarification

- Notions de base en comptabilité : 0 $/mois.

- Perspectives de Accounting Plus : 42,50 $/mois.

- Comptabilité et automatisation avancée : 85 $/mois.

- Échelle Accounting Plus : 255 $/mois.

Avantages

Cons

3. Xero (⭐4.0)

Xero is a well-known name in the comptabilité industrie.

Their AI-powered features, like the Financial Superagent JAX, help automate bank reconciliations and data entry.

JAX learns your business rhythms to faire smart suggestions.

The system uses NLP to understand your queries and provide actionable insights.

Libérez son potentiel grâce à notre Tutoriel Xero.

Notre avis

Rejoignez plus de 2 millions d'entreprises utilisation de Xero Logiciel de comptabilité. Découvrez dès maintenant ses puissantes fonctionnalités de facturation !

Principaux avantages

- Rapprochement bancaire automatisé

- Facturation et paiements en ligne

- Gestion des factures

- Intégration de la paie

- Rapports et analyses

Tarification

- Démarreur: 29 $/mois.

- Standard: 46 $/mois.

- Prime: 69 $/mois.

Avantages

Cons

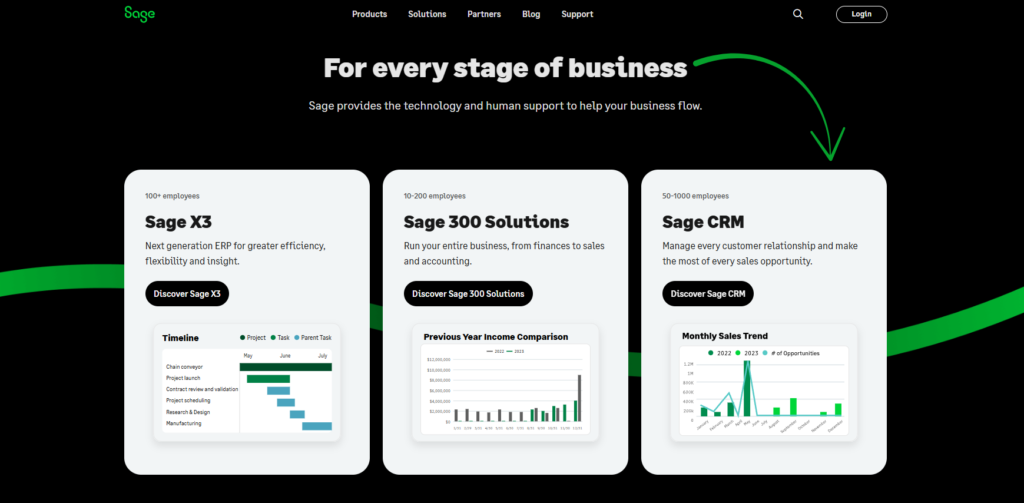

4. Sauge (⭐️3,8)

Sage is a comprehensive platform for managing business finances.

Sage AI, especially through Sage Copilot, streamlines financial processes.

It uses AI to automate tasks like invoice ingestion and duplicate detection.

This technology provides predictive analytics to help you with cash flow and reportage.

It’s a great choice for firms looking for robust data analysis and automation.

Libérez son potentiel grâce à notre Tutoriel Sage.

Notre avis

Prêt à booster vos finances ? Les utilisateurs de Sage ont constaté une augmentation moyenne de 73 % de leur productivité et une réduction de 75 % du temps de cycle de traitement.

Principaux avantages

- Facturation et paiements automatisés

- Rapports financiers en temps réel

- Un système de sécurité renforcé pour protéger les données

- Intégration avec d'autres outils d'entreprise

- Solutions de paie et de RH

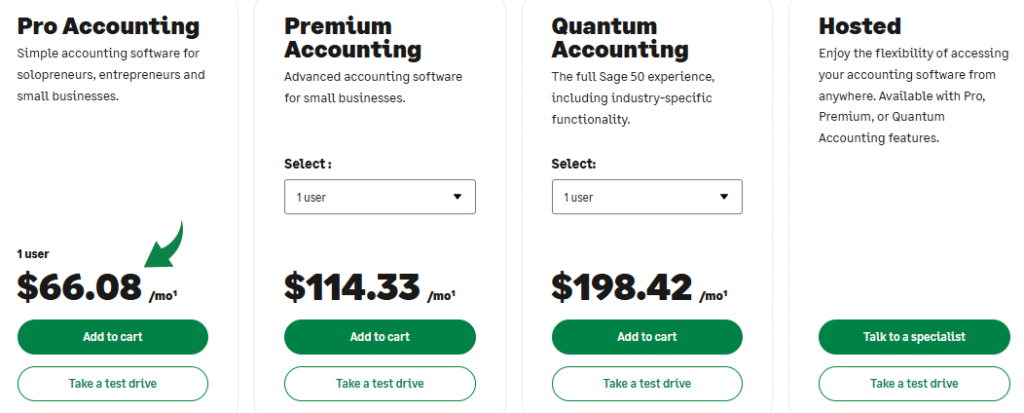

Tarification

- Comptabilité professionnelle : 66,08 $/mois.

- Comptabilité premium : 114,33 $/mois.

- Comptabilité quantique : 198,42 $/mois.

- Solutions RH et paie groupées : Tarification personnalisée en fonction de vos besoins.

Avantages

Cons

5. Synder (⭐3,6)

Synder helps you sync transactions from various e-commerce and payment platforms.

It uses AI technology to automate data entry and reconciliation, making it a powerful tool for businesses that sell online.

This allows you to easily analyze financial data from multiple sources.

It’s all about bringing your data together and making sense of it.

Développez tout son potentiel grâce à notre tutoriel Synder.

Notre avis

Synder automatise votre comptabilité en synchronisant de manière transparente les données de vente avec QuickBooks. Xeroet bien plus encore. Les entreprises utilisant Synder déclarent économiser en moyenne plus de 10 heures par semaine.

Principaux avantages

- Synchronisation automatique des données de vente

- Suivi des ventes multicanaux

- Rapprochement des paiements

- Intégration de la gestion des stocks

- Rapports de vente détaillés

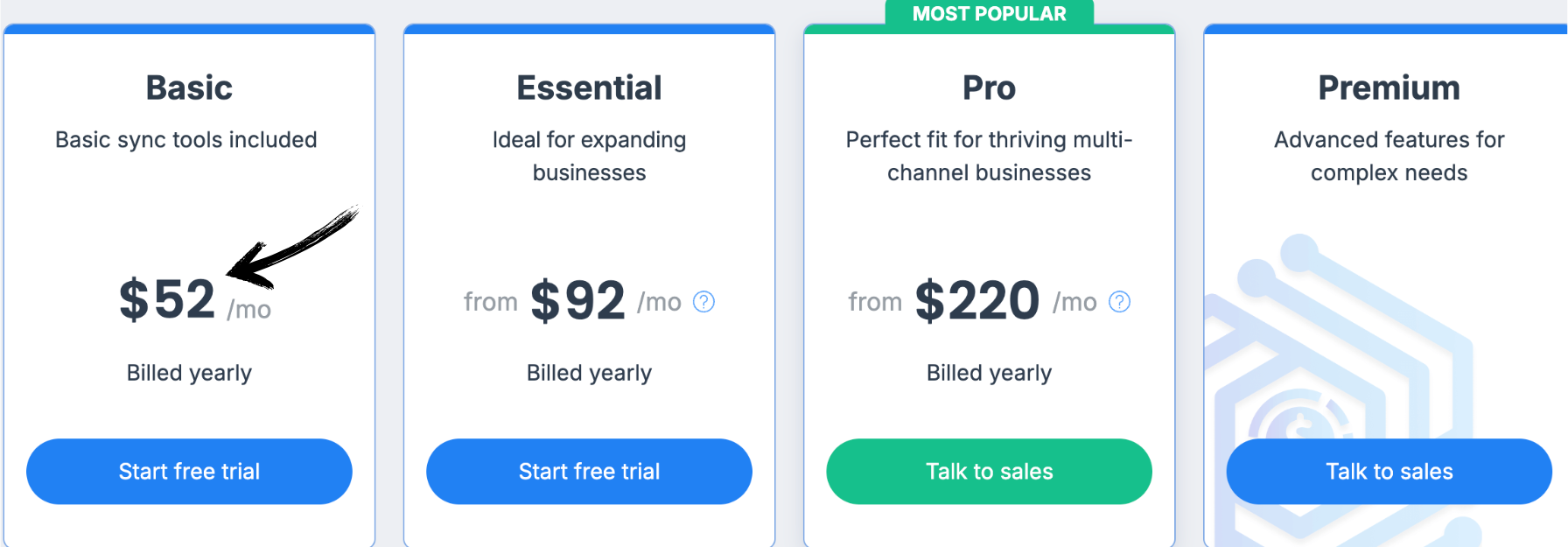

Tarification

Tous les plans seront Facturé annuellement.

- Basique: 52 $/mois.

- Essentiel: 92 $/mois.

- Pro: 220 $/mois.

- Prime: Tarification personnalisée.

Avantages

Cons

6. Fin de mois facile (⭐3,4)

Easy Month End is designed to simplify the most painful part of accounting—the month-end close.

It uses natural language processing to help comptabilité professionals automate repetitive tasks.

This AI technology helps organize and process financial data.

It’s a lifesaver for anyone who dreads the end-of-the-month scramble.

Libérez son potentiel grâce à notre Tutoriel facile de fin de mois.

Notre avis

Améliorez la précision de vos finances avec Easy Month End. Bénéficiez du rapprochement automatisé et de rapports conformes aux exigences d'audit. Planifiez une démonstration personnalisée pour simplifier votre processus de clôture mensuelle.

Principaux avantages

- Flux de travail de rapprochement automatisés

- Gestion et suivi des tâches

- Analyse de la variance

- Gestion documentaire

- Outils de collaboration

Tarification

- Démarreur: 24 $/mois.

- Petit: 45 $/mois.

- Entreprise: 89 $/mois.

- Entreprise: Tarification personnalisée.

Avantages

Cons

7. RefreshMe (⭐️3,2)

RefreshMe is a personal finance tool with a strong AI assistant.

While it’s geared towards personal use, its features can easily be applied by real estate agents.

The AI analyzes financial data, tracks spending, and offers personalized insights.

It helps you keep an eye on your expenses and manage your budget effortlessly.

Libérez son potentiel grâce à notre Tutoriel Refreshme.

Notre avis

Le point fort de RefreshMe réside dans sa capacité à fournir des informations exploitables en temps réel. Toutefois, l'absence de tarification publique et des fonctionnalités comptables de base potentiellement moins complètes pourraient constituer des points à prendre en compte pour certains utilisateurs.

Principaux avantages

- Tableaux de bord financiers en temps réel

- Détection d'anomalies basée sur l'IA

- Rapports personnalisables

- prévision des flux de trésorerie

- Évaluation comparative des performances

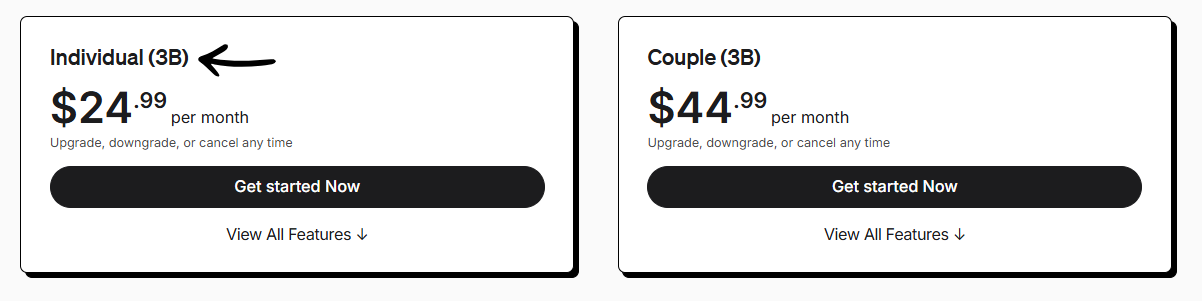

Tarification

- Individu (3B) : 24,99 $/mois.

- Couple (3B) : 44,99 $/mois.

Avantages

Cons

8. QuickBooks (⭐3.0)

QuickBooks has been a staple for years, and now it’s getting even smarter with AI.

Their AI agents work behind the scenes to help with everything from categorizing transactions to reconciling accounts.

This artificial intelligence makes financial processes smoother.

It’s designed to give you more accurate data and streamline your day-to-day comptabilité.

Libérez son potentiel grâce à notre Tutoriel QuickBooks.

Principaux avantages

- Catégorisation automatisée des transactions

- Création et suivi des factures

- Gestion des dépenses

- Services de paie

- Rapports et tableaux de bord

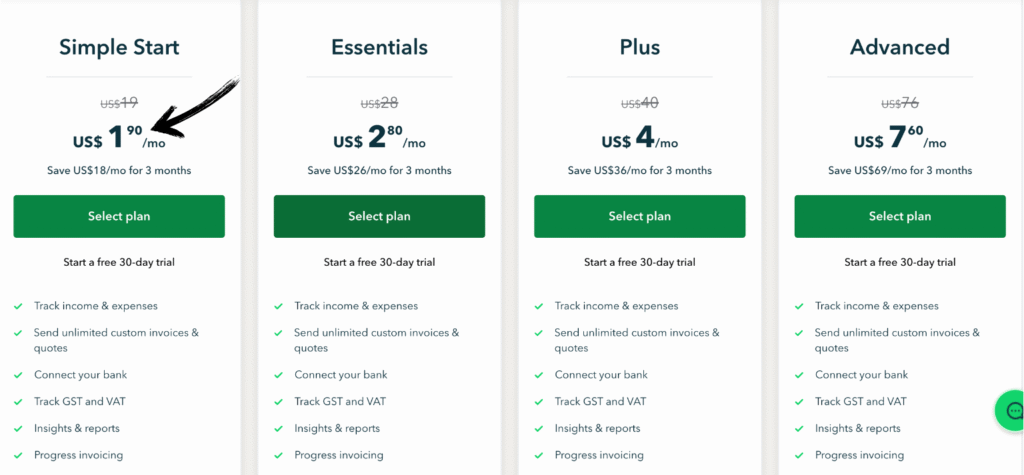

Tarification

- Démarrage simple : 1,90 $/mois.

- Essentiel: 2,80 $/mois.

- Plus: 4 $/mois.

- Avancé: 7,60 $/mois.

Avantages

Cons

9. Docyt (⭐2,8)

Docyt’s AI engine is built for precision. It’s a great tool for accounting firms and individual professionals.

This platform uses AI technology to automate complex comptabilité flux de travail.

It can process financial data, generate analytics, and even detect anomalies.

It’s all about giving you cleaner financials with less manual work.

Libérez son potentiel grâce à notre Tutoriel Docyt.

Principaux avantages

- Automatisation basée sur l'IA : Docyt utilise l'intelligence artificielle. Elle extrait automatiquement des données de documents financiers, notamment des informations provenant de plus de 100 000 fournisseurs.

- Comptabilité en temps réel : Vos comptes sont mis à jour en temps réel. Vous disposez ainsi d'une image financière précise à tout moment.

- Gestion documentaire : Centralise tous les documents financiers. Vous pouvez facilement les rechercher et y accéder.

- Automatisation du paiement des factures : Automatisez le processus de paiement des factures. Programmez et payez vos factures facilement.

- Remboursement des frais : Simplifiez le traitement des notes de frais des employés. Soumettez et approuvez les dépenses rapidement.

- Intégrations transparentes : S'intègre aux logiciels de comptabilité les plus courants. Cela inclut QuickBooks et Xero.

- Détection des fraudes : Son IA peut aider à repérer les transactions inhabituelles. Cela ajoute une couche de sécurité. sécuritéIl n'existe aucune garantie spécifique pour le logiciel, mais des mises à jour continues sont fournies.

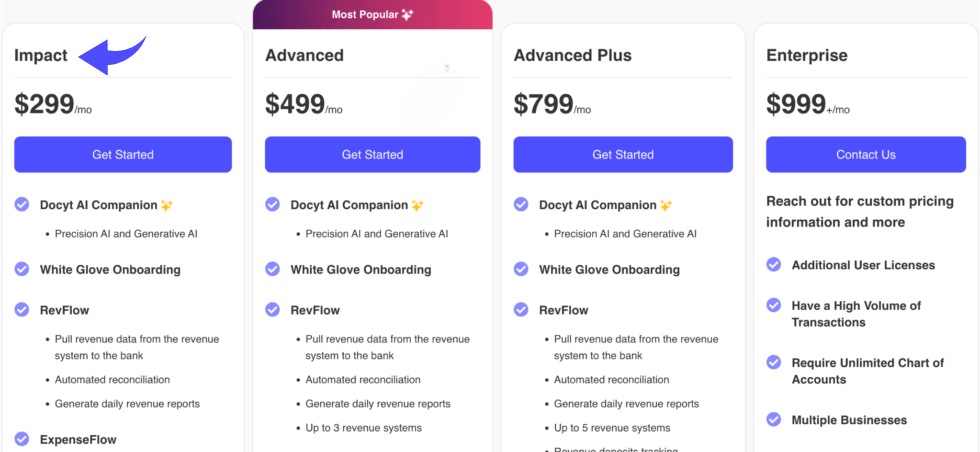

Tarification

- Impact: 299 $/mois.

- Avancé: 499 $/mois.

- Avancé Plus: 799 $/mois.

- Entreprise: 999 $/mois.

Avantages

Cons

What Real Estate Agents need in an Accounting Software?

When you’re an agent, you want a tool that works for you, not the other way around.

Choosing the right AI accounting software is a crucial step for your business.

So, what features should you be on the lookout for?

- Automation is key. The whole point of using AI in accounting is to save time. Look for softwares that use machine learning algorithms & robotic process automation to handle repetitive tasks like data entry and expense reports. These features should reduce the risk of human error and free you up for more important work.

- Predictive insights matter. The best accounting AI goes beyond just recording what happened. It should be able to analyze financial data to help with financial planning and forecasting. A good system will give you the insights you must need to make smart & strategic business decisions.

- It needs to handle real estate specifics. Your accounting processes are different from a typical business. Look for software that understands the unique aspects of your internal accounting processes, like commission tracking, property expenses, and complex financial statements.

- Don’t forget about tax compliance. Nobody loves tax season. The right software can make it a breeze by using AI to track deductions and prepare financial reporting. This helps you stay on top of tax compliance without a headache.

- Integration is non-negotiable. The software should play nicely with other tools you already use, like your CRM or bank accounts. Seamless integration means less manual work and a more efficient workflow for finance and accounting professionals.

- Security is a priority. When you’re dealing with sensitive financial data, then the security is paramount. Make sure the tool has wide security measures in place to prevent hackers & protect your information.

- Don’t worry, AI won’t replace accountants entirely. It’s a tool, not a replacement. AI can handle the tedious, number-crunching parts of your work, leaving you to focus on the human side of your business.

How Can Real Estate Agents Benefit from Using Accounting Software?

Using AI accounting tools can truly change how you run your business.

These tools are designed to automate repetitive accounting tasks that take up so much of your day.

This includes everything from data management to managing accounts payable.

By letting the AI software handle these tasks, you free up a ton of time.

This means you can focus on what you do best: helping clients and growing your business.

These tools don’t just automate; they also give you a clear view of your business’s financial health.

They use predictive analytics by analyzing historical data to help you with financial planning.

This helps businesses manage their finances better & makes smarter decisions.

While some might worry about AI replacing accountants, the truth is that AI accounting tools are here to help, not replace.

They make your financial operations smoother and help reduce human error.

You get to spend less time on paperwork and more time on the parts of your job that you love.

Guide d'achat

We know how important it is to choose the right accounting system.

To help you make the best decision, we conducted our research based on several key factors.

We wanted to make sure our list was comprehensive and useful for real estate professionals.

Voici un aperçu de notre processus :

- Tarification : We started by looking at the cost of each outil d'IA. We examined pricing models to see what kind of value they offered for different budgets. It’s important to find a tool that fits your financial plan and helps you save time in the long run.

- Caractéristiques: Next, we dove into the features. We looked for AI systems that went beyond basic data entry. We paid close attention to advanced capabilities like cash flow forecasting, fraud detection, and accounting automation. We wanted to see how these accounting tools help with financial performance and risk management.

- Points négatifs : No tool is perfect. We identified the downsides of each product. This included anything from missing features to a steep learning curve. We believe it’s important to be transparent about what you might be missing.

- Soutien et communauté : We checked to see what kind of support each product offered. Do they have a community forum, live chat, or a solid refund policy? Good support is crucial, especially when you’re dealing with important financial data.

- Capacités de l'IA : We specifically looked at how artificial intelligence (AI) was integrated. We assessed how the AI tool helps automate routine tasks & analyze data to provide valuable insights. We focused on tools that are shaping future trends in the accounting world and helping finance departments and business leaders succeed. We also considered how these tools could reduce the need for manual data entry.

Conclusion

The world of real estate is changing, and AI tools are leading the way.

These AI powered tools are not here to make financial professionals obsolete.

Instead, they are here to automate repetitive comptabilité tasks and help your accounting team work smarter.

By providing real time insights and helping you identify patterns in your financial reports, AI helps improve cash flow and client communication.

Embracing these new business models is key to business growth.

Trust in our research and the information we’ve provided to help you find the best tool for your needs.

Foire aux questions

Will AI replace accountants in the real estate industry?

No, AI won’t replace accountants. It handles repetitive tasks, allowing financial professionals and accounting firms to focus on strategic advice and client communication.

How does AI analyze financial data?

AI systems use machine learning and algorithms to analyze financial data. They identify patterns, automate data entry, and provide real-time insights to improve financial performance.

What kind of accounting industry tasks can AI tools automate?

AI tools automate a range of tasks, including invoice processing, bank reconciliation, expense categorization, and generating financial reports, which saves significant time.

Is AI accounting software secure?

Yes. Most AI accounting tools use advanced security measures like data encryption and secure logins to protect sensitive financial data, ensuring privacy and compliance.

How can AI benefit a small real estate business?

AI helps small businesses manage their finances efficiently by automating tasks, reducing human error, and offering valuable insights for smart decisions and business growth.