Quick Start

This guide covers every Wave feature:

- Erste Schritte — Create account and basic setup

- How to Use Account Reconciliation — Match bank records and catch errors

- How to Use Charts of Accounts — Organize your finances by category

- How to Use Invoices — Send professional invoices and get paid faster

- How to Use Products & Services — Track what you sell and charge

- How to Use Tax Filing — Prepare taxes without the headaches

- How to Use Expense Tracking — Monitor every dollar going out

- How to Use Financial Reporting — See your business health at a glance

- How to Use Mobile App — Manage finances on the go

- How to Use Multi-Currency Support — Handle international transactions

Time needed: 5 minutes per feature

Also in this guide: Pro Tips | Common Mistakes | Fehlerbehebung | Preisgestaltung | Alternativen

Why Trust This Guide

I’ve used Wave for over 2 years and tested every feature covered here. This tutorial comes from real hands-on experience — not marketing fluff or vendor screenshots.

Wave is one of the most popular free Buchhaltung tools for small businesses today.

But most users only scratch the surface of what it can do.

This guide shows you how to use every major feature.

Step by step, with screenshots and pro tips.

Wave Tutorial

This complete Wave tutorial walks you through every feature step by step, from initial setup to advanced tips that will make you a power user.

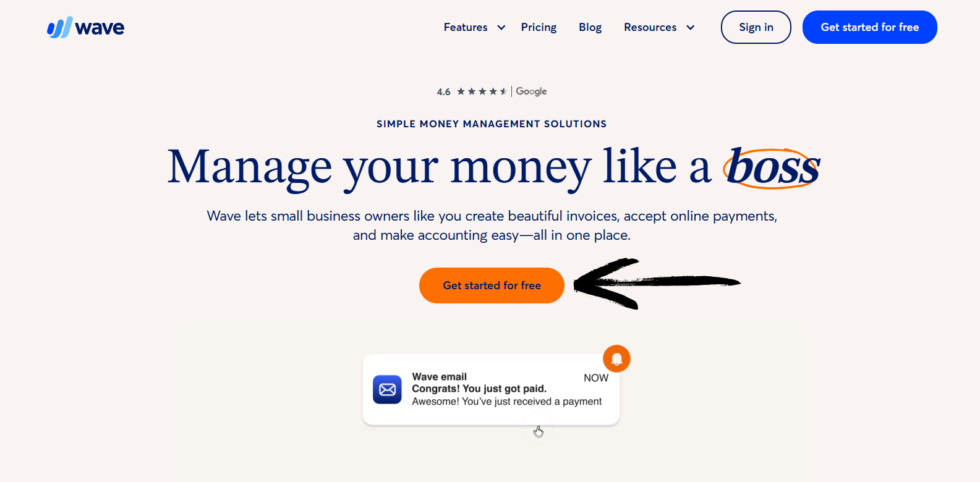

Welle

Free accounting, invoicing, and receipt scanning for small businesses. Wave handles your Buchhaltung so you can focus on growing your business. Start for free — no credit card needed.

Erste Schritte mit Wave

Before using any feature, complete this one-time setup.

It takes about 3 minutes.

Watch this quick overview first:

Now let’s walk through each step.

Step 1: Create Your Account

Go to waveapps.com and click “Sign Up Free.”

Geben Sie Ihre Daten ein Geschäft email and create a password.

You can also sign up with Google for faster access.

✓ Checkpoint: Überprüfen Sie Ihre Posteingang for a confirmation email.

Step 2: Set Up Your Business Profile

Enter your business name and select your industry.

Add your business address and upload your logo.

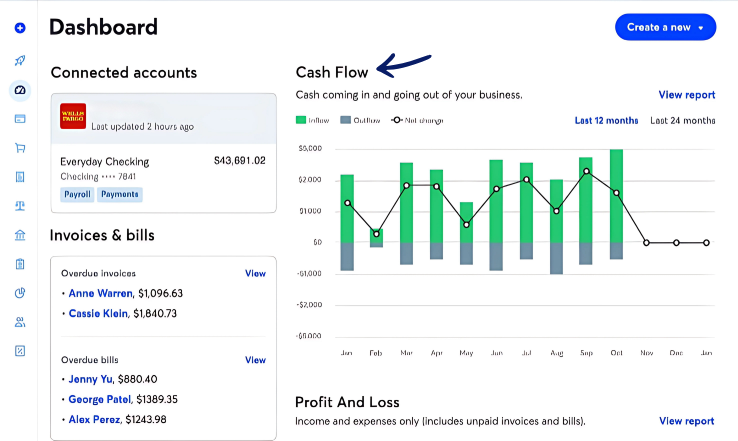

Here’s what the dashboard looks like:

✓ Checkpoint: You should see the main dashboard with your business name.

Step 3: Connect Your Bank Account

Click “Banking” in the left menu and select “Connect an Account.”

Search for your bank and enter your login details.

Wave uses 256-bit SSL encryption to keep your data safe.

✅ Done: You’re ready to use any feature below.

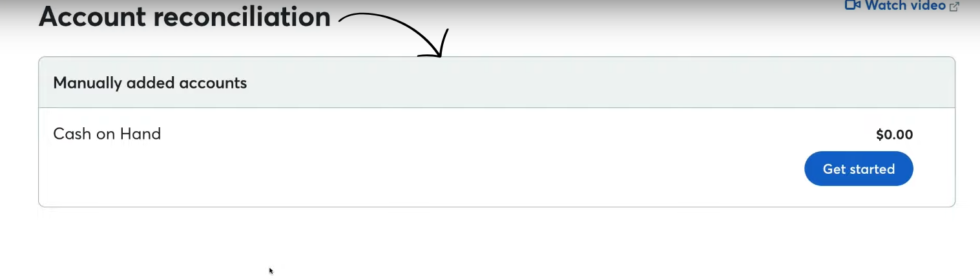

How to Use Wave Account Reconciliation

Kontenabstimmung lets you match bank records with your books to catch mistakes.

Here’s how to use it step by step.

Watch Account Reconciliation in action:

Now let’s break down each step.

Step 1: Open the Reconciliation Page

Click “Accounting” then “Reconciliation” in the left sidebar.

Select the bank account you want to reconcile.

Step 2: Enter Your Bank Statement Balance

Type in the ending balance from your bank statement.

Enter the statement date to match the correct period.

✓ Checkpoint: You should see a list of transactions to review.

Step 3: Match and Confirm Transactions

Check each transaction that matches your bank statement.

Click “Finish” when the difference shows $0.00.

✅ Result: Your books now match your bank records exactly.

💡 Profi-Tipp: Reconcile monthly to catch errors früh. Waiting too long makes it harder to find mistakes.

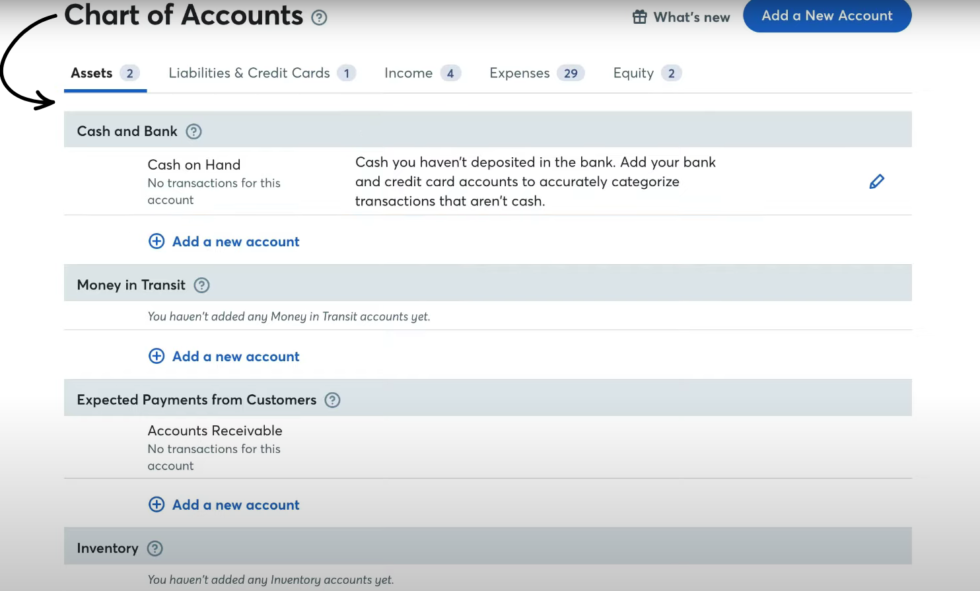

How to Use Wave Charts of Accounts

Kontenpläne lets you organize all your income and expenses into clear categories.

Here’s how to use it step by step.

Watch Charts of Accounts in action:

Now let’s break down each step.

Step 1: Navigate to Chart of Accounts

Click “Accounting” then “Chart of Accounts” in the menu.

You’ll see Wave’s default categories already set up.

Step 2: Add a New Account Category

Click “Add a New Account” at the top right.

Choose the account type like Income, Expense, or Asset.

Name the category something clear like “Office Supplies” or “Client Payments.”

✓ Checkpoint: Your new category should appear in the list.

Step 3: Assign Transactions to Categories

Go to any transaction and select your new category from the dropdown.

Wave remembers your choices for future similar transactions.

✅ Result: Your finances are organized into clean, trackable categories.

💡 Profi-Tipp: Create custom categories that match your tax deductions. This saves hours at tax time.

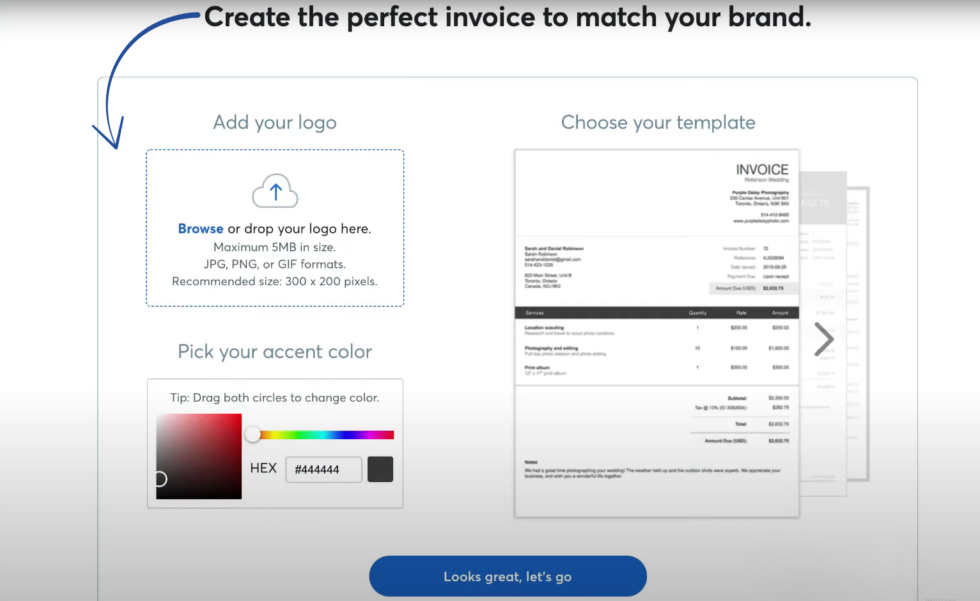

How to Use Wave Invoices

Rechnungen lets you create professional-looking invoices and get paid online.

Here’s how to use it step by step.

Watch Invoices in action:

Now let’s break down each step.

Step 1: Create a New Invoice

Click “Invoicing” then “New Invoice” from the dashboard.

Select or add a customer from the dropdown.

Step 2: Add Line Items and Details

Add each product or service with description, quantity, and price.

Set the due date and add any notes for your client.

Wave auto-calculates the total including tax if enabled.

✓ Checkpoint: You should see a preview of your branded invoice.

Step 3: Send and Track Your Invoice

Click “Send” to email the invoice directly to your client.

Wave notifies you when the client views and pays the invoice.

✅ Result: Your invoice is sent and payment is tracked automatically.

💡 Profi-Tipp: Enable online payments so clients can pay by credit card or bank transfer. It cuts payment time by 3x.

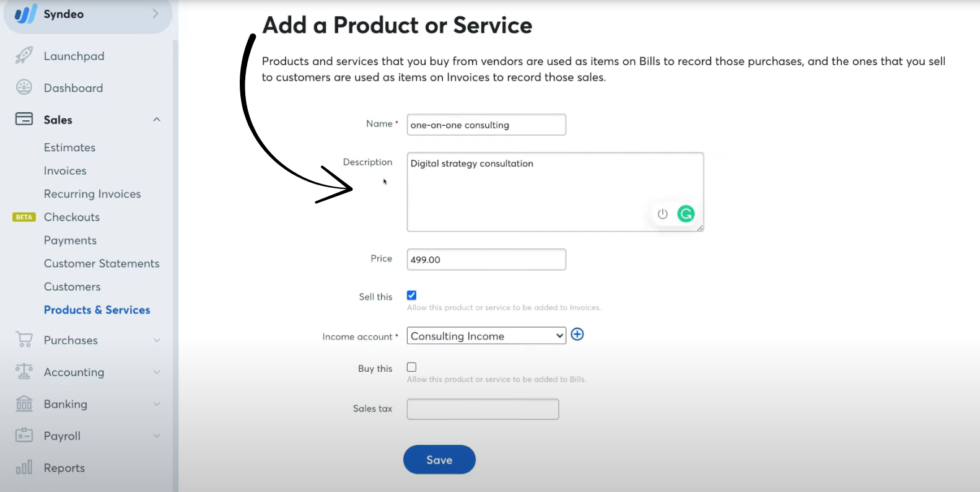

How to Use Wave Products & Services

Produkte und Dienstleistungen lets you save items you sell so invoicing is faster.

Here’s how to use it step by step.

Watch Products & Services in action:

Now let’s break down each step.

Step 1: Open Products & Services

Click “Sales” then “Products & Services” in the sidebar.

This is where you manage everything you sell.

Step 2: Add a New Product or Service

Click “Add a Product or Service” and enter the name and price.

Choose the income account where revenue should go.

Add a description that will appear on invoices.

✓ Checkpoint: Your product should appear in the Products list.

Step 3: Use Products in Invoices

When creating an invoice, select your saved product from the dropdown.

Wave auto-fills the price and description for you.

✅ Result: Your products are saved and ready to add to any invoice sofort.

💡 Profi-Tipp: Create products for your most common services. This saves 5+ minutes per invoice.

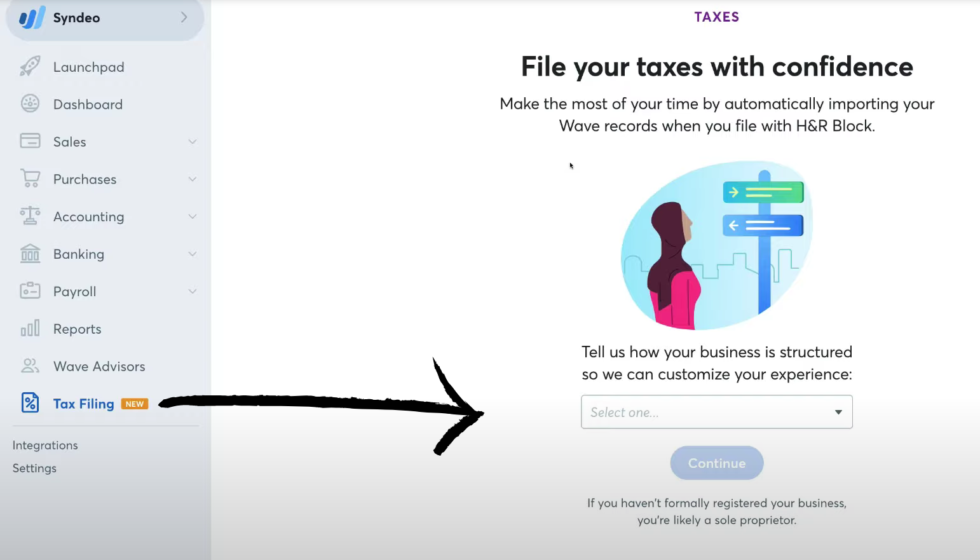

How to Use Wave Tax Filing

Tax Filing lets you prepare and organize your tax documents without stress.

Here’s how to use it step by step.

Watch Tax Filing in action:

Now let’s break down each step.

Step 1: Review Your Transaction Categories

Go to “Accounting” and check that all transactions are categorized.

Uncategorized transactions cause problems at tax time.

Step 2: Generate Your Tax Reports

Click “Reports” and select “Profit & Loss” or “Balance Sheet.”

Set the date range to your tax year.

Wave generates the report with all your income and expenses sorted.

✓ Checkpoint: You should see totals for each income and expense category.

Step 3: Export or Share with Your Accountant

Click “Export” to download the report as a CSV or PDF.

You can also invite your accountant as a collaborator.

✅ Result: Your tax documents are ready to file or share.

💡 Profi-Tipp: Attach receipts to transactions throughout the year. This makes tax audits painless.

How to Use Wave Expense Tracking

Ausgabenverfolgung lets you monitor every dollar leaving your business.

Here’s how to use it step by step.

Watch Expense Tracking in action:

Now let’s break down each step.

Step 1: View Your Transactions

Click “Transactions” in the left sidebar.

If your bank is connected, expenses import automatically on the Pro plan.

Step 2: Categorize Each Expense

Click on a transaction and assign it to the correct expense category.

Add a note or attach a receipt photo for documentation.

✓ Checkpoint: The transaction should show the correct category and receipt.

Step 3: Review Expense Reports

Go to “Reports” and select “Expenses by Category.”

This shows exactly where your money is going each month.

✅ Result: You have a clear picture of all business expenses.

💡 Profi-Tipp: Keep personal and business expenses separate from day one. It prevents a mess at tax time.

How to Use Wave Financial Reporting

Financial Berichterstattung lets you see your business health at a glance.

Here’s how to use it step by step.

Watch Financial Reporting in action:

Now let’s break down each step.

Step 1: Open the Reports Section

Click “Reports” in the left sidebar menu.

You’ll see options like Profit & Loss, Balance Sheet, and more.

Step 2: Select and Customize a Report

Choose a report type and set your date range.

Switch between cash basis and accrual basis as needed.

✓ Checkpoint: You should see your financial data in a clean table format.

Step 3: Export or Print Your Report

Click “Export” to download as CSV or PDF.

Share with your accountant or use it for business planning.

✅ Result: You have a detailed financial snapshot of your business.

💡 Profi-Tipp: Run Profit & Loss reports monthly to spot trends before they become problems.

How to Use Wave Mobile App

Mobile App lets you manage invoices and receipts from your phone.

Here’s how to use it step by step.

Watch Mobile App in action:

Now let’s break down each step.

Step 1: Download the Wave App

Search “Wave” in the App Store (iOS) or Google Play (Android).

Install and log in with your existing Wave account.

Step 2: Scan a Receipt

Tap the camera icon and snap a photo of your receipt.

Wave’s OCR reads the receipt and auto-fills the amount and vendor.

✓ Checkpoint: The receipt data should appear with the correct amount.

Step 3: Send Invoices on the Go

Tap “Invoicing” to create or resend invoices from anywhere.

You can also check payment status in real time.

✅ Result: You can manage your finances from anywhere with your phone.

💡 Profi-Tipp: Scan receipts the moment you get them. It takes 10 seconds and saves hours of data entry später.

How to Use Wave Multi-Currency Support

Multi-Currency Support lets you handle international transactions in different currencies.

Here’s how to use it step by step.

Watch Multi-Currency Support in action:

Now let’s break down each step.

Step 1: Enable Multi-Currency

Go to “Settings” and find the currency options.

Select your base currency first, then add other currencies you use.

Step 2: Create a Foreign Currency Invoice

When creating an invoice, select the client’s currency from the dropdown.

Wave converts amounts using current exchange rates.

✓ Checkpoint: The invoice should display in the selected foreign currency.

Step 3: Track Foreign Currency Transactions

All foreign transactions appear in your reports with converted values.

Wave handles the exchange rate math for your books automatically.

✅ Result: You can bill clients worldwide in their local currency.

💡 Profi-Tipp: Set your base currency carefully during setup. Changing it later affects all existing transactions.

Wave Pro Tips and Shortcuts

After testing Wave for over 2 years, here are my best tips.

Tastenkombinationen

| Action | Shortcut |

|---|---|

| Create New Invoice | Click “+” then “Invoice” |

| Add Transaction | Click “+” then “Transaction” |

| Quick Search | Use search bar at top of dashboard |

| Duplicate Invoice | Open invoice → “More” → “Duplicate” |

Hidden Features Most People Miss

- Wiederkehrende Rechnungen: Set up automatic monthly invoices for repeat clients under Invoicing settings.

- Google Sheets Add-on: Import and export customers, products, and invoices to Google Sheets for bulk editing.

- Collaborator Access: Invite your accountant with view-only or edit access without sharing your login.

Wave Common Mistakes to Avoid

Mistake #1: Mixing Personal and Business Transactions

❌ Wrong: Using one bank account for personal and business expenses.

✅ Right: Keep separate accounts and only connect your business account to Wave.

Mistake #2: Not Categorizing Transactions Regularly

❌ Wrong: Letting hundreds of uncategorized transactions pile up.

✅ Right: Categorize transactions weekly so your books stay accurate and current.

Mistake #3: Creating Duplicate Entries from Bank Imports

❌ Wrong: Manually entering transactions that also import from your bank feed.

✅ Right: Use either manual entry or bank import for each transaction — never both.

Wave Troubleshooting

Problem: Bank Connection Not Syncing

Cause: Your bank may have changed its Sicherheit settings or login credentials.

Fix: Disconnect the bank account in Settings, wait 5 minutes, then reconnect with updated credentials.

Problem: Invoice Not Showing as Paid

Cause: The payment may not have been recorded or matched to the invoice.

Fix: Go to the invoice, click “Record a Payment,” and enter the payment details manually.

Problem: Receipt Scans Are Blurry

Cause: The mobile app camera may need better lighting or focus.

Fix: Update the Wave app to the latest version. Hold your phone steady with good lighting when scanning.

📌 Notiz: If none of these fix your issue, contact Wave support.

Was ist eine Welle?

Welle is a free accounting tool that helps small businesses manage invoicing, expenses, and Buchhaltung.

Think of it like a personal accountant that works 24/7 for free.

Watch this quick overview:

It includes these key features:

- Account Reconciliation: Match bank records with your books to catch errors fast.

- Charts of Accounts: Organize finances into clear income and expense categories.

- Invoices: Create professional invoices and accept online payments.

- Products & Services: Save items you sell for faster invoicing.

- Tax Filing: Generate tax-ready reports and share with your accountant.

- Ausgabenverfolgung: Monitor every dollar leaving your business.

- Financial Reporting: Get Profit & Loss, Balance Sheet, and more in one click.

- Mobile App: Scan receipts and send invoices from your phone.

- Multi-Currency Support: Bill clients in their local currency.

For a full review, see our Wave review.

Wellenpreis

Here’s what Wave costs in 2026:

| Planen | Preis | Am besten geeignet für |

|---|---|---|

| Starterplan | $0 | Freiberufler and new businesses that need basic invoicing and bookkeeping |

| Pro-Tarif | 19 $/Monat | Growing businesses that want automatic bank imports and receipt scanning |

Kostenlose Testversion: The Starter Plan is free forever with no credit card needed.

Geld-zurück-Garantie: You can cancel the Pro plan anytime before your next billing cycle.

💰 Best Value: Starter Plan — You get unlimited invoices, expense tracking, and financial reports at no cost. Upgrade to Pro only when you need automatic bank imports.

Wave vs Alternatives

How does Wave compare? Here’s the competitive landscape:

| Werkzeug | Am besten geeignet für | Preis | Rating |

|---|---|---|---|

| Welle | Free accounting for small biz | 0 €/Monat | ⭐ 4 |

| QuickBooks | Advanced features and integrations | $1.90/mo | ⭐ 4.4 |

| FreshBooks | Freelancer invoicing and Zeiterfassung | $21/mo | ⭐ 4.3 |

| Xero | Unlimited users and global accounting | 29 $/Monat | ⭐ 4.5 |

| Zoho Books | Budget-friendly with Automatisierung | 0 €/Monat | ⭐ 4.3 |

| Salbei | Simple bookkeeping for solo owners | Frei | ⭐ 4.2 |

| Kosten erhöhen | Expense management and receipt tracking | $5/mo | ⭐ 4.1 |

| NetSuite | Enterprise-level ERP accounting | Brauch | ⭐ 4.5 |

Quick picks:

- Best overall: Wave — Free core features that rival paid tools for small businesses.

- Best budget: Zoho Books — Free plan with strong Automatisierung and inventory tracking.

- Best for beginners: FreshBooks — The easiest interface for non-accountants.

- Best for growing businesses: QuickBooks — Deep integrations with 750+ apps.

🎯 Wave Alternatives

Looking for Wave alternatives? Here are the top options:

- 🚀 Puzzle IO: AI-powered accounting built for startups with real-time financial data and founder-friendly dashboards.

- 💰 Dext: Automates receipt capture and data extraction so you spend less time on manual bookkeeping tasks.

- 🌟 Xero: Cloud accounting with unlimited users and strong global support, perfect for small teams.

- ⚡ Snyder: Syncs e-commerce and payment platforms automatically into your accounting books without manual entry.

- 🔧 Unkomplizierter Monatsabschluss: Simplifies the month-end close process with checklists and automated reconciliation tools.

- 🧠 Docyt: AI bookkeeping that automates transaction coding, revenue reconciliation, and financial reporting.

- 🏢 Salbei: Trusted Buchhaltungssoftware with plans ranging from free solo use to full business management.

- 💼 Zoho Books: Feature-rich free plan with invoicing, inventory, and automation for budget-conscious businesses.

- 📊 Beschleunigen: Personal and Kleinunternehmen finance tracking with budgeting tools starting at $2.99 per month.

- 🔒 Hubdoc: Fetches and stores financial documents automatically from banks, utilities, and suppliers.

- 🎨 Kosten erhöhen: Best-in-class expense reporting with smart scan receipts and corporate card management.

- ⭐ QuickBooks: The industry standard with deep reporting, payroll, inventory, and 750+ app integrations.

- 👶 Automatische Eingabe: Captures invoices and receipts, then pushes the data directly into your Buchhaltungssoftware.

- 🎯 FreshBooks: Built for freelancers with beautiful invoicing, time tracking, and easy expense management.

- 🔥 NetSuite: Enterprise ERP with full financial management for large or fast-scaling businesses.

For the full list, see our Wellenalternativen guide.

⚔️ Wave Compared

Here’s how Wave stacks up against each competitor:

- Wave vs Puzzle IO: Wave is simpler and free. Puzzle IO offers better startup analytics but starts at $42.50 per month.

- Wave vs. Dext: Dext excels at receipt capture. Wave covers full accounting while Dext focuses only on data extraction.

- Wave vs. Xero: Xero has more integrations and unlimited users. Wave wins on price with a free plan.

- Wave vs Synder: Synder is better for e-commerce sellers. Wave is better for service-based freelancers.

- Wellen vs. Einfaches Monatsende: Easy Month End specializes in close processes. Wave covers broader daily accounting needs.

- Wave vs Docyt: Docyt has stronger AI automation but starts at $299 per month. Wave is free for basic needs.

- Wave vs. Sage: Both offer free plans. Sage has better scalability for growing teams with more employees.

- Wave vs Zoho Books: Zoho Books adds inventory management. Wave has better invoicing for service businesses.

- Wave vs Beschleunigen: Quicken handles personal and business finance together. Wave is purely business-focused.

- Wave vs Hubdoc: Hubdoc is a document fetch tool, not full accounting. Wave gives you complete bookkeeping.

- Welle vs. Ausgaben: Expensify wins for team expense reports. Wave wins for full Kleinunternehmen Buchhaltung.

- Wave vs. QuickBooks: QuickBooks has deeper features and more integrations. Wave is free and easier to learn.

- Wave vs AutoEntry: AutoEntry automates data entry only. Wave provides the full accounting platform you enter data into.

- Wave vs. FreshBooks: FreshBooks has better time tracking and project tools. Wave beats it on price at $0.

- Wave vs. NetSuite: NetSuite is enterprise-grade ERP. Wave is built for small businesses with simple needs.

Start Using Wave Now

You learned how to use every major Wave feature:

- ✅ Account Reconciliation

- ✅ Charts of Accounts

- ✅ Invoices

- ✅ Products & Services

- ✅ Tax Filing

- ✅ Expense Tracking

- ✅ Financial Reporting

- ✅ Mobile App

- ✅ Multi-Currency Support

Next step: Pick one feature and try it now.

Most people start with Invoices.

It takes less than 5 minutes.

Häufig gestellte Fragen

How does the Wave app work?

Wave is a cloud-based accounting platform you access through your browser or mobile app. You sign up for free, connect your bank account, and Wave pulls in your transactions. You can then categorize expenses, send invoices, and run financial reports all from one dashboard.

Is Wave easy to use for beginners?

Yes. Wave is built for small business owners without accounting backgrounds. The interface is clean and has in-app guidance to explain common financial tasks. Most users set up their account and send their first invoice in under 10 minutes.

Can I use Wave for free?

Yes. Wave’s Starter Plan is completely free with no trial period. It includes unlimited invoicing, expense tracking, and financial reports. You only pay if you choose the Pro plan at $19 per month for automatic bank imports and receipt scanning.

Is Wave as good as QuickBooks?

Wave is better for freelancers and micro-businesses that need free, simple accounting. QuickBooks is better for growing businesses that need inventory tracking, advanced reporting, and 750+ app integrations. If your business has fewer than 10 employees and no inventory, Wave works great.

Does Wave App report to IRS?

Wave itself does not report directly to the IRS. However, Wave generates financial reports like Profit & Loss statements that you or your accountant use to file taxes. If you use Wave Payroll, it handles tax filings for payroll in supported states.

How much does Wave cost?

Wave’s Starter Plan is free forever. The Pro plan costs $19 per month and adds automatic bank transaction imports and receipt scanning. Wave Payments charges 2.9% plus $0.60 per credit card transaction. Payroll is a separate add-on at $40 per month plus $6 per employee.

What are the drawbacks of Wave Accounting?

Wave lacks inventory management, has limited integrations compared to QuickBooks, and customer support can be slow. The free plan requires manual transaction entry since automatic bank imports are on the paid plan. It also doesn’t offer advanced reporting features.

Is WaveApps better than QuickBooks?

It depends on your needs. WaveApps is better if you want free accounting with solid invoicing for a small service business. QuickBooks is better if you need inventory tracking, payroll in all states, time tracking, and deep third-party app integrations.

What is the best free bookkeeping software?

Wave is the best free bookkeeping software for most small businesses. It offers unlimited invoicing, expense tracking, and financial reports at no cost. Zoho Books also has a free plan but limits it to businesses under $50K in annual revenue. Wave has no revenue cap on its free plan.

Can I use Wave in the USA?

Yes. Wave works in the USA and is fully supported for US-based businesses. It handles US tax reporting, supports USD transactions, and integrates with US banks. Wave Payroll is also available in select US states for automated tax filing and employee payments.