Êtes-vous un comptable enseveli sous une montagne de feuilles de calcul ?

Avez-vous déjà rêvé d'une baguette magique pour gérer les dossiers clients sans vous ruiner ?

Trouver des outils à la fois puissants et gratuits peut s'avérer très difficile.

La bonne nouvelle, c'est que vous n'avez pas besoin de vous ruiner pour démarrer ou gérer vos petits clients.

Cet article vous présentera les meilleurs sites gratuits comptabilité Un logiciel pour les comptables afin de travailler plus intelligemment, et non plus durement.

Quel est le meilleur logiciel de comptabilité gratuit ?

Trouver les meilleurs services gratuits comptabilité Le développement logiciel peut sembler impossible.

Avec autant d'options disponibles, comment savoir laquelle vous convient le mieux ?

Notre guide vous explique tout en détail.

Nous avons passé en revue les meilleurs outils gratuits pour vous aider à trouver celui qui vous convient parfaitement. entreprise, pour que vous puissiez cesser de vous inquiéter et commencer à gérer vos finances en toute simplicité.

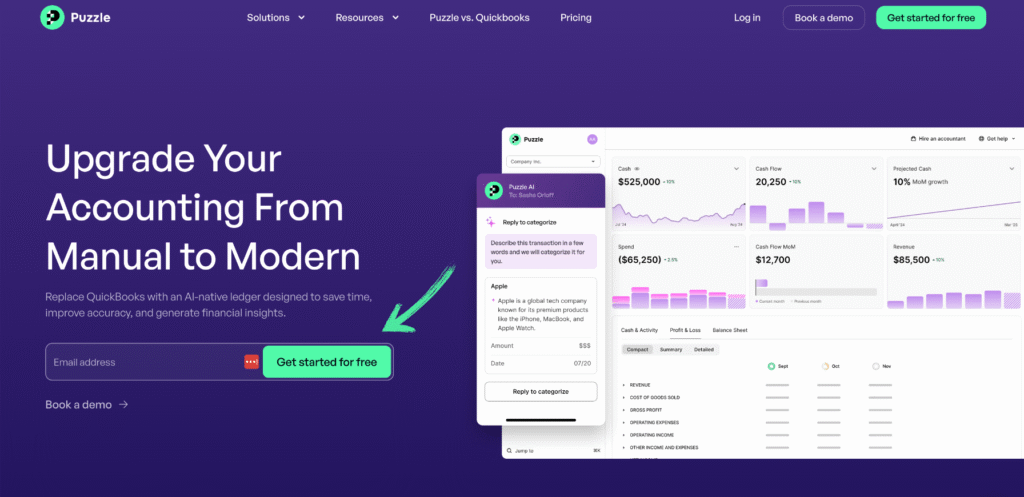

1. Puzzle IO (⭐4,8)

Puzzle IO est un outil d'IA qui vous aide à résoudre vos problèmes. comptabilité automation.

Il peut gérer de nombreuses tâches routinières. Cela signifie que vous n'avez pas à effectuer autant de tâches manuelles. données entrée.

Elle utilise l'intelligence artificielle (IA) pour vous fournir les données les plus précises.

C'est intelligent comptabilité Un outil pour les professionnels de la finance d'aujourd'hui.

Libérez son potentiel grâce à notre Tutoriel Puzzle IO.

Notre avis

Envie de simplifier vos finances ? Découvrez comment Puzzle io peut vous faire gagner jusqu’à 20 heures par mois. Faites-en l’expérience dès aujourd’hui !

Principaux avantages

Puzzle IO excelle vraiment lorsqu'il s'agit de vous aider à comprendre où votre entreprise se dirige.

- 92% de Les utilisateurs font état d'une meilleure précision des prévisions financières.

- Obtenez des informations en temps réel sur vos flux de trésorerie.

- Créez facilement différents scénarios financiers pour planifier.

- Collaborez harmonieusement avec votre équipe sur les objectifs financiers.

- Suivez les indicateurs clés de performance (KPI) en un seul endroit.

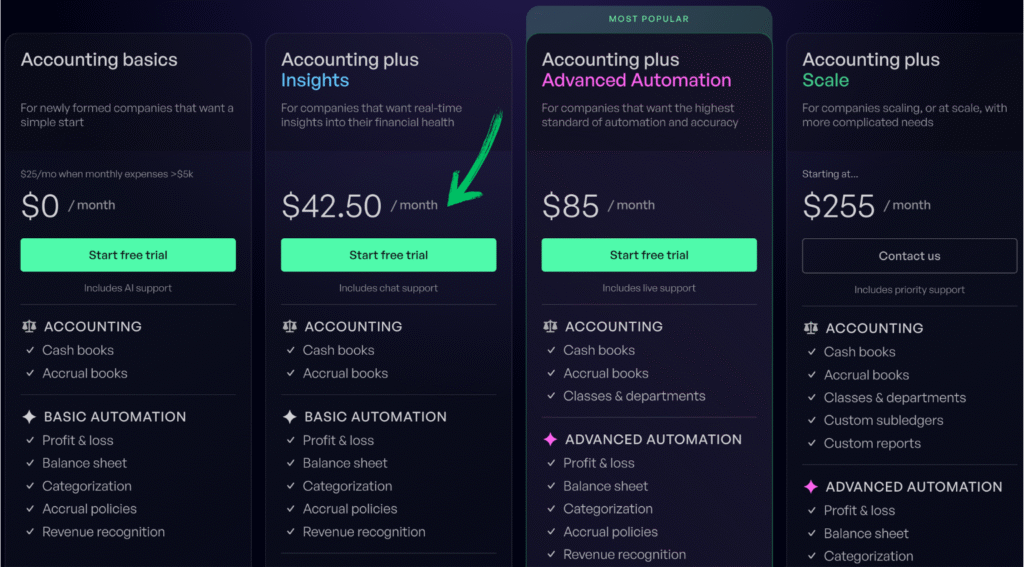

Tarification

- Notions de base en comptabilité : 0 $/mois.

- Perspectives de Accounting Plus : 42,50 $/mois.

- Comptabilité et automatisation avancée : 85 $/mois.

- Échelle Accounting Plus : 255 $/mois.

Avantages

Cons

2. Synder (⭐4,5)

Synder est intelligent comptabilité Cet outil vous aide à gérer votre argent et à éviter les erreurs.

Elle utilise la comptabilité automation Pour gagner du temps. Cela permet aux professionnels de la finance de se concentrer sur le développement de leur activité.

Synder vous offre des informations précieuses sur vos performances financières.

C'est d'une grande aide dans le comptabilité monde.

Libérez son potentiel grâce à notre Synder tutorial.

Notre avis

Synder automatise votre comptabilité en synchronisant de manière transparente les données de vente avec QuickBooks. Xeroet bien plus encore. Les entreprises utilisant Synder déclarent économiser en moyenne plus de 10 heures par semaine.

Principaux avantages

- Synchronisation automatique des données de vente

- Suivi des ventes multicanaux

- Rapprochement des paiements

- Intégration de la gestion des stocks

- Rapports de vente détaillés

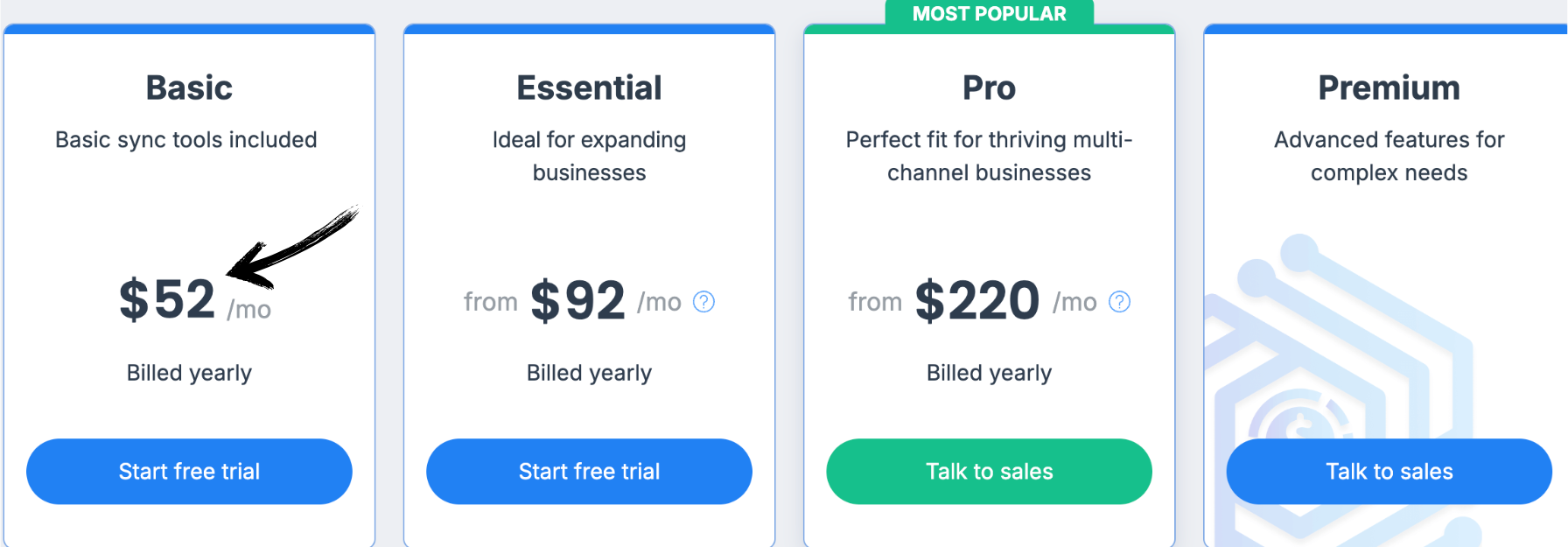

Tarification

Tous les plans seront Facturé annuellement.

- Basique: 52 $/mois.

- Essentiel: 92 $/mois.

- Pro: 220 $/mois.

- Prime: Tarification personnalisée.

Avantages

Cons

3. Dext (⭐4.0)

Dext est un outil d'IA Conçu pour aider les professionnels de la finance.

Il utilise l'intelligence artificielle (IA) pour automatiser la saisie manuelle des données. Vous pouvez l'utiliser pour analyser rapidement les données.

Cela simplifie considérablement l'automatisation comptable.

Il vous permet d'obtenir des informations précieuses et d'améliorer vos performances financières. Dext vous aide à gagner du temps sur les tâches routinières.

Libérez son potentiel grâce à notre Tutoriel Dext.

Notre avis

Prêt à récupérer plus de 10 heures par mois ? Découvrez comment la saisie de données automatisée, le suivi des dépenses et les rapports de Dext peuvent simplifier vos finances.

Principaux avantages

Dext excelle vraiment lorsqu'il s'agit de simplifier au maximum la gestion des dépenses.

- 90 % des utilisateurs font état d'une diminution significative de l'encombrement de papiers.

- Il affiche un taux de précision supérieur à 98 %. dans l'extraction de données à partir de documents.

- Créer des notes de frais devient incroyablement rapide et facile.

- S'intègre parfaitement aux plateformes comptables populaires, telles que QuickBooks et Xero.

- Permet de ne jamais perdre la trace de documents financiers importants.

Tarification

- Abonnement annuel : $24

Avantages

Cons

4. QuickBooks (⭐3,8)

QuickBooks est un logiciel de comptabilité réputé. Il offre de nombreuses fonctionnalités destinées aux professionnels de la finance.

Grâce à son automatisation comptable, il vous permet de gagner du temps.

Il peut analyser les données pour vous fournir des informations précieuses.

C'est un puissant comptabilité un outil qui peut vous aider dans l'élaboration de vos rapports financiers.

Libérez son potentiel grâce à notre Tutoriel QuickBooks.

Principaux avantages

- Catégorisation automatisée des transactions

- Création et suivi des factures

- Gestion des dépenses

- Services de paie

- Rapports et tableaux de bord

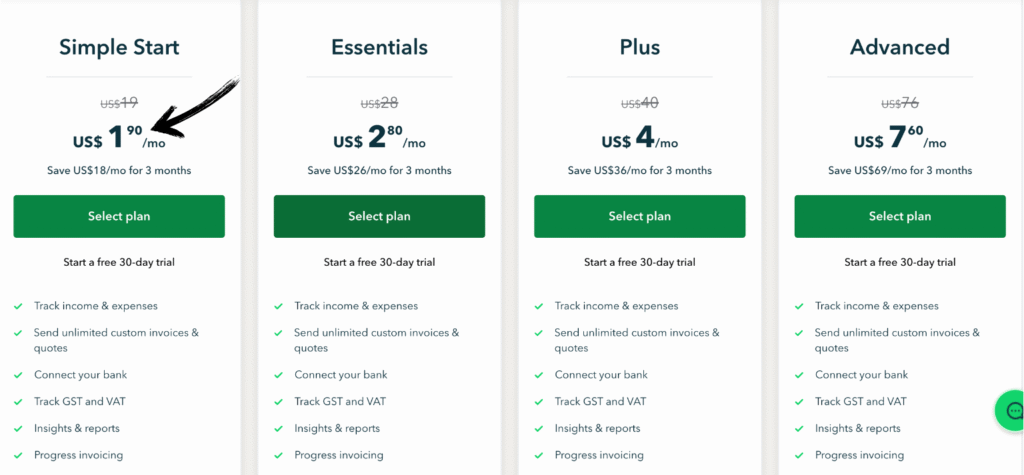

Tarification

- Démarrage simple : 1,90 $/mois.

- Essentiel: 2,80 $/mois.

- Plus: 4 $/mois.

- Avancé: 7,60 $/mois.

Avantages

Cons

5. Sauge (⭐️3,6)

Sage est un excellent système comptable. C'est un outil comptable très puissant pour les professionnels de la finance.

Il vous aide dans les tâches routinières et la saisie manuelle de données.

Sage vous aide à automatiser votre comptabilité pour vous fournir des informations précieuses.

Cela contribue également à la gestion des risques et à la détection des fraudes, améliorant ainsi vos performances financières.

Libérez son potentiel grâce à notre Tutoriel Sage.

Notre avis

Prêt à booster vos finances ? Les utilisateurs de Sage ont constaté une augmentation moyenne de 73 % de leur productivité et une réduction de 75 % du temps de cycle de traitement.

Principaux avantages

- Facturation et paiements automatisés

- Rapports financiers en temps réel

- Un système de sécurité renforcé pour protéger les données

- Intégration avec d'autres outils d'entreprise

- Solutions de paie et de RH

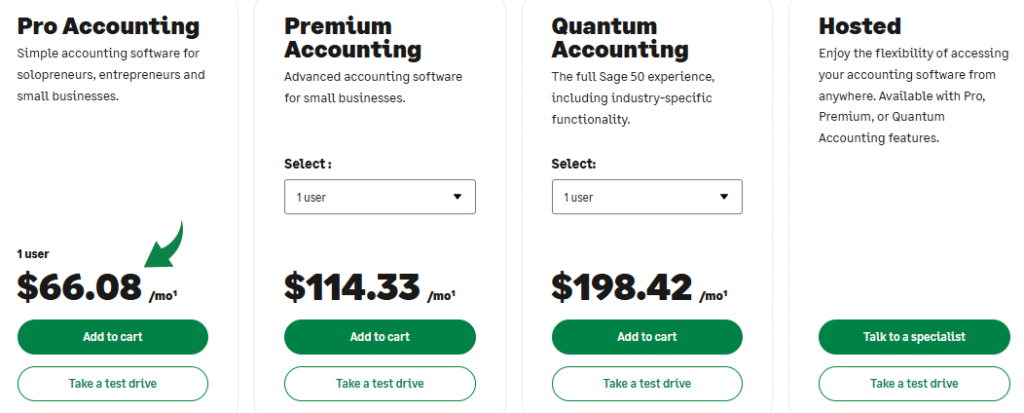

Tarification

- Comptabilité professionnelle : 66,08 $/mois.

- Comptabilité premium : 114,33 $/mois.

- Comptabilité quantique : 198,42 $/mois.

- Solutions RH et paie groupées : Tarification personnalisée en fonction de vos besoins.

Avantages

Cons

6. Fin de mois facile (⭐3,4)

Easy Month End est un outil d'IA conçu pour le monde de la comptabilité.

Il vous permet de gagner un temps précieux sur les tâches routinières. C'est un système comptable intelligent qui utilise l'automatisation.

Il vous aide à analyser les données et à créer des rapports financiers.

Cela vous donne des informations importantes sur vos performances financières. C'est un outil précieux pour tout professionnel de la finance.

Libérez son potentiel grâce à notre Tutoriel facile de fin de mois.

Notre avis

Améliorez la précision de vos finances avec Easy Month End. Bénéficiez du rapprochement automatisé et de rapports conformes aux exigences d'audit. Planifiez une démonstration personnalisée pour simplifier votre processus de clôture mensuelle.

Principaux avantages

- Flux de travail de rapprochement automatisés

- Gestion et suivi des tâches

- Analyse de la variance

- Gestion documentaire

- Outils de collaboration

Tarification

- Démarreur: 24 $/mois.

- Petit: 45 $/mois.

- Entreprise: 89 $/mois.

- Entreprise: Tarification personnalisée.

Avantages

Cons

7. Xero (⭐3,2)

Xero est un système de comptabilité en nuage populaire.

C'est un outil comptable qui facilite les tâches courantes. Il simplifie l'automatisation de la comptabilité.

Cela permet aux professionnels de la finance de gagner du temps.

Xero vous aide à analyser vos données et à en tirer des enseignements précieux. Vous pouvez l'utiliser pour créer des rapports financiers professionnels.

Libérez son potentiel grâce à notre Tutoriel Xero.

Notre avis

Rejoignez plus de 2 millions d'entreprises utilisation de Xero Logiciel de comptabilité. Découvrez dès maintenant ses puissantes fonctionnalités de facturation !

Principaux avantages

- Rapprochement bancaire automatisé

- Facturation et paiements en ligne

- Gestion des factures

- Intégration de la paie

- Rapports et analyses

Tarification

- Démarreur: 29 $/mois.

- Standard: 46 $/mois.

- Prime: 69 $/mois.

Avantages

Cons

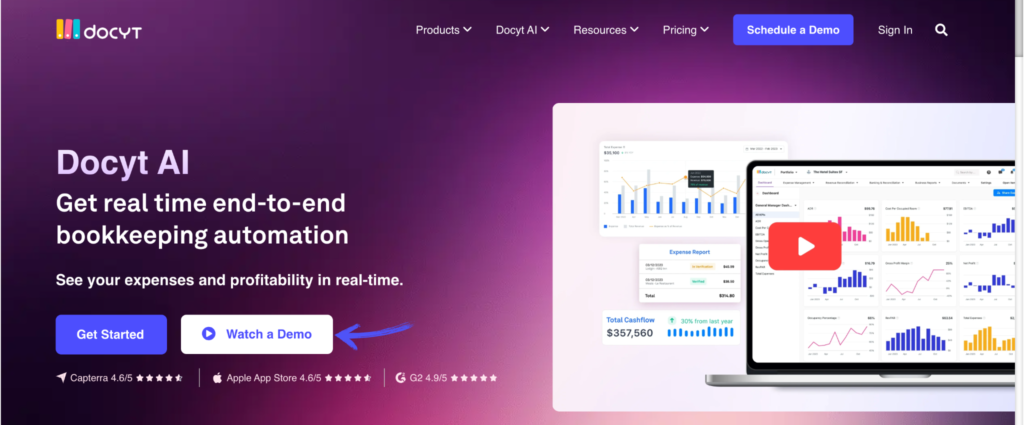

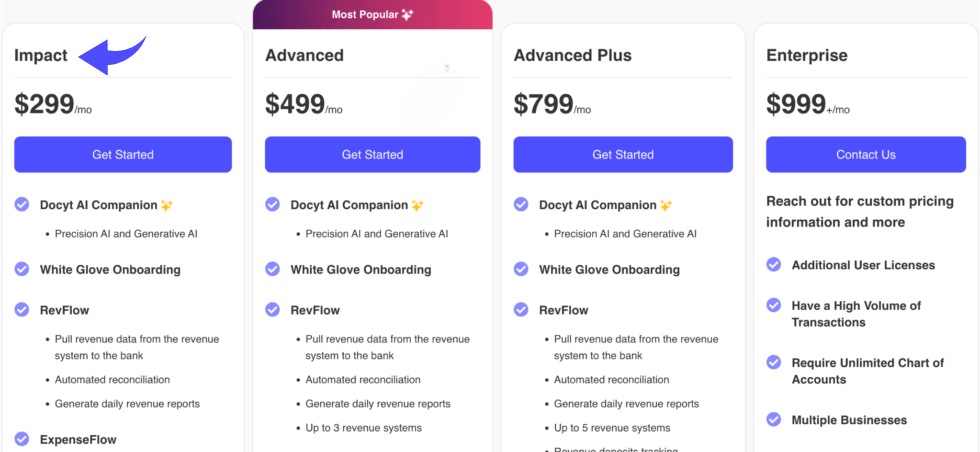

8. Docyt (⭐3.0)

Docyt est un excellent outil d'IA pour le monde de la comptabilité. Il utilise l'intelligence artificielle (IA) pour réduire la saisie manuelle de données.

Cela simplifie l'automatisation comptable et permet aux professionnels de la finance de gagner du temps.

Vous pouvez l'utiliser pour analyser des données et en tirer des enseignements précieux. Cela contribue à améliorer vos performances financières.

Libérez son potentiel grâce à notre Tutoriel Docyt.

Principaux avantages

- Automatisation basée sur l'IA : Docyt utilise l'intelligence artificielle. Elle extrait automatiquement des données de documents financiers, notamment des informations provenant de plus de 100 000 fournisseurs.

- Comptabilité en temps réel : Vos comptes sont mis à jour en temps réel. Vous disposez ainsi d'une image financière précise à tout moment.

- Gestion documentaire : Centralise tous les documents financiers. Vous pouvez facilement les rechercher et y accéder.

- Automatisation du paiement des factures : Automatisez le processus de paiement des factures. Programmez et payez vos factures facilement.

- Remboursement des frais : Simplifiez le traitement des notes de frais des employés. Soumettez et approuvez les dépenses rapidement.

- Intégrations transparentes : S'intègre aux logiciels de comptabilité les plus courants. Cela inclut QuickBooks et Xero.

- Détection des fraudes : Son IA peut aider à repérer les transactions inhabituelles. Cela ajoute une couche de sécurité. sécuritéIl n'existe aucune garantie spécifique pour le logiciel, mais des mises à jour continues sont fournies.

Tarification

- Impact: 299 $/mois.

- Avancé: 499 $/mois.

- Avancé Plus: 799 $/mois.

- Entreprise: 999 $/mois.

Avantages

Cons

9. FreshBooks (⭐2,8)

Freshbooks est un système comptable très convivial.

C'est un outil comptable populaire auprès des professionnels de la finance.

Cela vous permet de gagner un temps précieux sur les tâches routinières comme la facturation. L'automatisation comptable devient ainsi simple.

Cela vous permet d'obtenir des informations précieuses sur vos performances financières.

Libérez son potentiel grâce à notre Tutoriel Freshbooks.

Notre avis

Fatigué(e) de la comptabilité complexe ? Plus de 30 millions d’entreprises font confiance à FreshBooks pour créer des factures professionnelles. Simplifiez-vous la vie ! logiciel de comptabilité aujourd'hui!

Principaux avantages

- Création de factures professionnelles

- Rappels de paiement automatisés

- Suivi du temps

- outils de gestion de projet

- Suivi des dépenses

Tarification

- Lite : 2,10 $/mois.

- Plus: 3,80 $/mois.

- Prime: 6,50 $/mois.

- Sélectionner: Tarification personnalisée.

Avantages

Cons

Quels sont les critères à prendre en compte pour choisir le meilleur logiciel de comptabilité gratuit ?

- Recherchez le meilleur logiciel de comptabilité basé sur l'IA. Il gérera vos processus comptables internes, ce qui permettra à votre cabinet comptable de fonctionner sans encombre.

- Faire Certes, un logiciel comptable peut analyser des données financières. Il devrait pour cela utiliser l'intelligence artificielle. C'est un élément clé du secteur comptable.

- Le logiciel devrait utiliser l'intelligence artificielle. Cela accélérera considérablement vos processus financiers et facilitera la gestion des notes de frais.

- Vérifiez si l'outil d'IA comptable utilise le traitement automatique du langage naturel. Cela facilite son utilisation et représente une nouvelle approche de l'analyse des données.

- Un bon outil d'IA comptable peut faire toute la différence pour les professionnels de la comptabilité. Il leur permettra de consacrer plus de temps au développement de leur activité.

- Le logiciel doit être capable de protéger vos données financières. C'est très important.

- Recherchez des outils qui automatisent les processus comptables clés. C'est le principal avantage des logiciels de comptabilité basés sur l'IA.

Comment les meilleurs logiciels de comptabilité gratuits peuvent-ils vous être utiles ?

L'utilisation d'outils comptables basés sur l'IA change la donne pour vos opérations financières.

Au lieu d'effectuer des tâches répétitives, vous pouvez utiliser l'automatisation des processus robotiques et les algorithmes d'apprentissage automatique pour les gérer.

Cela vous permet d'éviter les erreurs humaines et de gagner un temps précieux.

Alors que certains craignent que l'IA ne remplace comptablesEn réalité, ces outils aident les professionnels de la finance et de la comptabilité en leur permettant de se consacrer à des tâches de plus haut niveau, comme la planification financière.

Ces outils basés sur l'IA vous aident à respecter vos obligations fiscales en fournissant des états financiers précis et opportuns.

Ils peuvent également créer des données financières détaillées reportage d'un simple clic.

En automatisant vos processus métier et en améliorant la gestion des données, ces outils vous fournissent des données pertinentes et des informations précieuses.

Cela vous aide à comprendre la santé financière de votre entreprise et à prendre de meilleures décisions grâce à l'analyse prédictive.

Guide d'achat

Nous avons soigneusement étudié chaque produit afin de vous fournir les meilleures informations.

Voici les étapes que nous avons suivies pour examiner chaque logiciel et ce que nous avons recherché.

Nos facteurs de recherche

- Tarification : Nous avons examiné le prix de chaque produit. Nous nous sommes concentrés sur les options gratuites, mais nous avons également noté les fonctionnalités incluses dans les versions payantes. Cela vous permet de comprendre ce que vous obtenez gratuitement et ce que vous devrez peut-être payer. plus tard à mesure que la croissance de votre entreprise l'exige davantage.

- Caractéristiques: Nous avons analysé en profondeur les atouts de chaque produit. Nous avons recherché les fonctionnalités permettant d'automatiser les tâches répétitives, comme la saisie de données. Nous avons également vérifié la présence de fonctionnalités avancées telles que la prévision des flux de trésorerie et l'analyse des données historiques afin de vous offrir une vision claire des performances financières d'une entreprise. Nous avons privilégié les logiciels utilisant des outils et des systèmes d'intelligence artificielle pour faciliter ces tâches.

- Points négatifs : Qu'est-ce qui manquait à chaque produit ? Nous avons relevé les limitations de chaque version gratuite, qu'il s'agisse du nombre d'utilisateurs ou des fonctionnalités manquantes. Nous avons également recherché les plaintes et les inconvénients les plus fréquents. Par exemple, certaines versions gratuites pouvaient être dépourvues de fonctionnalités importantes de prévision des flux de trésorerie.

- Assistance et remboursement : Nous avons examiné le type d'assistance proposé. Existe-t-il un forum communautaire ? Une équipe d'assistance est-elle joignable ? Pour les abonnements payants, nous avons étudié leur politique de remboursement. C'est essentiel pour les entreprises qui souhaitent gérer leurs opérations en toute sérénité. Nous sommes convaincus qu'un bon système d'assistance est tout aussi important qu'un excellent logiciel d'IA.

Conclusion

Trouver le bon logiciel de gestion des dépenses est important pour toute entreprise.

Il vous aide à gérer les tâches comptables telles que les comptes fournisseurs sans trop de travail manuel.

En utilisant ces outils gratuits, vous pouvez automatiser ces tâches comptables répétitives et gagner beaucoup de temps.

Cela vous permet de vous concentrer sur ce qui compte vraiment : faire croître votre entreprise.

Nous savons que ces outils peuvent faire une énorme différence pour les dirigeants d'entreprise et les services financiers.

Nos recherches ont porté sur les fonctionnalités qui comptent vraiment et sur la manière dont ces outils s'adaptent aux différents modèles d'entreprise.

Nous espérons que ce guide vous aidera à trouver le logiciel gratuit idéal pour simplifier votre travail et améliorer vos résultats.

Foire aux questions

Quel est le meilleur logiciel de comptabilité IA pour les cabinets comptables ?

Les meilleurs logiciels de comptabilité basés sur l'IA aident l'équipe comptable en automatisant les tâches de tenue de livres et en fournissant des informations en temps réel, améliorant ainsi l'efficacité et la précision.

Comment l'IA aide-t-elle les cabinets comptables à analyser les données financières ?

Les logiciels comptables basés sur l'IA peuvent identifier des tendances dans les données financières, aidant ainsi les cabinets comptables à repérer les évolutions et les risques. Il en résulte une vision plus claire des finances des clients.

L'IA peut-elle améliorer la communication avec les clients dans le secteur comptable ?

Oui, les outils basés sur l'IA peuvent rationaliser et automatiser certaines parties de la communication avec les clients, comme l'envoi de rapports et de mises à jour, permettant ainsi à l'équipe comptable d'être plus proactive.

Comment les outils d'IA permettent-ils d'obtenir des informations en temps réel sur les flux de trésorerie ?

Les outils comptables basés sur l'IA analysent en temps réel les données et transactions bancaires pour vous aider à gérer et à prévoir les flux de trésorerie, prévenant ainsi les problèmes de liquidités avant qu'ils ne surviennent.

Quelles sont les tendances futures du secteur comptable liées à l'IA ?

Les tendances futures verront apparaître des outils d'IA et d'apprentissage automatique plus avancés pour automatiser les tâches complexes, offrant des analyses approfondies et recentrant l'attention sur le conseil stratégique.