Êtes-vous stressé(e) par le suivi de vos entreprise argent?

Ça peut être difficile !

Choisir le bon logiciel peut sembler une décision importante.

Xero et QuickBooks sont deux options populaires.

Cet article expliquera les principales différences de manière simple.

Nous allons examiner chaque offre et vous aider à déterminer laquelle est la meilleure, Xero ou QuickBooks.

Aperçu

Nous avons testé Xero et QuickBooks en profondeur.

Découvrir leurs fonctionnalités et leur facilité d'utilisation.

Nos tests pratiques se sont concentrés sur le monde réel. petite entreprise des scénarios pour vous apporter une vision claire.

Rejoignez plus de 2 millions d'entreprises qui utilisent le logiciel de comptabilité en ligne Xero. Découvrez dès maintenant ses puissantes fonctionnalités de facturation !

Tarification : Il propose un essai gratuit. L'abonnement payant commence à 29 $/mois.

Caractéristiques principales :

- Rapprochement bancaire

- Facturation

- Signalement

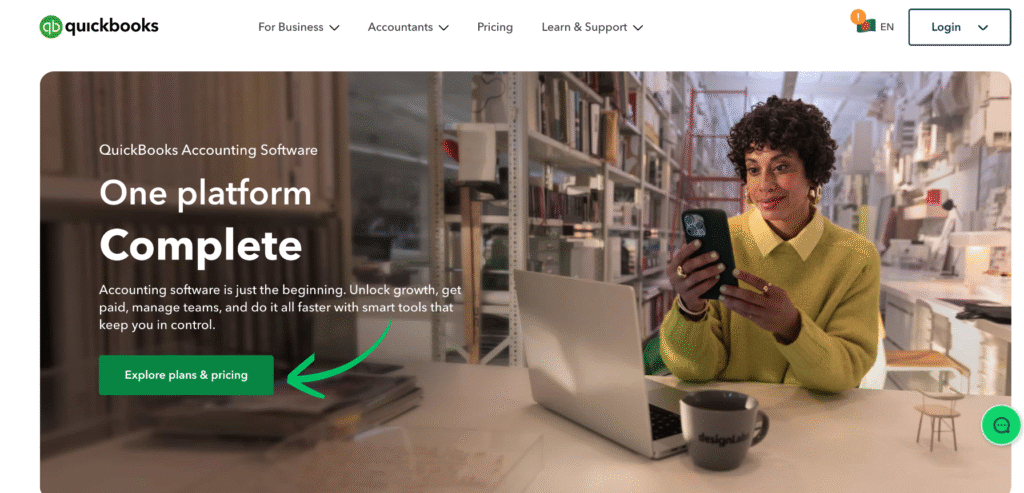

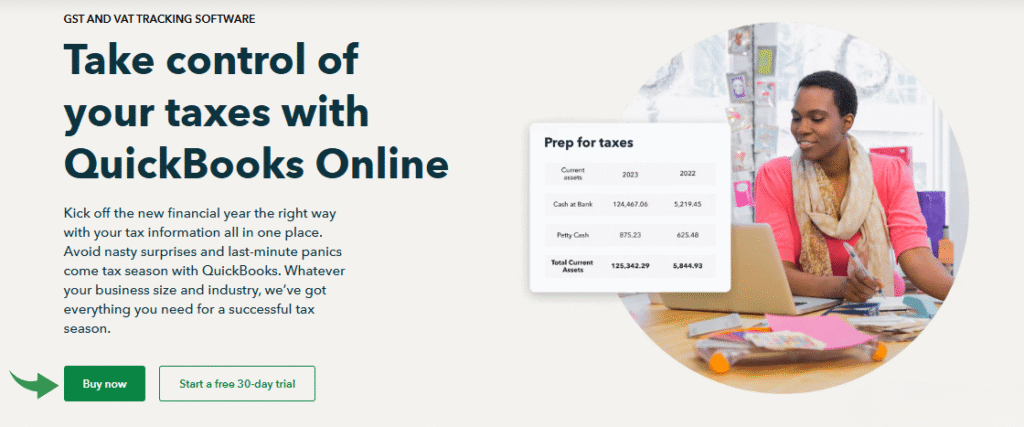

Utilisé par plus de 7 millions d'entreprises, QuickBooks peut vous faire gagner en moyenne 42 heures par mois sur comptabilité.

Tarification : Il propose un essai gratuit. L'abonnement commence à 1,90 $/mois.

Caractéristiques principales :

- Gestion des factures

- Suivi des dépenses

- Signalement

Qu'est-ce que Xero ?

Alors, parlons de Xero.

C'est logiciel de comptabilité conçu pour simplifier les choses pour les petites entreprises.

Considérez-le comme votre plateforme financière en ligne.

En un seul endroit, vous pouvez gérer vos factures, suivre leurs paiements et voir comment votre entreprise se porte.

Découvrez également nos favoris Alternatives à Xero…

Notre avis

Rejoignez plus de 2 millions d'entreprises utilisation de Xero Logiciel de comptabilité. Découvrez dès maintenant ses puissantes fonctionnalités de facturation !

Principaux avantages

- Rapprochement bancaire automatisé

- Facturation et paiements en ligne

- Gestion des factures

- Intégration de la paie

- Rapports et analyses

Tarification

- Démarreur: 29 $/mois.

- Standard: 46 $/mois.

- Prime: 69 $/mois.

Avantages

Cons

Qu'est-ce que QuickBooks ?

Bon, parlons maintenant de QuickBooks.

C'est un autre populaire comptabilité logiciels, notamment aux États-Unis.

Beaucoup petites entreprises J'aime ça parce que ça existe depuis un certain temps.

Découvrez également nos favoris Alternatives à QuickBooks…

Principaux avantages

- Catégorisation automatisée des transactions

- Création et suivi des factures

- Gestion des dépenses

- Services de paie

- Rapports et tableaux de bord

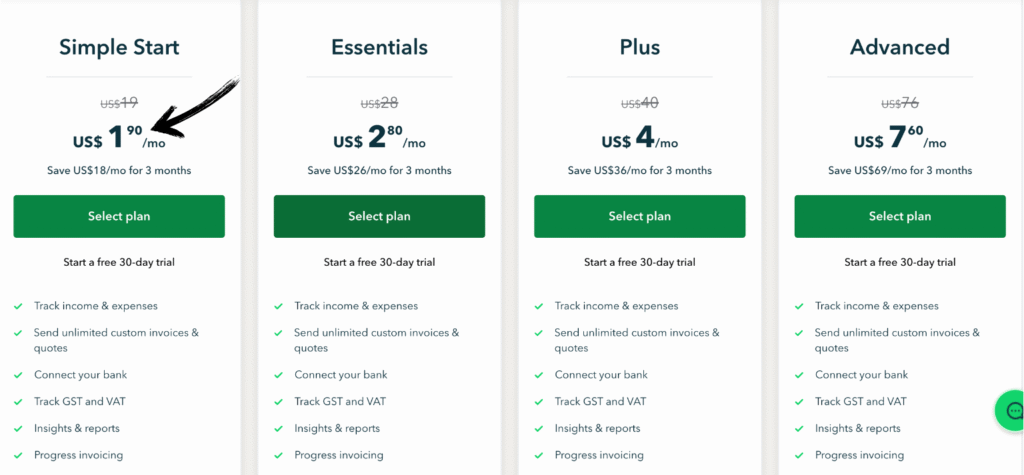

Tarification

- Démarrage simple : 1,90 $/mois.

- Essentiel: 2,80 $/mois.

- Plus: 4 $/mois.

- Avancé: 7,60 $/mois.

Avantages

Cons

Comparaison des fonctionnalités

Cette comparaison vous aidera à décider lequel comptabilité Le logiciel est la solution idéale pour votre entreprise.

We’ll look at the key accounting features to help you make an informed choice.

1. Documents et rapports financiers

- QuickBooks : QuickBooks aide les entreprises à tenir leurs registres financiers. Il est personnalisable. reportage Elle offre une analyse approfondie de la situation financière et des performances d'une entreprise. Ses fonctionnalités de reporting constituent un atout majeur pour de nombreux utilisateurs.

- Xero : Les fonctionnalités de reporting de Xero offrent des informations en temps réel. données et offre un aperçu de la santé financière d'une entreprise. Il comprend des rapports personnalisables pour aider les entreprises à gérer leurs données financières.

2. Facturation et comptes clients

- QuickBooks : QuickBooks vous permet de créer des factures en ligne, d'envoyer des factures de services professionnels et d'être payé par carte bancaire. Il aide les entreprises à gérer leurs comptes clients et à envoyer des rappels de paiement.

- Xero : Xero vous permet de créer des factures et de les suivre. Xero facilite la tâche pour petite entreprise Il permet aux propriétaires de gérer les factures dues et inclut une fonctionnalité de paiement en ligne.

3. Comptes fournisseurs

- QuickBooks : QuickBooks aide les entreprises à gérer leurs comptes fournisseurs. Vous pouvez payer les factures, programmer les paiements et suivre les données des fournisseurs. Ce logiciel permet également aux entreprises de suivre leurs flux financiers et de rester bien organisées.

- Xero : Xero offre des fonctionnalités de paiement performantes. Vous pouvez saisir les factures et programmer les paiements aux fournisseurs. Le système aide les entreprises à gérer leurs opérations financières.

4. Transactions et données bancaires

- QuickBooks : QuickBooks vous permet de connecter vos comptes bancaires et de gérer vos transactions. Il vous fait gagner du temps en important automatiquement vos données financières.

- Xero : Xero propose des flux bancaires automatiques qui importent les transactions bancaires. Cette fonctionnalité aide les propriétaires de petites entreprises à tenir leurs comptes à jour et à conserver des registres financiers précis.

5. Gestion des stocks et taxe de vente

- QuickBooks : QuickBooks possède des fonctionnalités performantes de gestion des stocks. Il aide les entreprises à gérer leurs stocks, à suivre les données d'inventaire et à optimiser leurs ventes. Il gère également la collecte de la taxe de vente.

- Xero : Xero propose des fonctionnalités de gestion des stocks. Il aide les entreprises à suivre leurs stocks, mais certaines fonctionnalités avancées peuvent entraîner des frais supplémentaires.

6. Paie

- QuickBooks : QuickBooks propose son propre système de paie intégré. Intuit QuickBooks simplifie la gestion de la paie des employés et des travailleurs indépendants, notamment le dépôt direct et la préparation des déclarations fiscales.

- Xero : Xero s'intègre aux solutions de paie pour gérer les paiements et les impôts. Cette solution comptable est excellente, mais peut entraîner des frais supplémentaires.

7. Accessibilité

- QuickBooks : QuickBooks, logiciel de comptabilité en ligne basé sur le cloud, offre un accès depuis n'importe où. Il existe également une version pour ordinateur, mais la version cloud est plus répandue.

- Xero : Xero est un logiciel de comptabilité basé sur le cloud et fonctionne sur les deux iOS et les appareils Android, vous offrant un accès constant à votre compte Xero.

8. Planification des ressources de l'entreprise (ERP)

- QuickBooks : QuickBooks offre certaines fonctionnalités avancées pour les grandes entreprises, mais il ne s'agit pas d'un système de planification des ressources d'entreprise complet.

- Xero : Xero est un logiciel de comptabilité Xero performant, mais ce n'est pas un système ERP complet de comptabilité Xero. Il est plus adapté aux petites entreprises et aux entreprises en croissance, et non aux grandes entreprises.

9. Assistance clientèle et ressources

- QuickBooks : Les avis sur QuickBooks mentionnent souvent son service client complet, notamment l'assistance téléphonique. L'entreprise propose de nombreuses ressources en ligne pour faciliter la gestion des finances.

- Xero : Xero propose une assistance en ligne 24h/24 et 7j/7 via Xero Central. Vous pouvez tester Xero et son assistance, mais l'assistance téléphonique n'est pas disponible.

Quels sont les critères à prendre en compte lors du choix d'un logiciel de comptabilité ?

- Vérifiez s'il prend en charge la paie QuickBooks ou les paiements aux sous-traitants de votre équipe.

- Réfléchissez à ce qui vous convient le mieux : la version de bureau de QuickBooks ou l'accès au cloud pour votre ordinateur et vos clients.

- Recherchez des rapports financiers solides, notamment des bilans et des analyses de flux de trésorerie.

- Déterminez si vous avez besoin d'un service complet comptabilité soutenir ou préférer les outils des travailleurs indépendants.

- Consultez les avis sur le logiciel de comptabilité Xero et les produits QuickBooks pour en savoir plus sur leurs fonctionnalités clés et la sécurité des données de l'entreprise.

- Avant d'annuler, évaluez les tarifs, y compris ceux de Xero, les frais d'installation et les conditions de licence.

- Vérifiez s'il peut gérer plusieurs devises et plusieurs sites pour les entreprises en expansion.

- Vérifiez si le système inclut les bons de commande et le suivi des projets.

- Examinez la facilité de migration des données et les outils de gestion globale des flux de trésorerie.

- Assurez-vous qu'il fournisse un bon plan comptable pour une bonne organisation.

- Si vous êtes une entreprise de taille moyenne, vous pouvez bénéficier de fonctionnalités avancées ou d'un forfait établi.

- Déterminez si le logiciel, comme Xero, autorise un nombre illimité de factures et si vous recommandez Xero après l'avoir testé.

- Comparez la facilité de saisie manuelle des données à celle des flux bancaires automatisés.

- Évaluez si le plan initial ou le plan établi répond à vos besoins actuels de croissance d'entreprise.

- Optez pour un tableau de bord Xero épuré pour une gestion financière simplifiée.

Verdict final

Après avoir comparé ces deux options, nous sommes enclins à recommander Xero pour de nombreuses entreprises modernes.

Pourquoi ? Xero excelle grâce à son application mobile élégante et son interface conviviale, qui vous permettent de gérer les données clients où que vous soyez.

Bien que QuickBooks soit un logiciel performant, notamment si vous avez des données complexes à traiter sur votre ordinateur ou utiliser QuickBooks Vérification.

Le design épuré et le coût de Xero sont idéaux pour les entreprises établies.

Les formules tarifaires de Xero, même celles qui vous limitent initialement à cinq factures, offrent un excellent rapport qualité-prix.

We feel Xero is currently the best accounting software for businesses prioritizing ease of use and modern cloud features.

Si votre comptable connaît déjà Xero, c'est un autre avantage important d'utiliser Xero.

Plus d'informations sur Xero

Choisir le bon logiciel de comptabilité implique d'examiner plusieurs options.

Voici un aperçu rapide de Xero par rapport à d'autres produits populaires.

- Xero contre QuickBooks: QuickBooks est un concurrent majeur. Bien que les deux logiciels offrent des fonctionnalités de base similaires, Xero est souvent apprécié pour son interface épurée et son nombre illimité d'utilisateurs. QuickBooks peut s'avérer plus complexe, mais il propose des outils de reporting très performants.

- Xero contre FreshBooks: FreshBooks est une option populaire, notamment pour les travailleurs indépendants et les entreprises de services. Il excelle dans la facturation et le suivi du temps. Xero offre une solution comptable plus complète.

- Xero contre Sage: Sage et Xero proposent tous deux des solutions pour les petites entreprises. Cependant, Sage fournit également des outils de planification des ressources d'entreprise (ERP) plus complets pour les grandes entreprises.

- Xero contre Zoho Books: Zoho Books fait partie d'une vaste suite d'applications professionnelles. Elle offre souvent des fonctionnalités avancées pour la gestion des stocks et se révèle très économique. Xero, quant à elle, est une solution de choix pour sa simplicité et sa facilité d'utilisation.

- Xero contre Wave: Wave est réputé pour sa version gratuite. C'est une excellente option pour les très petites entreprises ou les indépendants disposant d'un budget limité. Xero offre une gamme de fonctionnalités plus étendue et est mieux adapté à la croissance des entreprises.

- Xero contre Quicken: Quicken est principalement destiné aux finances personnelles. Bien qu'il propose certaines fonctionnalités professionnelles, il ne s'agit pas d'une véritable solution de comptabilité d'entreprise. Xero, quant à lui, est conçu spécifiquement pour gérer la complexité de la comptabilité d'entreprise.

- Xero contre HubdocCes deux outils ne sont pas des concurrents directs. Dext et Hubdoc automatisent la capture de documents et la saisie de données. Ils s'intègrent directement à Xero pour une comptabilité plus rapide et plus précise.

- Xero contre Synder: Synder est une plateforme qui connecte les canaux de vente et les passerelles de paiement aux logiciels de comptabilité. Elle automatise la saisie de données provenant de plateformes comme Shopify et Stripe directement dans Xero.

- Xero contre ExpensifyExpensify se concentre spécifiquement sur la gestion des dépenses. Bien que Xero propose des fonctionnalités de gestion des dépenses, Expensify offre des outils plus avancés pour la gestion des frais et des remboursements des employés.

- Xero contre Netsuite: NetSuite est un système ERP complet destiné aux grandes entreprises. Il offre une suite complète d'outils de gestion. Xero n'est pas un ERP, mais constitue une excellente solution comptable pour les petites entreprises.

- Xero contre Puzzle IO: Puzzle IO est une plateforme financière conçue pour les startups, axée sur les états financiers en temps réel et la saisie automatisée de données.

- Xero vs Easy Month End: Ce logiciel est un outil spécialisé permettant d'automatiser le processus de clôture mensuelle, facilitant le rapprochement bancaire et la traçabilité des opérations. Il est conçu pour fonctionner avec Xero, et non pour le remplacer.

- Xero contre Docyt: Docyt utilise l'IA pour automatiser les tâches administratives et comptables. Elle permet de consulter tous vos documents et données financières au même endroit.

- Xero contre RefreshMe: RefreshMe est un logiciel de comptabilité plus simple, doté de fonctionnalités de base, souvent utilisé pour les finances personnelles ou les très petites entreprises.

- Xero contre AutoEntry: À l'instar de Dext et Hubdoc, AutoEntry est un outil qui automatise l'extraction de données à partir de reçus et de factures, conçu pour s'intégrer et améliorer les logiciels comptables tels que Xero.

Plus d'informations sur QuickBooks

- QuickBooks contre Puzzle IOCe logiciel est axé sur la planification financière des startups grâce à l'intelligence artificielle. Son équivalent est dédié aux finances personnelles.

- QuickBooks contre DextIl s'agit d'un outil professionnel permettant de saisir les reçus et les factures. L'autre outil sert à suivre les dépenses personnelles.

- QuickBooks contre XeroIl s'agit d'un logiciel de comptabilité en ligne populaire auprès des petites entreprises. Son concurrent est destiné à un usage personnel.

- QuickBooks contre SynderCet outil synchronise les données de commerce électronique avec les logiciels de comptabilité. Son alternative est axée sur les finances personnelles.

- QuickBooks vs Easy Month EndIl s'agit d'un outil professionnel permettant de simplifier les tâches de fin de mois. Son concurrent est destiné à la gestion des finances personnelles.

- QuickBooks contre DocytL'une utilise l'IA pour la comptabilité et l'automatisation des entreprises. L'autre utilise l'IA comme assistant de finances personnelles.

- QuickBooks contre SageIl s'agit d'une suite comptable complète pour entreprises. Son concurrent est un outil plus facile à utiliser pour la gestion des finances personnelles.

- QuickBooks contre Zoho BooksIl s'agit d'un outil de comptabilité en ligne destiné aux petites entreprises. Son concurrent est conçu pour un usage personnel.

- QuickBooks contre WaveCe logiciel propose une version gratuite de la comptabilité pour les petites entreprises. Son équivalent est destiné aux particuliers.

- QuickBooks contre QuickenCe sont deux outils de gestion de finances personnelles, mais celui-ci offre un suivi des investissements plus approfondi. L'autre est plus simple.

- QuickBooks contre HubdocCe logiciel est spécialisé dans la numérisation de documents pour la comptabilité. Son concurrent est un outil de gestion de finances personnelles.

- QuickBooks contre ExpensifyIl s'agit d'un outil de gestion des dépenses professionnelles. L'autre sert au suivi des dépenses personnelles et à la gestion du budget.

- QuickBooks contre AutoEntryCe logiciel est conçu pour automatiser la saisie de données comptables. Son alternative est un outil de gestion de finances personnelles.

- QuickBooks contre FreshBooksIl s'agit d'un logiciel de comptabilité destiné aux indépendants et aux petites entreprises. Son alternative est dédiée aux finances personnelles.

- QuickBooks contre NetSuiteIl s'agit d'une suite logicielle de gestion d'entreprise performante pour les grandes entreprises. Son concurrent est une simple application de finances personnelles.

Foire aux questions

Quelles sont les principales différences entre Xero et QuickBooks Online ?

Xero est réputé pour son interface conviviale et ses nombreuses intégrations. QuickBooks Online offre une expérience plus traditionnelle et des fonctionnalités de paie robustes.

QuickBooks propose-t-il une version en ligne gratuite ?

QuickBooks ne propose pas de version en ligne entièrement gratuite. L'entreprise offre généralement des périodes d'essai pour ses abonnements payants.

Xero et QuickBooks Online permettent-ils de suivre le temps de travail des employés ?

QuickBooks propose QuickBooks Time pour le suivi des heures de travail des employés. Xero s'intègre à diverses applications de suivi du temps.

Quelles sont les fonctionnalités comptables les mieux adaptées aux petites entreprises ?

Les principales fonctionnalités comptables incluent la facturation, le rapprochement bancaire, le suivi des dépenses et la production de rapports, toutes proposées par Xero et QuickBooks Online.

Intuit et QuickBooks sont-ils la même entreprise ?

Oui, Intuit est la société qui développe et possède QuickBooks ainsi qu'une gamme d'autres logiciels financiers.