Do you hate digging through piles of crumpled receipts?

It is a total pain. You waste hours manually entering datos every week.

One small mistake can actually mess up your whole tax return.

This stress keeps you away from growing your actual negocio.

There is a much better way. Dext handles the hard work for you.

This guide shows you exactly how to use Dext to save time.

Vamos hacer your life easier right now.

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reportando Puede agilizar sus finanzas.

Dext Tutorial

Getting started is easy and takes just a few minutes.

First, download the app on your phone.

Snap a clear photo of any receipt you have. The AI reads the data for you.

Finally, send it to your contabilidad software.

How to use Dext Bookkeeping Automation

Automating your books is the best way to save time.

Dext Prepare does the heavy lifting for you.

It connects your real-world spending to your digital books.

You do not have to type in data by hand anymore.

Follow these steps to set up your workflow and let the system run itself.

Step 1: Connect Your Software

You need to link your accounts first. This tells Dext where to send your data.

- Log in to your Dext account using the web app on your computer.

- Go to the “Connections” tab to link your contabilidad software.

- Navigate to the “Bank” section.

- Click “Add Bank Account” to set up a bank feed.

- This lets the system match your receipts to your bank account transactions effortlessly.

Step 2: Feed Data into the System

Automatización needs data to work. You can submit receipts and invoices in many ways.

- Mobile Capture: Open the mobile app (also called the Dext app).

- Use “Single Mode” for one document.

- Switch to multiple modes if you have several documents. This lets you snap many photos in a row.

- Usethe combine mode if a bill has multiple pages.

- If you have a very long bill, take a picture of the long receipt, and the app stitches it together.

- Computer Upload: You can start uploading documents directly on the web. If you have a lot of files, you can even drop in a zip file.

- Email Forwarding: Every user gets a unique Dext email address. Forward your digital bills there to skip the manual upload.

Step 3: Set Rules to Auto Publish

Now you can tell Dext what to do with that data.

- The system will automatically pull the date, total, and tax from your photos.

- You can also upload supplier statements to check if you missed any invoices.

- Go to your supplier settings and turn on auto-publish for regular bills.

- Once this is on, your paperwork goes straight to your accounting software without you having to click a thing.

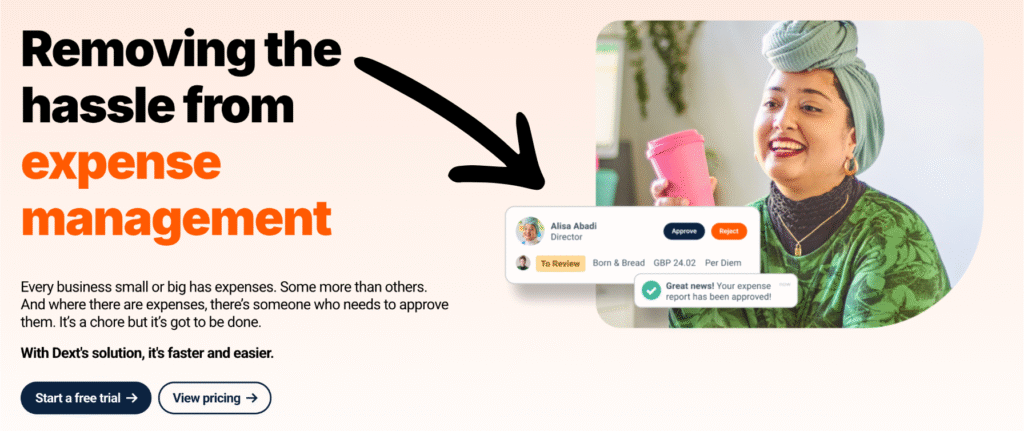

How to use Dext for Business Management

Running a company means watching every penny.

Dext helps you manage your team and money in one place.

Getting started with Dext for negocio management is simple.

It lets you track who spends what and keeps your records straight.

Here is how to process your admin work without the stress.

Step 1: Add Your Team Members

You do not have to do everything alone.

You can create accounts for your staff to work collaboratively.

- Go to the “Users” tab in the menu.

- Click to add a new user by entering their email.

- This lets them submit items themselves.

- They can upload receipts or use the app to submit expenses.

- You can control their access so they only see what they need to see.

Step 2: Control How Data is Captured

Make sure your team knows how to send in a document.

- Most employees will be using the mobile app.

- Teach them to use single mode for a quick snap of one receipt.

- They can also forward digital invoices to their designated email address.

- You can set rules for line item extraction. This reads every single line on a bill, not just the total.

- This is how Dext works to provide more detail about what you are buying.

Step 3: Track Costs and Reports

You need to see where your money goes.

This step helps you organize financial data for you and your clients.

- Use the dashboard to view all transactions in real time.

- This helps you control costs before they get too high.

- You can connect Dext to your accounting software to keep the two systems in sync.

- When you are ready, you can bundle these expenses into a report.

- This makes it easy to spot errors before you officially file your taxes.

How to use Dext to Capture Receipts & Invoices

Capturing paperwork is easy with Dext.

It moves data from paper into your computer systems.

You can stop losing receipts and save time.

Step 1: Snap Photos on Your Phone

Use your phone to capture data quickly.

- Open the app and look at the camera screen.

- Select the camera mode that fits your needs.

- Take a clear image of the receipt.

- Make sure the date and total paid are visible.

- You can add a note to your team explaining the cost.

- This helps you skip typing it out later.

Step 2: Send Digital Files

You do not need to print out online bills.

- Forward files and PDFs directly to your Dext bandeja de entrada.

- You can invite your suppliers or a new vendor to email bills to you.

- You can also upload a single page from your computer.

- This keeps all relevant documents in one place.

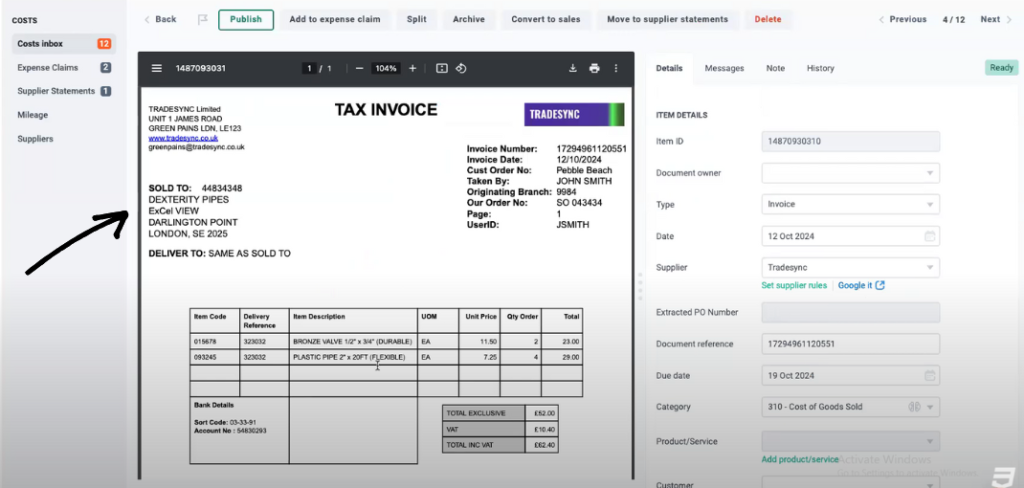

Step 3: Review and Publish

Once the data is in, you need to check it.

- Start by navigating to your inbox to see new items.

- Log in and review the details.

- You can edit the sales tax or category if needed.

- Set rules so the system learns for next time.

- Match the receipt to your bank feed.

- Finally, hit publish to finish.

- This article helps you master every step.

Alternativas a Dext

- Xero: Esta es una popular plataforma de contabilidad en la nube. Es una alternativa a las funciones de contabilidad de Atera, ofreciendo herramientas para facturación, conciliación bancaria y seguimiento de gastos.

- Sabio: Sage, un conocido proveedor de software de gestión empresarial, ofrece una gama de soluciones contables y financieras que pueden servir como alternativa al módulo de gestión financiera de Atera.

- Libros de Zoho: Parte de la suite Zoho, esta potente herramienta de contabilidad para pequeñas y medianas empresas facilita la facturación, el seguimiento de gastos y la gestión de inventario, y es una excelente alternativa para quienes necesitan herramientas financieras integrales.

- Synder: Este software se centra en sincronizar sus plataformas de comercio electrónico y pago con su software de contabilidad. Es una alternativa útil para empresas que necesitan automatizar el flujo de datos desde los canales de venta hasta sus libros contables.

- Fin de mes fácil: Esta herramienta está diseñada específicamente para agilizar el proceso de cierre de mes. Es una alternativa especializada para empresas que desean mejorar y automatizar sus informes financieros y tareas de conciliación.

- Docyt: Docyt, una plataforma de contabilidad basada en IA, automatiza los flujos de trabajo financieros. Competirá directamente con las funciones de contabilidad basadas en IA de Atera, ofreciendo datos en tiempo real y gestión automatizada de documentos.

- Rompecabezas IO: Este es un software de contabilidad moderno diseñado para startups. Utiliza IA para automatizar la contabilidad y proporcionar información financiera en tiempo real. Es una buena alternativa para empresas de rápido crecimiento que buscan una solución sencilla y tecnológica.

- Refrescarme: Esta es una plataforma de gestión financiera personal. Si bien no es una alternativa empresarial directa, ofrece funciones similares, como el seguimiento de gastos y facturas.

- Ola: Este es un popular software financiero gratuito. Es una excelente opción para autónomos y pequeñas empresas para la facturación, la contabilidad y el escaneo de recibos.

- Acelerar: Una herramienta reconocida para finanzas personales y de pequeñas empresas. Facilita la elaboración de presupuestos, el control de gastos y la planificación financiera.

- Hubdoc: Este software es una herramienta de gestión documental. Obtiene automáticamente sus documentos financieros y los sincroniza con su software de contabilidad.

- Expensificar: Esta plataforma se centra en la gestión de gastos. Es ideal para escanear recibos, gestionar viajes de negocios y crear informes de gastos.

- QuickBooks: Uno de los programas de contabilidad más utilizados. QuickBooks es una alternativa potente que ofrece un conjunto completo de herramientas para la gestión financiera.

- Entrada automática: Esta herramienta automatiza la entrada de datos. Es una buena alternativa a las funciones de captura de recibos y facturas de Atera.

- FreshBooks: Este programa es ideal para facturación y contabilidad. Es popular entre autónomos y pequeñas empresas que necesitan una forma sencilla de controlar el tiempo y los gastos.

- NetSuite: Una potente y completa suite de gestión empresarial basada en la nube. NetSuite es una alternativa para grandes empresas que necesitan más que solo gestión financiera.

Dext comparado

También hemos analizado cómo se compara Dext con otras herramientas de contabilidad y gestión de gastos:

- Dext frente a Xero: Xero ofrece contabilidad integral con funciones integradas de gestión de gastos.

- Dext contra Rompecabezas IO: Puzzle IO destaca por sus perspectivas y previsiones financieras basadas en IA.

- Dext contra Synder: Synder se centra en la sincronización de datos de ventas de comercio electrónico y el procesamiento de pagos.

- Dext vs Easy Month End: Easy Month End agiliza los procedimientos de cierre financiero de fin de mes.

- Dext frente a Docyt: Docyt utiliza IA para automatizar tareas de contabilidad y gestión documental.

- Dext frente a RefreshMe: RefreshMe proporciona información en tiempo real sobre el rendimiento financiero de la empresa.

- Dext contra Sage: Sage ofrece una gama de soluciones de contabilidad con capacidades de seguimiento de gastos.

- Dext frente a Zoho Books: Zoho Books proporciona contabilidad integrada con funciones de gestión de gastos.

- Dext contra Wave: Wave ofrece software de contabilidad gratuito con funciones básicas de seguimiento de gastos.

- Dext frente a Quicken: Quicken es popular para las finanzas personales y el seguimiento de gastos comerciales básicos.

- Dext contra Hubdoc: Hubdoc se especializa en la recopilación automatizada de documentos y la extracción de datos.

- Dext frente a Expensify: Expensify ofrece soluciones sólidas de informes y gestión de gastos.

- Dext frente a QuickBooks: QuickBooks es un software de contabilidad ampliamente utilizado con herramientas de gestión de gastos.

- Dext frente a entrada automática: AutoEntry automatiza la entrada de datos de facturas, recibos y extractos bancarios.

- Dext frente a FreshBooks: FreshBooks está diseñado para empresas de servicios con facturación y seguimiento de gastos.

- Dext frente a NetSuite: NetSuite ofrece un sistema ERP integral con funcionalidades de gestión de gastos.

Conclusión

Learning how to use Dext changes the way you work.

You no longer have to stress over lost receipts.

You can stop typing data by hand. The app does the hard work for you.

It organizes your money and keeps your team on track.

This gives you more free time to grow your actual business.

You can relax knowing your books are accurate.

Start simple. Snap a few photos today. Connect your bank and let the automation run.

Your future self will thank you for getting organized right now.

Preguntas frecuentes

Is Dext easy to use?

Yes, it is very simple. You just download the app and snap a photo. The software reads the texto for you. Most people learn it in a few minutes.

How does Dext software work?

It uses smart technology to read your paper receipts. It pulls out the numbers and dates. Then, it sends that digital data straight to your accounting software.

How to use Dext for expenses?

Snap a picture of your receipt immediately. Dext reads the cost and category. Submit it in the app. It automatically keeps your spending records safe and organized.

How do I send receipts to Dext?

You have three main ways. You can use the mobile app camera. You can email them to your Dext address. Or, you can upload files to your computer.

Is Dext free to use?

No, Dext is not free. You usually have to pay a monthly fee. However, they often offer a free trial so you can test it before you buy.

More Facts about Dext

- Smart Reading: Dext uses special smart technology (called AI) to read and pull information from the documents you upload.

- Automatic Downloads: The software can connect to supplier websites to automatically find and download your bills.

- Muchas conexiones: Dext integrates with over 30 other accounting programs and connects to more than 11,500 banks and financial institutions.

- Three Main Tools: Dext is a family of three tools: Dext Prepare (for receipts), Dext Precision (for error checking), and Dext Commerce (for online sales).

- Fast Scanning: The software can process a document in about 30 seconds, which is much quicker than typing it in by hand.

- Alta precisión: The technology it uses to read text is very accurate, getting it right more than 99% of the time.

- Aplicación móvil: You can use the Dext app on your phone to snap a photo of a receipt, and it will instantáneamente upload it to your account.

- Catching Mistakes: The “Precision” tool analyzes your data to find duplicate payments orincorrect amountss so you can fix them quickly.

- Puntuación de salud: It gives your business data a “Health Score” to show you how accurate and clean your financial records are.

- Online Sellers: The “Commerce” tool is built for people who sell things on websites like Amazon or Shopify. It automatically grabs all the sales data.

- Safe Storage: Dext keeps your digital records safe for 10 years using the same security banks use.

- Seguimiento de gastos: It helps business owners see exactly how much they are spending in real time.

- Mileage Tracking: You can use the app to track how many work miles you drive so you can be reimbursed for viajar costs.

- Acceso del equipo: You can give your employees their own login so they can upload their own receipts without seeing everything else.