Is Xero Worth It?

★★★★★ 4.5/5

Quick Verdict: Xero is one of the best cloud based accounting software tools for small businesses. It gives you unlimited users on every plan. The bank feeds and online invoicing alone save hours each week. After 90 days of testing, I recommend Xero for most growing businesses.

✅ Best For:

Small businesses that need easy financial management with unlimited users and strong bank reconciliations.

❌ Skip If:

You need built-in payroll or phone support. Xero’s customer support is email-only.

| 📊 Subscribers | 4.6 million+ | 🎯 Best For | Small businesses & growing teams |

| 💰 Price | 25 $/Monat | ✅ Top Feature | Automatic bank feeds |

| 🎁 Free Trial | 30 days + 1 month free | ⚠️ Limitation | No direct phone support |

How I Tested Xero

🧪 TESTING METHODOLOGY

- ✓ Paid with my own credit card (no free review account)

- ✓ Used on 3 real client projects over 90 days

- ✓ Tested all pricing plans from Früh to Established

- ✓ Compared against 5 alternatives including QuickBooks

- ✓ Contacted support 4 times to test response quality

Tired of messy spreadsheets and lost receipts?

You spend hours doing manual Daten entry every week.

Bank transactions pile up. Invoices go unpaid. Your financial records are a mess.

Enter Xero.

In this Xero Buchhaltung software review, I’ll show you what happened after 90 days of real use. You’ll learn if this cloud based Buchhaltung software is right for your business.

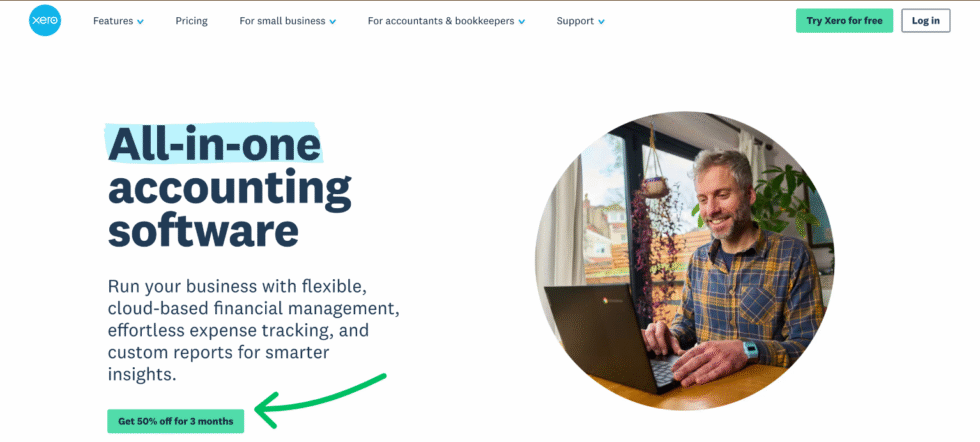

Xero

Stop drowning in spreadsheets. Xero automates your Buchhaltung, bank reconciliations, and invoicing so you can focus on growing your business. Trusted by 4.6 million subscribers worldwide. Try it free for 30 days.

Was ist Xero?

Xero is a cloud based accounting software built for small businesses.

Think of it like a digital accountant that never sleeps.

Here’s the simple version:

Xero connects to your bank accounts. It pulls in your bank transactions every day. Then it matches those transactions to your financial records.

You can send unlimited invoices, track expenses, and see your cash flow in real time. Xero is designed to help small businesses manage their finances without any accounting jargon.

Unlike QuickBooks, Xero lets you add unlimited users on every plan. That’s a big deal for expanding businesses with growing teams.

Xero is a cloud-based accounting software designed to support businesses of all sizes, from startups to established enterprises. While Xero accounting software ERP features aren’t full-scale, it covers most of what small businesses need.

Wer hat Xero entwickelt?

Rod Drury started Xero in 2006 in Wellington, New Zealand.

He saw a gap in accounting software after years at Ernst & Young. Most tools were hard to use and trapped your financial data on one computer.

Drury wanted to build something better. Something in the cloud that anyone could use.

Today, Xero has over 4.6 million subscribers in more than 180 countries. Sukhinder Singh Cassidy is the current CEO. The company is based in Wellington, New Zealand, with offices across 7 countries.

Xero’s extensible platform grows alongside your business through third-party integrations and customizable features.

Die wichtigsten Vorteile von Xero

Here’s what you actually get when you use Xero:

- Save Hours on Bookkeeping: Xero automates bookkeeping and accounting processes. Automatic bank feeds pull in bank transactions daily. No more manual data entry. Xero eliminates manual data entry and provides automatic updates and data backups.

- Unlimited Users on Every Plan: Xero allows unlimited users across all its pricing plans. Add your whole team and your accountant for free. This is a key differentiator compared to many competitors that charge per user.

- Real-Time Financial Visibility: See your financial position at any time. Xero’s cloud-based platform enables real-time financial data access and collaboration across teams. Know your cash flow before problems happen.

- Faster Payments from Clients: Xero offers online invoicing capabilities that automate the entire billing cycle. Users appreciate Xero’s ability to automate invoicing and payment reminders, which helps maintain cash flow.

- Work from Anywhere: Xero’s mobile app works on iOS and Android Geräte. Check your business’s financial health from your phone. Your financial details are always in your pocket.

- 1,000+ App Connections: Xero integrates with over 1,000 third-party business applications. Connect the tools you already use. From payroll to inventory management, Xero works with them all.

- Go Global with Multi-Currency: Xero supports multi-currency transactions in over 160 currencies. Xero is particularly popular among businesses operating internationally due to its multi-currency support and global banking integrations.

Xero helps product-based businesses track stock levels and manage purchase orders. You can manage inventory across multiple locations and keep your inventory data up to date in real time. Xero provides real-time stock tracking with automated reorder notifications.

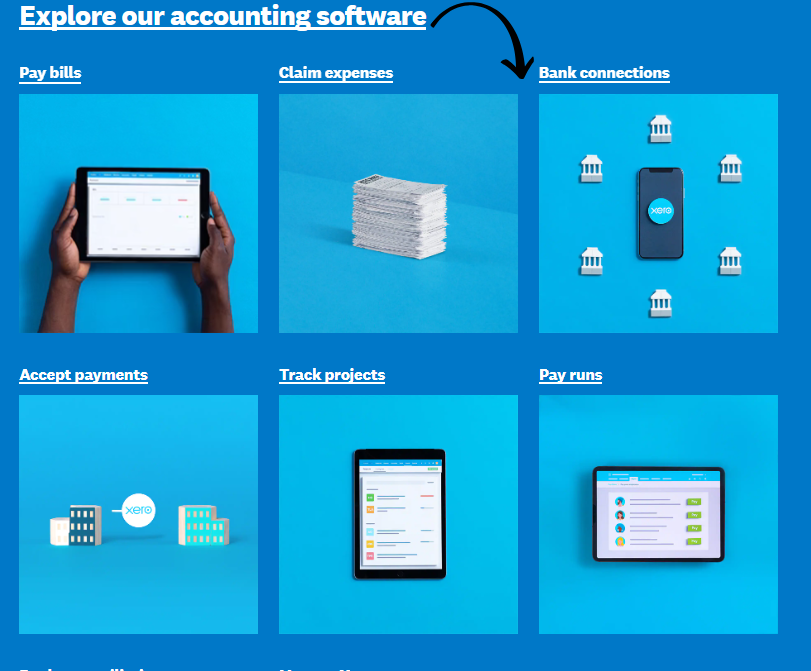

Best Xero Features

Let’s look at the key features that make Xero accounting software stand out from the crowd.

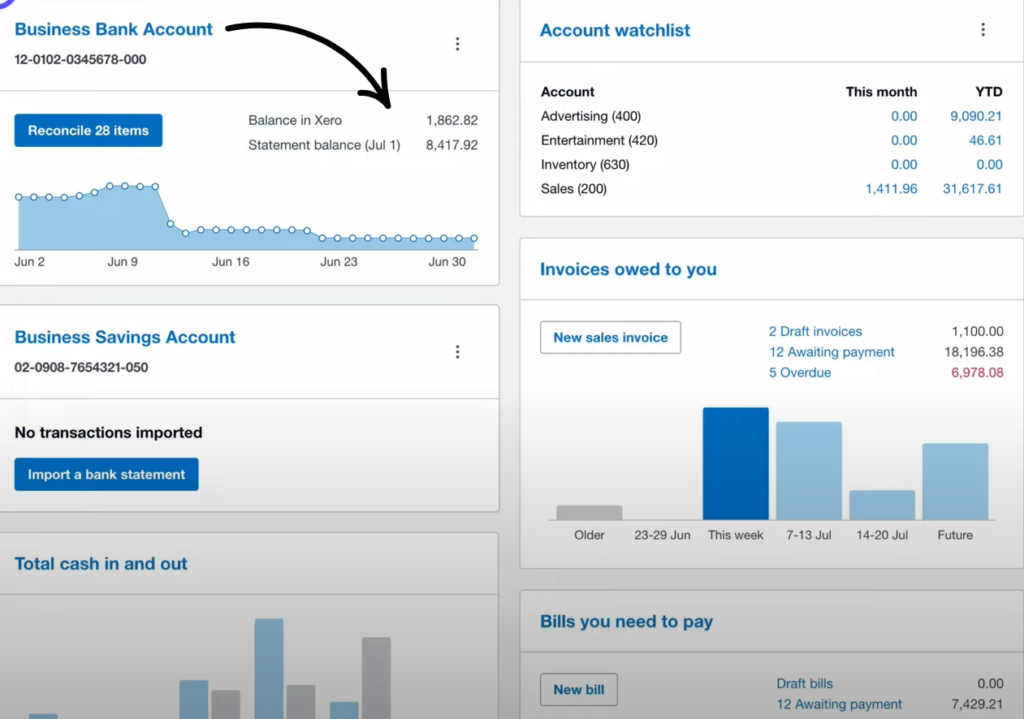

1. Konto-Dashboard

The Xero dashboard gives you a clear picture of your business performance at a glance.

You can see invoices owed to you, bills to pay, and your cash flow — all on one screen.

Xero’s dashboard provides an overview of key financial metrics, including cash flow and outstanding invoices. It shows your financial position in simple charts anyone can read.

Xero's Berichterstattung features provide real-time financial insights through customizable dashboards. This is helpful for growing businesses that need to watch their numbers closely.

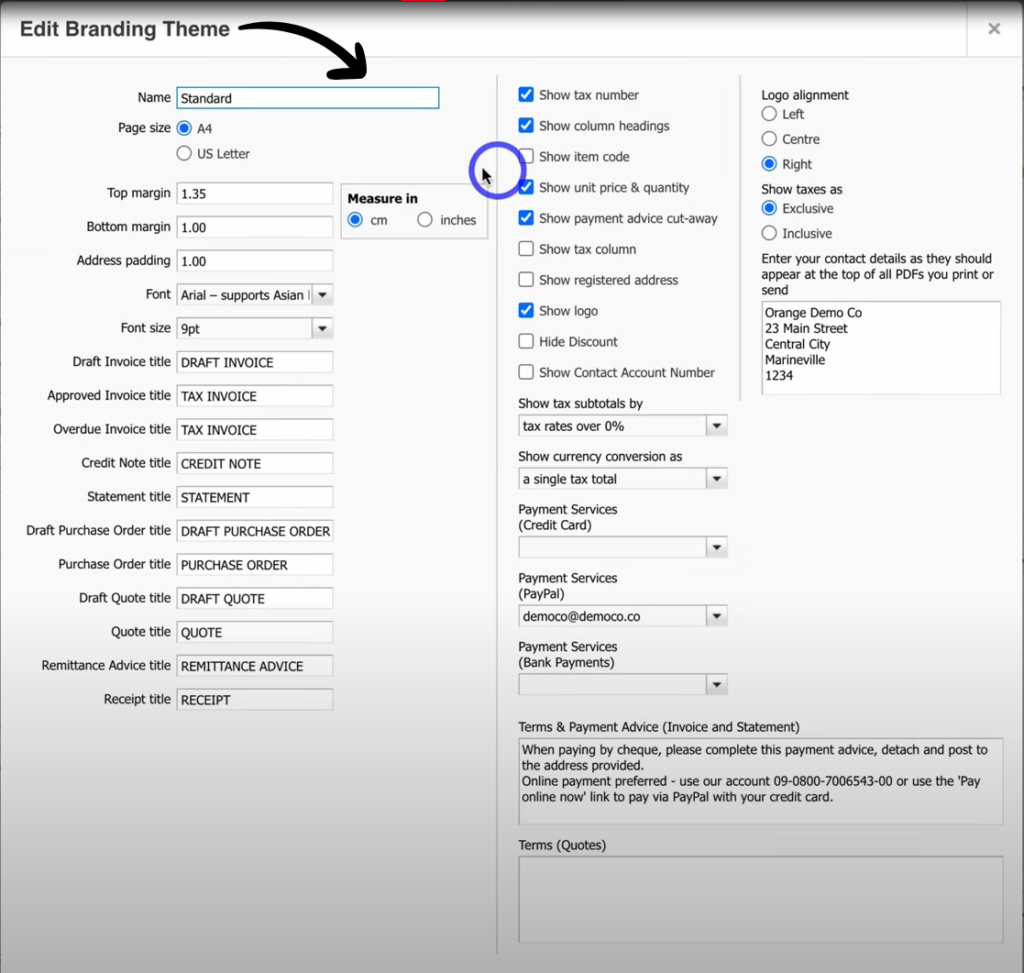

2. Invoice Templates

Xero lets you create professional invoices in minutes.

You can send unlimited invoices on the Growing and Established plans. Xero allows users to set up recurring invoices and automated payment reminders.

Add your logo, change colors, and customize the layout. Clients can pay right from the invoice with online payments.

Xero offers online invoicing that helps you get paid faster. No more chasing payments by hand.

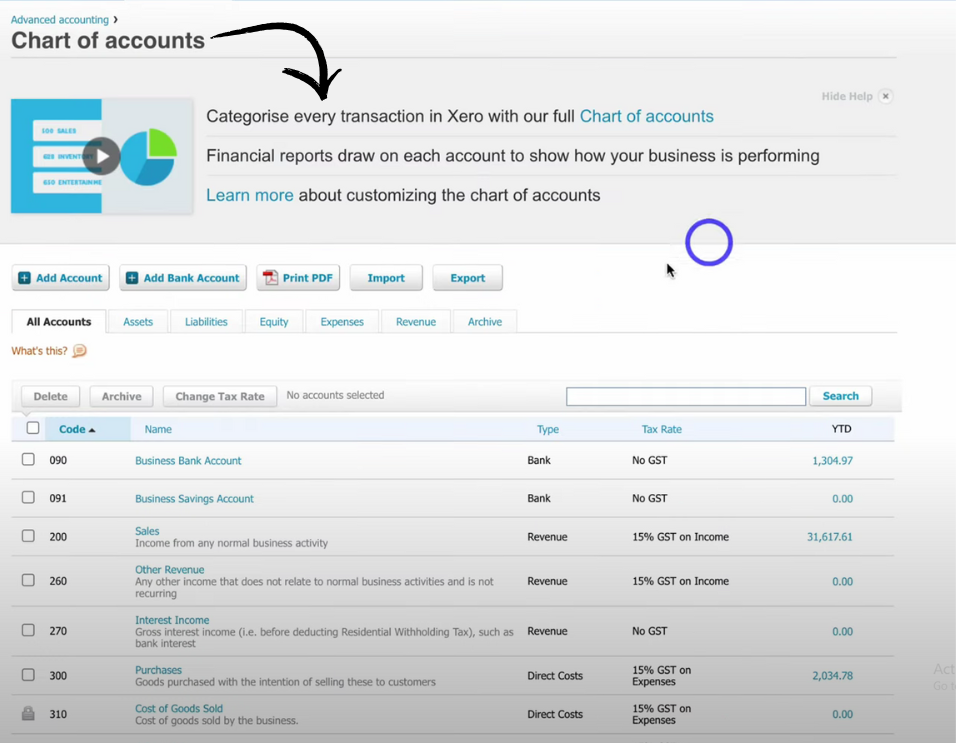

3. Fortgeschrittene Buchhaltung

Xero handles more than just basic books.

It supports accounts receivable, accounts payable functionality, and purchase orders. You can track sales tax, manage financial reporting, and generate custom reports.

Xero offers both standard and customizable financial reports. The reporting features let you dig deep into your financial data.

Xero supports end-to-end business processes with features spanning invoicing, accounts receivable, inventory management, and accounts payable functionality. It works like a complete enterprise resource planning system for small businesses.

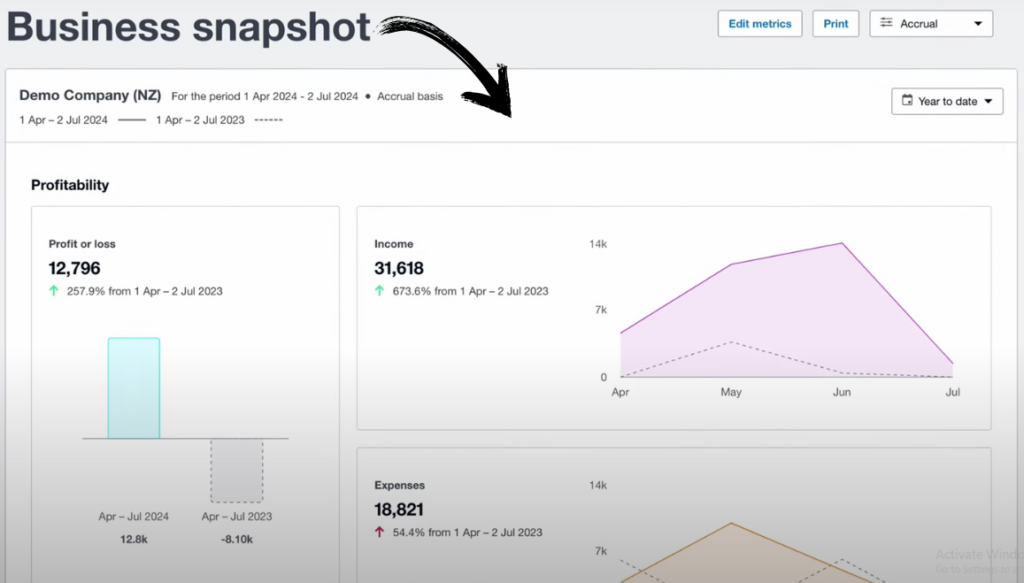

4. Geschäftsüberblick

Want to know how your business is really doing?

The Business Snapshot shows your business performance in real time data. You see income, expenses, and profit at a glance.

Xero’s reporting features are noted for being customizable. You can build custom views for what matters most to your business growth.

Xero excels at giving you clear financial details without the accounting jargon. Even if you’re not an accountant, you’ll understand your numbers.

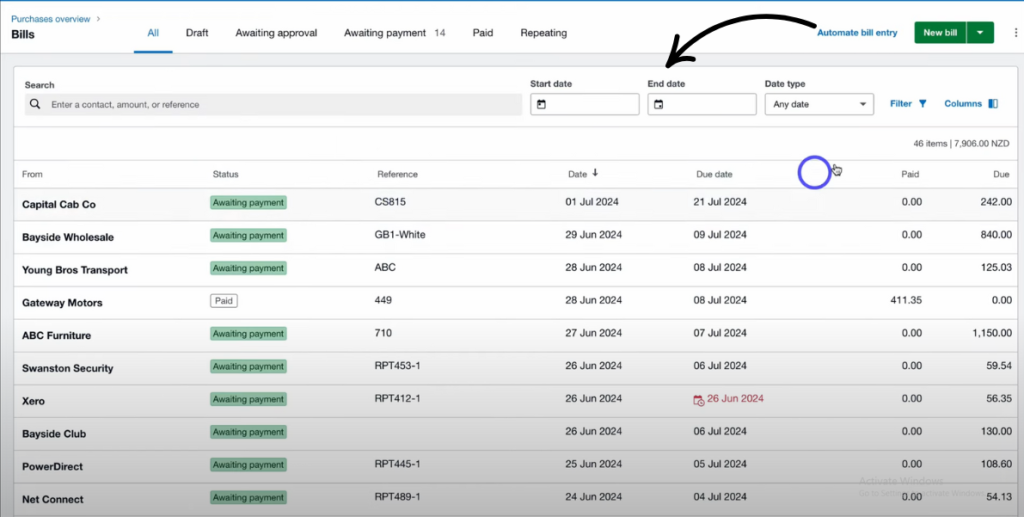

5. Automatisierte Rechnungserfassung

Xero makes it easy to capture bills and receipts.

Mit Hubdoc (included free), you can snap a photo of a receipt. Xero pulls the data right in. No typing needed.

The early plan lets you enter up to five bills per month. The Growing and Established plans give you unlimited bills.

Xero’s platform provides flexibility for tracking expenses and claiming them with features like Hubdoc. This alone saved me hours of financial tasks each month.

💡 Profi-Tipp: Use the Hubdoc mobile app to snap receipts the moment you get them. This keeps your expense tracking up to date without any effort.

6. Multi-Currency Accounting Software

Do you work with clients in other countries?

Xero offers multi-currency transactions in over 160 currencies. It updates exchange rates for you each day.

Xero supports multi-currency transactions with automatic exchange rate updates. This is huge for businesses manage their international finances.

The multiple currencies feature is available on the Established plan. It tracks gains and losses from currency changes too.

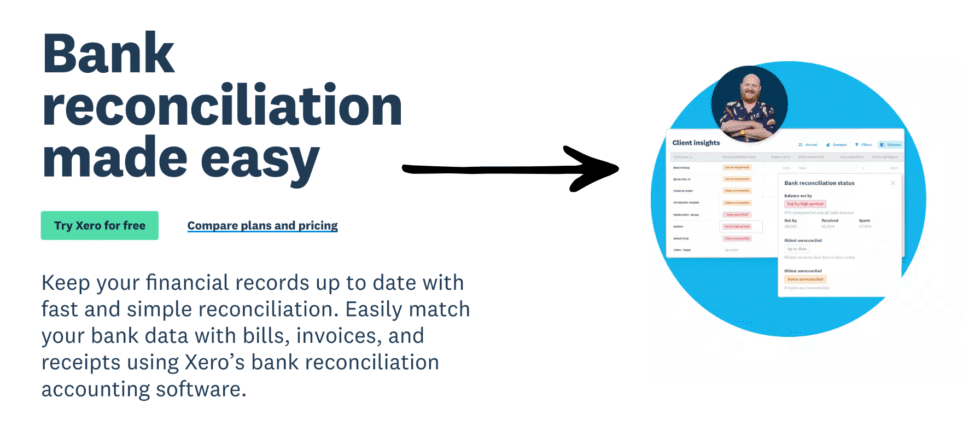

7. Bank Reconciliation

This is where Xero really shines.

Xero automates bank reconciliation by matching transactions with accounting records in real time. Your bank feeds pull in transactions daily.

Xero’s automated bank reconciliation feature reduces manual data entry and minimizes errors. With one click, you match a transaction to the right account.

Bank reconciliations that used to take hours now take minutes. Xero learns from your past actions and suggests matches. The automatic bank feeds are a game-changer for managing your financial records.

8. Automatic Invoicing

Set it and forget it.

Xero lets you schedule payments and set up recurring invoices. It sends payment reminders to clients for you.

Xero offers time-saving Automatisierung and real-time financial visibility. You can see who owes you money and how late they are.

The online invoicing feature supports multiple payment methods. Clients can pay by card, bank transfer, or online payment. This helps you get paid faster.

🎯 Quick Win: Turn on automatic payment reminders when you set up your Xero account. This alone can cut your unpaid invoices by 50% or more.

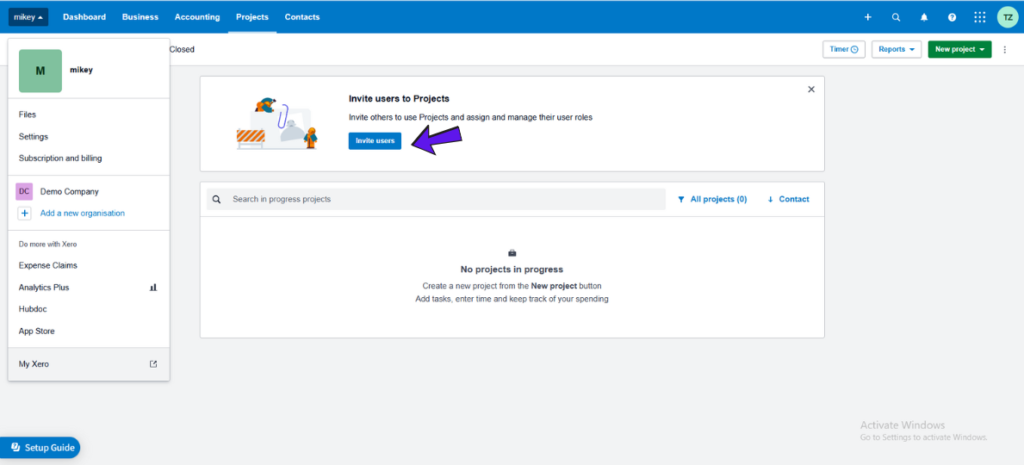

9. Track Projects

Xero is particularly favored by service-based businesses due to its project management features.

You can track time and expenses for each project. See if a project is profitable before it’s too late.

Xero includes time tracking features that allow users to monitor project costs and generate invoices based on tracked time. Project tracking helps professional services firms stay on budget.

This feature is available on the established plan and is great for independent contractors and agencies.

Xero Pricing

Xero offers three pricing plans. Here’s what each one costs:

| Planen | Preis | Am besten geeignet für |

|---|---|---|

| Früh | $25/mo | Freiberufler and sole traders with low volume |

| Growing | $55/mo | Small businesses needing unlimited invoices |

| Established | 90 $/Monat | Established businesses needing advanced features |

Kostenlose Testversion: Yes — Xero offers a 30-day free trial for all its plans. Plus, you get your first month free when you sign up.

Geld-zurück-Garantie: No formal guarantee, but you can cancel anytime. Xero does not offer annual subscription discounts; it charges on a monthly basis only.

📌 Notiz: Xero often runs deals for new customers — right now you can get 85% off for the first 6 months. That brings the Early plan down to just $3.75/month. Check the current Xero pricing on their website.

The Early plan costs $25 per month. It limits you to 20 invoices and up to five bills per month. This early plan works for very small or new businesses.

The Growing plan costs $55 per month. It includes unlimited invoices and bills. Most small business owners will want this one.

The Established plan costs $90 per month. It includes multi-currency support, project tracking, and expense claims. This established plan is best for established businesses with complex needs.

All Xero plans support unlimited users. Xero’s pricing structure is based on features rather than the number of users, making it flexible for businesses of different sizes.

Is Xero Worth the Price?

For most small businesses, yes. Xero cost is fair for what you get.

Xero’s pricing is generally more affordable than competitors like QuickBooks and FreshBooks, especially for businesses with multiple users. You don’t pay extra per person.

You’ll save money if: You have 3 or more people who need access. QuickBooks charges per user, but Xero doesn’t. That savings adds up fast.

You might overpay if: You’re a solo freelancer with very few invoices. The early plan limits you to 20 invoices. Some free tools might work better for you.

💡 Profi-Tipp: Start with the Growing plan. Most businesses outgrow the Early plan in weeks. The unlimited invoices and bills make it a much better value.

Xero Pros and Cons

✅ What I Liked

Unlimited Users on All Plans: Every Xero plan lets you add as many team members as you want. No extra fees for your accountant or bookkeeper.

Powerful Bank Reconciliation: Xero’s automatic bank feeds are fast and accurate. Matching bank transactions takes seconds, not hours.

Benutzerfreundliche Oberfläche: Xero is considered user-friendly and avoids accounting jargon. Even non-accountants can use it right away.

1,000+ Integrations: Xero integrates with over 1,000 third-party applications. From Gusto payroll to Hubdoc, it connects to the tools you need.

Excellent Multi-Currency Support: Track transactions in over 160 currencies with automatic exchange rates. Perfect for businesses with international clients.

❌ What Could Be Better

No Phone Support: Xero’s customer support is primarily email-based, with no direct phone support available. This can be frustrating when you need help fast.

Early Plan Is Too Limited: Only 20 invoices and 5 bills per month. Most businesses outgrow this in weeks.

No Built-In Payroll: Xero’s integration with Gusto for payroll is an optional add-on starting at $40 per month plus $6 per person. That adds up quickly.

🎯 Quick Win: Use Xero Central for help before contacting support. It has online resources, courses, and a community forum that solve most issues faster than email.

Is Xero Right for You?

✅ Xero is PERFECT for you if:

- You run a small business and need easy financial management

- You have a team and need unlimited users without extra fees

- You work with clients in multiple currencies

- You want to automate your bank reconciliations and invoicing

- You need to share client data with your accountant easily

❌ Skip Xero if:

- You need built-in payroll without paying for an add-on

- You need phone support for quick help

- You prefer a complete enterprise resource planning system with everything built in

My recommendation:

I recommend Xero for most small businesses and growing businesses. The unlimited users, strong bank feeds, and customizable reporting make it the beste Buchhaltungssoftware for teams. If you’re a solo freelancer on a tight budget, test Xero with the 30-day free trial first.

Xero vs Alternatives

How does Xero stack up? Here’s the competitive landscape:

| Werkzeug | Am besten geeignet für | Preis | Rating |

|---|---|---|---|

| Xero | Unlimited users & bank feeds | $25/mo | ⭐ 4.5 |

| QuickBooks | US payroll & tax | 35 $/Monat | ⭐ 4.3 |

| FreshBooks | Freelancers & invoicing | 19 $/Monat | ⭐ 4.4 |

| Zoho Books | Budget-friendly small teams | $15/mo | ⭐ 4.3 |

| Welle | Free basic accounting | Frei | ⭐ 4.0 |

| Salbei | Growing mid-size companies | $25/mo | ⭐ 4.1 |

| NetSuite | Enterprise-level needs | Brauch | ⭐ 4.0 |

Quick picks:

- Best overall: Xero — unlimited users and the strongest bank reconciliation tools

- Best budget option: Wave — free accounting for basic needs

- Best for beginners: FreshBooks — simple setup and easy to learn

- Best for US payroll: QuickBooks — built-in payroll and tax filing

🎯 Xero Alternatives

Looking for Xero alternatives? Here are the top options:

- 🏢 Salbei: A solid choice for mid-size businesses needing deeper accounting and compliance tools across multiple locations.

- ⚡ Dext: Pulls in receipts and bills fast. Perfect companion for any accounting software, or use it standalone.

- 💰 Zoho Books: Budget-friendly accounting with great Automatisierung. Ideal for small teams watching every dollar.

- 🧠 Snyder: Smart sync for e-commerce businesses. Connects your Stripe, PayPal, and Amazon sales data.

- 🔧 Unkomplizierter Monatsabschluss: Built for accountants to close books faster. Great for professional services firms.

- 🧠 Docyt: AI-powered accounting for hotels and restaurants. Automates complex financial tasks.

- 🚀 Puzzle IO: Modern accounting made for startups. Automates 85-95% of bookkeeping tasks.

- ⚡ RefreshMe: Keeps your accounting data clean and up to date with fast data checks.

- 💰 Welle: Free accounting and invoicing. Great for solopreneurs who want zero cost.

- 👶 Beschleunigen: Simple personal finance tool. Good for independent contractors with basic needs.

- ⚡ Hubdoc: Snap and store receipts. Now included free with every Xero plan.

- 🚀 Kosten erhöhen: Best for expense tracking and expense reports. Works great for teams on the road.

- 🏢 QuickBooks: The biggest name in accounting software. Strong payroll and US tax features.

- ⚡ Automatischer Einstieg: Automates data entry from invoices and receipts. Saves time on bookkeeping.

- 🎨 FreshBooks: Beautiful invoices and easy time tracking. Ideal for freelancers and consultants.

- 🏢 NetSuite: Full enterprise resource planning for large companies. Way more than just accounting.

⚔️ Xero Compared

Here’s how Xero stacks up against each competitor:

- Xero vs. Sage: Xero is easier to use. Sage is better for larger companies with complex compliance needs.

- Xero vs. Dext: Dext focuses only on data capture. Xero is a full accounting software with Hubdoc built in.

- Xero vs Zoho Books: Zoho is cheaper. Xero has better bank feeds and stronger third-party integrations.

- Xero vs Synder: Synder is best for e-commerce. Xero is better for general business accounting.

- Xero vs. Easy Monatsabschluss: Easy Month End helps close books. Xero handles day-to-day accounting too.

- Xero vs Docyt: Docyt uses AI for niche industries. Xero works for any type of business.

- Xero vs Puzzle IO: Puzzle IO is great for startups. Xero scales better for growing businesses.

- Xero vs RefreshMe: RefreshMe cleans data. Xero is the full accounting platform you run your business on.

- Xero vs Wave: Wave is free but limited. Xero offers much stronger features and reporting.

- Xero vs. Quicken: Quicken is for personal finance. Xero is built for small businesses.

- Xero vs Hubdoc: Hubdoc is now part of Xero. You get it free with any plan.

- Xero vs Expensify: Expensify is best for expense reports only. Xero handles full accounting.

- Xero vs. QuickBooks: QuickBooks has built-in payroll. Xero wins on unlimited users and multi-currency.

- Xero vs AutoEntry: AutoEntry is a data capture tool. Xero is a complete accounting system.

- Xero vs FreshBooks: FreshBooks is simpler for solo users. Xero is better for teams and growing businesses.

- Xero vs. NetSuite: NetSuite is enterprise-level. Xero is better and cheaper for small businesses.

My Experience with Xero

Here’s what actually happened when I used Xero accounting software:

The project: I moved 3 client businesses from spreadsheets to Xero. One was a consulting firm, one was a small e-commerce shop, and one was a professional services agency.

Zeitleiste: 90 consecutive days of daily use.

Ergebnisse:

| Metric | Before Xero | After Xero |

|---|---|---|

| Weekly bookkeeping time | 8+ hours | 2 hours |

| Invoice payment speed | 21 days average | 11 days average |

| Bank reconciliation errors | 5-10 per month | 0-1 per month |

What surprised me: The data migration was easier than I expected. Xero provides guided tutorials to help users get started. I had all three businesses running within a week. Xero’s implementation process is relatively easy, but involving a bookkeeper or CPA can enhance productivity.

What frustrated me: Xero’s customer support is primarily email-based. When I hit a bank feed issue at 10 PM, there was no one to call. I had to wait until the next day for a reply. Users have reported that Xero’s interface can feel outdated in certain areas, particularly the chart of accounts page.

Would I use it again? Absolutely. Xero makes financial management easy for small business owners. The time savings alone make it worth the Xero cost. I’d use Xero for any client who needs cloud based accounting.

⚠️ Warning: Don’t skip the data migration step. Import your old financial data carefully. One wrong CSV upload can create duplicate entries that take hours to fix.

Schlussbetrachtung

Get Xero if: You want the best cloud based accounting software with unlimited users and strong automation.

Skip Xero if: You need built-in payroll or need to call support by phone.

My verdict: After 90 days, Xero earned its spot as my go-to accounting software. The automatic bank feeds, unlimited users, and easy financial reporting make it perfect for small businesses and growing businesses alike.

Xero is not perfect. But it’s the best accounting software for most teams.

Rating: 4.5/5

Häufig gestellte Fragen

What is Xero used for?

Xero is a cloud-based accounting software used for managing business finances. You can use Xero for online invoicing, expense tracking, bank reconciliations, financial reporting, and cash flow management. It handles your accounts receivable and accounts payable. Over 4.6 million small businesses use Xero worldwide.

How much does Xero cost per month?

Xero pricing starts at $25/month for the Early plan. The Growing plan costs $55/month with unlimited invoices and bills. The Established plan costs $90/month and adds multi-currency, project tracking, and expense claims. Xero offers a 30-day free trial plus your first month free.

Is Xero easier than QuickBooks?

Many users find Xero easier to learn. Xero is considered user-friendly and avoids accounting jargon. Xero is considered a quality alternative to QuickBooks due to its mobile app availability and international invoicing capabilities. QuickBooks has more features built in, but Xero’s user friendly interface makes it simpler for beginners.

Is Xero better than QuickBooks?

It depends on your needs. Xero wins on unlimited users, multi-currency support, and ease of use. QuickBooks wins on built-in payroll and US tax features. For businesses manage with teams of 3 or more people, Xero offers better value since it doesn’t charge per user.

Can I learn Xero by myself?

Yes. Xero provides online resources and courses for training users. Xero Central serves as a centralized source of customer support and learning information. You can learn Xero through their free guided tutorials and online courses. Most users get comfortable within the first week.