Manually typing invoices and receipts is a huge waste of time.

It is boring, slow, and leads to mistakes that mess up your books.

You sit at your desk for hours, feeling stressed as the pile of paper grows.

It feels like you will never finish.

Stop the headache right now.

Our guide shows you how to use AutoEntry to handle the hard work for you.

Read on to learn how to automate your Daten entry and win back your free time!

Ready to save 90% of your time on paperwork? Join over 3,000 firms that use AutoEntry to process documents with 99% accuracy. Start your free trial today and automate your first 25 documents for free!

AutoEntry Tutorial

First, upload your receipts or invoices to the app.

AutoEntry reads the data sofort using smart technology.

Next, check the details to make sure they are correct.

Finally, click publish to send the info to your Buchhaltung Software.

It is that simple to save your time.

How to use Automatischer Einstieg Easy Data Entry

Managing paperwork is a full-time job.

Viele Buchhalter and bookkeepers spend hours every day just typing numbers into a computer.

This feature fixes that problem.

It lets you send documents to your software without manual typing.

Step 1: Choose your upload method

You have a few ways to get your data into the system.

Most accountants and bookkeepers prefer using the mobile app because it is fast.

You can also email your files.

- Open the mobile app on your smartphone.

- Take a clear photo of your receipt or invoice.

- If you have digital files, send them to your unique AutoEntry email address.

- You can also drag & drop PDF files directly into your web browser.

Step 2: Set your automation rules

To make things run smoothly, you need to provide some basic details.

If you are a Sage Geschäft partner, you might need to link specific accounts.

- Go to your settings and enter the required Geschäft phone and a valid phone number.

- Make sure you provide a valid email address salutation so your contacts look professional.

- If the system asks, enter your required account number to link your bank.

- Every existing Sage customer should double-check that their tax settings match their software.

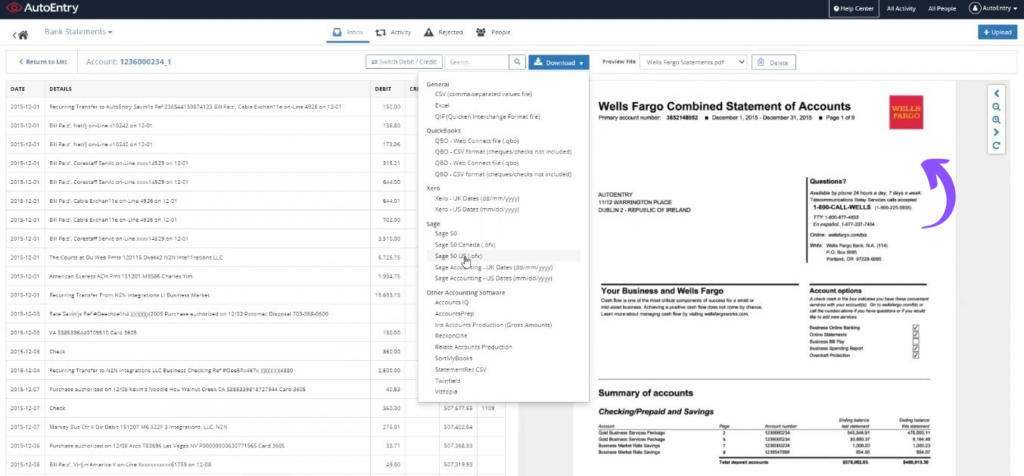

Step 3: Review and process bank statements

AutoEntry isn’t just for bills; it handles bank statements too.

This saves you from having to type out every transaction by hand.

- Upload your paper bank statements as a PDF or high-quality scan.

- Wait a few minutes for the AI to read the dates and amounts.

- Check that the valid phone number entered fields are correct if you are adding new contacts.

- Since you are a required existing Sage customer, you can now sync these transactions directly to your ledger.

How to use Smart Analysis

Smart Analysis is a powerful tool that looks deep into your documents.

It goes beyond simple numbers to find hidden patterns in your automated data.

This helps you understand your spending habits without doing any math yourself.

It is the smartest way to keep your books healthy and accurate.

Step 1: Activate Smart Analysis for your profile

To get the most out of this feature, you need to make sure your business profile is complete.

The system uses your details to give you better insights into your specific industry.

- Go to your account settings and fill in your required job title.

- Enter your required annual revenue so the AI knows the size of your business.

- Provide a professional email address and a business phone number.

- Every field is required to ensure your reports are accurate and secure.

Step 2: Upload documents for deep scanning

Once your profile is ready, you can start sending files for analysis.

You can do this from your desk or while you are out meeting clients.

- Upload your complex invoices or bills to the web portal.

- You can also continue mobile phone uploads by using the app on your mobile phone.

- Make sure each document shows a clear address line for the vendor.

- If you have questions about a specific scan, you can ask a sage representative for help.

Step 3: Set up your communication preferences

Smart Analysis can send you alerts when it finds something important.

You get to choose how you want to stay informed about your business data and new features.

- Check your contact details to make sure you have a valid phone number.

- Select if you want to receive promotional communications or electronic communications.

- If you want instant alerts, choose to receive sms communications or receive sms messages.

- Click please accept to continue after you review the sms communications and promotional communications settings.

- You can also opt-in to get sage marketing emails or other marketing communications to stay updated on the latest tools.

How to use Automated Publishing

Automated publishing is the final step to save time and stop manual work.

It allows your documents to flow directly from AutoEntry into your Buchhaltung Software.

With seamless integration, you don’t even have to click “upload” every time.

It is like having a robot do your Buchhaltung für dich!

Step 1: Connect your accounting software

Before the magic happens, you must link AutoEntry to your favourite tools, such as Sage Business or QuickBooks.

This ensures all your line items go to the right place.

- Go to the “Integrations” tab and select the Sage products you use.

- You will need to fill in your required company name and required country.

- Enter your required city, required state, and your zip or postal code.

- Please confirm that the email address that you provided is my professional work email to ensure Sicherheit.

- To finish the setup, provide your job title and annual revenue to verify your business profile.

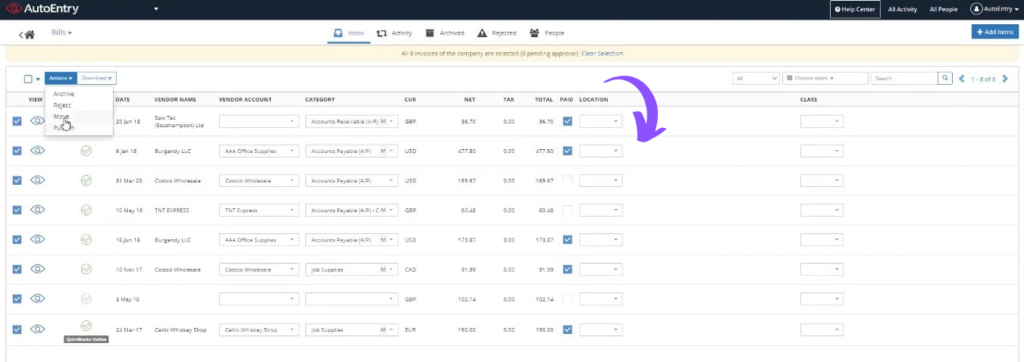

Step 2: Set up Auto-Publishing rules

Now you can tell the system which suppliers to trust.

When you trust a vendor, their invoices will sync automatically without you checking them first.

- Select a supplier and toggle the “Auto-Publish” switch to “On.”

- Enter the account number for that specific vendor.

- Make sure you have filled in the required zip and continue industry type in your settings.

- During this required session, you can indicate whether you agree to be contacted with the marketing communications.

- If you agree to be contacted, your data will be added to the system to send you sage marketing news.

- You can choose to receive from your sms messages to learn about updates or receive marketing content via email.

Step 3: Check your accounting software

After a few minutes, your data will appear in your books.

This works for invoices and even credit card statements.

- Open your accounting tool to see the new entries.

- Note that your personal data and the details you have provided are handled as part of b2b marketing privacy rules.

- If you ever want to stop receiving marketing content from Sage, you can unsubscribe from our communications at any time using the unsubscribe link.

- Your added to our database helps a Sage representative get back from a Sage office to help you if you get stuck.

- You can choose if you want help, including by electronic communications or sms messages.

Alternatives to Autoentry

Hier sind einige Alternativen zur automatischen Eingabe, kurz erklärt:

- Puzzle IO: Diese Software konzentriert sich auf KI-gestützte Finanzplanung.

- Dext: Dieses Tool eignet sich hervorragend zum Erfassen von Dokumenten und zum Extrahieren von Daten.

- Xero: Dies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen.

- Snyder: Das Unternehmen ist auf die Synchronisierung von E-Commerce- und Zahlungsdaten mit Buchhaltungssoftware spezialisiert.

- Unkomplizierter Monatsabschluss: Diese Software wurde entwickelt, um Ihre Finanzaufgaben zum Monatsende zu vereinfachen.

- Docyt: Es nutzt künstliche Intelligenz für die Buchhaltung und automatisiert Finanzprozesse.

- Salbei: Dies ist eine umfassende Software-Suite für Unternehmen und Buchhaltung.

- Zoho Books: Es handelt sich um ein Online-Buchhaltungstool, das dafür bekannt ist, preiswert und ideal für kleine Unternehmen zu sein.

- Welle: Diese Option bietet kostenlose Buchhaltungssoftware für Kleinunternehmen.

- Beschleunigen: Ein beliebtes Tool zur Verwaltung der persönlichen Finanzen, das bei der Budgetplanung hilft.

- Hubdoc: Das Unternehmen ist auf die Erfassung und Organisation von Finanzdokumenten für die Buchhaltung spezialisiert.

- Kosten erhöhen: Diese App konzentriert sich auf das Ausgabenmanagement und ermöglicht das einfache Erfassen und Einreichen von Belegen.

- QuickBooks: Eine sehr bekannte Buchhaltungssoftware, die Unternehmen bei allem von der Rechnungsstellung bis zur Lohnabrechnung unterstützt.

- FreshBooks: Diese Software wurde speziell für Freiberufler und kleine Unternehmen entwickelt und konzentriert sich auf Rechnungsstellung und Zeiterfassung.

- NetSuite: Eine leistungsstarke und umfassende cloudbasierte Business-Management-Suite für größere Unternehmen.

Vergleich der automatischen Eingabe

- Automatischer Einstieg vs. PuzzleDiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- AutoEntry vs DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- AutoEntry vs. XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- AutoEntry vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- Automatischer Monatsabschluss vs. Einfaches MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- AutoEntry vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- AutoEntry vs. SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- AutoEntry vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- AutoEntry vs WaveDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- AutoEntry vs. QuickenBeides sind Tools für die persönliche Finanzplanung, aber dieses hier bietet eine detailliertere Investitionsverfolgung. Das andere ist einfacher.

- AutoEntry vs HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- AutoEntry vs ExpensifyDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- AutoEntry vs QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- AutoEntry vs FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- AutoEntry vs NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Abschluss

Now you know how autoentry works to make your life easier.

It is a great tool for accountants and bookkeepers who want to stop wasting time.

You can stop typing and start growing your business today.

Make sure your contact details and valid phone number are correct in your profile.

You can even continue the mobile phone setup so you can work from anywhere.

We hope this free guide helped you.

If you get Sage marketing emails, remember you can unsubscribe at any point.

Sage, including by electronic mail, treats b2b marketing data with great care and safety.

Häufig gestellte Fragen

How does AutoEntry work?

AutoEntry captures data from receipts and invoices using AI. It sends this info to your software, so accountants and bookkeepers don’t have to type. It makes sure b2b marketing your data stays safe.

How to use Sage AutoEntry?

Connect your Sage account in the settings. Upload photos through the app or email. Ensure you have a valid phone number and address saved. You can continue mobile phone for fast uploads.

How long does AutoEntry take to process?

Most bills take 10 to 120 minutes. Bank statements take longer. You can check the status at any time. If you get emails you don’t want, unsubscribe in the footer.

How to set up AutoEntry?

Create an account and link your bank or accounting tool. Add your team as users. Double-check your contact details are correct. Use the free guide if you get stuck during setup.

Is AutoEntry free with Sage?

It is not free, but it has flexible monthly plans. You only pay for what you use. Accountants and bookkeepers can start with a free trial of 25 credits to see how it works.

More Facts about AutoEntry

- Works with Others: AutoEntry connects easily with popular tools like QuickBooks, Sage, and Xero.

- Mobilfreundlich: You can use your phone to snap pictures of receipts and send them right to the app.

- Fast and Smart: The software is quick, and it actually gets smarter and faster the more you use it.

- Safe and Sound: Your private information is kept very safe and follows strict privacy rules called GDPR.

- Credit System: Instead of a flat fee, you buy “credits” to pay for the work the software does.

- Cost per Paper: Usually, one credit covers one simple bill or receipt.

- Extra Details: If you want the software to read every single line on a bill, it costs two credits.

- Bank Records: It takes three credits to process one page of a bank statement.

- Fair Pricing: You only pay for what you actually use, which helps save money.

- Monthly Plans: Subscriptions are affordable, often starting around $15 to $17 a month depending on your plan.

- Cloud-Speicher: All your documents are saved safely online so you can find them later.

- Expense Reports: Employees can send in their work expenses through the app for a boss to approve.

- Remembers your Choices: Once you tell the app how to handle a bill from one store, it remembers that for next time.

- Auto-Upload: When you take a photo of a receipt, the info goes straight into your accounting books.

- Spart Zeit: Because the computer does the typing, accountants can spend more time helping their clients with bigger goals.

- Accurate Records: It pulls data directly from bank statements to make sure the numbers are always right.

- Learning Machine: The software uses “machine learning,” which means it learns from its mistakes to get better at reading handwriting and Text.

- Bulk Uploads: You can scan a large pile of papers at once and upload them through your computer.

- Automatic Settings: You can set up the app to automatically add tax codes to certain bills.

- Einfache Einrichtung: To start, you just link it to your accounting software and import your list of accounts.

- Simple Menus: You can usually find the connection settings right inside the main menu of your accounting software.

- Better Business: By doing the boring data entry for you, AutoEntry makes running a business much smoother.