Doing your own taxes is a total nightmare.

Most software costs too much and feels way too hard to learn.

You just want to track your money without a headache.

Wave is a free tool that can solve these problems fast.

It makes sending invoices and tracking expenses very simple.

You do not need to be a math genius to use it.

Our guide shows you exactly how to use Wave to get started today.

You will feel like a pro in just a few minutes.

Let’s get your бизнес organized right now.

Готовы отказаться от электронных таблиц и сэкономить время? Пользователи Docyt сообщают об экономии до 20 часов в месяц. бухгалтерский учет tasks. Start your free trial today and see how Docyt can revolutionize your бизнес!

Wave Tutorial

Getting started with Wave is easier than you think.

First, set up your free account and link your bank.

This lets the software automatically track your spending.

Next, we will show you how to create professional invoices and quickly organize your business receipts.

How to Use Account Reconciliation

Малый бизнес owners need smart solutions to focus on growth.

You must access your bank transactions to get rid of every error. This point is vital.

You will match online payments, bills, and other transactions to catch mistakes.

Follow these tips to ensure every payment is correct.

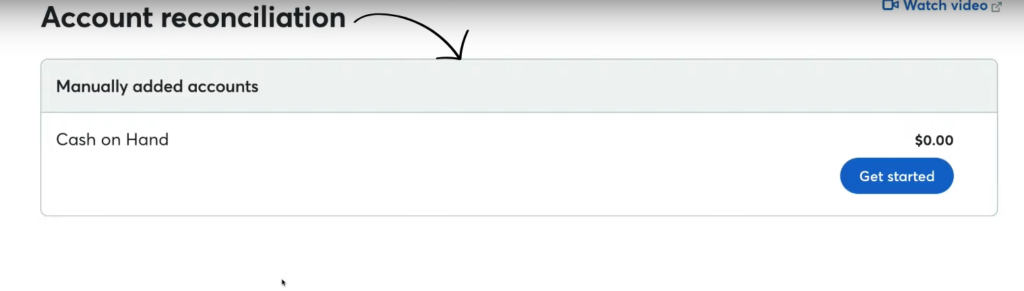

Step 1: Start a New Reconciliation

- Navigate to the sidebar and click on Бухгалтерский учет.

- Select Reconciliation from the dropdown menu to view your accounts.

- Choose the specific bank account or credit card you want to check.

- Click on Get Started or New Reconciliation to begin the process.

Step 2: Enter Statement Details

- Grab your physical or digital bank statement for the month.

- Find the Ending Balance and the Ending Date on your statement.

- Enter these exact numbers into the Wave reconciliation screen.

- Click Next to verify your данные and view the transaction list.

Step 3: Match Transactions

- Look at the list of charges on your screen.

- Check the box next to every item that matches your bank statement.

- Watch the “Difference” number at the top of the page.

- Keep checking boxes until the difference reaches $0.00.

- Click Save to finish reconciling your month.

How to Use Expense Tracking

Running a business is hard work.

Many people face tax issues for years because they lose receipts.

You must avoid this mess. It takes a bit of time to set up, but Wave runs the checks for you.

You can view where money goes and share data easily.

Read these steps to make your life easier.

This simple process works great.

Step 1: Connect Your Bank Account

- Navigate to the left-hand menu on your dashboard.

- Click on Banking and then select Connected Accounts.

- Choose your specific bank from the secure list.

- Enter your online banking login details to link the data.

- Select the checking or savings accounts you want to import.

Step 2: Classify Your Transactions

- Go to the Бухгалтерский учет tab and click on Transactions.

- Look at the list of imported spending from your bank.

- Click on a specific transaction to open the details.

- Select a Category (like “Office Supplies” or “Rent”).

- Wave learns your habits and will categorize similar items automatically next time.

Step 3: Upload Receipts

- Download the Wave mobile app or use the desktop version.

- Take a clear photo of your paper receipt.

- Upload the image to the Receipts section in the menu.

- Wait for Wave to scan the numbers and date for you.

- Click Verify to save the expense to your books officially.

How to Use Multi-Currency Support

Selling to people in other countries is a great way to grow your business.

But dealing with different money types can be confusing and hard.

You do not need to do the math yourself every time.

Wave handles the exchange rates automatically for you.

This tool lets you send bills in Euros, Pounds, or Pesos easily.

It keeps your records accurate without extra work.

You can now do business globally without stress.

Step 1: Add a New Currency

- Scroll to the bottom of the menu & click Settings.

- Look for the Currencies section in the list.

- Click the button that says Add Currency.

- Select the specific money type you need from the dropdown list.

- Click Save to add it to your system.

Step 2: Assign Currency to a Customer

- Go to the Sales tab, then click Customers.

- Click Add a customer to make a new profile or edit an old one.

- Find the Currency field in their profile settings.

- Change it from your home currency to their local currency (like Euros).

- Click Save to update the customer profile.

Step 3: Create a Foreign Invoice

- Go to Invoices and click Create New.

- Select the global customer you just set up in Step 2.

- Notice that the invoice automatically switches to their currency symbols.

- Enter your prices (Wave estimates the exchange rate for your reports).

Click Send to email the invoices to your client.

Alternatives to Wave

Если Wave не совсем соответствует вашим потребностям, вот несколько альтернатив Wave, которые стоит рассмотреть:

- Головоломка IO: Это программное обеспечение ориентировано на финансовое планирование с использованием искусственного интеллекта.

- Декст: Этот инструмент отлично подходит для захвата документов и извлечения данных.

- Ксеро: Это популярная онлайн-программа для бухгалтерского учета, предназначенная для малых предприятий.

- Снайдер: Компания специализируется на синхронизации данных электронной коммерции и платежей с бухгалтерским программным обеспечением.

- Простой конец месяца: Это программное обеспечение разработано для оптимизации ваших финансовых задач в конце месяца.

- Доцит: Она использует искусственный интеллект для ведения бухгалтерского учета и автоматизирует финансовые процессы.

- Мудрец: Это комплексный пакет программного обеспечения для ведения бизнеса и бухгалтерского учета.

- Zoho Books: Этот онлайн-инструмент для ведения бухгалтерского учета известен своей доступностью и отлично подходит для малого бизнеса.

- Quicken: Популярный инструмент для управления личными финансами, помогающий организовать бюджет.

- Хабдок: Компания специализируется на сборе и систематизации финансовых документов для ведения бухгалтерского учета.

- Expensify: Это приложение ориентировано на управление расходами, упрощая отслеживание и отправку квитанций.

- QuickBooks: Очень известная бухгалтерская программа, которая помогает предприятиям во всем, от выставления счетов до расчета заработной платы.

- АвтоВвод: Этот инструмент автоматизирует ввод данных путем сканирования и анализа документов, таких как счета-фактуры и квитанции.

- FreshBooks: Это программное обеспечение разработано специально для фрилансеров и малых предприятий, с упором на выставление счетов и учет рабочего времени.

- NetSuite: Мощный и полнофункциональный облачный пакет для управления бизнесом, предназначенный для крупных компаний.

Сравнение волн

- Wave vs Puzzle IOЭто программное обеспечение ориентировано на финансовое планирование для стартапов с использованием искусственного интеллекта. Аналогичное программное обеспечение предназначено для управления личными финансами.

- Волна против ДекстаЭто бизнес-инструмент для учета квитанций и счетов-фактур. Другой инструмент отслеживает личные расходы.

- Wave против XeroЭто популярное онлайн-программное обеспечение для бухгалтерского учета, предназначенное для малого бизнеса. Его конкурент предназначен для личного использования.

- Волна против СнайдераЭтот инструмент синхронизирует данные электронной коммерции с бухгалтерским программным обеспечением. Его альтернатива ориентирована на личные финансы.

- Волна против легкого конца месяцаЭто бизнес-инструмент для оптимизации задач по закрытию месяца. Его конкурент предназначен для управления личными финансами.

- Wave vs Docyt: Одна из них использует ИИ для ведения бухгалтерского учета и автоматизации бизнеса. Другая использует ИИ в качестве личного финансового помощника.

- Волна против МудрецаЭто комплексный пакет бухгалтерских программ для бизнеса. Его конкурент — более удобный инструмент для управления личными финансами.

- Wave против Zoho BooksЭто онлайн-инструмент для ведения бухгалтерского учета для малых предприятий. Его конкурент предназначен для личного использования.

- Wave против QuickenОба инструмента предназначены для управления личными финансами, но этот предлагает более детальное отслеживание инвестиций. Другой же проще.

- Wave против HubdocЭтот продукт специализируется на оцифровке документов для ведения бухгалтерского учета. Его конкурентом является инструмент для управления личными финансами.

- Wave против ExpensifyЭто инструмент для управления расходами бизнеса. Другой инструмент предназначен для отслеживания личных расходов и составления бюджета.

- Wave против QuickBooksЭто хорошо известная бухгалтерская программа для бизнеса. Её альтернатива разработана для управления личными финансами.

- Wave против AutoEntryЭто приложение предназначено для автоматизации ввода данных в бухгалтерский учет предприятий. Его альтернативой является инструмент для управления личными финансами.

- Wave против FreshBooksЭто бухгалтерское программное обеспечение для фрилансеров и малых предприятий. Его альтернатива предназначена для управления личными финансами.

- Wave против NetSuiteЭто мощный пакет программного обеспечения для управления бизнесом, предназначенный для крупных компаний. Его конкурентом является простое приложение для управления личными финансами.

Заключение

Wave helps you take control of your business money.

You do not need to be an expert to use it well.

We showed you how to track your spending and easily fix mistakes.

We also looked at how to get paid in other currencies.

This tool takes the heavy stress out of tax season.

Your financial records will be clean and safe from now on.

You can finally stop worrying about messy spreadsheets.

The best part is that it costs nothing to start. Go set up your account today.

Your future self will thank you for being organized.

Часто задаваемые вопросы

Is WaveApps completely free?

Wave offers a robust Стартовый план that is completely free. It includes unlimited invoicing, expense tracking, and basic отчетность. However, they recently introduced a План Про (approx. $16/month) which is required for automated bank import features and live support. Payroll and payment processing fees are extra.

Is WaveApps better than QuickBooks?

For freelancers and micro-businesses, Wave is often better because it is simpler and free. QuickBooks is superior for larger businesses requiring inventory management, complex payroll, or аудит trails. Wave is the “lite,” user-friendly alternative; QuickBooks is the heavy-duty industry standard.

Does Wave App report to the IRS?

Yes, regarding payment processing. If you accept payments through Wave (Wave Payments) and meet the IRS thresholds, Wave automatically files Form 1099-K with the IRS and sends you a copy. However, it does not file your annual income tax return (like Schedule C) for you.

What are the drawbacks of Wave Accounting?

Wave has limitations: it lacks inventory management, project management features, and audit trails. Additionally, the free plan does not include live customer support (only чат-бот), and recent updates moved automatic bank syncing to the paid Pro plan.

How does the Wave app work?

Wave is a cloud-based financial platform. You create an account, connect your bank (on Pro) or upload statements, and categorize transactions as “Income” or “Expense.” It compiles this data into reports like Profit & Loss statements, making tax time significantly easier for non-accountants.

Is Wave easy to use for beginners?

Extremely. Wave is built specifically for non-accountants. Its dashboard is clean, jargon-free, and intuitive. Unlike traditional software that requires бухгалтерский учет knowledge, Wave focuses on simple workflows: “Send Invoice,” “Add Expense,” and “View Report.

How much does it cost to use Wave?

Он Стартовый план is $0/month. The План Про is roughly $16/month (billed monthly) or $170/year. Payroll services start at a base fee of $40/month plus $6 per employee. Credit card processing fees are standard industry rates (approx. 2.9% + $0.60 per transaction).

More Facts about Wave Software

- WAVE is a set of tools designed to help you make websites easier for everyone to use.

- The tool cannot decide on its own if a website is perfect; a human still needs to make the final decision.

- It is easy to use. You can check a webpage just by typing in its address.

- You can add WAVE to Chrome, Firefox, or Edge browsers to check pages directly on your computer.

- WAVE adds small icons to the webpage to provide information about accessibility.

- If you see red icons, it means there are errors you need to fix.

- It helps you follow important accessibility guidelines, such as WCAG 2.2, to ensure your site works for everyone.

- It helps you check things that computers can’t understand, like whether a picture has a good description.

- You can turn off the website’s design (CSS) to see the page structure clearly.

- WAVE checks the page after it has fully loaded to give you an accurate report.

- The tool is designed for use by people with disabilities.

Wave (The Бухгалтерский учет & Finance App)

- You can create reports to see how much profit your projects are making.

- Wave Payments lets your clients pay bills with credit cards, bank transfers, or Apple Pay to help you get money faster.

- The Pro Plan lets you link your business bank account so transactions appear automatically.

- Scanning receipts helps you prepare for taxes by saving the proof right next to your purchase records.

- The mobile app can read текст from your receipts and sort them into the right projects for you.

- You can create your own income & expense groups to organize your spending.

- It is a good idea to keep your business money and personal money separate when using this tool.

- Wave is built for freelancers and малый бизнес, offering free tools for accounting and sending invoices.

- You can let partners view or edit your data without giving them your password.

- To start, you sign up with a business email and set up your company’s look, like your logo and colors.

- Это позволяет малый бизнес owners create professional-looking invoices and accept online payments.

- The software is simple and made for people running their own businesses at any stage.

- You can easily track your cash flow & read important business reports.

- There is a Google Sheets tool that lets you move your customer and product data in and out of Wave.

- You can add buttons to your invoices so customers can pay by card or bank transfer.

- If a customer needs a refund, you can issue a full or partial refund.

- If you type in a transaction that the bank also sends automatically, you might see the same entry twice.