Do you ever feel buried under a mountain of receipts and invoices?

For many businesses, keeping up with financial paperwork is a huge headache.

This is where tools like QuickBooks and AutoEntry come in.

Deciding between QuickBooks vs AutoEntry for your accounting needs means understanding what each offers.

Let’s dig into their features and see which one truly stands out for your business.

Overview

We’ve spent a lot of time putting both QuickBooks and AutoEntry through their paces.

Our goal was to see how each tool performs in real-world business accounting, giving us a clear picture for this direct comparison.

Used by over 7 million businesses, QuickBooks can save you an average of 42 hours per month on bookkeeping.

Pricing: It has a free trial. Plan starts at $1.90/month.

Key Features:

- Invoice Management

- Expense Tracking

- Reporting

Stop wasting 10+ hours/week on manual data entry. See how Autoentry slashed invoice processing time by 40% for Sage users.

Pricing: It has a free trial. Paid plan starts at $12/month.

Key Features:

- Data Extraction

- Receipt Scanning

- Supplier Automation

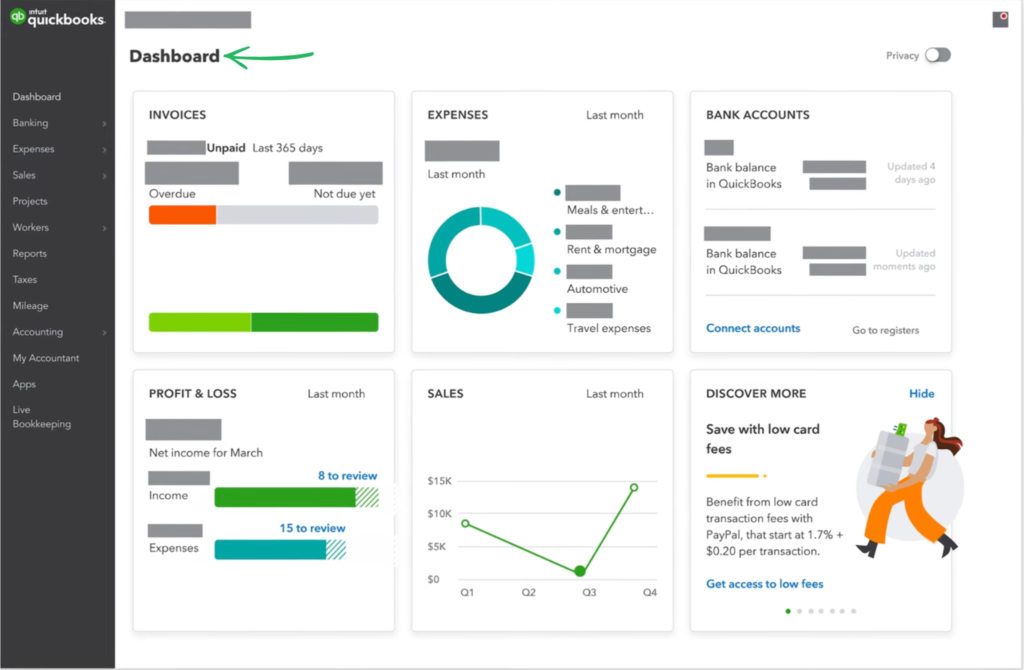

What is QuickBooks?

QuickBooks is a big name in accounting software.

It’s built to help all sorts of businesses, from freelancers to growing companies, manage their money.

Think of it as your central hub for tracking income, expenses, and everything in between.

Also, explore our favorite QuickBooks alternatives…

Key Benefits

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

Pricing

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Pros

Cons

What is AutoEntry?

AutoEntry is all about saving you time. It focuses on taking the pain out of data entry.

You just snap a picture or upload a document.

Then, AutoEntry reads it for you. It pulls out key information.

Also, explore our favorite AutoEntry alternatives…

Our Take

Ready to cut your bookkeeping time? AutoEntry processes over 28 million documents each year and offers up to 99% accuracy. Start today and join the over 210,000 businesses worldwide that have reduced their data entry hours by up to 80%!

Key Benefits

AutoEntry’s biggest win is saving hours of boring work.

Users often see up to 80% less time spent on manual data entry.

It promises up to 99% accuracy in its data extraction.

AutoEntry does not offer a specific money-back warranty, but its monthly plans allow you to cancel at any time.

- Up to 99% accuracy on data.

- Unlimited users on all paid plans.

- Pulls full line items from invoices.

- Easy mobile app for receipt snaps.

- 90 days for unused credits to roll over.

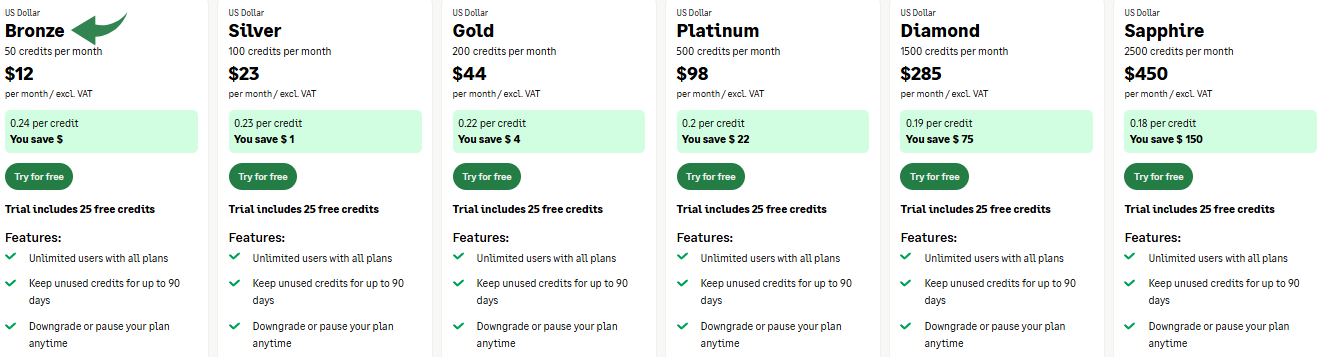

Pricing

- Bronze: $12/month.

- Silver: $23/month.

- Gold: $44/month.

- Platinum: $98/month.

- Diamond: $285/month.

- Sapphire: $450/month.

Pros

Cons

Feature Comparison

Comparing these tools shows a key difference.

QuickBooks is the primary hub for business finances, while AutoEntry is a top-tier assistant focused on automation.

Let’s look closer at how they handle your documents and money.

1. Full Service Bookkeeping vs. Document Entry

- QuickBooks: This is a full-service bookkeeping platform. Intuit QuickBooks helps medium-sized businesses and self-employed users. It lets you track money and manage all business finances.

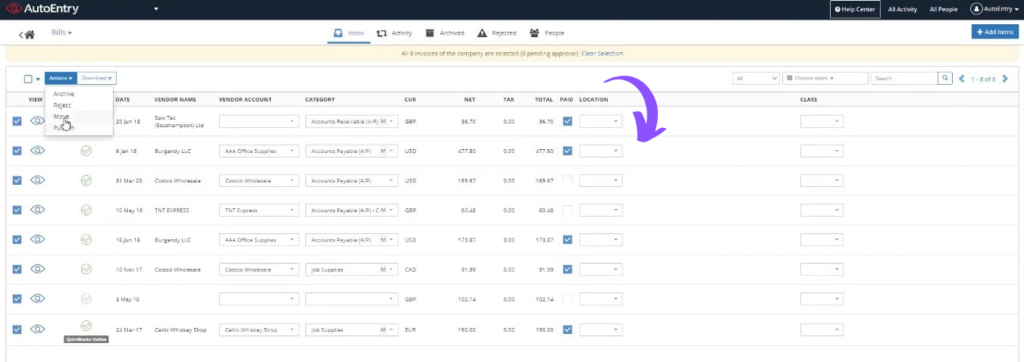

- AutoEntry: AutoEntry is a dedicated tool. It specializes in reducing manual data entry. It processes financial documents like receipts and purchase invoice items.

2. Data Capture Technology

- QuickBooks: The online version offers basic optical character recognition (OCR) for receipt images. The goal is to capture and maintain accurate business data.

- AutoEntry: It uses highly accurate optical character recognition. AutoEntry is built specifically for data extraction from various formats. This minimizes time spent on capture.

3. Pricing Model for Clients

- QuickBooks: Pricing is typically per month based on users and features. Higher tiers include QuickBooks Payroll and advanced services.

- AutoEntry: It features flexible pricing based on document credits per month. It supports unlimited users across all plans, a great value for clients.

4. Payroll and Direct Payments

- QuickBooks: QuickBooks Payroll is an integrated product. It handles direct deposit for employees and contractor payments. It also lets users pay bills directly.

- AutoEntry: AutoEntry has no built-in payroll services. It focuses on capturing the expense data, like a purchase invoice, before it is entered for payment.

5. Access and Platform Support

- QuickBooks: QuickBooks Online offers 24/7 online access. Desktop data is available via QuickBooks Desktop, but the online version provides the best mobility.

- AutoEntry: It is cloud-based for easy online access. The mobile phone app helps clients capture documents immediately.

6. Tax Preparation and Sales Tax

- QuickBooks: intuit QuickBooks helps with sales tax tracking. It provides reports essential for tax preparation. The chart of accounts is fully managed here.

- AutoEntry: AutoEntry extracts data needed for tax preparation. It doesn’t calculate or file sales tax itself; that happens in the linked accounting platform.

7. Integration and Workflow

- QuickBooks: Offers seamless integration with many QuickBooks products. It includes automatic payment reminders and bank account connections.

- AutoEntry: Its main value is seamless integration with platforms like QuickBooks Online. It can auto-publish documents after processing.

8. Time and Expense Management

- QuickBooks: QuickBooks Time is a powerful product. It tracks employee time and contractor payments efficiently. It also lets users set up purchase orders.

- AutoEntry: The tool handles the expense capture process. It greatly reduces the manual data entry time spent by clients or employees.

9. User Reputation and Support

- QuickBooks: QuickBooks reviews often praise its depth. Users like the comprehensive tools for business finances, though setup can be complex.

- AutoEntry: AutoEntry reviews highlight its accurate data extraction. Users appreciate how easy it is to setup and cancel the service.

What to Look for When Choosing Accounting Software?

- Security & Access: Does the security service protect sensitive business data from online attacks? Look for a security solution to prevent being blocked from accessing your computer or desktop version by a cloudflare ray id found or similar system, especially after an action that could trigger this block, like an incorrect sql command.

- Document Processing: Can it easily handle bank statements, credit cards, and other financial documents? Check if it extracts line items accurately and minimizes manual data entry effort.

- Reporting & Insight: Will it create and provide you with clear balance sheets, cash flow statements, and the insights you need to stay organized?

- Cost Structure: Beyond the monthly fees and overall autoentry pricing, understand the total license cost and the benefits received per month.

- Functionality Match: Can you easily handle reconciliation and manage vendors? Make sure the desktop version (if needed) and quickbooks checking features align with your specific workflow.

Final Verdict

QuickBooks is our choice for the primary accounting system.

While AutoEntry is an expert at data entry—saving you the effort of manual data entry from financial documents—it is a specialized tool.

QuickBooks is a full platform; it generates your crucial financial reports, handles invoicing for customers, and tracks every date.

If an action you just performed triggered the security solution, making you unable to access a page, you should email the site owner to resolve it.

Since QuickBooks manages all these key functions and provides full business control.

It is the superior all-in-one solution.

More of QuickBooks

- QuickBooks vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- QuickBooks vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- QuickBooks vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- QuickBooks vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- QuickBooks vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- QuickBooks vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- QuickBooks vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- QuickBooks vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- QuickBooks vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- QuickBooks vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- QuickBooks vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- QuickBooks vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- QuickBooks vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- QuickBooks vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- QuickBooks vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

More of AutoEntry

- AutoEntry vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- AutoEntry vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- AutoEntry vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- AutoEntry vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- AutoEntry vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- AutoEntry vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- AutoEntry vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- AutoEntry vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- AutoEntry vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- AutoEntry vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- AutoEntry vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- AutoEntry vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- AutoEntry vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- AutoEntry vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- AutoEntry vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Can AutoEntry integrate directly with QuickBooks?

Yes, AutoEntry integrates seamlessly with QuickBooks. It pushes extracted data directly into your QuickBooks account, streamlining your financial records.

Is QuickBooks suitable for very small businesses or freelancers?

Absolutely. QuickBooks offers plans like Simple Start that are perfect for freelancers and very small businesses needing basic income and expense tracking.

Does AutoEntry replace the need for an accountant?

No, AutoEntry automates data entry, saving time for you or your accountant. It doesn’t replace an accountant’s expertise in financial analysis, tax planning, or compliance.

Which is better for managing inventory, QuickBooks or AutoEntry?

QuickBooks is much better for inventory management. Its Plus and Advanced plans offer robust features for tracking stock, costs, and product sales. AutoEntry does not manage inventory.

Can I try QuickBooks or AutoEntry before buying?

Yes, both QuickBooks and AutoEntry typically offer free trials. This allows you to test their features and see how they fit your business needs before committing to a subscription.