Thinking about how to handle your business money? It can be a real headache!

Many business owners struggle with keeping track of every dollar.

Two big names often come up when you’re looking for help: Expensify and QuickBooks.

But which one is the right fit for your business?

This guide will break down what Expensify vs QuickBooks offers so that you can pick the best one.

Overview

We’ve spent a good amount of time with both Expensify and QuickBooks.

Putting them through their paces to see how they handle real-world business accounting.

This hands-on testing has given us a clear picture of their strengths and weaknesses, leading us to this detailed comparison.

Join over 15 million users who trust Expensify to simplify their finances. Save up to 83% on time spent on expense reports.

Pricing: It has a free trial. The premium plan starts at $5/month.

Key Features:

- SmartScan Receipt Capture

- Corporate Card Reconciliation

- Advanced Approval Workflows.

Used by over 7 million businesses, QuickBooks can save you an average of 42 hours per month on bookkeeping.

Pricing: It has a free trial. Plan starts at $1.90/month.

Key Features:

- Invoice Management

- Expense Tracking

- Reporting

What is QuickBooks?

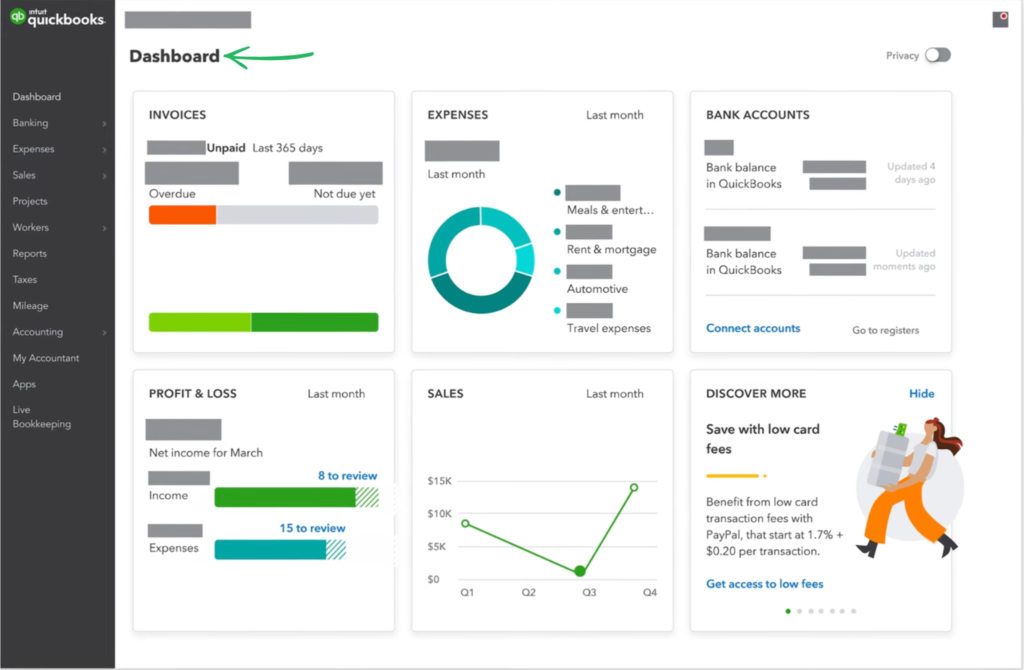

QuickBooks is a super popular accounting tool.

It helps businesses, especially small ones, keep track of their money.

Think of it like your financial organizer.

Also, explore our favorite Quickbooks alternatives…

Key Benefits

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

Pricing

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Pros

Cons

What is Expensify?

Expensify is all about making expense tracking easy.

It’s especially good for businesses where people spend money often, like for travel or project costs.

You just snap a picture of a receipt, and Expensify does the rest.

Also, explore our favorite Expensify alternatives…

Key Benefits

- SmartScan technology scans receipt details and extracts them with over 95% accuracy.

- Employees get reimbursed quickly, often in as little as one business day via ACH.

- The Expensify Card can save you up to 50% on your subscription with its cash back program.

- No warranty is offered; their terms state that liabilities are limited.

Pricing

- Collect: $5/month.

- Control: Custom Pricing.

Pros

Cons

Feature Comparison

Choosing the right financial platform is crucial for the self employed and medium sized businesses.

This comparison uses Expensify reviews and QuickBooks reviews to highlight the differences between the dedicated expense automation of Expensify and the full-scale accounting system of Intuit QuickBooks.

1. Core Functionality and Focus

- Expensify is a specialized tool that helps company manage expenses and simplify the reimbursement process. Its main focus is on expense reports and quick approval workflows for employees and contractors.

- QuickBooks offers a full accounting system to maintain business finances. Its key features include the chart of accounts, reconciliation, managing sales and vendors, paying taxes, and generating financial reports.

2. Expense Capture and Automation

- Expensify makes expense capture a lightning-fast process. The user can chhose and snap a photo of a receipt with the Expensify app in their pocket, and the data is extracted in a few seconds, ready to submit for approval.

- QuickBooks helps save time by automatically importing bank transactions and linking credit card data. It includes receipt scanning capabilities and tools to easily log mileage and track money for tax preparation.

3. Expense Report and Reimbursement

- Expensify manages the end-to-end expense reports process. Employers can set up policies and approve requests immediately. The platform is excellent for handling direct deposit reimbursement to the user bank account quickly.

- QuickBooks handles expense reporting but integrates it within the broader payables system. It requires careful setup to ensure expenses are coded correctly before they can be payable as bills or linked to QuickBooks Payroll for employee benefits.

4. Pricing and Platform

- Expensify has a flexible pricing structure, often based on the user or team size per month. It offers the Expensify Card to save on fees and automate payments. The interface is accessible on web and mobile.

- QuickBooks‘ pricing is tiered and generally higher, reflecting the complexity of full service bookkeeping. It offers both a cloud-based online version (easy online access) and QuickBooks Desktop (locally stored desktop data on your computer).

5. Specialized Financial Tools

- Expensify is built to manage expenses for projects and corporate spending. It includes features to code transactions using tags and categories for complex organization needs. The user can quickly export data to QuickBooks.

- QuickBooks offers deep business data tracking, managing purchase orders, calculating sales tax, and tracking employee time with QuickBooks Time. It provides robust financial reports, such as balance sheets, crucial for strategic management.

6. Security and Compliance

- Expensify products use strong security and real time policy checks to protect company funds. The user is sometimes blocked if an action performed could trigger this block or is expected to be malicious, forcing them to respond to resolve the trigger.

- Intuit QuickBooks is trusted by decades of use to protect sensitive business finances. It is designed to ensure accurate tax preparation and compliance with legal taxes, providing the accountant with reliable reports.

7. User Interface and Ease of Use

- Expensify’s user interface is clean, fast, and designed for minimal interaction. This makes the entire process of completing expense reports simple and intuitive, even for a small number of users or a new team member.

- QuickBooks has a steeper initial learning curve due to the breadth of its services and the complexity of its chart of accounts. However, once mastered, QuickBooks helps users maintain clear organization and streamline complex workflows.

8. Multi-User and Management

- Expensify allows multiple users to submit and approve reports, creating a controlled, accountable system for employers to manage spending. Expensify helps save time by reducing the back-and-forth phone calls needed to resolve reports.

- QuickBooks offers scalable user licenses and role-based access to allow multiple users and the accountant to work on the company data simultaneously. This is vital for medium sized businesses that need internal controls.

9. Business Banking and Payments

- QuickBooks offers QuickBooks Checking for business banking and provides comprehensive payments services, including direct deposit for both employees and contractors. It helps vendors get pay quickly and accurately.ure Comparison

- The Expensify Card is a credit card that integrates immediately with the app, automating the expense reconciliation process for corporate payments.

What to Look for in an Accounting Software?

Here are key insights to consider when making your choice:

- Ease of Use: Is it simple to learn and navigate?

- Scalability: Can it grow with your business?

- Integration: Does it connect with other tools you use?

- Reporting: Does it offer the financial insights you need?

- Mobile Access: Can you manage finances on the go?

- Customer Support: Is help readily available if you get stuck?

- Security: How does it protect your financial data?

- Pricing Structure: Is it transparent and budget-friendly for your needs?

- Specific Features: Does it have unique features important to your industry?

- Automation: How much can it automate to save time and reduce errors?

Final Verdict

After looking closely at both, our pick between QuickBooks and Expensify truly depends on your main need.

If you require full accounting, like invoicing and payroll.

QuickBooks is a comprehensive accounting system and often the best choice.

It simplifies the entire expense management process.

We’ve used both extensively, so trust our insights to help you pick the right tool for your money.

QuickBooks may be more robust, but Expensify excels in its specific area.

More of QuickBooks

- QuickBooks vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- QuickBooks vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- QuickBooks vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- QuickBooks vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- QuickBooks vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- QuickBooks vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- QuickBooks vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- QuickBooks vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- QuickBooks vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- QuickBooks vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- QuickBooks vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- QuickBooks vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- QuickBooks vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- QuickBooks vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- QuickBooks vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

More of Expensify

- Expensify vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Expensify vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Expensify vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Expensify vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Expensify vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Expensify vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Expensify vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Expensify vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Expensify vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Expensify vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Expensify vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Expensify vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Expensify vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Expensify vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Can I use Expensify and QuickBooks together?

Yes, Expensify and QuickBooks offer seamless integration. This allows expense data to flow directly into your accounting system, helping you save time and reduce errors in your financial management.

Which is better for a small business: Expensify vs QuickBooks?

It depends on your business needs. Expensify excels as a dedicated expense management solution for tracking spending and reimbursements. QuickBooks is a comprehensive accounting software covering broader financial tasks.

Does Expensify track billable and non-billable expenses?

Yes, Expensify allows you to categorize both billable and non-billable expenses. This feature helps you accurately assign costs to clients or projects.

What expense tracking features does QuickBooks also offer?

QuickBooks also offers robust expense tracking features including receipt capture, categorization, and the ability to link credit card transactions. It’s integrated within its broader financial management tools.

When should I use QuickBooks Online versus use Expensify?

Use QuickBooks Online for complete accounting, invoicing, and payroll needs. If your primary focus is streamlining expense management process and employee reimbursements, Expensify is ideal.