Running a business is very exciting, but managing money can be a real headache.

Are you tired of manual bookkeeping, missed payments, or confusing spreadsheets?

It’s tough to grow when your finances feel messy.

The good news is, great accounting software can fix these problems.

It helps you keep track of every dollar, so you know exactly where your business stands.

This guide will show you the 9 Best Accounting Software for businesses in 2025 to make your financial life easier.

What is the Best Accounting Software?

Choosing the right accounting software can change your business.

It helps you track income, expenses and makes tax time easier.

We’ve looked at many options to find the top performers.

Here’s our list of the 9 best accounting software programs to help your business thrive.

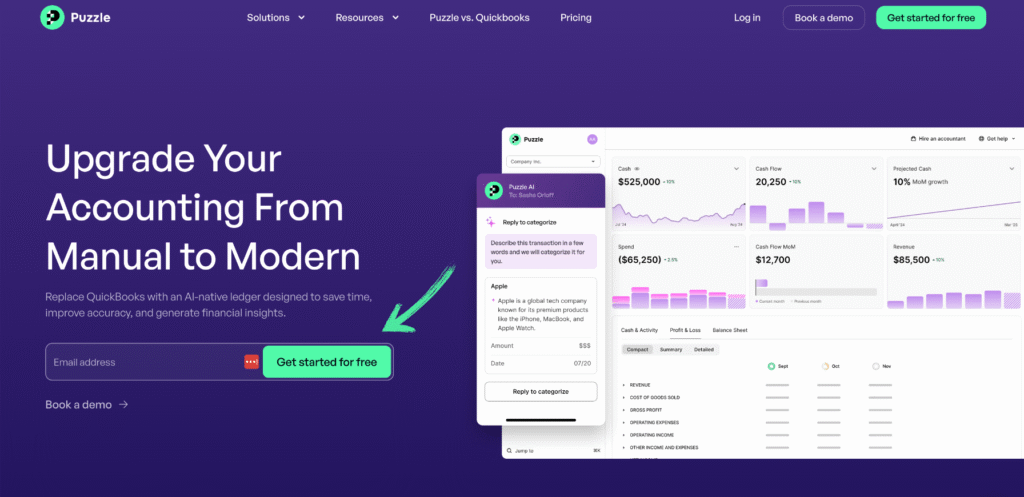

1. Puzzle IO (⭐️4.6)

Puzzle is an AI-first accounting platform built specifically for fast-moving startups and founders.

It combines your general ledger with real-time financial insights in one sleek dashboard.

The system automatically drafts up to 95% of your categorizations, saving you hours of manual work.

You can track key metrics like burn rate, runway, and ARR instantly without waiting for month-end reports.

It is the perfect choice for leaders who want to spend less time on spreadsheets and more time scaling.

Unlock its potential with our Puzzle IO tutorial.

Our Take

Ready to simplify your finances? See how Puzzle io can save you up to 20 hours a month. Experience the difference today!

Key Benefits

Puzzle IO really shines when it comes to helping you understand where your business is headed.

- 92% of users report better financial forecasting accuracy.

- Get real-time insights into your cash flow.

- Easily create different financial scenarios to plan.

- Collaborate seamlessly with your team on financial goals.

- Track key performance indicators (KPIs) in one place.

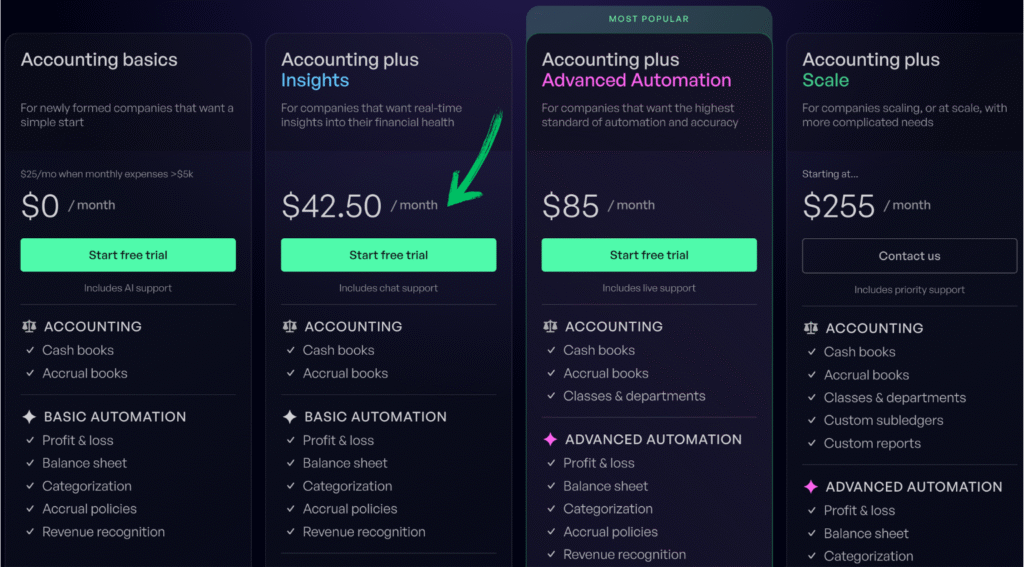

Pricing

- Accounting basics: $0/month.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Pros

Cons

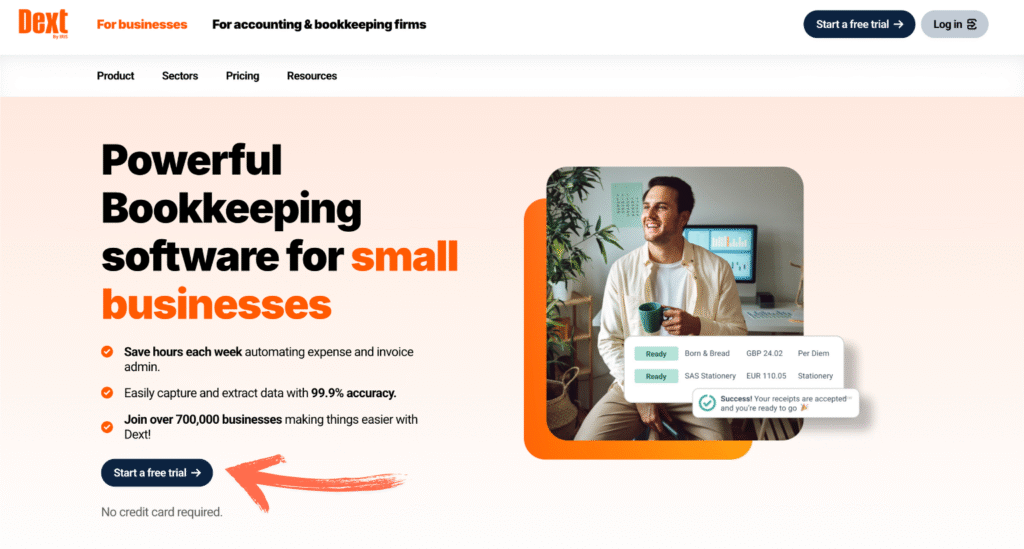

2. Dext (⭐️4.4)

Dext is a smart tool that eliminates manual data entry by snapping photos of your receipts and invoices.

It uses high-accuracy AI to extract dates, amounts, and tax info so you don’t have to type them in.

You can submit documents through the mobile app, email, or even by linking it directly to your favorite stores.

It syncs perfectly with software like Xero and QuickBooks to keep your books updated in real-time.

This is the best choice if you are tired of losing paper receipts or spending hours on expense reports.

Unlock its potential with our Dext tutorial…

Our Take

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Key Benefits

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

Pricing

- Annually Subscription: $24

Pros

Cons

3. Xero (⭐️4.2)

Xero is a cloud-based platform that puts your money tasks in one clean dashboard.

It uses smart technology to help you check cash flow from your phone anywhere.

The system acts like a companion to draft invoices and answer questions in plain English.

It connects to over 1,000 apps to grow alongside your business.

This tool is perfect if you want to cut out boring data entry.

Unlock its potential with our Xero tutorial…

Our Take

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features now!

Key Benefits

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

Pricing

- Starter: $29/month.

- Standard: $46/month.

- Premium: $69/month.

Pros

Cons

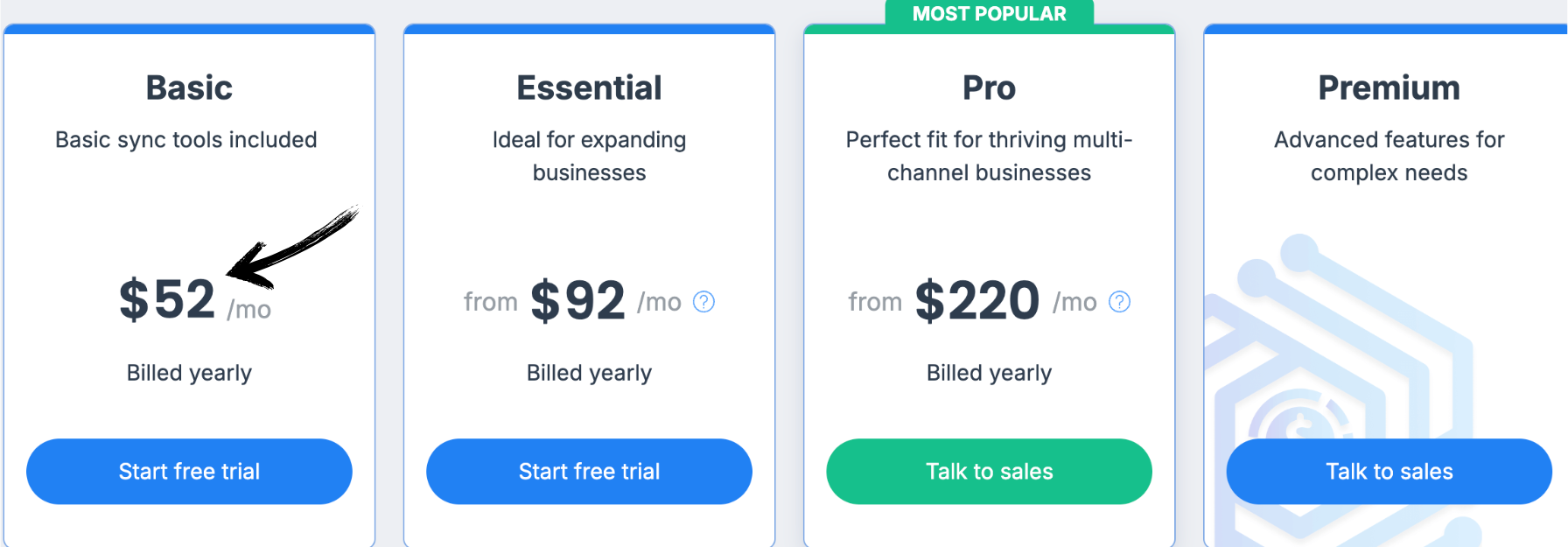

4. Synder (⭐️3.8)

Synder is an automation powerhouse that connects your e-commerce shops and payment gateways to your accounting books.

It acts as a bridge between platforms like Shopify, Amazon, or Stripe and software like QuickBooks or Xero.

The system automatically syncs sales, fees, and taxes, so you don’t have to spend hours on manual data entry.

You can use its smart rules to categorize transactions and keep your profit and loss statements accurate in real-time.

This is a must-have tool for online sellers who want a one-click reconciliation process and clean, audit-ready books.

Unlock its potential with our Synder tutorial…

Our Take

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Key Benefits

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

Pricing

All the plans will be Billed Annually.

- Basic: $52/month.

- Essential: $92/month.

- Pro: $220/month.

- Premium: Custom Pricing.

Pros

Cons

5. Easy Month End (⭐️3.6)

Easy Month End is a specialized tool that turns the chaotic “month-end close” into a simple, organized checklist.

It acts as a command center for finance teams to track reconciliations and work allocation without messy spreadsheets.

The platform automatically reads your balance sheet from QuickBooks or Xero to make verification much faster.

You can invite auditors directly into the system, which provides a clear audit trail and saves you from endless back-and-forth emails.

This is the best pick for teams that want to stop the overtime and stress that usually come with closing the books each month.

Unlock its potential with our Easy Month End tutorial…

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

6. Sage (⭐️3.4)

Sage is a heavy hitter that combines the power of desktop software with the freedom of the cloud.

It is built for businesses that need serious reliability and high-level security for their financial data.

The platform features Sage Copilot, an AI assistant that handles data entry and flags budget issues automatically.

You get advanced tools for inventory tracking and job costing that many simpler apps leave out.

It is the best choice if you want a system that is fully compliant with tax laws and grows with you as you scale.

Unlock its potential with our Sage tutorial…

Our Take

Ready to supercharge your finances? Sage users have reported an average of 73% higher productivity and a 75% faster process cycle time.

Key Benefits

- Automated invoicing and payments

- Real-time financial reports

- Strong security to protect data

- Integration with other business tools

- Payroll and HR solutions

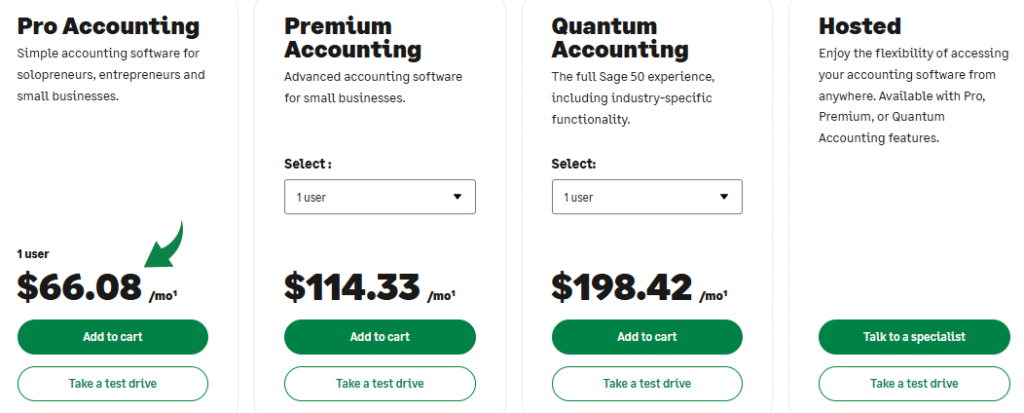

Pricing

- Pro Accounting: $66.08/month.

- Premium Accounting: $114.33/month.

- Quantum Accounting: $198.42/month.

- HR and Payroll bundles: Custom Pricing based on your needs.

Pros

Cons

7. RefreshMe (⭐️3.2)

RefreshMe is an all-in-one financial dashboard that brings your banking, credit, and investments into one view.

It uses an AI Assistant to analyze your spending and provide personalized tips to help you save.

The platform connects with over 12,000 banks to ensure your transaction data is always updated in real-time.

It features a built-in budget manager that alerts you before you overspend in specific categories.

This tool is a great fit for business owners who want a clear, automated picture of their total financial health and identity protection.

Unlock its potential with our RefreshMe tutorial…

Our Take

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Key Benefits

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

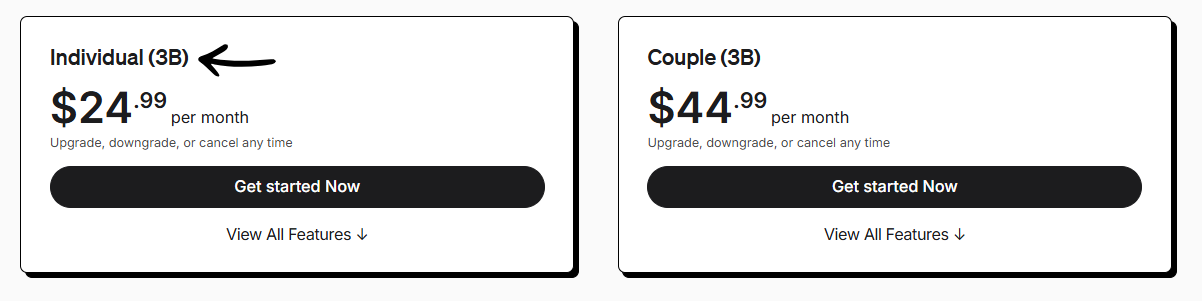

Pricing

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pros

Cons

8. QuickBooks (⭐️3.0)

QuickBooks is the industry standard for keeping business books in balance.

It uses Intuit Assist AI to automate bookkeeping and answer questions instantly.

New AI Agents automatically categorize transactions and flag potential errors.

The mobile app tracks mileage and scans receipts while you are on the go.

This is the top choice for a reliable, all-in-one financial system.

Unlock its potential with our QuickBooks tutorial…

Key Benefits

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

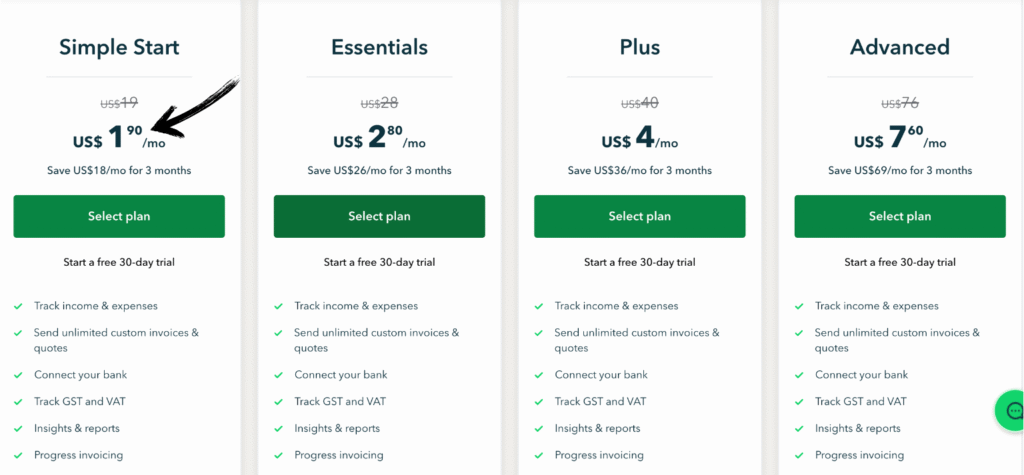

Pricing

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Pros

Cons

9. FreshBooks (⭐️2.8)

FreshBooks is the go-to choice for freelancers and service-based business owners.

It makes you look professional with custom invoices you can create in seconds.

The built-in time tracker ensures you bill for every minute of work you do.

Smart automation handles late payment reminders and recurring billing for you.

It simplifies tax season by organizing your expenses and mileage in one place.

Unlock its potential with our FreshBooks tutorial…

Our Take

Tired of complex accounting? 30 million+ businesses trust FreshBooks to create professional invoices. Simplify your accounting software today!

Key Benefits

- Professional invoice creation

- Automated payment reminders

- Time tracking

- Project management tools

- Expense tracking

Pricing

- Lite: $2.10/month.

- Plus: $3.80/month.

- Premium: $6.50/month.

- Select: Custom Pricing.

Pros

Cons

What to look for when buying the best AI accounting software?

- Automation of Repetitive Tasks: The primary goal of AI technology is to handle repetitive tasks like data entry and reconciliation. This frees up accounting professionals to focus on strategy.

- Advanced Data Management: Look for AI accounting tools that offer robust data management to organize high volumes of relevant data without human error.

- Intelligent Financial Reporting: The best AI accounting software uses machine learning algorithms to generate financial statements and financial reporting in real-time.

- Predictive Analytics for Planning: Modern ai in accounting should include predictive analytics. This helps finance and accounting professionals with accurate financial planning and forecasting.

- Natural Language Processing (NLP): High-end AI-powered tools use natural language processing so you can ask questions like “show me last month’s trends” and get instant answers.

- Automated Expense Management: Seek out expense management software that uses artificial intelligence to scan expense reports and flag anomalies instantly.

- Streamlined Accounts Payable: Efficient AI accounting software automates accounts payable by matching invoices and purchase orders using robotic process automation.

- Tax Compliance and Audit Ready: Ensure the software helps with tax compliance by automatically updating to new laws within the accounting industry.

- Deep Data Analysis: Choose tools that can analyze financial data deeply to find hidden patterns in your financial operations and internal accounting processes.

- Addressing the “AI Replace Accountants” Myth: The best tools are designed to assist, not AI replace accountants. They augment the skills of accounting firms by handling the “grunt work” of accounting processes.

- Scalable Machine Learning: As your business grows, machine learning helps the software learn your specific accounting tasks, making it more accurate over time.

How can accounting software benefit you?

- Using an accounting system helps automate repetitive tasks like data entry and bookkeeping tasks.

- This allows your accounting team to save time and focus on business growth.

- These AI tools analyze data from historical data to identify patterns and future trends.

- Business leaders gain valuable insights and real-time insights into their company’s financial performance.

- Analyzing historical data with AI systems improves risk management and fraud detection for financial professionals.

- Instead of manual data entry or routine tasks, accounting automation creates financial reports.

- Using AI software for repetitive accounting tasks improves business processes and the business’s financial health.

- These accounting tools and AI tool features help finance departments stay competitive in the accounting world.

- Artificial intelligence ai improves client communication and tracks financial performance within business models.

Buyers’ Guide

When doing our research to find the best product, we determined using these factors:

- Pricing: We compared the monthly and annual costs of each subscription to ensure they offer fair value for different budget levels.

- Features: Our team analyzed the IT Autopilot and AI Copilot capabilities to see how well they handle automation.

- Negatives: We looked for any missing tools or limitations that could hinder your daily operations.

- Support or refund: We verified if the companies provide a reliable community, technical support, or a clear refund policy.

Wrapping Up

Choosing the right tool for your financial processes is a major step toward long-term success.

We’ve covered everything from basic bookkeeping to advanced AI features like IT Autopilot.

You should listen to us because we specialize in tracking the latest trends in the accounting industry to bring you honest, factual recommendations.

Our goal is to help you cut through the noise so you can focus on growing your company.

By picking a solution that fits your specific business model, you ensure your money is working as hard as you do.

Would you like me to help you set up a comparison table for the pricing of your favorite three options?

Frequently Asked Questions

What is accounting software?

Accounting software helps businesses manage money. It tracks income, expenses, and invoices. It also helps with payroll and reports, making financial tasks easier and more accurate than doing them by hand.

Who needs accounting software?

Any business, big or small, can benefit from it. Freelancers, startups, and established companies use it. It helps them keep track of money, understand finances, and prepare for taxes more efficiently.

Can I use free accounting software?

Yes, some free options exist, often with basic features. They can be good for very small businesses or personal use. However, paid versions usually offer more tools, better support, and greater security for growing needs.

Is my data safe with online accounting software?

Reputable online accounting software uses strong security to protect your data. They often use encryption and other measures. Always choose well-known providers to ensure your financial information is secure.

Does accounting software replace an accountant?

No, it doesn’t replace an accountant. It automates tasks and provides data. An accountant still offers expert advice, helps with complex tax situations, and interprets your financial data to guide business decisions.