Dealing with your business’s finances can feel like trying to solve a Rubik’s Cube blindfolded.

You’re a Mac user, so you expect software that just… works.

No clunky interfaces, no weird workarounds.

You’re tired of sifting options that promise the world but don’t feel native to your Apple ecosystem.

We’ve done the hard work for you.

We’ve reviewed the Best Accounting Software for Mac: Top 9 Picks for 2025 so you can find a solution that fits your Mac-ios like a glove.

What is the Best Accounting Software for Mac in 2025?

Finding the right accounting software for your Mac doesn’t have to be hard.

We’ve done the digging to find out which programs work best with your Apple computer.

Whether you’re a freelancer, a small business owner, or a growing team, this list will help you pick a tool that makes managing your money a breeze.

1. Xero (⭐4.8)

Xero is a popular cloud-based accounting software. It’s perfect for small businesses and freelancers.

Xero uses machine learning to automate tasks like bank reconciliation and categorizing transactions, which helps reduce human error.

It simplifies data management and automates many repetitive accounting tasks.

This tool has AI accounting tools that learn from your historical data to provide smart suggestions.

Unlock its potential with our Xero tutorial.

Our Take

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features now!

Key Benefits

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

Pricing

- Starter: $29/month.

- Standard: $46/month.

- Premium: $69/month.

Pros

Cons

2. Dext (⭐4.5)

Dext is an expense management software that makes it easy to handle receipts and invoices.

It uses AI to capture relevant data from your documents.

This powerful AI software is perfect for digitizing your financial documents.

Dext helps streamline financial operations by quickly processing your accounts payable.

It’s a great way to save time and reduce manual data entry, helping businesses manage their finances more efficiently.

Unlock its potential with our Dext tutorial.

Our Take

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Key Benefits

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

Pricing

- Annually Subscription: $24

Pros

Cons

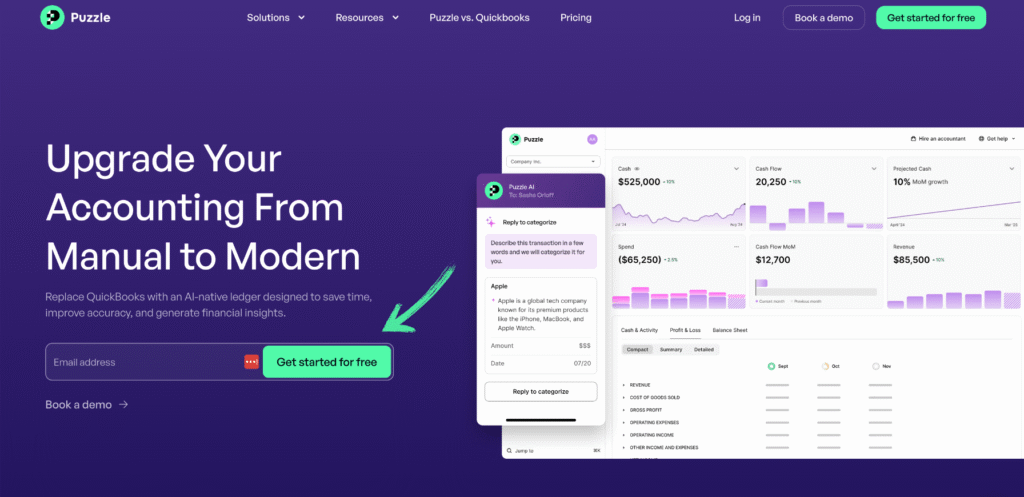

3. Puzzle IO (⭐4.0)

Puzzle IO is designed for modern startups.

It uses AI powered tools to provide real-time financial insights.

This automation helps you focus on business growth and other important business processes.

Puzzle IO is built to give you a clear view of your business’s financial health by analyzing historical data and automating routine accounting tasks.

Unlock its potential with our Puzzle IO tutorial.

Our Take

Ready to simplify your finances? See how Puzzle io can save you up to 20 hours a month. Experience the difference today!

Key Benefits

Puzzle IO really shines when it comes to helping you understand where your business is headed.

- 92% of users report better financial forecasting accuracy.

- Get real-time insights into your cash flow.

- Easily create different financial scenarios to plan.

- Collaborate seamlessly with your team on financial goals.

- Track key performance indicators (KPIs) in one place.

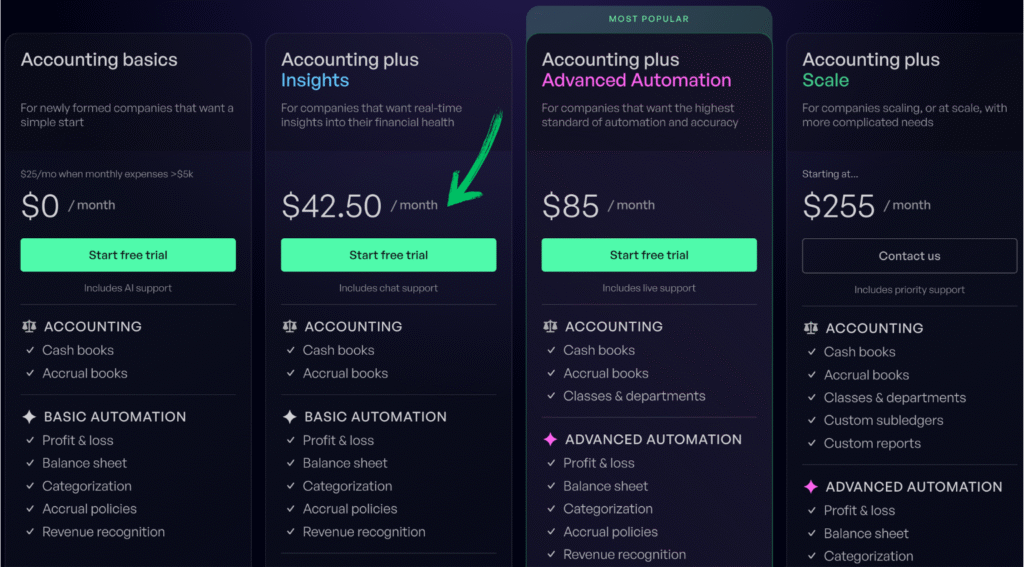

Pricing

- Accounting basics: $0/month.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Pros

Cons

4. Synder (⭐3.8)

Synder is great for e-commerce businesses.

It connects your online sales platforms with your accounting software.

Synder uses AI accounting tools to automate repetitive tasks like transaction categorization and reconciliation.

This helps you get a complete picture of your online sales without any manual work.

By using this AI software, you can streamline your financial operations & focus on growing your business.

Unlock its potential with our Synder tutorial.

Our Take

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Key Benefits

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

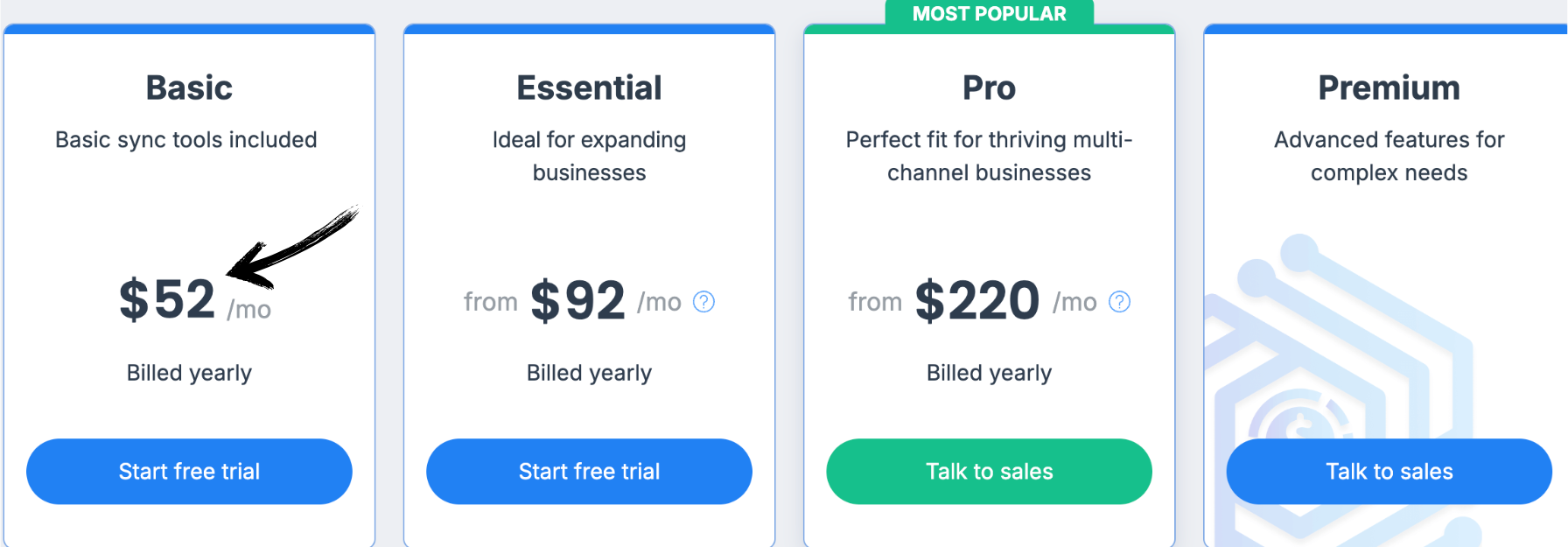

Pricing

All the plans will be Billed Annually.

- Basic: $52/month.

- Essential: $92/month.

- Pro: $220/month.

- Premium: Custom Pricing.

Pros

Cons

5. Easy Month End (⭐3.6)

Easy Month End is all about making the month-end closing process simple.

It uses AI to automate several of the manual tasks involved.

This helps reduce human error & ensures that everything is recorded accurately.

With its AI powered tools, the software ensures that all necessary steps are completed on time.

Easy Month End is one of the top AI accounting tools for quickly and accurately closing your books.

Unlock its potential with our Easy Month-End tutorial.

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

6. QuickBooks (⭐3.4)

QuickBooks is a well-known name in the industry.

It has embraced AI to help businesses manage their money.

With its machine learning capabilities, it automatically sorts expenses and predicts cash flow.

This gives you important insights into your business’s financial health.

It’s a comprehensive platform with many ai powered tools designed to simplify your accounting tasks.

Unlock its potential with our QuickBooks tutorial.

Key Benefits

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

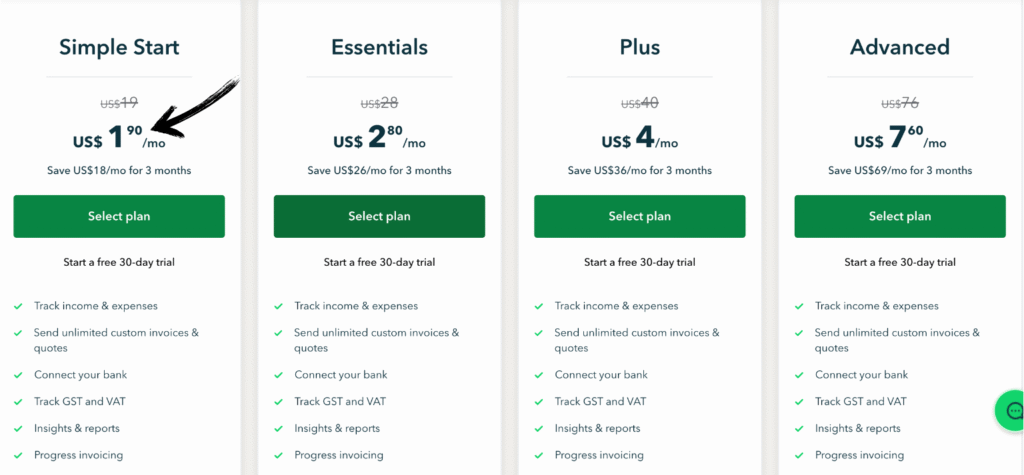

Pricing

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Pros

Cons

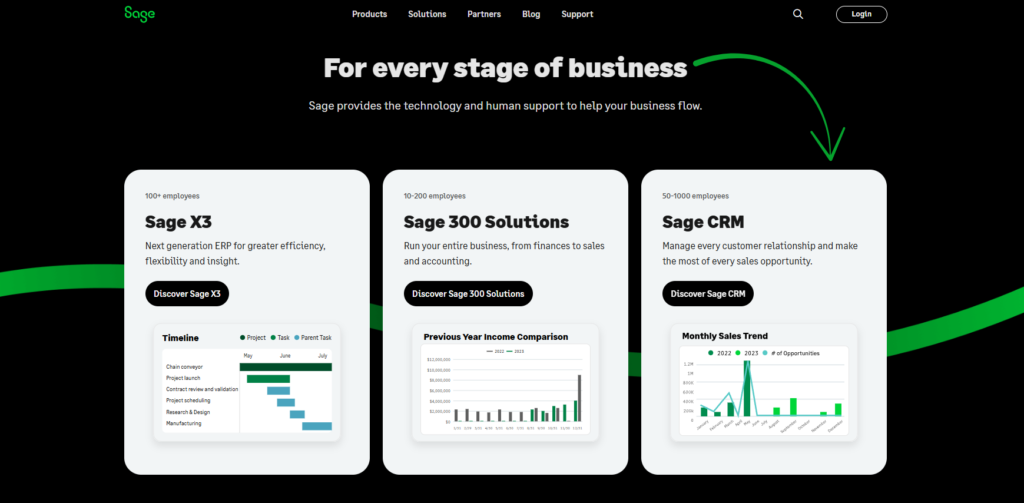

7. Sage (⭐️3.2)

Sage is a robust platform that has incorporated AI powered tools to enhance its features.

It uses predictive analytics & machine learning to help you make smarter business decisions.

By analyzing historical data, Sage can forecast your cash flow and identify trends.

This makes it a great solution for simplifying complex financial operations and supporting business growth.

Unlock its potential with our Sage tutorial.

Our Take

Ready to supercharge your finances? Sage users have reported an average of 73% higher productivity and a 75% faster process cycle time.

Key Benefits

- Automated invoicing and payments

- Real-time financial reports

- Strong security to protect data

- Integration with other business tools

- Payroll and HR solutions

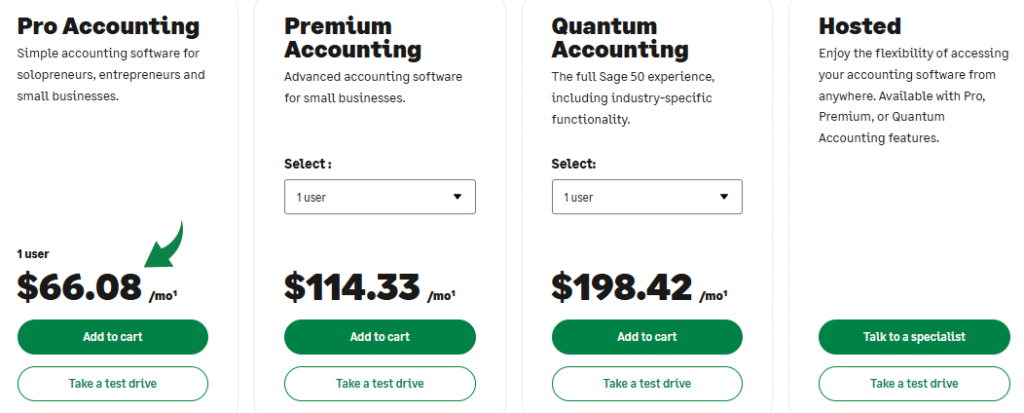

Pricing

- Pro Accounting: $66.08/month.

- Premium Accounting: $114.33/month.

- Quantum Accounting: $198.42/month.

- HR and Payroll bundles: Custom Pricing based on your needs.

Pros

Cons

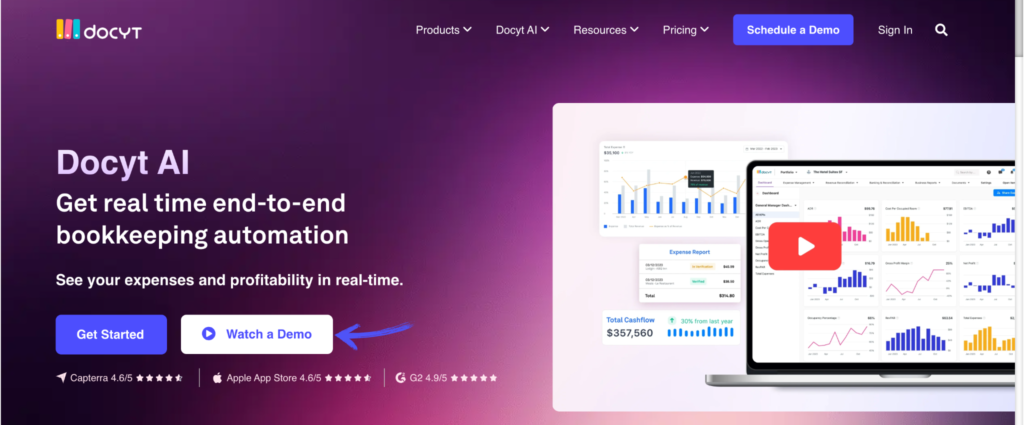

8. Docyt (⭐3.0)

Docyt is an AI-powered bookkeeping platform. It is designed to automate your entire accounting workflow.

Docyt’s AI accounting tools learn from your business to categorize transactions.

It can handle all your accounting tasks and even prepare analytics, making it a great alternative to hiring junior AI replace accountants.

It helps streamline your business processes and gives you a real-time view of your finances.

Unlock its potential with our Docyt tutorial.

Key Benefits

- AI-Powered Automation: Docyt uses artificial intelligence. It automatically extracts data from financial documents. This includes details from over 100,000 vendors.

- Real-time Bookkeeping: Keeps your books updated in real-time. This provides an accurate financial picture at any moment.

- Document Management: Centralizes all financial documents. You can easily search and access them.

- Bill Pay Automation: Automates the bill payment process. Schedule and pay bills easily.

- Expense Reimbursement: Streamlines employee expense claims. Submit and approve expenses quickly.

- Seamless Integrations: Integrates with popular accounting software. This includes QuickBooks and Xero.

- Fraud Detection: Its AI can help flag unusual transactions. This adds a layer of security. There’s no specific warranty for the software, but continuous updates are provided.

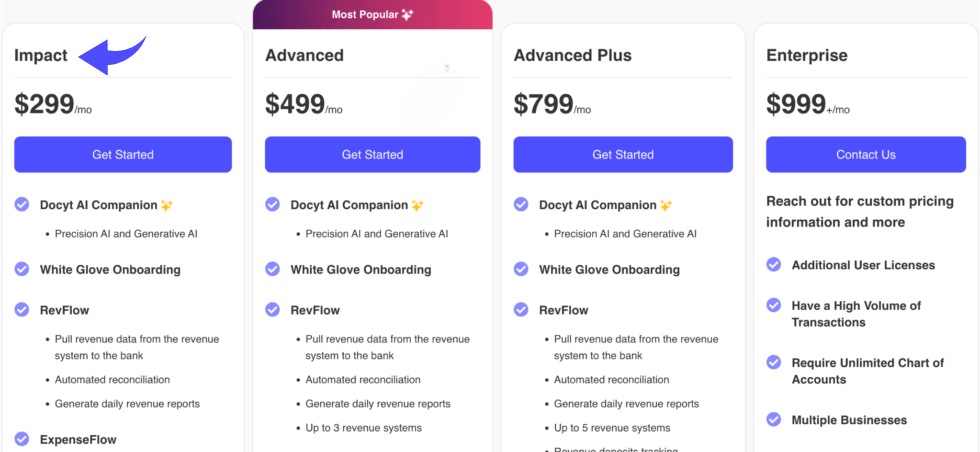

Pricing

- Impact: $299/month.

- Advanced: $499/month.

- Advanced Plus: $799/month.

- Enterprise: $999/month.

Pros

Cons

9. RefreshMe (⭐️2.8)

RefreshMe is a personal finance tool. It uses an AI assistant to help you manage your money.

This software uses machine learning to analyze your spending and provide insights.

While it’s more for personal use, its AI features can help you with basic data management and setting financial goals.

It’s a simple tool that shows how AI can help with even the smallest accounting tasks.

Unlock its potential with our Refreshme tutorial.

Our Take

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Key Benefits

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

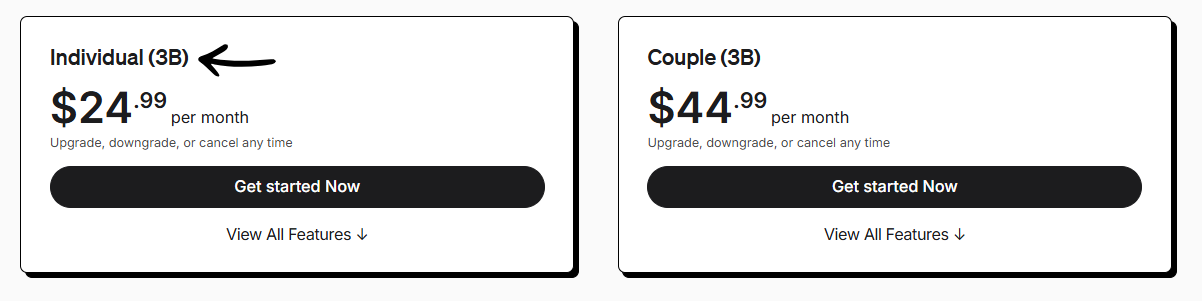

Pricing

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pros

Cons

What Mac Users need in an Accounting Software?

- Financial Processes Automation: Look for software that uses AI in accounting to automate repetitive tasks. This includes things like data entry, invoicing, and generating expense reports. This is a key feature that helps accounting professionals save time and reduce human error.

- AI and Machine Learning: The best AI accounting software leverages artificial intelligence & machine learning algorithms. These technologies can analyze financial data to provide valuable insights for financial planning and spotting trends in your financial data.

- Integration and Data Management: The software should seamlessly integrate with your bank and other business tools. It should also be great at data analysis and managing your financial data securely. Look for platforms that use robotic process automation to make your internal accounting processes more efficient.

- Reporting and Insights: The right accounting ai should go beyond basic bookkeeping. It should generate clear financial statements and provide insights into your finances. Look for main features like natural language processing (NLP) that allow you to get information by simply asking a question.

- Tax Compliance: The software should help you with tax compliance by accurately tracking income and expenses and preparing reports. This is critical for both individuals and larger accounting firms.

- Advanced Features: Beyond the basics, consider features like predictive analytics that can help you forecast your business growth. Also, check for AI accounting software that can handle complex financial processes and help you with tax compliance.

How Can Mac Users Benefit from Using Accounting Software?

Accounting software built for Mac can change the way you do business. It automates boring, routine tasks like data entry using smart AI tools.

This means less manual data entry and more time for you to focus on growing your business.

These AI systems are transforming the entire accounting industry.

These tools also provide powerful insights into your company’s financial performance.

The accounting system uses an AI tool to analyze data and give you real-time information.

This helps business leaders with financial reporting and even cash flow forecasting.

The insights from this accounting system can help you spot future trends and improve your business models.

Buyers Guide

- Pricing: We looked at how much each accounting tool costs. We compared the different pricing plans to make sure they offer good value. We also considered if they offer a free trial or a refund policy.

- Features: We focused on features that help finance and accounting professionals save time. We looked for features like accounting automation that streamline daily bookkeeping tasks. We also checked for AI-powered features that provide valuable insights and help with risk management.

- Negatives: No software is perfect. We looked at what was missing from each product. We noted any potential downsides, like a steep learning curve or lack of specific integrations, so you can make an informed decision.

- Support & Refund: Good support is crucial. We checked if the companies offer a community, live chat, or email support. We also looked at their refund policies to ensure you have a safety net. This is important for finance departments and smaller businesses alike.

- AI Technology: A key part of our research was evaluating how each tool uses artificial intelligence (AI). We looked at how their AI helps with things like fraud detection, making accurate financial reports, and improving client communication. These features help accounting teams and individuals in the modern accounting world to make smarter decisions and identify patterns in their data.

Wrapping Up

Choosing the best AI accounting software for your Mac is a big decision.

It can truly transform your business. We explored some of the best options.

We looked at how powerful AI accounting can simplify your daily work.

It can also give you real time insights into your finances. The right tool will help you manage your cash flow.

It will give your accounting team and financial professionals the power to make smarter choices.

We did the research for you. Our goal is to help you find a solution.

One that saves you time and reduces stress. You can then focus on what matters most: growing your business.

Frequently Asked Questions

What is the best AI accounting software for small businesses?

The top AI accounting software depends on your significant needs, but popular options often include features like automated expense tracking, invoicing, and streamlined reporting to help you manage your finances efficiently.

How is AI transforming the accounting industry?

AI is automating repetitive tasks, improving the accuracy of financial data analysis, and providing predictive insights. This allows accounting firms and professionals to focus on strategic advice and higher-value work.

Can AI accounting software replace a human accountant?

No, AI accounting software is not designed to replace accountants. Instead, it serves as a powerful tool to handle routine tasks, allowing human financial professionals to focus on complex analysis, client relationships, and strategic planning.

What are the key features of the best AI accounting software?

Key features include automated data entry, real-time reporting, predictive analytics, and integration with other business tools. These features provide a clear overview of your business’s financial health.

How does AI help with financial data security?

AI enhances security through continuous monitoring and fraud detection. It can identify unusual patterns in transactions that may indicate fraudulent activity, providing an additional layer of protection for your sensitive financial information.