Is managing your small business finances a headache?

Many entrepreneurs struggle with keeping their books straight.

It’s a newer option that might fit your needs even better.

This guide will break down Refreshme vs QuickBooks.

We’ll look at what each offers so you can pick the best accounting software for your business.

Let’s find out which one truly helps you save time and money.

Overview

We put both Refreshme and QuickBooks to the test.

We looked at how easy they are to use, their main features, and what they cost.

This hands-on review helps us see which one truly serves small businesses better.

Unlock deeper financial insights! Refresh Me analyzes your spending and helps you save smarter.

Try it now!

Pricing: It has a free trial. The premium plan at $24.99/month.

Key Features:

- Automated Reconciliation

- Streamlined Workflows

- User-Friendly Interface

Used by over 7 million businesses, QuickBooks can save you an average of 42 hours per month on bookkeeping.

Pricing: It has a free trial. Plan starts at $1.90/month.

Key Features:

- Invoice Management

- Expense Tracking

- Reporting

What is RefreshMe?

RefreshMe is a tool to help you track your spending.

It can help you keep your receipts in one place. It also helps you see where your money is going.

It tries to make expense tracking simple for everyone.

Also, explore our favorite Refreshme alternatives…

Our Take

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Key Benefits

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

Pricing

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pros

Cons

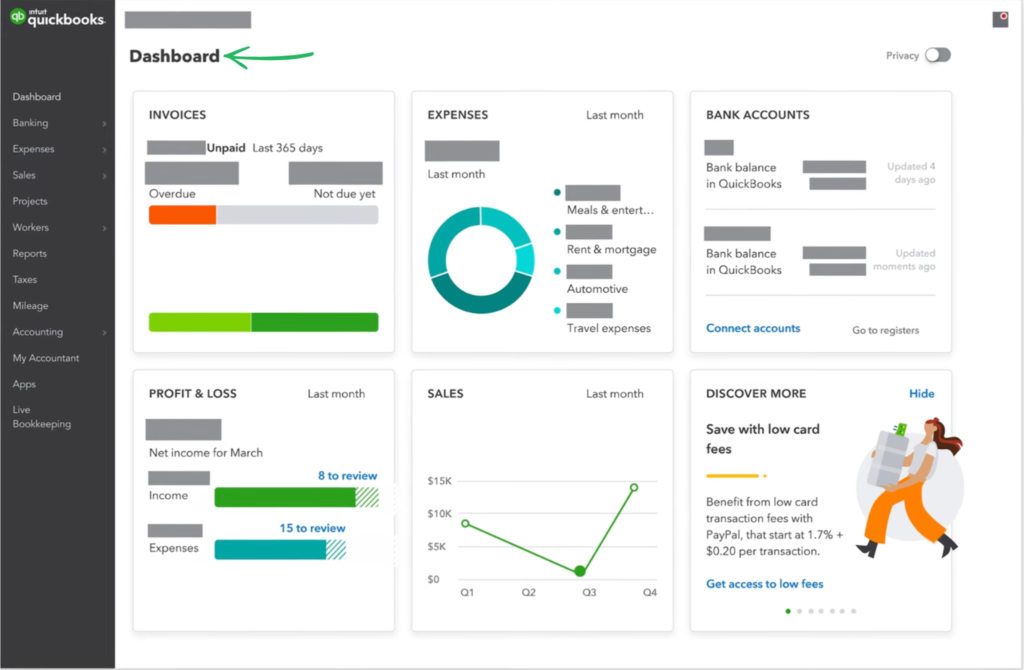

What is QuickBooks?

QuickBooks is like a helpful friend for your business money stuff.

It helps you keep track of what money comes in and what money goes out.

Lots of small businesses like using it.

Also, explore our favorite Quickbooks alternatives…

Key Benefits

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

Pricing

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Pros

Cons

Feature Comparison

When choosing accounting software for a small business, it is essential to compare the features of each tool.

This Feature Comparison of Refreshme and QuickBooks will highlight the key differences to help you make an perfect informed decision.

1. Business & Personal Finance

- Refreshme: This is a personal finance tool designed to help individuals and families track money, manage bills, and stay organized with a simplified system. Its core services are tailored to help an individual analyze their spending and improve their financial health.

- QuickBooks: It is a professional business accounting system built for businesses of all sizes, from self employed individuals to medium sized businesses. It helps a company maintain accurate business finances, manage taxes, and create detailed financial reports.

2. Accounting and Bookkeeping

- Refreshme: It provides tools to track money, set a budget, and get a quick review of your personal cash flow. The system helps you collect and analyze your personal financial data to improve your spending habits.

- QuickBooks: It offers full service bookkeeping and professional accounting services. QuickBooks helps a business automate bookkeeping, track expenses, reconcile a bank account, and maintain a chart of accounts. The intuit quickbooks system makes it easy to pay bills and stay organized for tax preparation.

3. Payroll and Employee Management

- Refreshme: It does not have payroll or employee management features, as its services are designed for personal use.

- QuickBooks: It offers comprehensive QuickBooks Payroll services, including direct deposit, contractor payments, and automated tax preparation. It also has QuickBooks Time, an integrated system to track employee time and manage projects for your team.

4. Invoicing and Payments

- Refreshme: It provides tools for bill management and payment reminders for personal finance.

- QuickBooks: It is a robust system for invoicing and payments. You can create an invoice and set up automatic payment reminders. QuickBooks offers integrated services to accept online payments from customers via credit cards and QuickBooks Checking.

5. Reporting and Financial Insights

- Refreshme: It provides reports on personal spending habits and a quick review of your cash flow. Its financial insights are tailored to help an individual manage their personal money.

- QuickBooks: It has an extensive library of detailed reports, such as balance sheets details & cash flow statements, that give a company valuable insights into its financial health. These reports are essential for a company to track money and make informed business decisions.

6. Data Access and Sync

- Refreshme: It is a cloud-based service, providing online access to your financial data. The system allows you to sync your bank account and credit cards for real-time tracking of expenses.

- QuickBooks: The QuickBooks Online provides seamless online access from anywhere. It also has features for desktop data migration, allowing users to move from the desktop version to the online version with ease.

7. Tax Preparation

- Refreshme: It offers basic tax reports to help an individual calculate taxes payable on different income types.

- QuickBooks: It has advanced tax preparation features, including automated sales tax tracking and the ability to file taxes directly from the software, which helps a company stay compliant with tax regulations.

8. User Management and Security

- Refreshme: It focuses on privacy and data security. The system offers features to protect your personal data and monitor for identity theft.

- QuickBooks: It provides a high level of security and allows a user to set up custom roles and permissions. Intuit QuickBooks helps you maintain the security of your business finances and control access for employees and your accountant.

9. Feature Set and Usability

- Refresh me: It has a simple, easy to use user interface, making it perfect for an individual with basic needs. Its core benefits are simplicity and affordability. You can easily get a sense of the features in this quick review of the service.

- QuickBooks: It has an intuitive user interface and offers a wider range of QuickBooks products and services for a business to maintain their financials. QuickBooks helps users streamline their workflow and offers a robust setup and onboarding process.

What to look for in an Accounting Software?

Here are some extra things to think about:

- Scalability: Can the software grow with your specific business data? The license structure of quickbooks desktop might restrict the number of users, and sometimes you have to cancel a plan and buy a new one as your needs change.

- Support: What kind of help or treatment is available if you have questions? Check reviews to see how quickly they refresh their system when a major issue is found, and what fees are charged for dedicated support.

- Ease of Use: Is it something you and your team can learn quickly and what’s the difference? Learning how to process purchase orders to vendors or perform a reconciliation on the right date can be a challenge.

- Specific Needs: Does it handle the unique things your business does? Does it effectively manage all your clients and vendors? The software should be updated regularly.

- Security: How safe is your financial data with this software? A strong license helps protect business data and ensures the security features are updated against new threats.

This software review will not offer a proper comparison to a work of art. If a treatment failed due to old cookies, it would take a longer time to enter the updated content in most cases.

The age of a client’s database or website face can change and affect the cookies, making it harder to offer relevant content over longer periods, as in some cases.

Final Verdict

So, which one wins: Refreshme or QuickBooks?

It really comes down to what you need.

It’s built for individual use with strong privacy features for your identity and data.

However, for small businesses that need to handle income, expenses, and full financial reports.

QuickBooks is the clear winner. It’s a robust platform for business accounting.

We’ve gone through all the details to help you make this choice.

Pick the tool that fits your unique financial needs best.

More of Refreshme

- Refresh me vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Refresh me vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Refresh me vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Refresh me vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Refresh me vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Refresh me vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Refresh me vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Refresh me vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Refresh me vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Refresh me vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- Refresh me vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Refresh me vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Refresh me vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Refresh me vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Refresh me vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Refresh me vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

More of QuickBooks

- QuickBooks vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- QuickBooks vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- QuickBooks vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- QuickBooks vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- QuickBooks vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- QuickBooks vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- QuickBooks vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- QuickBooks vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- QuickBooks vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- QuickBooks vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- QuickBooks vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- QuickBooks vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- QuickBooks vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- QuickBooks vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- QuickBooks vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Is Refreshme good for small businesses?

Refreshme is mainly for personal finance. It helps individuals track spending and budgets. For small businesses, QuickBooks is a much better fit as it handles business income, expenses, and payroll.

Can QuickBooks track personal investments?

QuickBooks is built for business accounting. While you can record some business investments, it’s not designed to track personal investments like stocks or mutual funds for an individual’s portfolio. Refreshme is better for that.

Is my data safe with Refreshme?

Yes, Refreshme focuses heavily on data security and privacy. It includes features like identity theft protection and secure data handling to keep your personal financial information safe.

Which is easier to use for beginners in Refreshme vs QuickBooks?

Refreshme is often seen as simpler for personal budgeting beginners due to its focused features. QuickBooks has a steeper learning curve because it offers more complex tools for business accounting needs.

Are both Refreshme and QuickBooks cloud-based?

Yes, both Refreshme and QuickBooks are cloud-based platforms. This means you can access your financial data and manage your accounts from any device with an internet connection, like a computer or smartphone.