Are you tired of juggling expense reports and trying to keep your accounting in order?

Many businesses face this exact problem.

It’s tough to find the right tools to make sure every dollar is accounted for.

This is where software like Expensify and NetSuite come in.

We’ll explore Expensify vs NetSuite, which one might be the best fit for your business’s accounting needs.

Overview

We’ve thoroughly tested both Expensify and NetSuite to give you a clear picture of their strengths and weaknesses.

Our hands-on experience has guided this direct comparison.

Helping you understand how each product performs in real-world accounting scenarios.

Boost productivity by up to 78%! See how NetSuite’s automation tools can transform your workday. Explore it for more!

Pricing: It has a free trial. Custom pricing Plans Are Available.

Key Features:

- ERP Integration,

- CRM

- Advanced Analytics

Join over 15 million users who trust Expensify to simplify their finances. Save up to 83% on time spent on expense reports.

Pricing: It has a free trial. The premium plan starts at $5/month.

Key Features:

- SmartScan Receipt Capture

- Corporate Card Reconciliation

- Advanced Approval Workflows.

What is NetSuite?

NetSuite is a big-picture business software.

It’s not just for expenses; it handles almost everything.

Think of it as a complete control center for your entire company.

Also, explore our favorite NetSuite alternatives…

Our Take

Want enterprise power? NetSuite serves over 30,000 customers globally with its comprehensive platform. If you need full ERP integration and advanced analytics, choose NetSuite to drive growth.

Key Benefits

- It unites finance, CRM, and ERP into a single cloud system.

- It supports businesses in over 200 countries and 27 languages.

- Over 40,000 organizations use this scalable platform.

- You get built-in analytics for real-time visibility into your data.

Pricing

They offer custom pricing plans based on your requirements. Please contact them to get your perfect pricing package.

Pros

Cons

What is Expensify?

Expensify is all about making expense reports easy.

Think of it as a smart helper for your spending.

You take a picture of a receipt, and it figures out the details for you.

Also, explore our favorite Expensify alternatives…

Key Benefits

- SmartScan technology scans receipt details and extracts them with over 95% accuracy.

- Employees get reimbursed quickly, often in as little as one business day via ACH.

- The Expensify Card can save you up to 50% on your subscription with its cash back program.

- No warranty is offered; their terms state that liabilities are limited.

Pricing

- Collect: $5/month.

- Control: Custom Pricing.

Pros

Cons

Feature Comparison

Choosing the right business solutions is key to success.

We’ve gone in depth to compare these two fully integrated platforms, helping you see which one best fits your financial processes and business needs.

1. Core Financial Processes

- NetSuite: As a full NetSuite ERP, it offers end-to-end financial processes. This includes General Ledger, Accounts Payable, Accounts Receivable, and powerful cash management. It gives you a complete view of your business’s finances.

- Expensify: The focus here is strictly on the expense management process. It excels at capturing expenses, submitting reports, and quick reimbursement but does not handle core accounting functions like Accounts Payable or Accounts Receivable.

2. Expense Management Specialization

- NetSuite: It has built-in expense features, but they are one of many other modules in the suite. NetSuite users often use it to track expenses as part of project accounting.

- Expensify: This is a dedicated expense management process tool. Expensify makes it incredibly simple for employees to submit an expense with a photo in a few seconds. The mobile app is designed solely to simplify this task.

3. Corporate Card Management

- NetSuite: It handles corporate payment options through its general accounting features, allowing for reconciliation and tracking of card transactions with other software.

- Expensify: The Expensify card offers cash back and is tightly integrated with the platform. You get real-time data and reconciliation for immediate visibility, helping employers keep up with spending.

4. Global Accounting Capabilities

- NetSuite: Built for large businesses, Oracle NetSuite is strong in global accounting. It supports multiple currencies, subsidiaries, and tax compliance across different business units.

- Expensify: While it can reimburse employees globally and supports multi-currency, its core strength remains the ease of use for the individual employee to file the expense, rather than full global accounting compliance.

5. Enterprise-Level HR and Supply Chain

- NetSuite: This is a key difference. Oracle Corporation offers deep functionality for human capital management, payroll management, workforce management, supply chain management, warehouse management, and order management.

- Expensify: It is not an ERP. It has no features for warehouse management or payroll management. Its features are limited to expense and basic invoice handling, and it relies on seamless integration with other systems.

6. Audit Trails and Compliance

- NetSuite: As an ERP, it is designed to enhance audit trails across all business processes. It provides a robust, detailed record necessary for compliance checks for large businesses.

- Expensify: It offers great audit trails specifically for the expense review and approval process. Expensify reviews show it automatically links the receipt photo to the expense, ensuring high compliance for employee spending.

7. Professional Services Automation

- NetSuite: It has professional services automation (PSA) other modules that let service firms manage projects, resources, and billing. This is a massive capability for service-based companies.

- Expensify: It can track expenses against projects using tags and categories to help bill clients, but it lacks the full resource scheduling and project management that professional services automation requires.

8. Visibility and Key Metrics

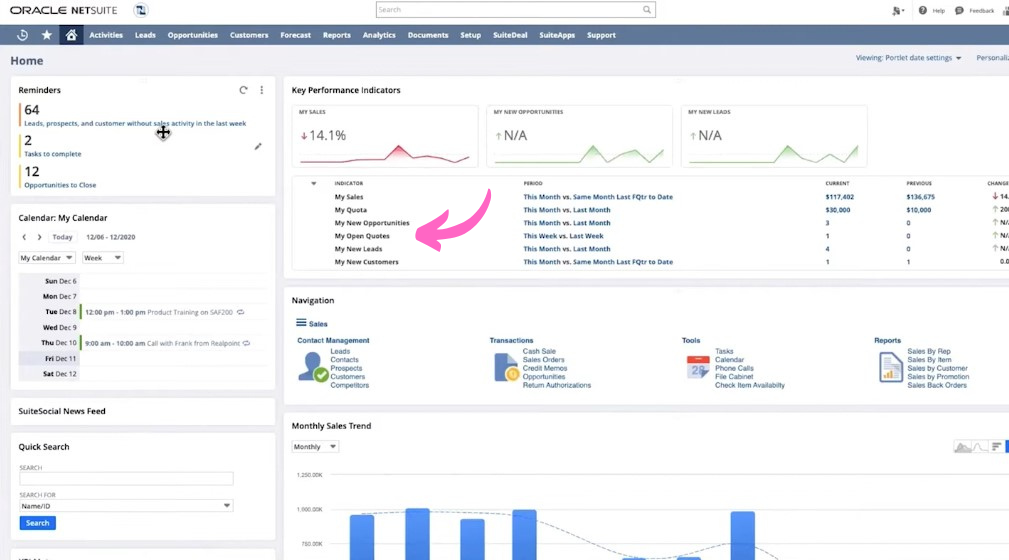

- NetSuite: It uses custom dashboards to display key performance indicators (KPIs) across the entire business, giving you real-time visibility into overall financial performance.

- Expensify: It gives you real time visibility primarily into employee spending and where expense reports are in the approval workflow, helping the manager see who needs to submit their reports.

9. Business Size Suitability

- NetSuite: We recommend netsuite for medium sized businesses and large businesses that need all departments under one roof. It is often too much for small business owners.

- Expensify: It is ideal for small business owners and mid-market companies who want to simplify the expense log and reimburse process without the cost and complexity of a full ERP.

What to Look for When Choosing Accounting Software?

- ERP Integration: Does the platform offer a seamless connection with your cloud-based ERP system?

- Ease of Use: Is the interface user-friendly on both desktop and web so users can immediately learn it?

- Expense Workflow: Can it streamline the expense submission process, allowing employees to submit reports and requests from their pocket using a phone?

- Data Visibility: Can it provide real-time visibility into financial statements, inventory management, and customer data?

- Coding and Categorization: Does it offer the ability to quickly code and categorize expenses and vendor bills, making it easy to save and export data?

- Support and Training: Is adequate support provided, and how easy is the initial setup?

- Customization and Flexibility: Can you create custom reports, set flexible approval rules, and use custom integrations with your sales team and other systems?

- Asset and Liability Tracking: Does it manage fixed assets, track mileage, and store necessary documentation?

- Vendor Management: Can it track payments to contractors and help resolve billing issues?

- Scalability: Is it appropriate for a small number of users or a large organization, as seen in NetSuite reviews?

- Core Accounting: Does the software handle essential functions like reconciliation (QuickBooks), even if it’s a NetSuite alternative product?

- System Triggers: Can you set up rules to trigger actions, ensuring compliance and timely approve of reports?

- CRM Capability: Does it include crm features or offer strong integration where NetSuite offers full crm?

Final Verdict

So, Expensify or NetSuite? It truly depends on your business.

For focused expense management and easy daily spending.

Expensify is great for small to mid-sized teams.

But if your business is growing fast and needs a complete system for finances, inventory, and sales.

More than just a tool like Concur—NetSuite is the stronger, all-in-one choice.

We’ve compared them thoroughly to help you decide.

More of NetSuite

- NetSuite vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- NetSuite vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- NetSuite vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- NetSuite vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- NetSuite vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- NetSuite vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- NetSuite vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- NetSuite vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- NetSuite vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- NetSuite vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- NetSuite vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- NetSuite vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- NetSuite vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- NetSuite vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

More of Expensify

- Expensify vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Expensify vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Expensify vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Expensify vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Expensify vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Expensify vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Expensify vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Expensify vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Expensify vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Expensify vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Expensify vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Expensify vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Expensify vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Expensify vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Is Expensify good for small businesses?

Yes, Expensify is excellent for small businesses. Its simple design and automated features make managing expenses easy without needing complex accounting knowledge.

What is NetSuite primarily used for?

NetSuite is an all-in-one business management software. It handles financial management, enterprise resource planning (ERP), customer relationship management (CRM), and e-commerce for larger, growing companies.

How does Expensify compare to Concur?

Expensify and Concur both manage expenses. Expensify often gets praise for its user-friendliness and SmartScan. Concur is also robust but can be seen as more complex, often preferred by larger corporations.

Can NetSuite handle international businesses?

Absolutely. NetSuite is designed for global operations. It supports multiple currencies, languages, and tax regulations across many countries, making it ideal for international companies.

Is it possible to integrate Expensify with NetSuite?

Yes, it is possible. Many businesses integrate Expensify for detailed expense reporting and then sync that data into NetSuite for broader financial management and accounting.