Are you tired of piles of receipts and messy expense reports?

It can be a real headache trying to keep track of where your money is going, right?

Well, there is!

Two popular tools, Synder vs Expensify, aim to simplify expense management.

But which one is the better fit for you?

Let’s take a closer look and help you decide.

Overview

We looked closely at both Synder and Expensify.

We tried out their features.

We saw how easy they were to use.

This helped us compare them side-by-side.

Now we can show you what each one does best.

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Check it out today!

Pricing: It has a free trial. The premium plan starts at $52/month.

Key Features:

- Multi-Channel Sales Sync

- Automated Reconciliation

- Detailed Reporting

Join over 15 million users who trust Expensify to simplify their finances. Save up to 83% on time spent on expense reports.

Pricing: It has a free trial. The premium plan starts at $5/month.

Key Features:

- SmartScan Receipt Capture

- Corporate Card Reconciliation

- Advanced Approval Workflows.

What is Synder?

Let’s talk about Synder.

It’s a tool that helps your different business apps talk to each other.

Think of it like a helper that moves your money info where it needs to go.

This can save you a lot of time.

Also, explore our favorite Synder Alternatives…

Our Take

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Key Benefits

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

Pricing

All the plans will be Billed Annually.

- Basic: $52/month.

- Essential: $92/month.

- Pro: $220/month.

- Premium: Custom Pricing.

Pros

Cons

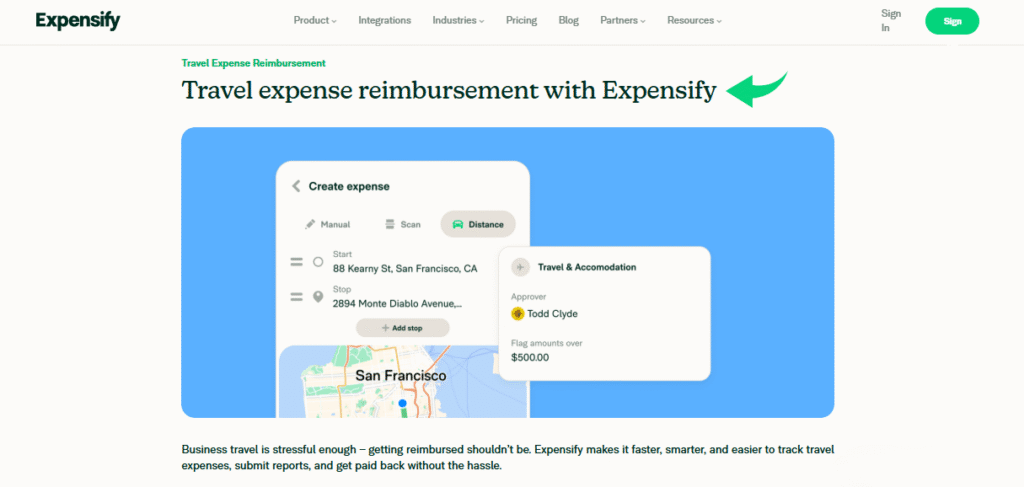

What is Expensify?

Okay, so let’s talk about Expensify.

It’s a tool that helps you keep track of all your business spending.

Think of it like a helper that remembers where your money goes.

It can grab info from your receipts and bank stuff. Pretty handy!

Also, explore our favorite Expensify alternatives…

Key Benefits

- SmartScan technology scans receipt details and extracts them with over 95% accuracy.

- Employees get reimbursed quickly, often in as little as one business day via ACH.

- The Expensify Card can save you up to 50% on your subscription with its cash back program.

- No warranty is offered; their terms state that liabilities are limited.

Pricing

- Collect: $5/month.

- Control: Custom Pricing.

Pros

Cons

Feature Comparison

Let’s dive into the details of what each tool offers.

We will look at nine key features to help you see how they are different and which one might work best for you.

1. Sales Channels & Transaction Syncing

Synder is built for ecommerce businesses.

It can connect to all your sales channels like Shopify, Etsy, eBay, Stripe, Square, and PayPal.

This allows it to bring in a high volume of sales data, including historical transactions.

It can sync mode to keep everything up to date, which helps keep your books balanced in real time.

2. Expense Management

Expensify is a powerful tool for the expense management process.

You can take a photo of a receipt with the app. It will then capture the details in a few seconds.

This makes it easy for employees to submit their costs and manage expenses.

It also has the Expensify card to make things even faster.

3. Financial Automation & Bookkeeping

Synder’s main goal is automated accounting.

It helps finance teams with bookkeeping. It can automatically record sales and expenses from your sales channels.

Expensify is more about automating the expense management process.

It uses AI to simplify submitting and getting approval for reports.

4. Multi-Currency & Payouts

For businesses that sell in different countries, multi-currency support is important.

Synder handles this well. It also helps you track payouts from your different platforms and match them with your bank account.

Expensify also has multi-currency features to handle international spending.

5. Integrations

Both platforms are compatible with many other programs.

Expensify can integrate with popular accounting systems like QuickBooks Online, NetSuite, and Xero.

Synder is also compatible with these and more, including Sage Intacct.

6. User Experience

Synder is designed to run in the background.

You just do a quick setup, and then it handles things on its own.

Expensify is very easy to use for the user on a phone, web, or desktop.

You can capture a receipt with a quick photo and it is immediately ready.

7. Team Management & Approval

Expensify is perfect for finance teams who need to streamline their approval process.

A manager can review a report in a few seconds and approve it.

You can log mileage and track different projects.

You can also give access to contractors.

8. Real-Time Data & Insights

With Synder, you get real time data. It gives you insights into your sales.

You can see all the details from your sales channels.

Expensify also gives you real-time data for your expenses.

This lets a manager respond to requests right away.

9. Issue Resolution

Sometimes things can go wrong.

Synder can help you resolve issues with fees, taxes, refunds, and discounts.

This helps keep your balance sheets accurate.

Expensify can also help you resolve issues when an expense is blocked or has details that need to be fixed.

What to look for when choosing an Accounting Software?

When you’re ready to switch from a manual system, it can be a lot of stress to pick the right tool.

The truth is, the best choice depends on what your organization needs.

Here are some key things to focus on to avoid mistakes and find the best connection.

- Look at the Expensify reviews and other product feedback to see what real employers and accountants think.

- Check if it can handle multi-channel sales. You want a tool that can reimburse employees and manage all your sales channels, from your website to Clover.

- A good tool helps keep your books balanced and supports reconciliation to prevent financial mistakes.

- For your team, the tool should be easy to use and not a stress. It should allow employees to capture a photo and file it in a flexible way.

- Make sure it handles subscriptions, shipping, taxes, and refunds automatically. This will help you achieve proper revenue recognition and gaap compliance.

- The tool should make it simple for a small number of users to submit expenses and get them approved with one click.

- Check if the tool allows you to add tags and categories to transactions. This helps with organization and getting expected insights.

- The best tools are compatible with what you already use. It should export data easily to your accounting system.

- See how it handles different types of expenses, like inventory or mileage. It should be flexible enough for your unique business needs.

- A connection to all your sales channels like Clover is key for an ecommerce business. It helps keep your inventory and sales records straight.

- Look for a tool that makes it easy for employees to get reimbursed for completing their expense reports. They should be able to file reports and have them stored on a single page.

- A tool should also let you set up triggers or rules. This means a report can be highlighted or approved based on certain details.

Final Verdict

So, which one should you pick: Synder or Expensify?

It’s easy to use for snapping receipts and managing reimbursements.

However, if you run a small business and need help with things like invoices, getting paid.

And keeping your books in order with your accounting software, Synder might be the better fit.

Its ability to integrate and automate many financial tasks can save you a lot of time.

We think Synder offers a bit more for businesses that want to automate more of their money management.

We’ve looked closely at both, so we hope this helps you choose what works best for you!

More of Synder

- Synder vs Puzzle io: Puzzle.io is an AI-powered accounting tool built for startups, with a focus on metrics like burn rate and runway. Synder is more focused on syncing multi-channel sales data for a broader range of businesses.

- Synder vs Dext: Dext is an automation tool that excels at capturing and managing data from bills and receipts. Synder, on the other hand, specializes in automating the flow of sales transactions.

- Synder vs Xero: Xero is a full-featured cloud accounting platform. Synder works with Xero to automate data entry from sales channels, whereas Xero handles all-in-one accounting tasks like invoicing and reporting.

- Synder vs Easy Month End: Easy Month End is a tool designed to help businesses organize and streamline their month-end closing process. Synder is more about automating daily transaction data flow.

- Synder vs Docyt: Docyt uses AI for a wide range of bookkeeping, including bill pay and expense management. Synder is more focused on automatically syncing sales and payment data from multiple channels.

- Synder vs RefreshMe: RefreshMe is a personal finance and task management application. This is not a direct competitor, as Synder is a business accounting automation tool.

- Synder vs Sage: Sage is a long-standing, comprehensive accounting system with advanced features like inventory management. Synder is a specialized tool that automates data entry into accounting systems like Sage.

- Synder vs Zoho Books: Zoho Books is a complete accounting solution. Synder complements Zoho Books by automating the process of importing sales data from various ecommerce platforms.

- Synder vs Wave: Wave is a free, user-friendly accounting software, often used by freelancers and very small businesses. Synder is a paid automation tool designed for businesses with high-volume, multi-channel sales.

- Synder vs Quicken: Quicken is primarily personal finance management software, though it has some small business features. Synder is built specifically for business accounting automation.

- Synder vs Hubdoc: Hubdoc is a document management and data capture tool, similar to Dext. It focuses on digitizing bills and receipts. Synder focuses on syncing online sales and payment data.

- Synder vs Expensify: Expensify is a tool for managing expense reports and receipts. Synder is for automating sales transaction data.

- Synder vs QuickBooks: QuickBooks is a comprehensive accounting software. Synder integrates with QuickBooks to automate the process of bringing in detailed sales data, making it a valuable add-on rather than a direct alternative.

- Synder vs AutoEntry: AutoEntry is a data entry automation tool that captures information from invoices, bills, and receipts. Synder focuses on automating sales and payment data from ecommerce platforms.

- Synder vs FreshBooks: FreshBooks is an accounting software designed for freelancers and small service-based businesses, with a focus on invoicing. Synder is for businesses with a high volume of sales from multiple online channels.

- Synder vs NetSuite: NetSuite is a comprehensive Enterprise Resource Planning (ERP) system. Synder is a specialized tool that syncs ecommerce data into broader platforms like NetSuite.

More of Expensify

- Expensify vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Expensify vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Expensify vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Expensify vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Expensify vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Expensify vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Expensify vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Expensify vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Expensify vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Expensify vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Expensify vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Expensify vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Expensify vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Expensify vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

What is the main difference between Synder and Expensify?

Expensify is mostly for tracking expenses and receipts. Synder does that too, but it also helps with invoices, payments, and connects to your accounting software to automate things.

Is Synder better for small businesses?

Synder can be very helpful for a small business. It helps with getting paid and keeping your financial records organized by integrateing with tools like Zoho and FreshBooks.

Can Expensify integrate with my accounting software?

Yes, Expensify can integrate with many accounting software options. This helps you keep your expense information in one place.

Does Synder help with getting paid faster?

Yes, Synder helps you create and send invoices. It can also remind customers to pay, which can help you get paid faster.

Which tool is easier to use for a startup?

Both tools try to be easy to use. Expensify is simple for tracking expenses. Synder might take a little more time to set up all its automation features, but it can save time later for a startup.