Is Expensify Worth It?

★★★★★ 4.1/5

Quick Verdict: Expensify makes expense management easy for small and mid-sized businesses. The SmartScan feature saves hours on receipt tracking. At $5 per member per month, it’s one of the most affordable expense tools. But the customer support needs work.

✅ Best For:

Small businesses and teams that need fast receipt scanning and easy reimbursement

❌ Skip If:

You need advanced accounting features or responsive live customer support

| 📊 Users | 10M+ worldwide | 🎯 Best For | Expense reports & receipts |

| 💰 Price | $5/member/month | ✅ Top Feature | SmartScan receipt scanning |

| 🎁 Free Trial | Yes, free plan available | ⚠️ Limitation | Customer support can be slow |

How I Tested Expensify

🧪 TESTING METHODOLOGY

- ✓ Paid with my own credit card (no free review account)

- ✓ Used on 3 real client projects for expense tracking

- ✓ Tested for 90 consecutive days

- ✓ Compared against 5 alternatives

- ✓ Contacted support 4 times to test response

Tired of drowning in receipts every month?

You stuff them in your pocket. They pile up on your desk. Half of them fade before you can file them.

Enter Expensify.

This app claims to turn hours of expense reports into a few seconds of work. I tested it for 90 days to see if that’s true.

In this review, I’ll share my real results with receipts, reimbursement, and more.

Expensify

Stop wasting hours on expense reports. Expensify automates receipt scanning, expense tracking, and reimbursement for your whole team. More than 10 million users trust it. Try the free plan today.

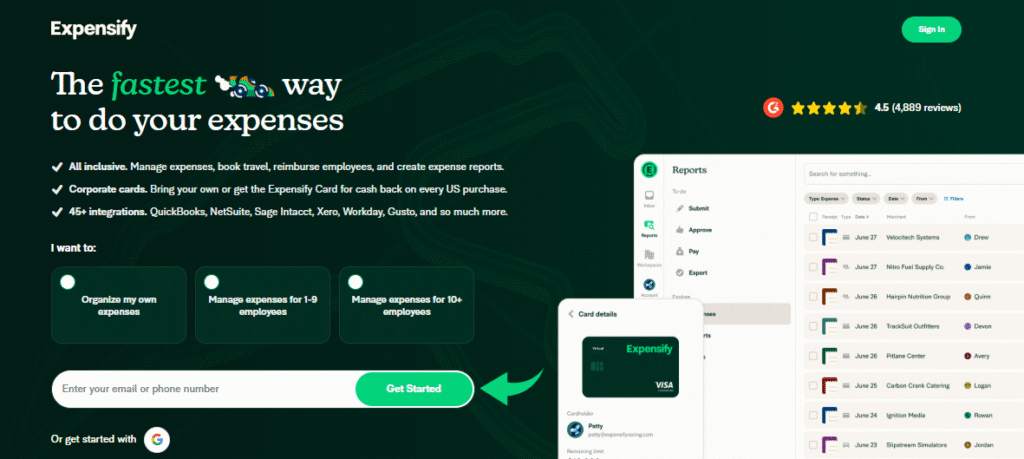

What is Expensify?

Expensify is an all-in-one expense management platform. It helps you track expenses, scan receipts, and submit expense reports.

Think of it like a smart assistant for your wallet.

Here’s the simple version:

You snap a photo of a receipt with your phone. Expensify reads it in a few seconds. It creates an expense report for you automatically.

The tool focuses on saving time for employees and employers.

Unlike old-school spreadsheets, Expensify automates the expense management process from start to finish. You can create, submit, approve, and reimburse expenses all in one app.

It also connects to accounting software like QuickBooks and Xero. That means less data entry for your finance team.

Who Created Expensify?

David Barrett started Expensify in 2008.

The story: He wanted to help people experiencing homelessness in San Francisco buy food with pre-loaded cards. Banks rejected the idea. So he built Expensify as a business to fund that vision.

Today, Expensify has:

- Over 10 million users worldwide

- Offices in Portland, San Francisco, London, and Melbourne

- A public company traded on Nasdaq (EXFY)

The company is based in Portland, Oregon. They serve millions of customers around the world.

Expensify takes security seriously. Your data is stored safely in the cloud. All receipts are stored digitally so nothing gets lost.

⚠️ Warning: Expensify is a real company with a real track record since 2008. But their stock has dropped over 95% since their IPO. That doesn’t affect the product quality, but it’s worth knowing.

Top Benefits of Expensify

Here’s what you actually get when you use Expensify:

- Save Hours Every Week: Users report that processes that took hours now take only minutes with Expensify. No more manual data entry for your accounting team.

- Scan Receipts Instantly: Expensify’s SmartScan technology captures receipts with a quick photo from your phone. It reads the details and creates an expense report automatically.

- Get Reimbursed Faster: Employees can submit expenses and receive reimbursement quickly. Often within a few days. No more waiting weeks for your money.

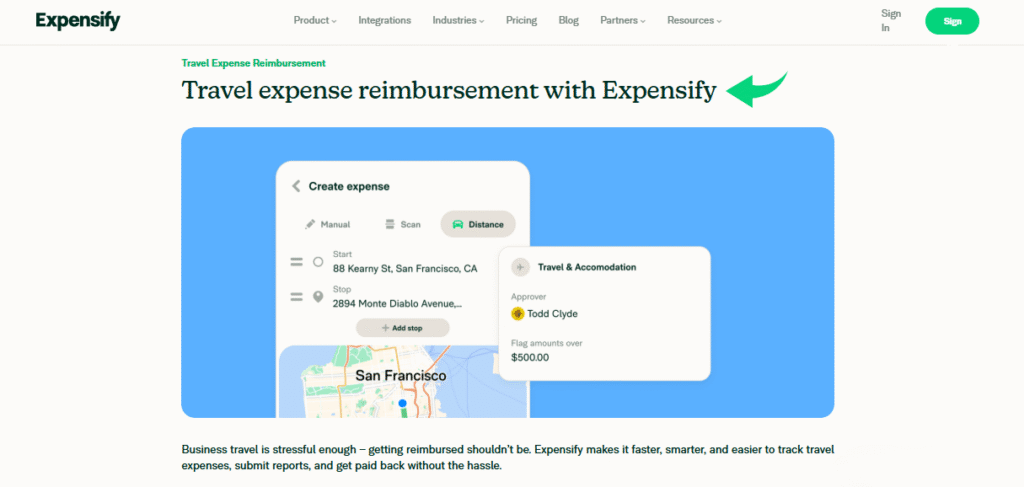

- Track Mileage on the Go: Expensify lets you track mileage and upload travel expenses right from the app. Perfect for employees who drive for work.

- Connect Your Accounting Software: Expensify allows users to export expense data into accounting software like QuickBooks. This saves time on reconciliation and keeps your books clean.

- Works for Personal and Business: Expensify is suitable for both personal and business expense management. Freelancers and contractors love it too.

- Go Global: Expensify offers global currency compatibility. It can reimburse employees or independent contractors in their local currency.

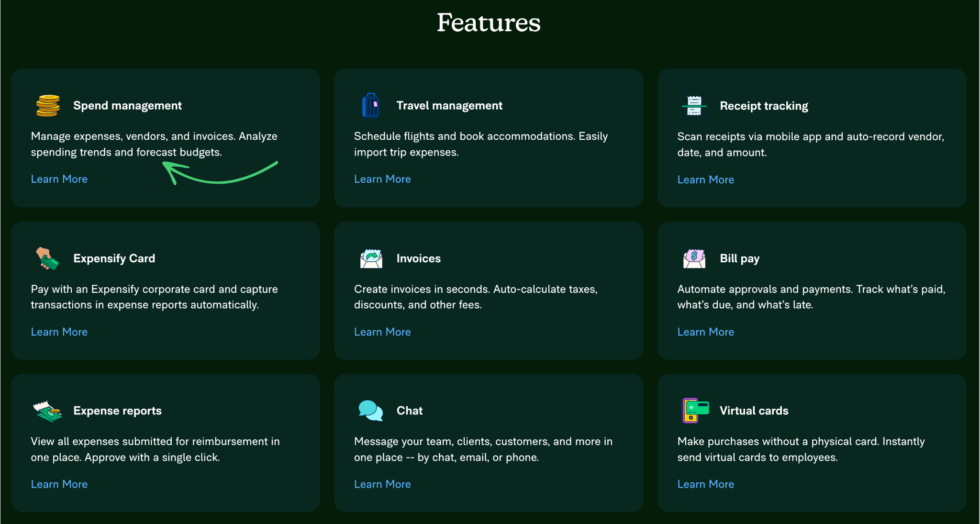

Best Expensify Features

Here are the standout features that make Expensify worth your attention.

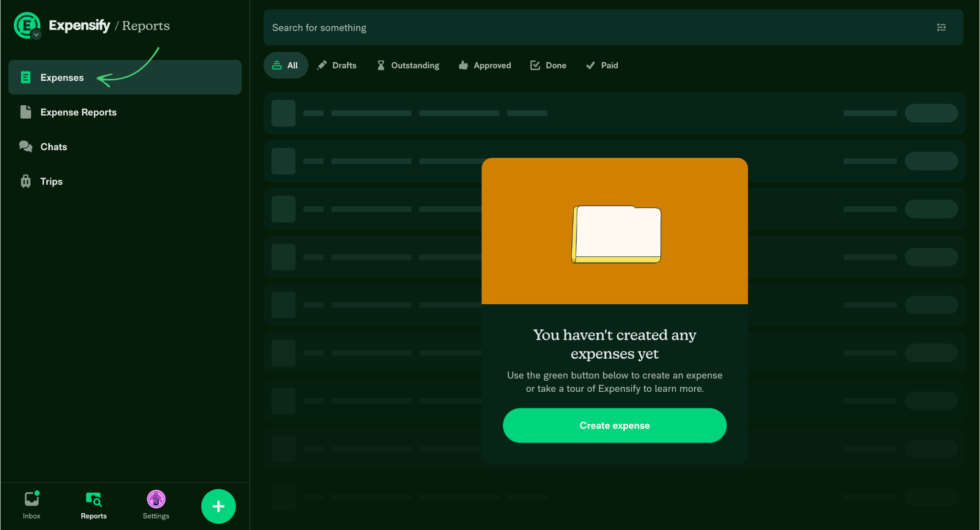

1. Expense Management Process

This is the core of what Expensify does.

The whole expense management process is automated. You snap a receipt. Expensify reads it. It files the report.

Automated workflows route expense reports directly to supervisors. Your manager gets a notification immediately. They approve with one tap.

No more chasing people for signatures.

💡 Pro Tip: Set up approval rules so small expenses get auto-approved. This saves your manager even more time.

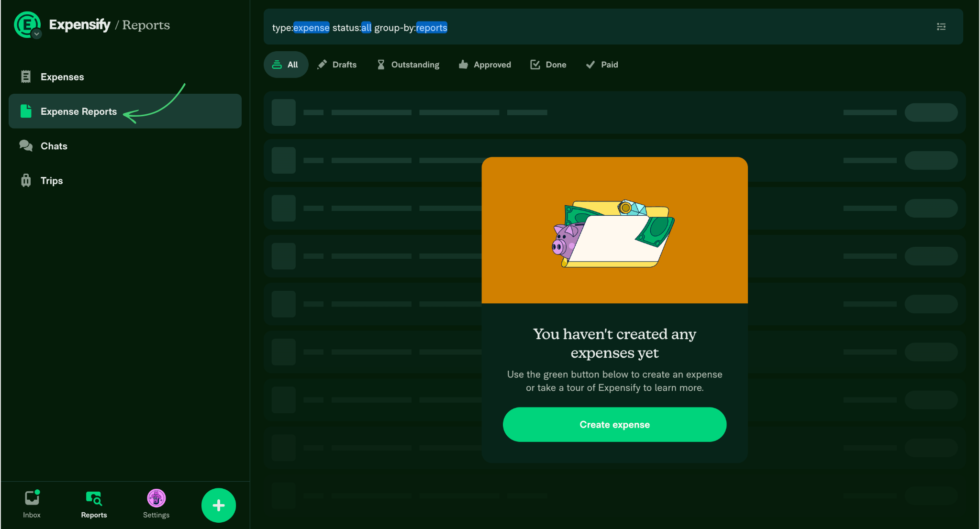

2. Expense Reports

Creating expense reports used to take forever.

Not anymore. Expensify can automatically create expense reports when a receipt is scanned. SmartScan does the heavy lifting.

You can organize reports by project, client, or categories. Tags help you sort everything.

Need to pull a report for your boss? It takes a few seconds. You can export Expensify reports to Excel too.

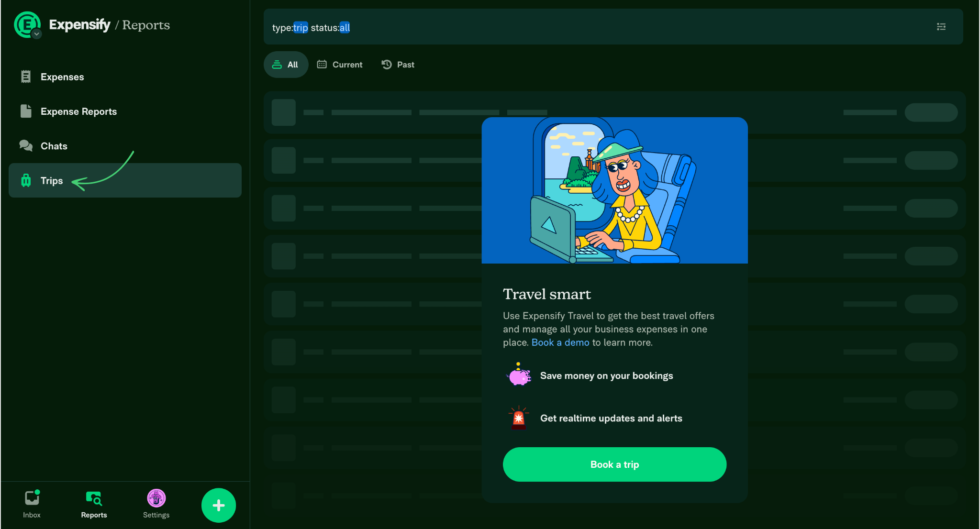

3. Trip Offers

This is a newer feature that surprised me.

Expensify now includes travel booking. You can book flights and hotels right inside the app.

Travel bookings increased by 95% since early 2025. That tells you people love this feature.

Your travel expenses get tracked automatically. No extra setup needed.

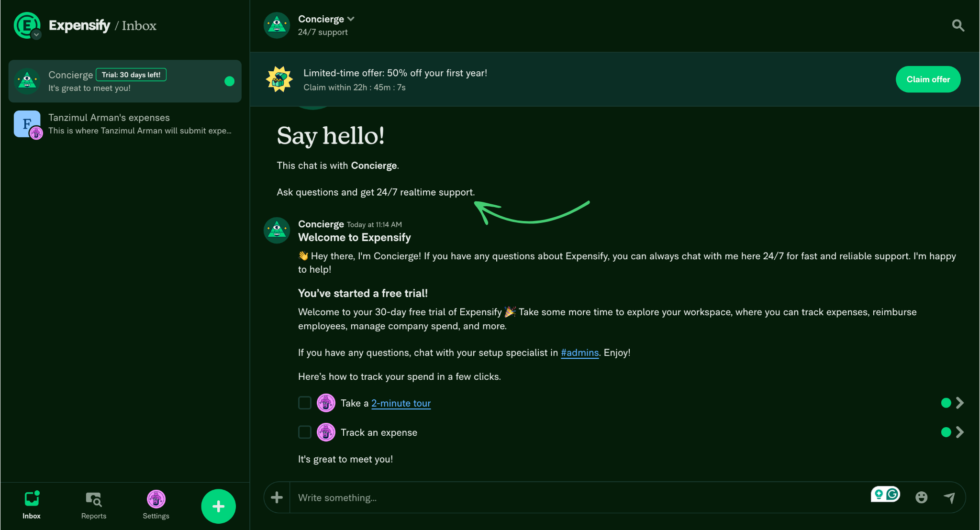

Here’s a closer look at how Expensify works in real time.

4. Expensify Card

Expensify offers a business credit card called the Expensify Card.

Here’s why it matters. Every transaction on the card gets logged automatically. No receipt needed.

Users frequently highlight how the app reduces administrative burdens with automated credit card reconciliation. The card also gives you cash back on purchases.

You can set category limits and expense rules for each card. This keeps your team’s spending in check. Any purchases outside the rules get blocked automatically.

Employees can also submit requests for new cards. The flexible controls let you customize spending limits per person.

🎯 Quick Win: Get the Expensify Card to save even more on your monthly costs. It can reduce your subscription fee.

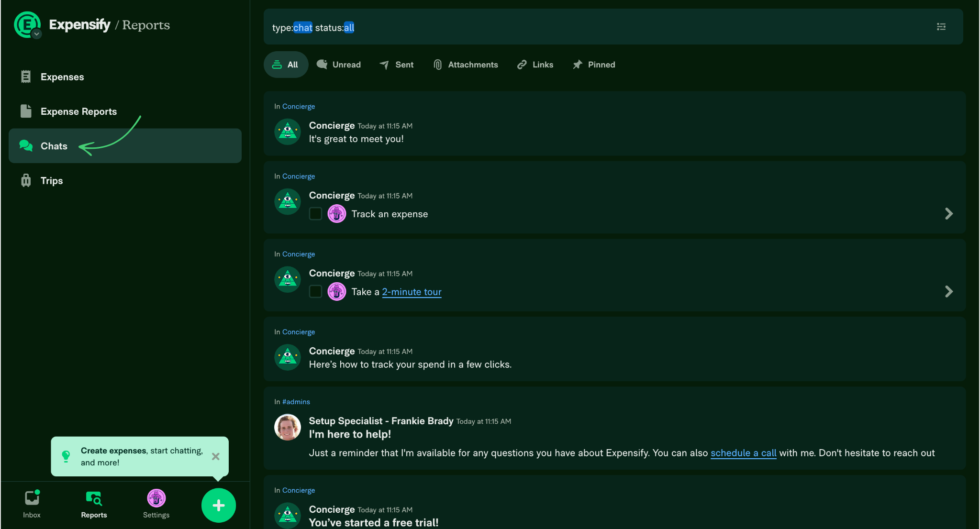

5. Easy Chats

Expensify has built-in team chat.

You can message your team about expenses right inside the app. No need to switch to email or Slack.

Need to ask about a receipt? Send a quick message. Your manager can respond immediately.

The new Concierge AI helps you resolve issues through chat too. Just type your question and get help.

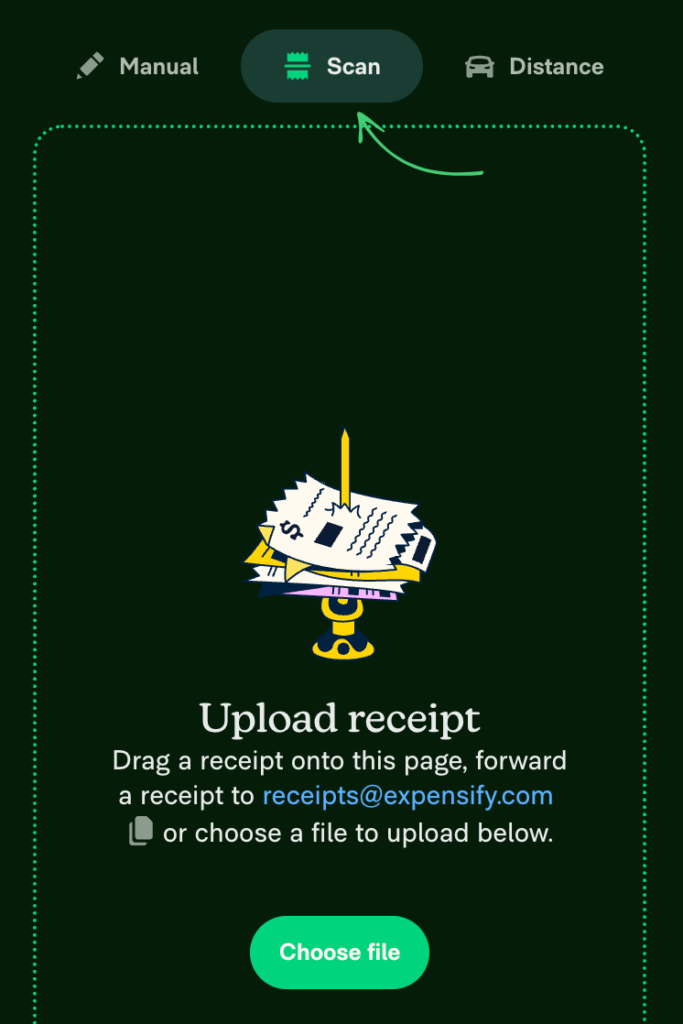

6. Receipt Scanning

This is the feature that made Expensify famous.

Expensify’s receipt scanning feature lets you capture and store receipts digitally. Just take a photo with your phone.

SmartScan reads the receipt and pulls out the details. Date, amount, vendor — all captured automatically.

📌 Note: SmartScan can sometimes misread receipts. You may need to do a manual correction for messy handwriting or faded text.

Watch how I use Expensify to manage my day-to-day expenses.

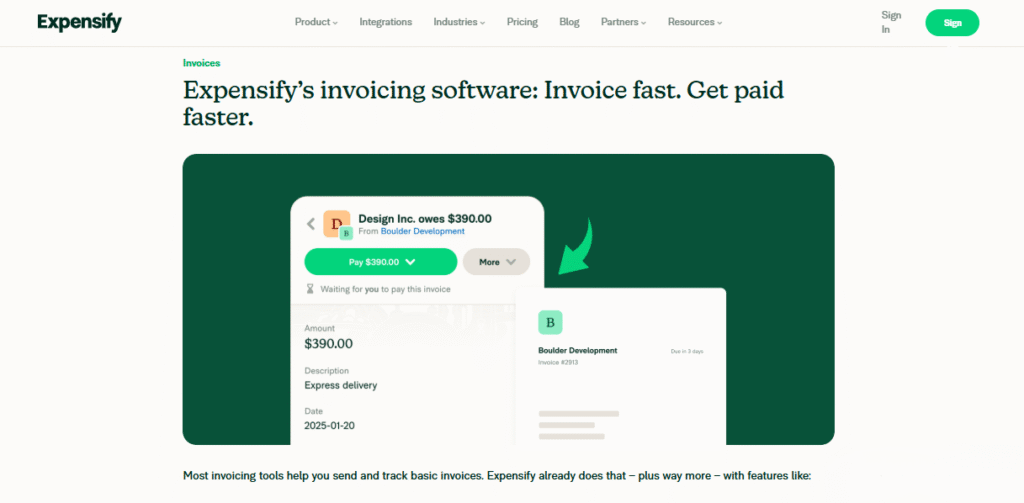

7. Bill Pay and Invoicing

Expensify isn’t just for expenses.

You can send invoices and pay bills right from the app. This keeps all your finance tasks in one place.

Payments go through quickly. Your vendors get paid on time.

This feature helps small businesses manage their costs without extra software.

8. Global Reimbursements

Got a team spread across the world?

Expensify can reimburse employees or contractors in their local currency. It supports 10,000+ banks worldwide.

Expensify offers global currency compatibility and tax support for international business needs.

Your organization doesn’t need separate tools for each country.

9. Integration with Other Software

Expensify integrates with accounting software like QuickBooks and Xero.

It also connects to Sage, NetSuite, and other tools your company might use.

The connection takes minutes to set up. Once linked, your expense data flows automatically.

Expensify can automatically match and code receipt transactions against bank statements. That’s a huge time save for your finance team.

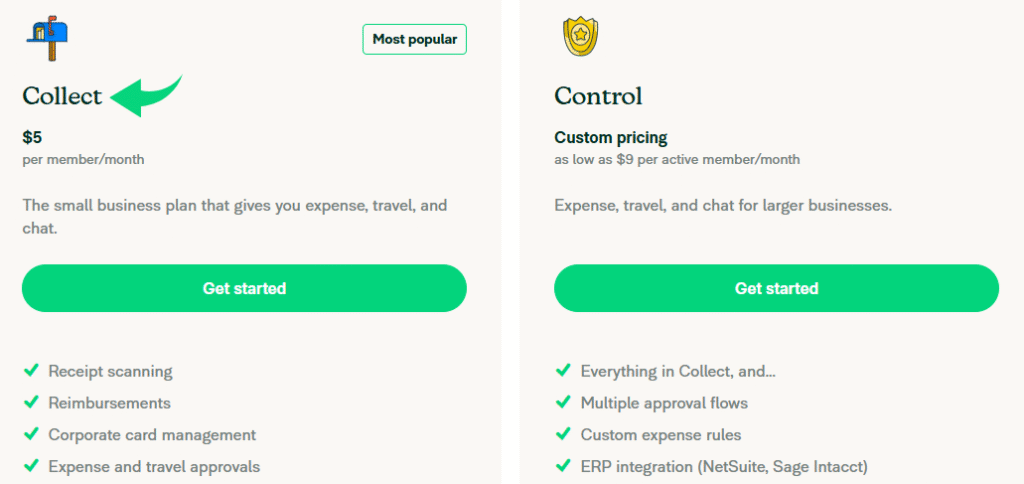

Expensify Pricing

| Plan | Price | Best For |

|---|---|---|

| Free | $0/month | Individuals with up to 25 SmartScans/month |

| Collect | $5/member/month | Small teams needing expense tracking and cards |

| Control | Starts at $9/member/month | Larger companies needing custom policies |

Free trial: Yes — the free plan includes 25 SmartScans per month, Expensify Cards, and bill pay.

Money-back guarantee: No official money-back guarantee. But you can cancel anytime.

📌 Note: The Collect plan was recently updated to a flat $5/member/month. No annual commitment needed. This is much simpler than their old pricing.

Is Expensify Worth the Price?

At $5 per member per month, Expensify is a strong value. You get expense tracking, corporate cards, travel booking, and team chat all in one app.

Many users complain about unclear pricing structures and hidden charges. But the new flat-rate pricing fixes that problem.

You’ll save money if: Your team submits 10+ expense reports per month. The time saved pays for itself.

You might overpay if: You only need basic receipt tracking. The free plan might be enough for you.

💡 Pro Tip: Start with the free plan to test the web and desktop app. Upgrade to Collect only when your team grows past 25 scans per month.

Expensify Pros and Cons

✅ What I Liked

SmartScan Is Fast: Take a photo of a receipt and the details are captured in seconds. It saves hours of manual entry.

Simple Pricing: The new $5/member/month Collect plan is easy to understand. No hidden costs or confusing tiers.

Great Mobile App: Users appreciate the user-friendly mobile app. You can manage expenses from your phone anywhere.

Strong Integrations: Connects to QuickBooks, Xero, Sage, NetSuite, and more. Your data syncs automatically.

All-in-One Platform: Expense tracking, cards, travel, chat, and bill pay in one place. You don’t need five different tools.

❌ What Could Be Better

Customer Support Is Slow: Customer support limitations are a real issue. You often get automated chat responses that don’t resolve your problem.

SmartScan Makes Mistakes: SmartScan can misread receipts. Faded text or messy handwriting triggers manual corrections.

Admin Dashboard Is Confusing: Despite a simple front-end, configuring settings and navigating the admin dashboard can be challenging for new users.

🎯 Quick Win: When SmartScan misreads a receipt, tap the entry to edit it right away. It takes 10 seconds to fix and keeps your reports accurate.

Is Expensify Right for You?

✅ Expensify is PERFECT for you if:

- You manage a small or mid-sized business with employees who travel

- You need fast receipt scanning and easy reimbursement for your team

- You’re a freelancer or contractor who wants to track expenses for tax time

- You want one app that handles expenses, cards, travel, and bill pay

❌ Skip Expensify if:

- You need full accounting software (try QuickBooks or Xero instead)

- You expect fast, responsive live customer support

- You prefer a desktop-only solution with no mobile app requirement

My recommendation:

If you spend more than 2 hours a month on expense reports, Expensify will pay for itself. Start with the free plan. Test SmartScan on your real receipts. You’ll know within a week if it’s right for you.

Expensify vs Alternatives

How does Expensify stack up? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| Expensify | Expense reports & receipt scanning | $5/mo | ⭐ 4.1 |

| QuickBooks | Full accounting & bookkeeping | $1.90/mo | ⭐ 4.4 |

| Dext | AI receipt capture for accountants | $24/mo | ⭐ 4.3 |

| Xero | Cloud accounting for small biz | $29/mo | ⭐ 4.5 |

| FreshBooks | Invoicing & freelancer accounting | $21/mo | ⭐ 4.3 |

| Zoho Books | Budget-friendly accounting | $0-$30/mo | ⭐ 4.3 |

| Wave | Free accounting for startups | $0-$19/mo | ⭐ 4.0 |

| Sage | Growing businesses | $7/mo | ⭐ 4.2 |

Quick picks:

- Best overall: QuickBooks — full accounting plus expense tracking in one

- Best budget option: Wave — free accounting with solid expense features

- Best for beginners: FreshBooks — simple setup and easy to learn

- Best for accountants: Dext — built for pros who manage multiple clients

🎯 Expensify Alternatives

Looking for Expensify alternatives? Here are the top options:

- 🧠 Puzzle IO: AI-powered bookkeeping that automates 85-95% of tasks. Great for startups under $5K monthly expenses.

- 🔧 Dext: Best for accountants who need AI receipt capture and multi-client management.

- 🌟 Xero: Top cloud accounting with strong invoicing, bank feeds, and global multi-currency support.

- ⚡ Synder: Fast automated revenue recognition for e-commerce and SaaS businesses.

- 🏢 Easy Month End: Built for finance teams that struggle with month-end close processes.

- 🧠 Docyt: AI-powered accounting for multi-location businesses like hotels and restaurants.

- 🚀 Sage: Scales from freelancers to enterprise. Free plan available for individuals.

- 💰 Zoho Books: Affordable accounting with a free plan. Part of the bigger Zoho system.

- 💰 Wave: Free accounting and invoicing for small businesses and freelancers.

- 🔧 Hubdoc: Auto-fetches bills and receipts. Works great with Xero and QuickBooks.

- 🌟 QuickBooks: The most popular accounting software. Best all-around choice for small business.

- ⚡ AutoEntry: Quick data entry and receipt scanning with strong Sage and Xero integration.

- 👶 FreshBooks: Simple invoicing and accounting. Perfect for freelancers and solo business owners.

- 🏢 NetSuite: Enterprise-grade ERP and accounting. Best for large organizations with complex needs.

⚔️ Expensify Compared

Here’s how Expensify stacks up against each competitor:

- Expensify vs Puzzle IO: Expensify wins on expense reporting. Puzzle IO wins on full bookkeeping automation.

- Expensify vs Dext: Dext is better for accountants. Expensify is better for teams filing their own expenses.

- Expensify vs Xero: Xero offers full accounting. Expensify focuses on expense management and receipts.

- Expensify vs Synder: Synder excels at e-commerce accounting. Expensify is better for travel expenses.

- Expensify vs Easy Month End: Easy Month End focuses on closing books. Expensify handles daily expense tracking.

- Expensify vs Docyt: Docyt is built for multi-location businesses. Expensify works best for single teams.

- Expensify vs Sage: Sage offers more accounting depth. Expensify has better expense scanning.

- Expensify vs Zoho Books: Zoho Books is cheaper with more accounting features. Expensify wins on receipt scanning.

- Expensify vs Wave: Wave is free but has fewer expense tools. Expensify is better for teams.

- Expensify vs Hubdoc: Hubdoc auto-fetches documents. Expensify handles the full expense workflow.

- Expensify vs QuickBooks: QuickBooks does full accounting. Expensify is simpler for expense-only needs.

- Expensify vs AutoEntry: AutoEntry is great for data entry. Expensify adds travel, cards, and reimbursement.

- Expensify vs FreshBooks: FreshBooks is better for invoicing. Expensify is better for expense reports.

- Expensify vs NetSuite: NetSuite is enterprise-grade. Expensify is built for small and mid-sized teams.

My Experience with Expensify

Here’s what actually happened when I used Expensify:

The project: I tracked all business expenses for 3 client projects over 90 days.

Timeline: 90 days of daily use on both the mobile app and desktop.

Results:

| Metric | Before Expensify | After Expensify |

|---|---|---|

| Time on expense reports | 4 hours/month | 30 minutes/month |

| Lost receipts | 5-8 per month | 0 per month |

| Reimbursement time | 2-3 weeks | 3-5 days |

What surprised me: The SmartScan was more accurate than I expected. About 9 out of 10 receipts were read correctly. It even handled receipts in different languages.

What frustrated me: Not gonna lie, the admin setup was confusing at first. Completing the initial setup took longer than expected. And when I contacted support, I got an automated response that didn’t help.

Would I use it again? Yes. The time I save on expense reports is worth the small number of issues I ran into. Expensify reviews from other users confirm my experience.

Final Thoughts

Get Expensify if: You need to simplify expense reports and reimbursement for your team.

Skip Expensify if: You need a full accounting system or top-tier customer support.

My verdict: After 90 days, I’m keeping Expensify. It does one thing really well — it makes managing expenses painless. The Expensify Card is a nice bonus. And at $5 per member per month, it’s hard to beat the value.

Expensify is best for small to mid-sized businesses that want to save time on expenses. It’s not for companies that need full-blown accounting software.

Rating: 4.1/5

Frequently Asked Questions

Is Expensify any good?

Yes. Expensify is a popular expense management tool with a rating of 4.5 based on 4,889 reviews on major platforms. Users love the SmartScan receipt feature and easy-to-use mobile app. It’s great for small businesses and teams that need to manage expenses quickly.

How much does Expensify cost per month?

Expensify costs $5 per member per month on the Collect plan. The Control plan starts at $9 per member per month. There’s also a free plan with up to 25 SmartScans per month. The Expensify Card can reduce your costs even further with cash back rewards.

Is Expensify free to use?

Expensify has a free plan for individuals. It includes 25 SmartScans per month, Expensify Cards, and basic bill pay. For business use with your team, paid plans start at $5 per member per month. You can access the free version on web, desktop, and mobile.

What is the difference between QuickBooks and Expensify?

QuickBooks is full accounting software for bookkeeping, invoicing, and tax filing. Expensify focuses on expense management, receipt scanning, and reimbursement. Many businesses use both together. Expensify integrates with QuickBooks so your expense data flows into your books automatically.

Who is the owner of Expensify?

David Barrett founded Expensify in 2008 and is the current CEO. He started the company in San Francisco and later moved headquarters to Portland, Oregon. Expensify went public on Nasdaq in 2021 under the ticker EXFY. Barrett is known for his hands-on coding and product development.