Drowning in expense reports and receipts? You’re not alone.

Many finance teams struggle with clunky systems that waste time and cause errors.

What if there was a better way?

This guide isn’t just about another tool. It’s about finding the right one for your team.

We’ve found the 9 Best Expensify Alternatives to simplify your expense process.

Save time, reduce stress, and make expense reporting much smoother.

Read on to find your team’s perfect solution!

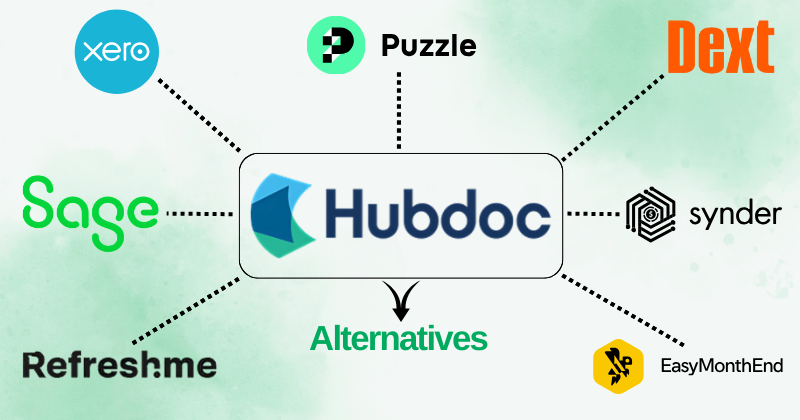

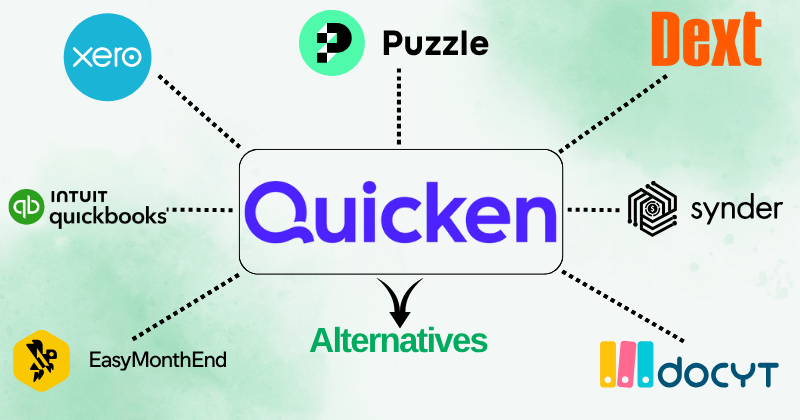

What Are the Best Alternatives to Expensify?

Tired of juggling expenses? We get it.

Finding the right tool can save your team a lot of headaches.

We’ve reviewed many options to bring you a handpicked list.

Discover the top choices that can truly make a difference for your finance team.

1. Xero (⭐4.8)

Xero is cloud accounting for small and growing businesses.

It’s built for small businesses. Think clean design and simple features.

It aims to make accounting less of a chore and more of a breeze.

Xero focuses on collaboration and cloud-based access.

Unlock its potential with our Xero tutorial.

Also, explore our Expensify vs Xero comparison!

Our Take

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features now!

Key Benefits

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

Pricing

- Starter: $29/month.

- Standard: $46/month.

- Premium: $69/month.

Pros

Cons

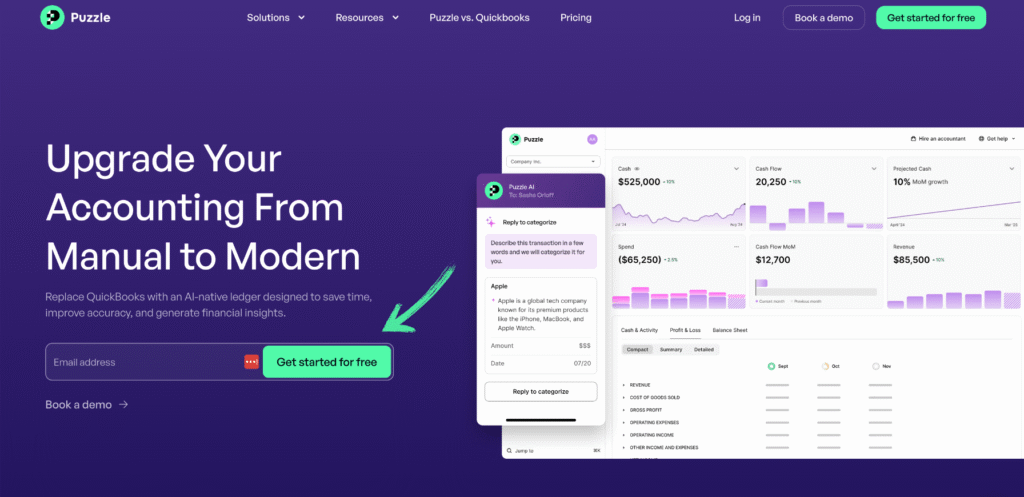

2. Puzzle IO (⭐4.5)

Puzzle is a modern accounting platform designed for startups and small businesses.

It combines bookkeeping, financial reporting, and forecasting in one place.

Think of it as a smart co-pilot for your business finances, giving you real-time insights without the usual headaches.

Unlock its potential with our Puzzle IO tutorial.

Also, explore our Expensify vs Puzzle IO comparison!

Our Take

Ready to simplify your finances? See how Puzzle io can save you up to 20 hours a month. Experience the difference today!

Key Benefits

Puzzle IO really shines when it comes to helping you understand where your business is headed.

- 92% of users report better financial forecasting accuracy.

- Get real-time insights into your cash flow.

- Easily create different financial scenarios to plan.

- Collaborate seamlessly with your team on financial goals.

- Track key performance indicators (KPIs) in one place.

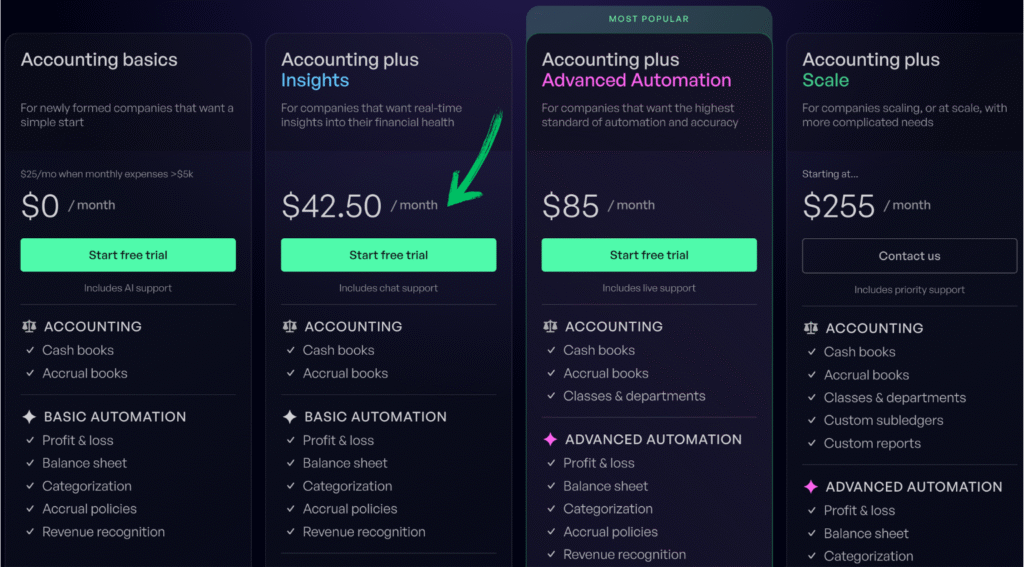

Pricing

- Accounting basics: $0/month.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Pros

Cons

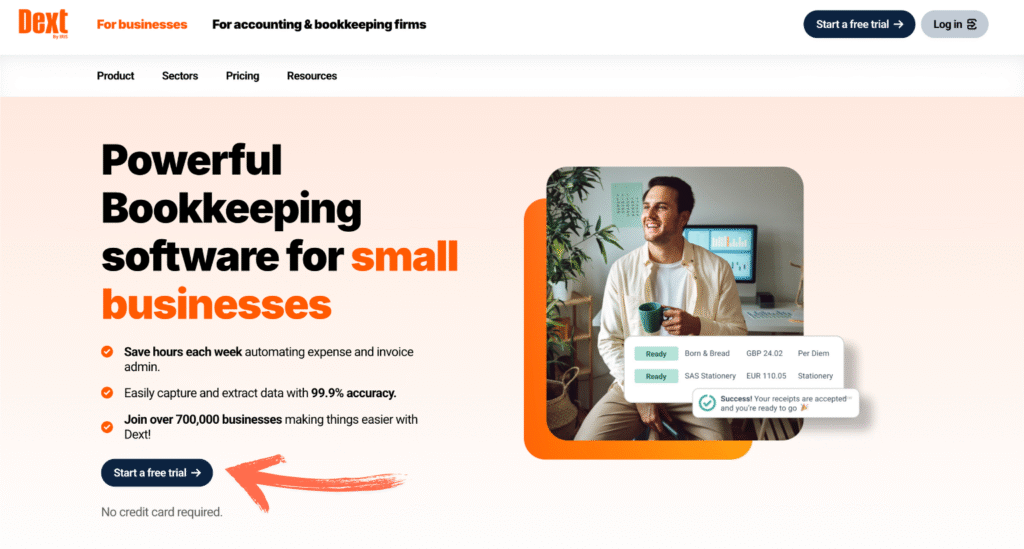

3. Dext (⭐4.0)

Dext (formerly Receipt Bank and GreenVault) is not exactly accounting software.

It’s more of an intelligent automation tool.

It helps you get data from receipts and invoices into your accounting software.

Think of it as a super-efficient data entry assistant. It saves you tons of time on manual data input.

Unlock its potential with our Dext tutorial.

Also, explore our Expensify vs Dext comparison!

Our Take

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Key Benefits

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

Pricing

- Annually Subscription: $24

Pros

Cons

4. Synder (⭐3.8)

Synder automates transaction syncing for online businesses.

It links your sales platforms and payment apps to your accounting software.

This means sales, fees, and payouts are always correct.

It saves you lots of manual work. Perfect for online sellers.

Unlock its potential with our Synder tutorial.

Also, explore our Expensify vs Synder comparison!

Our Take

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Key Benefits

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

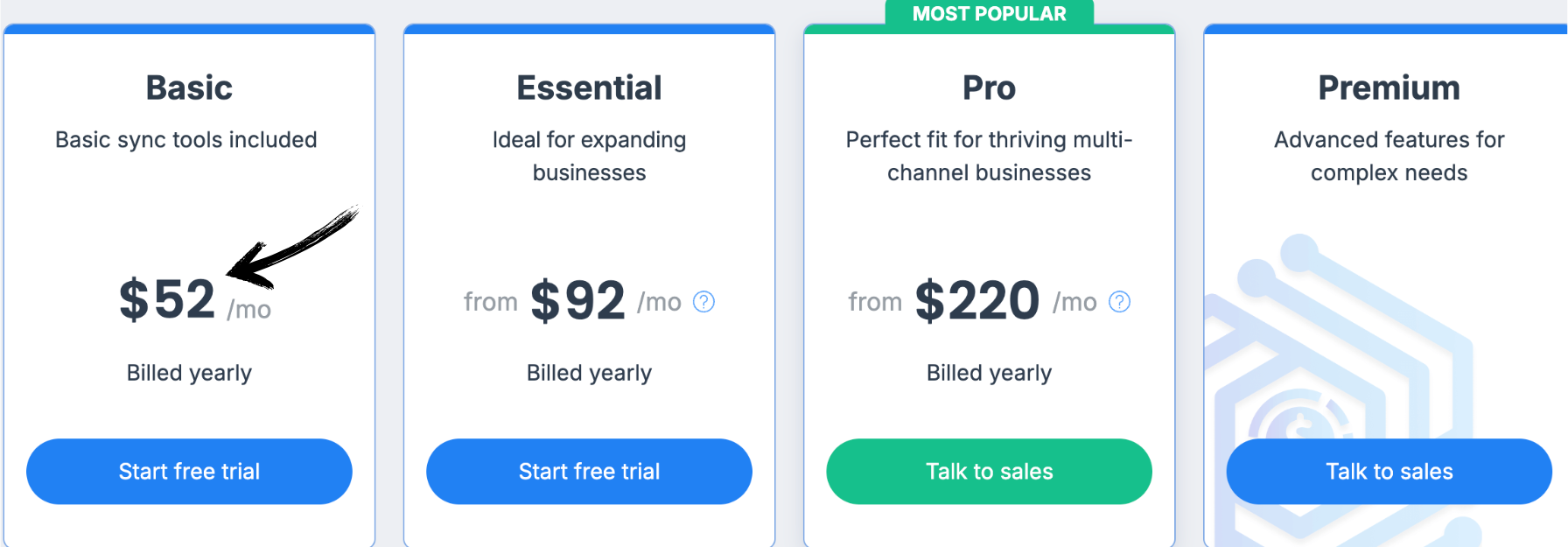

Pricing

All the plans will be Billed Annually.

- Basic: $52/month.

- Essential: $92/month.

- Pro: $220/month.

- Premium: Custom Pricing.

Pros

Cons

5. Easy Month End (⭐3.6)

Easy Month End helps accountants close books faster each month.

It’s like a smart checklist for your financial tasks.

Think of it as your checklist, task manager, and reconciliation assistant all in one place.

It helps you manage your financial tasks and get things done on time, every time.

Unlock its potential with our Easy Month End tutorial.

Also, explore our Expensify vs Easy Month End comparison!

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

6. Sage (⭐️3.4)

So, Sage is a big name in the accounting world. They have been around for a while.

Their software uses AI to help with things like invoicing and bank reconciliation.

From small startups to large enterprises. It helps manage finances, payroll, and operations.

It’s a well-established name in accounting.

Unlock its potential with our Sage tutorial.

Also, explore our Expensify vs Sage comparison!

Our Take

Ready to supercharge your finances? Sage users have reported an average of 73% higher productivity and a 75% faster process cycle time.

Key Benefits

- Automated invoicing and payments

- Real-time financial reports

- Strong security to protect data

- Integration with other business tools

- Payroll and HR solutions

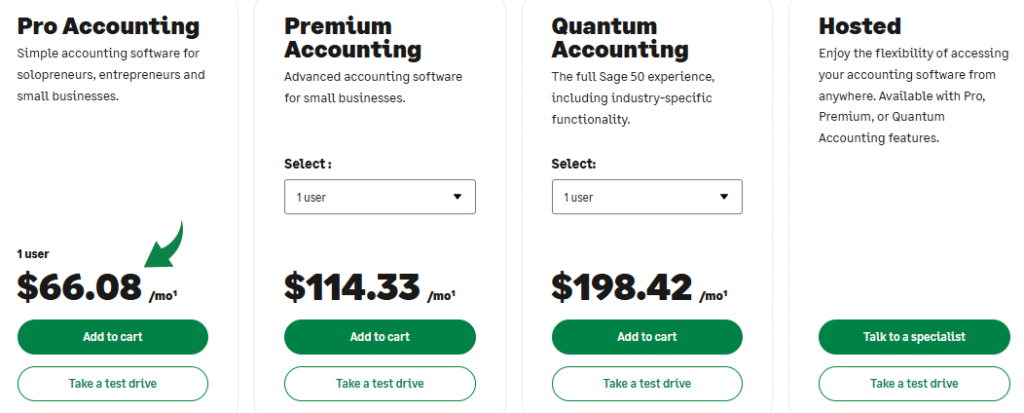

Pricing

- Pro Accounting: $66.08/month.

- Premium Accounting: $114.33/month.

- Quantum Accounting: $198.42/month.

- HR and Payroll bundles: Custom Pricing based on your needs.

Pros

Cons

7. RefreshMe (⭐️3.2)

RefreshMe focuses on providing real-time financial insights and analysis using AI.

It aims to give business owners a clear and up-to-date view of their financial health, helping them make informed decisions quickly.

This tool can save you from a lot of headaches and make sure your data is accurate.

It’s a handy addition to your accounting routine.

Unlock its potential with our Refreshme tutorial.

Also, explore our Expensify vs Refreshme comparison!

Our Take

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Key Benefits

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

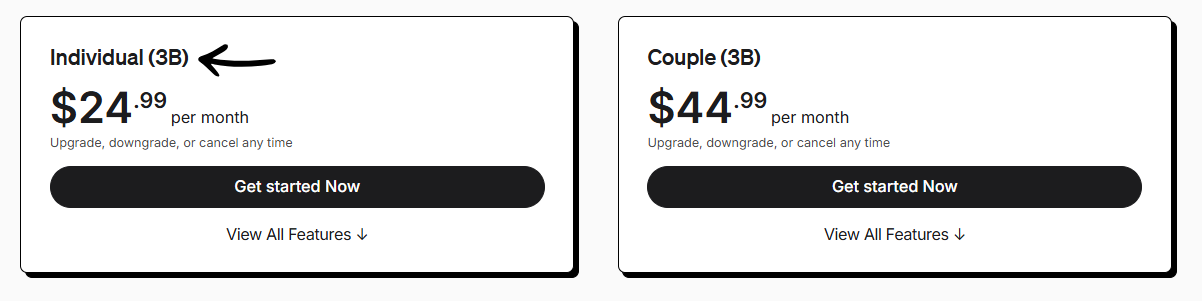

Pricing

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pros

Cons

8. Docyt (⭐3.0)

Docyt uses AI to automate bookkeeping for small businesses.

It’s more than just an expense tracker. It aims to be your entire back office.

Docyt can capture documents like receipts and invoices.

This means less manual work for you and cleaner financial data.

Unlock its potential with our Docyt tutorial.

Also, explore our Expensify vs Docyt comparison!

Key Benefits

- AI-Powered Automation: Docyt uses artificial intelligence. It automatically extracts data from financial documents. This includes details from over 100,000 vendors.

- Real-time Bookkeeping: Keeps your books updated in real-time. This provides an accurate financial picture at any moment.

- Document Management: Centralizes all financial documents. You can easily search and access them.

- Bill Pay Automation: Automates the bill payment process. Schedule and pay bills easily.

- Expense Reimbursement: Streamlines employee expense claims. Submit and approve expenses quickly.

- Seamless Integrations: Integrates with popular accounting software. This includes QuickBooks and Xero.

- Fraud Detection: Its AI can help flag unusual transactions. This adds a layer of security. There’s no specific warranty for the software, but continuous updates are provided.

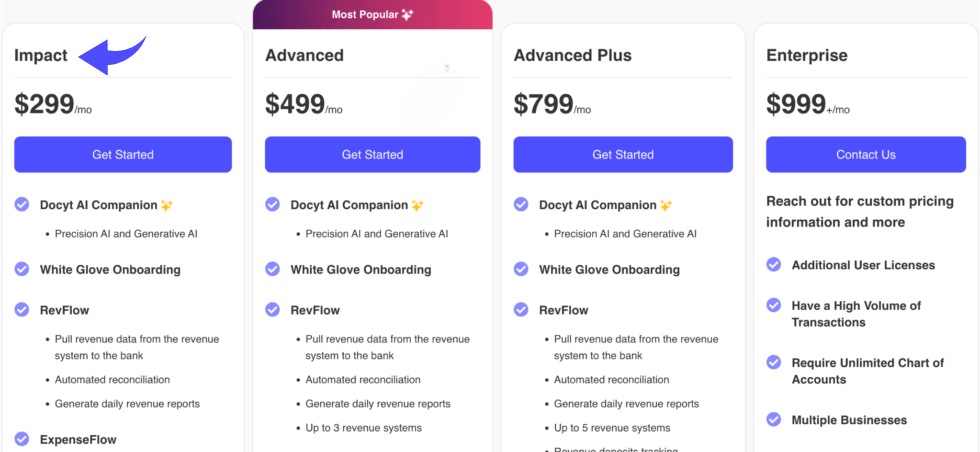

Pricing

- Impact: $299/month.

- Advanced: $499/month.

- Advanced Plus: $799/month.

- Enterprise: $999/month.

Pros

Cons

9. QuickBooks (⭐2.8)

QuickBooks is a huge name in accounting software.

Many small and medium-sized businesses use it.

It handles income, expenses, and invoicing all in one spot.

It’s built to simplify your money tasks.

Unlock its potential with our QuickBooks tutorial.

Also, explore our Expensify vs QuickBooks comparison!

Key Benefits

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

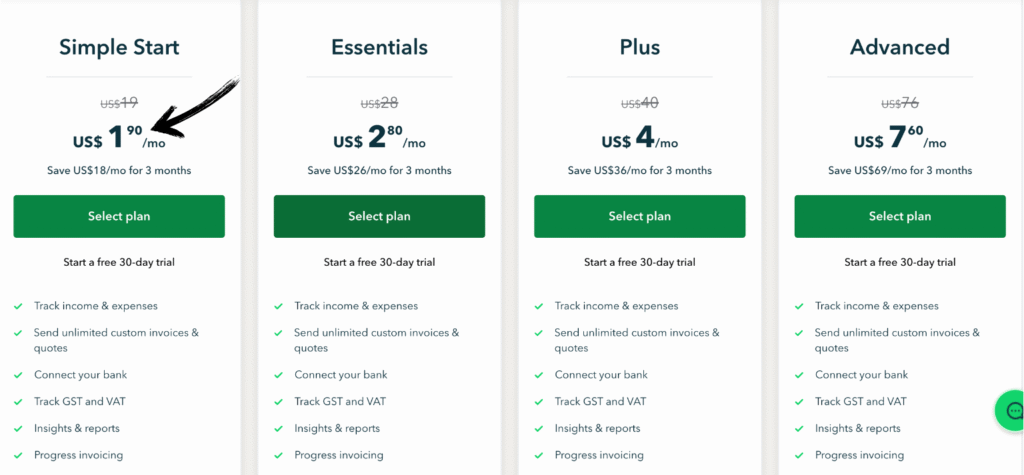

Pricing

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Pros

Cons

Buyers Guide

When we conducted our research to find the best alternative to Expensify, we determined the best expense management solution by using the following factors:

- Pricing: How much did each product cost? We looked at the flexible pricing plans and transparent pricing to find a cost-effective solution. We also checked for any annual fees or hidden costs that could impact the total spend management.

- Features: What were the best features of each product? We focused on comprehensive features that help streamline financial processes and the entire expense management process. This included automated expense tracking, real-time expense reporting, and automated receipt scanning, receipt tracking to simplify expense management and reduce manual data entry. We looked for features that could manage expenses from various sources, including business credit cards and corporate cards. We also looked at travel and expense management, invoice management, and bill payments. For more complex expense management, we evaluated advanced features like customizable approval workflows, multi-level approval workflows, and multi-currency support for international payments and global payments. We also considered spend controls and spending limits for corporate spending and real time visibility into financial operations. We also noted if the software could handle physical and virtual cards, and provide real time expense tracking.

- Negatives: What was missing from each product? We identified what was missing from each expense software to help manage business expenses. For example, some solutions might lack advanced features for multi currency, vendor management, or integrating with other financial tools and other accounting tools. We also looked for any issues related to handling sensitive financial data.

- Support & refund: Do they offer a community, support & refund policy? We assessed the quality of support for managing business expenses and financial workflows. We also looked at how well each solution integrates with existing credit card and other financial tools for seamless expense data and travel booking. We considered whether the solution was tailored for mid-sized companies with complex global operations, and if it could help them simplify financial workflows. We also checked for features that help you submit receipts and with invoice processing.

Wrapping Up

We’ve explored several options that can help you manage expenses.

Finding the right software that integrates expense management with your existing tools is crucial.

It’s not just about tracking expenses, but also about improving your cash flow management and understanding your spending patterns.

We’ve done the research to find tailored solutions that can help you streamline financial workflows.

We hope our guide helps you find the best tool for your needs and improves your cash flow.

Frequently Asked Questions

Is Expensify really free?

Yes, but with specific limits. The Free plan is robust for individuals and small teams, offering the Expensify Card, invoicing, and reimbursement. However, it caps “SmartScans” (automatic receipt reading) at 25 per month. For unlimited scanning and advanced approval workflows, you must upgrade to paid plans starting around $5/user/month.

Is Expensify better than Concur?

For most SMBs and mid-market companies, yes. Expensify allows for rapid setup, offers a superior mobile user experience, and costs significantly less. SAP Concur is an enterprise heavyweight—powerful for complex global compliance but often criticized for being clunky, expensive, and slow to implement.

What is the difference between Zoho expense and Expensify?

It comes down to ecosystem versus specialization. Zoho Expense is highly affordable and integrates perfectly if you already use Zoho Books. Expensify is platform-agnostic, boasting superior standalone OCR technology (SmartScan) and deeper integrations with major accounting tools like QuickBooks, Xero, and NetSuite.

What is the best expense management software?

There is no single winner. Expensify is the gold standard for SMBs needing solid reporting and reimbursement. Ramp is excellent for modern teams wanting automation and corporate cards. SAP Concur remains the default for massive enterprises requiring rigid compliance features.

Is Expensify no longer free?

It is still free, but the definition has shifted. You can use the platform without paying, but heavy reliance on the “SmartScan” feature is limited to 25 uses monthly on the free tier. Businesses requiring audit trails, custom policies, or ERP integrations must subscribe to the Collect or Control plans.

What is the difference between SimplyWise and Expensify?

Purpose. SimplyWise functions as a digital filing cabinet, optimized for organizing receipts for tax time and retirement document storage. Expensify is an active workflow tool designed to process employee expenses, enforce company policies, and execute reimbursements. One stores data; the other moves money.

Who is Concur’s biggest competitor?

In the SMB and mid-market sectors, Expensify is the primary challenger due to its ease of use. However, for modern automated finance stacks, Ramp and Navan (formerly TripActions) are rapidly stealing market share. For strictly enterprise-level replacements, Chrome River is often the direct alternative.

More Facts about Expensify Alternatives

Customer Support Issues

- Many users feel that Expensify’s customer support is not very helpful.

- Expensify mostly uses email for support, so users often wait a long time for a response.

- There is no phone number to call for Expensify support. You cannot speak to a real person on the phone.

- Fixing a problem with Expensify often takes many emails and a lot of time.

- Some companies, like Expensify, have cut back on support staff to save money. This forces users to search through help articles to fix problems themselves.

- If you want fast help, you might need to look for software that offers 24/7 chat or phone support.

- Tipalti is known for great support. They have a team in the US you can call or email, and 98% of their customers are happy with the help they get.

- Users say Airbase answers emails much faster than Expensify does.

- Navan offers travel support at any time of day or night. Expensify does not have this feature.

User Experience and Design

- Expensify focuses on reports made after you spend money. Some users think this feels old-fashioned compared to newer tools that use AI.

- If software is hard to use, employees waste time figuring it out instead of working.

- When expense software is confusing, employees might stop using it. This causes messy financial records.

- Good software is easy to understand. When it is simple, employees are more likely to follow the rules.

- Companies that want a smooth experience should look for software with easy “drag-and-drop” tools and a great mobile app.

- Newer tools like Ramp and Brex use AI to check receipts and rules the moment you buy something. This saves a lot of manual work.

Connecting with Other Systems (Integrations)

- It is very important for expense software to talk to your company’s other finance systems. This stops errors and speeds up work.

- Expensify has limited connections to other important business systems.

- Because Expensify doesn’t integrate well, users often have to move data manually. This can create mistakes.

- Companies with complex needs should choose software that connects easily with the systems they already use.

- If your expense software doesn’t connect to your accounting software, it takes much longer to close the books at the end of the month.

Competitors and Alternatives

- Ramp: Gives companies cards that track spending instantly. It uses AI to read receipts so you don’t have to type them. It is often cheaper than Expensify.

- Brex: Great for startups. It automatically generates receipts and fills in the details to prevent mistakes.

- Tipalti: Good for companies that pay bills globally. It helps stop fraud and follows strict rules.

- SAP Concur: The standard choice for very big companies that travel all over the world. It handles complex rules well.

- Navan: Best for companies that travel frequently because it combines trip booking and expense tracking.

- Airbase: Combines corporate cards, bill payments, and expense tracking all in one place.

- Zoho Expense: A very affordable option for small businesses. It connects well with other Zoho products.

- Payhawk: A finance tool from London that offers cards and expense tracking.

- Sage Expense Management (formerly Fyle): Good for businesses that want to keep using their current credit cards but need better software.

Cost and Pricing

- Expensify can be expensive. Their “Collect” plan starts at $5 per user, and the “Control” plan starts at $9 per user.

- Many companies end up paying around $36 per user each month for Expensify, depending on their settings.

- Expensify also charges extra fees for things like paying back employees in other countries.

- Brex has a free plan with many features. Their paid plan costs about $12 per user each month.

- Zoho Expense is very cheap. They have a free plan, and paid plans start at about $4 per user.

- Ramp is often seen as a better deal for growing businesses compared to Expensify.

- Coupa is powerful but expensive. Their full packages can cost thousands of dollars a year.

- Payhawk and Airbase do not list their prices publicly; you have to request a quote.