Are you spending too much time moving your business info around?

It can be a real pain, right?

Keeping your sales, payments, and accounting in sync feels like a never-ending task.

What if there was a better way?

In this article, we’re going to look at two popular tools, Synder vs Quicken.

Let’s dive in and find the best fit for you!

Overview

We looked closely at both Synder and Quicken.

We tried them out to see how they work.

This helped us compare them fairly.

Now we can show you what each one does best.

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Check it out today!

Pricing: It has a free trial. The premium plan starts at $52/month.

Key Features:

- Multi-Channel Sales Sync

- Automated Reconciliation

- Detailed Reporting

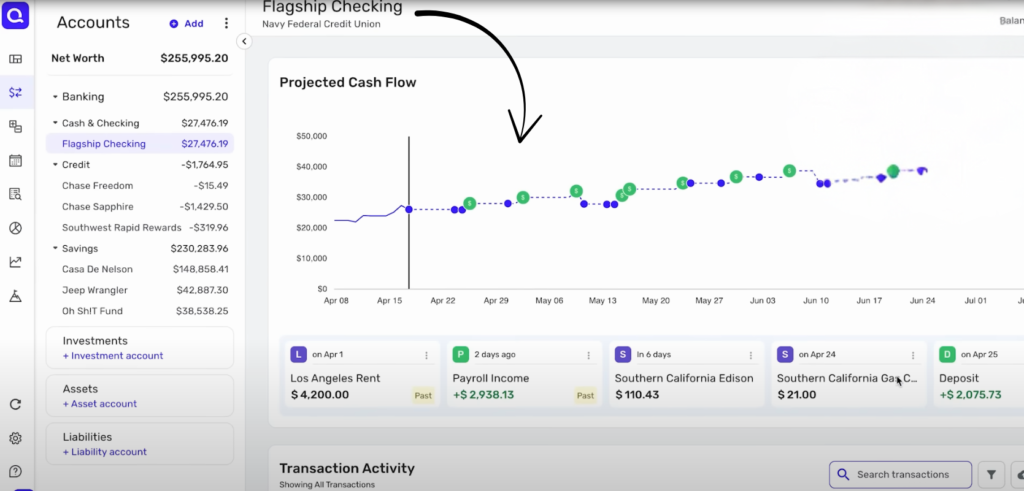

Want to take control of your finances? With Quicken, you can connect to thousands of financial institutions. Explore it for more!

Pricing: It has a free trial. The premium plan at $5.59/month.

Key Features:

- Budgeting Tools

- Bill Management

- Investment Tracking

What is Synder?

Let’s talk about Synder.

It’s a tool that helps your different business apps talk to each other.

Think of it like a helper that moves your money info where it needs to go.

This can save you a lot of time.

Also, explore our favorite Synder Alternatives…

Our Take

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Key Benefits

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

Pricing

All the plans will be Billed Annually.

- Basic: $52/month.

- Essential: $92/month.

- Pro: $220/month.

- Premium: Custom Pricing.

Pros

Cons

What is Quicken?

So, you’re wondering about Quicken?

It’s like a tool that helps you see all your money stuff in one place.

Think of it as your digital money organizer.

It can help you track your bank accounts, bills, and even investments.

Pretty handy, right?

Also, explore our favorite Quicken alternatives…

Key Benefits

Quicken is a powerful tool for getting your financial life in order.

They boast over 40 years of experience and have been a #1 best-selling product.

Their various plans can connect to over 14,500 financial institutions.

You can also get a 30-day money-back guarantee to try it out risk-free.

- Connects with thousands of banks and credit cards.

- Creates detailed budgets.

- Tracks investments and net worth.

- Offers retirement planning tools.

Pricing

- Quicken Simplifi: $2.99/month.

Pros

Cons

Feature Comparison

Here are more things Synder and Quicken can do.

We checked out some key features that matter.

This helps you pick the right tool for your money.

1. Who Is the Focus For?

- Quicken is a personal finance software.

- It is built to help individuals and families manage their money, track their expenses, and plan for the future and retirement.

- Synder’s focus is on small businesses, especially those with ecommerce and multi-channel sales.

- It helps businesses get all their sales channels connected to their accounting system, like QuickBooks Online or Xero.

2. Automated Accounting and Sync Mode

- Synder provides automated accounting by offering a sync mode.

- This feature automatically pulls your data from sales channels like Stripe or PayPal and enters it into your accounting system. It saves time and helps keep your books balanced.

- Quicken does not offer the same level of automated accounting.

- It is more focused on downloading and logging bank transactions and balances for your personal finances.

3. Handling Multi-Currency

- If your business sells to people in different countries, you deal with multiple currencies.

- Synder can handle and record these transactions correctly. This is very helpful for businesses that are truly high-volume ecommerce sellers.

- Quicken does not have a strong multi-currency feature. Since it is for personal finance, it is not its main functionality.

4. Bringing in Historical Transactions

- Synder lets you bring in historical transactions from your sales channels when you first set up the software.

- This is good for getting your books balanced and accurate from the beginning of your business.

- Quicken can log and track historical transactions from your bank accounts once you connect them.

5. Revenue Recognition

- Synder helps with revenue recognition for your business.

- It makes sure that income from platforms like Stripe or Square is recorded correctly in your accounting system, even with fees, refunds, and discounts.

- Quicken does not deal with complex business rules like revenue recognition.

- It simply logs income when it hits your bank account to help you see your financial picture.

6. GAAP Compliance and Reports

- Synder is built to help you maintain accurate records that follow standards like GAAP compliance (Generally Accepted Accounting Principles).

- It is made to work closely with your accountants to ensure your balance sheets and reports are correct.

- Quicken’s reports are for personal finance and planning.

- They help you with budgets and tracking expenses, but they are not made to ensure GAAP compliance.

7. Connecting to Your Accounting System

- Synder is made to link with major accounting systems like QuickBooks Online, Xero, and even larger systems like NetSuite or Sage Intacct.

- This is its core job: to automate the data process.

- Quicken is a standalone tool. It does not link to an accounting system.

- It is meant to be the main place where you track your personal finance team’s money.

8. Different Versions for Users

- Quicken has many versions like Quicken Deluxe, Quicken Premier, and Quicken Home & Business for different personal finance needs, investment accounts, and even rental properties.

- Synder offers subscription tiers based on your business size and high volume of transactions.

- Its features focus on automated accounting for ecommerce sellers.

9. Reconciliation

- Synder helps with the reconciliation of your daily payouts and transactions.

- It helps you quickly resolve any issues and makes sure that the money recorded in your books matches the money you got in your bank.

- Quicken helps with reconciliation by letting you check your bank balance against the balances it tracks.

- This process is for personal finance and is simpler than the full bookkeeping reconciliation Synder offers.

What to look for when choosing an Accounting Software?

Choosing the right software requires you to look past the sales talk.

Here are the key details to evaluate before you make a switch or purchase:

- Is it for business personal use or just business finances? This is the core question to resolve. Quicken is a Quicken brand that has been around for decades for personal finance, while Synder focuses on business finances and all your sales channels.

- Check the price and cost. Make sure the subscription price fits your budget. Don’t drop a tool without evaluating the long-term value of the alternatives.

- Look at the user interface and ease of setup. Is it simple to control your data? A confusing user interface can cause mistakes and stress when submitting your reports.

- Does it offer automation? The best tools create a simple process. Look for things like bill tracking and one-click reconciliation to save time in the background.

- What are the platform requirements? Does it work on Mac and Windows? Can you use the mobile app to get details or do a quick review on the go?

- How does it protect your data? Ask about security and getting a secure ID to access your data. Since this is your money, you need to feel glad that your details are safe.

- Check for integrations with your platforms, like eBay or Clover. If you have inventory or shipping needs, make sure the tool is compatible with your existing website.

- Can you get deep analysis and insights? Good software should not just record data; it should give you clear insights into your market and customers.

- Consider the company background. For example, Aquiline Capital Partners has invested in the Quicken brand. Look at the company’s past to feel sure about its future.

- Talk to your accountants. They can give you the truth on which system works best for formal business finances.

Final Verdict

After looking closely at both tools, the choice is clear.

If you just need to track money for your family, Quicken is the right tool to stay organized and watch your personal cash flow.

You can easily pay bills and see your credit cards balance.

However, for serious business owners, Synder is the clear winner.

It directly solves the problem of getting your complex business data from your sales platforms into your chart of accounts on your main accounting software.

This setup is key for getting accurate financial reports and managing sales tax.

While Intuit QuickBooks offers many products and services like QuickBooks Payroll and full-service bookkeeping.

Synder helps you maximize those tools by keeping your online access clean.

Listen to us because we highlighted the truth about both to help your business win.

More of Synder

- Synder vs Puzzle io: Puzzle.io is an AI-powered accounting tool built for startups, with a focus on metrics like burn rate and runway. Synder is more focused on syncing multi-channel sales data for a broader range of businesses.

- Synder vs Dext: Dext is an automation tool that excels at capturing and managing data from bills and receipts. Synder, on the other hand, specializes in automating the flow of sales transactions.

- Synder vs Xero: Xero is a full-featured cloud accounting platform. Synder works with Xero to automate data entry from sales channels, whereas Xero handles all-in-one accounting tasks like invoicing and reporting.

- Synder vs Easy Month End: Easy Month End is a tool designed to help businesses organize and streamline their month-end closing process. Synder is more about automating daily transaction data flow.

- Synder vs Docyt: Docyt uses AI for a wide range of bookkeeping, including bill pay and expense management. Synder is more focused on automatically syncing sales and payment data from multiple channels.

- Synder vs RefreshMe: RefreshMe is a personal finance and task management application. This is not a direct competitor, as Synder is a business accounting automation tool.

- Synder vs Sage: Sage is a long-standing, comprehensive accounting system with advanced features like inventory management. Synder is a specialized tool that automates data entry into accounting systems like Sage.

- Synder vs Zoho Books: Zoho Books is a complete accounting solution. Synder complements Zoho Books by automating the process of importing sales data from various ecommerce platforms.

- Synder vs Wave: Wave is a free, user-friendly accounting software, often used by freelancers and very small businesses. Synder is a paid automation tool designed for businesses with high-volume, multi-channel sales.

- Synder vs Quicken: Quicken is primarily personal finance management software, though it has some small business features. Synder is built specifically for business accounting automation.

- Synder vs Hubdoc: Hubdoc is a document management and data capture tool, similar to Dext. It focuses on digitizing bills and receipts. Synder focuses on syncing online sales and payment data.

- Synder vs Expensify: Expensify is a tool for managing expense reports and receipts. Synder is for automating sales transaction data.

- Synder vs QuickBooks: QuickBooks is a comprehensive accounting software. Synder integrates with QuickBooks to automate the process of bringing in detailed sales data, making it a valuable add-on rather than a direct alternative.

- Synder vs AutoEntry: AutoEntry is a data entry automation tool that captures information from invoices, bills, and receipts. Synder focuses on automating sales and payment data from ecommerce platforms.

- Synder vs FreshBooks: FreshBooks is an accounting software designed for freelancers and small service-based businesses, with a focus on invoicing. Synder is for businesses with a high volume of sales from multiple online channels.

- Synder vs NetSuite: NetSuite is a comprehensive Enterprise Resource Planning (ERP) system. Synder is a specialized tool that syncs ecommerce data into broader platforms like NetSuite.

More of Quicken

- Quicken vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Quicken vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Quicken vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Quicken vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Quicken vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Quicken vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Quicken vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Quicken vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Quicken vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Quicken vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Quicken vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Quicken vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Quicken vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Quicken vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Quicken vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

What is the main difference between Synder and Quicken?

Synder is mainly for businesses to connect different sales and payment platforms with accounting software. Quicken is mostly for individuals to manage personal finances, track spending, and budget.

Is Synder good for personal use?

Synder is designed for business use, especially for those who sell online. While it deals with money, its features are geared towards business transactions rather than personal budgeting.

Can Quicken connect to my online store?

Quicken primarily connects to banks and financial institutions for personal finance tracking. It doesn’t typically integrate with online sales platforms like Shopify or Etsy.

Which software is easier to learn?

Quicken is generally considered easier to learn for personal finance management due to its straightforward interface. Synder, while user-friendly, might have a slightly steeper learning curve due to its business integrations.

Does Synder help with taxes?

Synder helps by keeping your business financial data organized and synced, which can make tax preparation easier. However, it’s not a direct tax preparation software.