Are you struggling to keep track of your money?

Do you wish there was an easier way to manage your finances, whether for personal use or your small business?

Many people feel this way, and finding the right tools can make a huge difference.

Both promise to help you get your financial house in order, but they do so in different ways.

How do you pick the one that’s truly best for your needs?

Let’s break it down, Quicken vs Hubdoc, to help you make an informed decision.

Overview

We looked closely at both Quicken and Hubdoc.

We used them ourselves to see how they work.

This helped us understand their main features and how they can help you manage your money.

Want to take control of your finances? With Quicken, you can connect to thousands of financial institutions. Explore it for more!

Pricing: It has a free trial. The premium plan at $5.59/month.

Key Features:

- Budgeting Tools

- Bill Management

- Investment Tracking

Save time with Hubdoc! Users typically save 4 hours a week on data entry. Plus, Hubdoc auto-organizes 99% of docs.

Pricing: It has a free trial. The premium plan starts at $12/month.

Key Features:

- Automated Document Fetching

- Data Extraction

- Direct Accounting Integration

What is Quicken?

So, you’re wondering about Quicken?

It’s like a tool that helps you see all your money stuff in one place.

Think of it as your digital money organizer.

It can help you track your bank accounts, bills, and even investments.

Also, explore our favorite Quicken alternatives…

Key Benefits

Quicken is a powerful tool for getting your financial life in order.

They boast over 40 years of experience and have been a #1 best-selling product.

Their various plans can connect to over 14,500 financial institutions.

You can also get a 30-day money-back guarantee to try it out risk-free.

- Connects with thousands of banks and credit cards.

- Creates detailed budgets.

- Tracks investments and net worth.

- Offers retirement planning tools.

Pricing

- Quicken Simplifi: $2.99/month.

Pros

Cons

What is Hubdoc?

Okay, let’s talk about Hubdoc.

Think of it like a helpful assistant for your papers.

It grabs your bills and statements from different places online.

Then, it keeps them all organized in one spot.

Also, explore our favorite Hubdoc alternatives…

Key Benefits

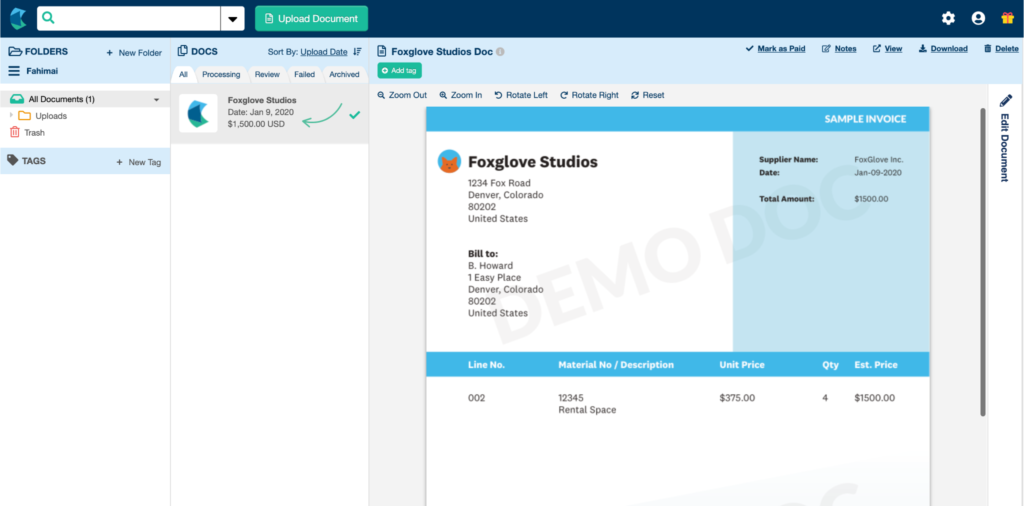

Hubdoc’s main strength is its focus on document automation.

- 99% accuracy: Hubdoc uses OCR to ensure data is captured correctly.

- Audit-proof storage: It stores documents securely, so you never lose a file again.

- Saves 10 hours monthly: Users report significant time savings by eliminating manual entry.

- Automated supplier fetching.

- Mobile photo capture.

- Seamless Xero integration.

Pricing

- Hubdoc price: $12/month.

Pros

Cons

Feature Comparison

Navigating accounting software options is vital for any small business owner.

This Quicken review and Hubdoc review will help you evaluate the functionality of these alternatives, which serve distinct roles in a business’s financial picture and business operations.

1. Core Purpose and Platform

- Quicken is a personal finance software platform designed to help users manage all their finances. The Quicken Business version extends this to track business personal income and expenses. It is a desktop download for Windows or Mac, with mobile functionality.

- Hubdoc is a cloud-based document management solution for online accounting. Its primary functionality is to automate tasks by collecting and extracting data from financial documents. It is not a complete accounting program.

2. Expense and Document Management

- Quicken’s expense tracking relies on connecting to bank accounts to log transactions. While you can attach files, its primary method for managing expenses is through monitoring of balances and categories.

- Hubdoc is the ultimate tool for financial documents. It can connect to over 700 online accounting services to fetch bills and receipts, and its key features include converting these records into usable transactions automatically, saving less time for the bookkeeper.

3. Business Accounting Functionality

- Quicken offers the ability to create basic invoices, send invoices, pay bills, and track time tracking and sales for a small business. It also supports management of rental properties and tax time reporting.

- Hubdoc has no built-in business accounting functions like creating a purchase order, setting sales tax, or managing accounts receivable. Its value is solely in streamlining the document process for the accountant.

4. Accessibility and Collaboration

- Quicken is mainly a single-user software. While you can download the program and connect to a local computer, it is not designed for multiple users or team-based access over a large date range.

- Hubdoc is built for accountant access and collaboration. It stores unlimited bookkeeping records in the cloud with an internet connection & making it easy for each employees or the bookkeeper to upload documents and for the accountant to access them.

5. Financial Analysis and Reporting

- Quicken is excellent for analysis and planning of personal and business finances. Its key features include detailed reports on investment accounts and retirement savings, giving the users real time data on their cash flow and profit.

- Hubdoc does not generate a full picture of financial reports. It simply provides the raw, organized data and source financial documents to the best accounting software (like Xero users typically use) for the accountant to run your business reports.

6. Pricing and Plans

- The Quicken brand has decades of history, with versions like Quicken Deluxe and Quicken Premier available via subscription. The cost is generally low and is detailed in any quicken review.

- Hubdoc is often available as free free bookkeeping software when bundled with Xero or other third party apps, but it is also available via a billing period with a starter plan. It does not have a completely free version on its own.

7. Document Security and Storage

- Quicken allows the users to control the physical file location of their records on their desktop or local computer, but also offers cloud backup. It focuses on helping the individual protect their personal finances.

- Hubdoc stores all financial documents and records securely in the cloud. This secure, central repository helps businesses stay compliant and provides an audit-proof trail for the date of the transactions.

8. Specific Business Features

- The Quicken Business version allows for bill tracking, income tracking, and basic budgeting tools. It is best suited for an independent contractor or a very small business at the beginning of its journey.

- Hubdoc is an app built for small business accounting. It is an essential component of a streamlined digital workflow for an accountant or bookkeeper who processes a high volume of vendor invoices.

9. Platform Deployment

- Quicken gives the users a choice between its traditional on premise desktop software or its newer cloud-enabled versions. This split provides flexibility but can complicate data management.

- Hubdoc is purely an online accounting platform. It is not self hosted and relies on an internet connection and third party apps to fulfill its function within the ecosystem. The latest aquiline capital partners news related to Quicken is irrelevant to Hubdoc’s process.

What to look for in an Accounting Software?

- Scalability: Can the software grow with your every business?Quicken software is a powerful tool for individual users, but it is generally not built to scale for growing companies. While Quicken Home & Business allows you to manage multiple accounts and a high volume of bank transactions and bank transfers, it is better suited for the self-employed or a small business with limited employees. Quicken’s functionality doesn’t typically integrate with a wide range of external business apps.

- Support: What kind of help is available if you have questions Quicken offers extensive support resources, including a large online community forum where users share advice. The level of customer support available (phone, chat) often depends on your subscription level (Quicken Deluxe, Quicken Premier, etc.). They provide detailed help articles to guide you through complex features, but real-time support may require a higher-tier payments plan.

- Ease of Use: Is it something you and your team can learn quickly? The user interface of Quicken is deep and feature-rich, which can create a learning curve. While simple tasks like viewing bank transactions and track expenses are easy, mastering the entire system for complex financial planning takes time. However, for core payments and expense tracking, the streamlined interface of the newer online versions makes it accessible.

- Specific Needs: Does it handle the unique things your business does? Quicken is an excellent solution for the solo entrepreneur who needs to track mileage for tax deductions and manage business payments and clients. However, it does not include true run payroll functionality for a company with employees. For simple invoicing and payments from customers, Quicken offers a good built-in solution that keeps your business finances organized.

- Security: How safe is your financial data with this software? Quicken uses industry-standard encryption to protect your data during bank transfers and when connecting accounts. Since the Classic version stores the main file on your computer, you have more direct control over the primary copy of your business finances. This robust security history makes it a trusted brand in the market.

Final Verdict

Which one is the winner? It depends on you.

For most people managing their money, Quicken is our top choice.

It helps with personal budgets. It tracks spending. It plans your financial future.

If you want to know where your money goes, Quicken is for you.

But if you need to gather bills and receipts, especially for a business, then Hubdoc is better.

It collects documents. We showed you the differences.

Use our guide to pick the right tool for your life or business.

More of Quicken

- Quicken vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Quicken vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Quicken vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Quicken vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Quicken vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Quicken vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Quicken vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Quicken vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Quicken vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Quicken vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Quicken vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Quicken vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Quicken vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Quicken vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Quicken vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

More of Hubdoc

- Hubdoc vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Hubdoc vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Hubdoc vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Hubdoc vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Hubdoc vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Hubdoc vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Hubdoc vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Hubdoc vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Hubdoc vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Hubdoc vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Hubdoc vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Hubdoc vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Hubdoc vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Hubdoc vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Is Hubdoc included with QuickBooks Online?

Yes, Hubdoc is often included with certain QuickBooks Online subscriptions. This helps streamline your bookkeeping by automating document management. It saves time on manual data entry.

What is the main difference in price between Quicken vs Hubdoc?

Quicken typically has an annual subscription price based on the version you choose for personal finance. Hubdoc’s cost is usually bundled with accounting software like QuickBooks or Xero, focusing on document automation and data extraction.

Can Hubdoc help with invoice management?

Yes, Hubdoc excels at invoice management. It can automatically fetch invoices from various sources. This helps organize your documents and speeds up your workflow, making it easier for accounting.

How does Hubdoc compare to Dext (formerly AutoEntry)?

Hubdoc and Dext both offer document data extraction and automation. Hubdoc often syncs closely with QuickBooks and Xero. Dext also offers strong integration, focusing on simplifying bookkeeping tasks and reducing manual data entry.

Is Hubdoc useful for personal finance like Quicken?

No, Hubdoc is not designed for personal finance management like Quicken. Hubdoc focuses on document collection and data extraction for businesses and bookkeeping, helping to automate and streamline workflows. Quicken handles budgeting and financial planning for individuals.