Struggling to pick the right accounting tool for your business?

You’re not alone.

Both promise to make your financial life easier, but which one delivers for your specific needs?

This guide will break down Wave vs Autoentry.

Let’s find out which one is better!

Overview

We put Wave and AutoEntry to the test.

We used them like a real business would. This helped us see what each tool does best.

Now, let’s compare them side-by-side.

Over 4 million small businesses trust Wave to manage their finances. Explore Wave’s plans and find the right fit.

Pricing: Free plan available. Paid plan starts at $19/month.

Key Features:

- Invoicing

- Banking

- Payroll add-on.

Stop wasting 10+ hours/week on manual data entry. See how Autoentry slashed invoice processing time by 40% for Sage users.

Pricing: It has a free trial. Paid plan starts at $12/month.

Key Features:

- Data Extraction

- Receipt Scanning

- Supplier Automation

What is Wave?

Okay, let’s talk about Wave.

Think of it like a helpful friend for your business money.

It lets you do things like send invoices and track what money comes in and goes out.

It can help you see the big picture of your business finances.

Also, explore our favorite Wave alternatives…

Our Take

Don’t settle for less! Join the over 2 million small businesses that rely on Wave’s powerful, free core accounting features to streamline their finances today.

Key Benefits

Wave’s strengths include:

- A 100% free core accounting plan.

- Serving over 2 million small businesses.

- Easy invoice creation and payment processing.

- No long-term contracts or warranties.

Pricing

- Starter Plan: $0month.

- Pro Plan: $19month.

Pros

Cons

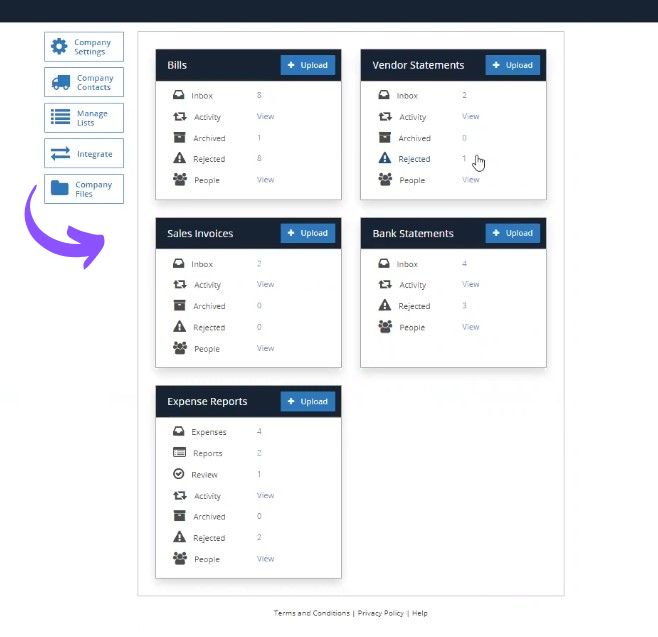

What is AutoEntry?

Okay, so let’s talk about AutoEntry.

It’s a tool that helps you get your paperwork into your computer without typing everything yourself.

Think of it like a smart helper for your bills and receipts.

It reads them and puts the info where it needs to go.

Also, explore our favorite AutoEntry alternatives…

Our Take

Ready to cut your bookkeeping time? AutoEntry processes over 28 million documents each year and offers up to 99% accuracy. Start today and join the over 210,000 businesses worldwide that have reduced their data entry hours by up to 80%!

Key Benefits

AutoEntry’s biggest win is saving hours of boring work.

Users often see up to 80% less time spent on manual data entry.

It promises up to 99% accuracy in its data extraction.

AutoEntry does not offer a specific money-back warranty, but its monthly plans allow you to cancel at any time.

- Up to 99% accuracy on data.

- Unlimited users on all paid plans.

- Pulls full line items from invoices.

- Easy mobile app for receipt snaps.

- 90 days for unused credits to roll over.

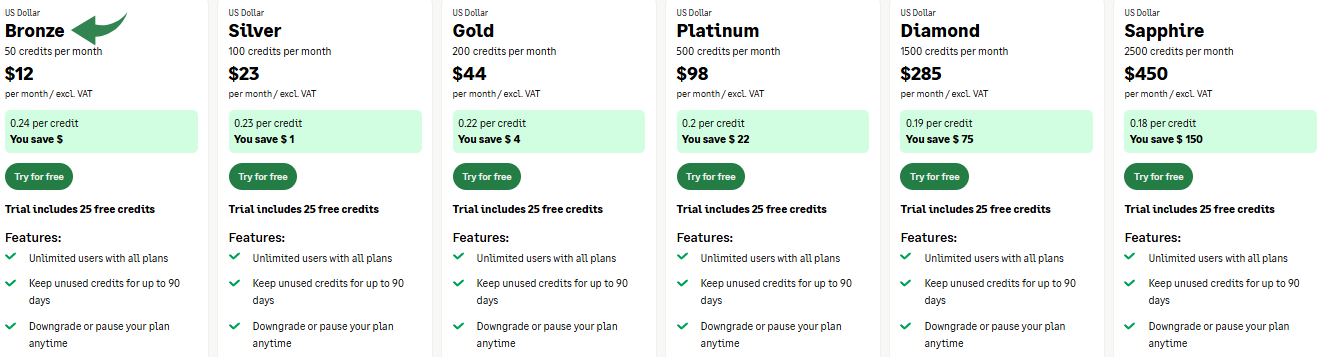

Pricing

- Bronze: $12/month.

- Silver: $23/month.

- Gold: $44/month.

- Platinum: $98/month.

- Diamond: $285/month.

- Sapphire: $450/month.

Pros

Cons

Feature Comparison

Selecting the right financial platform requires knowing its primary focus. The Wave review and AutoEntry reviews comparison will contrast a full free accounting software with a specialized data extraction service.

Helping you find the tool to resolve your most time-consuming accounting issues.

1. Core Purpose and Focus

- Wave Financial is a dedicated small business accounting software that provides a complete double-entry accounting system, including a general ledger. The free plan includes core accounting features for running a small service business or managing multiple companies.

- AutoEntry is an automation tool with a singular focus on eliminating manual data entry. It uses optical character recognition to extract any type of data from financial documents, like purchase invoices and bank statements, for auto publishing to other systems. It is not a complete accounting program.

2. Pricing and Subscription

- Wave’s free version (free platform) includes core accounting and unlimited invoices for all users. Its two plans (starter plan and paid pro plan) keep a low-cost structure, offering an excellent discounted rate for an independent contractor.

- AutoEntry pricing is based on a flexible pricing model, often charging per month or per document. There is no truly free plan, but the cost is justified by the significant time spent manual data entry it saves, a key point in many AutoEntry reviews.

3. Expense and Document Capture

- Wave offers basic receipt scanning via its mobile app, but digital receipt capture is an additional costs feature in the starter plan. Wave’s core method of track expenses is through directly linking bank accounts to import bank transactions.

- AutoEntry is built for high-volume document management. You can upload documents via a mobile phone, email, or desktop, and it accurately captures line items and details from bank statements and other financial documents. This is a major benefit for bookkeeping records.

4. Integration and Seamless Integration

- Wave’s strength is its built-in suite (Wave Payroll, payment processing). While Wave integrates with some other systems, it lacks the seamless integration with core accounting and payroll software that dedicated automation tools provide.

- AutoEntry’s core value is its seamless integration with popular accounting software (like QuickBooks and Xero). It is designed to be an automated bridge to quickly extract data and minimize the effort of transferring information.

5. Automation of Transactions

- Wave’s paid pro plan allows you to auto import bank transactions and auto merge them with your records. You can also set up recurring invoices and transactions automatically for simple recurring billing.

- AutoEntry automates the entire document-to-data process. You just upload the document, and the optical character recognition system automatically prepares the data for posting, saving a vast amount of time spent on manual data entry.

6. User and Access Management

- Wave offers unlimited users on its paid pro plan and supports multiple users for your business or multiple companies at once, giving peace of mind to small business accounting software users.

- AutoEntry also supports unlimited users, making it easy for bookkeepers to grant their clients access to upload documents. The process is focused on document flow rather than multi-user permissions within a full accounting ledger.

7. Security and Error Handling

- Wave uses multi factor authentication and strong encryption to protect your bank accounts and data. If you have an issue, you can consult their online help center.

- AutoEntry employs robust measures to protect itself from online attacks. A major concern for this type of service is a security service to protect their site, where several actions that could trigger a security block, including submitting a certain word or phrase or a sql command or malformed data, are blocked. If the action you just performed triggered the security solution with a cloudflare ray id found, you’ll be unable to access the page and must email the site owner with your ip to resolve the issue.

8. Invoicing and Payments

- Wave offers advanced invoicing features that allow you to accept online payments via credit card & bank payments. The credit card transaction fee applies, but the core invoicing software is free. You can also set up several automated payment reminders.

- AutoEntry does not have invoicing features and cannot receive online payments or manage payment reminders. Its focus is on the capture of documents related to expenses, not sales.

9. Payroll and Advanced Features

- Wave Payroll is an integrated, paid add-on that lets you pay your active employee or independent contractor and manages payroll processing. Wave is continually adding advanced features like Apple Pay payment options.

- AutoEntry is a single-focus tool. It does not offer payroll processing or other money management features like budget financial reports or billable hours tracking.

What to look for in an Accounting Software?

- Scalability: Can the software grow with any of your business?Scalability is about whether the tool can handle your future growth without forcing a complete switch. Wave makes this straightforward with a free starter plan that’s great for an independent contractor paid by a few clients. When you grow, you can move to a paid plan to unlock features like the ability to track multiple companies and add multiple users. A platform that offers tiered subscription levels shows it’s built to adapt to your changing needs.

- Support: What kind of help is available if you have questions?Good support is a key feature that provides confidence. A wave accounting review often highlights their extensive help center and online resources. Look for clear support channels and check if they commit to responding within a reasonable timeframe, such as a few business days. Reliable assistance is essential for maintaining accurate financial records and is why many recommend Wave for new small business owners.

- Ease of Use: Is it something you and your team can learn quickly? The simplicity of the user interface is vital. Wave makes financial management accessible for those without an accounting background. The design should be intuitive enough that you and your team members can quickly learn to track expenses and generate reports. The less time spent learning the software, the more time you can spend focusing on your business operations.

- Specific Needs: Does it handle the unique things your business does? Ensure the software meets your specialized requirements. For instance, if you rely on immediate income, check the speed of processing for credit card payments. You should be able to customize reports based on a date range for specific periods or easily separate personal finance transactions from your business finances within the same system.

- Security: How safe is your financial data with this software?Protecting your sensitive information, such as bank accounts and credit card transaction data, is paramount. Look for strong security measures like multi factor authentication across all subscription levels. Knowing that the software is committed to protecting your data provides peace of mind.

Final Verdict

Which is better, Wave or AutoEntry? It depends on your needs.

If you run a small business or have just started one, Wave is your best bet.

It’s a complete, free accounting system. It helps you manage all your basic money tasks.

But maybe you already use accounting software.

Think QuickBooks or Xero. And you have many paper receipts and invoices.

Then, AutoEntry is the clear winner. It’s a strong tool. It automates that messy data entry.

We’ve shown you both in detail.

Choose the one that fixes your business’s problems.

More of Wave

- Wave vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Wave vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Wave vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Wave vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Wave vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Wave vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Wave vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Wave vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Wave vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- Wave vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Wave vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Wave vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Wave vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Wave vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Wave vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

More of AutoEntry

- AutoEntry vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- AutoEntry vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- AutoEntry vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- AutoEntry vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- AutoEntry vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- AutoEntry vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- AutoEntry vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- AutoEntry vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- AutoEntry vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- AutoEntry vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- AutoEntry vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- AutoEntry vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- AutoEntry vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- AutoEntry vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- AutoEntry vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Is Wave accounting truly free for small business owners?

Yes, Wave accounting offers its core features, like invoicing and basic accounting, completely free. This makes it a popular accounting solution for many startups and very small businesses looking to manage their cash flow without upfront costs.

How does AutoEntry compare to Hubdoc for expense tracking?

AutoEntry and Hubdoc both aim to streamline expense tracking by automating data capture from receipts and invoices. AutoEntry often boasts broader software integrations and deeper data extraction capabilities, making it a strong choice for businesses needing detailed automation.

Can Wave accounting handle payroll?

Yes, Wave accounting does offer payroll services. However, this is an additional paid feature. It helps small business owners manage employee payments, direct deposits, and payroll tax filings, further consolidating their financial needs within one accounting solution.

Is AutoEntry a full accounting solution on its own?

No, AutoEntry is not a standalone accounting solution. It’s designed to integrate with existing accounting software like QuickBooks or Xero. Its primary function is to streamline data entry for expenses, invoices, and bills, making expense tracking easier for other systems.

Which tool is better for improving cash flow for small businesses?

For improving cash flow, both tools help, but in different ways. Wave accounting provides a full overview of your finances, helping you track money in and out. AutoEntry streamlines data entry, giving you quicker, more accurate financial data for better decision-making about your cash flow.