Feeling stuck trying to pick the right financial software for your business?

You’re not alone!

Many business owners struggle when comparing options like Quicken and NetSuite.

This guide will help you understand the key differences between Quicken vs NetSuite.

Overview

We put Quicken and NetSuite through their paces.

Our team tested features, ease of use, and what kind of business each helps most.

Want to take control of your finances? With Quicken, you can connect to thousands of financial institutions. Explore it for more!

Pricing: It has a free trial. The premium plan at $5.59/month.

Key Features:

- Budgeting Tools

- Bill Management

- Investment Tracking

Boost productivity by up to 78%! See how NetSuite’s automation tools can transform your workday. Explore it for more!

Pricing: It has a free trial. Custom pricing Plans Are Available.

Key Features:

- ERP Integration,

- CRM

- Advanced Analytics

What is Quicken?

So, you’re wondering about Quicken?

It’s like a tool that helps you see all your money stuff in one place.

Think of it as your digital money organizer.

It can help you track your bank accounts, bills, and even investments.

Pretty handy, right?

Also, explore our favorite Quicken alternatives…

Key Benefits

Quicken is a powerful tool for getting your financial life in order.

They boast over 40 years of experience and have been a #1 best-selling product.

Their various plans can connect to over 14,500 financial institutions.

You can also get a 30-day money-back guarantee to try it out risk-free.

- Connects with thousands of banks and credit cards.

- Creates detailed budgets.

- Tracks investments and net worth.

- Offers retirement planning tools.

Pricing

- Quicken Simplifi: $2.99/month.

Pros

Cons

What is NetSuite?

So, what’s the deal with NetSuite?

Think of it like a giant toolbox for your whole business.

It helps you with things like money, customers, and even what you have in stock.

It’s all in one place!

Also, explore our favorite Netsuite alternatives…

Our Take

Want enterprise power? NetSuite serves over 30,000 customers globally with its comprehensive platform. If you need full ERP integration and advanced analytics, choose NetSuite to drive growth.

Key Benefits

- It unites finance, CRM, and ERP into a single cloud system.

- It supports businesses in over 200 countries and 27 languages.

- Over 40,000 organizations use this scalable platform.

- You get built-in analytics for real-time visibility into your data.

Pricing

They offer custom pricing plans based on your requirements. Please contact them to get your perfect pricing package.

Pros

Cons

Feature Comparison

Making the move from managing personal finance to an enterprise resource planning (ERP) system requires careful consideration.

This quicken review versus netsuite reviews comparison examines the fundamental key features and value of each to help evaluate your financial future.

1. Core Purpose and Design Philosophy

- Quicken: The quicken brand is built on decades of personal finance software expertise. Quicken software’s functionality is designed for the individual user who needs to manage finances (business personal) and household budgets, often with a desktop download for windows or mac.

- NetSuite ERP is a business management software solution from oracle corporation, designed to manage business processes for medium sized businesses and large businesses across global accounting. It is a cloud based erp and fully integrated erp system.

2. Financial Management Scope

- Quicken offers basic accounting capabilities with a focus on monitoring bank balances and tracking spending. It includes specialized tools for rental properties and investment accounts analysis to gain a financial picture of your retirement and total wealth.

- Netsuite offers comprehensive financial management and cash management modules. Its accounting capabilities extend to revenue recognition, fixed assets management, and managing multiple currencies, providing a complete view of the business’s finances.

3. Enterprise Resource Planning (ERP) Modules

- Quicken: As a personal finance tool, quicken software does not include other core erp services. It lacks management software functionality for supply chain management, order management, or warehouse management.

- NetSuite: The oracle netsuite platform integrates all other modules like inventory management, customer relationship management (CRM), and professional services automation. This fully integrated approach links the sales team to financial processes.

4. Scalability and Multi-User Access

- Quicken has different versions (quicken deluxe, quicken premier) but is generally single-user software. Its focus on business personal finances means it does not scale easily for growing companies or large teams.

- NetSuite is highly scalable for large businesses. Netsuite users can be added easily, and the cloud based system accommodates increasing transaction volume and complexity across multiple business units.

5. Payroll and Workforce Management

- Quicken offers basic payroll features, often through third-party add-ons, suitable for a solo user or very small business. It does not include tools for workforce management or advanced employee benefits.

- Netsuite offers payroll management and human capital management modules that automate tax and compliance, supporting complex payroll needs for thousands of employees across different countries.

6. Data Visibility and Reporting

- Quicken: Provides financial reports and budgets for personal planning. You can create reports on bill tracking and category spending, but the analysis is basic and mainly for the single user.

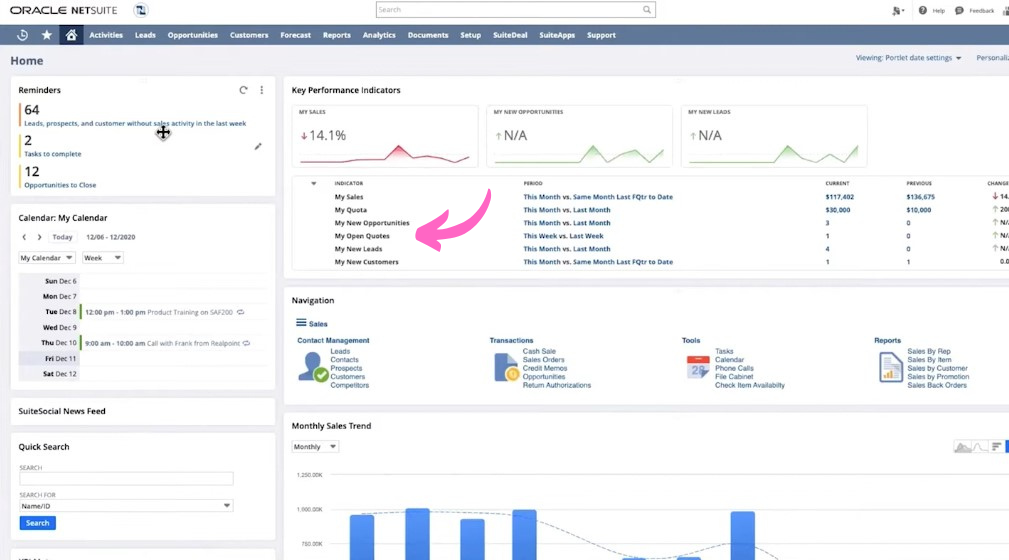

- NetSuite: Provides real time data and real time visibility through customizable dashboards and key performance indicators. NetSuite’s advanced audit trails and robust reporting enhance audit trails for compliance and strategy.

7. Business Transactions and Tools

- Quicken’s primary functionality is helping users connect bank accounts and track the balances. Its quicken home version is geared toward household payments and purchase records.

- NetSuite simplifies all core business processes like processing vendor bills, pay bills (accounts payable), and tracking accounts receivable. It netsuite offers order management and e commerce capabilities.

8. Ease of Use and Implementation

- Quicken: Known for its user friendly user interface and relative simplicity, making it ideal for the beginning user. The initial setup is straightforward. The aquiline capital partners ownership reflects its long-term stability in the market.

- NetSuite: Due to its vast functionality, NetSuite has a steeper learning curve, but the support provided and specialized consultants ensure proper implementation. Its modular approach allows you to access and purchase only the necessary other systems or other modules.

9. Security and Deployment

- Quicken offers tools to protect data through password control and local file backup. Its mobile app provides access to balances on the go, but the main data is often stored on the desktop.

- NetSuite: As a cloud based system, NetSuite protects customer data with enterprise-grade security and access controls. It provides superior data integrity and compliance features, which is why experts recommend netsuite for growing companies over netsuite alternatives.

What to look for in an Accounting Software?

Here are some extra things to think about:

- Scalability: Can the software grow with any of your business?Scalability depends entirely on your product choice. QuickBooks offers comprehensive business solutions with tiered subscription plans designed for small business owners and medium sized businesses to scale. Quicken Business, however, is primarily built for a single user and their business finances. The quicken brand does not provide the depth of features or custom integrations needed when your company outgrows a simple ledger.

- Support: What kind of help is available if you have questions?Both QuickBooks and Quicken provide support resources, but QuickBooks offers more extensive services, including dedicated live help and a vast network of accountant professionals. Timely help is crucial when managing complex tasks. You can often log into a dedicated help center to find the details you need, regardless of which other software you choose.

- Ease of Use: Is it something you and your team can learn quickly? Quicken Business is generally simpler to setup and use for basic business finances, largely because it is less complex. QuickBooks has a slight steeper learning curve due to its depth, but its streamlined workflows are intuitive for accounting tasks. You can easily log transactions and track expenses in either system.

- Specific Needs: Does it handle the unique things your business does? Evaluate the tools needed for your business finances. QuickBooks provides in depth functionality for sales tax, inventory, and managing expense reports. Quicken Business allows you to track expenses and manage rental properties and investment accounts alongside your personal finance in one view, a feature that QuickBooks does not match.

- Security: How safe is your financial data with this software?Both platforms utilize strong security measures to protect your financial data. QuickBooks is a cloud-based solution (Online), while Quicken is typically a desktop download where the primary data file is stored locally, giving the user more control over the security of the data.

- Reporting: Does it offer the reports you need? Good reports provide valuable insights? Reporting is where the in depth difference lies. QuickBooks provides robust, customizable financial statements (balance sheets, profit and loss) that give small business owners a complete view of their financial performance for a date range. Quicken Business financial statements are more basic, often focusing on simplified tax preparation reports.

Final Verdict

So, which one wins? Quicken or NetSuite? It truly depends on your business.

For personal money or tiny businesses, Quicken is best. It’s easy to use for simple tracking.

But if your business is growing, or you have employees and products, NetSuite is the choice.

It’s a strong, all-in-one system. It’s built for bigger companies.

We’ve looked closely at both.

You can trust our guide to pick what’s right for your money.

More of Quicken

- Quicken vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Quicken vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Quicken vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Quicken vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Quicken vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Quicken vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Quicken vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Quicken vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Quicken vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Quicken vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Quicken vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Quicken vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Quicken vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Quicken vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Quicken vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

More of NetSuite

- NetSuite vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- NetSuite vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- NetSuite vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- NetSuite vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- NetSuite vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- NetSuite vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- NetSuite vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- NetSuite vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- NetSuite vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- NetSuite vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- NetSuite vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- NetSuite vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- NetSuite vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- NetSuite vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

Frequently Asked Questions

Is Quicken good for small businesses?

Quicken works for very small businesses or freelancers. It helps with basic income and expense tracking. It’s not for businesses with many employees or complex needs.

Can NetSuite replace all my business software?

Yes, NetSuite can replace many tools. It handles accounting, sales, inventory, and more. It aims to be an all-in-one system for your whole business.

Which is cheaper, Quicken or NetSuite?

Quicken is much cheaper. It’s built for personal use or very small businesses. NetSuite costs a lot more. Its price depends on features and users.

Does NetSuite require a lot of training?

Yes, NetSuite can be complex. It has many features. Training is usually needed to use it well. Quicken is much simpler to learn quickly.

Can I upgrade from Quicken to NetSuite?

You can move your financial data. But it’s not a direct upgrade. NetSuite is a completely different system. You would migrate your information to the new platform.