Are you struggling to manage your money?

Especially with the growing mix of personal and business finances?

Choosing between options like Docyt and Quicken can be tough.

Let’s dive in and compare Docyt vs Quicken strengths to help you make the best choice.

Overview

We’ve thoroughly tested both Docyt and Quicken.

Evaluating their features, ease of use, and overall accounting capabilities.

This hands-on experience has led us to this detailed comparison, which will help you see which platform truly excels.

Tired of manual bookkeeping? Docyt AI automates data entry and reconciliation, saving users an average of 40 hours.

Pricing: It has a free trial. The premium plan starts at $299/month.

Key Features:

- Automated Reconciliation

- Streamlined Workflows

- User-Friendly Interface

Want to take control of your finances? With Quicken, you can connect to thousands of financial institutions. Explore it for more!

Pricing: It has a free trial. The premium plan at $5.59/month.

Key Features:

- Budgeting Tools

- Bill Management

- Investment Tracking

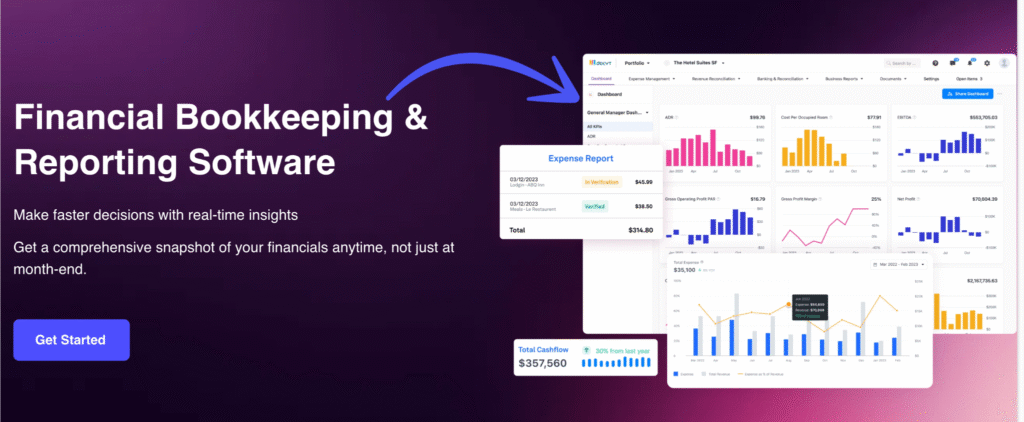

What is Docyt?

So, what exactly is Docyt? Think of it as your smart accounting assistant.

It uses artificial intelligence to handle many of the boring tasks.

It’s built for businesses, especially those that need to keep track of a lot of transactions.

Also, explore our favorite Docyt alternatives…

Key Benefits

- AI-Powered Automation: Docyt uses artificial intelligence. It automatically extracts data from financial documents. This includes details from over 100,000 vendors.

- Real-time Bookkeeping: Keeps your books updated in real-time. This provides an accurate financial picture at any moment.

- Document Management: Centralizes all financial documents. You can easily search and access them.

- Bill Pay Automation: Automates the bill payment process. Schedule and pay bills easily.

- Expense Reimbursement: Streamlines employee expense claims. Submit and approve expenses quickly.

- Seamless Integrations: Integrates with popular accounting software. This includes QuickBooks and Xero.

- Fraud Detection: Its AI can help flag unusual transactions. This adds a layer of security. There’s no specific warranty for the software, but continuous updates are provided.

Pricing

- Impact: $299/month.

- Advanced: $499/month.

- Advanced Plus: $799/month.

- Enterprise: $999/month.

Pros

Cons

What is Quicken?

So, you’ve heard of Quicken, right?

Quicken has been around for ages, helping people manage their money. Unlike Docyt, it really excels at personal finance.

Many people use it to get a full picture of their financial life, all in one spot.

Also, explore our favorite Quicken alternatives…

Key Benefits

Quicken is a powerful tool for getting your financial life in order.

They boast over 40 years of experience and have been a #1 best-selling product.

Their various plans can connect to over 14,500 financial institutions.

You can also get a 30-day money-back guarantee to try it out risk-free.

- Connects with thousands of banks and credit cards.

- Creates detailed budgets.

- Tracks investments and net worth.

- Offers retirement planning tools.

Pricing

- Quicken Simplifi: $2.99/month.

Pros

Cons

Feature Comparison

Let’s dive deeper into the core functionalities.

This section compares how Docyt and Quicken handle crucial accounting processes and financial operations, helping you match a platform to your specific needs.

1. AI Bookkeeping and Automation

- Docyt: Docyt‘s AI-powered platform is a game-changer for eliminating manual data entry. It uses AI bookkeeping and AI automation software to handle tedious tasks and automate back-office duties, freeing up your team. Docyt learns your business intricacies.

- Quicken: Quicken is a user-friendly tool. It helps automate bookkeeping duties by downloading transactions from bank accounts. However, it relies more on human input and lacks Docyt‘s deep, business-focused AI-powered accounting processes.

2. Real-Time Financial Reporting

- Docyt: Docyt provides real-time financial reports and instant financial status visibility. It is focused on offering real-time insights into key performance indicators. This is vital for strategic decision-making and ensuring constant financial control.

- Quicken: Quicken offers real-time reports on your cash flow and spending, which is excellent for personal finance software. The reporting is less tailored for complex business analysis, unlike Docyt‘s specialized tools.

3. Multi-Entity and Consolidation

- Docyt: Docyt excels at managing multiple businesses and business locations effortlessly. It can generate consolidated roll up reports, providing an aggregate view or individual financial statements. This makes constant financial control across your portfolio simple.

- Quicken: The Quicken business version can track multiple businesses using tags, but it lacks the robust, automated features for a consolidated roll up report. Its focus is more on managing separate accounts within a single file.

4. Expense and Receipt Capture

- Docyt: The platform handles expense management using automated receipt capture. This system reduces revenue accounting errors and is key to automating back office operations, making life easier for accountants.

- Quicken: Quicken offers receipt capture functionality, but it is less integrated and automated than Docyt‘s. It provides solid bill tracking and expense categorization, primarily for personal finance software.

5. Bill Pay and Cash Flow

- Docyt: Docyt‘s integrated bill pay feature is part of the automated accounting processes. It manages payments, reducing the time spent on these time-consuming tasks and giving you better cash flow visibility.

- Quicken: Quicken offers robust bill pay and bill tracking features. It gives you an overall financial picture and helps with planning your cash flow by managing upcoming payments from your bank accounts.

6. Investment Tracking

- Docyt: Docyt is designed for bookkeeping and automating accounting processes. It is not built to track investment accounts or deep personal financial planning. Its strength is in business locations management.

- Quicken: Quicken is a leader in tracking investment accounts. The Quicken Premier and Quicken Deluxe versions offer extensive tools for portfolio monitoring and retirement planning, which is a core feature of the Quicken brand.

7. Departmental Accounting

- Docyt: Docyt supports detailed departmental accounting. This helps you track key performance indicators and profitability across different parts of your business, offering real time insights for managers.

- Quicken: Quicken‘s features are more generalized, focusing on business personal income and expenses. It is not designed for the complex needs of multi-layered departmental accounting found in larger businesses.

8. Bank Reconciliation

- Docyt: Docyt‘s system includes automated bank reconciliation and revenue reconciliation. This significantly speeds up accounting processes and ensures constant financial control by quickly spotting discrepancies.

- Quicken: Quicken provides strong bank reconciliation tools. It reliably syncs bank accounts to help you reconcile your records, a feature the Quicken software has offered for decades.

9. Technology and Security

- Docyt: Docyt‘s ai powered platform uses cutting-edge AI for security and automation. It is a cloud-based app designed for the modern team of accountants.

- Quicken: The Quicken software has a long history and offers options for both desktop (windows and mac) and mobile app functionality. It maintains strong security to protect your financial picture.

What to Look for When Choosing Accounting Software?

- Key Features: Does it have the exact key features you need for your business finances?

- Target User: Is it built for individuals (Quicken Home) or accounting firms?

- AI Automation: How well does it automate tasks and handle time-consuming tasks like managing invoices?

- Multi-Entity: Can it track and consolidate accounts if you have rental properties or multiple businesses?

- User Interface: Is the user interface intuitive for your team (average user)?

- Subscription Cost: Is the recurring cost worth the value you get, especially looking at the future?

- Reporting: Does the software provide essential balances and sales reports from the beginning?

- AI Bookkeeper: Does it include an AI bookkeeper to speed up the month-end close and complete the month-end?

- Integrations: Does it work well with QuickBooks Online and other alternatives?

- Support: Is there good support if you run into problems?

Final Verdict

After looking closely, our pick depends on your goal.

For serious business accounting features and automation, Docyt wins.

It provides comprehensive cloud accounting and cuts manual work.

We use testing and verified user reviews to bring you authentic software comparisons.

Such as whether QuickBooks is a widely used tool, or compared to other tools.

For personal money or a small side hustle, Quicken is better.

It’s affordable and great for budgeting. So, what do you need most?

More of Docyt

When looking for the right accounting software, it’s helpful to see how different platforms stack up.

Here is a brief comparison of Docyt vs many of its alternatives.

- Docyt vs Puzzle IO: While both help with finances, Docyt focuses on AI-powered bookkeeping for businesses, while Puzzle IO simplifies invoicing and expenses for freelancers.

- Docyt vs Dext: Docyt offers a complete AI bookkeeping platform, whereas Dext specializes in automated data capture from documents.

- Docyt vs Xero: Docyt is known for its deep AI automation. Xero provides a comprehensive and user-friendly accounting system for general business needs.

- Docyt vs Synder: Docyt is an AI bookkeeping tool for back-office automation. Synder focuses on syncing e-commerce sales data with your accounting software.

- Docyt vs Easy Month End: Docyt is a full AI accounting solution. Easy Month End is a niche tool designed specifically to streamline and simplify the month-end closing process.

- Docyt vs RefreshMe: Docyt is a business accounting tool, whereas RefreshMe is a personal finance and budgeting app.

- Docyt vs Sage: Docyt uses a modern, AI-first approach. Sage is a long-standing company that offers a wide range of traditional and cloud-based accounting solutions.

- Docyt vs Zoho Books: Docyt focuses on AI accounting automation. Zoho Books is an all-in-one solution that offers a full suite of features at a competitive price.

- Docyt vs Wave: Docyt provides powerful AI automation for growing businesses. Wave is a free accounting platform best suited for freelancers and micro-businesses.

- Docyt vs Quicken: Docyt is built for business accounting. Quicken is primarily a tool for personal finance management and budgeting.

- Docyt vs Hubdoc: Docyt is a complete AI bookkeeping system. Hubdoc is a data capture tool that automatically collects and processes financial documents.

- Docyt vs Expensify: Docyt handles a full range of bookkeeping tasks. Expensify is a specialist in managing and reporting on employee expenses.

- Docyt vs QuickBooks: Docyt is an AI automation platform that enhances QuickBooks. QuickBooks is a comprehensive accounting software for all business sizes.

- Docyt vs AutoEntry: Docyt is a full-service AI bookkeeping solution. AutoEntry focuses specifically on document data extraction and automation.

- Docyt vs FreshBooks: Docyt uses advanced AI for automation. FreshBooks is a user-friendly solution popular with freelancers for its invoicing and time-tracking features.

- Docyt vs NetSuite: Docyt is an accounting automation tool. NetSuite is a full enterprise resource planning (ERP) system for large corporations.

More of Quicken

- Quicken vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Quicken vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Quicken vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Quicken vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Quicken vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Quicken vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Quicken vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Quicken vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Quicken vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Quicken vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Quicken vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Quicken vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Quicken vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Quicken vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Quicken vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Is Quicken good for small businesses?

Quicken, especially its Home & Business version, can work for very small businesses or freelancers. However, dedicated business accounting software is usually better for more complex operations.

What is the main difference between Docyt and Quicken?

Docyt focuses on AI-driven accounting automation for businesses, handling tasks like transaction categorization. Quicken is primarily for personal finance management, including budgeting and investment tracking.

Does Docyt integrate with other accounting software?

Yes, Docyt integrates with many existing accounting systems. This allows it to streamline workflows even if you’re using software like QuickBooks or other popular platforms.

Is Docyt similar to NetSuite?

NetSuite is a comprehensive cloud ERP system, much broader than Docyt. While Docyt specializes in accounting automation, NetSuite offers a comprehensive cloud ERP covering many business functions beyond just accounting.

How does Docyt’s AI work?

Docyt’s AI learns your business as you use it. It automates data extraction from documents and categorizes transactions, reducing manual effort and improving accuracy over time.