Month-end close often feels like a giant, messy puzzle, especially with manual accounting.

Endless spreadsheets, constant re-checking, and the dread of errors can drain your time and energy.

It’s a real headache that can hold your business back.

Let’s explore Easy Month End vs NetSuite, which option best fits your accounting needs.

Overview

We’ve spent considerable time with both traditional month-end processes and NetSuite’s capabilities.

Our comparison stems from hands-on testing and in-depth analysis of how each approach tackles the real-world demands of accounting.

This Easy month-end, join 1,257 users who saved an average of 3.5 hours and reduced errors by 15%. Start your free trial!

Pricing: It has a free trial. The premium plan starts at $45/month.

Key Features:

- Automated Reconciliation

- Streamlined Workflows

- User-Friendly Interface

Boost productivity by up to 78%! See how NetSuite’s automation tools can transform your workday. Explore it for more!

Pricing: It has a free trial. Custom pricing Plans Are Available.

Key Features:

- ERP Integration,

- CRM

- Advanced Analytics

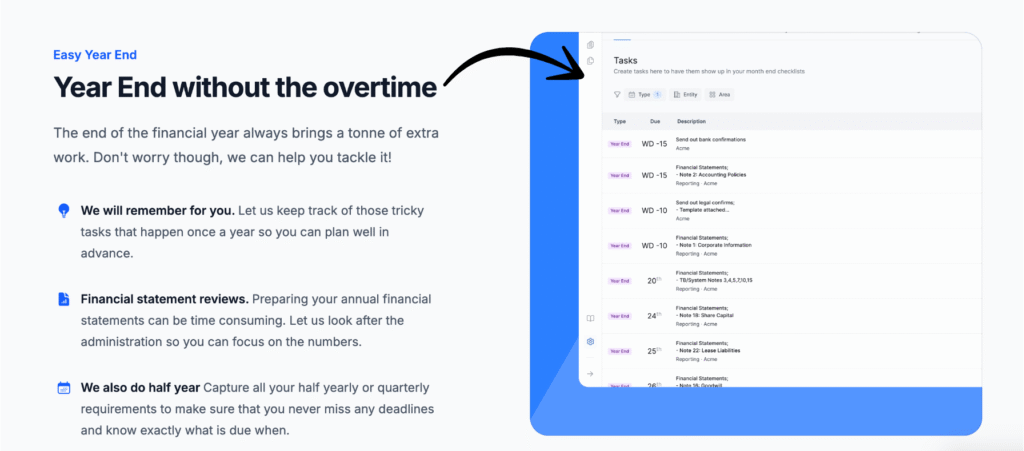

What is Easy Month End?

So, you’re looking for an easier way to close your books each month?

Easy Month End is a tool built just for that.

Think of it as your digital checklist and assistant for all those month-end tasks.

Also, explore our favorite Easy Month End alternatives…

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

What is NetSuite?

So, what is NetSuite? It’s a huge software system for businesses.

Think of it as an all-in-one platform. It handles your accounting, inventory, and even customer relationships.

It’s designed for bigger companies. It aims to connect all your business operations.

Also, explore our favorite NetSuite alternatives…

Our Take

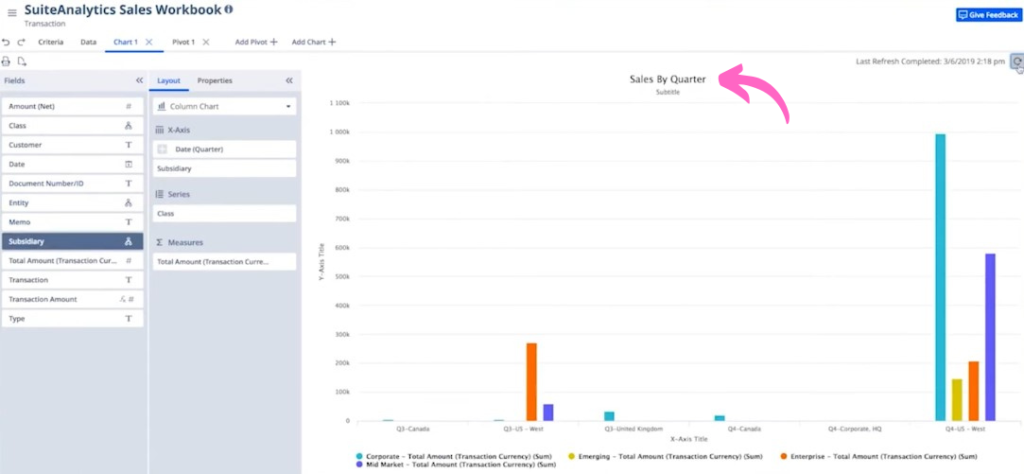

Want enterprise power? NetSuite serves over 30,000 customers globally with its comprehensive platform. If you need full ERP integration and advanced analytics, choose NetSuite to drive growth.

Key Benefits

- It unites finance, CRM, and ERP into a single cloud system.

- It supports businesses in over 200 countries and 27 languages.

- Over 40,000 organizations use this scalable platform.

- You get built-in analytics for real-time visibility into your data.

Pricing

They offer custom pricing plans based on your requirements. Please contact them to get your perfect pricing package.

Pros

Cons

Feature Comparison

It’s time for a deeper dive.

Your finance team deserves a tool that simplifies their workflow management and makes their lives easier.

Let’s compare how these two platforms handle key financial processes and business solutions in detail.

1. Workflow and Task Management

- Easy Month End: This cloud-based management software is a dedicated workflow management tool. It provides a single platform to handle all your finance team tasks. You can assign tasks, track progress, and get faster balance sheet reconciliations. It’s a structured approach that makes your first month-end a total breeze.

- NetSuite: As a full enterprise resource planning (ERP) system, NetSuite includes workflow management but on a much broader scale. NetSuite ERP allows you to automate entire business processes, from order management to supply chain. While it helps, its workflow management is just one part of a complex system.

2. Team Collaboration

- Easy Month End: This is where this management software shines. It’s built for team collaboration. Your team works from a shared single platform where you can leave comments on tasks, get real-time sign-offs, and provide auditors with audit evidence. This eliminates delays and hassle.

- NetSuite: NetSuite offers team collaboration through its fully integrated platform. NetSuite users can access customer data, vendor bills, and expense reports from a single source. Additionally, its cloud-based ERP nature allows multiple business units to work together, but it’s not as purpose-built for the smoother month-end close workflow as Easy Month End.

3. Financial Close and Reporting

- Easy Month End: The ability to handle month-end, quarter-end, and year-end tasks is its core strength. You can automatically track all your reconciliations and collect audit evidence in one place. It helps you reconcile your accounts without manual confirmations, but it relies on an external accounting software for the underlying bookkeeping.

- NetSuite: NetSuite’s accounting capabilities are designed to enhance audit trails and produce comprehensive financial statements. It centralizes financial processes, providing real-time visibility into your business’s finances. As a full clERP based erp, it offers a fully integrated general ledger, cash management, and accounts receivable to get an accurate financial performance overview.

4. Integration and Connectivity

- Easy Month End: This management software is designed to be a standalone tool for the month-end close process. While you can upload and import data from Excel or other files, it lacks the seamless integration with other software or other systems that a larger ERP system provides.

- NetSuite: Oracle Corporation built NetSuite ERP for seamless integration. It can integrate with other modules like customer relationship management (crm), warehouse management, and supply chain management. This creates a complete business management software that gives you a single platform to access all your data.

5. Ad Hoc and Contracts Management

- Easy Month End: Easy Month End allows you to create ad hoc tasks for one-off projects. You can leave comments on a specific ticket, ensuring your team works efficiently on unexpected finance team tasks. It helps manage any stress and delays from unplanned work.

- NetSuite: NetSuite has features for contracts and project management, which are part of its professional services automation (PSA) and human capital management (HCM) modules. This goes far beyond simple task management and is designed to handle detailed workforce management and payroll management for large entities.

6. Expense and Payment Management

- Easy Month End: While it helps organize the tasks for expense reports and vendor bills, it doesn’t process the money or pay vendors directly. You can collect audit evidence and track the sign-offs for these tasks, but the actual bank transfer happens in other systems.

- NetSuite: NetSuite has native capabilities to track expenses and process vendor bills. It can manage bank transfers, automate payment options, and provide a full audit trail of every transaction. This level of control is essential for compliance in large businesses.

7. Global Accounting and Multi-Currency

- Easy Month End: Supports multiple currencies within its checklists and reports to handle global operations. It helps organize the month-end close for companies with multiple entities by having a separate checklist for each.

- NetSuite: NetSuite’s global accounting features are a key selling point. The Oracle Corporation built NetSuite to handle multiple currencies and localized tax codes for business units around the world. This is crucial for growing companies operating internationally.

8. User Experience and Accessibility

- Easy Month End: It’s a user-friendly interface designed for accountants. It focuses on clarity and simplicity, ensuring your finance team can access and use it without extensive training. You can import data from Excel easily for a breeze of the first month-end.

- NetSuite: While NetSuite reviews its platform to be user-friendly, its vast number of features can be overwhelming for new users. The system offers access to real-time data through key performance indicators (KPIs) and dashboards, but learning to navigate all your reconciliations can take time.

9. Price and Scalability

- Easy Month End: It has a clear and affordable pricing structure. It’s a great solution for small business owners and medium-sized businesses that need to cancel at any time with no contracts. You can upload and review your reconciliations and answer any comments with ease.

- NetSuite: NetSuite is a significant investment. The cost is high, but it’s built to scale with large businesses. It offers custom integrations and other modules for e commerce, human capital management, professional services automation, and more. Netsuite reviews show it to be a powerful, if expensive, enterprise resource planning system.

What to Look for When Choosing Accounting Software?

- Your Business Size: Does the software fit your current business size and future growth? Small businesses have different needs from large enterprises.

- Specific Needs: Do you need a focused accounting solution like Easy Month End for just the month-end close process, or a full ERP system like Oracle NetSuite?

- Budget: Can you afford the upfront and ongoing costs? Consider both licensing and implementation.

- Ease of Use: How quickly can your accounting team and finance team learn and adapt to the workflow?

- Integration: Will it work well with your existing systems, or will it replace them? Think vs. QuickBooks, if that’s your current system.

- Automation Levels: How much automation do you need for transaction processing, journal entries, and revenue recognition?

- Reporting: Does it provide the financial data insights and balance sheet reports you need for decision-making?

Final Verdict

For most service-based businesses and smaller operations aiming to streamline their month-end.

We pick Easy Month End.

It’s simple, affordable, and perfect for that specific month-end close process headache.

It won’t manage every invoice or all your financial planning, but it gets the job done.

However, if you’re a larger company needing full cloud accounting and management software that handles everything,

NetSuite is the top choice.

We’ve seen how these tools perform, so you can choose what’s best for your accounting team.

More of Easy Month End

Here is a brief comparison of Easy Month End with some of the leading alternatives.

- Easy Month End vs Puzzle io: While Puzzle.io is for startup accounting, Easy Month End focuses specifically on streamlining the close process.

- Easy Month End vs Dext: Dext is primarily for document and receipt capture, whereas Easy Month End is a comprehensive month-end close management tool.

- Easy Month End vs Xero: Xero is a full accounting platform for small businesses, while Easy Month End provides a dedicated solution for the close process.

- Easy Month End vs Synder: Synder specializes in integrating e-commerce data, unlike Easy Month End which is a workflow tool for the entire financial close.

- Easy Month End vs Docyt: Docyt uses AI for bookkeeping and data entry, while Easy Month End automates the steps and tasks of the financial close.

- Easy Month End vs RefreshMe: RefreshMe is a financial coaching platform, which is different from Easy Month End’s focus on close management.

- Easy Month End vs Sage: Sage is a large-scale business management suite, while Easy Month End offers a more specialized solution for a critical accounting function.

- Easy Month End vs Zoho Books: Zoho Books is an all-in-one accounting software, whereas Easy Month End is a purpose-built tool for the month-end process.

- Easy Month End vs Wave: Wave provides free accounting services for small businesses, while Easy Month End offers a more advanced solution for close management.

- Easy Month End vs Quicken: Quicken is a personal finance tool, making Easy Month End a better choice for businesses needing to manage a month-end close.

- Easy Month End vs Hubdoc: Hubdoc automates document collection, but Easy Month End is designed to manage the full close workflow and team tasks.

- Easy Month End vs Expensify: Expensify is an expense management software, which is a different function than Easy Month End’s core focus on the financial close.

- Easy Month End vs QuickBooks: QuickBooks is a comprehensive accounting solution, while Easy Month End is a more specific tool for managing the month-end close itself.

- Easy Month End vs AutoEntry: AutoEntry is a data capture tool, whereas Easy Month End is a complete platform for task and workflow management during the close.

- Easy Month End vs FreshBooks: FreshBooks is for freelancers and small businesses, while Easy Month End offers a dedicated solution for the month-end close.

- Easy Month End vs NetSuite: NetSuite is a full-featured ERP system, which is broader in scope than Easy Month End’s specialized focus on the financial close.

More of NetSuite

- NetSuite vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- NetSuite vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- NetSuite vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- NetSuite vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- NetSuite vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- NetSuite vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- NetSuite vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- NetSuite vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- NetSuite vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- NetSuite vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- NetSuite vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- NetSuite vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- NetSuite vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- NetSuite vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

Frequently Asked Questions

Is Easy Month End a full accounting software like NetSuite?

No, Easy Month End is a specialized tool for managing the month-end close process. NetSuite is a comprehensive ERP system that handles all aspects of financial management and business processes.

Can small businesses use NetSuite?

While NetSuite is powerful, its complexity and cost often make it less suitable for most small businesses. Easy Month End is typically a more practical accounting solution for their specific business needs.

How does automation differ between the two?

Easy Month End automates task tracking and reminders for your accounting team. NetSuite offers deeper automation across financial data entry, journal entries, and extensive workflow integration.

Does Easy Month End handle invoice processing?

No, Easy Month End does not process individual invoice or transaction data. It focuses on organizing the close checklist tasks required to finalize accounts, not the underlying bookkeeping.

Which is better for financial planning?

NetSuite offers robust modules for financial planning and budget management as part of its ERP system. Easy Month End does not directly support financial planning; it’s solely for the month-end close process.