Tired of month-end closing feeling like a never-ending puzzle?

You’re not alone!

Many businesses struggle to make this crucial process smooth and efficient.

Choosing the right accounting software can make a huge difference.

We’re diving into two popular contenders: Easy Month End vs Docyt.

Overview

We’ve put both Easy Month End and Docyt through their paces.

Exploring their features and ease of use.

Our hands-on testing focused on key areas like data entry, reporting, and month-end closing workflows to bring you a clear comparison.

This Easy month-end, join 1,257 users who saved an average of 3.5 hours and reduced errors by 15%. Start your free trial!

Pricing: It has a free trial. The premium plan starts at $45/month.

Key Features:

- Automated Reconciliation

- Streamlined Workflows

- User-Friendly Interface

Tired of manual bookkeeping? Docyt AI automates data entry and reconciliation, saving users an average of 40 hours.

Pricing: It has a free trial. The premium plan starts at $299/month.

Key Features:

- Automated Reconciliation

- Streamlined Workflows

- User-Friendly Interface

What is Easy Month End?

So, Easy Month End, what’s it all about?

Well, it’s accounting software designed to make your month-end close, well, easier!

It aims to streamline tasks and reduce the stress often associated with this period.

Also, explore our favorite Easy Month End alternatives…

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

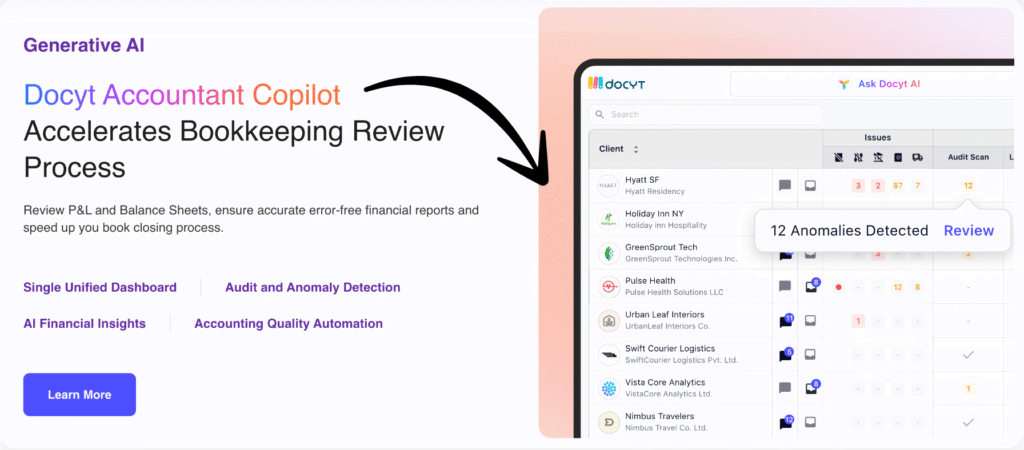

What is Docyt?

Alright, let’s talk about Docyt.

This software takes a different approach.

It leans heavily on AI to automate many accounting tasks. Think of it as a smart assistant for your finances.

Also, explore our favorite Docyt alternatives…

Key Benefits

- AI-Powered Automation: Docyt uses artificial intelligence. It automatically extracts data from financial documents. This includes details from over 100,000 vendors.

- Real-time Bookkeeping: Keeps your books updated in real-time. This provides an accurate financial picture at any moment.

- Document Management: Centralizes all financial documents. You can easily search and access them.

- Bill Pay Automation: Automates the bill payment process. Schedule and pay bills easily.

- Expense Reimbursement: Streamlines employee expense claims. Submit and approve expenses quickly.

- Seamless Integrations: Integrates with popular accounting software. This includes QuickBooks and Xero.

- Fraud Detection: Its AI can help flag unusual transactions. This adds a layer of security. There’s no specific warranty for the software, but continuous updates are provided.

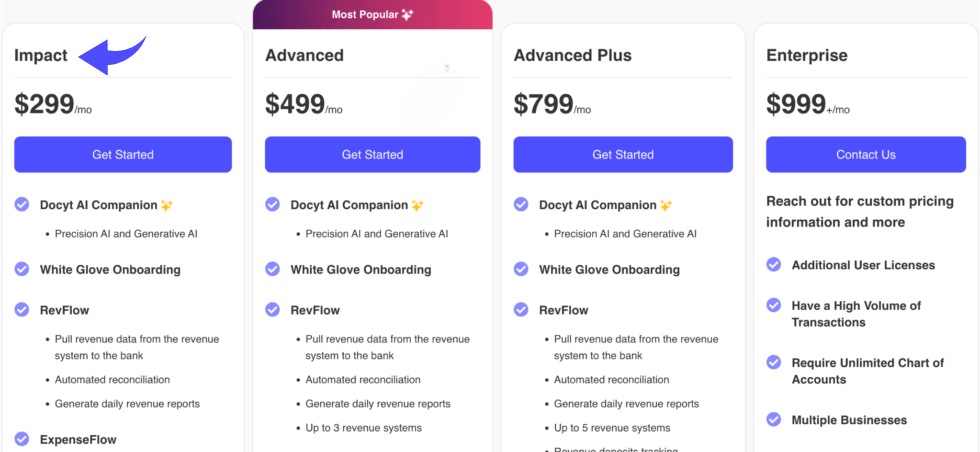

Pricing

- Impact: $299/month.

- Advanced: $499/month.

- Advanced Plus: $799/month.

- Enterprise: $999/month.

Pros

Cons

Feature Comparison

Let’s dig into the details and compare the core features of each platform.

This will help you see how they approach the same finance team tasks and which one might make your finance team more efficient.

1. Month-End Process Management

- Docyt: Docyt‘s AI-driven approach automates much of the month-end close process. It handles time-consuming tasks like data entry and reconciliation, helping to ensure a smoother month-end close. This can be a game-changer for a finance team that wants to focus on higher-level tasks.

- Easy Month End: This platform is built around a customizable checklist to manage the month-end process. It provides a clear, step-by-step approach to help your finance team follow a structured process and ensures nothing falls through the cracks.

2. Balance Sheet Reconciliation

- Docyt: Docyt uses AI bookkeeping to automate reconciliation. It connects with your bank accounts and can automatically match transactions, making faster balance sheet reconciliations and providing real-time reports on your financial health.

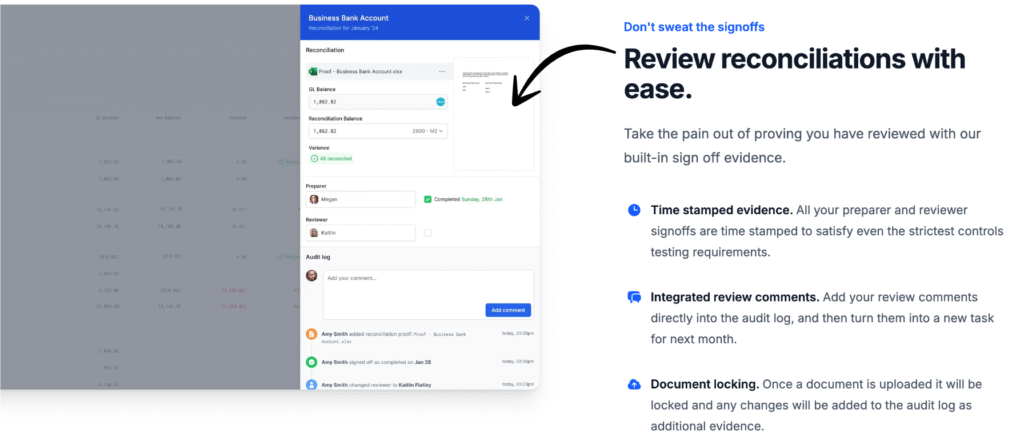

- Easy Month End: This software gives your finance team a dedicated space to handle all your reconciliations. You can upload supporting documents and get the necessary sign-offs, making the process of creating audit evidence much simpler.

3. Workflow Management and Team Collaboration

- Docyt: Docyt offers a unified platform where a finance team can collaborate. It has features for assigning tasks and communicating, which help a team work together on different aspects of a bill payment or other financial tasks.

- Easy Month End: This platform is a powerful workflow management tool. You can assign tasks, set deadlines, and leave comments directly within the system. It helps with team collaboration and tracking progress for your finance team to get a clear overview of the month-end close process.

4. Audit & Compliance

- Docyt: Docyt‘s ai automation software maintains a robust audit trail, simplifying the process for auditors. The system stores all documents and data in one place, making it a single platform for collecting audit evidence without delays.

- Easy Month End: The platform is designed to make it a hassle-free experience to collect audit evidence. It automatically creates a detailed record of every change and approval, which is great for auditors during the quarter-end or year-end close.

5. AI Bookkeeping & Automation

- Docyt: This is where Docyt truly shines. Its AI bookkeeping capabilities are a game-changer. It automates tasks like receipt capture and bill pay, saving your team a massive amount of time by eliminating manual data entry.

- Easy Month End: While it offers some automation, its primary focus is on managing the workflow, not automating back office tasks like Docyt’s AI-powered platform. It helps organize the manual effort rather than replacing it.

6. Multi-Entity Management

- Docyt: Docyt learns the business intricacies and has the ability to generate consolidated roll up reports. It also allows you to manage multiple businesses and get an instant financial status visibility across all your business locations effortlessly.

- Easy Month End: While it can handle multiple entities, its strength lies more in managing the workflow for each one. It doesn’t have the same robust, AI-driven capability to generate consolidated roll up reports on a granular level.

7. Reporting & Analytics

- Docyt: Docyt provides real-time reports and analytics, giving you instant financial status visibility. Its AI can track key performance indicators, which helps with financial management and strategic planning.

- Easy Month End: This software offers customizable reporting that gives you a clear overview of your progress and completed tasks. It helps you see where the team works best and what’s causing delays.

8. Financial Operations & Financial Planning

- Docyt: By automating bookkeeping duties, Docyt makes your entire financial operations more efficient. The ai bookkeeper handles tedious tasks, leaving the finance team more time for financial planning.

- Easy Month End: This platform’s main focus is on the close process itself. It helps with the organization and tracking of tasks, which can assist in financial planning, but it’s not its primary function.

9. Team Management

- Docyt: Docyt offers great team management features. You can assign tasks and manage user access, allowing you to give different team members the ability to handle specific financial workflows.

- Easy Month End: Its workflow management is a form of team management. You can assign tasks, track progress, and see who’s on track, which gives a finance team the ability to identify bottlenecks.

What to Look for When Choosing Accounting Software?

- It should make your finance team’s life easier and lead to a more efficient finance team.

- Look for features that provide real-time insights and real-time financial reports, so you can stay ahead with strategic decision-making.

- The software should help with expense management for all your expenses and invoices, and offer automated bank reconciliation to manage your bank transfers.

- Check if it helps in ensuring constant financial control and spotting revenue accounting errors before they become a problem.

- The platform needs to have the ability to import and reconcile data, making the first month-end a breeze.

- A good system helps you handle month-end with features like manual confirmations and a clear ad hoc process for tasks.

- It’s important that the software streamlines accounting processes and helps with revenue reconciliation and departmental accounting.

- Look for an app that fits your specific needs and provides the security to protect your individual financial statements.

- The best software offers accounting automation to eliminate tedious tasks and make your life easier.

- Find a tool that makes it easy for your accounting firms to access and find all the necessary audit evidence.

- Ensure it can help you get a handle on your cash flow and improve your overall profitability.

- The system should make it simple for a preparer to get all the data, with features like Outlook integration.

- Make sure you can cancel or change your plan easily as your human needs expand.

- A good solution should have high efficiency and help reduce common errors and delays.

- It should provide answers to your questions and make your business lives easier.

- The software should work well with tools you already use, like QuickBooks Online or a ticket system for issues.

- The finance team deserves a single platform that simplifies their daily contracts and tasks.

- Look for a platform that has a high average user satisfaction.

Final Verdict

So, we looked closely at Easy Month End and Docyt.

Both have good things going for them.

But if we had to pick one, we’d lean towards Docyt. Why?

Plus, getting real-time financial updates without much effort is a big win.

If you’re a small business wanting to save time and see your money situation clearly.

Docyt feels like the better choice.

We’ve spent time testing these tools, so trust us on this one!

More of an Easy Month End

Here is a brief comparison of Easy Month End with some of the leading alternatives.

- Easy Month End vs Puzzle io: While Puzzle.io is for startup accounting, Easy Month End focuses specifically on streamlining the close process.

- Easy Month End vs Dext: Dext is primarily for document and receipt capture, whereas Easy Month End is a comprehensive month-end close management tool.

- Easy Month End vs Xero: Xero is a full accounting platform for small businesses, while Easy Month End provides a dedicated solution for the close process.

- Easy Month End vs Synder: Synder specializes in integrating e-commerce data, unlike Easy Month End which is a workflow tool for the entire financial close.

- Easy Month End vs Docyt: Docyt uses AI for bookkeeping and data entry, while Easy Month End automates the steps and tasks of the financial close.

- Easy Month End vs RefreshMe: RefreshMe is a financial coaching platform, which is different from Easy Month End’s focus on close management.

- Easy Month End vs Sage: Sage is a large-scale business management suite, while Easy Month End offers a more specialized solution for a critical accounting function.

- Easy Month End vs Zoho Books: Zoho Books is an all-in-one accounting software, whereas Easy Month End is a purpose-built tool for the month-end process.

- Easy Month End vs Wave: Wave provides free accounting services for small businesses, while Easy Month End offers a more advanced solution for close management.

- Easy Month End vs Quicken: Quicken is a personal finance tool, making Easy Month End a better choice for businesses needing to manage a month-end close.

- Easy Month End vs Hubdoc: Hubdoc automates document collection, but Easy Month End is designed to manage the full close workflow and team tasks.

- Easy Month End vs Expensify: Expensify is an expense management software, which is a different function than Easy Month End’s core focus on the financial close.

- Easy Month End vs QuickBooks: QuickBooks is a comprehensive accounting solution, while Easy Month End is a more specific tool for managing the month-end close itself.

- Easy Month End vs AutoEntry: AutoEntry is a data capture tool, whereas Easy Month End is a complete platform for task and workflow management during the close.

- Easy Month End vs FreshBooks: FreshBooks is for freelancers and small businesses, while Easy Month End offers a dedicated solution for the month-end close.

- Easy Month End vs NetSuite: NetSuite is a full-featured ERP system, which is broader in scope than Easy Month End’s specialized focus on the financial close.

More of Docyt

When looking for the right accounting software, it’s helpful to see how different platforms stack up.

Here is a brief comparison of Docyt vs many of its alternatives.

- Docyt vs Puzzle IO: While both help with finances, Docyt focuses on AI-powered bookkeeping for businesses, while Puzzle IO simplifies invoicing and expenses for freelancers.

- Docyt vs Dext: Docyt offers a complete AI bookkeeping platform, whereas Dext specializes in automated data capture from documents.

- Docyt vs Xero: Docyt is known for its deep AI automation. Xero provides a comprehensive and user-friendly accounting system for general business needs.

- Docyt vs Synder: Docyt is an AI bookkeeping tool for back-office automation. Synder focuses on syncing e-commerce sales data with your accounting software.

- Docyt vs Easy Month End: Docyt is a full AI accounting solution. Easy Month End is a niche tool designed specifically to streamline and simplify the month-end closing process.

- Docyt vs RefreshMe: Docyt is a business accounting tool, whereas RefreshMe is a personal finance and budgeting app.

- Docyt vs Sage: Docyt uses a modern, AI-first approach. Sage is a long-standing company that offers a wide range of traditional and cloud-based accounting solutions.

- Docyt vs Zoho Books: Docyt focuses on AI accounting automation. Zoho Books is an all-in-one solution that offers a full suite of features at a competitive price.

- Docyt vs Wave: Docyt provides powerful AI automation for growing businesses. Wave is a free accounting platform best suited for freelancers and micro-businesses.

- Docyt vs Quicken: Docyt is built for business accounting. Quicken is primarily a tool for personal finance management and budgeting.

- Docyt vs Hubdoc: Docyt is a complete AI bookkeeping system. Hubdoc is a data capture tool that automatically collects and processes financial documents.

- Docyt vs Expensify: Docyt handles a full range of bookkeeping tasks. Expensify is a specialist in managing and reporting on employee expenses.

- Docyt vs QuickBooks: Docyt is an AI automation platform that enhances QuickBooks. QuickBooks is a comprehensive accounting software for all business sizes.

- Docyt vs AutoEntry: Docyt is a full-service AI bookkeeping solution. AutoEntry focuses specifically on document data extraction and automation.

- Docyt vs FreshBooks: Docyt uses advanced AI for automation. FreshBooks is a user-friendly solution popular with freelancers for its invoicing and time-tracking features.

- Docyt vs NetSuite: Docyt is an accounting automation tool. NetSuite is a full enterprise resource planning (ERP) system for large corporations.

Frequently Asked Questions

How does Docyt vs Easy Month End handle bank reconciliation?

Docyt uses AI to automate transaction matching from bank statements, while Easy Month End offers tools for manual or semi-automated reconciliation.

Which is better for a very small business with limited bookkeeping needs?

Easy Month End’s simpler interface and lower starting price might be preferable for very basic bookkeeping requirements.

Does Docyt vs Easy Month End integrate with other software?

Docyt boasts a wider range of integrations (over 50), while Easy Month End has fewer, though it still covers essential tools.

What kind of customer support do they offer?

Both offer support, but response times and availability can vary. Check recent reviews for the most up-to-date information.

Is Docyt vs Easy Month End suitable for non-accountants?

Docyt’s AI aims to simplify processes for non-accountants, while Easy Month End’s user-friendly design also caters to those without deep accounting knowledge.