Are you a small business owner feeling overwhelmed by managing your money?

Imagine wasting hours every week on manual data entry.

We’ll break down their features, pricing, and what makes them tick.

This guide dives deep into Docyt vs Wave, two popular accounting software options.

Overview

We’ve spent time thoroughly testing both Docyt and Wave.

Putting their features, ease of use, and overall value through their paces to bring you a straightforward comparison.

Tired of manual bookkeeping? Docyt AI automates data entry and reconciliation, saving users an average of 40 hours.

Pricing: It has a free trial. The premium plan starts at $299/month.

Key Features:

- Automated Reconciliation

- Streamlined Workflows

- User-Friendly Interface

Over 4 million small businesses trust Wave to manage their finances. Explore Wave’s plans and find the right fit.

Pricing: Free plan available. Paid plan starts at $19/month.

Key Features:

- Invoicing

- Banking

- Payroll add-on.

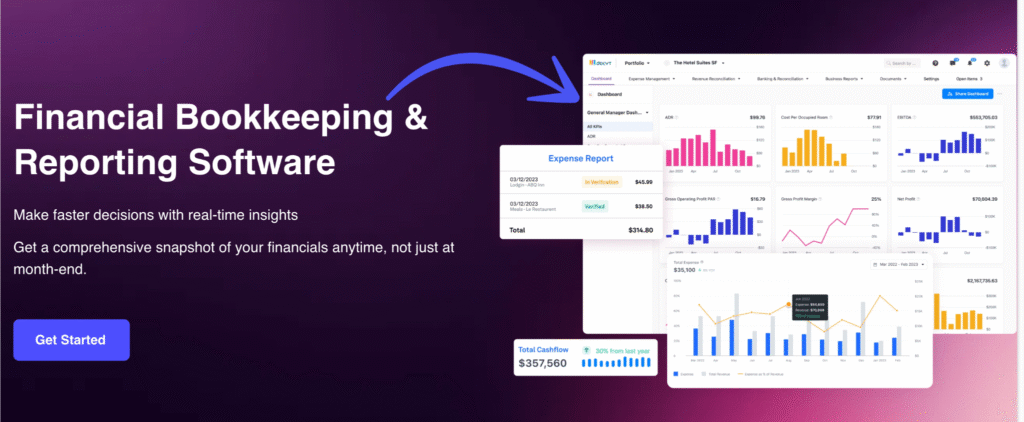

What is Docyt?

So, what exactly is Docyt?

Think of it as your super-smart financial assistant.

It uses artificial intelligence to help you manage your money.

Also, explore our favorite Docyt alternatives…

Key Benefits

- AI-Powered Automation: Docyt uses artificial intelligence. It automatically extracts data from financial documents. This includes details from over 100,000 vendors.

- Real-time Bookkeeping: Keeps your books updated in real-time. This provides an accurate financial picture at any moment.

- Document Management: Centralizes all financial documents. You can easily search and access them.

- Bill Pay Automation: Automates the bill payment process. Schedule and pay bills easily.

- Expense Reimbursement: Streamlines employee expense claims. Submit and approve expenses quickly.

- Seamless Integrations: Integrates with popular accounting software. This includes QuickBooks and Xero.

- Fraud Detection: Its AI can help flag unusual transactions. This adds a layer of security. There’s no specific warranty for the software, but continuous updates are provided.

Pricing

- Impact: $299/month.

- Advanced: $499/month.

- Advanced Plus: $799/month.

- Enterprise: $999/month.

Pros

Cons

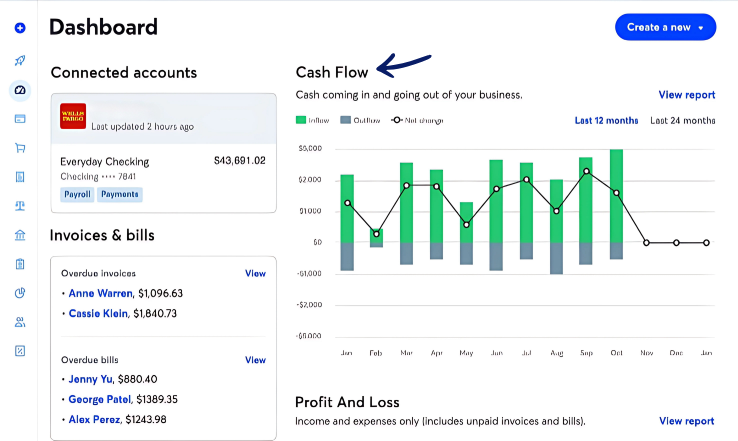

What is Wave?

So, what about Wave?

This is a popular choice for many small businesses, especially freelancers and solo entrepreneurs.

It offers a lot of essential accounting features for free.

Also, explore our favorite Wave alternatives…

Our Take

Don’t settle for less! Join the over 2 million small businesses that rely on Wave’s powerful, free core accounting features to streamline their finances today.

Key Benefits

Wave’s strengths include:

- A 100% free core accounting plan.

- Serving over 2 million small businesses.

- Easy invoice creation and payment processing.

- No long-term contracts or warranties.

Pricing

- Starter Plan: $0month.

- Pro Plan: $19month.

Pros

Cons

Feature Comparison

Choosing the right accounting software can make your life easier.

We’ve compared Docyt vs Wave to help you decide.

Our analysis looks at key features to help you find a great accounting solution.

1. Automation & AI

- Docyt: This platform’s strength is its AI automation software. Docyt AI handles time-consuming tasks and tedious tasks like a human. It works to significantly reduce revenue accounting errors, which helps ensure constant financial control.

- Wave: Wave offers basic automations to make things easier, such as auto-importing bank transactions and syncing with your bank accounts. It does not have the advanced AI bookkeeping features that Docyt provides.

2. Invoicing

- Docyt: Docyt handles invoicing as part of its larger financial operations workflow. The focus is on automating the bill pay and accounts receivable process.

- Wave: Wave is known for its free accounting software. It has strong invoicing features, allowing you to create and send unlimited recurring invoices. This is a key feature for small business owners.

3. Financial Reporting

- Docyt: Docyt’s AI-powered platform provides instant financial status visibility. It helps generate consolidated roll up and individual financial statements for all business locations effortlessly. You get real-time insights to help with strategic decision-making.

- Wave: Wave offers standard financial reports like Profit & Loss. It gives you a good look at your cash flow and is enough for most small business owners. It doesn’t have the deep-dive reporting for multiple companies.

4. Expense & Receipt Management

- Docyt: Docyt is a game-changer for expense management, eliminating manual data entry. It uses digital receipt capture to automatically pull data, ensuring constant financial control.

- Wave: Wave lets you track expenses and has a digital receipt capture tool on its app. However, it requires more manual work than Docyt, as you have to classify transactions automatically.

5. Multi-Entity Accounting

- Docyt: Docyt’s AI automation is built to handle multiple businesses and different business locations. You can generate consolidated roll-up reports to see how all your locations are doing.

- Wave: Wave allows you to manage multiple companies under one account. However, it’s not as tailored for departmental accounting or consolidating roll-up reports for multiple business locations.

6. Bookkeeping & Month-End Close

- Docyt: The Docyt AI bookkeeper handles bookkeeping duties and can greatly speed up the month-end close. This is part of the overall accounting automation platform. It makes bookkeeping a simpler part of your accounting processes.

- Wave: Wave makes bookkeeping easier with its free platform. It offers an automated bank reconciliation feature. You can easily keep your bookkeeping records up-to-date and complete your month-end tasks.

7. Payroll

- Docyt: Docyt’s primary focus is on core accounting. While it can help manage payroll-related expenses, it does not offer a direct payroll processing service.

- Wave: Wave Payroll is an optional paid plan. It lets you pay employees and an independent contractor with a direct deposit and handles tax filing for an additional costs.

8. Payments

- Docyt: Docyt supports various payment methods as part of its financial operations. Its focus is on automating the process from start to finish.

- Wave: The free version lets you accept credit card payments, but there are fees per credit card transaction and per bank payments. The paid pro plan may offer a discounted rate. Wave also supports Apple Pay.

9. Pricing & Value

- Docyt: Docyt has a more expensive paid plan. It’s meant for businesses that need deep AI automation. The value comes from saving time and eliminating manual data entry

- Wave: Wave’s free plan for accounting software is a huge draw for small business owners on a budget. The paid plan is affordable, making it a great option for those with simple money management features. You get a lot of key features without a big subscription level.

What to Look for When Choosing Accounting Software?

- Free Starter Plan Availability: Does it offer a free starter plan or free accounting software for basic needs?

- Invoicing Features: Can you send unlimited invoices and use recurring billing easily?

- Payment Processing: Does it accept online payments and support credit card processing?

- Payroll Needs: Does it handle accounting and payroll, including paying an independent contractor or an active employee?

- Automation: Does the software automate tasks like receipt scanning or offer advanced features like Docyt AI?

- Integration: Can it integrate with services like QuickBooks Online or other accounting firms‘ tools?

- Reporting: Does it offer real-time financial reports and track key performance indicators?

- Security: Does it offer multi-factor authentication and strong data security?

- Scalability: Can it handle the business intricacies of your financial management as you grow?

- Support: Is there a good mobile app, help center, and reliable customer service?

- User Limits: Does the free version or paid plan allow multiple users or unlimited users?

- Data Control: Does it let you customize the date range for reports and easily auto-merge data?

- Overall Value: Does the wave accounting review or general consensus recommend Wave or the alternative for your specific needs?

- Peace of Mind: Does the software give you peace of mind by accurately managing your general ledger and automating back office work?

Final Verdict

The winner is clearly Docyt.

The Wave review highlights its value as small business accounting software with a free starter plan.

Docyt is the superior choice for any ambitious team.

Docyt learns your business intricacies, offering real-time insights into profitability that Wave simply cannot match.

Its core strength is its ability to handle revenue reconciliation and generate accurate, real-time reports.

The ability to automate the bulk of the billable hours and send automated payment reminders saves a huge time.

This dedication to automation and deep financial management is a game-changer.

Ultimately, giving peace of mind far beyond what the average invoicing software offers.

More of Docyt

When looking for the right accounting software, it’s helpful to see how different platforms stack up.

Here is a brief comparison of Docyt vs many of its alternatives.

- Docyt vs Puzzle IO: While both help with finances, Docyt focuses on AI-powered bookkeeping for businesses, while Puzzle IO simplifies invoicing and expenses for freelancers.

- Docyt vs Dext: Docyt offers a complete AI bookkeeping platform, whereas Dext specializes in automated data capture from documents.

- Docyt vs Xero: Docyt is known for its deep AI automation. Xero provides a comprehensive and user-friendly accounting system for general business needs.

- Docyt vs Synder: Docyt is an AI bookkeeping tool for back-office automation. Synder focuses on syncing e-commerce sales data with your accounting software.

- Docyt vs Easy Month End: Docyt is a full AI accounting solution. Easy Month End is a niche tool designed specifically to streamline and simplify the month-end closing process.

- Docyt vs RefreshMe: Docyt is a business accounting tool, whereas RefreshMe is a personal finance and budgeting app.

- Docyt vs Sage: Docyt uses a modern, AI-first approach. Sage is a long-standing company that offers a wide range of traditional and cloud-based accounting solutions.

- Docyt vs Zoho Books: Docyt focuses on AI accounting automation. Zoho Books is an all-in-one solution that offers a full suite of features at a competitive price.

- Docyt vs Wave: Docyt provides powerful AI automation for growing businesses. Wave is a free accounting platform best suited for freelancers and micro-businesses.

- Docyt vs Quicken: Docyt is built for business accounting. Quicken is primarily a tool for personal finance management and budgeting.

- Docyt vs Hubdoc: Docyt is a complete AI bookkeeping system. Hubdoc is a data capture tool that automatically collects and processes financial documents.

- Docyt vs Expensify: Docyt handles a full range of bookkeeping tasks. Expensify is a specialist in managing and reporting on employee expenses.

- Docyt vs QuickBooks: Docyt is an AI automation platform that enhances QuickBooks. QuickBooks is a comprehensive accounting software for all business sizes.

- Docyt vs AutoEntry: Docyt is a full-service AI bookkeeping solution. AutoEntry focuses specifically on document data extraction and automation.

- Docyt vs FreshBooks: Docyt uses advanced AI for automation. FreshBooks is a user-friendly solution popular with freelancers for its invoicing and time-tracking features.

- Docyt vs NetSuite: Docyt is an accounting automation tool. NetSuite is a full enterprise resource planning (ERP) system for large corporations.

More of Wave

- Wave vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Wave vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Wave vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Wave vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Wave vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Wave vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Wave vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Wave vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Wave vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- Wave vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Wave vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Wave vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Wave vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Wave vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Wave vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Which is better, Wave vs Docyt, for a brand-new small business?

Wave is generally better for new small businesses due to its free core accounting features. It offers a straightforward approach to invoicing and expense tracking without initial cost.

Can an accountant easily use both Docyt and Wave?

Yes, an accountant can use both. Docyt offers deep automation for complex needs, while Wave provides a user-friendly platform for basic bookkeeping. The choice depends on the client’s business scale.

What makes Docyt different from Wave?

Docyt focuses on AI-powered automation and real-time financial insights, aiming to reduce manual data entry significantly. Wave offers free basic accounting services, emphasizing ease of use for invoicing and simple expense tracking.

How did you conduct your research or methodology for this comparison?

Our research involved hands-on testing of both platforms, examining features, pricing, and user experience. We also analyzed verified user reviews and industry insights to provide a comprehensive and objective comparison.

Where can I get more information or try these software options?

You can visit a provider’s official website directly to learn more about their features, pricing, and to sign up for a free trial or account. This allows you to test them yourself.