Picking the right accounting software can feel like a big decision for your business, right?

You’ve likely heard of Wave and QuickBooks, two popular choices.

But which one is truly the best fit for your needs?

This article will break down Wave vs QuickBooks.

Overview

We put Wave and QuickBooks through their paces.

We used each software to manage real business finances.

This hands-on testing helped us see how they work.

Now, we can compare them fairly for you.

Over 4 million small businesses trust Wave to manage their finances. Explore Wave’s plans and find the right fit.

Pricing: Free plan available. Paid plan starts at $19/month.

Key Features:

- Invoicing

- Banking

- Payroll add-on.

Used by over 7 million businesses, QuickBooks can save you an average of 42 hours per month on bookkeeping.

Pricing: It has a free trial. Plan starts at $1.90/month.

Key Features:

- Invoice Management

- Expense Tracking

- Reporting

What is Wave?

Okay, let’s talk about Wave.

Think of it like a helpful friend for your business money.

It lets you do things like send invoices and track what money comes in and goes out.

It can help you see the big picture of your business finances.

Also, explore our favorite Wave alternatives…

Our Take

Don’t settle for less! Join the over 2 million small businesses that rely on Wave’s powerful, free core accounting features to streamline their finances today.

Key Benefits

Wave’s strengths include:

- A 100% free core accounting plan.

- Serving over 2 million small businesses.

- Easy invoice creation and payment processing.

- No long-term contracts or warranties.

Pricing

- Starter Plan: $0month.

- Pro Plan: $19month.

Pros

Cons

What is QuickBooks?

QuickBooks is like a helpful friend for your business money stuff.

It helps you keep track of what money comes in and what money goes out.

Lots of small businesses like using it.

Also, explore our favorite Quickbooks alternatives…

Key Benefits

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

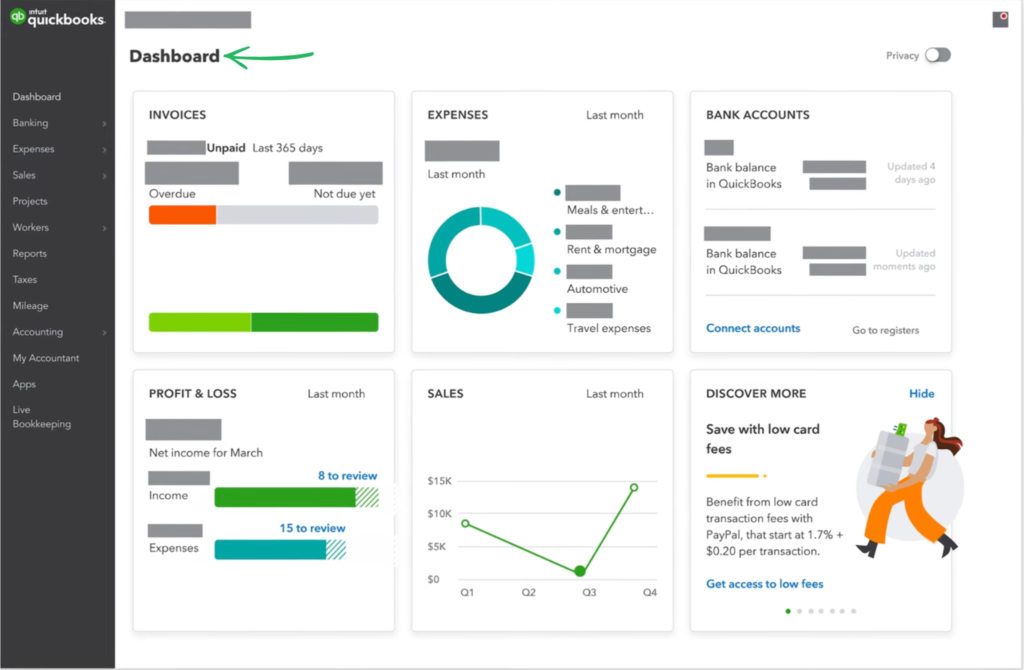

- Reporting and dashboards

Pricing

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Pros

Cons

Feature Comparison

For small business owners, choosing the right accounting solution often comes down to cost versus comprehensive features.

This Wave review versus QuickBooks reviews comparison will detail the differences between a free, essential platform and a feature-rich, scalable subscription service to help you track money and stay organized.

1. Payroll and Employee Management

- Wave Payroll is an integrated add-on, billed at an additional costs. It handles payroll processing and tax filing for active employee and independent contractor paid via direct deposit.

- QuickBooks Payroll is a robust service that supports full service bookkeeping, managing employee time (QuickBooks Time), contractor payments, and all related taxes. Intuit QuickBooks products offer comprehensive benefits and tax preparation support.

2. Core Accounting Foundation

- Wave’s free accounting features are robust for essential tasks. The system includes double-entry bookkeeping records and financial reports like balance sheets and P&L. It supports tracking multiple companies from a single Wave account.

- QuickBooks is an industry-standard system offering comprehensive accounting features. It features a detailed chart of accounts and full reconciliation tools that QuickBooks helps maintain accurate business data and financial reports.

3. Invoicing and Payments

- Wave’s invoicing features are powerful and included for free. You can plan and create professional invoices, set up recurring invoices & accept online payments via credit card payments and bank payments (credit card transaction fee applies).

- QuickBooks offers advanced features for clients and customers, such as converting estimates to invoices, and offers online payments options, including Apple Pay. It provides strong payment reminders and tools to manage recurring billing effectively.

4. Expense Management and Data Entry

- Wave allows you to track expenses by connecting to your bank accounts and credit card. The paid pro plan includes the ability to auto import bank transactions and features digital receipt capture for easy receipt scanning.

- QuickBooks products simplify the expense tracking process by allowing users to automatically pull bank transactions from their bank account and credit cards. QuickBooks helps save time by providing automatic matching and tracking of bills for vendors.

5. Pricing and Access

- Wave Financial offers a strong free starter plan that acts as a complete accounting system. The free version includes a general ledger and unlimited invoices for free. Wave makes financial management accessible for unlimited users at the core level.

- Intuit QuickBooks products are built on a tiered, paid subscription level. QuickBooks offers multiple plans, each with varying additional costs, starting from a single-user license. QuickBooks helps growing businesses scale by supporting up to 25 users in its advanced features plan.

6. Specialized Business Tools

- Wave offers essential money management features but lacks tools for managing inventory or job profitability. Its key features are centered on the needs of the self employed and micro-businesses who want simplicity and to track cash flow.

- QuickBooks offers more specialized functionality, such as inventory management, tracking sales tax, and managing purchase orders. Its integrated ecosystem provides insights into business data and reports that cater to medium sized businesses.

7. Accessibility and Platform

- Wave is a cloud-native platform, giving you online access to your financial reports and data from the mobile app. It is an ideal free platform for simple accounting tasks.

- QuickBooks offers both a cloud-based online version and a desktop version (where desktop data is locally stored). The online version provides superior flexibility and online access to your accountant and users.

8. Customer Support and Security

- A wave accounting review often points out that live support is generally limited to those on a paid plan (or using Wave Payroll or payments). Security includes multi factor authentication to protect users’ bank accounts.

- QuickBooks products protect business data with high-level security and offer more accessible and comprehensive support, often including phone and chat. This giving peace of mind is a major selling point in QuickBooks reviews.

9. Automation and Workflow

- Wave offers tools like auto merge to simplify reconciliation and automatically manage transactions automatically from your bank. Wave products pay attention to automated reminders and reducing manual data entry.

- QuickBooks offers deep automation features that simplify complex workflows. Its system helps pay bills on time, manage date range reports, and track money with sophisticated automated reconciliation rules.

What to look for in an Accounting Software?

Selecting the right small business accounting software requires evaluating a few key areas to ensure the program fits your current operations and future growth.

- Pricing Model and Core Features: Look beyond the initial cost. Many vendors offer a free plan or a generous trial, but often the necessary functionality is locked behind a paid plan. For instance, some providers offer two plans to cater to basic users and growing businesses, which may include a discounted rate for an annual commitment. Evaluate whether the core features, such as invoicing software and general ledger tools, are adequate for your needs.

- Scalability and User Access: Consider how the software manages growth. If your team expands, you’ll need a platform that supports multiple users without excessive extra fees. While most small business accounting software can handle basic personal finance tracking, look for systems that allow you to manage multiple entities or fully integrate external data as your business grows.

- Specialization and Automation: The best programs excel at automating complex workflows. If you bill clients for services, a crucial feature is tracking billable hours. Furthermore, reliable automation like automated payment reminders will significantly improve your cash flow. Check if the software offers integrated solutions like accounting and payroll, or if the vendor (wave integrates) seamlessly with other necessary third-party services.

- Support and Ease of Use: An intuitive design is essential. A wave accounting review often highlights platforms that are simple to use, which is why many recommend wave for new entrepreneurs. Ensure the vendor provides a comprehensive help center with accessible resources and clear support response times, ideally within a few business days, to quickly resolve any questions you may have.

Final Verdict

We looked closely at both. We pick QuickBooks.

It’s better for most growing businesses.

Wave is free and simple. But QuickBooks has more features.

It also has better support. It handles complex tasks. This is good as your business grows.

We tested both well. Our tests show QuickBooks has more power.

It also has more flexibility. For managing your money seriously, it’s stronger.

It will help your business do well.

More of Wave

- Wave vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Wave vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Wave vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Wave vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Wave vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Wave vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Wave vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Wave vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Wave vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- Wave vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Wave vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Wave vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Wave vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Wave vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Wave vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

More of QuickBooks

- QuickBooks vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- QuickBooks vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- QuickBooks vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- QuickBooks vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- QuickBooks vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- QuickBooks vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- QuickBooks vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- QuickBooks vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- QuickBooks vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- QuickBooks vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- QuickBooks vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- QuickBooks vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- QuickBooks vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- QuickBooks vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- QuickBooks vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Is QuickBooks Online better than Wave Accounting?

QuickBooks Online often offers more features and better scalability for growing businesses. Wave Accounting is great for very small companies or freelancers needing basic, free accounting. The “better” choice depends on your specific business needs and budget.

Can I do inventory management with Wave?

Wave Accounting does not offer built-in inventory management. If you need to track inventory, you’ll likely need to use a separate app and integrate it. QuickBooks Desktop and some QuickBooks Online plans offer more robust inventory tools.

What are the main differences between QuickBooks Desktop and QuickBooks Online?

QuickBooks Desktop is installed on your computer, while QuickBooks Online is cloud-based and accessed via a web browser. Online offers more flexibility and accessibility. Desktop provides more control and are often a one-time purchase, though they lack cloud convenience.

Is there truly free accounting software like Wave for small business owners?

Yes, Wave Accounting is a truly free option for basic accounting needs. While it’s free for core features, some services like payroll or payment processing may incur a fee. It’s a solid choice for “software for small” businesses on a tight budget.

How does the pricing plan of QuickBooks compare to Wave?

Wave’s core accounting features are free. QuickBooks operates on a subscription-based pricing plan with various tiers offering different features. While Wave offers free basics, QuickBooks provides more comprehensive features at a cost, making it suitable for businesses ready to invest.