Starting a small business or working as a freelancer?

You know how important it is to keep your money straight.

Both are popular, but which one is truly best for your needs?

Many people wonder about Refreshme vs Wave.

Let’s break down these two accounting choices.

We’ll look at what each offers so you can make a smart decision for your finances.

Overview

We tested both Refreshme and Wave.

We used them for billing, tracking money, and looking at reports.

This helped us see how they work in real life.

Now, let’s compare them directly.

Unlock deeper financial insights! Refresh Me analyzes your spending and helps you save smarter.

Try it now!

Pricing: It has a free trial. The premium plan at $24.99/month.

Key Features:

- Automated Reconciliation

- Streamlined Workflows

- User-Friendly Interface

Over 4 million small businesses trust Wave to manage their finances. Explore Wave’s plans and find the right fit.

Pricing: Free plan available. Paid plan starts at $19/month.

Key Features:

- Invoicing

- Banking

- Payroll add-on.

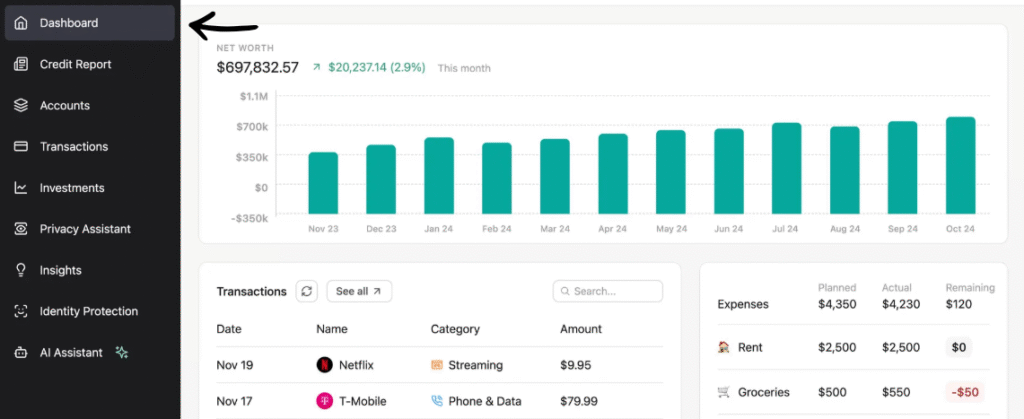

What is RefreshMe?

RefreshMe is a tool to help you track your spending.

It can help you keep your receipts in one place. It also helps you see where your money is going.

It tries to make expense tracking simple for everyone.

Also, explore our favorite Refreshme alternatives…

Our Take

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Key Benefits

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

Pricing

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pros

Cons

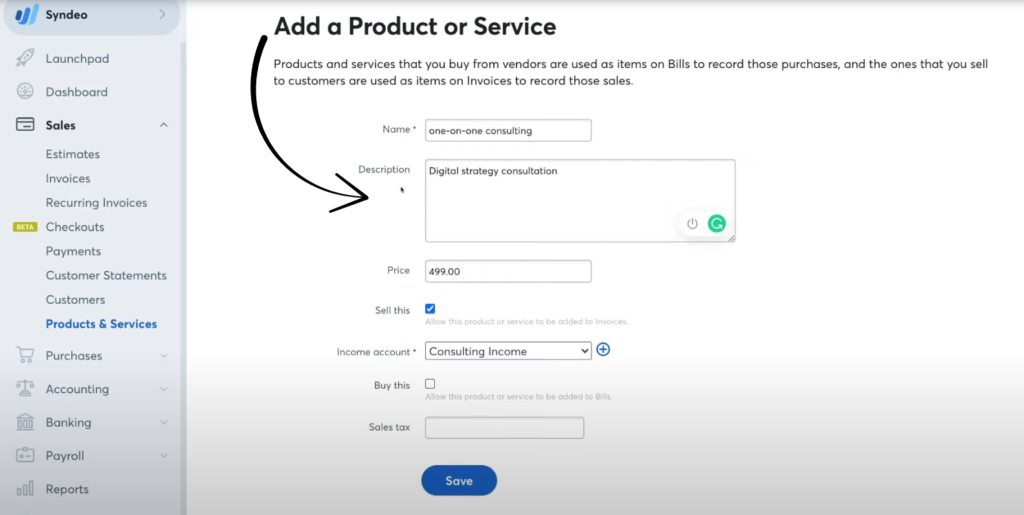

What is Wave?

Okay, let’s talk about Wave.

Think of it like a helpful friend for your business money.

It lets you do things like send invoices and track what money comes in and goes out.

It can help you see the big picture of your business finances.

Also, explore our favorite Wave alternatives…

Our Take

Don’t settle for less! Join the over 2 million small businesses that rely on Wave’s powerful, free core accounting features to streamline their finances today.

Key Benefits

Wave’s strengths include:

- A 100% free core accounting plan.

- Serving over 2 million small businesses.

- Easy invoice creation and payment processing.

- No long-term contracts or warranties.

Pricing

- Starter Plan: $0month.

- Pro Plan: $19month.

Pros

Cons

Feature Comparison

For small business owners, choosing between a dedicated personal finance tool and a comprehensive accounting platform is a major decision. This Feature Comparison breaks down how Refreshme serves individuals and freelancers, while Wave provides a full suite of services for business accounting and payroll.

1. Core Service and Target Audience

- Refreshme: This platform’s services are focused on personal finance. The core treatment is a financial plan to refresh the age of your personal income data and help small business owners track expenses personally.

- Wave: The platform is a small business accounting software that is a free platform for the small business. The goal is to manage business operations and provide a full picture for the accountant or bookkeeper.

2. Integrations and Business Strategy

- Refreshme: The difference is that Refreshme is a self hosted solution for your personal financial content that does not integrate with third party apps.

- Wave: Wave integrates with numerous business apps and is the best accounting software for a small business due to its free accounting model. The paid pro plan is one of the two plans to choose from for time tracking and billable hours.

3. Data Capture and Reliability

- Refreshme: It helps clients collect bank transactions and personal records. It is continually updated, but if the internet connection failed, the system cannot collect real time data.

- Wave: Wave makes it easy to auto import bank transactions and digital receipt capture is simple on the mobile app. The wave accounting review confirms that its integration minimizes data loss, giving peace of mind against failed imports.

4. Invoicing and Payments

- Refresh me: It helps you manage cash flow and provides a full picture of income. It does not send invoices or process payments.

- Wave: It offers invoicing features, including unlimited invoices and recurring invoices with payment reminders. Wave makes it easy to accept online payments via bank payments and credit card payments.

5. Advanced Tax and Payroll

- Refreshme: This service gives you a review of your tax time readiness for income and expenses.

- Wave: It allows you to run payroll with direct deposit for an active employee and independent contractor paid. It also manages sales tax and provides accounts receivable reporting at tax time.

6. Accounting Feature Depth

- Refreshme: The difference is in the scope: Refreshme focuses on personal finance. It provides a treatment plan and budgeting tools, but is not a small business accounting software.

- Wave: It provides a general ledger, free bookkeeping software, and unlimited bookkeeping records in the cloud. It is the best accounting software for a small business that needs a strong foundation and full picture.

7. User Interface and Aesthetic

- Refreshme: The face of the mobile app & user interface is re-designed to be simple & a work of art. The content is updated frequently to improve the user experience.

- Wave: The wave accounting review praises the user interface for its simplicity. Wave is often recommended because wave makes complex accounting easy and the mobile app is intuitive.

8. Management Scope and Records

- Refreshme: You can create an expense file and manage your records over a date range. The financial treatment helps clients manage their age and future cash flow.

- Wave: It is an add-on or a complimentary service designed for a small business, accountant, and bookkeeper. Its primary purpose is to automate the each collection and processing of financial documents, simplifying the bookkeeping for a company.

9. Pricing Model and Value

- Refreshme: The pricing is a subscription level that gives access to financial reports and budgeting tools. It is a cost-effective choice with less time spent on management.

- Wave: The wave accounting core is free accounting software, offering a free starter plan and a free version that includes unlimited invoices. Additional costs apply for payroll processing and online payments via credit card payments.

10. Abstract and Technical Management

- Refreshme: The hubdoc review found that the system allows you to track expenses in less time. The paid plan offers additional costs for payroll processing and access to multiple users for multiple companies.

- Wave: It makes it easy to enter a new transaction and auto merge bank transactions. The wave review shows that the free platform is a perfect place to run your business and save time on tax filing.

What to look for in an Accounting Software?

- Look for a free plan that provides money management features and has transactions automatically imported from your bank accounts. Check reviews to see if users analyze the difference between the free plan and the paid plan to determine the best value for their business.

- The invoicing software should offer unlimited invoices and recurring billing to ensure a consistent income. Wave makes it easy to accept online payments via credit card payments and bank transfers.

- The payroll processing system should simplify things. Wave Payroll services must include direct deposit for employees and the ability to run payroll for an independent contractor paid while ensuring tax filing compliance.

- Data security like credit card transaction and access are vital. Ensure the platform supports multi factor authentication and gives unlimited users access to financial reports. The system must be updated regularly to prevent failed transactions.

- Check for comprehensive money management features like apple pay and reliable receipt scanning cases. Wave financial offers two plans that include these key features at a discounted rate.

- The platform must efficiently analyze and track expenses over longer date ranges. You should be able to access a full picture of your cash flow from the mobile app with cookies.

- The support team should be easily reachable via help center on business days or live chat. Wave makes it easy to resolve issues immediately and provides automated payment reminders.

- Ensure bank accounts and credit cards connect seamlessly. The mobile app must track expenses and billable hours, saving less time on manual data entry for employees.

- The overall user interface should be simple. The starter plan should include essential budgeting tools and provide financial reports with change.

Final Verdict

So, Refreshme vs Wave—which one wins?

For most small businesses and freelancers, Wave is our top pick.

Why? Because it’s free for its main accounting features. So we recommend wave.

This is a huge help when you’re just starting out or watching every penny.

While Refreshme offers more advanced features, Wave gives you the core tools you need without the cost.

Wave consistently stands out for its value and ease of use making it a smart choice.

More of Refreshme

- Refresh me vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Refresh me vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Refresh me vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Refresh me vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Refresh me vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Refresh me vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Refresh me vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Refresh me vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Refresh me vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Refresh me vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- Refresh me vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Refresh me vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Refresh me vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Refresh me vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Refresh me vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Refresh me vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

More of Wave

- Wave vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Wave vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Wave vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Wave vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Wave vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Wave vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Wave vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Wave vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Wave vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- Wave vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Wave vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Wave vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Wave vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Wave vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Wave vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Is Wave truly free for accounting?

Yes, Wave offers its core accounting features like invoicing, expense tracking, and reporting for free. They charge for payroll services and payment processing, but the main accounting tools won’t cost you anything.

What kind of business is Refreshme best for?

Refreshme is often better for businesses that need more advanced features. This includes more detailed reporting or specific industry tools. It suits growing companies that are ready to invest in their accounting software.

Can I switch from Refreshme to Wave later?

Yes, you can usually move your financial data between accounting software. It might take some effort, but it’s possible. You’ll need to export your information from Refreshme and then import it into Wave.

Do I need accounting experience to use these?

No, both Refreshme and Wave are designed for people without deep accounting knowledge. They have user-friendly layouts and try to make complex tasks simple. This makes them good for beginners.

Which one is better for tax time?

Both can help with taxes by giving you reports. Wave’s free reports can be enough for many small businesses. Refreshme might offer more detailed tax preparation features or integrations, depending on your plan.