Feeling swamped by your monthly accounting tasks?

Imagine the stress of scrambling to find receipts, reconcile accounts, and meet deadlines.

All while trying to run your business.

This article dives into two popular accounting solutions.

We’ll break down Easy Month End vs FreshBooks features to help you decide which one will truly simplify your accounting.

Overview

To give you the clearest picture.

We extensively tested Easy Month End and FreshBooks, examining their features, ease of use, and overall value.

This Easy month-end, join 1,257 users who saved an average of 3.5 hours and reduced errors by 15%. Start your free trial!

Pricing: It has a free trial. The premium plan starts at $45/month.

Key Features:

- Automated Reconciliation

- Streamlined Workflows

- User-Friendly Interface

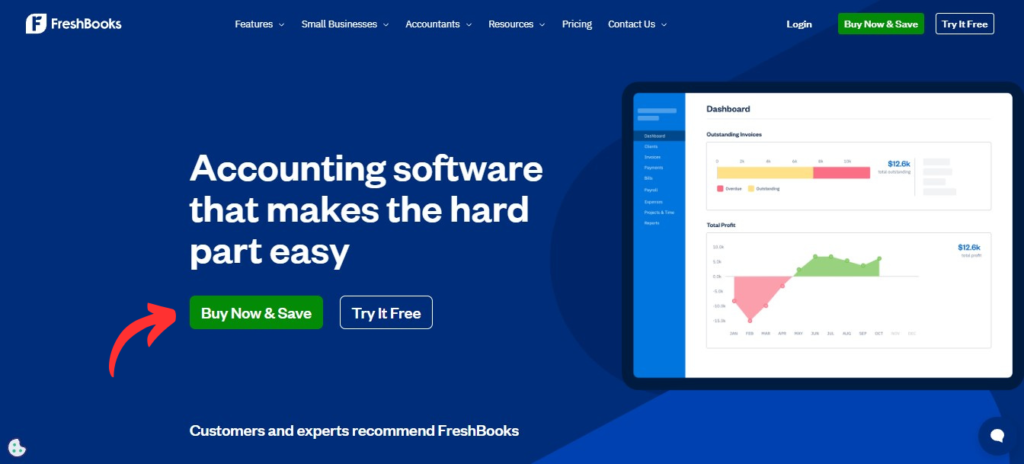

Ready to simplify your invoicing and get paid faster? Over 30 million people have used FreshBooks. Explore it for more!

Pricing: It has a free trial. Paid plan starts at $2.10/month.

Key Features:

- Time Tracking

- Invoicing

- Bookkeeping

What is Easy Month End?

Let’s talk about Easy Month End. What is it?

It’s a tool designed to make your monthly accounting close simple.

Think of it as your guide through that often-dreaded process.

Also, explore our favorite Easy Month End alternatives…

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

What is FreshBooks?

Now, let’s talk about FreshBooks. What is it all about?

It’s a popular accounting software. Many freelancers and small businesses use it.

It helps with invoicing, tracking expenses, and managing projects.

Also, explore our favorite FreshBooks alternatives…

Our Take

Tired of complex accounting? 30 million+ businesses trust FreshBooks to create professional invoices. Simplify your accounting software today!

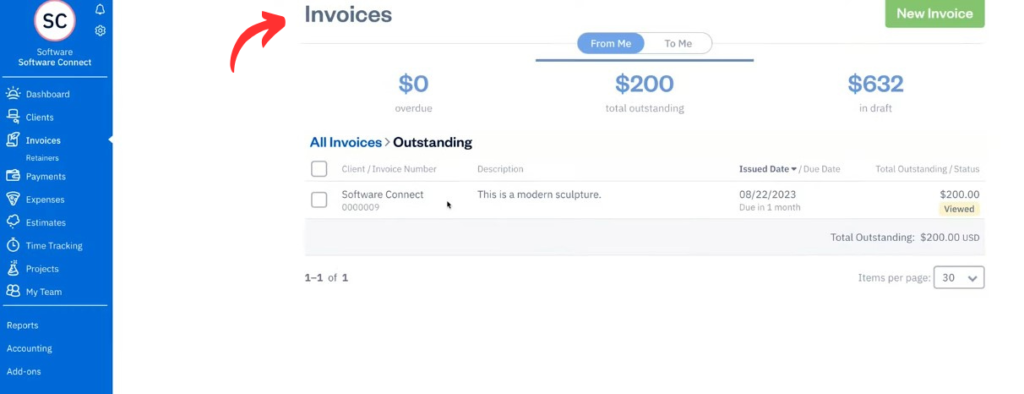

Key Benefits

- Professional invoice creation

- Automated payment reminders

- Time tracking

- Project management tools

- Expense tracking

Pricing

- Lite: $2.10/month.

- Plus: $3.80/month.

- Premium: $6.50/month.

- Select: Custom Pricing.

Pros

Cons

Feature Comparison

Here’s a detailed look at how Easy Month End and FreshBooks stack up against each other.

We’ll explore key features to help you understand which platform better suits.

Your unique business needs as you navigate choosing accounting software.

1. Core Purpose

- Easy Month End: This tool’s sole purpose is to help a more efficient finance team handle the month-end closing process. It’s a specialized solution for specific finance team tasks.

- FreshBooks: This is a broader accounting software solutions platform for small business owners. It handles everything from invoicing to expense tracking and basic reporting.

2. Invoicing & Payments

- Easy Month End: This tool does not have any invoicing features.

- FreshBooks: FreshBooks excels here. You can create professional invoices, set up recurring billing, and even accept advanced payments like credit cards and ACH payments directly. This makes it easy to accept payments and get paid faster.

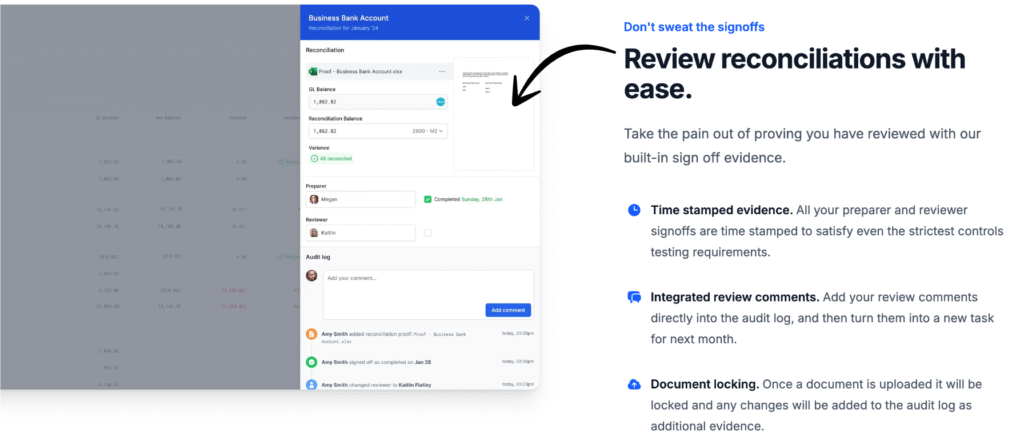

3. Month-End Close & Reconciliation

- Easy Month End: This is its main strength. It provides a structured workflow to manage all your reconciliations. It helps you collect audit evidence and streamlines the process, leading to a smoother month-end close and fewer errors and delays.

- FreshBooks: It handles basic bank reconciliation, but it is not built as a dedicated tool for formal balance sheet reconciliations or providing documentation for auditors.

4. Team Collaboration & Workflow

- Easy Month End: It is designed for team management. You can assign finance team tasks, track sign-offs, and leave comments on a ticket to ensure a task is completed correctly.

- FreshBooks: The platform allows multiple users to collaborate on projects. However, its workflow features are not as deep or specific for closing processes as Easy Month End.

5. Reporting & Accounting

- Easy Month End: Reporting is limited to the closing process itself. It’s not a full accounting software.

- FreshBooks: It provides standard accounting reports like profit and loss. On higher plans, it offers double-entry accounting and helps with project profitability tracking.

6. Pricing & Plans

- Easy Month End: Has three main pricing plans that scale with the size of your team.

- FreshBooks: Offers four plans, including a Lite plan and a Plus plan, which scale with the number of billable clients and features you need. Pricing is typically per month.

7. Ease of Use & Platform

- Easy Month End: The platform is straightforward but is tailored for accounting professionals who understand a closing workflow. It is a single platform for its specific purpose.

- FreshBooks: Known for its user-friendly FreshBooks dashboard. It is considered one of the best accounting software options for self-employed professionals and small business owners due to its intuitive design.

8. Data & Integrations

- Easy Month End: Integrates with other accounting software like QuickBooks and Xero to import data for reconciliations.

- FreshBooks: Integrates with over 100 apps. This makes it a great hub for managing finances, particularly for a service-based business that uses other software to manage projects and clients.

9. Mobile Capabilities

- Easy Month End: This is a web-based application. It does not have a dedicated mobile app.

- FreshBooks: Has a highly-rated FreshBooks mobile app for both iOS and Android devices. You can manage your business on the go with a simple internet connection.

What to Look for When Choosing Accounting Software?

- Your Business Type: Are you a freelancer, service-based, or product-based? Your specific needs will dictate the best fit.

- Scalability: Can the software grow with your business? Consider future business needs.

- Integration Needs: Does it connect with your other tools (e.g., payment gateways, CRM)?

- Mobile Access: Do you need to manage finances on the go?

- Customer Support: What kind of help is available if you run into problems?

- Reporting Depth: Do you need simple overviews or detailed financial analysis?

- Security: How does the platform protect your sensitive financial data?

- User Interface: Is it easy for you and any team members to learn and use? This is key for new users.

Final Verdict

After testing both, we recommend FreshBooks.

While Easy Month End is great for its dedicated month-end process.

FreshBooks is a more complete solution for a small business.

Its platform handles everything from sending invoices to managing project management and time tracking.

For your money, FreshBooks gives you more daily value.

Its premium plan and other pricing plans offer a range of features like recurring invoices and FreshBooks Payments, simplifying your finances and giving your finance team the tools it deserves.

For most small business owners, it’s the smarter choice to simplify their lives and manage money without the hassle.

More of Easy Month End

Here is a brief comparison of Easy Month End with some of the leading alternatives.

- Easy Month End vs Puzzle io: While Puzzle.io is for startup accounting, Easy Month End focuses specifically on streamlining the close process.

- Easy Month End vs Dext: Dext is primarily for document and receipt capture, whereas Easy Month End is a comprehensive month-end close management tool.

- Easy Month End vs Xero: Xero is a full accounting platform for small businesses, while Easy Month End provides a dedicated solution for the close process.

- Easy Month End vs Synder: Synder specializes in integrating e-commerce data, unlike Easy Month End which is a workflow tool for the entire financial close.

- Easy Month End vs Docyt: Docyt uses AI for bookkeeping and data entry, while Easy Month End automates the steps and tasks of the financial close.

- Easy Month End vs RefreshMe: RefreshMe is a financial coaching platform, which is different from Easy Month End’s focus on close management.

- Easy Month End vs Sage: Sage is a large-scale business management suite, while Easy Month End offers a more specialized solution for a critical accounting function.

- Easy Month End vs Zoho Books: Zoho Books is an all-in-one accounting software, whereas Easy Month End is a purpose-built tool for the month-end process.

- Easy Month End vs Wave: Wave provides free accounting services for small businesses, while Easy Month End offers a more advanced solution for close management.

- Easy Month End vs Quicken: Quicken is a personal finance tool, making Easy Month End a better choice for businesses needing to manage a month-end close.

- Easy Month End vs Hubdoc: Hubdoc automates document collection, but Easy Month End is designed to manage the full close workflow and team tasks.

- Easy Month End vs Expensify: Expensify is an expense management software, which is a different function than Easy Month End’s core focus on the financial close.

- Easy Month End vs QuickBooks: QuickBooks is a comprehensive accounting solution, while Easy Month End is a more specific tool for managing the month-end close itself.

- Easy Month End vs AutoEntry: AutoEntry is a data capture tool, whereas Easy Month End is a complete platform for task and workflow management during the close.

- Easy Month End vs FreshBooks: FreshBooks is for freelancers and small businesses, while Easy Month End offers a dedicated solution for the month-end close.

- Easy Month End vs NetSuite: NetSuite is a full-featured ERP system, which is broader in scope than Easy Month End’s specialized focus on the financial close.

More of FreshBooks

- FreshBooks vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- FreshBooks vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- FreshBooks vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- FreshBooks vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- FreshBooks vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- FreshBooks vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- FreshBooks vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- FreshBooks vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- FreshBooks vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- FreshBooks vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- FreshBooks vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- FreshBooks vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- FreshBooks vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- FreshBooks vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- FreshBooks vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

What is the main difference between Easy Month End and FreshBooks?

Easy Month End focuses primarily on streamlining the accounting month-end close process and reconciliation workflows. In contrast, FreshBooks vs provides a broader cloud-based accounting solution, excelling at invoicing, expense tracking, and basic bookkeeping for freelancers and small businesses.

Can FreshBooks replace Xero or QuickBooks?

FreshBooks can be a strong alternative for businesses that prioritize invoicing and project tracking. However, for more complex inventory, payroll, or advanced bookkeeping needs, some businesses might still prefer dedicated solutions like vs Xero or vs QuickBooks.

Is Easy Month End suitable for very small businesses or freelancers?

Easy Month End is more beneficial for small businesses or teams that have a structured month-end closing process. Freelancers or very small businesses with simpler needs might find FreshBooks vs more comprehensive for their overall financial management.

Do these platforms help with tax preparation?

Both platforms provide reports that can assist with tax preparation, such as profit and loss statements. However, neither offers direct tax filing services. You’ll typically use their financial data for your tax accountant or software.

Are there any hidden fees with FreshBooks vs Easy Month End pricing?

Both clearly outline their pricing tiers. FreshBooks charges per user for additional team members and has transaction fees for online payments. Easy Month End’s pricing scales with team size and entities, so always check the specific plan details for all frequently asked questions.