Managing money for your business can feel like a real headache, right?

Especially when it comes to wrapping up each month.

Are you tired of messy spreadsheets or clunky systems that make month-end close a nightmare?

You’re not alone.

Which one is truly the best fit for your business between Easy Month End vs Expensify accounting needs?

Overview

We’ve put both Easy Month End and Expensify through their paces.

Testing their features, ease of use, and overall performance in real-world accounting scenarios.

This hands-on experience has led us to a direct comparison, helping you see how they stack up.

This Easy month-end, join 1,257 users who saved an average of 3.5 hours and reduced errors by 15%.

This Easy month-end, join 1,257 users who saved an average of 3.5 hours and reduced errors by 15%. Start your free trial!

Pricing: It has a free trial. The premium plan starts at $45/month.

Key Features:

- Automated Reconciliation

- Streamlined Workflows

- User-Friendly Interface

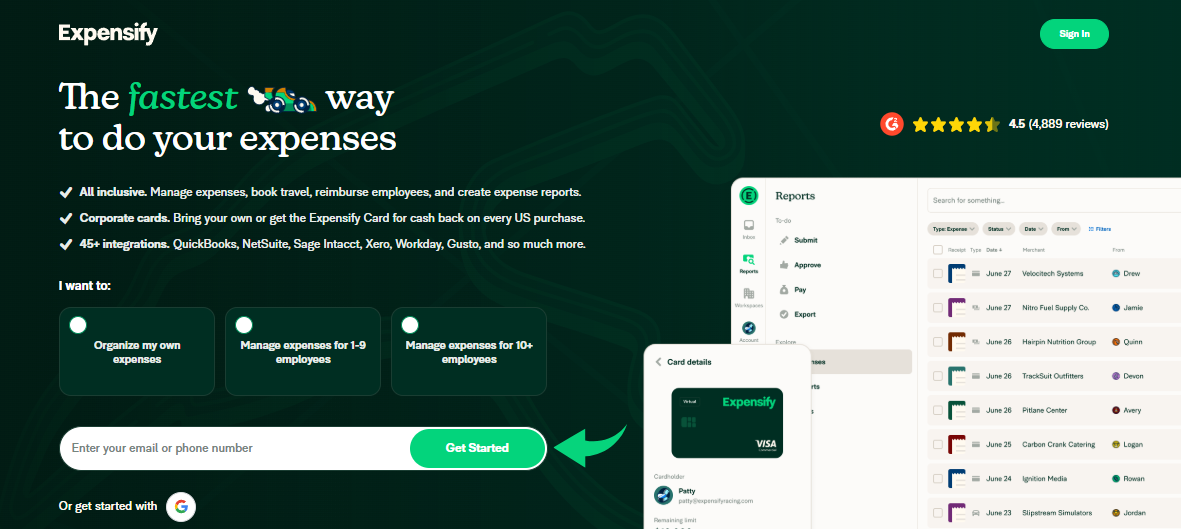

Streamline expenses with Expensify. Join the 10+ million users who’ve automated their reports.

Join over 15 million users who trust Expensify to simplify their finances. Save up to 83% on time spent on expense reports.

Pricing: It has a free trial. The premium plan starts at $5/month.

Key Features:

- SmartScan Receipt Capture

- Corporate Card Reconciliation

- Advanced Approval Workflows.

What is Easy Month End?

So, what exactly is Easy Month End?

Think of it as your personal guide to closing your books each month.

It’s designed to make that often-stressful process much smoother.

Also, explore our favorite Easy Month End alternatives…

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

What is Expensify?

So, what about Expensify?

It’s really focused on making expense reports easy.

Think of it as your smart assistant for receipts.

Also, explore our favorite Expensify alternatives…

Key Benefits

- SmartScan technology scans receipt details and extracts them with over 95% accuracy.

- Employees get reimbursed quickly, often in as little as one business day via ACH.

- The Expensify Card can save you up to 50% on your subscription with its cash back program.

- No warranty is offered; their terms state that liabilities are limited.

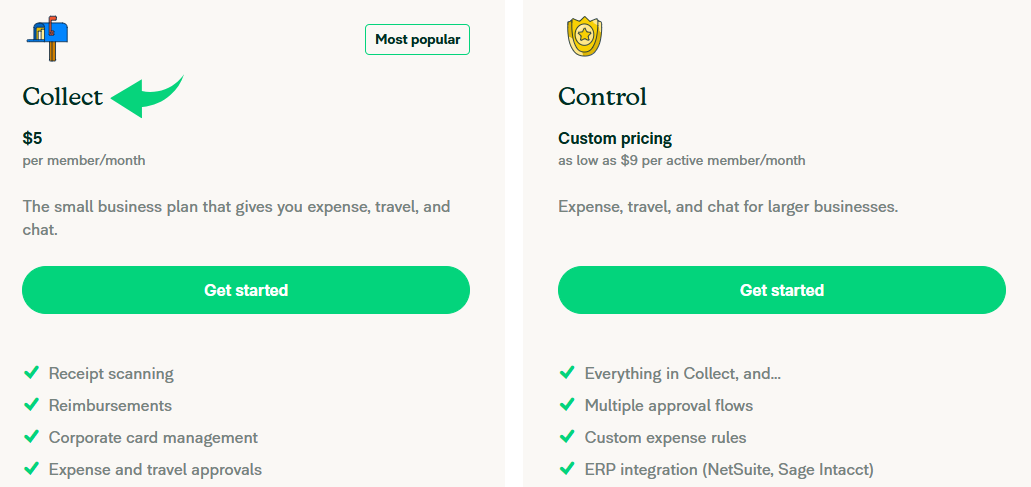

Pricing

- Collect: $5/month.

- Control: Custom Pricing.

Pros

Cons

Feature Comparison

Let’s dive into the details.

This comparison will show you how each tool tackles the key aspects of managing your finances to give your finance team a more efficient and easier life.

1. Month-End Close & Reconciliation

Easy Month End’s core purpose is to streamline the entire month-end process.

It gives your finance team checklists to guide them, leading to a smoother month-end close.

Expensify helps by providing data for the balance sheet reconciliation.

But it’s not a complete workflow management solution for the entire month-end process.

2. Expense Management Process

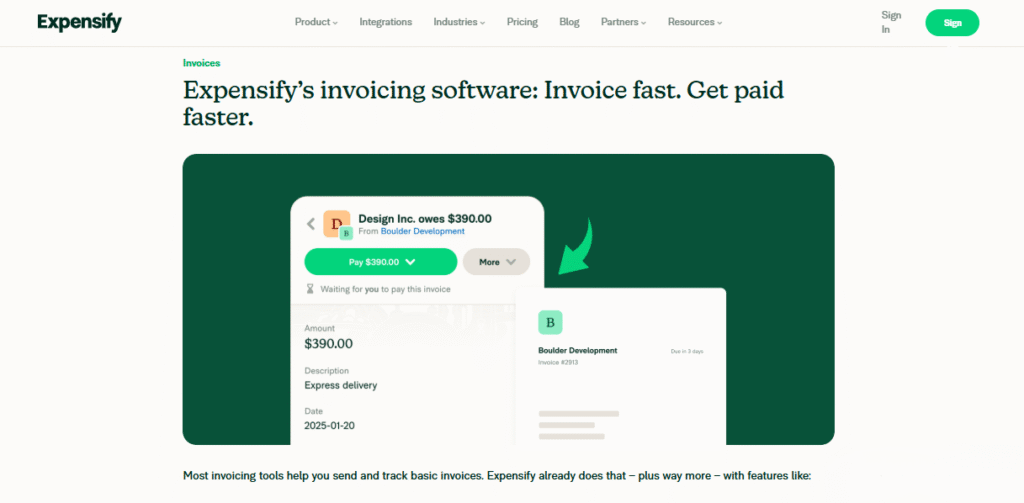

The expense management process is where Expensify truly shines.

An employee can simply take a photo of a receipt with their phone in a few seconds.

Expensify makes it easy to manage expenses by automatically extracting information and storing it.

So you never have to worry about a lost ticket or receipt.

3. Workflow Management

Easy Month End is a dedicated workflow management tool.

It helps you handle month-end, quarter-end, and even year-end tasks.

You can assign tasks and track progress to avoid delays.

Expensify’s workflow is focused on the approval of expense reports, but it is not built for the comprehensive month-end process.

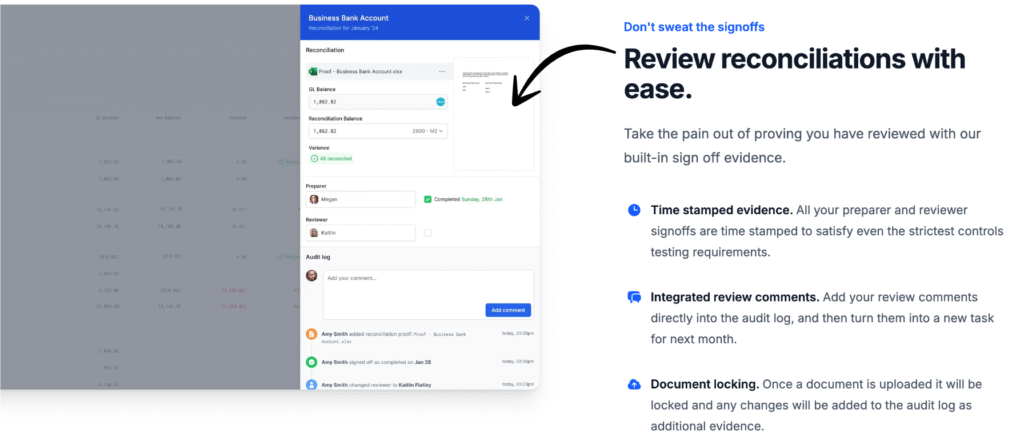

4. Audit & Compliance

To ensure compliance, both tools help, but differently.

Easy Month End helps you collect audit evidence by providing time-stamped logs of tasks and sign-offs for your auditors.

You have the ability to invite them to the platform. Expensify helps by providing digital records for every expense, ensuring you have a digital log of every transaction.

5. Team Collaboration

Easy Month End is built for team collaboration.

You can leave comments and answer questions directly on a task, which helps the finance team tasks go smoothly.

It reduces the need for constant emails or calls.

In Expensify, you can leave comments and communicate on specific expense reports to help resolve issues quickly.

6. Payments & Reimbursement

Expensify is a pro at this. It has the ability to quickly reimburse employees and contractors via bank transfer.

You can even get the Expensify Card to automatically pay for expenses.

Easy Month End does not handle direct payments or reimbursements.

7. Data Sync & Connections

Expensify provides a seamless connection to various accounting software like QuickBooks, NetSuite, and Xero.

You can export your data easily.

Easy Month End also has a strong connection and can automatically sync with platforms like QuickBooks, making your balance sheet reconciliation easier.

8. Mobile & Desktop Access

Expensify provides a great experience on both desktop and a mobile device you have in your pocket.

The experience is consistent whether you’re at your desk or on the go.

Easy Month End is a web-based platform that you access via your computer, which works great for a desk-based finance team.

9. Usability & User Experience

Expensify is praised for its flexible and intuitive design.

Users can tag expenses and categorize them immediately, which is an expected feature.

Easy Month End has a simple layout that removes the hassle of using Outlook or Excel for finance team tasks.

It is designed to make a professional’s life easier.

What to Look for When Choosing Accounting Software?

- Security & Compliance: Your company must have a robust security setup to prevent data from being blocked. It’s crucial for protecting your financial information from a small number of bad actors.

- Workflow & Team Management: Look for software that gives your finance team the ability to create and approve ad hoc requests. The more efficient finance team you have, the better. Your finance team deserves tools that make their lives easier.

- Reconciliation & Close: The tool should help you with all your reconciliations. Look for features that provide faster balance sheet reconciliations and a clear month end close process. Your preparer should have an easy time with the first month end.

- Collaboration & Communication: It’s a hassle to rely on manual confirmations. The platform should allow your team to leave comments and answer each other’s questions directly. This makes a breeze of team management and communication.

- Daily Tasks: The system should allow employees to submit expenses easily. They should be able to file receipts and upload documents with just a photo. This makes the expense management process much simpler.

- Connectivity: Does the software connect to your other platforms? The ability to import data from a single platform is a huge plus.

- Mobile Experience: Does the app allow you to log mileage from your phone? Is it simple for employers and manager to respond to requests while on the go?

Final Verdict

After reviewing both tools, our pick is Expensify for daily expense management.

Based on numerous Expensify reviews, its efficiency and ease of use for managing projects and contracts is unmatched.

It makes life easier for your whole team and lets your organization focus on what matters most—your customers.

However, if your primary goal is to reconcile accounts and reduce the stress of your month end close.

Easy Month End is a fantastic specialized tool.

For a comprehensive view of your finances, a single platform like Expensify, with its expanded features and integrations, is the smarter choice for long-term efficiency and growth.

More of Easy Month End

Here is a brief comparison of Easy Month End with some of the leading alternatives.

- Easy Month End vs Puzzle io: While Puzzle.io is for startup accounting, Easy Month End focuses specifically on streamlining the close process.

- Easy Month End vs Dext: Dext is primarily for document and receipt capture, whereas Easy Month End is a comprehensive month-end close management tool.

- Easy Month End vs Xero: Xero is a full accounting platform for small businesses, while Easy Month End provides a dedicated solution for the close process.

- Easy Month End vs Synder: Synder specializes in integrating e-commerce data, unlike Easy Month End which is a workflow tool for the entire financial close.

- Easy Month End vs Docyt: Docyt uses AI for bookkeeping and data entry, while Easy Month End automates the steps and tasks of the financial close.

- Easy Month End vs RefreshMe: RefreshMe is a financial coaching platform, which is different from Easy Month End’s focus on close management.

- Easy Month End vs Sage: Sage is a large-scale business management suite, while Easy Month End offers a more specialized solution for a critical accounting function.

- Easy Month End vs Zoho Books: Zoho Books is an all-in-one accounting software, whereas Easy Month End is a purpose-built tool for the month-end process.

- Easy Month End vs Wave: Wave provides free accounting services for small businesses, while Easy Month End offers a more advanced solution for close management.

- Easy Month End vs Quicken: Quicken is a personal finance tool, making Easy Month End a better choice for businesses needing to manage a month-end close.

- Easy Month End vs Hubdoc: Hubdoc automates document collection, but Easy Month End is designed to manage the full close workflow and team tasks.

- Easy Month End vs Expensify: Expensify is an expense management software, which is a different function than Easy Month End’s core focus on the financial close.

- Easy Month End vs QuickBooks: QuickBooks is a comprehensive accounting solution, while Easy Month End is a more specific tool for managing the month-end close itself.

- Easy Month End vs AutoEntry: AutoEntry is a data capture tool, whereas Easy Month End is a complete platform for task and workflow management during the close.

- Easy Month End vs FreshBooks: FreshBooks is for freelancers and small businesses, while Easy Month End offers a dedicated solution for the month-end close.

- Easy Month End vs NetSuite: NetSuite is a full-featured ERP system, which is broader in scope than Easy Month End’s specialized focus on the financial close.

More of Expensify

- Expensify vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Expensify vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Expensify vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Expensify vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Expensify vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Expensify vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Expensify vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Expensify vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Expensify vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Expensify vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Expensify vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Expensify vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Expensify vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Expensify vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Is Easy Month End better for a small e-commerce business?

Easy Month End provides structured checklists to help e-commerce businesses streamline their month-end reconciliation. It’s useful for ensuring all financial data is accurate before closing the books, regardless of sales volume.

Does Expensify work well for service-based businesses?

Yes, Expensify is excellent for service-based businesses. It simplifies expense management for employees who travel or incur costs, offering easy receipt capture and quick reimbursements, which helps streamline cash flow.

Can I use both Easy Month End and Expensify together?

Yes, you can use both. Expensify handles daily expense management and feeds data, while Easy Month End provides the structured framework for the overall month-end close, including reconciliation of all financial data.

Which tool is better for tracking credit card spending?

Expensify is superior for credit card spending. Its Expensify Card and direct bank feeds offer real-time transaction capture and categorization, making daily expense management and reconciliation much simpler.

How do these tools help with annual audits?

Both contribute to easier audits. Expensify provides clear, categorized expense management records. Easy Month End creates an auditable trail of month-end tasks and sign-offs, showing diligence in your financial management processes.