Choosing the right accounting software feels like a huge task.

What if you make the wrong choice?

A bad fit can cause real headaches.

You might waste precious time, miss tracking important expenses, or mess up your books.

That’s where we come in. We’re looking at two popular names: Puzzle IO vs Expensify.

Overview

Through rigorous feature-by-feature analysis and hands-on testing of core functionalities like receipt scanning and report generation.

Ready to simplify your finances? See how Puzzle IO can save you up to 20 hours a month. Experience the difference.

Pricing: Free Plan available. Paid plan starts at $42.50/month.

Key Features:

- Financial Planning

- Forecasting

- Real-time Analytics

Join over 15 million users who trust Expensify to simplify their finances. Save up to 83% on time spent on expense reports.

Pricing: It has a free trial. The premium plan starts at $5/month.

Key Features:

- SmartScan Receipt Capture

- Corporate Card Reconciliation

- Advanced Approval Workflows.

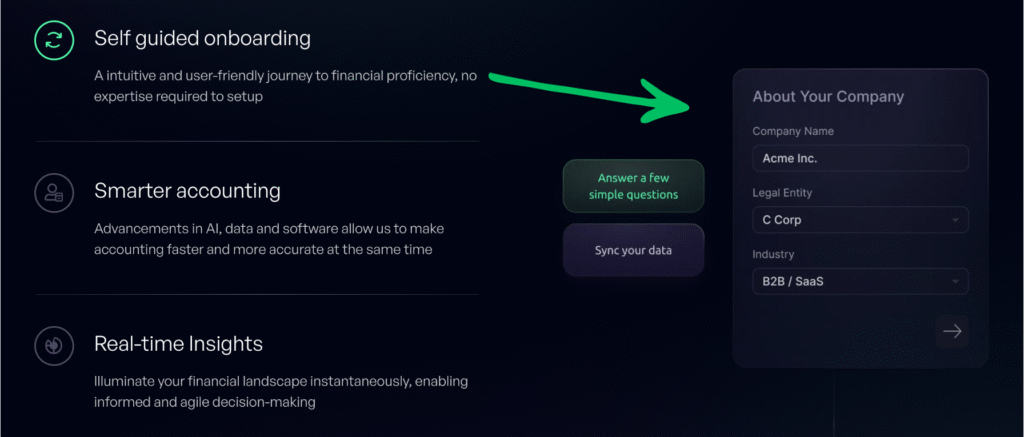

What is Puzzle IO?

Hey, so Puzzle IO, right? It’s an expense management tool.

It seems pretty focused on project costs. Good for keeping tabs on budgets.

Also, explore our favorite Puzzle IO alternatives…

Our Take

Ready to simplify your finances? See how Puzzle io can save you up to 20 hours a month. Experience the difference today!

Key Benefits

Puzzle IO really shines when it comes to helping you understand where your business is headed.

- 92% of users report better financial forecasting accuracy.

- Get real-time insights into your cash flow.

- Easily create different financial scenarios to plan.

- Collaborate seamlessly with your team on financial goals.

- Track key performance indicators (KPIs) in one place.

Pricing

- Accounting basics: $0/month.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Pros

Cons

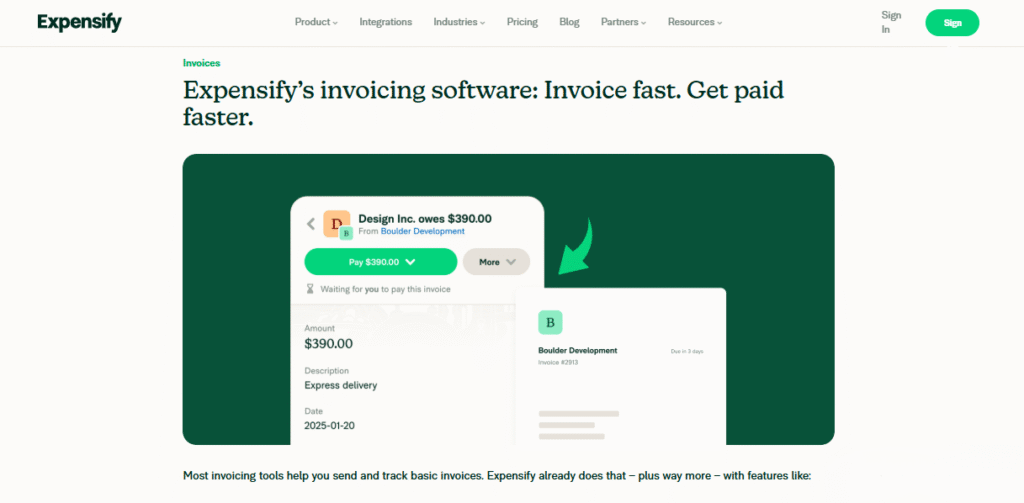

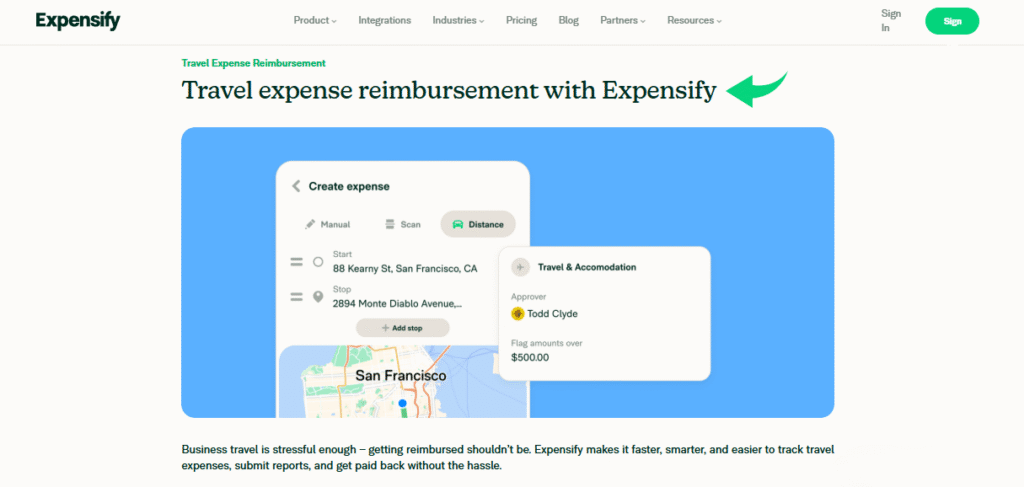

What is Expensify?

Okay, so Expensify is another option.

It feels really strong on receipt handling. Their SmartScan seems pretty slick.

Good if you deal with lots of individual expenses.

Also, explore our favorite Expensify alternatives…

Key Benefits

- SmartScan technology scans receipt details and extracts them with over 95% accuracy.

- Employees get reimbursed quickly, often in as little as one business day via ACH.

- The Expensify Card can save you up to 50% on your subscription with its cash back program.

- No warranty is offered; their terms state that liabilities are limited.

Pricing

- Collect: $5/month.

- Control: Custom Pricing.

Pros

Cons

Feature Comparison

Navigating small business finances can be challenging.

This comparison highlights key features of Puzzle IO and Expensify.

Examining how each platform addresses bookkeeping, expense reports, and automation to help you simplify financial management.

1. Core Audience & Focus

- Puzzle IO is a game-changer built for early-stage startups and co-founder teams, focusing on up-to-date financial statements and key metrics right out of the box.

- Expensify focuses on an efficient expense management process for employees and contractors, making it easy for them to file and for employers to reimburse.

2. Automated Bookkeeping

- Puzzle IO is designed for autonomous bookkeeping, using AI to automate tedious tasks and provide an accurate picture of the current state of the company quickly.

- Expensify automation is concentrated on receipts and expense report creation, aiming to simplify the process for the user and their manager’s approval.

3. Startup Financial Health Metrics

- Puzzle IO provides startup founders with instant access to key metrics like cash runway, burn rate, and MRR, offering clear insights into their financial health.

- Expensify focuses on spending, helping companies control spending and reconcile the Expensify Card, but does not natively provide comprehensive startup metrics.

4. Complex Accrual Accounting

- Puzzle IO includes built-in accrual automation to handle complex items like revenue recognition and prepaid expenses automatically, which is vital for providing a true and accurate picture of revenue.

- Expensify does not focus on the underlying accrual accounting logic for things like fixed assets and deferred revenue; its strength is expense capture.

5. Expense Reporting Experience

- Puzzle IO allows for transaction categorization and expense tracking, but does not specialize in complex, multi-level expense management processes and reimbursement workflows.

- Expensify makes it easy for the team to log mileage, snap a photo of a receipt in a few seconds, and get reimbursed quickly, which is a game-changer for employees.

6. AI-Powered Functionality

- Puzzle IO uses AI for smart transaction categorization, continuous accuracy checks, and streamlining the setup for non-accountants.

- Expensify uses its SmartScan technology for receipt data extraction and AI-powered automation to match transactions, making the process less time-consuming.

7. Focus on Financial Statements

- Puzzle IO’s primary goal is to generate real-time, audit-ready financial statements, helping startup founders stay up to date and prepare for investors or tax time.

- Expensify is a pre-accounting tool that passes expense data to other tools like QuickBooks or Xero for final statement generation by a finance expert.

8. Corporate Card Management

- Puzzle IO integrates with various cards, focusing on getting data into the books quickly.

- Expensify offers the Expensify Card, which links seamlessly to its system, automates reconciliation, and allows employers to set smart spending limits.

9. Ease of Setup

- Puzzle IO offers an easy setup and a modern interface, minimizing errors and making it simple for the co founder who may be a non accountants.

- Expensify also offers a quick and easy setup for the expense management process, which helps employees and contractors submit expenses and reports in less time.

What to Look for When Choosing Accounting Software?

- Look beyond basic Expensify reviews to see how the software handles the complete general ledger and organization.

- The software needs a reliable connection to your bank accounts to avoid manual data entry and reduce errors.

- Ensure the platform gives you a clear cash runway and not just a summary of past data—don’t wait for insights.

- The ability to manage expenses must be flexible, supporting phone, desktop, and web access.

- Check the speed of completing reports and the ease of exporting data to your clients or accountant.

- It should allow users to create and submit requests immediately, and managers to approve them quickly.

- The system must reliably respond to inputs and not be blocked by simple issues.

- All financial details should be securely stored in a digital pocket for easy review.

- The software should offer automated code assignment and customizable categories and tags.

- Your final thoughts should confirm that the system can scale with your future organization, moving you away from spreadsheets.

- A key insight is whether the platform is structured for a small number of users or a growing organization.

- An efficient system should trigger notifications when action is expected, simplifying the single-view page workflow.

- Consider why others chose Puzzle or a similar full-stack tool over a pure expense manager.

Final Verdict

Picking between Puzzle IO and Expensify depends on your main needs.

Expensify is tops for expense reports and receipts.

But Puzzle IO does more for overall money tracking, invoices, and connecting with payroll (even like QuickBooks).

Both are cloud-based.

If you want a wider view of your business, money, and something that can grow.

Puzzle IO wins. We checked them out carefully.

So our advice should help you choose the right software to save time.

Neither doesn’t really offer free accounting for most businesses.

More of Puzzle IO

We’ve looked at how Puzzle IO compares to other accounting tools. Here’s a quick peek at their standout features:

- Puzzle IO vs Xero: Xero offers broad accounting features with strong integrations

- Puzzle IO vs Dext: Puzzle IO excels in AI-powered financial insights and forecasting.

- Puzzle IO vs Synder: Synder excels in syncing sales and payment data.

- Puzzle IO vs Easy Month End: Easy Month End simplifies the financial closing process.

- Puzzle IO vs Docyt: Docyt uses AI to automate bookkeeping tasks.

- Puzzle IO vs RefreshMe: RefreshMe focuses on real-time monitoring of financial performance.

- Puzzle IO vs Sage: Sage provides robust accounting solutions for various business sizes.

- Puzzle IO vs Zoho Books: Zoho Books offers affordable accounting with CRM integration.

- Puzzle IO vs Wave: Wave provides free accounting software for small businesses.

- Puzzle IO vs Quicken: Quicken is known for personal and small business finance management.

- Puzzle IO vs Hubdoc: Hubdoc specializes in collecting documents and extracting data.

- Puzzle IO vs Expensify: Expensify offers comprehensive expense reporting and management.

- Puzzle IO vs QuickBooks: QuickBooks is a popular choice for small business accounting.

- Puzzle IO vs AutoEntry: AutoEntry automates data entry from invoices and receipts.

- Puzzle IO vs FreshBooks: FreshBooks is tailored for service-based business invoicing.

- Puzzle IO vs NetSuite: NetSuite offers a comprehensive suite for enterprise resource planning.

More of Expensify

- Expensify vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Expensify vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Expensify vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Expensify vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Expensify vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Expensify vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Expensify vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Expensify vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Expensify vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Expensify vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Expensify vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Expensify vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Expensify vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Expensify vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

What key features should software for small businesses include?

Essential features are invoicing, expense tracking, bank reconciliation, and reporting to manage business finances effectively.

Can accounting software help with automation?

Yes, many platforms offer automation for tasks like data entry, bank feeds, and payment reminders, saving time.

Is there free accounting software suitable for small businesses?

Some free options exist with basic features, but they may lack advanced capabilities or scalability for growing businesses.

How can AI-powered features benefit small business accounting?

AI can automate categorization, detect anomalies, and provide insights, improving accuracy and efficiency in financial management.

Which type of accounting software is best for my small business?

The best software depends on your specific business needs, size, and complexity. Consider features, integrations, and scalability.