Dealing with business expenses can be a real headache, right?

You’re tracking receipts, trying to make sense of numbers, and hoping everything lines up for tax time.

It’s a common problem for many businesses, big or small.

But what if you could make this whole process simpler and faster?

We’re here to help you figure out Expensify vs AutoEntry which one is the best fit for your business.

Overview

We’ve tested Expensify and AutoEntry, testing their features, ease of use, and how well they handle different accounting tasks.

Our goal was to see firsthand how these tools stack up so you can make a smart choice for your business.

Join over 15 million users who trust Expensify to simplify their finances. Save up to 83% on time spent on expense reports.

Pricing: It has a free trial. The premium plan starts at $5/month.

Key Features:

- SmartScan Receipt Capture

- Corporate Card Reconciliation

- Advanced Approval Workflows.

Stop wasting 10+ hours/week on manual data entry. See how Autoentry slashed invoice processing time by 40% for Sage users.

Pricing: It has a free trial. Paid plan starts at $12/month.

Key Features:

- Data Extraction

- Receipt Scanning

- Supplier Automation

What is Expensify?

So, what is Expensify all about? It’s a popular tool for managing expenses.

It aims to make tracking your spending super easy.

You can snap photos of receipts. It handles everything from there. It’s built for businesses of all sizes.

Also, explore our favorite Expensify alternatives…

Key Benefits

- SmartScan technology scans receipt details and extracts them with over 95% accuracy.

- Employees get reimbursed quickly, often in as little as one business day via ACH.

- The Expensify Card can save you up to 50% on your subscription with its cash back program.

- No warranty is offered; their terms state that liabilities are limited.

Pricing

- Collect: $5/month.

- Control: Custom Pricing.

Pros

Cons

What is AutoEntry?

So, what is AutoEntry? It’s a tool designed to automate data entry.

Think of it as a smart scanner for documents.

It captures information from invoices and receipts.

Also, explore our favorite AutoEntry alternatives…

Our Take

Ready to cut your bookkeeping time? AutoEntry processes over 28 million documents each year and offers up to 99% accuracy. Start today and join the over 210,000 businesses worldwide that have reduced their data entry hours by up to 80%!

Key Benefits

AutoEntry’s biggest win is saving hours of boring work.

Users often see up to 80% less time spent on manual data entry.

It promises up to 99% accuracy in its data extraction.

AutoEntry does not offer a specific money-back warranty, but its monthly plans allow you to cancel at any time.

- Up to 99% accuracy on data.

- Unlimited users on all paid plans.

- Pulls full line items from invoices.

- Easy mobile app for receipt snaps.

- 90 days for unused credits to roll over.

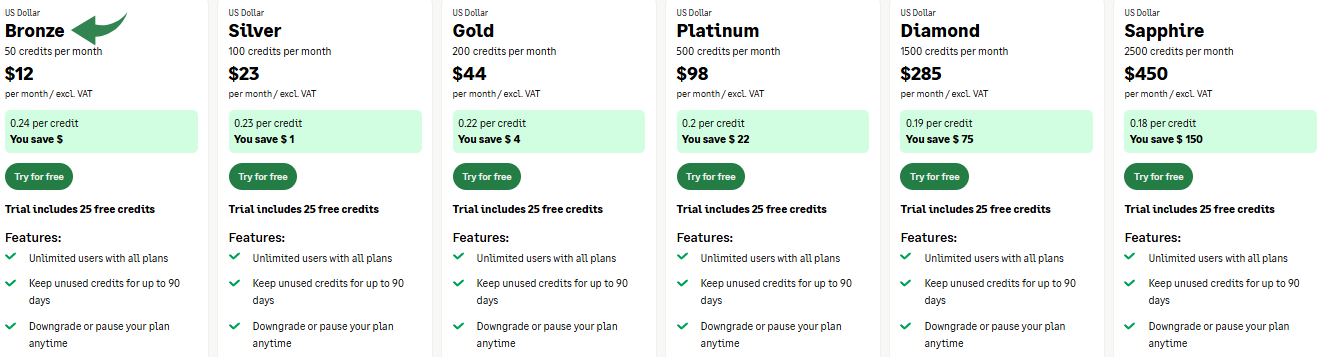

Pricing

- Bronze: $12/month.

- Silver: $23/month.

- Gold: $44/month.

- Platinum: $98/month.

- Diamond: $285/month.

- Sapphire: $450/month.

Pros

Cons

Feature Comparison

Navigating the world of document automation requires choosing between platforms built for specific tasks.

This comparison contrasts Expensify—the expense reporting specialist—with AutoEntry—the data capture engine—to detail their different functionalities and help you resolve your most critical accounting challenges.

1. Core Purpose and Focus

- Expensify makes the entire expense management process simple. It is a user-centric tool designed to help employees submit expense reports and get reimbursement quickly. Its core focus is on real time expense management process and approval workflows for employers.

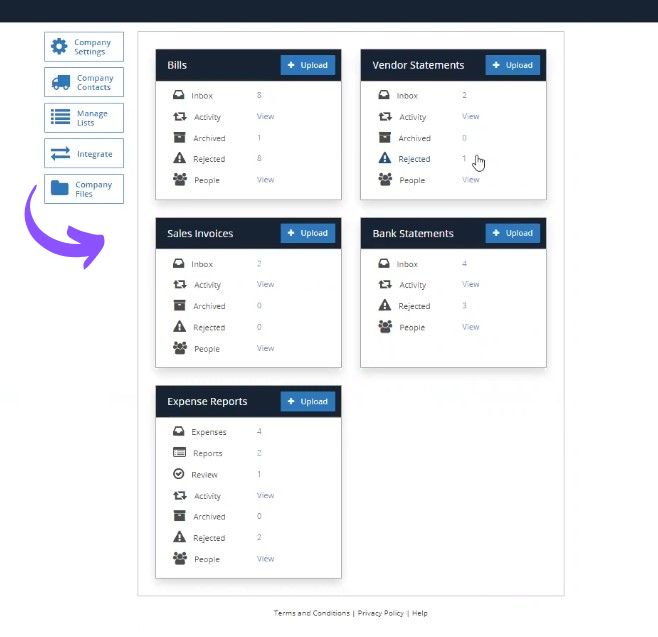

- AutoEntry is an automation security solution built to automatically extract data from paperwork and financial documents. Its purpose is not accounting but eliminating the effort and time spent on manual data entry, providing unlimited users with seamless integration.

2. Receipt Capture and Data Extraction

- Expensify excels at capture. You snap a photo of a receipt with the mobile phone app in your pocket, and Expensify makes the data ready for logging in a few seconds. This is crucial for employees on the web or mobile to immediately track spending.

- AutoEntry uses optical character recognition technology to upload purchase invoices, bank statements, and other financial documents. It captures line items and all details for transactions and is designed to handle high volumes of paperwork quickly.

3. Workflow and Approval Process

- Expensify features a robust approval workflow where the manager or finance team can review requests and approve them. The system helps employers reimburse employees and contractors via direct deposit and respond to reports in real time.

- AutoEntry’s workflow is focused on automated data export. It is primarily a staging platform where data is automatically extracted, coded, and marked for auto publishing directly into accounting software, greatly simplifying the data entry process.

4. Pricing and Usage Model

- Expensify pricing per month is flexible, often based on the count every of active users or the volume of reports submitted. The Expensify Card offers automated expense management and reimbursement workflows for employees.

- AutoEntry pricing is usage-based, sold on a credit system. The platform allows unlimited users and provides flexible pricing so that clients pay only for the volume of documents and bank statements they need to process per month.

5. Integration and Data Flow

- Expensify integrates strongly with accounting software like QuickBooks. This connection allows clients to export expense reports, mileage logs, and other details and transactions into their financial system for tax filing.

- AutoEntry’s strength is its seamless integration with many accounting software solutions (like Xero or QuickBooks). It is specifically built to efficiently transfer purchase invoice and expense data to another system.

6. Security and Online Threats

- Expensify takes security seriously, protecting user data and corporate policies. In some cases, a security trigger may occur. Expensify will respond to resolve these security requests via phone or chat support.

- AutoEntry protects itself from online attacks by using a security service like Cloudflare. Occasionally, several actions that could trigger a block, including submitting a certain word or phrase, a sql command or malformed data, or a file containing a certain word, can cause the action you just performed to be blocked and require the site owner to let you access the page by email the site owner with your ip address and cloudflare ray id found.

7. Specialized Features

- Expensify is robust for travel and project management. It can log mileage automatically, and users can tag expenses to specific projects or categories for complex organization. It offers dedicated tools to manage expense reports quickly.

- AutoEntry’s specialization lies in accurate data capture. It can process full line items from an invoice and automatically code transactions based on previous entries, providing seamless integration for bookkeeping.

8. User Interface and Access

- Expensify’s interface is clean and intuitive, designed for fast mobile use. It provides real time access to expense reports and pending requests from both the web and mobile phone app.

- AutoEntry’s web interface is focused on document flow and editing extracted details. While easy to upload documents, its main access is focused on the manager or accountant reviewing the file before posting to the accounting system.

9. Management and Control

- Expensify gives employers control over spending by allowing them to create and enforce policies immediately. They can set limits on credit card usage and approve expenses before they are reimbursed, helping finance teams save time and money.

- AutoEntry helps save time and effort for the finance team by automating data entry for purchase invoices and statements. The process is designed to streamline bookkeeping tasks and file transactions to the right categories with minimal review.

What to Look for in an Accounting Software?

Choosing the right accounting software involves more than just comparing features. Consider these key insights:

- Integration is Key: Does it sync with your existing accounting software like QuickBooks, Xero, or FreshBooks? Seamless connections save time.

- Automation Capabilities: Look for strong automation. How much manual data entry can it eliminate for financial data?

- User Interface: Is the system easy to use daily? A clunky interface can slow you down.

- Scalability: Can the software grow with your business? You don’t want to switch platforms every few years.

- Support: What kind of customer support is available? Timely help is crucial when issues arise.

- Security: How does it protect your sensitive financial data? Data security is paramount.

- Reporting: Does it offer the reports you need? Good reports provide valuable insights.

Final Verdict

So, which one wins? For most businesses needing full expense management, we pick Expensify.

It offers complete expense tracking and approvals.

Its mobile app is great for quick receipt scans.

But if your main need is just automated data entry for bills and invoices, especially for accounting firms with high volumes.

AutoEntry is strong. It truly excels at getting financial data into your accounting software.

We’ve tested both thoroughly so that you can trust our insights.

More of Expensify

- Expensify vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Expensify vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Expensify vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Expensify vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Expensify vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Expensify vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Expensify vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Expensify vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Expensify vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Expensify vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Expensify vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Expensify vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Expensify vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Expensify vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

More of AutoEntry

- AutoEntry vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- AutoEntry vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- AutoEntry vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- AutoEntry vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- AutoEntry vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- AutoEntry vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- AutoEntry vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- AutoEntry vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- AutoEntry vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- AutoEntry vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- AutoEntry vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- AutoEntry vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- AutoEntry vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- AutoEntry vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- AutoEntry vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Is Expensify good for small businesses?

Yes, Expensify is generally very good for small businesses. Its SmartScan feature and automated expense reporting simplify financial tracking, saving time for smaller teams.

Does AutoEntry work with QuickBooks?

Yes, AutoEntry integrates seamlessly with QuickBooks, both the Desktop and Online versions. This allows for automated data transfer of invoices and receipts directly into your QuickBooks accounting software.

Can I use both Expensify & AutoEntry?

While they have some overlapping features, it’s generally not necessary or cost-effective to use both simultaneously for core tasks. Choose the one that best fits your primary accounting and expense management needs.

How accurate is the OCR in these tools?

Both Expensify and AutoEntry boast high OCR accuracy. Expensify’s SmartScan is typically around 95% accurate for receipts, while AutoEntry often reaches 98% for various document types.

Which is better for just digitizing receipts?

Suppose your sole focus is digitizing and extracting data from receipts and invoices. In that case, AutoEntry might have a slight edge due to its specialized focus on automated data extraction and high accuracy.