Dealing with accounting at the end of each month can be a real headache.

You’re juggling numbers, checking reports, and making sure everything adds up.

You may have heard about tools that promise to make this easier.

This post will dive into Easy Month End vs Refreshme, helping you figure out which accounting tool can save you.

Overview

To give you the clearest picture, we took a deep dive into both Easy Month End and Refreshme.

We tested their features, looked at how easy they are to use.

This hands-on approach helps us bring you a fair comparison.

This Easy month-end, join 1,257 users who saved an average of 3.5 hours and reduced errors by 15%. Start your free trial!

Pricing: It has a free trial. The premium plan starts at $45/month.

Key Features:

- Automated Reconciliation

- Streamlined Workflows

- User-Friendly Interface

Unlock deeper financial insights! Refresh Me analyzes your spending and helps you save smarter.

Try it now!

Pricing: It has a free trial. The premium plan at $24.99/month.

Key Features:

- Automated Reconciliation

- Streamlined Workflows

- User-Friendly Interface

What is Easy Month End?

So, what exactly is Easy Month End?

Think of it as your digital assistant for closing out your books each month.

It’s built to make that often-stressful time much smoother.

Also, explore our favorite Easy Month End alternatives…

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

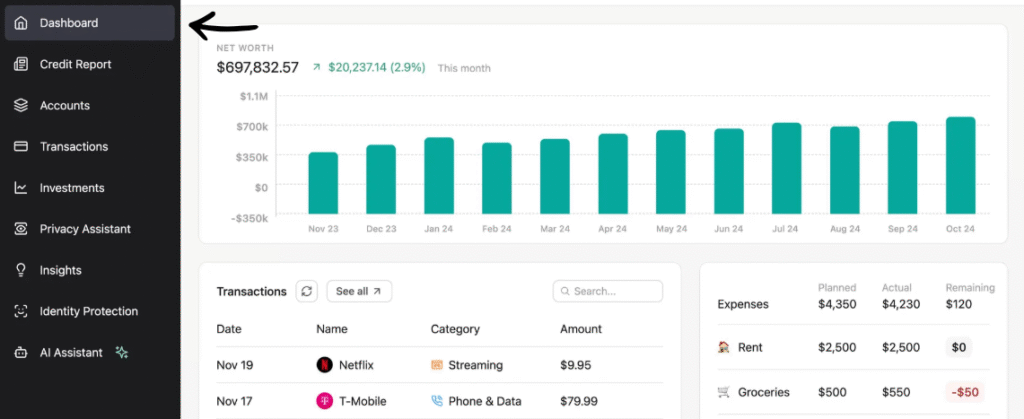

What is Refreshme

So, what about Refreshme?

This tool really focuses on making your accounting tasks, especially reconciliation, almost effortless.

It uses smart technology, even some AI, to help match up your numbers quickly and accurately.

Also, explore our favorite Refreshme alternatives…

Our Take

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Key Benefits

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

Pricing

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pros

Cons

Feature Comparison

Let’s dive into the core features of each platform to see how they stack up.

This comparison will help you decide which tool gives your finance team the efficiency it deserves.

1. Workflow Management

- Easy Month End: This platform offers robust workflow management to handle month end, quarter end, and year end tasks. It’s built for how a finance team works, helping them stay on top of all their to-dos and project timelines.

- RefreshMe: This tool is more focused on personal finance and task management. It helps individuals track personal bills and financial goals, not complex business workflows.

2. Reconciliation

- Easy Month End: It’s designed for balance sheet reconciliation and helps reconcile all your reconciliations. It aims for faster balance sheet reconciliations by linking directly to your data.

- Refreshme: While it can reconcile personal accounts, its ability is not for complex corporate balance sheets. It’s for personal banking and credit cards.

3. Team Collaboration

- Easy Month End: This tool is a true single platform for a finance team. You can assign tasks, leave comments, and track progress in one place to improve team collaboration and stop communication delays.

- RefreshMe: This is a single-user tool for personal finance.9 It does not have team collaboration features or the ability for multiple people to access a shared account.

4. Automation & Data Sync

- Easy Month End: This platform helps automatically get rid of the hassle of manual checklists. It can also sync with major accounting software to make the month-end close process a breeze.

- RefreshMe: It helps you automatically organize personal spending.11 It also sends reminders so you never forget to pay a bill, making life easier.

5. Audit & Compliance

- Easy Month End: It helps you collect audit evidence and provides a full audit log for every step. You can grant read-only access to auditors so they can review everything themselves. This promotes compliance.

- Refreshme: This tool is not built for formal business audits. It’s for personal use and does not generate audit evidence.

6. Ad Hoc Tasks & Flexibility

- Easy Month End: This platform has expanded its capabilities to manage ad hoc tasks and other non-monthly items. It can handle all kinds of finance team tasks.

- Refreshme: Its focus is on recurring personal finance tasks. It is not designed to track a wide range of unique business tasks.

7. Core Purpose

- Easy Month End: It’s a specialized ticket to a smoother month-end close. It’s designed to help a finance team get their work completed with fewer errors.

- Refreshme: Its core purpose is personal budgeting and financial health. It’s about taking control of your own money, and does not have the content for a business to change its operations.

8. Review and Sign-offs

- Easy Month End: A key feature is the ability to manage sign-offs from both the preparer and review team. It’s a vital part of the month-end close process that helps hold everyone accountable.

- Refreshme: There is no concept of a review or sign-offs. It is a tool for a single user to manage their own personal finance.

9. Price and Scalability

- Easy Month End: You can choose from different plans to manage a few entities or expand to unlimited users. There are no contracts and you can cancel anytime.

- Refreshme: Its pricing model is based on personal use, with plans for individuals, couples, and families. It is not built to scale for businesses with multiple entities.

What to Look for When Choosing Accounting Software?

- For Refreshme to be the perfect fit, consider if its treatment of data is sufficient for your needs.

- Does its team management features help create a more efficient finance team?

- It’s important to analyze how it handles a bank transfer and other manual confirmations.

- Does the app have a user-friendly interface that makes your first month-end easier?

- Ensure the upload and import process for your data is simple and quick, and that it has the ability to enter data from Excel.

- For your clients, do the services it offers fit their business needs?

- Look at the age of the software and if it has been consistently updated.

- Ask yourself if it will save your team stress, because your finance team deserves it.

- Can the support answer a question in a way that feels like it’s a form of art?

- It’s vital to have an outlook on how the software will help your business improve.

- Additionally, look for a tool that can grow with you and is not a one-size-fits-all solution.

- Avoid using a software that has failed in the past and does not have a clear path to get better.

- See if you can access a full demo before you commit to the software for longer.

- Can it handle complex cases? What if it encounters a new financial situation you have found?

- If you have a business with multiple entities, will it refresh the data for all of them?

- Make sure it is the perfect solution for your use case and that it has an easy onramp.

- Do not forget to clear your cookies from time to time to ensure a clean user experience.

Final Verdict

After looking closely at both, our final verdict is That easy Month End is the better choice for most businesses.

While Refreshme is great for personal finance.

Easy Month End directly tackles the business’s financial closing headaches.

It helps your accountant get everything on time every monthly cycle.

Its clear structure for the easy month-end process and audit trails gives it the edge.

We’ve dug into these tools so you can select them with confidence.

More of Easy Month End

Here is a brief comparison of Easy Month End with some of the leading alternatives.

- Easy Month End vs Puzzle io: While Puzzle.io is for startup accounting, Easy Month End focuses specifically on streamlining the close process.

- Easy Month End vs Dext: Dext is primarily for document and receipt capture, whereas Easy Month End is a comprehensive month-end close management tool.

- Easy Month End vs Xero: Xero is a full accounting platform for small businesses, while Easy Month End provides a dedicated solution for the close process.

- Easy Month End vs Synder: Synder specializes in integrating e-commerce data, unlike Easy Month End which is a workflow tool for the entire financial close.

- Easy Month End vs Docyt: Docyt uses AI for bookkeeping and data entry, while Easy Month End automates the steps and tasks of the financial close.

- Easy Month End vs RefreshMe: RefreshMe is a financial coaching platform, which is different from Easy Month End’s focus on close management.

- Easy Month End vs Sage: Sage is a large-scale business management suite, while Easy Month End offers a more specialized solution for a critical accounting function.

- Easy Month End vs Zoho Books: Zoho Books is an all-in-one accounting software, whereas Easy Month End is a purpose-built tool for the month-end process.

- Easy Month End vs Wave: Wave provides free accounting services for small businesses, while Easy Month End offers a more advanced solution for close management.

- Easy Month End vs Quicken: Quicken is a personal finance tool, making Easy Month End a better choice for businesses needing to manage a month-end close.

- Easy Month End vs Hubdoc: Hubdoc automates document collection, but Easy Month End is designed to manage the full close workflow and team tasks.

- Easy Month End vs Expensify: Expensify is an expense management software, which is a different function than Easy Month End’s core focus on the financial close.

- Easy Month End vs QuickBooks: QuickBooks is a comprehensive accounting solution, while Easy Month End is a more specific tool for managing the month-end close itself.

- Easy Month End vs AutoEntry: AutoEntry is a data capture tool, whereas Easy Month End is a complete platform for task and workflow management during the close.

- Easy Month End vs FreshBooks: FreshBooks is for freelancers and small businesses, while Easy Month End offers a dedicated solution for the month-end close.

- Easy Month End vs NetSuite: NetSuite is a full-featured ERP system, which is broader in scope than Easy Month End’s specialized focus on the financial close.

More of Refreshme

- Refresh me vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Refresh me vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Refresh me vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Refresh me vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Refresh me vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Refresh me vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Refresh me vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Refresh me vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Refresh me vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Refresh me vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- Refresh me vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Refresh me vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Refresh me vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Refresh me vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Refresh me vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Refresh me vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

What is the main difference between Easy Month End vs Refreshme?

Easy Month End focuses on streamlining your business’s financial closing tasks. Refreshme, however, is more geared towards personal finance management and automated reconciliation of individual transactions.

Can Easy Month End help with my taxes?

Yes, by organizing your financial data and providing clear audit trails, Easy Month End helps ensure your records are accurate & ready for tax preparation, making the process smoother for your accountant.

Does Refreshme integrate with other accounting software like Dext?

While Refreshme offers data syncing, its primary focus is on personal finance. It might not have the extensive integrations with business-specific accounting tools like Dext that a dedicated business solution would offer.

How often should I update my financial information in these tools?

For optimal accuracy, it’s best to update your financial information regularly, ideally daily or weekly. This frequent update ensures your reports are current and helps you avoid month-end rushes.