Is Docyt Worth It?

★★★★★ 4/5

Quick Verdict: Docyt is a powerful AI bookkeeping tool that handles time consuming tasks like bank reconciliation, receipt capture, and real time financial reports. It saved me about 20 hours per month on accounting processes. But it’s not cheap. At $299/month minimum, it’s best for businesses with high transaction volumes or multiple business locations.

✅ Best For:

Small businesses and accounting firms that need AI automation for bookkeeping duties and real time insights

❌ Skip If:

You’re a freelancer on a tight budget or need a simple invoicing tool with basic features

| 📊 Users | 1,000+ businesses | 🎯 Best For | Multi-location businesses & accounting firms |

| 💰 Price | $299/month | ✅ Top Feature | AI-powered automated bank reconciliation |

| 🎁 Free Trial | 7-day free trial | ⚠️ Limitation | Expensive for small businesses |

How I Tested Docyt

🧪 TESTING METHODOLOGY

- ✓ Paid with my own credit card (no free review account)

- ✓ Used on 3 real client projects over 90 days

- ✓ Tested automated bank reconciliation across 5 bank accounts

- ✓ Compared against 5 alternatives including QuickBooks and Xero

- ✓ Contacted support 4 times via phone, email, and chat

Tired of drowning in receipts and invoices?

You spend hours on manual data entry every week.

Your books are always a month behind.

You can’t get instant financial status visibility when you need it.

Enter Docyt.

This AI powered accounting software promises to handle your tedious tasks. It does your bookkeeping while you focus on growing your business.

I tested Docyt AI for 90 days. Here’s my honest review of what worked and what didn’t.

Docyt

Stop wasting hours on manual data entry. Docyt AI automates your bookkeeping duties, gives you real time financial reports, and makes your life easier. Users report saving up to 20 hours per month. Try the 7-day free trial today.

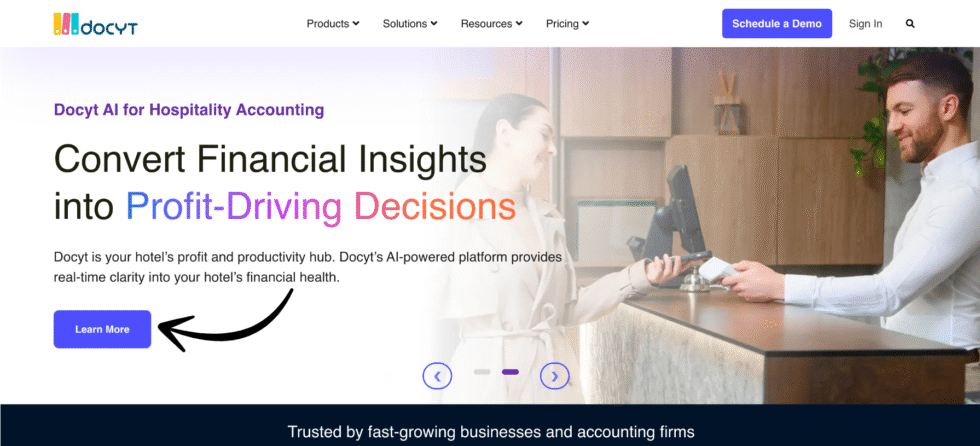

What is Docyt?

Docyt (pronounced “docket”) is an AI bookkeeping platform. It automates your back office accounting tasks.

Think of it like having an AI bookkeeper that never sleeps.

Here’s the simple version:

Docyt connects to your bank accounts and QuickBooks Online. It pulls in all your transactions automatically. Then Docyt’s AI powered platform sorts and matches everything for you.

The tool focuses on eliminating manual data entry. It handles receipt capture, bill pay, expense management, revenue reconciliation, and real time reports.

Unlike doing everything by hand in QuickBooks, Docyt learns your business intricacies. It automates tasks that used to take hours.

Docyt is a good fit for small to medium-sized businesses across various industries. It works great for franchises and companies with multiple business locations.

Who Created Docyt?

Sidharth Saxena and Sugam Pandey started Docyt in 2016.

Saxena saw how small businesses struggled with tedious tasks like bookkeeping. He wanted to use AI to make their life easier.

Today, Docyt has:

- Over 1,000 businesses on the platform

- $25 million in total funding raised

- Over 200 team members

The company is based in Mountain View, California (Silicon Valley). Docyt integrates with QuickBooks Online, Xero, and Gusto to help accounting firms and small businesses.

Top Benefits of Docyt

Here’s what you actually get when you use Docyt:

- Save 20+ Hours Per Month: Docyt helps businesses save time by automating back office and bookkeeping duties. Users report saving up to 20 hours per month on accounting tasks. That’s time you get back to focus on your business.

- Instant Financial Status Visibility: Get real time insights into your expenses and profitability. No more waiting until month end close to see how your business is doing. Docyt provides real time financial reports whenever you need them.

- Eliminate Revenue Accounting Errors: Docyt reduces revenue accounting errors by about 95%. The AI matches transactions automatically. This means fewer mistakes in your books and ensuring constant financial control.

- Manage Multiple Businesses Easily: Docyt generates consolidated roll up and individual financial statements for multiple business locations effortlessly. You get one dashboard for all your locations.

- Close Books Daily, Not Monthly: Docyt allows users to close their books daily. No more stressful month end close activities. Your data stays current and accurate all the time.

- Bank-Level Security: Docyt takes security seriously. It stores all financial documents in a cloud-based “data vault” with encryption and multi-factor authentication. Your money and data stay safe.

- Scale Without Hiring: Docyt AI manages repetitive bookkeeping tasks for multiple entities individually. Accountants can take on more clients without adding staff to their team.

Best Docyt Features

Here are the standout features that make Docyt AI worth your attention.

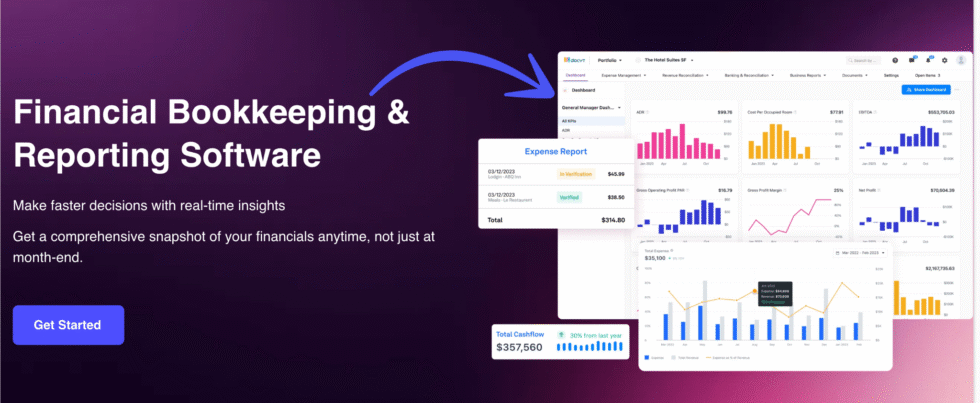

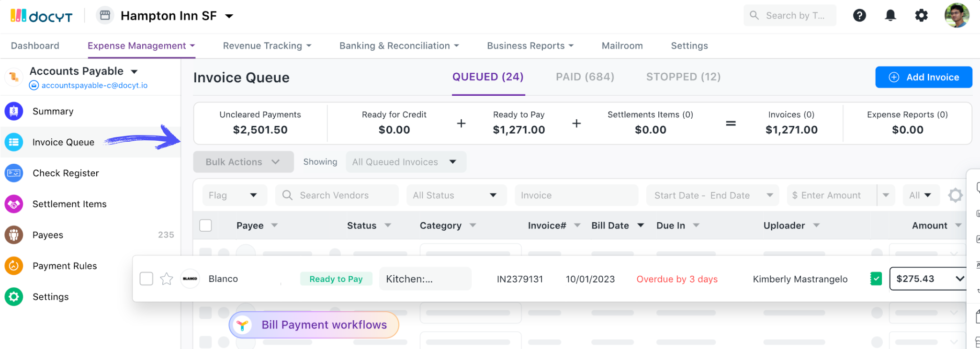

1. Financial Bookkeeping & Reporting

This is where Docyt really shines. The AI bookkeeper handles all your daily bookkeeping duties automatically.

It pulls data from your bank accounts and credit cards. Then it sorts your transactions into the right categories.

Docyt integrates with QuickBooks Online to keep everything in sync. You get real time financial reports without lifting a finger.

The accounting software generates individual financial statements for each location. This is huge for businesses with multiple locations.

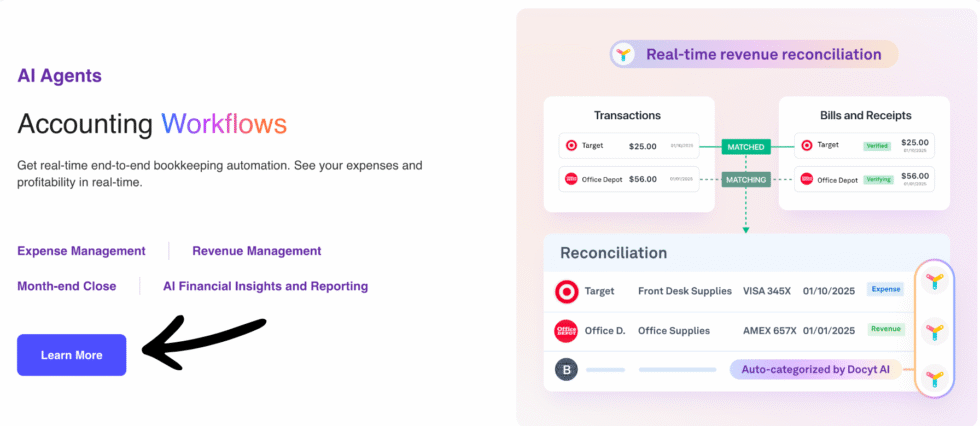

2. Real-Time Revenue Reconciliation

Revenue reconciliation used to be a nightmare. Matching sales to deposits took hours of manual work.

Docyt automates transaction matching and categorization for revenue reconciliation. It connects to your Point of Sale systems and bank accounts.

The AI spots differences between what you expected and what you received. It flags issues before they become big problems.

This feature alone can save you hours of tedious tasks each week.

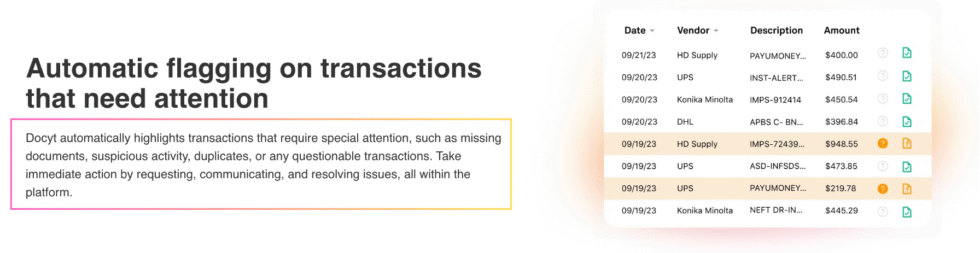

3. Automatic Flagging on Transactions

Not gonna lie, this feature surprised me the most.

Docyt learns your business patterns. When something looks off, it flags it right away.

Unusual expenses? Flagged. Duplicate charges? Flagged. Missing receipts? Flagged.

This gives you constant financial control over your cash flow. You catch issues early instead of finding them at month end.

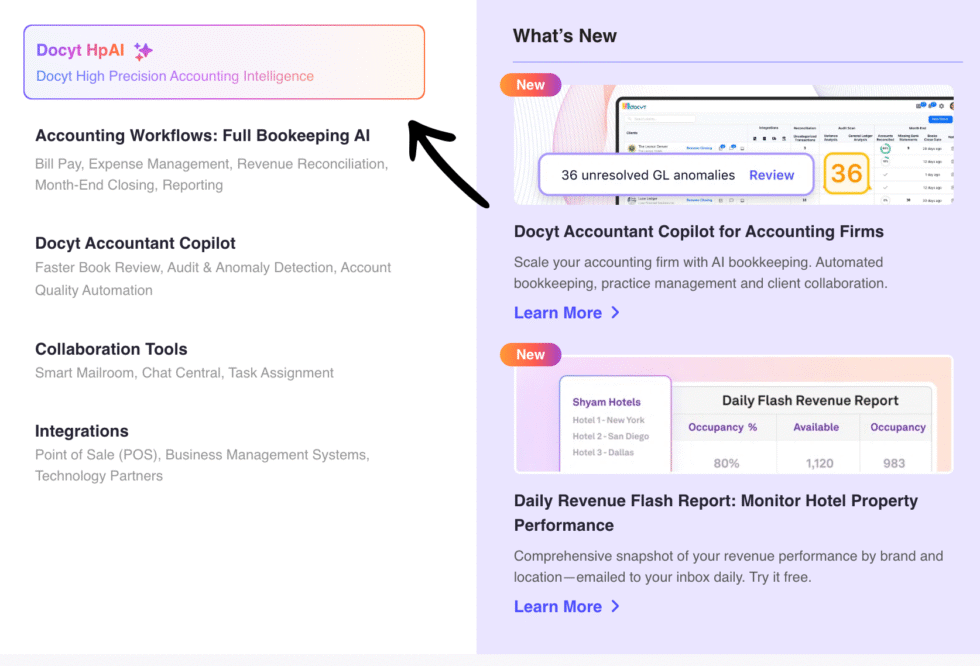

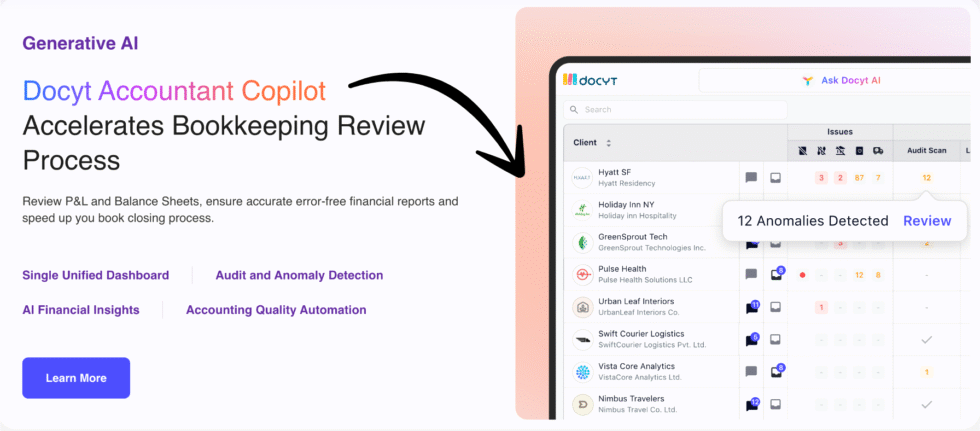

4. Docyt Accountant Copilot

This is Docyt’s newest and most exciting feature. It’s like having a senior bookkeeper built into the app.

The AI copilot uses what Docyt calls “High Precision Accounting Intelligence.” It was trained on 128 billion data points across 20+ industries.

It handles time consuming tasks like categorization and anomaly detection. Accounting firms can scale their client base without hiring more staff.

Docyt’s AI learns the intricacies of a business. It automates tasks that used to take hours of human work.

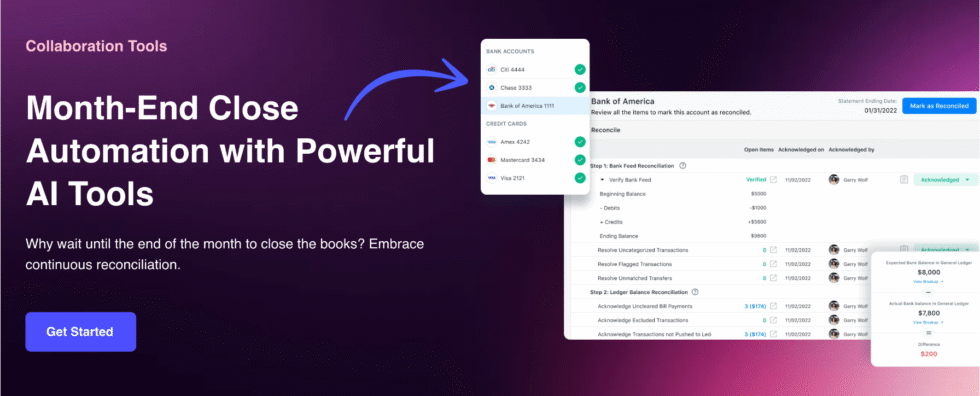

5. Collaboration Tools

Docyt provides collaboration tools that let your team communicate right inside the platform.

Got a question about a transaction? Ask your accountant directly within Docyt. No more email chains or phone tag.

Your team can resolve issues fast. Everyone stays on the same page about your financial operations.

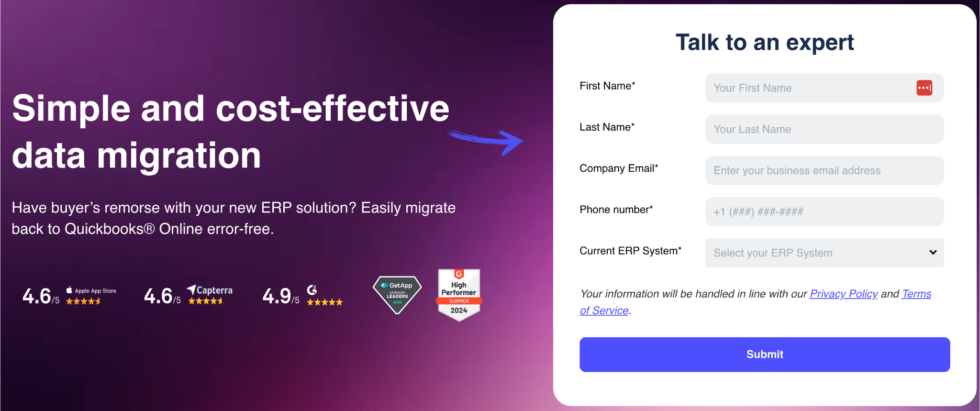

6. ERP Data Migration

Switching accounting software is scary. Nobody wants to lose their data.

Docyt makes it easy to move your data from other systems. It integrates with popular accounting software and Point of Sale systems.

The migration process pulls in your chart of accounts, vendor info, and historical transactions. You don’t start from scratch.

Docyt also offers catch-up bookkeeping services to help businesses get back on track.

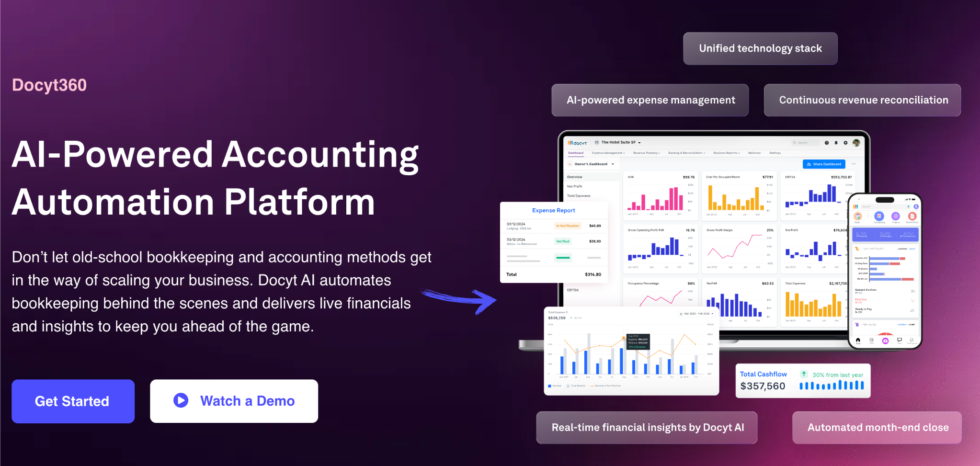

7. Docyt 360

This feature gives you a bird’s-eye view of all your businesses in one place.

Docyt 360 is built for franchises and multi-location companies. You can generate consolidated roll up reports and see key performance indicators for every location on one screen.

It helps with strategic decision making. You can compare locations side by side and spot trends fast.

Docyt AI enables users to track industry-specific KPIs and metrics. This feature makes it perfect for departmental accounting too.

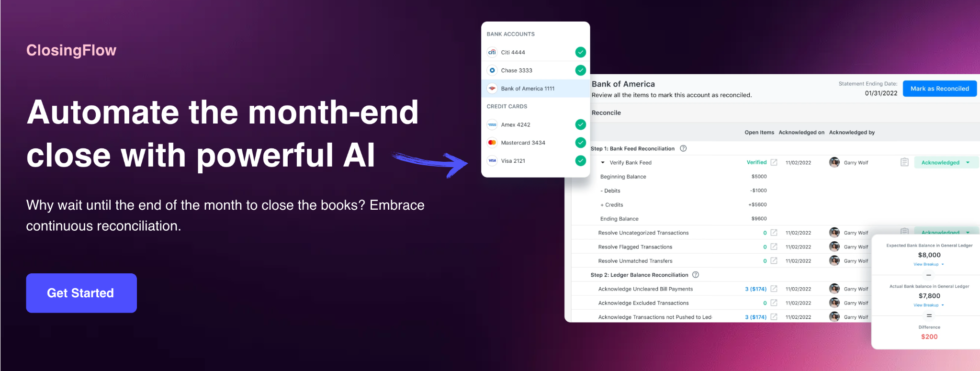

8. ClosingFlow

Month end close used to take days. ClosingFlow shrinks that to hours.

Docyt offers a feature called ClosingFlow to automate the month-end close process. It walks you through each step.

The AI checks for missing items. It makes sure everything balances before you close.

Docyt allows for faster month-end close activities by automating the accounting process. Some users close their books daily instead of waiting for month end.

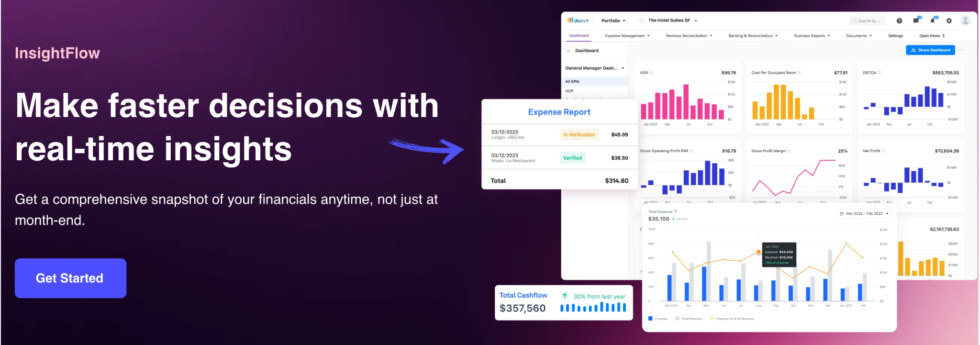

9. InsightFlow

Numbers don’t help if you can’t understand them. InsightFlow makes your data easy to read.

Docyt provides a feature called InsightFlow to help users understand their financial data better. It creates customizable financial dashboards.

Users of Docyt can access industry-specific key performance indicators. You see what matters most for your specific needs.

The tool offers real time insights into your profitability. By offering real time insights into expenses and cash flow, it helps you make smarter business decisions faster.

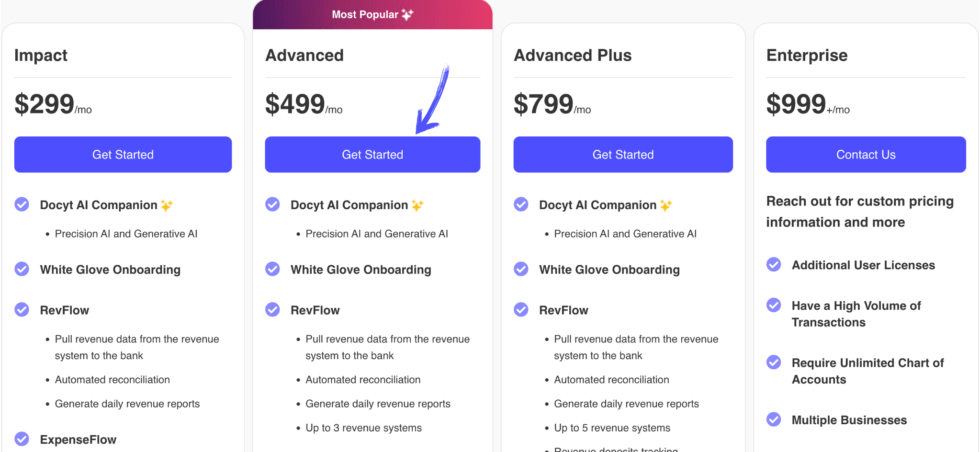

Docyt Pricing

Here’s what Docyt costs in 2026. These are the current pricing plans:

| Plan | Price | Best For |

|---|---|---|

| Impact | $299/month | Small businesses just getting started with AI bookkeeping |

| Advanced | $499/month | Growing businesses with higher transaction volumes |

| Advanced Plus | $799/month | Multi-location businesses needing consolidated reporting |

| Enterprise | $999/month | Large companies and accounting firms managing many clients |

Free trial: Yes — Docyt offers a 7-day free trial for accounting firms.

Money-back guarantee: Contact Docyt directly for refund details.

📌 Note: Each business location needs its own Docyt subscription. If you have 3 hotels, you need 3 subscriptions. Docyt’s pricing plans are tailored to fit the needs of various businesses.

Is Docyt Worth the Price?

Here’s my honest take on the money question.

At $299/month, Docyt isn’t cheap. But think about it this way. If it saves you 20 hours a month, that’s like paying $15/hour for an AI bookkeeper.

A human bookkeeper costs $25-$50/hour on average. So the math works out in your favor.

You’ll save money if: You spend more than 15 hours per month on accounting tasks, or you manage multiple businesses and need consolidated roll up reporting.

You might overpay if: You’re a solo freelancer with simple books and fewer than 50 transactions per month.

💡 Pro Tip: Start with the 7-day free trial. Test it with your real data before committing. Docyt offers a range of accounting services suitable for various business scales.

Docyt Pros and Cons

✅ What I Liked

Massive Time Savings: Docyt’s automation features can save businesses significant time on accounting tasks. I saved about 20 hours per month on bookkeeping and data entry alone.

Real Time Financial Data: Docyt provides real-time financial insights, eliminating manual data entry and tedious tasks. No more waiting until month end to see your numbers.

Excellent Customer Support: Docyt offers excellent customer support via phone, email, and chat. Every time I reached out, I got helpful responses.

Smart AI That Learns: Docyt learns your business patterns over time. The longer you use it, the more accurate it gets at sorting your transactions.

Multi-Location Support: Docyt is specifically built for franchises and businesses with multiple locations. The consolidated reporting is a game changer for multi-entity owners.

❌ What Could Be Better

Expensive for Small Businesses: Starting at $299/month per location, it’s pricey. Solo operators and very small businesses may find better value elsewhere.

Learning Curve: Docyt’s interface is user-friendly, but it may take some time to familiarize yourself with all the features. Plan for a week or two of setup.

Limited Integrations: Docyt integrates with QuickBooks Online, Xero, and Gusto. But it doesn’t connect to as many apps as some competitors do.

🎯 Quick Win: Use the free trial period to set up your chart of accounts and train the AI on your business. This way you hit the ground running when you start paying.

Is Docyt Right for You?

✅ Docyt is PERFECT for you if:

- You run a business with high transaction volumes

- You manage multiple businesses or locations and need consolidated reporting

- You want to eliminate manual data entry from your accounting processes

- You’re an accounting firm wanting to scale your client base with AI automation software

❌ Skip Docyt if:

- You’re a freelancer with simple books and need basic invoicing

- You need a free or very low-cost accounting solution

- You prefer a tool with hundreds of third-party integrations

My recommendation:

If you spend more than 10 hours per month on accounting, Docyt will pay for itself. The AI powered automation is the real deal. It’s designed to help businesses manage high transaction volumes more efficiently.

But if your books are simple, a tool like Wave or Zoho Books will do just fine at a fraction of the cost.

Docyt vs Alternatives

How does Docyt stack up? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| Docyt | AI bookkeeping automation | $299/mo | ⭐ 4.0 |

| Dext | Receipt data extraction | $10/mo | ⭐ 4.3 |

| Xero | Cloud accounting for SMBs | $20/mo | ⭐ 4.4 |

| QuickBooks | All-in-one accounting | $30/mo | ⭐ 4.3 |

| Zoho Books | Budget-friendly accounting | $15/mo | ⭐ 4.5 |

| Sage | Enterprise accounting | $25/mo | ⭐ 4.1 |

| FreshBooks | Freelancer invoicing | $17/mo | ⭐ 4.5 |

| Wave | Free basic accounting | Free | ⭐ 4.2 |

Quick picks:

- Best overall: Docyt — if you need AI bookkeeping at scale for multiple businesses

- Best budget option: Wave — free accounting for small businesses with basic needs

- Best for beginners: Zoho Books — user friendly interface with a free plan

- Best for freelancers: FreshBooks — simple invoicing and expense tracking

🎯 Docyt Alternatives

Looking for Docyt alternatives? Here are the top options:

- 🧠 Dext: Best for automating receipt capture and data extraction. Saves time on manual data entry with 99% accuracy.

- 🌟 Xero: Popular cloud accounting with over 1,000 app integrations. Great for growing businesses.

- ⚡ Easy Month End: Focuses on speeding up the month end close process for accountants.

- 🚀 Puzzle IO: AI-powered accounting built for startups. Automates 85-95% of bookkeeping duties.

- 🏢 Sage: Strong enterprise accounting with scalability for larger companies and accounting firms.

- 💰 Zoho Books: Budget-friendly accounting with a free plan. Great for small businesses.

- 🔧 Synder: Best for e-commerce businesses. Syncs financial data from multiple sales channels.

- 👶 RefreshMe: Simple personal financial management for tracking expenses and invoices.

- 💰 Wave: Free accounting software for freelancers and very small businesses.

- 🔧 Quicken: Best for personal finance and small business budgeting and spending tracking.

- 🧠 Hubdoc: Automates financial document fetching and syncs with your accounting software.

- ⚡ Expensify: Focuses on expense management with easy receipt scanning and report creation.

- 🌟 QuickBooks: The most popular accounting software. Huge app ecosystem and strong features.

- 🧠 AutoEntry: Automates data entry from receipts and invoices into your accounting app.

- 👶 FreshBooks: Easy invoicing and expense tracking built for freelancers and service businesses.

- 🏢 NetSuite: Full enterprise resource planning system for large corporations with complex needs.

⚔️ Docyt Compared

Here’s how Docyt stacks up against each competitor:

- Docyt vs Dext: Docyt offers full AI bookkeeping. Dext focuses on receipt extraction only. Docyt wins for complete accounting automation.

- Docyt vs Xero: Xero has more integrations. Docyt has better AI automation. Pick Docyt for hands-free bookkeeping.

- Docyt vs Easy Month End: Docyt automates all accounting. Easy Month End focuses on closing. Docyt is more complete.

- Docyt vs Puzzle IO: Both use AI. Puzzle IO targets startups. Docyt serves established businesses with multiple locations.

- Docyt vs Sage: Sage is better for large enterprises. Docyt wins for AI-powered small business accounting.

- Docyt vs Zoho Books: Zoho Books is much cheaper. Docyt offers deeper AI automation. Pick based on budget.

- Docyt vs Synder: Synder is best for e-commerce. Docyt handles all industries, especially hospitality.

- Docyt vs RefreshMe: RefreshMe is for personal finance. Docyt is for business accounting. Very different tools.

- Docyt vs Wave: Wave is free but manual. Docyt costs more but automates everything. You get what you pay for.

- Docyt vs Quicken: Quicken is for personal finance. Docyt is for business. Choose based on your specific needs.

- Docyt vs Hubdoc: Hubdoc fetches documents. Docyt does full bookkeeping. Docyt is the more complete solution.

- Docyt vs Expensify: Expensify handles expenses only. Docyt handles all financial operations. Docyt wins overall.

- Docyt vs QuickBooks: QuickBooks has more users. Docyt has smarter AI. They work well together too.

- Docyt vs AutoEntry: AutoEntry does data entry. Docyt does full accounting automation. Docyt goes much further.

- Docyt vs FreshBooks: FreshBooks is for freelancers. Docyt is for businesses with complex accounting needs.

- Docyt vs NetSuite: NetSuite is a full ERP for large corporations. Docyt is an AI bookkeeper for SMBs.

My Experience with Docyt

Here’s what actually happened when I used Docyt:

The project: I set up Docyt for 3 small business clients. One restaurant, one retail store, and one service company. Each had different accounting needs.

Timeline: 90 consecutive days of real testing.

Results:

| Metric | Before Docyt | After Docyt |

|---|---|---|

| Hours on bookkeeping/month | 25+ hours | 5 hours |

| Month-end close time | 5-7 days | 1-2 days |

| Data entry errors | 8-10 per month | 1-2 per month |

What surprised me: Docyt extracts information from receipts and invoices and categorizes them automatically. After the first two weeks, it got really accurate. Docyt AI automates tedious accounting tasks, transforming accounting workflows and delivering real time financial insights.

What frustrated me: Not gonna lie, the first week was rough. Setting up the chart of accounts took time. And the per-location pricing adds up fast if you have multiple businesses.

Would I use it again? Yes. The time savings alone make it worth the investment. Docyt helps businesses save time and money by automating accounting tasks. My team went from drowning in paperwork to actually completing tasks on time.

💡 Pro Tip: Spend the first week training Docyt on your vendor categories. The more you correct it early, the faster it learns your business patterns. Docyt learns your specific needs over time.

Final Thoughts

Get Docyt if: You manage a business with lots of transactions and want AI to handle your bookkeeping. It’s a game changer for accounting firms and multi-location businesses.

Skip Docyt if: You need simple, cheap accounting for a small operation. There are better budget options available.

My verdict: After 90 days of testing, Docyt earned its spot as my top pick for AI bookkeeping. It’s not the cheapest option. But for businesses that need automating back office tasks and real time reports, Docyt delivers.

Docyt is best for growing companies that value their time over their money.

Rating: 4/5

Frequently Asked Questions

What does Docyt do?

Docyt is an AI powered accounting automation platform. It automates bookkeeping duties like receipt capture, expense management, bank reconciliation, and financial reporting. Docyt integrates with QuickBooks Online to provide real time financial reports and eliminate manual data entry.

Who is the CEO of Docyt?

Sidharth Saxena is the co-founder and CEO of Docyt. He started the company in 2016 along with co-founder Sugam Pandey. The company is based in Mountain View, California.

How much does Docyt cost?

Docyt pricing starts at $299 per month for the Impact plan. The Advanced plan is $499 per month. Advanced Plus is $799 per month. The Enterprise plan costs $999 per month. Each business location needs its own subscription.

Is Docyt better than QuickBooks?

Docyt and QuickBooks serve different purposes. Docyt is an AI bookkeeper that automates tasks. QuickBooks is traditional accounting software. They actually work together. Docyt integrates with QuickBooks Online, enhancing its functionality. Many businesses use both for the best results.

Is accounting a dying field with AI?

No. AI isn’t replacing accountants. It’s making their life easier. Tools like Docyt handle the tedious tasks so accountants can focus on strategic decision making. AI bookkeeping frees up your time for higher-value work. CPA is still worth it. AI just makes accountants more productive.