Buried in receipts? Is your accounting software a headache, not a help?

Many businesses struggle with inefficient tools.

It’s like fighting a fire with a squirt gun – inefficient and frustrating.

But what if you could ditch the financial chaos and focus on growth?

This guide reveals the 9 best Docyt alternatives for 2025. Discover software that frees you from financial drudgery.

Get ready for a smoother, smarter financial future!

What Are the Best Docyt Alternatives?

Choosing the top accounting software can feel overwhelming.

We’ve dug deep to find the top options that can truly help your business.

Forget the hassle and discover tools that make managing your money simple.

Here’s our list of the 9 best Docyt alternatives.

1. Xero (⭐4.8)

Xero is another popular cloud-based accounting software.

It’s known for being easy to use and having a clean design.

Many small businesses love Xero for its simplicity and good features.

It helps you keep track of invoices, bills, and your bank transactions.

Unlock its potential with our Xero tutorial.

Also, explore our Docyt vs Xero comparison!

Our Take

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features now!

Key Benefits

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

Pricing

- Starter: $29/month.

- Standard: $46/month.

- Premium: $69/month.

Pros

Cons

2. Puzzle IO (⭐4.5)

Puzzle IO is designed for small businesses and solo entrepreneurs.

It aims to simplify tasks like invoicing and expense tracking.

Think of it as a helpful assistant that keeps your finances organized without a lot of complicated steps.

It’s built to be very user-friendly.

Unlock its potential with our Puzzle IO tutorial.

Also, explore our Docyt vs Puzzle IO comparison!

Our Take

Ready to simplify your finances? See how Puzzle io can save you up to 20 hours a month. Experience the difference today!

Key Benefits

Puzzle IO really shines when it comes to helping you understand where your business is headed.

- 92% of users report better financial forecasting accuracy.

- Get real-time insights into your cash flow.

- Easily create different financial scenarios to plan.

- Collaborate seamlessly with your team on financial goals.

- Track key performance indicators (KPIs) in one place.

Pricing

- Accounting basics: $0/month.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Pros

Cons

3. Dext (⭐4.0)

Dext (formerly Receipt Bank) isn’t full accounting software.

It’s a smart tool for receipts and invoices.

It automates receipt and invoice processing. You snap a picture.

Dext then grabs all the important info. This saves you tons of time on manual data entry.

It works great with other accounting programs.

Unlock its potential with our Dext tutorial.

Also, explore our Docyt vs Dext comparison!

Our Take

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Key Benefits

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

Pricing

- Annually Subscription: $24

Pros

Cons

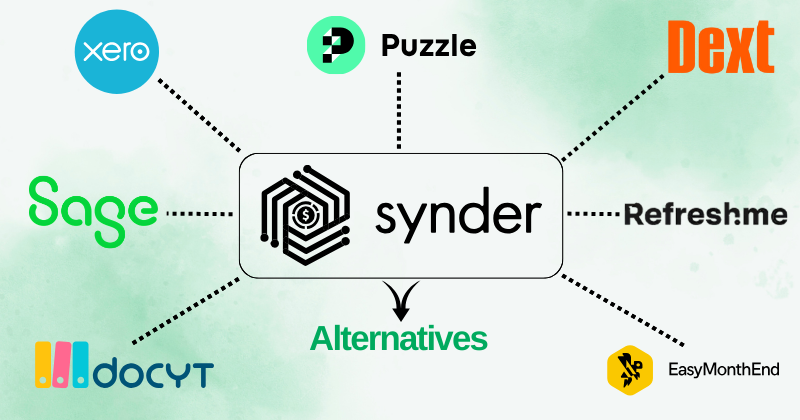

4. Synder (⭐3.8)

Synder is a tool that helps online businesses.

If you sell on Shopify, Amazon, or PayPal, Synder connects all that sales data.

It sends this info right into your main accounting software.

This makes sure your online sales are perfectly recorded without manual work.

Unlock its potential with our Synder tutorial.

Also, explore our Docyt vs Synder comparison!

Our Take

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Key Benefits

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

Pricing

All the plans will be Billed Annually.

- Basic: $52/month.

- Essential: $92/month.

- Pro: $220/month.

- Premium: Custom Pricing.

Pros

Cons

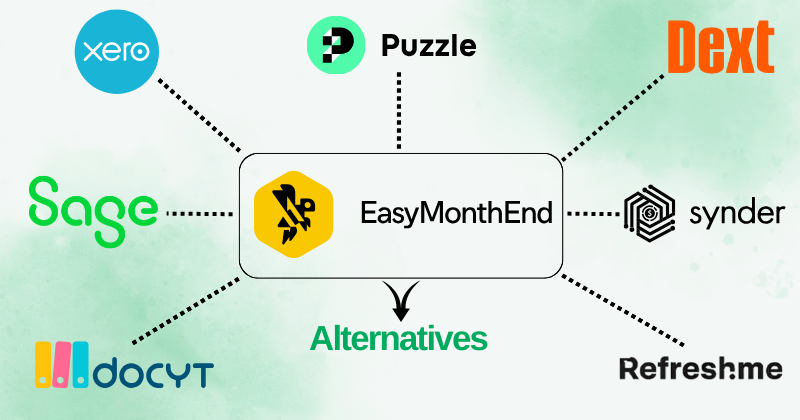

5. Easy Month End (⭐3.6)

Easy Month End helps accountants and bookkeepers finish month-end tasks faster.

It’s not full accounting software.

It’s designed to bring more order and less stress to your financial closing process.

Think of it as your assistant for getting everything wrapped up smoothly each month.

Unlock its potential with our Easy Month End tutorial.

Also, explore our Docyt vs Easy Month End comparison!

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

6. Sage (⭐3.4)

Sage is a well-known name in the accounting world.

It’s a powerful tool that helps with many business expenses.

It can handle a lot, from managing your cash flow to doing tax calculations.

It’s a strong option for bigger businesses that need a comprehensive system.

It also connects with other accounting software.

Unlock its potential with our Sage tutorial.

Also, explore our Docyt vs Sage comparison!

Our Take

Ready to supercharge your finances? Sage users have reported an average of 73% higher productivity and a 75% faster process cycle time.

Key Benefits

- Automated invoicing and payments

- Real-time financial reports

- Strong security to protect data

- Integration with other business tools

- Payroll and HR solutions

Pricing

- Pro Accounting: $66.08/month.

- Premium Accounting: $114.33/month.

- Quantum Accounting: $198.42/month.

- HR and Payroll bundles: Custom Pricing based on your needs.

Pros

Cons

7. RefreshMe (⭐3.2)

RefreshMe is a less-known but viable option for small businesses.

It’s designed to be simple and affordable.

The focus is on core accounting needs like expense tracking and invoicing.

While it might lack some of the more advanced features of its competitors, it provides a straightforward platform for those with basic financial needs.

Unlock its potential with our Refreshme tutorial.

Also, explore our Docyt vs Refreshme comparison!

Our Take

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Key Benefits

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

Pricing

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pros

Cons

8. FreshBooks (⭐3.0)

FreshBooks is designed with freelancers and small service-based businesses in mind.

It’s really strong on invoicing and time tracking.

If you bill clients for your time or projects, FreshBooks makes that super simple.

It helps you get paid faster.

Unlock its potential with our FreshBooks tutorial.

Also, explore our Docyt vs FreshBooks comparison!

Our Take

Tired of complex accounting? 30 million+ businesses trust FreshBooks to create professional invoices. Simplify your accounting software today!

Key Benefits

- Professional invoice creation

- Automated payment reminders

- Time tracking

- Project management tools

- Expense tracking

Pricing

- Lite: $2.10/month.

- Plus: $3.80/month.

- Premium: $6.50/month.

- Select: Custom Pricing.

Pros

Cons

9. QuickBooks (⭐2.8)

It’s a really popular choice for managing your business finances.

Think of it as a complete toolbox for all your accounting needs.

Many small and medium-sized businesses use it because it’s so versatile.

It handles all your money tasks, from invoices to payroll.

It’s user-friendly, even if you’re not an accounting expert.

Unlock its potential with our QuickBooks tutorial.

Also, explore our Docyt vs QuickBooks comparison!

Key Benefits

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

Pricing

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Pros

Cons

Buyers Guide

When our team was looking for a new tool, we researched Docyt alternatives.

We knew we needed a solution that would help with expense management and get rid of manual data entry.

We also wanted to find a tool that our employees would like and that worked well with our existing systems, like QuickBooks.

Here’s how we did our research:

- Pricing: We looked at how much each product cost. We wanted a good price for the features we needed, especially since we wanted to save valuable time. We looked at different plans and what was included.

- Features: We compared the best features of each product. We looked for things like a user friendly interface, good expense reporting, and strong document management. We also paid close attention to a security service and how it would protect itself from online attacks.

- Negatives: We checked for what was missing. We looked for things that actions that could trigger the way of our work. For example, we researched why a user might be unable to access a website or page. We found that several actions could trigger this block, including submitting a certain word or phrase. Sometimes a security service might be performed triggered by a sql command or malformed data. If this happens, you might see a message like cloudflare ray id found or just cloudflare ray i. If your connection is blocked, you might be unable to go forward.

- Support or Refund: We looked into their support and refund policies. We wanted to know what to do if we had an issue, like a cloudflare ray issue. The company’s security solution should be able to help. We checked if we could email the site owner to resolve an issue, especially if our ip address was part of the problem. We also looked for clear steps on what to do if a security block was performed triggered and how the company takes several actions to help.

- Security: We checked each product by using a security service. We wanted a tool that would protect our company from online threats. We also researched what would happen if a security issue was performed triggered the security of a phrase a sql command. This helped us choose a solution that we knew was safe. We wanted a tool where triggered the security solution would be triggered by a real threat, not just a simple mistake.

Wrapping Up

We have looked at a lot of tools today.

From full accounting programs to special ones for receipts or online sales.

The best choice helps you manage your money without a lot of hassle or errors.

The action you just performed to learn more is smart.

The right security service to protect your business starts with good software.

A wrong move, like a strange sql command, could get you blocked.

This is what triggered the security solution we have in place.

Trust our guides to help you make these important choices and avoid problems.

Frequently Asked Questions

What is the alternative to Docyt?

Docyt has several strong rivals. Xero stands as the top overall choice for automation. Stampli and BILL are excellent if you specifically need AI-driven accounts payable. For freelancers, FreshBooks offers a more streamlined, user-friendly experience.

What is the best app to help with accounting?

QuickBooks Online remains the industry titan. It offers unmatched depth and customization. However, if you are a freelancer, FreshBooks is better. Micro-businesses should look at Wave for its powerful free tier. It simply works.

What is the alternative to Bectran?

Invoiced is currently the highest-rated alternative for AR automation. Billtrust and YayPay are also heavy hitters in the credit management space. They offer predictive analytics that Bectran sometimes lacks. Choose based on your ERP integration needs.

Who is Xero’s biggest competitor?

QuickBooks Online is the primary global rival. In 2026, QuickBooks holds roughly 34% of the market share. FreshBooks and Zoho Books are catching up quickly by targeting small service-based businesses. It’s a tight race for dominance.

Who are DataArt competitors?

For high-end software engineering, EPAM Systems and SoftServe are the biggest threats. They offer similar global scale. If you’re a startup, Founders Arm provides faster offshore scaling. It depends on whether you need consulting or raw code.

Who are Doxel competitors?

Autodesk Construction Cloud and Procore are the dominant platforms here. They offer comprehensive project management. For AI-specific reality capture, OpenSpace and Buildots are Doxel’s direct tech rivals. They turn jobsite photos into actionable data.

Who are Totalmobile competitors?

Salesforce Field Service is the gold standard for enterprise-level mobile workforces. For smaller teams, Jobber and Housecall Pro are much easier to deploy. Connecteam is also a rising star for deskless employee communication. Efficiency is the goal.

More Facts about docyt alternatives

- M-Files finds files by what is inside them, not just what folder they are in. This helps companies follow strict rules.

- Docyt uses smart computers to help businesses do their math and automatically keep track of their paperwork.

- Zeni uses robots and real money experts to help new companies see how much money they have right now.

- Sage Intacct is a powerful online tool that helps large companies manage their finances.

- In 2026, there are many new choices for businesses that want to use robots to help with their paperwork and math.

- QNE Accounting is built to make it easier for businesses to handle their financial tasks.

- SaasAnt helps move sales lists into money-tracking software so people don’t have to type them in.

- SAP Concur helps workers track the money they spend while traveling for work.

- Xero is a simple website for business math that is known for being very easy to use.

- Puzzle is a modern way for new tech companies to track their spending and see their financial health.

- Dext automatically reads receipts and bills, so you don’t have to write down the numbers yourself.

- Synder takes sales from places like Amazon and puts them right into a company’s main math software.

- QuickBooks is a widely used tool for tracking finances among small and medium-sized businesses.

- FreshBooks is great for people who work for themselves and need to send bills or track their work hours.

- Hubdoc grabs your digital bills and pulls the info out so it can be sent straight to Xero.

- Zoho Books is a helpful tool for small businesses that need a wide range of features in one place.

- DocuWare is a high-tech system for storing important documents and ensuring they are safe and easy to find.

- TaxDome is an all-in-one platform for tax offices to communicate with clients and sign documents safely.

- Botkeeper uses “brain-like” computers to handle the boring parts of bookkeeping and generate financial reports.

- Ramp is a special credit card and system that takes a picture of your receipt and instantly matches it to your spending.