Are you confused about managing your money?

It can be tough to keep track of everything.

Two popular tools, Dext and Quicken, can help.

But which one should you choose?

We’ll look closely at both Dext vs Quicken.

Let’s make money management easier together!

Overview

We looked closely at how both Dext and Quicken work.

We tried out their features like tracking bills and seeing where the money goes.

This helped us see which one might be better for different people managing their money.

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and streamlining your finances.

Pricing: It has a free trial. The premium plan starts at $24/month.

Key Features:

- Receipt Scanning

- Expense Reports

- Bank Reconciliation

Want to take control of your finances? With Quicken, you can connect to thousands of financial institutions. Explore it for more!

Pricing: It has a free trial. The premium plan at $5.59/month.

Key Features:

- Budgeting Tools

- Bill Management

- Investment Tracking

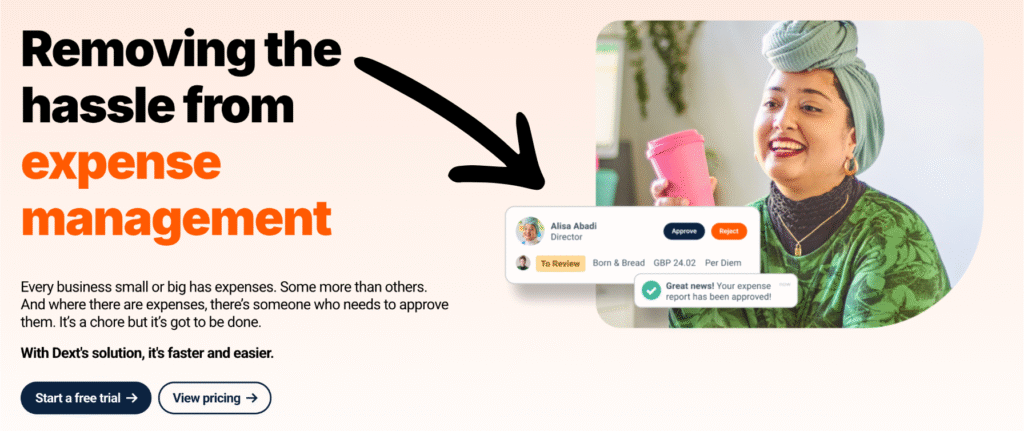

What is Dext?

Think of it like a super smart helper for your papers.

It mostly takes care of things like bills and receipts.

You just snap a picture, and Dext gets all the important info.

Pretty neat, huh?

Unlock its potential with our Dext alternatives…

Our Take

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Key Benefits

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

Pricing

- Annually Subscription: $24

Pros

Cons

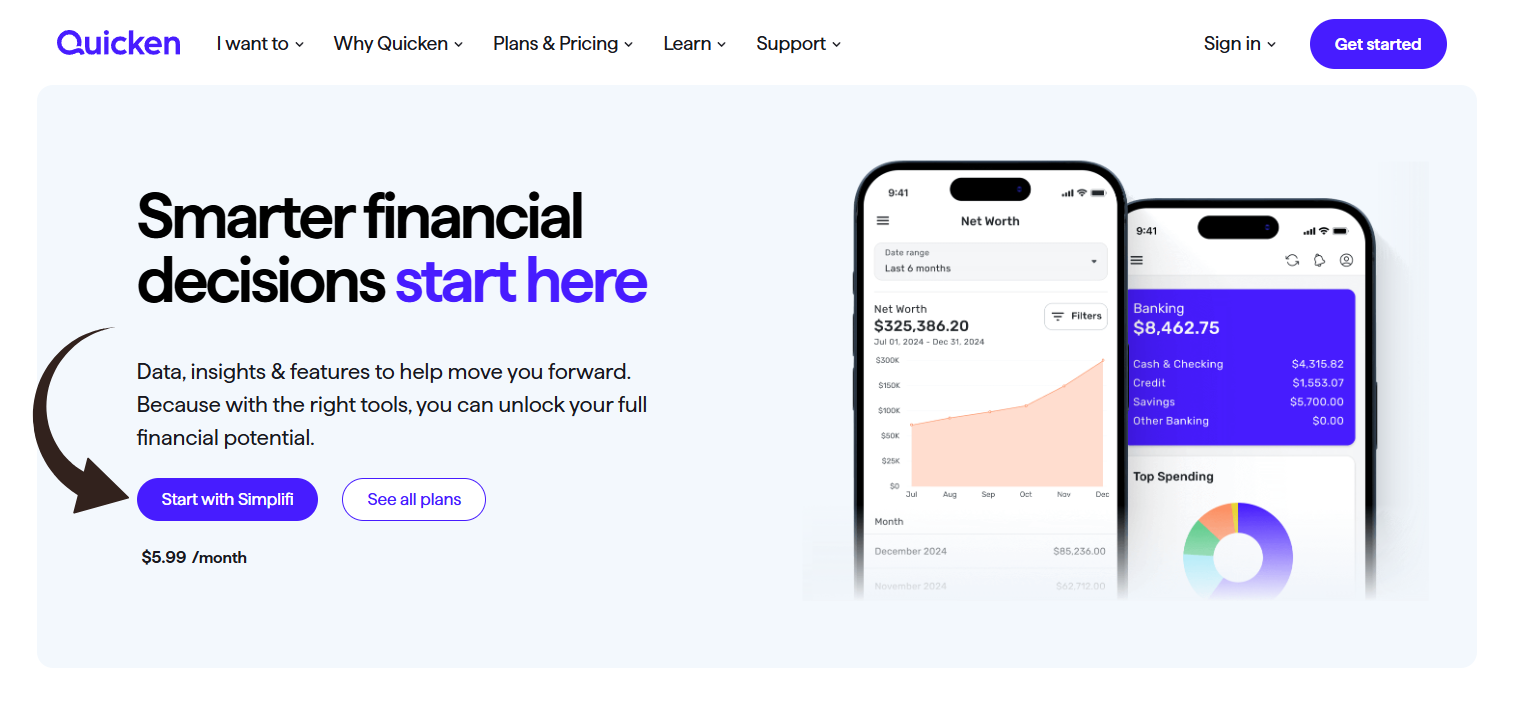

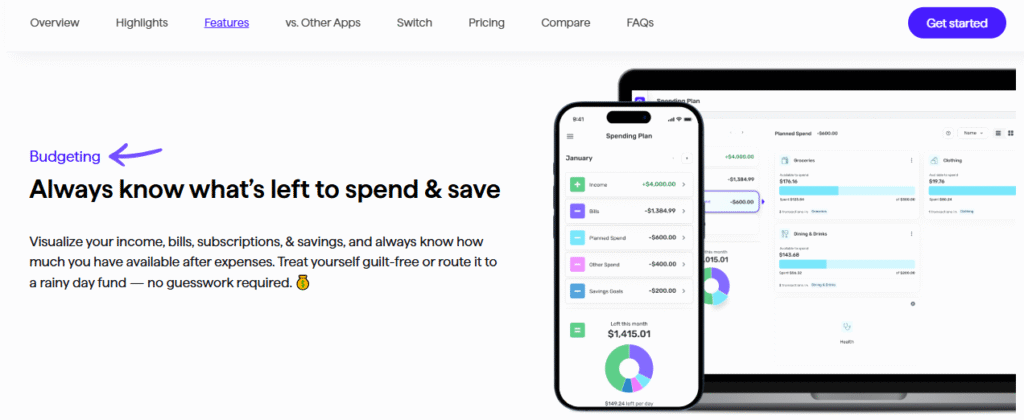

What is Quicken?

So, you’re wondering about Quicken?

It’s like a tool that helps you see all your money stuff in one place.

Think of it as your digital money organizer.

It can help you track your bank accounts, bills, and even investments.

Pretty handy, right?

Unlock its potential with our Quicken alternatives…

Key Benefits

Quicken is a powerful tool for getting your financial life in order.

They boast over 40 years of experience and have been a #1 best-selling product.

Their various plans can connect to over 14,500 financial institutions.

You can also get a 30-day money-back guarantee to try it out risk-free.

- Connects with thousands of banks and credit cards.

- Creates detailed budgets.

- Tracks investments and net worth.

- Offers retirement planning tools.

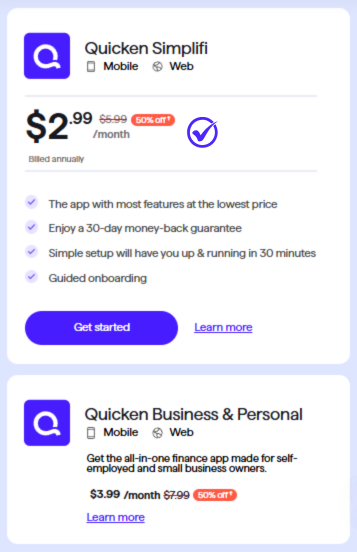

Pricing

- Quicken Simplifi: $2.99/month.

Pros

Cons

Feature Comparison

Choosing the right tool is key for smart small business owners.

We looked at how Dext and Hubdoc handle documents to see which one makes bookkeeping workflows easier for you.

1. Mobile App and Receipt Capture

- Dext mobile app is often faster for users.

- You can easily capture receipts and submit receipts on the go.

- Hubdoc also lets you upload financial documents.

- Some Hubdoc users note occasional accuracy issues with its data extraction.

2. Optical Character Recognition

- Dext has higher accuracy in its data extraction using OCR technology.

- It generally requires fewer corrections than Hubdoc.

- Hubdoc’s optical character recognition (ocr technology) is less reliable with complex invoices.

- This can lead to more checks and manual entry time.

3. Accounting Software Direct Integrations

- Hubdoc offers strong direct integrations with Xero and QuickBooks Online.

- Dext also integrates with these platforms.

- Dext offers a wider range of direct integrations with platforms like Sage and MYOB.

- This is better for businesses using a broader tech stack.

4. Invoice and Sales Data Fetching

- Both can automatically extract data and fetch invoices directly from supplier websites.

- Dext often offers better functionality for automatically fetching and handling both cost and sales data.

- This gives Dext a more complete financial picture.

5. Workflow and Supplier Rules

- Dext offers more advanced automation for accounting and bookkeeping workflows.

- You can create detailed supplier rules and split invoices into line items.

- Dext can also spot missing documents.

- Hubdoc mainly relies on basic supplier rules for simple categorization.

6. Security Solution and Data Protection

- Both provide a high-level security solution with 256-bit encryption.

- They both use two-factor authentication for a secure data flow.

- Your financial documents are stored safely, protecting you from online attacks.

- Neither can access or control your bank accounts.

7. Pricing Plans and Free Trial

- Hubdoc is often included for free with certain Xero subscriptions.

- If not free, Hubdoc has a simple single price.

- Dext offers more complex pricing plans based on client volume and features.

- Both offer a free trial so you can try dext or Hubdoc before committing.

8. Expense Management and Control

- Dext is a powerful expense management tool.

- It lets you manage team expense claims and split transactions in detail.

- Dext is designed to help you manage expenses easily.

- Hubdoc focuses more on getting the document and basic data into your accounting software.

9. Scalability and System Dependability

- Dext handles a higher volume of documents and offers user permissions.

- This makes it ideal for a growing business concerned with system dependability.

- Hubdoc works well for a very small business with low document volume.

- Dext’s design supports better long-term use and system dependability as you scale.

What to look for when choosing an Accounting Software?

- Your Needs: First, evaluate if you need personal finance software (like Quicken software) or a tool for business expenses (like Dext Prepare).

- Product Features: Check the key features. Do you need to track investment accounts, rental properties, or simple budgeting and bill tracking?

- Accuracy and Automation: Look at the accuracy of data extraction. Dext, for example, is known to help you avoid manual data entry, and Dext saves you time.

- Security and Reliability: Ensure the security service is robust. Look for mentions of secure storage for receipts and invoices and a high system dependability. Avoid issues like a malformed data log.

- Ease of Use: Test the user interface. Is the dext mobile app or Quicken offers on desktop and mobile easy for you to use?

- Submission Methods: How will you collect receipts? Check if the software (dext offers multiple ways like email submission, mobile scanning, or bank feeds).

- Cost and Support: Evaluate the pricing plans and whether a free trial is offered today. Look up quicken reviews or Dext reviews for support quality.

- Compatibility: Check if the software works on your devices (Windows, Mac). Also, ensure deep integration with your existing accounting software.

- Business vs. Personal: Decide between a tool like quicken home or quicken business. You must choose a version that fits your needs (quicken deluxe, quicken premier).

- Scalability: Consider if the software can grow with your needs, from a beginning user to handling complex business finances and purchase orders.

- Data Insights: Does the software provide valuable analysis of your spending, income, and balances?

- Known Issues: Watch out for odd error messages or technical issues reported by the site owner or users (e.g., a cloudflare ray id found or cloudflare ray id log).

Final Verdict

If you are a business owner needing to track expenses and automate data collection, Dext is our choice.

Dext works by automatically processing receipts and invoices in just a few minutes, removing hassle from your bookkeeping workflows.

You can store receipts easily in your dext account and set up tracking categories.

For personal finance, the established quicken brand is better for planning your retirement and payments.

Since we have shown you both powerful alternatives, you can evaluate which one offers the best value.

Try a free trial today to see the solution that works best for you!

More of Dext

We’ve also taken a look at how Dext compares with other expense management and accounting tools:

- Dext vs Xero: Xero offers comprehensive accounting with integrated expense management features.

- Dext vs Puzzle IO: Puzzle IO excels in AI-powered financial insights and forecasting.

- Dext vs Synder: Synder focuses on syncing e-commerce sales data and payment processing.

- Dext vs Easy Month End: Easy Month End streamlines the month-end financial closing procedures.

- Dext vs Docyt: Docyt uses AI to automate bookkeeping and document management tasks.

- Dext vs RefreshMe: RefreshMe provides real-time insights into business financial performance.

- Dext vs Sage: Sage offers a range of accounting solutions with expense tracking capabilities.

- Dext vs Zoho Books: Zoho Books provides integrated accounting with expense management features.

- Dext vs Wave: Wave offers free accounting software with basic expense tracking features.

- Dext vs Quicken: Quicken is popular for personal finance and basic business expense tracking.

- Dext vs Hubdoc: Hubdoc specializes in automated document collection and data extraction.

- Dext vs Expensify: Expensify offers robust expense reporting and management solutions.

- Dext vs QuickBooks: QuickBooks is a widely used accounting software with expense management tools.

- Dext vs AutoEntry: AutoEntry automates data entry from invoices, receipts, and bank statements.

- Dext vs FreshBooks: FreshBooks is designed for service-based businesses with invoicing and expense tracking.

- Dext vs NetSuite: NetSuite offers a comprehensive ERP system with expense management functionalities.

More of Quicken

- Quicken vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Quicken vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Quicken vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Quicken vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Quicken vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Quicken vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Quicken vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Quicken vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Quicken vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Quicken vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Quicken vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Quicken vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Quicken vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Quicken vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Quicken vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

What is the main difference between Dext and Quicken?

Dext is primarily for businesses to manage invoices and expenses, often working with accounting software like QuickBooks and Xero. Quicken is designed for individuals to track personal finances, budgets, and investments.

Can Quicken connect with my accountant?

Quicken doesn’t have the same direct collaboration features for accountants as Dext. Dext is built to streamline the workflow between businesses and their accountants for easier sharing of financial data.

Is Dext better for business data entry?

Yes, Dext excels at automating data entry from receipts and bank statements, which can save time for businesses. Quicken requires more manual data input for business-related transactions if used for that purpose.

Does Quicken integrate with other business software?

Quicken has limited integration with business accounting software or ERP systems like NetSuite. Dext is specifically designed to integrate with these platforms to sync financial data seamlessly.

Which software is more affordable?

The cost depends on your needs. Quicken has different personal finance plans. Dext’s pricing is usually based on usage and the number of users, which can vary for businesses. It’s best to check their specific pricing pages.