Are you struggling to keep your finances organized?

Many people find themselves overwhelmed by receipts, bank statements, and the never-ending task of data entry.

This is where financial software comes in, promising to make things easier.

But with so many options, how do you pick the right one?

Let’s dive into a key comparison: Quicken vs AutoEntry.

Overview

We looked at both Quicken and AutoEntry very closely.

We used them ourselves to see how they work.

This helped us understand their strengths and weaknesses for everyday money tasks.

Want to take control of your finances? With Quicken, you can connect to thousands of financial institutions. Explore it for more!

Pricing: It has a free trial. The premium plan at $5.59/month.

Key Features:

- Budgeting Tools

- Bill Management

- Investment Tracking

Stop wasting 10+ hours/week on manual data entry. See how Autoentry slashed invoice processing time by 40% for Sage users.

Pricing: It has a free trial. Paid plan starts at $12/month.

Key Features:

- Data Extraction

- Receipt Scanning

- Supplier Automation

What is Quicken?

So, you’re wondering about Quicken?

It’s like a tool that helps you see all your money stuff in one place.

Think of it as your digital money organizer.

It can help you track your bank accounts, bills, and even investments.

Pretty handy, right?

Also, explore our favorite Quicken alternatives…

Key Benefits

Quicken is a powerful tool for getting your financial life in order.

They boast over 40 years of experience and have been a #1 best-selling product.

Their various plans can connect to over 14,500 financial institutions.

You can also get a 30-day money-back guarantee to try it out risk-free.

- Connects with thousands of banks and credit cards.

- Creates detailed budgets.

- Tracks investments and net worth.

- Offers retirement planning tools.

Pricing

- Quicken Simplifi: $2.99/month.

Pros

Cons

What is AutoEntry?

Okay, so let’s talk about AutoEntry.

It’s a tool that helps you get your paperwork into your computer without typing everything yourself.

Think of it like a smart helper for your bills and receipts.

It reads them and puts the info where it needs to go.

Also, explore our favorite AutoEntry alternatives…

Our Take

Ready to cut your bookkeeping time? AutoEntry processes over 28 million documents each year and offers up to 99% accuracy. Start today and join the over 210,000 businesses worldwide that have reduced their data entry hours by up to 80%!

Key Benefits

AutoEntry’s biggest win is saving hours of boring work.

Users often see up to 80% less time spent on manual data entry.

It promises up to 99% accuracy in its data extraction.

AutoEntry does not offer a specific money-back warranty, but its monthly plans allow you to cancel at any time.

- Up to 99% accuracy on data.

- Unlimited users on all paid plans.

- Pulls full line items from invoices.

- Easy mobile app for receipt snaps.

- 90 days for unused credits to roll over.

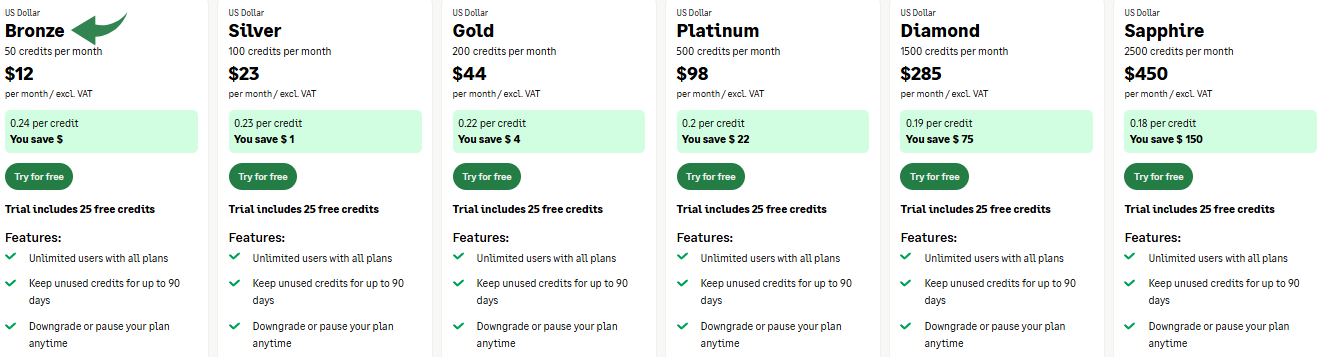

Pricing

- Bronze: $12/month.

- Silver: $23/month.

- Gold: $44/month.

- Platinum: $98/month.

- Diamond: $285/month.

- Sapphire: $450/month.

Pros

Cons

Feature Comparison

Choosing between accounting software versions can be a challenge.

This comparison of Quicken vs AutoEntry will help you evaluate which platform’s functionality and key features align with your business personal needs.

We’ll review each to see which provides the best value and control for your financial management.

1. Core Purpose and Functionality

- Quicken software has been a trusted personal finance software brand for decades. Its purpose is to help users manage their entire financial picture, from budgeting to monitoring investment accounts and planning for retirement.

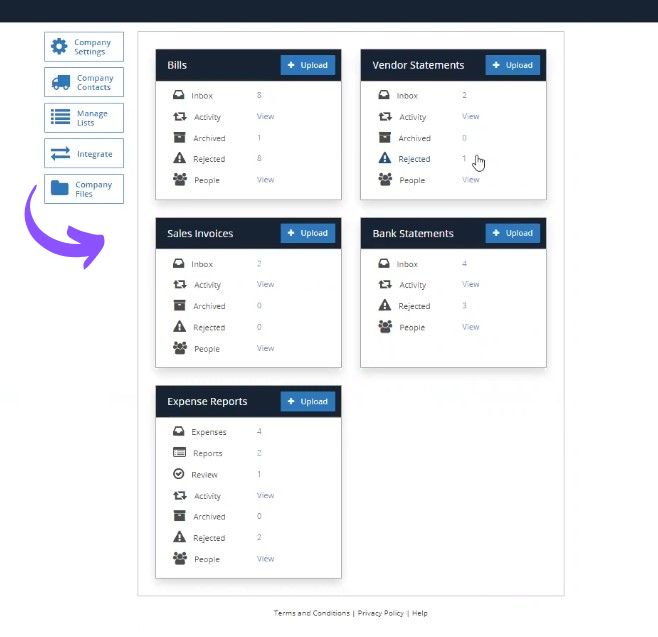

- AutoEntry is a modern alternative that specializes in data capture and is not a full accounting platform.

2. Data Capture and Automation

- AutoEntry uses optical character recognition to extract data from financial documents, such as a purchase invoice or receipts. You can capture documents via a mobile phone app or email.

- The software’s review from clients shows it saves a lot of time spent on any type of manual data entry, but the cost depends on your usage of credits.

3. Longevity and Ownership

- Quicken has been in the market for decades. The brand was acquired by Aquiline Capital Partners, a detail worth noting as it will influence the future development of the software.

- AutoEntry reviews show that it’s a newer, more specialized product and a good choice to evaluate if your main goal is to reduce time spent on data entry.

4. Business & Personal Finances

- Quicken Business is a desktop application for Windows or Mac that allows users to create invoices and manage both their business personal and personal finances in one place.

- AutoEntry’s focus is on streamlining bookkeeping for businesses by auto-publishing data to platforms like QuickBooks.

5. Data Security and Access

- A security solution is crucial to protect your financial documents. Both platforms take data security seriously. For instance, sometimes a security service to protect against online attacks will block an action you just performed.

- This could trigger an alert with a cloudflare ray id found, indicating a block including submitting a certain word or phrase, a sql command, or malformed data, and you may be unable to access the page.

6. Managing Finances

- Quicken offers a comprehensive platform for managing all aspects of your finances, from monitoring investment balances to tracking your spending. It is a long-standing market leader and offers various alternatives for different use cases.

- AutoEntry’s management is specifically for extracting and publishing data, not for full financial analysis.

7. Integrations

- The Quicken brand is a standalone platform, but it can connect with thousands of financial institutions.

- AutoEntry’s value comes from its seamless integration with other accounting platforms like QuickBooks, eliminating the need to log in to several different apps to process your purchase invoices and other financial documents.

8. Accessibility and Platform

- Quicken is primarily a desktop download for Windows or Mac, with a mobile app for monitoring.

- AutoEntry is a cloud-based service, so you can access your data from any mobile phone or computer. The beginning of a business often requires mobile access to track expenses and sales.

9. Pricing and Plans

- The Quicken brand offers different versions, such as Quicken Deluxe, Quicken Premier, and Quicken Business, with prices based on the subscription.

- The AutoEntry pricing model is a flexible pricing plan based on a credit system for unlimited users. This allows you to purchase only what you need and gives you control over your spending.

What to look for in an Accounting Software?

Here are some extra things to think about:

- Scalability: Can the specific tool grow with your business? When you begin, you may only need basic bill tracking, but as your business finances grow, your needs will change. Look for tiered plans and consider the cost per month. For example, Quicken has different versions, from Quicken Home to more feature-rich plans that can handle rental properties and complex income streams. You should evaluate the pricing structure to ensure the software can scale without requiring excessive effort or a complete system change.

- Support: What kind of help is available if you have questions?Good customer support is invaluable. The software should have accessible resources to help you resolve issues. This includes a knowledge base or the ability to email the site owner or support team. Check a recent Quicken review to see what existing users say about their support experience. Knowing that a team is there to help is crucial for running your business smoothly.

- Ease of Use: Is it something you and your team can learn quickly? The user interface is key to adoption. A streamlined and intuitive interface reduces the learning curve for you and your team. You want to focus on your business finances, not on figuring out complicated software. Look for a clean layout that makes it easy to log transactions and find specific line items quickly.

- Specific Needs: Does it handle the unique things your business does? Ensure the software supports your specific transactions, such as payments to vendors or tracking income from rental properties. This includes how easily it can handle different types of income and expenses. Choosing the right tool from the alternatives available in the market will save you considerable time and frustration in the long run.

- Security: How safe is your financial data with this software Data security is paramount. All software should protect itself from online threats, often using a security service to protect user accounts. Be aware that sometimes a perfectly legitimate action you just performed could trigger this block from the security system, particularly when entering specific financial details. If you are blocked, you’ll see a message that the security solution has been triggered, often providing your IP address. This is why you must have a way to quickly contact the site owner to let them know and resolve the issue. The software should also detail the several actions that could trigger a security block, including submitting unusual data, to prevent you from being unnecessarily locked out.

Final Verdict

So, which one is better: Quicken or AutoEntry?

It truly depends on what you need.

If you want one program to handle all your personal money, Quicken is your best bet.

It does budgeting and tracks investments. It gives you a full financial picture.

However, if your main need is just putting info from receipts into other accounting software, AutoEntry is the specialist.

It’s great for that specific job. We’ve used both. We know they help different people.

Pick the one that solves your biggest money problem!

More of Quicken

- Quicken vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Quicken vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Quicken vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Quicken vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Quicken vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Quicken vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Quicken vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Quicken vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Quicken vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Quicken vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Quicken vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Quicken vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Quicken vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Quicken vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Quicken vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

More of AutoEntry

- AutoEntry vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- AutoEntry vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- AutoEntry vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- AutoEntry vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- AutoEntry vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- AutoEntry vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- AutoEntry vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- AutoEntry vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- AutoEntry vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- AutoEntry vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- AutoEntry vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- AutoEntry vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- AutoEntry vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- AutoEntry vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- AutoEntry vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

What is the main difference between Quicken vs AutoEntry?

Quicken is a full personal finance manager for budgeting and investments. AutoEntry focuses on data extraction from documents like receipts. It helps streamline getting information into other accounting software.

Can AutoEntry replace programs like Hubdoc or Dext?

Yes, AutoEntry is a direct competitor to services like Hubdoc and Dext. All these tools aim to automate the process of turning physical documents into digital data for accounting. They all help with automation.

Is Quicken good for small business expense categorization?

Quicken can help with basic categorization for small business expenses. However, for more advanced business accounting and tax purposes, specialized accounting software might be more suitable, often working with tools like AutoEntry.

How does AutoEntry help my accounting workflow?

AutoEntry improves your workflow by reducing manual data entry. You upload documents, and it extracts the key information. This data can then sync directly with your accounting software, saving time and reducing errors.

Does AutoEntry offer strong automation features?

Yes, AutoEntry is designed for automation. It uses smart technology to read and process invoices and receipts quickly. This allows for efficient data extraction and helps automate the transfer of financial details.