Are you tired of spending hours typing in invoices and receipts?

It’s a real pain, right?

You’re looking for a way to save time and get back to actually running your business.

Some awesome tools can help you ditch manual data entry.

Two big names you might have heard of are Xero vs AutoEntry.

Overview

We’ve spent time putting both Xero and AutoEntry through their paces.

Seeing how they handle real-world accounting tasks.

This comparison comes from our hands-on experience, which involves examining closely what each software offers and how well it performs.

Join 2 million+ businesses using Xero cloud-based accounting software. Explore its powerful invoicing features now!

Pricing: It has a free trial. paid plan starts at $29/month.

Key Features:

- Bank Reconciliation

- Invoicing

- Reporting

Stop wasting 10+ hours/week on manual data entry. See how Autoentry slashed invoice processing time by 40% for Sage users.

Pricing: It has a free trial. Paid plan starts at $12/month.

Key Features:

- Data Extraction

- Receipt Scanning

- Supplier Automation

What is Xero?

So, what’s the deal with Xero?

It’s basically an online hub for all your business finances.

Think of it as a digital filing cabinet, bank teller, and report generator all rolled into one.

It helps you keep track of your money without drowning in paperwork.

Also, explore our favorite Xero alternatives…

Our Take

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features now!

Key Benefits

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

Pricing

- Starter: $29/month.

- Standard: $46/month.

- Premium: $69/month.

Pros

Cons

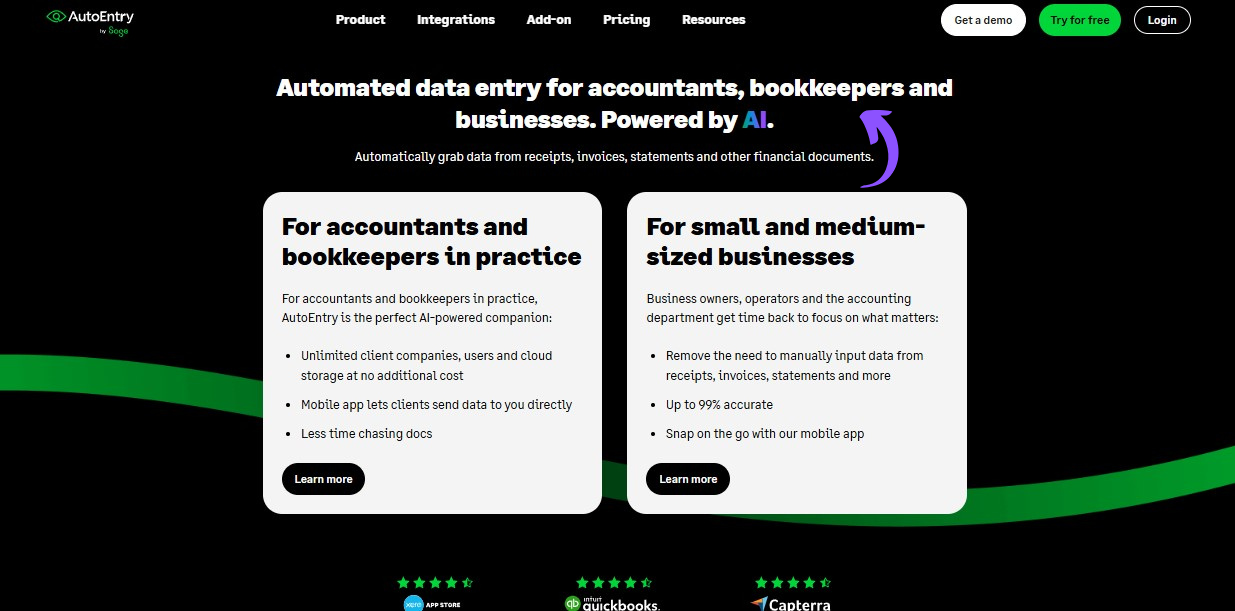

What is AutoEntry?

Now, let’s chat about AutoEntry. This tool is all about taking the pain out of data entry.

Imagine just snapping a photo of your invoices and receipts.

And bam—the info is automatically captured. It’s like having a digital assistant for your paperwork.

Also, explore our favorite AutoEntry alternatives…

Our Take

Ready to cut your bookkeeping time? AutoEntry processes over 28 million documents each year and offers up to 99% accuracy. Start today and join the over 210,000 businesses worldwide that have reduced their data entry hours by up to 80%!

Key Benefits

AutoEntry’s biggest win is saving hours of boring work.

Users often see up to 80% less time spent on manual data entry.

It promises up to 99% accuracy in its data extraction.

AutoEntry does not offer a specific money-back warranty, but its monthly plans allow you to cancel at any time.

- Up to 99% accuracy on data.

- Unlimited users on all paid plans.

- Pulls full line items from invoices.

- Easy mobile app for receipt snaps.

- 90 days for unused credits to roll over.

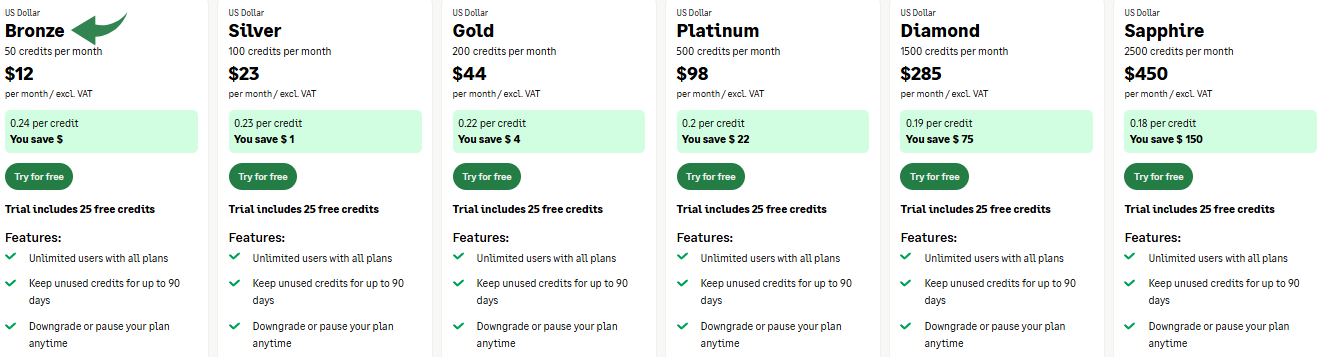

Pricing

- Bronze: $12/month.

- Silver: $23/month.

- Gold: $44/month.

- Platinum: $98/month.

- Diamond: $285/month.

- Sapphire: $450/month.

Pros

Cons

Feature Comparison

Let’s dive into a direct comparison of Xero and AutoEntry, looking at specific features to help you decide on the right cloud-based accounting software for your business.

1. Data Automation & Capture

- Xero: While Xero lets you capture bills and receipts, its primary focus is on managing your financial tasks once they are in the system. The platform offers some automation, but it is not its main purpose.

- AutoEntry: AutoEntry is built around automation. Its core function is to extract data from invoices owed, receipts, and other financial documents using advanced OCR. It’s a specialist tool for this one specific job.

2. Financial Reporting

- Xero: Xero excels in this area. It provides a full suite of customizable reporting options. This is a key part of Xero accounting software, giving you a clear view of your business performance, financial position, and cash flow. You get a lot of insight.

- AutoEntry: AutoEntry does not provide financial reporting. Its job is to accurately prepare the data and send it to your accounting software so that you can create reports there.

3. Bank Feeds & Reconciliation

- Xero: With its automatic bank feeds, Xero makes bank reconciliations simple. It pulls real-time data from your bank accounts and suggests matches, saving you a huge amount of time. This is a major selling point.

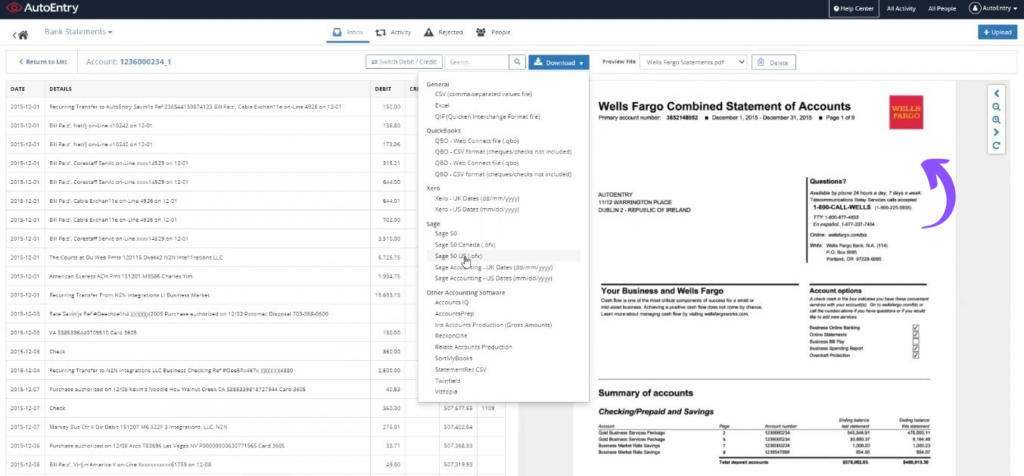

- AutoEntry: AutoEntry can handle bank statements, too. It extracts data from the statement page by page to speed up the reconciliation process once you import it into your main accounting software.

4. Accounts Payable & Receivable

- Xero: The accounts payable and accounts receivable features in Xero accounting software are very strong. You can create online invoicing and schedule payments. The established plan even includes purchase orders for growing businesses.

- AutoEntry: AutoEntry’s main goal is to automate the capture and entry of your bills and invoices. It handles the data side of accounts payable, but it does not have the comprehensive management tools that a full cloud-based accounting system provides.

5. Inventory Management

- Xero: Xero lets you manage inventory and track your stock levels. The inventory management features help with a business’s financial health, as all your inventory data is connected to your sales records.

- AutoEntry: AutoEntry does not have any inventory management capabilities. Its purpose is to process documents, not to track stock.

6. Pricing & Plans

- Xero: Xero pricing is based on pricing plans that scale with your business. The early plan has limits, such as up to five bills and 20 invoices, while the established plan offers unlimited invoices and bills for expanding businesses.

- AutoEntry: AutoEntry pricing is based on credit usage, offering a more flexible pricing model. You only pay for the documents you process, which can be great for independent contractors or very small business owners.

7. Customer Support

- Xero: Xero provides customer support primarily through online resources via a system called Xero Central. You can also find a lot of help through guides and articles.

- AutoEntry: AutoEntry has a strong reputation for customer support. Their online resources and live chat are highly rated in many autoentry reviews, ensuring you can get help when you need it.

8. Cloudflare Security

- Xero: If your request to test Xero or use a Xero dashboard is blocked, it’s often because a security service like Cloudflare has been triggered. This is a common security solution to protect a site from online attacks. The Cloudflare Ray ID is a unique identifier found on the error page.

- AutoEntry: You might get a similar error when accessing the AutoEntry site. If your request is blocked, it means an action you just performed triggered the security solution. This could be a SQL command or malformed data, or simply an action that could trigger this block, including submitting a certain word or phrase. You should email the site owner to resolve the issue.

9. Expense Tracking & Mobile Access

- Xero: The Xero mobile app, available on iOS and Android devices, is excellent for expense tracking. It allows you to check your financial details and cash flow management on the go.

- AutoEntry: AutoEntry also offers a mobile phone app. It lets you capture receipts and expenses by taking a photo, ensuring a seamless integration between your physical documents and financial records.

What to Look For When Choosing Accounting Software?

- Core Function: Do you need full-featured Xero accounting software or a specific tool to upload a purchase invoice?

- Automation: Does it use optical character recognition for fast and accurate data capture, including line items?

- Scalability: Is it designed for established businesses or just starting out? Can it handle multiple currencies and multiple locations?

- Advanced Features: Does it offer key features like project tracking and inventory management, or is it basic?

- Reporting: Check out Xero’s reporting features to ensure you get deep insights into financial management.

- User Experience: Is it a user-friendly interface that your team and clients can actually use Xero with minimal effort?

- Cost: Does the total Xero cost match your budget per month?

- Security: Know that websites protect themselves from online threats using a security service like Cloudflare. If you are unable to access, check for the Cloudflare Ray ID.

Final Verdict

If you are a business owner seeking a full platform, we recommend Xero.

It is true Xero accounting software, offering financial data, bank transactions, and sales tax functionality needed for business growth.

While not a complete enterprise resource planning system.

Its features and integrations are ideal for professional services.

AutoEntry is great for saving time spent on data entry, but Xero gives you the full picture to manage your business.

If you see a Cloudflare ray ID found, it is just a security service to protect the site from several actions that could be triggered.

More of Xero

Choosing the right accounting software means looking at a number of options.

Here’s a quick look at Xero vs other popular products.

- Xero vs QuickBooks: QuickBooks is a major competitor. While both offer similar core features, Xero is often praised for its clean interface and unlimited users. QuickBooks can be more complex, but it offers very powerful reporting.

- Xero vs FreshBooks: FreshBooks is a popular option, especially for freelancers and service-based businesses. It excels at invoicing and time tracking. Xero provides a more well-rounded accounting solution.

- Xero vs Sage: Both Sage and Xero offer solutions for small businesses. However, Sage also provides more comprehensive enterprise resource planning (ERP) tools for larger companies.

- Xero vs Zoho Books: Zoho Books is part of a large suite of business apps. It often has more advanced features for inventory and is very cost-effective. Xero, meanwhile, is a leading option for simplicity and ease of use.

- Xero vs Wave: Wave is known for its free plan. It’s a great option for very small businesses or freelancers on a tight budget. Xero offers a wider range of features and is better for business growth.

- Xero vs Quicken: Quicken is mainly for personal finance. While it has some business features, it’s not a true business accounting solution. Xero is built specifically to handle the complexities of business accounting.

- Xero vs Hubdoc: These are not direct competitors. Both Dext and Hubdoc are tools that automate document capture and data entry. They integrate directly with Xero to make bookkeeping faster and more accurate.

- Xero vs Synder: Synder is a platform that connects sales channels and payment gateways to accounting software. It helps automate data entry from platforms like Shopify and Stripe directly into Xero.

- Xero vs Expensify: Expensify focuses specifically on expense management. While Xero has expense features, Expensify offers more advanced tools for managing employee expenses and reimbursements.

- Xero vs Netsuite: Netsuite is a comprehensive ERP system for large corporations. It offers a full suite of business management tools. Xero is not an ERP but is an excellent accounting solution for small businesses.

- Xero vs Puzzle IO: Puzzle IO is a finance platform designed for startups, focusing on real-time financial statements and automated data entry.

- Xero vs Easy Month End: This software is a specialized tool for automating the month-end closing process, helping with reconciliation and audit trails. It is designed to work with Xero, not replace it.

- Xero vs Docyt: Docyt uses AI to automate back-office and bookkeeping tasks. It provides a way to view all your financial documents and data in one place.

- Xero vs RefreshMe: RefreshMe is a simpler accounting software with basic features, often used for personal finance or very small businesses.

- Xero vs AutoEntry: Similar to Dext and Hubdoc, AutoEntry is a tool that automates data extraction from receipts and invoices, designed to integrate with and enhance accounting software like Xero.

AutoEntry Compared

- AutoEntry vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- AutoEntry vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- AutoEntry vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- AutoEntry vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- AutoEntry vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- AutoEntry vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- AutoEntry vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- AutoEntry vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- AutoEntry vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- AutoEntry vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- AutoEntry vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- AutoEntry vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- AutoEntry vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- AutoEntry vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- AutoEntry vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Does Xero offer a free trial?

Yes, Xero typically provides a free trial period so you can test its features before subscribing. Check their website for the current offer.

Can AutoEntry work without accounting software?

No, AutoEntry is designed to integrate with accounting software like Xero or QuickBooks Online to automate data entry.

Is AutoEntry’s data extraction accurate?

AutoEntry boasts high accuracy, often over 99%, but the quality of the document image can affect results.

Which software is better for very small businesses?

It depends. AutoEntry saves time on data, while Xero offers broader accounting features. Consider your biggest need.

Do either Xero or AutoEntry offer a free trial?

Yes, both Xero and AutoEntry commonly offer new users a free trial or a free credit allowance to evaluate their services.