Quick Start

This guide covers every Xero feature:

- Getting Started — Create account and connect your bank

- How to Use Account Dashboard — See your finances at a glance

- How to Use Invoice Templates — Create and send professional invoices

- How to Use Bank Reconciliation — Match transactions in minutes

- How to Use Automatic Invoicing — Set up recurring invoices on autopilot

- How to Use Automate Bill Entry — Capture bills without manual data entry

- How to Use Advanced Accounting — Run reports and track your numbers

- How to Use Business Snapshot — Monitor business health in real time

- How to Use Multi-Currency Accounting — Handle international transactions

- How to Use Track Projects — Monitor project costs and profitability

Time needed: 5 minutes per feature

Also in this guide: Pro Tips | Common Mistakes | Troubleshooting | Pricing | Alternatives

Why Trust This Guide

I’ve used Xero for over two years and tested every feature covered here. This tutorial comes from real hands-on experience — not marketing fluff or vendor screenshots.

Xero is one of the most powerful cloud accounting tools available today.

But most users only scratch the surface of what it can do.

This guide shows you how to use every major feature.

Step by step, with screenshots and pro tips.

Xero Tutorial

This complete Xero tutorial walks you through every feature step by step, from initial setup to advanced tips that will make you a power user.

Xero

Run your small business accounting in the cloud. Xero automates invoicing, bank reconciliation, and financial reporting so you spend less time on bookkeeping. Try free for 30 days — no credit card required.

Getting Started with Xero

Before using any feature, complete this one-time setup.

It takes about 3 minutes.

Now let’s walk through each step.

Step 1: Create Your Account

Go to Xero’s website.

Click “Try Xero for free.”

Enter your name, email, and create a password.

Choose your country and business type.

✓ Checkpoint: Check your inbox for a confirmation email from Xero.

Step 2: Set Up Your Organization

Fill in your company name, address, and tax info.

Upload your business logo for branded invoices.

Set your financial year end date under Settings.

Here’s what the dashboard looks like:

✓ Checkpoint: You should see the main Xero dashboard.

Step 3: Connect Your Bank Account

Go to Settings then Bank Accounts.

Search for your bank and follow the prompts to connect.

Xero will start pulling in transactions automatically.

✅ Done: You’re ready to use any feature below.

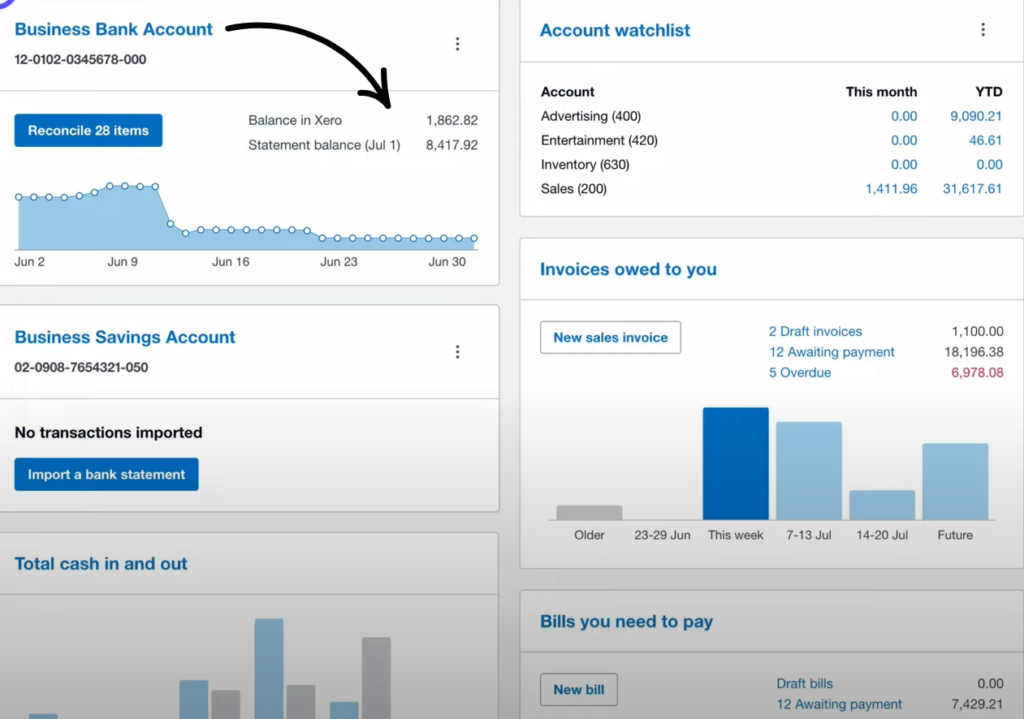

How to Use Xero Account Dashboard

Account Dashboard lets you see your entire financial picture at a glance.

Here’s how to use it step by step.

Step 1: Open Your Dashboard

Click “Dashboard” in the top menu bar.

You’ll see bank balances, invoices owed, and bills to pay.

Step 2: Review Your Cash Flow

Check the cash flow graph to spot trends.

Hover over any month to see exact amounts.

Here’s what this looks like:

✓ Checkpoint: You should see bank balances and cash flow data.

Step 3: Track Outstanding Invoices

Click “Invoices owed to you” to see who hasn’t paid.

Click any invoice to send a reminder directly.

✅ Result: You can monitor your finances without opening any reports.

💡 Pro Tip: Check your dashboard first thing every morning. It takes 30 seconds and keeps you on top of cash flow.

How to Use Xero Invoice Templates

Invoice Templates lets you create branded, professional invoices in seconds.

Here’s how to use it step by step.

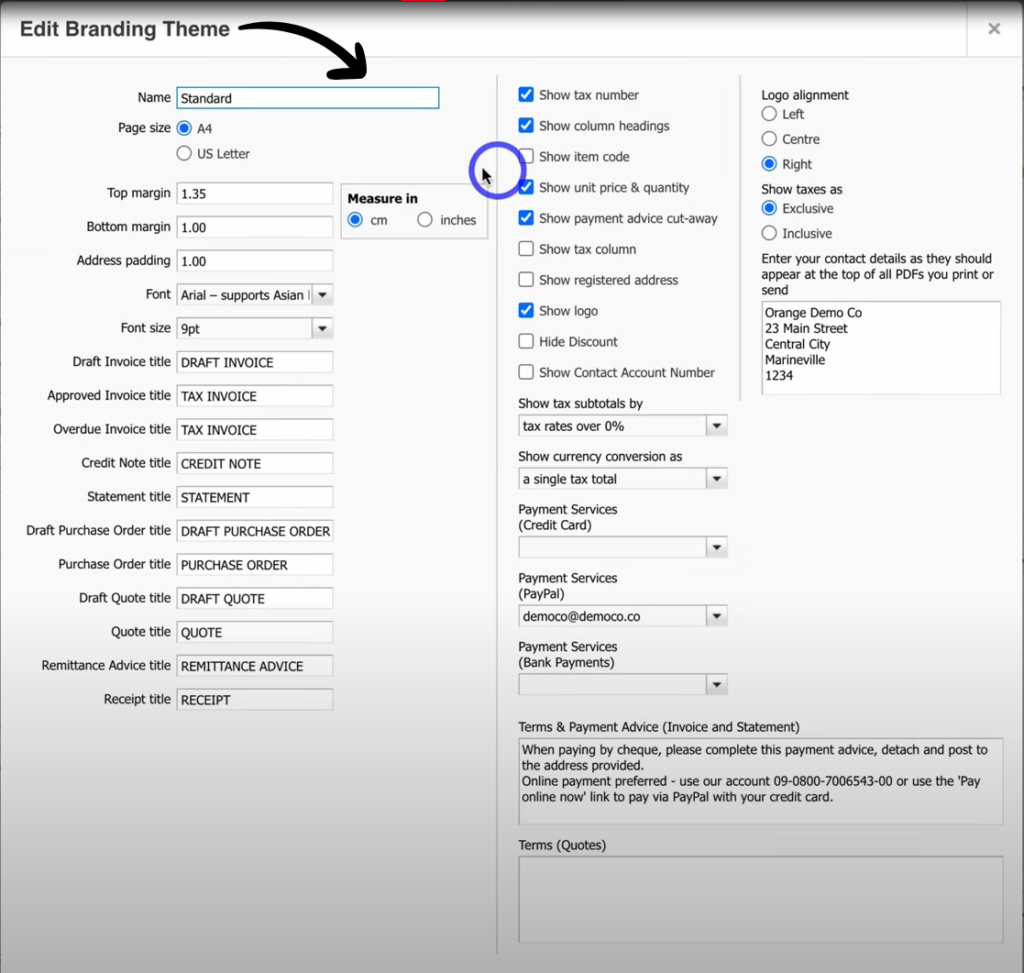

Step 1: Navigate to Invoice Settings

Go to Settings then Invoice Settings.

Click “New Branding Theme” to create a custom template.

Step 2: Customize Your Template

Upload your logo and set your brand colors.

Add your payment terms, footer notes, and bank details.

Here’s what this looks like:

✓ Checkpoint: You should see a preview of your branded invoice.

Step 3: Create and Send an Invoice

Click Business then Invoices then New Invoice.

Select your contact, add line items, and click “Approve.”

Hit “Send” to email the invoice to your customer.

✅ Result: Your customer receives a professional invoice with online payment options.

💡 Pro Tip: Add PayPal or Stripe under Payment Services so customers can pay you online directly from the invoice.

How to Use Xero Bank Reconciliation

Bank Reconciliation lets you match bank transactions to your books in minutes.

Here’s how to use it step by step.

Step 1: Open Bank Reconciliation

Click “Accounting” then “Bank Accounts.”

Click “Reconcile” next to the account you want to match.

Step 2: Match Transactions

Xero suggests matches automatically from imported transactions.

Click “OK” to confirm each correct match.

Here’s what this looks like:

✓ Checkpoint: Matched transactions disappear from the reconcile screen.

Step 3: Handle Unmatched Items

Use “Find & Match” to search for existing invoices or bills.

Or click “Create” to add a new transaction on the spot.

Set up bank rules to auto-categorize recurring transactions.

✅ Result: Your bank balance matches your Xero balance perfectly.

💡 Pro Tip: Reconcile daily or weekly. The longer you wait, the harder it gets to remember what each transaction was for.

How to Use Xero Automatic Invoicing

Automatic Invoicing lets you set up recurring invoices that send themselves.

Here’s how to use it step by step.

Step 1: Create a Repeating Invoice

Go to Business then Invoices then Repeating.

Click “New Repeating Invoice.”

Step 2: Set Your Schedule

Choose the frequency — weekly, monthly, or custom.

Set the start date and select “Approve for Sending.”

Here’s what this looks like:

✓ Checkpoint: You should see the repeat schedule and next invoice date.

Step 3: Add Line Items and Save

Add your products or services as line items.

Click “Save” and Xero handles the rest automatically.

✅ Result: Invoices go out on schedule without you lifting a finger.

💡 Pro Tip: Turn on payment reminders under Invoice Settings. Xero will chase overdue invoices for you automatically.

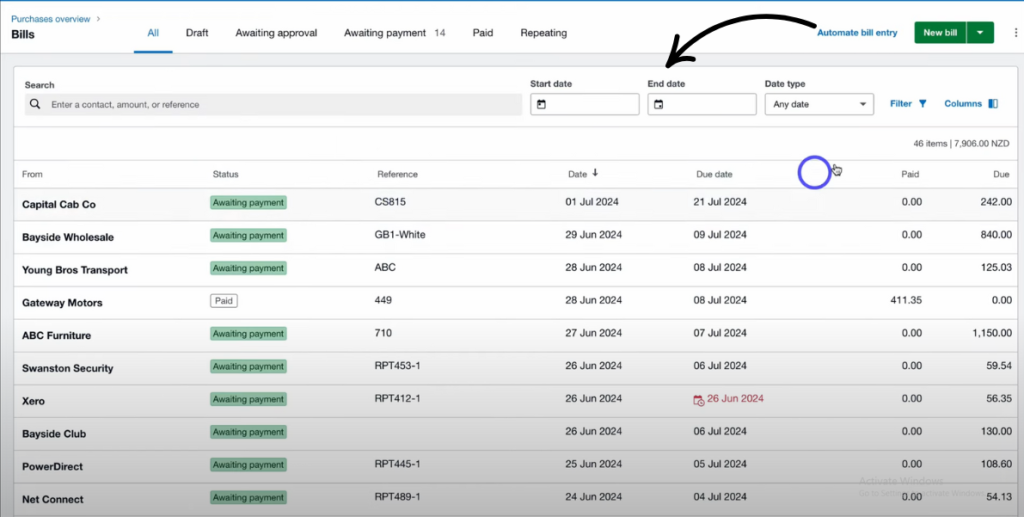

How to Use Xero Automate Bill Entry

Automate Bill Entry lets you capture bills and receipts without typing anything.

Here’s how to use it step by step.

Step 1: Open Hubdoc

Click “Files” in the top menu, then select “Hubdoc.

Hubdoc is included free with every Xero plan.

Step 2: Upload or Email Your Bill

Drag and drop a PDF or photo of your bill into Hubdoc.

Or forward the bill to your unique Hubdoc email address.

Here’s what this looks like:

✓ Checkpoint: Hubdoc extracts the date, amount, and supplier automatically.

Step 3: Publish to Xero

Review the extracted data and fix any errors.

Click “Publish” to send the bill directly into Xero.

✅ Result: Bills appear in Xero ready to approve and pay — no manual typing.

💡 Pro Tip: Set up auto-fetch in Hubdoc for utilities and subscriptions. It pulls bills from providers directly.

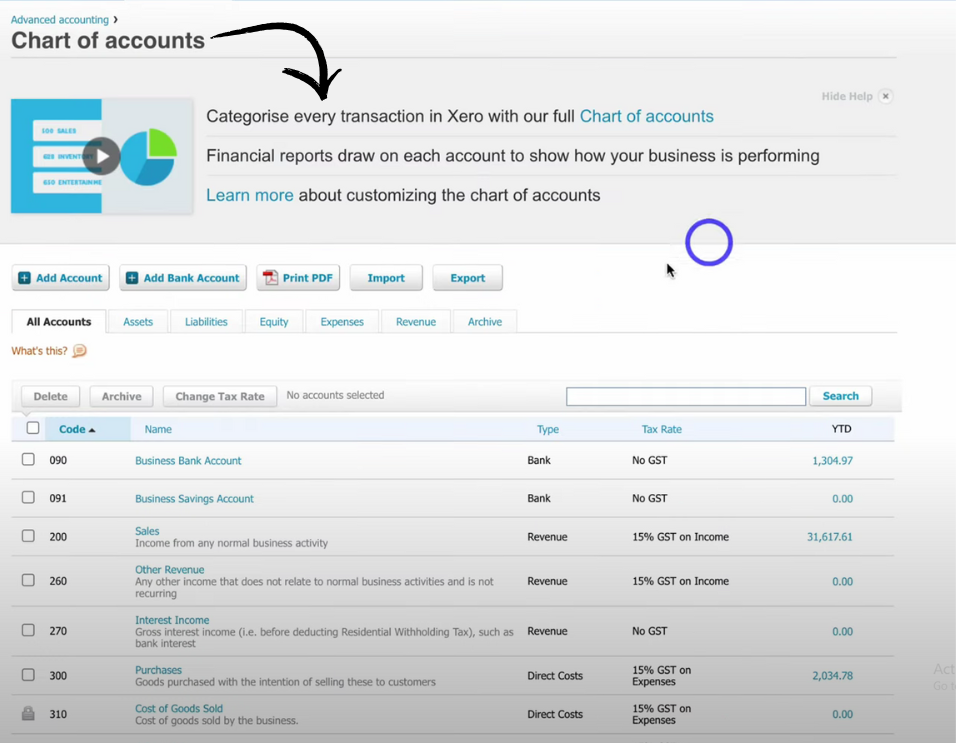

How to Use Xero Advanced Accounting

Advanced Accounting lets you run financial reports and manage your chart of accounts.

Here’s how to use it step by step.

Step 1: Access Reports

Click “Accounting” then “Reports” in the top menu.

You’ll see categories like Financial, Tax, and Payroll.

Step 2: Generate a Profit and Loss Report

Click “Profit and Loss” under Financial Statements.

Set your date range and click “Update.”

Here’s what this looks like:

✓ Checkpoint: You should see income, expenses, and net profit for the period.

Step 3: Customize the Chart of Accounts

Go to Accounting then Chart of Accounts.

Add, edit, or archive categories to match your business.

✅ Result: You have accurate financial reports that reflect your real business activity.

💡 Pro Tip: Customize the default chart of accounts early. Good categories save you hours at tax time.

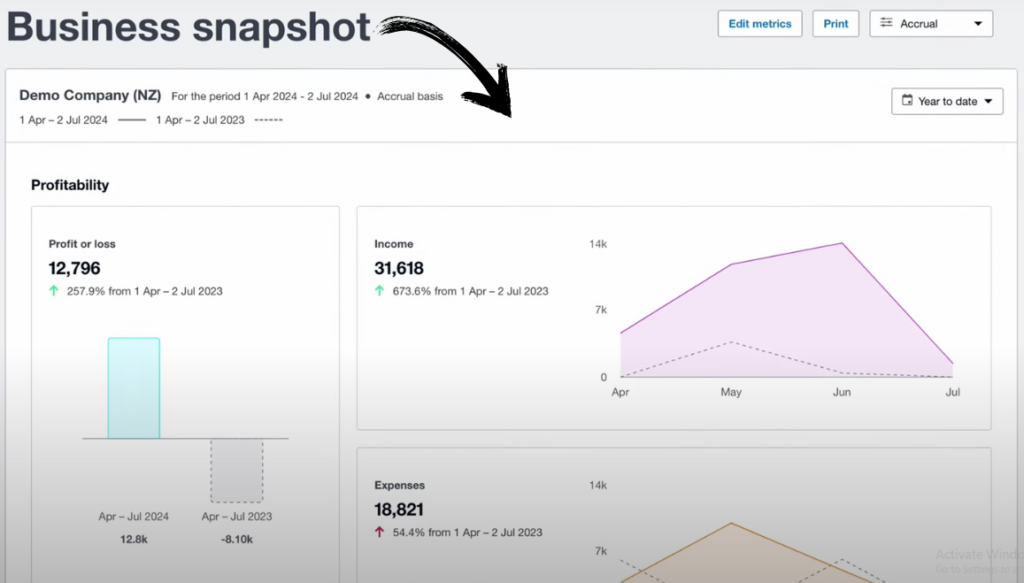

How to Use Xero Business Snapshot

Business Snapshot lets you monitor key business metrics in a single view.

Here’s how to use it step by step.

Step 1: Open Business Snapshot

Click “Business” in the top menu.

Select “Business Snapshot” from the dropdown.

Step 2: Review Key Metrics

Check revenue, expenses, and profit at a glance.

Compare this month to previous periods instantly.

Here’s what this looks like:

✓ Checkpoint: You should see graphs for income, expenses, and net profit.

Step 3: Drill Into the Details

Click any metric to see the full report behind the number.

Use the date selector to compare different time periods.

✅ Result: You can spot trends and make decisions without digging through reports.

💡 Pro Tip: Use Business Snapshot before client meetings. It gives you a clear picture in under 60 seconds.

How to Use Xero Multi-Currency Accounting

Multi-Currency Accounting lets you invoice and pay bills in any currency.

Here’s how to use it step by step.

Step 1: Enable Multi-Currency

Go to Settings then General Settings then Currencies.

This feature is available on the Established plan.

Step 2: Add Currencies

Search for and add the currencies you work with.

Xero auto-updates exchange rates daily.

Here’s what this looks like:

✓ Checkpoint: Your added currencies appear in the currency list.

Step 3: Create a Foreign Currency Invoice

Create a new invoice and select the contact’s currency.

Xero applies the current exchange rate automatically.

✅ Result: You can transact in multiple currencies with accurate conversions.

💡 Pro Tip: Review your unrealized currency gains and losses monthly. Exchange rate swings can impact your bottom line.

How to Use Xero Track Projects

Track Projects lets you monitor project costs, time, and profitability.

Here’s how to use it step by step.

Step 1: Create a New Project

Click “Projects” in the top menu.

Click “New Project” and give it a name and contact.

Step 2: Log Time and Expenses

Add time entries for work done on the project.

Assign expenses and bills to the project for cost tracking.

Here’s what this looks like:

✓ Checkpoint: You should see total time, costs, and profit margin for the project.

Step 3: Invoice from the Project

Click “Invoice” inside the project to bill your client.

Xero pulls in tracked time and expenses automatically.

✅ Result: You know exactly how profitable each project is before you bill.

💡 Pro Tip: Set a project budget at the start. Xero shows a progress bar so you know when costs are approaching the limit.

Xero Pro Tips and Shortcuts

After testing Xero for over two years, here are my best tips.

Keyboard Shortcuts

| Action | Shortcut |

|---|---|

| Go to Dashboard | / + D + Enter |

| Go to Invoices | / + I + Enter |

| Go to Bills | / + B + Enter |

| Go to Bank Accounts | / + A + Enter |

| Go to Contacts | / + C + Enter |

| Go to Reports | / + R + Enter |

| Enter Today’s Date | T |

| Go to Settings | / + S + Enter |

Hidden Features Most People Miss

- Lock Dates: Go to Settings then Financial Settings to lock past periods. This prevents accidental edits to finalized books.

- Demo Company: Xero includes a free demo company. Use it to test changes before touching your real data.

- Bank Rules: Create rules under Bank Accounts to auto-categorize repeating transactions. This cuts reconciliation time in half.

- Built-in Calculator: Type math in the Quantity, Unit Price, and Discount fields. Xero calculates the result when you press Tab.

Xero Common Mistakes to Avoid

Mistake #1: Not Reconciling Regularly

❌ Wrong: Waiting until month-end to reconcile hundreds of transactions at once.

✅ Right: Reconcile weekly or daily. It takes 5 minutes and keeps your books accurate.

Mistake #2: Using the Default Chart of Accounts

❌ Wrong: Keeping every default account even if it doesn’t apply to your business.

✅ Right: Archive unused accounts and add custom categories that match your business structure.

Mistake #3: Skipping Bank Rules

❌ Wrong: Manually categorizing every single bank transaction one by one.

✅ Right: Set up bank rules for recurring transactions like rent, subscriptions, and utilities.

Xero Troubleshooting

Problem: Bank Feed Not Updating

Cause: Your bank connection may have expired or your bank may be experiencing downtime.

Fix: Go to Settings then Bank Accounts. Click the affected bank and reconnect. If the issue persists, wait 24 hours and try again.

Problem: Invoice Not Sending

Cause: The invoice may still be in “Draft” status or the contact’s email is missing.

Fix: Open the invoice and click “Approve” first. Then check that the contact has a valid email address before clicking “Send.”

Problem: Reconciliation Balance Doesn’t Match

Cause: Duplicate transactions or manually entered items that overlap with the bank feed.

Fix: Check for duplicate entries in your bank account. Delete any manual transactions that have also been imported by the bank feed.

📌 Note: If none of these fix your issue, contact Xero support.

What is Xero?

Xero is a cloud accounting tool that helps small businesses manage invoicing, bank reconciliation, and financial reporting.

Think of it like a digital bookkeeper that works 24/7.

Watch this quick overview:

It includes these key features:

- Account Dashboard: See bank balances, cash flow, and outstanding invoices at a glance.

- Invoice Templates: Create branded invoices and send them with online payment options.

- Bank Reconciliation: Match bank transactions to your records in minutes.

- Automatic Invoicing: Schedule recurring invoices that send themselves.

- Automate Bill Entry: Capture bills and receipts with Hubdoc — no manual data entry.

- Advanced Accounting: Generate profit and loss statements and balance sheets.

- Business Snapshot: Monitor revenue, expenses, and trends in real time.

- Multi-Currency Accounting: Invoice and pay in any currency with automatic exchange rates.

- Track Projects: Track time, costs, and profitability per project.

For a full review, see our Xero review.

Xero Pricing

Here’s what Xero costs in 2026:

| Plan | Price | Best For |

|---|---|---|

| Starter | $29/mo | Freelancers and sole proprietors with low volume |

| Standard | $46/mo | Growing small businesses with unlimited invoicing |

Free trial: Yes — 30-day free trial with full access to all features.

Money-back guarantee: No refunds, but you can cancel anytime with no contract.

💰 Best Value: Standard — it removes all invoice and bill limits so you can grow without restrictions.

Xero vs Alternatives

How does Xero compare? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| Xero | Growing businesses | $29/mo | ⭐ 4.5 |

| QuickBooks | All-in-one accounting | $1.90/mo | ⭐ 4.4 |

| FreshBooks | Freelancers and invoicing | $21/mo | ⭐ 4.3 |

| Zoho Books | Budget-friendly accounting | $0/mo | ⭐ 4.3 |

| Sage | Small business basics | $7/mo | ⭐ 4.2 |

| Wave | Free accounting | $0/mo | ⭐ 4.0 |

| NetSuite | Enterprise accounting | Custom | ⭐ 4.5 |

| Expensify | Expense tracking | $5/mo | ⭐ 4.1 |

Quick picks:

- Best overall: Xero — unlimited users on every plan with 1,000+ app integrations.

- Best budget: Wave — completely free accounting with no hidden costs.

- Best for beginners: FreshBooks — the simplest interface for first-time business owners.

- Best for enterprises: NetSuite — full ERP with advanced financial management.

🎯 Xero Alternatives

Looking for Xero alternatives? Here are the top options:

- 🚀 Sage: Affordable starter plans from $7/mo with solid invoicing and expense tracking for micro-businesses.

- 💰 Dext: Automates receipt capture and data extraction, perfect for reducing bookkeeping admin work.

- 🎨 Zoho Books: Free plan available with full accounting features for businesses with under $50K annual revenue.

- ⚡ Synder: Syncs e-commerce and payment platform data into your accounting software automatically.

- 🔒 Easy Month End: Simplifies month-end close processes with automated checklists and reconciliation tools.

- 🧠 Docyt: AI-powered accounting automation for businesses that want hands-off bookkeeping.

- 👶 Puzzle IO: Free accounting basics plan with AI-driven insights built for startups.

- 🏢 RefreshMe: Budget tracking tool designed for personal and small household financial management.

- 🔧 Wave: Completely free accounting and invoicing with optional paid payroll add-on.

- 🌟 Quicken: Personal finance manager starting at $2.99/mo that also handles small business basics.

- ⭐ Hubdoc: Document capture tool that pulls bills and receipts into your accounting system automatically.

- 🎯 Expensify: Expense management starting at $5/member/mo with smart receipt scanning and approval workflows.

- 💼 QuickBooks: The most popular small business accounting software with plans from $1.90/mo.

- 📊 AutoEntry: Automated data entry tool starting at $12/mo that captures invoices and receipts.

- 🔥 FreshBooks: Invoicing-first accounting tool starting at $21/mo, ideal for freelancers and service businesses.

- 🏢 NetSuite: Enterprise-grade ERP and accounting suite with custom pricing for large organizations.

For the full list, see our Xero alternatives guide.

⚔️ Xero Compared

Here’s how Xero stacks up against each competitor:

- Xero vs Sage: Xero wins on integrations and multi-currency. Sage wins on price for very small businesses.

- Xero vs Dext: Different tools — Xero is full accounting, Dext is receipt capture. They work great together.

- Xero vs Zoho Books: Xero has more integrations and unlimited users. Zoho Books is cheaper with a free tier.

- Xero vs Synder: Synder specializes in e-commerce data sync. Xero is a full accounting platform.

- Xero vs Easy Month End: Xero covers full accounting. Easy Month End focuses only on the month-end close process.

- Xero vs Docyt: Docyt uses more AI automation but costs much more. Xero is better value for most small businesses.

- Xero vs Puzzle IO: Puzzle IO has a free plan for startups. Xero offers deeper features as your business grows.

- Xero vs RefreshMe: RefreshMe is personal finance only. Xero is built for business accounting.

- Xero vs Wave: Wave is free but limited. Xero gives you bank rules, multi-currency, and project tracking.

- Xero vs Quicken: Quicken is personal finance software. Xero is purpose-built for business accounting.

- Xero vs Hubdoc: Hubdoc is included free with Xero. It handles document capture inside the Xero platform.

- Xero vs Expensify: Expensify focuses on expense reports. Xero covers full accounting with expense claims built in.

- Xero vs QuickBooks: QuickBooks has more US-specific features. Xero wins on unlimited users and global currency support.

- Xero vs AutoEntry: AutoEntry is a data entry tool. Xero is a full accounting suite — they pair well together.

- Xero vs FreshBooks: FreshBooks is simpler for freelancers. Xero scales better for growing teams.

- Xero vs NetSuite: NetSuite is enterprise-grade ERP. Xero is better for small to mid-size businesses.

Start Using Xero Now

You learned how to use every major Xero feature:

- ✅ Account Dashboard

- ✅ Invoice Templates

- ✅ Bank Reconciliation

- ✅ Automatic Invoicing

- ✅ Automate Bill Entry

- ✅ Advanced Accounting

- ✅ Business Snapshot

- ✅ Multi-Currency Accounting

- ✅ Track Projects

Next step: Pick one feature and try it now.

Most people start with Account Dashboard.

It takes less than 5 minutes.

Frequently Asked Questions

Can I learn Xero by myself?

Yes, you can learn Xero by yourself. Xero offers free training courses, webinars, and a built-in demo company where you can practice without affecting real data. Most users get comfortable with the basics within a few hours of hands-on practice.

Is Xero easy to use for beginners?

Xero is designed for people without accounting backgrounds. The dashboard is visual, navigation is simple, and the software guides you through common tasks. If you can send an email, you can use Xero.

How to use Xero as a small business?

Start by connecting your bank account and setting up your chart of accounts. Then create invoice templates for your clients. Reconcile your bank transactions weekly and use the dashboard to monitor cash flow. That covers 90% of what most small businesses need.

How long does it take to learn Xero?

Most users learn the core features within 1-2 weeks of regular use. You can handle basic invoicing and reconciliation on day one. Advanced features like project tracking and multi-currency take a few more sessions to master.

Is Xero better than QuickBooks?

Xero and QuickBooks serve different strengths. Xero offers unlimited users on all plans and stronger multi-currency support. QuickBooks has more US-specific tax features and a larger US customer base. For growing businesses with multiple team members, Xero often wins on value.

How much does Xero cost per month?

Xero’s Starter plan costs $29/mo and the Standard plan costs $46/mo. Both plans include unlimited users. Xero also offers a free 30-day trial so you can test every feature before committing.

Do I need an accountant if I use Xero?

You don’t need an accountant for day-to-day bookkeeping with Xero. However, most businesses benefit from having an accountant review their books quarterly and handle tax filings. Xero makes it easy to invite your accountant to collaborate directly in your account.

What are the disadvantages of Xero?

Xero’s Starter plan limits you to 20 invoices and 5 bills per month. Some advanced features like project tracking and multi-currency are only on the Established plan. The accounts payable features are also less robust than some competitors like QuickBooks.