Quick Start

This guide covers every AutoEntry feature:

- Getting Started — Create account and basic setup

- How to Use Easy Data Entry — Capture invoices and receipts in seconds

- How to Use Detailed Dashboard — Track all documents from one screen

- How to Use Accounting Software Integration — Connect to Xero, Sage, or QuickBooks

- How to Use Bills Management — Track and organize all your bills

- How to Use Automated Publishing — Send data to your ledger hands-free

- How to Use Line Item Extraction — Capture every detail on an invoice

- How to Use Smart Analysis — Let AI remember your coding rules

- How to Use Bank Statement Processing — Digitize bank data in minutes

- How to Use Expense Reports — Create and manage employee expenses

Time needed: 5 minutes per feature

Also in this guide: Pro Tips | Common Mistakes | Troubleshooting | Pricing | Alternatives

Why Trust This Guide

I’ve used AutoEntry for over 6 months and tested every feature covered here. This tutorial comes from real hands-on experience — not marketing fluff or vendor screenshots.

AutoEntry is one of the most powerful data entry automation tools for accounting today.

But most users only scratch the surface of what it can do.

This guide shows you how to use every major feature.

Step by step, with screenshots and pro tips.

AutoEntry Tutorial

This complete AutoEntry tutorial walks you through every feature step by step, from initial setup to advanced tips that will make you a power user.

AutoEntry

Stop typing invoices and receipts by hand. AutoEntry captures your financial documents with up to 99% accuracy and sends the data straight to your accounting software. No contract required — cancel anytime.

Getting Started with AutoEntry

Before using any feature, complete this one-time setup.

It takes about 3 minutes.

Watch this quick overview first:

Now let’s walk through each step.

Step 1: Create Your Account

Go to AutoEntry’s website at autoentry.com.

Click “Register Now” or “Start Free Trial.”

Enter your email, business name, and create a password.

✓ Checkpoint: Check your inbox for a confirmation email.

Step 2: Connect Your Accounting Software

Log into your AutoEntry dashboard.

Go to Settings and select your accounting software.

AutoEntry works with Xero, Sage, QuickBooks, and FreeAgent.

Follow the on-screen prompts to authorize the connection.

Here’s what the dashboard looks like:

✓ Checkpoint: You should see your chart of accounts imported.

Step 3: Import Your Chart of Accounts and Tax Codes

AutoEntry pulls in your chart of accounts automatically.

Verify that all nominal codes and VAT/tax codes are correct.

Download the mobile app from iOS or Android if you want.

✅ Done: You’re ready to use any feature below.

How to Use AutoEntry Easy Data Entry

Easy Data Entry lets you capture invoices, receipts, and bills without typing.

Here’s how to use it step by step.

See Easy Data Entry in action:

Now let’s break down each step.

Step 1: Upload Your Document

Snap a photo with the mobile app or upload a PDF.

You can also email documents to your unique AutoEntry address.

Batch scanning is available through the desktop app.

Step 2: Review the Extracted Data

AutoEntry reads the document using AI-powered OCR.

It pulls the supplier name, date, amount, and tax details.

Check that all fields are correct before publishing.

✓ Checkpoint: You should see all key data fields filled in.

Step 3: Publish to Your Accounting Software

Click “Publish” to send the data to your ledger.

The entry appears in your accounting software within seconds.

✅ Result: Your invoice or receipt is now in your accounting software.

💡 Pro Tip: Use the email forwarding feature to skip uploads entirely. Just forward supplier invoices to your AutoEntry email address.

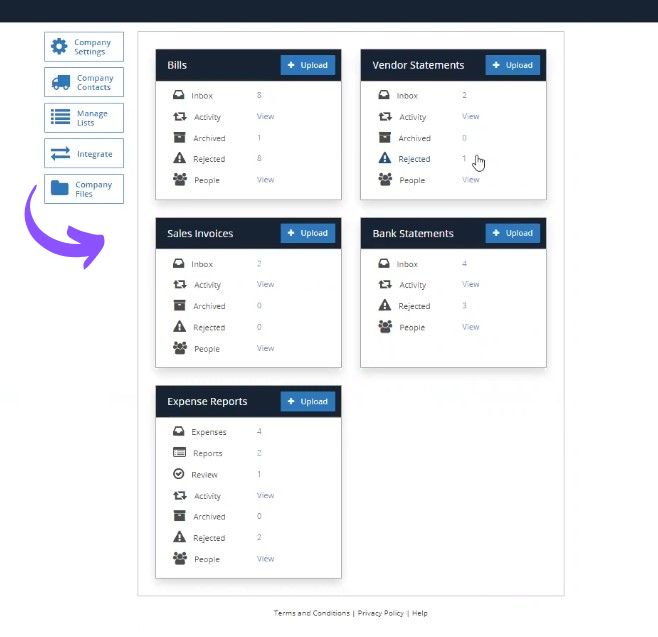

How to Use AutoEntry Detailed Dashboard

Detailed Dashboard lets you monitor all documents from a single screen.

Here’s how to use it step by step.

See the Detailed Dashboard in action:

Now let’s break down each step.

Step 1: Open the Dashboard

Log into AutoEntry and click the Dashboard tab.

You’ll see a summary of all recent uploads and their status.

Step 2: Filter and Sort Documents

Use filters to view documents by type, date, or status.

Sort by “Awaiting Review” to see items that need attention.

✓ Checkpoint: You should see documents organized by processing stage.

Step 3: Take Action on Pending Items

Click any document to review, edit, or publish it.

Use bulk actions to publish multiple items at once.

✅ Result: You have full visibility into every document’s status.

💡 Pro Tip: Check the dashboard daily to catch any documents stuck in “Awaiting Review” before they pile up.

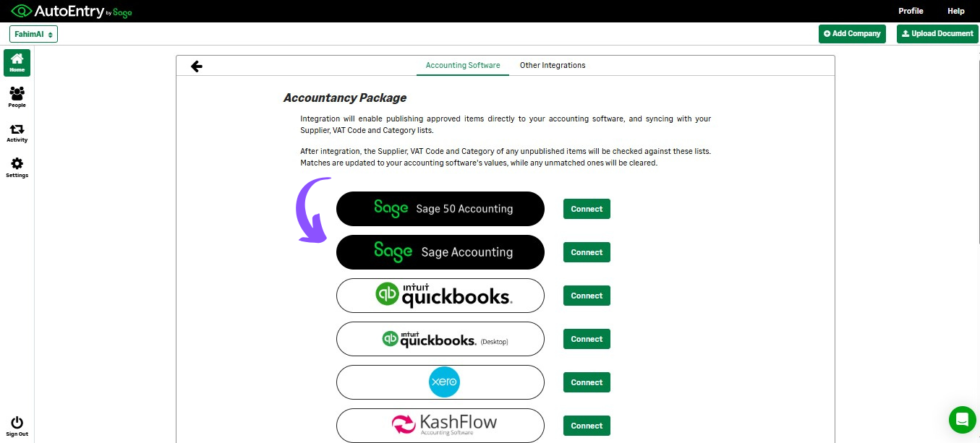

How to Use AutoEntry Accounting Software Integration

Accounting Software Integration lets you connect AutoEntry to Xero, Sage, QuickBooks, and more.

Here’s how to use it step by step.

See Accounting Software Integration in action:

Now let’s break down each step.

Step 1: Navigate to Settings

Go to your AutoEntry dashboard and click “Settings.”

Select “Accounting Software” from the menu.

Step 2: Choose Your Software and Authorize

Pick your accounting platform from the list.

Click “Connect” and sign into your accounting account.

Grant AutoEntry permission to access your data.

✓ Checkpoint: You should see a green “Connected” status badge.

Step 3: Verify Imported Data

Confirm your chart of accounts and tax codes pulled in correctly.

Map any missing accounts if prompted.

✅ Result: AutoEntry is now linked to your accounting software.

💡 Pro Tip: If you manage multiple clients, connect each company separately. AutoEntry supports unlimited companies on a single subscription.

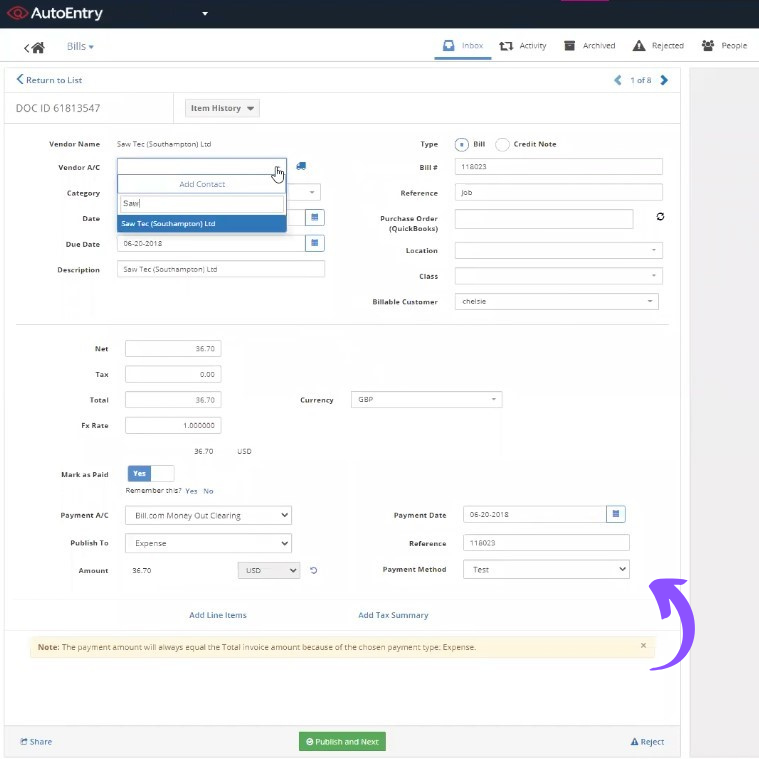

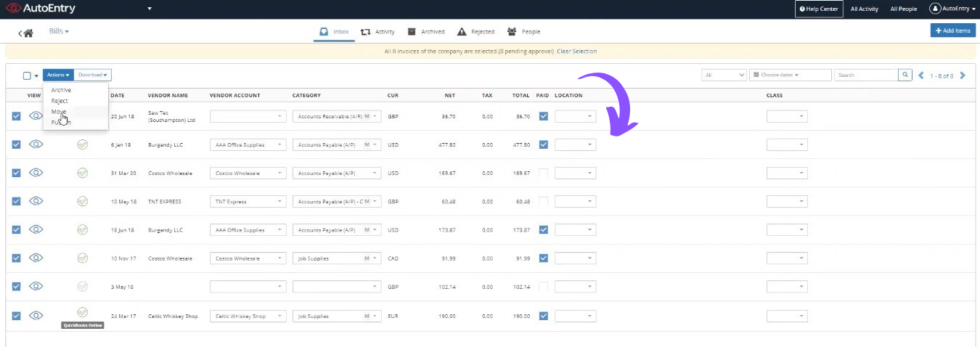

How to Use AutoEntry Bills Management

Bills Management lets you track due dates and organize all supplier bills.

Here’s how to use it step by step.

See Bills Management in action:

Now let’s break down each step.

Step 1: Upload Your Supplier Bills

Scan, email, or photograph your bills into AutoEntry.

AutoEntry reads the supplier name, amount, and due date.

Step 2: Review and Categorize

Assign each bill to the correct account and tax code.

AutoEntry remembers your choices for next time.

✓ Checkpoint: You should see all bills listed with due dates.

Step 3: Publish or Set Reminders

Publish approved bills to your accounting software.

Track upcoming payments to avoid late fees.

✅ Result: All your bills are organized and tracked in one place.

💡 Pro Tip: Use supplier statement reconciliation to match invoices against monthly statements from your vendors.

How to Use AutoEntry Automated Publishing

Automated Publishing lets you send data to your ledger without clicking “Publish.”

Here’s how to use it step by step.

See Automated Publishing in action:

Now let’s break down each step.

Step 1: Open Auto-Publish Settings

Go to Settings and select “Auto-Publish Rules.”

This feature works best for recurring suppliers you trust.

Step 2: Create a Publishing Rule

Select the supplier you want to auto-publish.

Set the account code, tax code, and approval threshold.

✓ Checkpoint: You should see the rule listed under Active Rules.

Step 3: Test with a New Document

Upload a document from that supplier.

It should publish to your accounting software automatically.

✅ Result: Regular bills now go straight to your ledger hands-free.

💡 Pro Tip: Start with just 2-3 trusted suppliers for auto-publish. Expand the list after you confirm accuracy.

How to Use AutoEntry Line Item Extraction

Line Item Extraction lets you capture every detail on an invoice, not just the total.

Here’s how to use it step by step.

Step 1: Upload a Multi-Line Invoice

Scan or upload an invoice that has multiple line items.

AutoEntry detects multi-line documents automatically.

Step 2: Review Each Line Item

AutoEntry extracts the description, unit price, and quantity.

Each item gets its own row in the data preview.

Verify that amounts match the original document.

✓ Checkpoint: You should see individual items listed with correct totals.

Step 3: Publish with Full Detail

Click “Publish” to send all line items to your software.

Each item posts separately in your accounting ledger.

✅ Result: Full line-by-line detail is now in your accounting software.

💡 Pro Tip: Line item extraction uses 2 credits per document instead of 1. Only enable it for invoices where you need the detail.

How to Use AutoEntry Smart Analysis

Smart Analysis lets AI learn your coding patterns and apply them automatically.

Here’s how to use it step by step.

See Smart Analysis in action:

Now let’s break down each step.

Step 1: Process Your First Few Documents Manually

Upload and categorize a few invoices from the same supplier.

Assign the correct account code and tax code each time.

Step 2: Watch AutoEntry Learn Your Preferences

After a few documents, AutoEntry starts suggesting codes.

It remembers which account you used for each supplier.

✓ Checkpoint: You should see pre-filled account and tax codes.

Step 3: Accept or Adjust Suggestions

Review the auto-filled codes and click “Accept” if correct.

Make changes if needed — AutoEntry updates its memory.

✅ Result: AutoEntry now codes documents from that supplier automatically.

💡 Pro Tip: Be consistent with your first 5-10 documents per supplier. This trains Smart Analysis faster and improves accuracy.

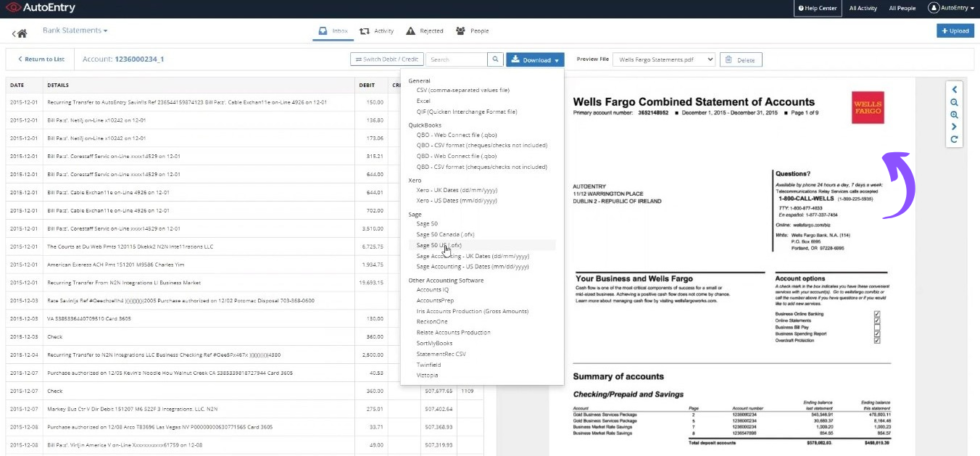

How to Use AutoEntry Bank Statement Processing

Bank Statement Processing lets you turn paper or PDF statements into digital data.

Here’s how to use it step by step.

See Bank Statement Processing in action:

Now let’s break down each step.

Step 1: Upload Your Bank Statement

Scan or upload a PDF of your bank statement.

AutoEntry accepts statements from most major banks.

Step 2: Review the Extracted Transactions

AutoEntry reads every transaction from the statement.

Each row shows the date, description, and amount.

✓ Checkpoint: You should see all transactions listed in a table format.

Step 3: Publish or Export

Publish directly to your accounting software.

You can also export as an Excel spreadsheet.

✅ Result: Your bank statement data is digitized and in your ledger.

💡 Pro Tip: Bank statements use 3 credits per page. Multi-page statements add up fast, so request digital PDFs from your bank when possible.

How to Use AutoEntry Expense Reports

Expense Reports lets you create and manage employee expense claims.

Here’s how to use it step by step.

See Expense Reports in action:

Now let’s break down each step.

Step 1: Snap Your Receipt

Open the AutoEntry mobile app on your phone.

Take a photo of the receipt right after the purchase.

Step 2: Add Expense Details

Select the expense category and add any notes.

AutoEntry extracts the vendor, date, and amount automatically.

✓ Checkpoint: You should see the expense listed in your pending reports.

Step 3: Submit for Approval

Group expenses into a report and submit it.

Managers can approve or reject through the dashboard.

✅ Result: Your expense report is submitted and ready for approval.

💡 Pro Tip: Snap receipts the same day you get them. Faded receipts are harder for OCR to read accurately.

AutoEntry Pro Tips and Shortcuts

After testing AutoEntry for over 6 months, here are my best tips.

Keyboard Shortcuts

| Action | Shortcut |

|---|---|

| Publish selected items | Ctrl + P |

| Select all documents | Ctrl + A |

| Delete selected item | Del |

| Open document preview | Spacebar |

Hidden Features Most People Miss

- Email forwarding address: Each company gets a unique email. Forward supplier invoices directly and skip manual uploads entirely.

- Supplier statement reconciliation: Upload monthly supplier statements to auto-match against captured invoices. Great for construction and trades.

- Credit rollover: Unused credits roll forward to the next month. Don’t worry about wasting them in quieter periods.

AutoEntry Common Mistakes to Avoid

Mistake #1: Uploading Blurry or Cropped Photos

❌ Wrong: Snapping receipts at odd angles with poor lighting and cut-off edges.

✅ Right: Place documents flat, use good lighting, and capture the full page in frame.

Mistake #2: Not Reviewing Before Publishing

❌ Wrong: Auto-publishing everything without checking the extracted data first.

✅ Right: Review the first few documents from each supplier before enabling auto-publish.

Mistake #3: Using Line Item Extraction for Everything

❌ Wrong: Turning on line item capture for simple one-line receipts and wasting credits.

✅ Right: Only use line item extraction when you need the detail. Single-line items need just 1 credit.

AutoEntry Troubleshooting

Problem: Document Not Processing

Cause: The image is too blurry, too dark, or in an unsupported format.

Fix: Re-upload a clearer image or PDF. Make sure the document is fully visible.

Problem: Wrong Data Extracted

Cause: The document layout confused the OCR engine.

Fix: Manually correct the fields and publish. AutoEntry learns from your corrections.

Problem: Accounting Software Not Syncing

Cause: The connection token expired or permissions changed.

Fix: Go to Settings, disconnect your accounting software, then reconnect it.

📌 Note: If none of these fix your issue, contact AutoEntry support via live chat.

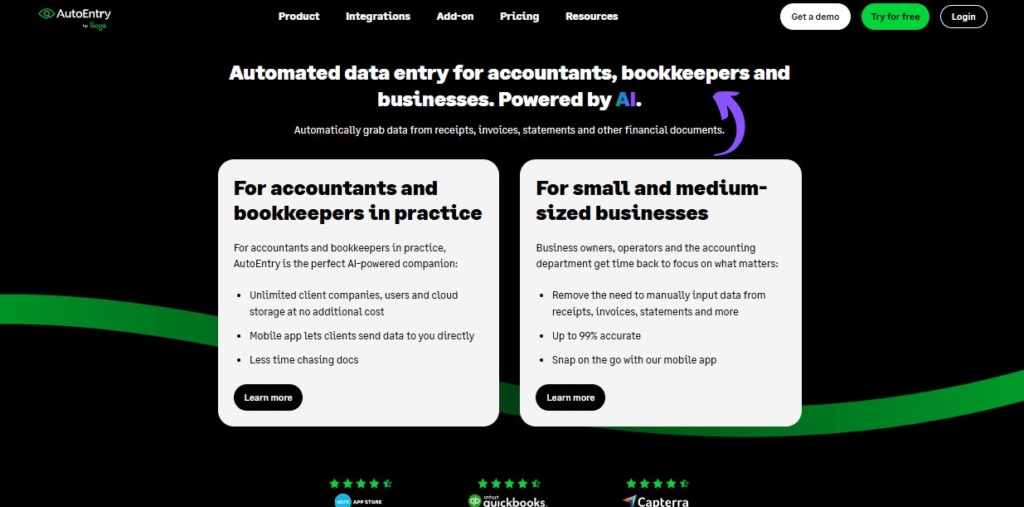

What is AutoEntry?

AutoEntry is a data entry automation tool that captures invoices, receipts, and bank statements using AI-powered OCR.

Think of it like a digital assistant that reads your paperwork and types the data into your accounting software for you.

Watch this quick overview:

It includes these key features:

- Easy Data Entry: Snap, scan, or email documents for automatic data capture.

- Detailed Dashboard: Monitor all documents and their processing status from one screen.

- Accounting Software Integration: Connects to Xero, Sage, QuickBooks, FreeAgent, and more.

- Bills Management: Track supplier bills, due dates, and payment status.

- Automated Publishing: Set rules to send data to your ledger without manual intervention.

- Line Item Extraction: Capture individual line items including description, quantity, and unit price.

- Smart Analysis: AI learns your coding patterns and applies them to future documents.

- Bank Statement Processing: Convert paper and PDF bank statements into digital data.

- Expense Reports: Employees snap receipts and submit expenses through the mobile app.

For a full review, see our AutoEntry review.

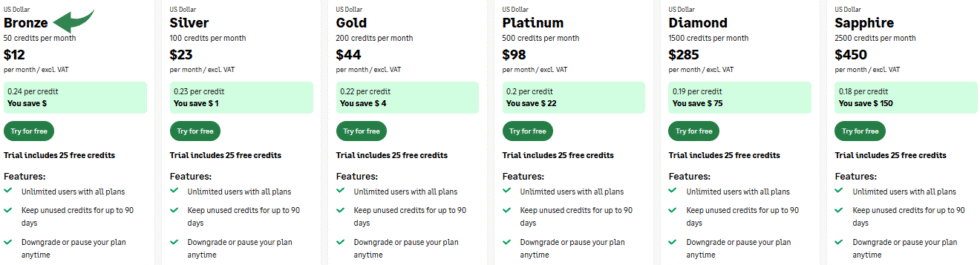

AutoEntry Pricing

Here’s what AutoEntry costs in 2026:

| Plan | Price | Best For |

|---|---|---|

| Bronze | $12/month | Solo freelancers with low document volume |

| Silver | $23/month | Small businesses with moderate invoicing |

| Gold | $44/month | Growing businesses with regular supplier bills |

| Platinum | $98/month | Bookkeepers managing multiple clients |

| Diamond | $285/month | Accounting firms with high document volume |

| Sapphire | $450/month | Large practices processing thousands monthly |

Free trial: Yes, AutoEntry offers a free trial to test the platform.

Money-back guarantee: No contract required. Cancel anytime with 24-hour notice.

💰 Best Value: Gold plan at $44/month — it gives enough credits for most small businesses without overspending.

AutoEntry vs Alternatives

How does AutoEntry compare? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| AutoEntry | Credit-based flexibility | $12/mo | ⭐ 4 |

| Dext | High-volume client management | $24/mo | ⭐ 4.3 |

| Xero | Full cloud accounting | $29/mo | ⭐ 4.5 |

| QuickBooks | All-in-one accounting | $1.90/mo | ⭐ 4.4 |

| Sage | UK/MTD compliance | $7/mo | ⭐ 4.2 |

| FreshBooks | Freelancer invoicing | $21/mo | ⭐ 4.3 |

| Zoho Books | Budget-friendly accounting | $0/mo | ⭐ 4.3 |

| Expensify | Expense management | $5/mo | ⭐ 4.1 |

Quick picks:

- Best overall: AutoEntry — flexible credit-based pricing with no contract

- Best budget: Zoho Books — free plan covers basic accounting needs

- Best for beginners: Wave — free accounting with a simple interface

- Best for accountants: Dext — built for practices managing many clients

🎯 AutoEntry Alternatives

Looking for AutoEntry alternatives? Here are the top options:

- 🚀 Puzzle IO: AI-powered bookkeeping with advanced automation and insights for growing firms.

- 💰 Dext: Market-leading receipt capture tool built for accountants managing multiple client companies.

- 🎨 Xero: Full cloud accounting platform with built-in invoicing, bank feeds, and reporting.

- ⚡ Synder: Automated accounting sync for ecommerce and SaaS businesses with multi-channel support.

- 🔒 Easy Month End: Simplifies month-end closing with automated reconciliation and checklists.

- 🧠 Docyt: AI-powered back-office accounting for restaurants, hotels, and multi-location businesses.

- 👶 Sage: Trusted accounting platform with MTD compliance and Sage Copilot AI assistant.

- 🏢 Zoho Books: Affordable cloud accounting with a generous free plan for small businesses.

- 🔧 Wave: Completely free accounting and invoicing for freelancers and micro-businesses.

- 🌟 Quicken: Personal and small business finance tracking with budgeting and investment tools.

- ⭐ Hubdoc: Free document capture for Xero users with basic data extraction features.

- 🎯 Expensify: Expense reporting and receipt scanning for teams and corporate travel management.

- 💼 QuickBooks: The most widely used small business accounting software with payroll and tax tools.

- 📊 FreshBooks: Cloud accounting built for service-based businesses with time tracking and proposals.

- 🔥 NetSuite: Enterprise-grade ERP with full accounting, CRM, and inventory in one platform.

For the full list, see our AutoEntry alternatives guide.

⚔️ AutoEntry Compared

Here’s how AutoEntry stacks up against each competitor:

- AutoEntry vs Puzzle IO: Puzzle IO offers deeper AI insights but AutoEntry wins on flexible pay-per-document pricing.

- AutoEntry vs Dext: Dext charges per client while AutoEntry charges per document. AutoEntry is better for low-volume clients.

- AutoEntry vs Xero: Xero is full accounting software. AutoEntry is a data capture add-on that works with Xero.

- AutoEntry vs Synder: Synder focuses on ecommerce transaction sync. AutoEntry is better for invoice and receipt capture.

- AutoEntry vs Easy Month End: Easy Month End handles month-end closing. AutoEntry handles daily document capture.

- AutoEntry vs Docyt: Docyt targets multi-location businesses with full back-office automation. AutoEntry is simpler and cheaper.

- AutoEntry vs Sage: Sage owns AutoEntry. Together they form a complete accounting and data capture solution.

- AutoEntry vs Zoho Books: Zoho Books is a full accounting suite. AutoEntry adds document capture to any accounting platform.

- AutoEntry vs Wave: Wave is free accounting software. AutoEntry adds automated data entry that Wave doesn’t have.

- AutoEntry vs Quicken: Quicken is personal finance software. AutoEntry is built for business accounting automation.

- AutoEntry vs Hubdoc: Hubdoc is free for Xero users but has fewer features. AutoEntry has better OCR and line item capture.

- AutoEntry vs Expensify: Expensify excels at expense management. AutoEntry handles invoices, bills, and bank statements too.

- AutoEntry vs QuickBooks: QuickBooks is full accounting software. AutoEntry adds better document capture to QuickBooks.

- AutoEntry vs FreshBooks: FreshBooks targets freelancers with invoicing. AutoEntry focuses on automated data entry for any business.

- AutoEntry vs NetSuite: NetSuite is enterprise ERP. AutoEntry is a lightweight data capture tool for small to mid-size firms.

Start Using AutoEntry Now

You learned how to use every major AutoEntry feature:

- ✅ Easy Data Entry

- ✅ Detailed Dashboard

- ✅ Accounting Software Integration

- ✅ Bills Management

- ✅ Automated Publishing

- ✅ Line Item Extraction

- ✅ Smart Analysis

- ✅ Bank Statement Processing

- ✅ Expense Reports

Next step: Pick one feature and try it now.

Most people start with Easy Data Entry.

It takes less than 5 minutes.

Frequently Asked Questions

How does AutoEntry work?

AutoEntry uses AI-powered OCR to read invoices, receipts, and bank statements. You upload a document by scanning, emailing, or snapping a photo. AutoEntry extracts the key data and publishes it directly to your accounting software like Xero, Sage, or QuickBooks.

How to use Sage AutoEntry?

Log into AutoEntry and connect your Sage account under Settings. AutoEntry imports your chart of accounts and tax codes from Sage. Then upload documents and publish the extracted data directly into your Sage ledger. The process works the same for Sage 50, Sage 200, and Sage Accounting.

How long does AutoEntry take to process?

Most documents process within a few minutes. Simple invoices and receipts are fastest. Bank statements and multi-page documents take slightly longer. The more you use AutoEntry, the faster it gets thanks to machine learning.

How to set up AutoEntry?

Create an account at autoentry.com and connect your accounting software. AutoEntry imports your chart of accounts and tax codes automatically. Download the mobile app to capture receipts on the go. The whole setup takes about 3 minutes.

Is AutoEntry free with Sage?

AutoEntry is not free with Sage. It requires a separate subscription starting at $12/month for the Bronze plan. However, Sage owns AutoEntry, so the two products work together very well. All plans include unlimited users and companies at no extra cost.