Are you tired of endless paperwork and manual data entry stealing your precious time?

Many small business owners and freelancers struggle with managing their finances, from invoices to expenses.

It’s a common problem that can lead to headaches, mistakes, and missed opportunities.

But what if there were tools to help?

Both promise to make your financial life easier, but which one is truly the best fit for your business?

Let’s compare Autoentry vs FreshBooks so you can make a smart choice and get back to what you do best.

Overview

We took a close look at both AutoEntry and FreshBooks.

We tested their main features and how easy they are to use.

This helped us see where each tool shines and where it falls short.

Stop wasting 10+ hours/week on manual data entry. See how Autoentry slashed invoice processing time by 40% for Sage users.

Pricing: It has a free trial. Paid plan starts at $12/month.

Key Features:

- Data Extraction

- Receipt Scanning

- Supplier Automation

Ready to simplify your invoicing and get paid faster? Over 30 million people have used FreshBooks. Explore it for more!

Pricing: It has a free trial. Paid plan starts at $2.10/month.

Key Features:

- Time Tracking

- Invoicing

- Bookkeeping

What is AutoEntry?

Okay, so let’s talk about AutoEntry.

It’s a tool that helps you get your paperwork into your computer without typing everything yourself.

Think of it like a smart helper for your bills and receipts.

It reads them and puts the info where it needs to go.

Also, explore our favorite AutoEntry alternatives…

Our Take

Ready to cut your bookkeeping time? AutoEntry processes over 28 million documents each year and offers up to 99% accuracy. Start today and join the over 210,000 businesses worldwide that have reduced their data entry hours by up to 80%!

Key Benefits

AutoEntry’s biggest win is saving hours of boring work.

Users often see up to 80% less time spent on manual data entry.

It promises up to 99% accuracy in its data extraction.

AutoEntry does not offer a specific money-back warranty, but its monthly plans allow you to cancel at any time.

- Up to 99% accuracy on data.

- Unlimited users on all paid plans.

- Pulls full line items from invoices.

- Easy mobile app for receipt snaps.

- 90 days for unused credits to roll over.

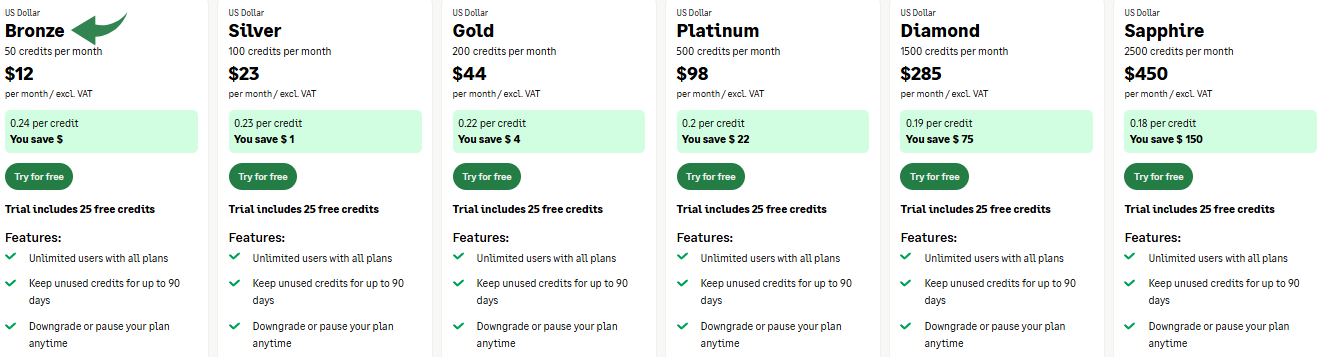

Pricing

- Bronze: $12/month.

- Silver: $23/month.

- Gold: $44/month.

- Platinum: $98/month.

- Diamond: $285/month.

- Sapphire: $450/month.

Pros

Cons

What is FreshBooks?

Okay, so let’s talk about FreshBooks.

Think of it like a helper for your money stuff.

It’s made for people who run small businesses and do freelance work.

It helps you send bills (invoices), keep track of your money coming in, and see where your money is going.

It’s like having a simple way to manage your business finances.

Also, explore our favorite FreshBooks alternatives…

Our Take

Tired of complex accounting? 30 million+ businesses trust FreshBooks to create professional invoices. Simplify your accounting software today!

Key Benefits

- Professional invoice creation

- Automated payment reminders

- Time tracking

- Project management tools

- Expense tracking

Pricing

- Lite: $2.10/month.

- Plus: $3.80/month.

- Premium: $6.50/month.

- Select: Custom Pricing.

Pros

Cons

Feature Comparison

Let’s look at how these two tools work side-by-side. We will focus on what each one does best.

This helps you choose the right tool for your specific needs.

1. Core Function

- AutoEntry: This tool is all about automation. It is an excellent accounting software solution for data extraction. Its main job is to eliminate manual data entry from documents. It is not full cloud-based accounting.

- FreshBooks: This is a complete cloud-based accounting program. It handles all your big financial tasks. It focuses on the bigger picture of your finances.

2. Invoicing and Payments

- FreshBooks: It has strong invoicing features. You can send recurring invoices easily. It lets you accept payments with online payments like FreshBooks Payments. You can create custom invoicing.

- AutoEntry: This tool does not have any invoicing features. It is designed to process incoming documents like a purchase invoice.

3. Pricing Structure

- FreshBooks: They offer several pricing plans: the Lite Plan, Plus Plan, and Select Plan. The cost is based on how many billable clients you have per month.

- AutoEntry: AutoEntry pricing is based on the number of documents, or credits, you use per month. It has flexible pricing that scales with your document volume.

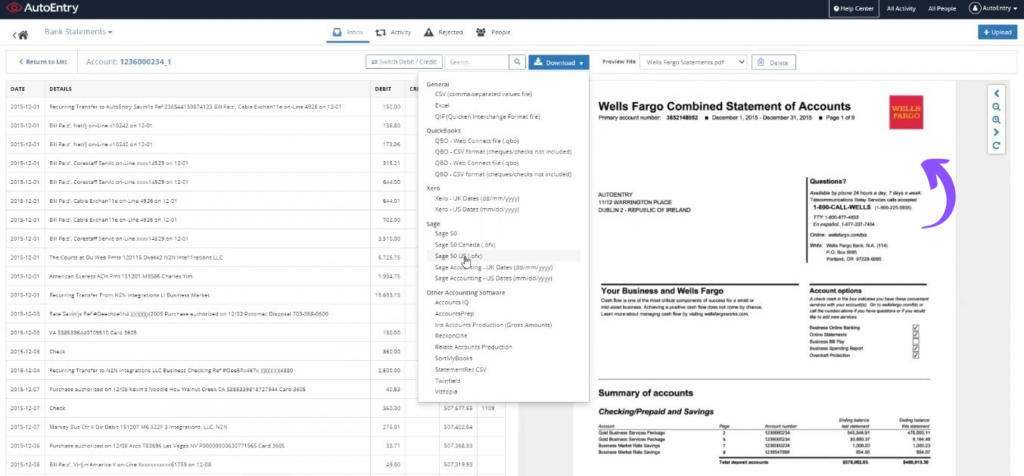

4. Document Capture

- AutoEntry: It uses smart technology called optical character recognition. It is very good at reading bills and other financial documents. It can extract data even from line items.

- FreshBooks: It offers simple receipt scanning with its FreshBooks mobile app. Its strength is not deep document work.

5. Project Tracking

- FreshBooks: It has tools to help you manage projects and track billable time. You can use project profitability tracking. This shows how much money you make from only the projects.

- AutoEntry: This tool does not have tools to manage projects. Its focus is just getting documents ready for your accounting system.

6. Accounting Depth

- FreshBooks: It offers double-entry accounting on its higher plans. This is important for formal records. It is great for self-employed professionals.

- AutoEntry: It is only a document tool. It does not handle the core accounting like double-entry accounting. It just helps the accountant with data input.

7. Team Use and Users

- AutoEntry: It allows unlimited users for no extra cost. This is great for an accountant and their team members. Flexible pricing is a big help here.

- FreshBooks: Many pricing plans require an additional user fee. You must pay extra if you need many team members or business partners.

8. Integrations

- AutoEntry: It has seamless integration with many other accounting software programs. This is its main strength. It helps to auto-publish data.

- FreshBooks: It also connects to many apps. It is more of a standalone solution for cloud accounting.

9. Mobile Use

- FreshBooks: The FreshBooks mobile app works on iOS and Android devices. You can do almost everything from your mobile device, like sending invoices.

- AutoEntry: Its mobile phone app is mainly for taking pictures of documents. It is very fast for receipt scanning.

What to look for when choosing an Accounting Software?

- Look at your main problem: If your main effort is getting data from receipts and bank statements, use AutoEntry reviews to guide you. If you need to create professional invoices and track all your money, look closely at FreshBooks accounting software.

- Check the Security: Make sure the security solution is strong. Tools should protect your data from online attacks. Be aware of things like the Cloudflare Ray ID security service message you sometimes see online. Do not worry about an SQL command being a problem if you are just using the website normally.

- Check Accounting Features: Does it have the advanced features you need? FreshBooks offers bank reconciliation, accounts payable, and accounting reports that help with tax time. See if you need its premium plan or if the three plans are enough.

- Payment Options: If you take client payments, check FreshBooks offers features like advanced payments and recurring billing. You can even use a virtual terminal on the higher plans to charge cards over the phone.

- Document Handling: AutoEntry can upload documents like bank statements and read them. This saves you a lot of time spent.

- Ease of Use: Check the FreshBooks dashboard and other software to see how easy it is to use every day. Many FreshBooks reviews praise its user-friendly design.

- Business Needs: Think about tracking time and projects. FreshBooks has good time tracking and project management tools. Look for inventory management if you sell physical goods.

- The Fine Print: Check what is covered in the plans. For example, FreshBooks’ client retainers or unlimited estimates might be tied to certain tiers. Check if they offer a free version or just a free trial.

Final Verdict

Which one should you choose?

We recommend FreshBooks as the best accounting software for most small business owners and freelancers.

It offers four plans and is a full financial hub.

FreshBooks lets you convert estimates into invoices and handle ACH transfers and bank transfers.

It helps clear up unreconciled transactions easily.

AutoEntry is powerful for data extraction, but FreshBooks is a complete platform.

It manages everything from invoicing with late fees to customer support and offers exclusive access to its features with just an internet connection.

Listen to our breakdown; we focused on the features that truly help you manage your money, not just documents.

More of AutoEntry

- AutoEntry vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- AutoEntry vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- AutoEntry vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- AutoEntry vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- AutoEntry vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- AutoEntry vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- AutoEntry vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- AutoEntry vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- AutoEntry vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- AutoEntry vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- AutoEntry vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- AutoEntry vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- AutoEntry vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- AutoEntry vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- AutoEntry vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

More of FreshBooks

- FreshBooks vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- FreshBooks vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- FreshBooks vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- FreshBooks vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- FreshBooks vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- FreshBooks vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- FreshBooks vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- FreshBooks vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- FreshBooks vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- FreshBooks vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- FreshBooks vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- FreshBooks vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- FreshBooks vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- FreshBooks vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- FreshBooks vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Can AutoEntry streamline my invoice processing?

Yes, AutoEntry is excellent for this. It uses automated data capture to extract details from invoices. This helps to eliminate manual data entry and save time.

Is FreshBooks user-friendly for small business owners?

Absolutely. FreshBooks is known for its user-friendly interface. It’s designed to simplify your financial management with easy-to-use tools for invoicing and expense management.

Do both tools offer a mobile app for on-the-go use?

Yes, both AutoEntry and FreshBooks provide a mobile app. AutoEntry’s app is great for receipt scanning. FreshBooks’ app lets you manage invoices and finances anywhere.

Can these tools integrate with QuickBooks Online?

AutoEntry integrates very well with QuickBooks Online and other major accounting software for small business. FreshBooks also offers integrations, making your workflow smoother.

Is there a free trial available for either AutoEntry or FreshBooks?

Yes, both AutoEntry and FreshBooks typically offer a free trial. This lets you try out their features. You can see how they fit your cloud-based accounting needs before you commit.