Frustrated with your current accounting software?

Feeling stuck with manual tasks or limited features? You’re not alone.

Imagine effortless financial organization and clear business insights.

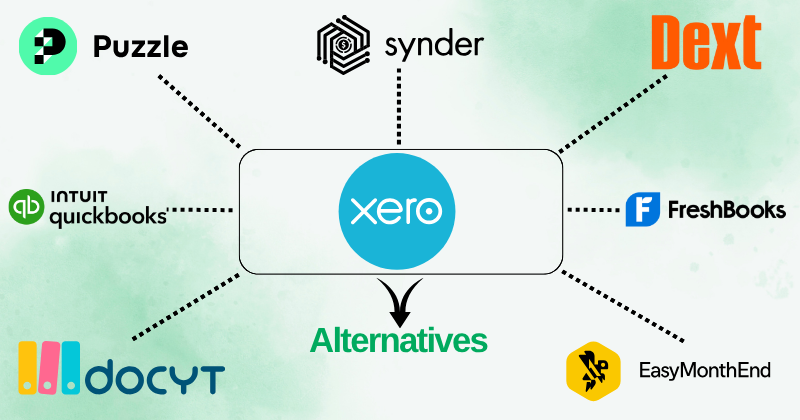

This article helps you find the 9 best Synder alternatives to achieve just that.

Discover options that save time, cut costs, and bring clarity to your finances.

Let’s find your perfect match!

What are the Best Synder Alternatives?

Looking for a new accounting solution?

It can be tough to pick the right one for your business.

We’ve dug deep to find the top tools that can do what Synder does, and often more.

Check out our list below to see which one fits your needs perfectly!

1. Xero (⭐4.8)

Xero is an online accounting platform built for small businesses.

You can send invoices, track expenses, and view your cash flow.

It connects directly to your bank, making reconciliation super easy.

Many businesses globally use it for its simplicity.

Unlock its potential with our Xero tutorial.

Also, explore our Synder vs Xero comparison!

Our Take

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features now!

Key Benefits

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

Pricing

- Starter: $29/month.

- Standard: $46/month.

- Premium: $69/month.

Pros

Cons

2. Puzzle IO (⭐4.5)

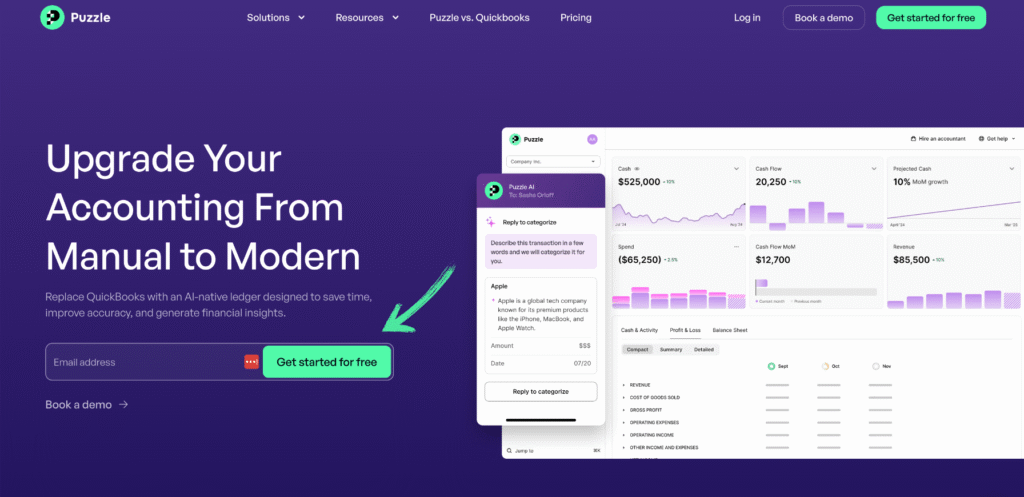

Puzzle is a new kind of accounting software.

It’s built for startups and fast-growing businesses.

Puzzle helps you keep track of all your money, from payments to cash flow.

It aims to make accounting simple and clear, even if you’re not an expert.

Unlock its potential with our Puzzle IO tutorial.

Also, explore our Synder vs Puzzle IO comparison!

Our Take

Ready to simplify your finances? See how Puzzle io can save you up to 20 hours a month. Experience the difference today!

Key Benefits

Puzzle IO really shines when it comes to helping you understand where your business is headed.

- 92% of users report better financial forecasting accuracy.

- Get real-time insights into your cash flow.

- Easily create different financial scenarios to plan.

- Collaborate seamlessly with your team on financial goals.

- Track key performance indicators (KPIs) in one place.

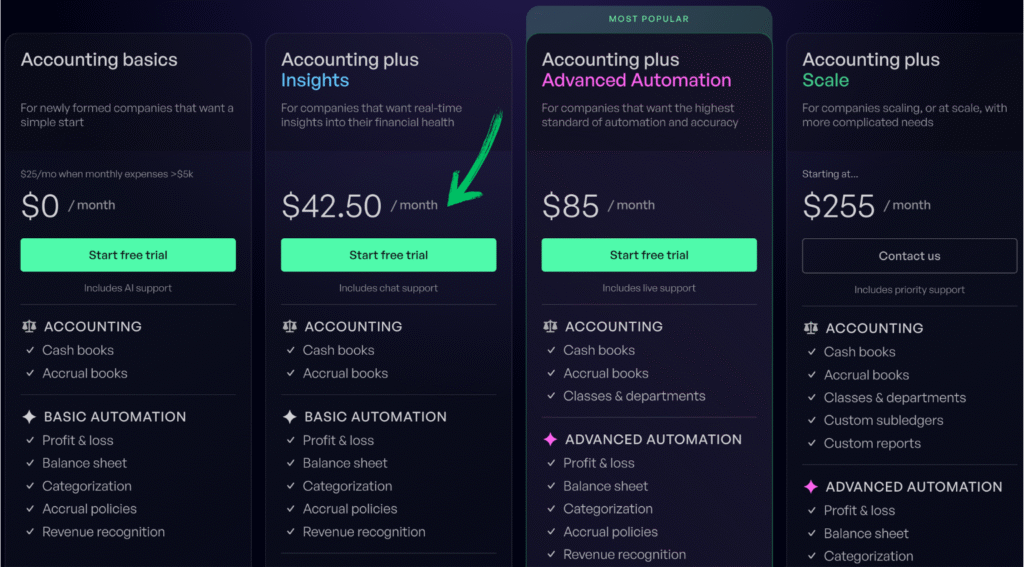

Pricing

- Accounting basics: $0/month.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Pros

Cons

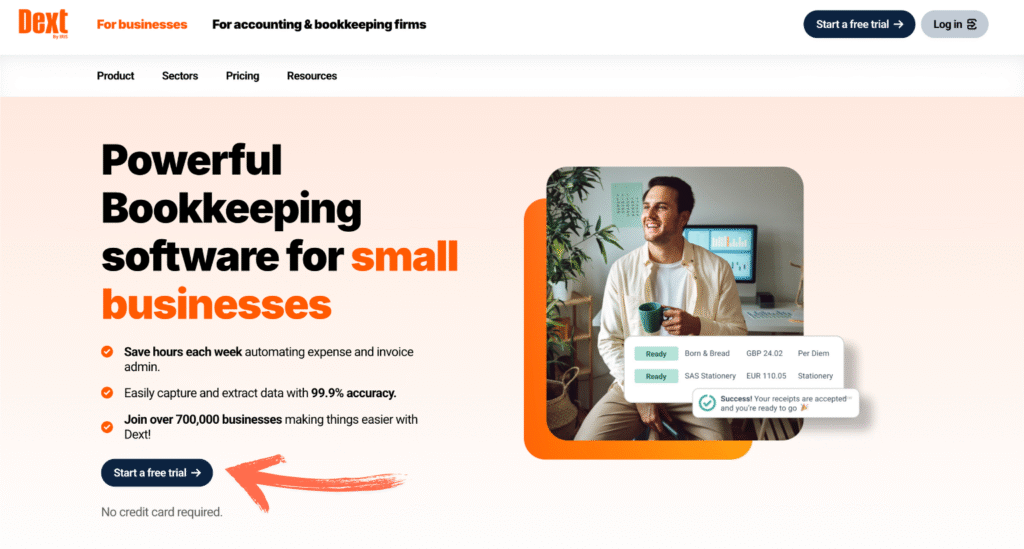

3. Dext (⭐4.0)

Dext is a smart tool for managing your receipts and invoices.

It helps you get rid of paper piles. Just snap a pic or email your documents.

Dext then grabs all the important info. This saves you tons of time on manual data entry.

It’s great for small businesses and accountants who deal with lots of paperwork.

Unlock its potential with our Dext tutorial.

Also, explore our Synder vs Dext comparison!

Our Take

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Key Benefits

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

Pricing

- Annually Subscription: $24

Pros

Cons

4. Easy Month End (⭐3.8)

Easy Month End is all about making your monthly financial closing easy.

It’s not one specific software but a goal.

Imagine a system that quickly balances your books and helps reconcile accounts fast.

The aim is to remove stress from closing your books each month and ensure accuracy for reports.

Unlock its potential with our Easy Month End tutorial.

Also, explore our Synder vs Easy Month End comparison!

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

5. Sage (⭐3.6)

Sage is a well-known name in the accounting world.

It can handle a lot, from managing your cash flow to doing tax calculations.

It’s a powerful tool that helps with many business expenses.

It’s a strong option for bigger businesses that need a comprehensive system.

It also connects with other accounting software.

Unlock its potential with our Sage tutorial.

Also, explore our Synder vs Sage comparison!

Our Take

Ready to supercharge your finances? Sage users have reported an average of 73% higher productivity and a 75% faster process cycle time.

Key Benefits

- Automated invoicing and payments

- Real-time financial reports

- Strong security to protect data

- Integration with other business tools

- Payroll and HR solutions

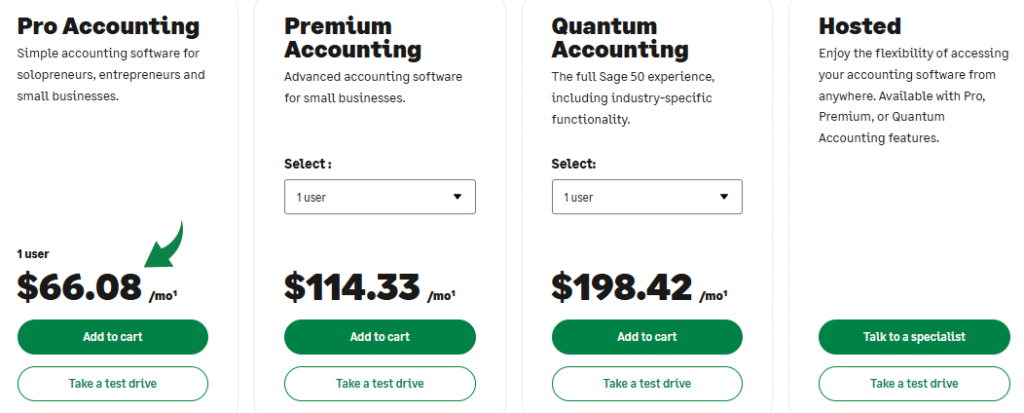

Pricing

- Pro Accounting: $66.08/month.

- Premium Accounting: $114.33/month.

- Quantum Accounting: $198.42/month.

- HR and Payroll bundles: Custom Pricing based on your needs.

Pros

Cons

6. RefreshMe (⭐3.4)

RefreshMe is a less-known but viable option for small businesses.

It’s designed to be simple and affordable.

While it might lack some of the more advanced features of its competitors, it provides a straightforward platform for those with basic financial needs.

The focus is on core accounting needs like expense tracking and invoicing.

Unlock its potential with our Refreshme tutorial.

Also, explore our Synder vs Refreshme comparison!

Our Take

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Key Benefits

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

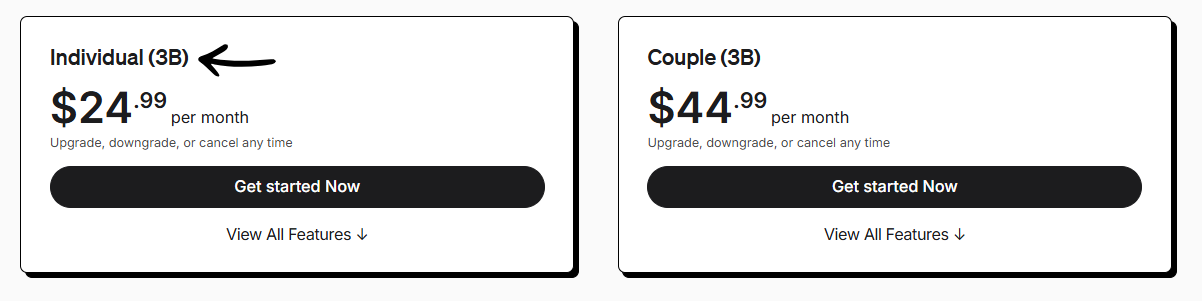

Pricing

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pros

Cons

7. FreshBooks (⭐3.2)

FreshBooks is an accounting software designed for small business owners and freelancers.

It’s super easy to use, especially for invoicing.

You can send professional invoices quickly. It also helps track your time and expenses.

Think of it as a friend that keeps your money organized.

Unlock its potential with our FreshBooks tutorial.

Also, explore our Synder vs FreshBooks comparison!

Our Take

Tired of complex accounting? 30 million+ businesses trust FreshBooks to create professional invoices. Simplify your accounting software today!

Key Benefits

- Professional invoice creation

- Automated payment reminders

- Time tracking

- Project management tools

- Expense tracking

Pricing

- Lite: $2.10/month.

- Plus: $3.80/month.

- Premium: $6.50/month.

- Select: Custom Pricing.

Pros

Cons

8. Docyt (⭐3.0)

Docyt is an AI-powered platform for finance and accounting.

It helps businesses automate their bookkeeping.

Think of it as a smart assistant for your money tasks.

Docyt can capture documents like receipts and invoices.

This means less manual work for you and cleaner financial data.

Unlock its potential with our Docyt tutorial.

Also, explore our Synder vs Docyt comparison!

Key Benefits

- AI-Powered Automation: Docyt uses artificial intelligence. It automatically extracts data from financial documents. This includes details from over 100,000 vendors.

- Real-time Bookkeeping: Keeps your books updated in real-time. This provides an accurate financial picture at any moment.

- Document Management: Centralizes all financial documents. You can easily search and access them.

- Bill Pay Automation: Automates the bill payment process. Schedule and pay bills easily.

- Expense Reimbursement: Streamlines employee expense claims. Submit and approve expenses quickly.

- Seamless Integrations: Integrates with popular accounting software. This includes QuickBooks and Xero.

- Fraud Detection: Its AI can help flag unusual transactions. This adds a layer of security. There’s no specific warranty for the software, but continuous updates are provided.

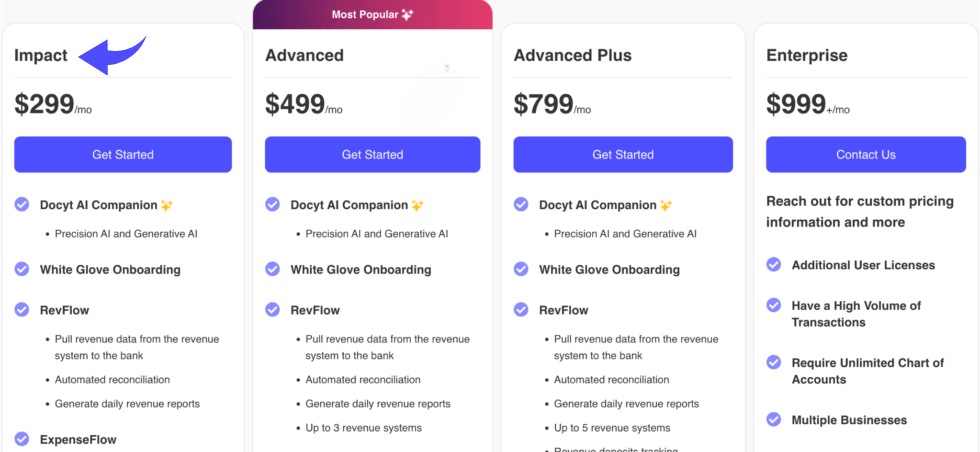

Pricing

- Impact: $299/month.

- Advanced: $499/month.

- Advanced Plus: $799/month.

- Enterprise: $999/month.

Pros

Cons

9. QuickBooks (⭐2.8)

QuickBooks is a very popular choice for small businesses.

It helps you manage all your money stuff in one place.

You can track income, expenses, and handle payroll.

Sending invoices and getting paid is easy, too.

Unlock its potential with our QuickBooks tutorial.

Also, explore our Synder vs QuickBooks comparison!

Key Benefits

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

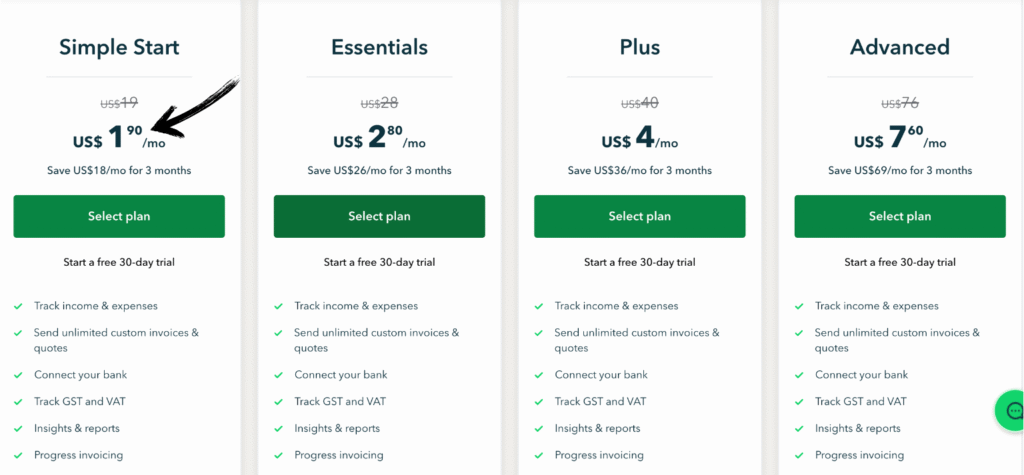

Pricing

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Pros

Cons

Buyers Guide

Here is a list of the steps of how we conducted our research to help small business owners make informed decisions:

- Initial Search and Identification: We started by searching for Synder alternatives to find the most popular accounting automation software options. We looked for financial tools that offered key functionalities for efficient financial management, such as the ability to automate bookkeeping and track financial transactions.

- Detailed Feature Analysis: For each product, we dug into the specific accounting tools it offered. We looked for features that enabled businesses to streamline various business operations and improve operational efficiency. This included robust features like inventory management, expense management, project management, and customizable invoicing. We also examined if they offered advanced automation, such as bank feeds and mobile apps to capture receipts and reduce manual data entry and manual errors. We also looked for advanced reporting and the ability to generate reports for real time financial insights and essential financial reports like cash flow statements.

- Pricing and Value Assessment: We carefully analyzed the pricing of each product. This included looking for an annual plan and evaluating the value of the features offered. We noted how each tool was a tailored solutions for a specific business size or need. We also considered if a comprehensive suite was offered, which could save money in the long run.

- Usability and User Experience Review: We evaluated the user interface of each software. We looked for an easy to use interface and an intuitive interface to determine if the software had a manageable learning curve. We considered how user-friendly the experience was, especially for everyday tasks like bank reconciliation and managing bank accounts. We also looked for customer support options to ensure a smooth onboarding process.

- Strengths and Weaknesses Evaluation: We compiled a list of pros and cons for each product. This included noting standout strengths like powerful workflow management and integration capabilities with popular accounting software like QuickBooks Online and QuickBooks Desktop. We also looked at how each tool handles multi currency transactions, online payments from various sales channels, and payment processors to ensure a robust bookkeeping process. We also sought out any negatives, such as missing features or a lack of support for specific financial tasks. This step was crucial for ensuring accurate financial records and for helping accounting firms find the best tools for their clients’ financial health.

- Data Synthesis and Final Assessment: Finally, we synthesized all the gathered information to provide a clear comparison. We paid close attention to how each tool ensures accurate financial records by reducing manual errors and providing real-time financial insights. This allowed us to provide a comprehensive overview for businesses looking to spread and improve their financial reporting and financial records. We also looked at features that helped to understand customer behavior.

Wrapping Up

Finding the right accounting solution is a big deal for small businesses.

Our guide shows you how to find the best tool for financial management.

We looked at the key features of popular accounting platforms, like how they handle accounting automation.

This includes things like mobile apps, document management, and project management tools.

We did all the research for you.

We looked at everything from customer support to how the apps work with QuickBooks Online and QuickBooks Desktop.

By following our guide, you can be sure you’re picking the best accounting solution for your business.

This helps you get the most important key features you need.

Frequently Asked Questions

What brand is similar to J.Crew?

Alex Mill and Everlane are top-tier alternatives for preppy, high-quality basics. Looking for more edge? Todd Snyder offers a premium, modern take on classic American style. These brands provide the same timeless look as J.Crew but often with a more curated, artisanal feel.

Who are Billy Reid’s competitors?

Sid Mashburn and Todd Snyder are his biggest rivals in the luxury heritage niche. They all share a focus on high-end materials and “lived-in” elegance. Brooks Brothers remains a classic competitor. However, Billy Reid wins on unique, Southern-inspired details and small-batch craftsmanship.

Who are Ben Sherman competitors?

Fred Perry is the ultimate rival, sharing that iconic 60s British Mod DNA. Merc and Baracuta also occupy this sharp-casual space. For a modern London twist, check out AllSaints. They all compete to define the look of modern, well-dressed British subcultures.

Who are Schneider’s biggest competitors?

Siemens and ABB are Schneider’s primary global competitors in industrial automation. They dominate the market. Rockwell Automation and Eaton also offer stiff competition in energy management and power distribution. These companies fight for dominance in the high-stakes world of smart infrastructure and industrial IoT.

What does Synder do?

Synder is a leading e-commerce accounting tool. It automates bookkeeping by syncing sales from platforms like Shopify and Amazon directly to QuickBooks or Xero. It’s precise. It eliminates manual entry. Features include multi-currency support and automated reconciliation to keep your books tax-ready.

Who are the competitors of Razor Group?

Thrasio and SellerX are the major rivals in the Amazon aggregator space. They all compete to buy and scale profitable e-commerce brands. GlobalBees is another key player. These firms use massive capital to transform small third-party sellers into global household names.

Who are the competitors of Intellect Design Arena?

They primarily compete with Temenos, Infosys Finacle, and Oracle Flexcube. These firms provide the core digital banking architecture for global financial institutions. It’s a fierce race. They compete on cloud scalability, AI integration, and the ability to modernize legacy banking systems without downtime.

More Facts about Snyder alternatives

- QuickBooks Online, Xero, and Zoho Books are the main choices for businesses that need to track all their money in one place.

- About 64% of business owners use computer tools to handle their math automatically.

- Picking the right software is a crucial decision for a business.

- Many programs can do the math for online stores without a human needing to help.

- These tools help work get done faster and stop people from making mistakes.

- Many tools can connect your Shopify or Amazon store to your math software so they can share information.

- A good store tool will help you track and report sales tax so you pay the right amount.

- Most new tools are made to be very easy to look at and use.

- The tool you pick can help your business grow bigger and work better.

- QuickBooks Online is great for managing money for people who sell things online.

- Many programs can link to several stores at once to keep all your sales data moving smoothly.

- Webgility is a powerful tool that moves information back and forth between your store and your accounting software. It helps you keep track of what you have in stock and what you spent.

- When choosing an alternative to Synder, consider the price, how it integrates with other apps, and the quality of the support team.

- Webgility is best for businesses that are growing fast. It can connect to more than 50 different marketplaces where you sell.

- Webgility works with big programs like NetSuite to help with very hard business tasks.

- A2X automatically matches the funds you receive from platforms like Amazon, Shopify, and Etsy to your records in QuickBooks or Xero.

- A2X is an expert at making sure sales from Amazon, Shopify, and Walmart are listed correctly in your math software.

- MyWorks Sync keeps your WooCommerce or Shopify store and your math software in sync. This is great for tracking your customers.

- Webgility connects over 50 sales channels to your math software, keeping your inventory numbers accurate in real time.

- If you don’t want to use Synder, other top choices are A2X, Webgility, Bookkeep, and MyWorks Sync.

- Synder is famous for fixing big messes when you sell in many places, and the numbers don’t match up.

- Synder is great for math, but it might not offer as many ways to customize or manage stock as some other tools.

- Many people prefer Webgility to Synder if they need to grow their business very large or use advanced automation.

- MyWorks Sync is easy to use and updates your data instantly, making it a great alternative to Synder.

- A2X is a better choice than Synder because it focuses on ensuring your bank and sales numbers match perfectly.

- Dext is often picked over Synder because it is very fast and accurate at reading information from receipts.

- Linnworks helps run an entire online store and offers more advanced order management features than Synder.

- Most tools that work like Synder can connect easily to Shopify and Amazon.

- These tools save time by doing the “bookkeeping” (writing down money spent and earned) for you.

- PayTraQer is an easy-to-use tool for small shops that need to sync their sales.

- Finaloop uses smart AI to give online stores a real-time view of their finances and helps match bank records.

- Zoho Books is good for small businesses because it sends reminders to people who owe you money and works with other Zoho apps.

- QuickBooks Online can calculate sales tax for you and connects to over 750 other apps.

- Bookkeep saves time by pulling daily totals from your apps and entering them into your math software, so you don’t have to type them in.

- Synder is very helpful for businesses that sell in different countries or receive money from many different sources.

- Synder lets you use different currencies (like Dollars and Euros) and automatically generates reports and tax documents.

- Synder offers many ways to get help, including a chat box, email, and a large list of “how-to” guides.

- The Synder screen has many buttons and might feel a bit confusing for someone just starting out.

- Synder is a great choice for medium- or large-sized businesses with complex financial tasks.

- Synder costs more than some basic tools, but it is a good investment for businesses that need its powerful features.